Abstract

The article aims to study current trends in the development of innovative banking products in Bashkortostan. The system approach was applied to study the global experience of implementation of the Internet banking. The authors describe the domestic experience in the development and implementation of remote banking services in the Republic of Bashkortostan. Internet banking services are various. Statistical analysis made it possible to identify the share of Internet banking users among the users with different income levels. It was identified that the most numerous users of Internet banking services are people with average and low-incomes. There is a direct correlation between experience of the Internet bank user and frequency of using Internet banking services. The choice of Micron tokens is justified. The companyare able to produce without purchasing foreign solutions and technologies which eliminates the need to purchase expensive licenses. This marker is an example of how biometrics can effectively solve many security and data protection issues. Most of the banking transactions are regular payments for mobile communication, the Internet, transfers between accounts and utilities payment. There are drawbacks of the Internet banking system to be eliminated. The authors analyzed development and implementation of remote banking services in Bashkortostan. Statistical analysis made it possible to identify the share of Internet banking users with different incomes. There is a direct correlation between experience of the Internet bank user and frequency of using Internet banking services.Economic benefits of the multifactor authentication based on biometric USB tokens were calculated.

Keywords: Remote customer serviceinternet bankingdevelopment trendsglobal experienceinnovative productbanking services

Introduction

Innovation is a phenomenon that determines economic growth, development and structural changes. In addition, innovation has become a basis for modern economic development and the banking sector. Innovation is closely related to competitiveness.

For example, rapid development of Internet banking began 20 years ago, when in 1983, a group of companies (Nottingham Building Society, a British telephone company, British Telecom and Bank of Scotland United) created a system allowing for online transfers.

This innovation marked the beginning of the transition of RBS systems from telephone networks and service centers to the Internet applications. The system of remote banking services via mobile and / or landline phones was the first one. The first experiments on implementation of remote access systems were carried out by Western banks in the 1980s.

British banks were the most active. They searched for additional ways to attract customers. The English National Westminster Bank became a pioneer in the field of remote access. Bank customers had the opportunity to make phone calls in real time to carry out bank transfers, buy and sell foreign currencies. The National Westminster Bank was the first which implemented the remote banking system. The client dialed the bank number and made standard payments. Access to the account management was provided by the client entering a five-digit code; the system was improved along with the development of digital communications and implementation of computer technologies. Then this innovation was implemented in Germany and Spain. In Latin America, this system has become an indispensable banking tool in the conditions of inflation, when people were forced to buy and sell currency and securities.

The system approach was applied to study the global experience of implementation of the Internet banking. The domestic experience in the remote banking services implemented in the Republic of Bashkortostan was studied;

Problem Statement

The global experience of the Internet banking system

Mobile business has been developing rapidly in the world, providing ever-widening content and services (Zhang, Zhu, & Liu, 2012), fostering stronger relationships than earlier ones between financial institutions and clients (Riquelme & Rios, 2010). It provides customer value creation due to being inherently time and place independent (Lin, 2012) – “anywhere and anytime” – free from temporal and spatial constraints (Laukkanen, 2007). Moving clients to electronic channels is an important issue for banks because it allows them to reduce operational costs (Calisir & Gumussoy, 2008), providing a more convenient means for customers to meet their banking needs with more complete and more timely information. In several African countries authorities issued legislation during the 2000s allowing mobile telecom operators to partner with financial institutions to provide mobile financial services.

As an example, let us consider the recent development of Internet banking in several emerging countries. The current global financial crisis is the result of the interest-based economies. The countries which were having very successful markets and were leading the whole world, were also hit with the crisis to such an extreme that now the interest rate is brought down nearly to zero. These countries are now taking keen interest in Islamic banking because it is not based on interestrate systems. Rather it is asset-based banking as compared to the conventional banking which is money based. A report by the State Bank of Pakistan confirms that the Islamic banking is not directly infected by the crisis (Anwar, 2012). Therefore, banks have developed various methods and services to meet customer needs and offer many different channels for accessing banking and other services, such as ATMs, telephone banking, online banking and mobile banking to provide SMS banking (Villavarajah, 2008).

Single country studies focusing on the Asian banking sectors have mainly examined the impact of different ownership forms on bank performance. Generally, the empirical evidence shows that foreign banks have succeeded in capitalizing on their advantages and exhibit a higher level of efficiency than their domestic bank peers. Thai bank experienced falling total factor productivity growth (TFP), while the average foreign bank experienced increasing TFP. In a study on the banking sector of the Philippines, Unite and Sullivan (2003) suggest that the entry of foreign banks in the Philippines has resulted in the reduction of interest rate spreads and profits of the domestic banks, particularly those that are affiliated with family business groups.

The prevalence of mobile technology in daily life, combined with more than 60% of coverage in Africa (Aker & Mbiti, 2010) has increased the popularity of mobile banking (Chen, 2013) and the importance of mobile banking services. Mobile banking can be defined as a type of execution of financial services in the course of which, within an electronic procedure, the customer uses mobile communication techniques in conjunction with mobile devices (Pousttchi & Schurig, 2004) or as a service whereby customers use a mobile phone or mobile device to access banking services and perform financial transactions (Anderson, 2010). Mobile banking is closely related to mobile devices and communications networks and could not exist without these. The device is the means to interact with banking applications and the communications network is the way to send/receive information and transactions to/from the bank.

This method of payment can also be expanded and implemented by state administrations. The authors, developed by the Central Bank of Ecuador, are presented as an alternative model for the electronic money system proposed in the public sector, seeking to provide the Ecuadorian population with an alternative for economic integration and Compatibility with various service providers and economic actors. This work presents the system design and comparison with other electronic payment projects. The results obtained are used to provide recommendations on how to improve and replicate the development of similar projects (Teran, Horst, Valencia, & Rodriguez, 2016).

The study also studies on efficiency in the Turkish banking industry through the use of innovative products and processes made by web-based banking product channels used in Turkey with structural analysis. The research was concluded by learning that the number of products used in web banking services and consumers using in these products is noticeably increasing in time. On the other hand, when compared to other samples in the world, using the Internet banking in Turkey has not reached the required level yet. When considering this provision, in order to spread to e-services, it is more than important to take some precautions. Bridging the clash between the web infrastructure and the banking security industry, diversifying from banking products, strengthening on understanding about the trend in using web banking, will act to accelerate the development of web banking services more and more (Sanli & Hobikoglu, 2015).

Banking risks have to be accounted for when implementing the Internet banking system. Baptista and Oliveira (2015) argue that the risk management function has evolved significantly: from an independent unit of risk assessment to a credit culture which needs to be taken into account everything. The concept of risk has gone beyond traditional measures such as credit, market and operational risks of corporate management, fraud and reputation risks, etc. New banking products developed on the Internet platforms are more convenient and less expensive. However, the Internet itself is not a safe place, and this risk concerns the entire banking industry, from regulators and supervisors of banks to financial institutions (Fitchratings, 2015).

Research Questions

The client has no special using only a web browser. Authentication involves entering a password and a one-time code received through the phone. In addition, the most common practice is that the development of Internet banking systems is carried out by third parties. Analysts of the company evaluated Russian Internet banks for functionality and usability, using more than 400 evaluation criteria. Internet bankingwhich meets all the needs of the user and has a user-friendly interface is considered more effective. The United States, Japan and other countries are expanding the area of financial services. New services are intensively entering the market under the influence of increasing competition, customer literacy and technological changes. In Japanese financial companies, some employees are replaced with robots automating business. By 2021, Mizuho Financial Group is going to automate the workload and reduce jobs by 8,000; by 2026, 19,000 jobs will be reduced. In addition, Bank of Tokyo-Mitsubishi UFJ is going to reduce the number of units.

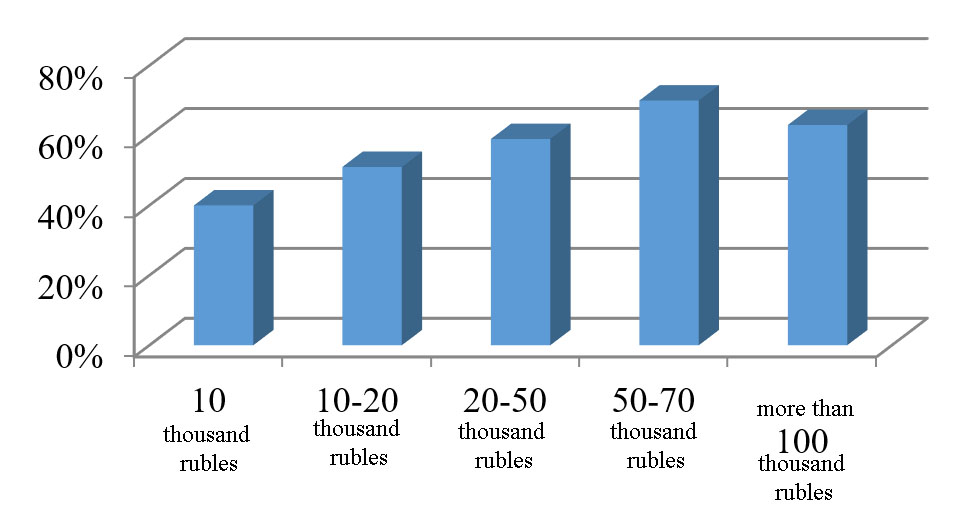

According to the results of the study for 2017, URALSIB, one of the largest banks in the republic, ranked 7th in the ranking of Russian Internet banks. This indicates a desire to develop, including in the field of RBS. URALSIB is developing electronic services and encouraging its customers to use remote services. The main incentive is to offer customers more attractive conditions for service through electronic channels. You can pay for many services through RBS channels paying no fee, open deposits at higher rates, make deals on buy and sell foreign currency online at more favorable rates. This direction reduces bank's costs of development of the branch network without violating the interests of the customers (Dyakova, 2011). The total number of adults who have access to the Internet is about 65%. The most numerous users of Internet banking services are people with an average income of 20 to 50 thousand rubles. People with high incomes (more than 50 thousand rubles) make up only 19% of the Internet banking customers. About half (43%) of Internet banking users are low-income people. As can be seen from Figure

There is a direct link between the experience of using the Internet banking and frequency of use. The users who were connected to the Internet Bank less than a year ago, only 22% access the Internet Bank more than once a week. At the same time, among the users who were connected to the Internet bank more than three years ago, this share is more than 45%. This group also shows a decrease in the share of customers using the Internet Bank once a month.

Purpose of the Study

The authors analyzed development and implementation of remote banking services in the Republic of Bashkortostan. Penetration of Internet banking services is different from bank to bank. Statistical analysis made it possible to identify the share of Internet banking users with different incomes. It was clarified that the most numerous users of Internet banking are groups of users of Internet banking - people with an average income level; people with high incomes; low income people. It was determined that there is a direct correlation between the experience of the Internet bank user and the frequency and breadth of using Internet banking. Most of the operations are accounted for by regular payments, such as: mobile communications, the Internet, transfers between their own accounts within the bank and payment of utilities. However, despite this, there are still limitations and some inconveniences in the operation of these systems that need to be improved.

There is a direct correlation between experience of the Internet bank user and frequency of using Internet banking services. Most of the banking transactions are regular payments for mobile communication, the Internet, transfers between accounts and utilities payment. There are drawbacks of the Internet banking system to be eliminated.

Research Methods

The economic benefits of the multifactor authentication based on biometric USB tokens were calculated. These systems should be implemented by legal entities attacked by hackers. We studied the market of biometric USB tokens to select a solution from the ISBC-ESMART Token GOST group which is a cryptographic information tool with hardware support for Russian cryptographic algorithms based on the domestic MIK 51 chip produced by NIIME and Micron Plant. The Micron group built a production chain from development to production of the final product which allows them to produce a range of high-tech products targeted for the mass market: RFID chips and tags, SIM cards, chipped transport and bank cards, protected microchips for social cards and state identification documents. The Micron company annually produces more than 400 million RFID tags, 50 million banking chips, 30 million bank cards, more than 5 million chips for biometric passports and electronic documents. It is the largest Russian exporter of industrial microchips — over 500 million chips manufactured by the Micron Group are exported to Europe and Southeast Asia.

Findings

The choice of Micron tokens is justified. The company can produce then without purchasing foreign solutions and technologies which eliminates the need to purchase expensive licenses. This marker is an example of how biometrics can effectively solve many security and data protection issues. The advantages of these tokens are their low cos. They can be used as electronic signatures. There is no need for special readers which cost several times higher than the USB tokens. A secure controller built into ESMART Token GOST provides protection against such attacks as Spa, DPA, DFA. Opening, light, impulse noise, voltage, and temperature sensors, hardware integrity monitoring and EEPROM protect key information from the unauthorized access. The EEPROM is an electrically erasable reprogrammable read-only memory of a non-volatile memory type. The Bashcomsnab bank amounts to 5% or 49-500 million to 30 billion rubles. This indicator was calculated using data from MarswebblntemetBanking 2016 on the penetration rate of Internet banking and Bashkomsnabbank statistics (Formula 1).

(75318/4,5 million*0.35)*100=4.79 (1)

where 75138 is the number of legal customers using the remote banking system of Bashkomsnabbank;

4.5 million - the number of registered legal entities in Russia;

0.35 - Internet banking penetration rate among Russian companies

Based on the estimates of Group-IB and Sberbank of Russia, in 2017-2018,Russian companies lost 10-400 billion rubles as a result of hacker attacks. It was assumed that distribution of hacker attacks coincides with the number of users of Internet banking. For Rosselkhozbank, it is 500-20000 million rubles. The economic sense of ESMART implementation is evaluated and shown in Table

Conclusion

The share of costs of implementation of multifactor authentication systems including biometrics will be from 55.7% to 1.4% of the possible losses from 50 hacker attacks. Based on this, we can conclude that implementation of these systems is required.

The cost of hacker attacks is high. To ensure the information security, it is necessary to apply a systematic approach, otherwise the bank can lose trust of the customers.

The Bashkomsnabbank ensures security of remote banking transactions by improving the current system and using leading domestic developments.

References

- Aker, J., & Mbiti, I. (2010). Mobile phones and economic development in Africa. Journal of Economic Perspectives, 24(3), 207–232.

- Anderson, J. (2010). M-banking in developing markets: Competitive and regulatory implications. Info, 12(1), 18–25.

- Anwar, Y. (2012). Islamic Banking Bulletin. State Bank of Pakistan. Islamic Banking Department Retrieved from: sbp.org.pk/ibd/bulletin/2012/IBB-sep-2012.pdf

- Baptista, G., & Oliveira, T. (2015). Understanding mobile banking: The unified theory of acceptance and use of technology combined with cultural moderators. Computers in Human Behavior, 418–430

- Calisir, F., & Gumussoy, C. A. (2008). Internet banking versus other banking channels: Young consumers’ view. International Journal of Information Management, 28(3), 215–221.

- Chen, C. (2013). Perceived risk, usage frequency of mobile banking services. Managing Service Quality, 23(5), 410– 4360.

- Dyakova, О. N. (2011). Remote banking services in the activities of banks. Saransk: University n.a. N.P. Ogarev.

- Fitchratings (2015). Rating of the creditworthiness of Bashsnoshbank (PAO) FitchRatings, Inc. Russia. Retrieved from: www.fitchratings.ru.

- Laukkanen, T. (2007). Internet vs mobile banking: comparing customer value perceptions. Business Process Management Journal, 13(6), 788–797.

- Lin, H.-F. (2012). Determining the relative importance of mobile banking quality factors. Computer Standards & Interfaces, 35(2), 195–2040.

- Pousttchi, K., & Schurig, M. (2004). Assessment of today ’s mobile banking applications from the view of customer requirements. In Proceeding of the 37th Hawaii International Conference on System Sciences (pp. 1–10).

- Riquelme, H. E., & Rios, R. E. (2010). The moderating effect of gender in the adoption of mobile banking. International Journal of Bank Marketing, 28(5), 328–341.

- Sanli, B., & Hobikoglu, B.E. (2015). DevelopmentofInternetBanking as the Innovative Distribution Channel. In Turkey Example «World conference on technology, innovation and entrepreneurship» (pp. 343–352). Istanbul, Turkey.

- Teran, L., Horst, L.C., Valencia, B.F., & Rodriguez, P. (2016). Public Electronic Payments A Case Study ofthe Electronic Cash System in Ecuador.In Third International Conference on Edemocracy & Egovernment (ICEDEG) (pp.65–70).Sangolqui, Ecuador.

- Unite, A.A., & Sullivan, M. J. (2003). The effect of foreign entry and ownership on the Philippine domestic banking market. Journal of Banking and Finance, 27(12), 2323–2345.

- Villavarajah, R. (2008). Changing face of banking moving towards branchless banking. Bankers Journal, 26(2), 7–10.

- Zhang, L., Zhu, J., & Liu, Q. (2012). A meta-analysis of mobile commerce adoption and the moderating effect of culture. Computers in Human Behavior, 28(5), 1902–1911.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2019

Article Doi

eBook ISBN

978-1-80296-075-4

Publisher

Future Academy

Volume

76

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3763

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Ponomaryova, L., Nurdavlyatova, E., Galimova, G., & Bayguzina*, L. (2019). System Approach To Development Of Innovative Bank Products In Bashkortosta. In D. Karim-Sultanovich Bataev, S. Aidievich Gapurov, A. Dogievich Osmaev, V. Khumaidovich Akaev, L. Musaevna Idigova, M. Rukmanovich Ovhadov, A. Ruslanovich Salgiriev, & M. Muslamovna Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism, vol 76. European Proceedings of Social and Behavioural Sciences (pp. 270-277). Future Academy. https://doi.org/10.15405/epsbs.2019.12.04.38