Abstract

Dynamic social economic development of meso-level is largely determined by the stability of the regional banking system, its structure and balance. Transformational processes in Russian economy and the banking sector affect topical issues of ensuring the smooth functioning of the credit and financial mechanism. In this regard, the problems of providing regional economic entities with financial institutions and a sustainable regional banking system are of particular relevance. This article is devoted to the study of problems in the development of regional banks during the financial recovery of the banking sector in Russia. International experience in building the architecture of the banking system is presented, and features of concentration processes of banking capital in developed and developing countries are also revealed. Tendencies and peculiarities of the formation and development of various categories of credit organizations are considered. Intermediate results and negative effects from aggressive regulatory policies with respect to a group of small and medium-sized banks in Brazil are identified as an example from the category of developing countries. The quantitative dynamics of the institutional structure of Russian banking system is assessed. Trends in the reduction of financial institutions in Russia, depending on their group. Main problems of transformation processes in Russian banking sector are defined. Negative intermediate results from the concentration of banking capital in Russia, which are not natural tendencies of free market relations and competitive environment in banking business, are indicated. The place of the “regional bank” category in the macro-banking policy of monetary authorities is determined.

Keywords: Banking systemBankRussiaconcentrationcapital

Introduction

Banking system is the financial basis for the implementation of the state economic strategy with long-term development of national economy and in particular the real sector of the economy. The success of social economic and innovative development of national economy is largely determined by the efficiency and sustainability of regional development, which depends on the quality of regional banks. However, the concepts of “regional bank” and “regional banking system” are absent in Russian legislation.

According to the author, the reason why Russian legal system has not yet formalized the concept of “regional bank” is the lack of the task of monetary authorities to maintain and develop the institution of regional (local, regional, urban) banks in Russia. At the same time, support is provided (administrative, financial, informational and legal) to larger credit organizations, which are either in the top 10 banks in terms of assets and capital or included in the list of systemically important ones. It is important to note that such a state recapitalization of major banks in the country, does not often have a positive impact on the banking system stability (Tashtamirov, 2017) and support for the real sectors of the economy (Tashtamirov & Varaev, 2018).

The importance and role of regional banks in social economic development of the meso-level territories in many countries is increasing. Various authors note the need to maintain regional banks in the country and stimulate the development of regional banking systems. Regional banks contribute to the formation of new commercial elements and the strengthening of business structures in their activities (Berger, Hasan, & Klapper, 2004). A sustainable regional banking system ensures the balanced and effective development of small and medium-sized entrepreneurship within a territorial entity (Guiso, Sapienza, & Zingales, 2004).

In addition to ensuring the operation of the financial mechanism for entrepreneurs work, a balanced regional banking system is of great importance for reducing the volume and dynamics of capital outflows beyond regional borders. Regional financial institutions as elements of the meso-level credit and financial mechanism mobilize and accumulate the local financial capital by generating and implementing effective immobilization into required spheres and sectors of the national economy (Hakenes, Hasan, Molyneux, & Xie, 2015). A similar thesis is noted among Russian researchers, regarding the role of a regional bank in issues of not only ensuring free competition on the banking services market, but also the effective distribution of the financial capital within the territories (Merzlikina & Kalinin, 2006).

The importance of the regional banking system in the diversification of regional business should be noted. It contributes to the dynamic growth of the economy at sub-federal level (Andieva, 2013).

Thus, the institution of regional banks and a sustainable regional banking system is an important category of modern banking architecture, both for developed countries and for emerging markets.

Problem Statement

Issues of the territorial structure of the banking sector, its clustering and defining the role of regional banks in social economic development of the meso-level are topical for modern Russian economy and sustainable development of regional financial systems. The current Russian macro-banking policy in the period from 2014 is aimed at carrying out the banking system transformation. This concerns the concentration of the banking capital, the nationalization of the banking sector, the monopolization of banking services market in the hands of the largest credit organizations in Russia. The necessity to investigate the influence of these processes on the category of regional banks and the stability of the banking system structure emerges in such conditions.

Research Questions

This study focuses on assessing the intermediate results of transformation processes in Russian banking sector and the implications for regional banks. For the disclosure of the specified subject of research it is important to determine the main objectives:

1. To provide a brief retrospective of the formation and development of Russian banking sector, highlighting the main features;

2. To study the international experience of transformation processes in the banking system of some developed and developing countries with an emphasis on the state of regional banks;

3. To identify the main problematic aspects in the policy of “stripping” the banking system from regional financial institutions;

4. To analyze the quantitative dynamics of financial institutions in Russia in the period of the banking sector transformation;

5. To determine negative trends in these processes for Russian banking system and identify the place of regional banks in macro-banking policy of monetary authorities.

Purpose of the Study

The purpose of the study is to determine the category place of regional banks in Russian banking system in terms of transformation of the banking sector architecture.

Research Methods

Russian banking system is a fairly young entity compared to capitalist countries that have been building their financial systems over the centuries. Therefore, the transformation processes that today have an institutional and structural aspect affecting the development trends of the banking sector are not complete. The stages of changes and reformations require comprehension and research in order to predict possible outcomes of such transformations and avoid crisis phenomena.

The quantitative development of Russian banking system has undergone significant changes since its inception in the early 90s. These processes are still ongoing. During the crisis years of the 1990s, the number of banks reached over 2,000 in Russia, which was associated with a low requirements to the authorized capital, numerous tax loopholes and schemes for the withdrawal of capital abroad, as well as money structuring and foreign exchange transactions (Anzoategui, Martinez Peria, & Melecky, 2010).

In the early 2000s, the tendencies were reversed; the number of banks began to decline sharply, with regional banks closing faster than those located in the central district of the country.

At the end of 2000, 1,311 credit institutions were operating in Russia, 47% of which were located in Moscow and Moscow region, while their share in assets was 83%.

At the beginning of 2019, the number of operating credit institutions decreased by three times up to 484, but the banking system was centralized in parallel with the reduction of banks, since 50.6% of all credit organizations were located in Moscow and Moscow region.

It is safe to say that such geography of the banking system is not exclusively Russian specifics, but is characteristic of many countries, albeit with significant features. The problem of uneven regional development and the asymmetry of financial potential is peculiar to world practice, while such a differentiation in the meso-level development is enhanced by the spatial redistribution of credit and financial institutions between central agglomerations and periphery in favor of the first. This is due to the high population density and concentration of business in these areas (Klagge & Martin, 2005).

The processes of concentration and centralization of banking business in Russian practice are the result of state support for large banks, the nationalization of the banking sector. However, it is very important to understand that the thesis “too big too fail”, which was the main criterion for reliability and sustainability of large banks in world practice, was wrong during the global financial crisis of 2008–2009. This is confirmed by many countries that have recognized the importance of local, small and regional banks during the post-crisis recovery period. Including the Chairman of the Bank of Russia S.M. Ignatiev in 2010 noted that “during the crisis, 81 credit organizations were closed: 46 - large and 35 - small in size”, recognizing the level of stability of small and medium-sized banks as high (as cited in Leibov, 2010).

Studies by authors from different countries confirm the important role of regional banks. In Germany, the negative impact and consequences of the financial crisis of 2008-2009 led to an increase in the importance of local banks and state policy on their support and development (Wyjcik & MacDonald-Korth, 2015). In the USA, the vast majority of banks are small regional banks (states, cities). Japan has a program to support urban small and medium-sized banks to build long-term financial relationships with local customers (Kondo, 2015).

There are also reverse examples of gaining concentration of the banking sector in capitals and large administrative territorial entities in the group of developed countries. An example is the UK, where the role of large banks continues to grow. However, it should be noted that these processes of concentration of the bank capital in this country have been going on for more than 30 years, and this is a market competitive nature. This aspect is fundamentally different from the tendencies of concentration and centralization of the bank capital that occur in Russia. The market system of management of Russian economy did not have time to form and grow stronger; the arbitrariness of political power and merging of political structures with business (including financial), monopolization of industries with administrative support, inefficiency of public investments and high levels of corruption are traced. All these factors do not contribute to building free market relations not only in the banking business, but also in most sectors of the national economy. Accordingly, the transformation processes of the banking sector “stripping” by the Bank of Russia and the largest state-owned credit organizations for the purpose of concentrating and centralizing banking capital are not the natural course of things and the result of competition.

As mentioned above, Russian economy belongs to the category of developing countries, therefore structural trends in the banking system of the countries of a given category should also be considered.

In the early 2000s, Brazil needed to carry out economic reforms, owing to the economy collapse, the deterioration of sectoral development, the decline in investment and the living standard. Institutional and financial reforms were the most important areas. The Central Bank of Brazil gained independence in the conducting of monetary policy, the course of “stripping” the banking system from inefficient and weak banks was set in the financial system. Also, an important task was to increase crediting to small and medium-sized entrepreneurship by expanding the branch network of large banks and cover most of the country with banking services through the development of information and communication technologies and the introduction of remote banking services for the population (Gapinath, 2002).

As a result, growth is noted in investment, economic volume and living standards. However, other problems related to the increasing of spatial unevenness in the development of municipalities and the national financial system were aggravated (Gapinath, 2002). The policy of strengthening the position of largest banks, developing their branch network and reducing the number of regional banks led to a widening gap in the financial development of the federal center and periphery. As noted in the work of Crocco, Santos, and Amaral (2010) the configuration of Brazilian financial system enhances the role of the federal center and adversely affects the periphery of the country. The systematic reduction of regional banks and their replacement by the branch network did not lead to an increase in entrepreneurial activity and smoothing out spatial financial fluctuations, but, on the contrary, strengthened the differentiation of the meso-level, firmed the position of large financial centers of the country and major banking institutions.

Thus, the “weak” (depressed) regions lost their territorial small banks, and the branches of large credit institutions that came to their places did not reflect the demands of local business entities and the dynamics of social economic development, which ultimately increased the spatial regional unevenness in the economic and territorial aspect.

Similar processes took place in Czech Republic, where, as a result of the transition economy, the number of banks was significantly reduced, to a large extent, small and medium-sized ones.

In Russia during the 2000s and the beginning of the 2010s, the banking system development took place without significant institutional shifts and transformations. However, in 2013 a new Chairman of the Bank of Russia, E.S. Nabiullina embarked on a financial restructuring of the banking sector, which meant mass struggle against inefficient banks, “bank-laundries”, as well as other financial institutions that systematically violated banking legislation, taking part in money structuring, output, capital concealment, plundering, fraud, tax evasion and etc. In practice, market participants called such course as “stripping” of Russian banking system, which was mainly aimed at small and medium-sized regional banks.

Thus, during the period of 2000-2013 the largest revocation of banking licenses accounted for 2006 - 62 licenses, and in 2014 this indicator was 86 licenses, in 2015 - 93, 2016 - 97, 2017 - 50, respectively.

For Russian banking sector, 2014 was the reporting period for transformation of the geography and institutional structure of the credit and financial system.

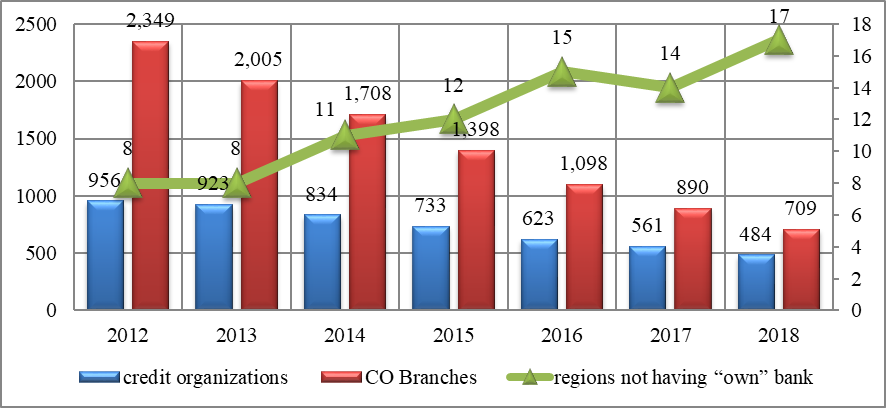

Figure

The data in Figure

These trends to reduce the number of credit organizations led to the growth of regions where the bank is absent, whose head office is located in the territory of this subject of Federation. There were 8 such regions before the structural optimization of the banking system in 2013, then at the end of 2018, 17 subjects of Federation did not have an “own” regional bank.

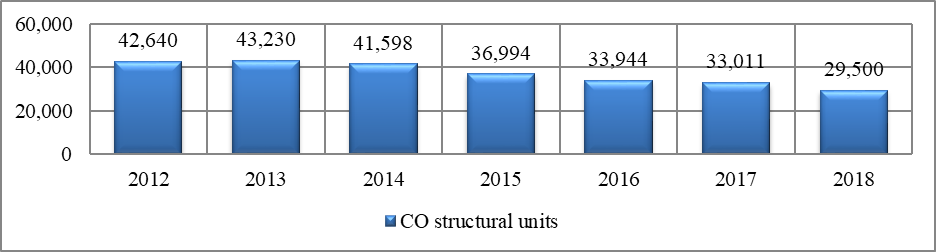

In the conditions of reducing the number of banks, it is important to take into account the dynamics of the number of access points to banking services through the system of structural units of credit organizations in the form of additional and operational offices, operational and cash centers, and etc.

Figure

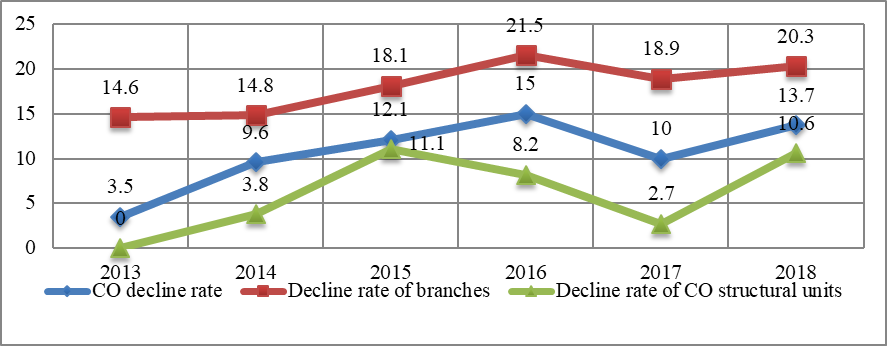

In the framework of the study, it is advisable to estimate the rate of annual reduction of financial institutions in Russia. For this purpose, figure

There is a more rapid reduction in the number of branches of credit institutions than of the banks and their structural divisions. Thus, annually the number of branches decreases by an average of 17.8%, credit institutions - by 9.7%, and structural units - by 6.3%, respectively.

Findings

Structural transformations of the banking sector lead to a systematic reduction of regional financial institutions, which are also being supplanted by a shrinking branch network of large credit organizations. The monopolization of the banking services market, the nationalization of the banking system, the processes of centralization and concentration of banking capital lead to a shift in the gravity center of financial capital to large federal cities and districts, which, with the reduction of regional banks, stimulates capital outflow from the periphery to richer regions and centers. Such trends enhance spatial regional unevenness in social economic development and financial asymmetry.

In modern period of transformational processes in the banking system of Russia, regional banks are compelled to compete with large banks of the federal center having administrative, state and institutional (Bank of Russia) support, and naturally not sustaining aggregate factors they lose financial independence from the federal center.

On the other hand, one of the reasons for the mass revocation of licenses from regional banks is not the criminal component of their activities, but the failure to comply with the norms of the Bank of Russia on capital adequacy and other requirements. Increasing requirements for credit organizations, the Bank of Russia is guided by a homogeneous departmental understanding of the banking system as a single object of centralized regulation and control. At the same time, the megaregulator formalizes banks as universal and applies a standardized method to all units of the banking system. However, the spatial unevenness of Russian regions in terms of financial and social economic development is not considered in the regulatory burden, which creates unequal opportunities and conditions for meeting all the requirements and standards of the Bank of Russia by market participants. Therefore, in order to preserve the work of a regional bank, they are forced to correct the accounting and financial statements, since the conditions of their operation do not allow forming the required amount of own capital (300 million rubles - 1 billion rubles). On the other hand, for sustainable development, a regional bank from a depressed or poorly developed region does not need such a size of its own funds, since economic agents operate at low levels of financial turnover.

Conclusion

Thus, the macro-banking policy of modern economic development of Russia is not interested in maintaining and supporting the institute of a regional bank and regional banking systems, paying more attention to large credit organizations, gradually increasing state participation in banking capital, reducing the institutional security of economic agents with banking services, and simultaneously centralizing and monopolizing the banking sector. Such trends are negative not only for the banking system, but also for the entire economy of the country.

Acknowledgments

The research was performed in the framework of RFBR grant № 18-410-200002.

References

- Andieva, E. V. (2013). Banks of the region: functioning and development. Terra Economicus, 3-3, 116–121.

- Anzoategui, D., Martinez Peria, M. S., & Melecky, M. (2010). Banking sector competition in Russia. World Bank Policy Research Working Paper, WPS5449.

- Berger, A. N., Hasan, I., & Klapper, L. F. (2004). Further evidence on the link between finance and growth: An international analysis of community banking and economic performance. Journal of Financial Services Research, 25(2-3), 169–202.

- Crocco, М., Santos, F., & Amaral, P. (2010). The spatial structure of financial development in Brazil. Spatial Economic Analysis, 5(2), 181–203.

- Gapinath, D. (2002). Brazil at a crossroad. Inst. Investor, 27(3), 53–58.

- Guiso, L., Sapienza, P., & Zingales, L. (2004). Does local financial development matter? Quarterly Journal of Economics, 119(3), 929–969.

- Hakenes, H., Hasan, I., Molyneux, P., & Xie, R. (2015). Small banks and local economic development. Review of Finance, 19(2), 653–683.

- Klagge, В., & Martin, R. (2005). Decentralized versus centralized financial systems: is there for capital markets. Journal of Economic Geography, 5(4), 387–421.

- Kondo, K. (2015). Cross-prefecture expansion of regional banks in Japan & its effects on lending-based income. Cogent Economics and Finance, 3, 1.

- Leibov, V. (2010) The Central Bank acknowledged that the stability of the bank does not depend on its size Retrieved from: httl://banker.ru (accessed date: 15.02.2019).

- Merzlikina, G. S., & Kalinin, D. O. (2006). Small business and small regional banks: cooperation and further development. Proceedings of VolgSTU, 5, 191–194.

- Tashtamirov, M. R., & Varaev, A. A. (2018). Systematically significant banks: current state and the threat of systemic risk. Scientific notes of Crimean Engineering and Pedagogical University, 2(60), 178–184.

- Tashtamirov, M. R. (2017). Features of clustering of the banking sector in Russia at present stage. In the collection: 6th annual final conference of the faculty of Chechen State University, pp. 30–37.

- Wyjcik, D., & MacDonald-Korth, D. (2015). The British and the German financial sectors in the wake of the crisis: size, structure and spatial concentration. Journal of Economic Geography, 15(5), 1033–1054.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2019

Article Doi

eBook ISBN

978-1-80296-075-4

Publisher

Future Academy

Volume

76

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3763

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Tashtamirov*, M., Tagaev, S., Iushaeva, R., Alieva, Z., & Tapaev, R. (2019). Place Of Regional Banks In Modern Transformation Processes Of Russian Banking Sector. In D. Karim-Sultanovich Bataev, S. Aidievich Gapurov, A. Dogievich Osmaev, V. Khumaidovich Akaev, L. Musaevna Idigova, M. Rukmanovich Ovhadov, A. Ruslanovich Salgiriev, & M. Muslamovna Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism, vol 76. European Proceedings of Social and Behavioural Sciences (pp. 3058-3065). Future Academy. https://doi.org/10.15405/epsbs.2019.12.04.412