Abstract

The paper addresses the issues related to the role of local governments and control of their activities in the system of financial and legal functioning of municipal entities of the Russian Federation. The results of the systematic study show that functions of local governments of the Russian Federation as an institution of public authority are reduced to solving local issues within the framework of the constitutionally fixed goal of the local governments and their functions. The function of local governments that is crucial for performance of all other functions is the financial and legal function. The study proceeds from the fact that the most relevant financial and legal element of local government control is the local budget, and the majority of the municipal entities currently formed are subsidized and have difficulties implementing local issues that have a very negative impact on the performance of local authorities. The authors consider the issues of financial and legal improvement of the activities of local governments aimed at sustainable socio-economic development of municipal entities of the Russian Federation and propose an algorithm of interaction of the municipal entities in any subject of the Russian Federation for consolidated actions of regional authorities and local governments to provide sustainable development. The algorithm proposed is focused primarily on financial sustainability of municipal entities of the Russian Federation, which implies the ability of local governments to ensure their authority provided for in the regulatory acts of the Russian Federation to control the activities of local governments.

Keywords: Municipal entityregionsocial developmenteconomic development

Introduction

Financial and legal aspects of the activities of local governments, and issues of improving the activities of local governments to ensure sustainable socio-economic development of municipal entities of the Russian Federation are one of the current areas of modern research. These aspects are of practical relevance for achievement of multifaceted socio-economic objectives of the state related to sustainable development of the national economy.

Problem Statement

At the present stage of the socio-economic development of the country, the activities of local governments are significantly limited in financial resources that affects the efficiency of solution of local issues assigned to municipal entities by law. In addition, there are a number of problems of legal control of local issues and securing appropriate resources required for their solution. The above determines the feasibility of further study, understanding and scientific substantiation of the processes of formation and development of financial and legal aspects of ensuring the activities of local governments.

Research Questions

The subject of this study is financial and legal relations to ensure effective functioning of municipal entities of the Russian Federation.

Purpose of the Study

This study aims to investigate the processes of formation and development of financial and legal aspects of ensuring the activities of local governments and developing recommendations based on study results to improve their activities using the algorithm of consolidated actions of regional authorities and local governments.

Research Methods

The research methodology is based on the use of theoretical and empirical research methods of theoretical and practical material on the research topic. The study employs statistical, comparative-typological, graphical, analytical, and system-logical methods.

Findings

Structural analysis of the main results of the activities of local governments performed to ensure functioning of municipal entities of the Russian Federation revealed a number of problems in effective control of local issues by local authorities, which, in our opinion, is primarily related to the problem of financial insolvency of most municipal entities of the Russian Federation (Ministry of Financial Policy, 2018). Based on the main research results, measures to strengthen the organizational and economic bases for functioning of municipal entities in several key areas are proposed to ensure effective control of local issues by local governments.

Among modern studies, rare papers address organizational and economic aspects of improving the activities of local governments to ensure effective development of municipal entities of the Russian Federation, since most publications are devoted to regulatory issues at the level of subjects of the Russian Federation, whose powers are very different from those of the municipal level.

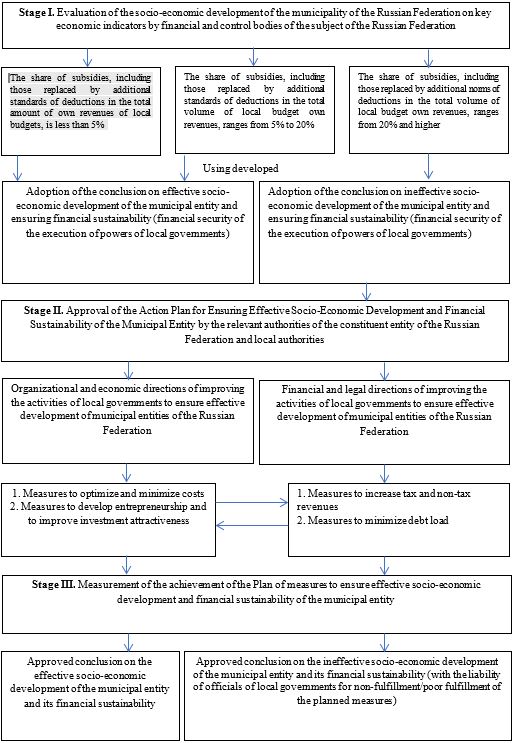

Nevertheless, the study of various domestic and foreign approaches to control of various regional institutions of government and administration (Taran, Durdyeva, Aslanov, Bindasova, & Borlakova, 2016; Novoselov, Shtapova, Kovalenko, Medyanik, & Ram, 2016; Gladkovskaya, Tsalo, & Teterkina, 2017; Makeykina & Guznova, 2017; Tukhbatullin, 2018) allowed development an algorithm for consolidated actions of regional authorities and local governments to ensure sustainable socio-economic development of municipal entities on a scale of any entity the Russian Federation (Figure

The algorithm proposed is focused primarily on achieving financial sustainability of municipal entities of the Russian Federation, which primarily implies understanding of the ability of local governments to make use of their powers stipulated by the regulatory legal acts of the Russian Federation to control the activities of local governments.

The use of this algorithm in practical activities of subjects and municipal entities of the Russian Federation will also serve as an effective tool for implementing the provisions of the Budget Code of the Russian Federation (in particular, Article 36 of the Civil Code of the Russian Federation, etc.) to control the activities of local governments (Bukhval'd & Voroshilov, 2018).

The key point of the algorithm is the approval of the appropriate authorities of the constituent entity of the Russian Federation and local authorities by the Action Plan for Ensuring Effective Socio-Economic Development and Ensuring Financial Sustainability of the Municipal Entity, which we divided into two areas – an organizational and economic, and a financial and legal one. This division was associated with the study of a number of organizational structures of local governments in different subjects of the Russian Federation. Based on this analysis, we concluded that these areas were implemented by different structural divisions of municipal administrations of the Russian Federation. Figure

The rationale for targets of these activities needs detailed consideration.

Organizational and economic aspects to improve the activities of local governments in ensuring effective development of municipal entities of the Russian Federation include (Taran et al., 2016):

1. Measures to optimize and reduce costs.

2. Activities for development of entrepreneurship and increasing investment attractiveness.

In our opinion, it is necessary to focus on reduction of the expenditures on local governments and on optimization of the mechanisms for managing local budget expenditures as part of measures to optimize and reduce the expenditures of municipal entities of the Russian Federation. In this regard, we suggest the following activities that will improve the activities of local governments aimed to ensure effective development of municipal entities of the Russian Federation:

It is necessary to strictly comply with the standards for expenditure of funds for maintenance of local governments, to take an inventory of these items of expenditures in order to reduce them if they are not priority, to rationalize the expenditure on local governments, to identify structural divisions and local government that duplicate functions in order to remove the employees to downsize these structures from municipal employees.

It is necessary to conduct a comprehensive audit of the activities of municipal organizations and institutions in order to identify low-functional or narrowly focused structures for their further consolidation. At the same time, local governments should consider the possibilities of consolidation for multidirectional organizations and institutions which are in municipal ownership. If an organization is extremely inefficient and it is not possible to conserve or lease municipal property, this property can be sold only if absolutely necessary. The proposal should be implemented carefully and based on a well-defined program. Due to this, we believe that after a comprehensive audit of the activities of municipal organizations and institutions, local governments should develop and approve the program for reorganization of the budget by industry and section. In addition, a decision on consolidation or integration of municipal organizations or institutions requires a decision on the centralization of accounting departments and other departments of these organizations. Accounting of municipal institutions can be transferred to the structural unit of the municipal administration, for example, the financial bodies of the municipal administration.

It is necessary to actively attract the non-state sector for provision of certain municipal services by outsourcing some functions to non-governmental institutions (food, transportation, etc.).

Methods of program-targeted planning of local budgets should be more actively employed in the activities of local governments, which can significantly affect savings of municipal entities. Similar to this, planning of capital expenditures should be carried out using energy-saving technologies, which can also significantly affect savings of municipalities.

Certain expenditures of local governments can be minimized by ensuring the effectiveness of municipal procurement (centralization of state and municipal procurement). However, this recommendation should be considered carefully, since it has both advantages and disadvantages. The advantages of centralized procurement are budget savings through the wholesale purchase of similar goods (works, services); highly qualified employees of the authorized body who possess specialized knowledge; simplification of the procedure to control organization and implementation of tenders. The disadvantages include a significantly increased amount of work to be done under the terms of the contract and increased time of procurement.

For local governments, an independent audit and permanent financial control will certainly help to solve the problem of the majority of Russia's municipal entities – timely identification and repayment of debts of municipal organizations and institutions, and optimization of budget expenditures. In addition, it is necessary to establish the responsibility of the management of these organizations and institutions for unauthorized increase of credit/debit debts. These measures are taken to reduce the expenditures of municipal entities for legal costs.

A comprehensive analysis of the possibilities for consolidation of municipal entities is required to improve the activities of local governments aimed at ensuring effective development of municipal entities of the Russian Federation. It should be noted that this tendency is not new; moreover, this procedure was legalized by the Federal Law No. 62-FZ of April 3, 2017 On Amendments to the Federal Law on General Principles of the Organization of Local Self-Government in the Russian Federation. A tendency to consolidation leads to reduced number of settlements, unification of all settlements within the boundaries of a municipal district, and to formation of the so-called urban districts. When optimizing budget expenditures, the initiators of territorial transformations should not ignore the effects of consolidation of settlements – the problems of the territorial accessibility of local government for people. Dialogue with people and regular feedback should be priorities in the work of local authorities.

In the framework of measures to develop entrepreneurship and to increase the investment attractiveness of municipal entities of the Russian Federation, in our opinion, it is necessary:

To update the municipal programs of socio-economic development, which in most municipal entities are drawn up for the medium and long term, which, in our opinion, does not allow the business community of municipal entities and potential investors to respond in a timely manner to changes in the economic and social life of municipal entities. In this regard, the programs need updating at least once a year with the involvement of the entire interested community, especially in terms of new investment projects aimed to develop municipal entities and to determine new trends of their development.

There is a need for activities of local governments to legalize a shadow component of the economy of municipal entities. This is due to the fact that information collected, processed and analyzed from open sources shows that the share of the shadow sector in the economy of municipal entities is significant and varies from sector to sector from 40% to 90%. Thus, almost any municipal entity has a significant tax potential that can be realized through legalization of the shadow component. This should be the primary strategic task of organizational and economic measures to improve the activities of local governments in order to ensure effective development of municipal entities and budget self-sufficiency (Taran & Sauvov, 2018).

Local governments should more actively use control tools that enhance the investment attractiveness of municipal entities. This involves improvement of the regulatory framework of the municipal entity in investment activity, mechanisms of municipal-private partnerships, and active participation of local governments in different events (forums, exhibitions, etc.) to attract investors to municipal entities.

Conclusion

Practical implementation of the considered proposals by local governments can be one of the most effective tools to improve the management system through development of municipal entities of the Russian Federation. The developed recommendations can be used to improve the theoretical and methodological framework for assessment of the activities of local governments, identification of additional sources of tax and non-tax revenues, and evaluation of the effectiveness of the development of municipal entities in any subject of the Russian Federation.

References

- Bukhval’d, E. M., & Voroshilov, N. V. (2018). Current issues in the development of municipal entities and in reforming the institution of local self-government. Economic and Social Changes: Facts, Trends, Forecast, vol. 1 (pp. 132–147). Retrieved from: http://esc.isert-ran.ru/article/2513/full (Received 20 February, 2019). DOI:

- Gladkovskaya, E. N., Tsalo, I. M., & Teterkina, L. B. (2017). Assessment of financial stability of regional budgets in Russia: methodology and algorithm of its application. Management Issues, 6(49), 119–131. Retrieved from: https://cyberleninka.ru/article/v/otsenka-finansovoy-ustoychivosti-regionalnyh-byudzhetov-v-rossii-metodika-i-algoritm-ee-primeneniya (Received 20 February, 2019).

- Makeykina, S. M., & Guznova, Yu. S. (2017). The strengthening of own revenues of the municipal budget in the context of ensuring its sustainability budget. Vectoreconomy, 1, 1–8. Retrieved from: http://www.vectoreconomy.ru/images/publications/2017/3/financeandcredit/Makeykina_Guznova.pdf (Received 20 February 2019)

- Ministry of Financial Policy (2018). Information on the results of monitoring the implementation of local budgets and inter-budgetary relations in the constituent entities of the Russian Federation at the regional and municipal levels for 2017. Retrieved from: https://www.minfin.ru/ru/perfomance/reforms/local_ government/?area_id=70&id_70=3259&page_id=177&popup=Y (Received 20 February, 2019).

- Novoselov, S. N., Shtapova, I. S., Kovalenko, A. A., Medyanik, N. V., & Ram, O. L. (2016). Research into Specifics of Management of Regional Development for the Purpose of Observance of Reproduction Proportions. International Review of Management and Marketing, 6(S1), 1–6. Retrieved from: http://www.econjournals.com/index.php/irmm/article/view/1857/pdf (Received 20 February, 2019)

- Taran, O. L., & Sauvov, I. K. (2018). Assessment of the impact of regional policy on the effectiveness of counteraction to the expansion of the shadow sector of the economy in the Republic of Dagestan. In Experience and results of economic activity of socio-economic systems, countries, regions, industries and sectors of the economy. Materials III all-Russian scientific-practical conference (pp. 149–154). Pyatigorsk: Institute of service, tourism and design (branch) NCFU in Pyatigorsk.

- Taran, O. L., Durdyeva, D. A., Aslanov, D. I., Bindasova, N. A., & Borlakova, M. I. (2016). Assessment and Analysis of Resource Approach to Formation of Strategic Potential of Economy of the Region. International Review of Management and Marketing, 6(S1), 84–89. Retrieved from: http://www.econjournals.com/index.php/irmm/article/view/1881/pdf (Received 20 February, 2019)

- Tukhbatullin, R. M. (2018). Measures of improving the fiscal sustainability of municipalities. Journal of Economy and entrepreneurship, 1(90), 622–629. Retrieved from: http://www.intereconom.com/archive/380.html (Received 20 February 2019)

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2019

Article Doi

eBook ISBN

978-1-80296-075-4

Publisher

Future Academy

Volume

76

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3763

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Taran*, O., Taran, N., Kilinkarova, S., Mihailuk, O., & Topuzidis, N. (2019). Organizational And Economic Aspects Of Improving Activities Of Russian Municipal Entities. In D. Karim-Sultanovich Bataev, S. Aidievich Gapurov, A. Dogievich Osmaev, V. Khumaidovich Akaev, L. Musaevna Idigova, M. Rukmanovich Ovhadov, A. Ruslanovich Salgiriev, & M. Muslamovna Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism, vol 76. European Proceedings of Social and Behavioural Sciences (pp. 3036-3042). Future Academy. https://doi.org/10.15405/epsbs.2019.12.04.409