Abstract

The paper analyzes sources of long-term financing of small and medium-sized enterprises (SMEs) in changing macroeconomic environment, in particular, economic sanctions and import substitution industrialization. With this in view, it actuates new challenges to provide financial support for SMEs, emanating from main obstacles to their performance and highlighting the need for external and internal factors that influence the decision as to which source of funding is most suitable for each business in a specific series of circumstances. It proposes a scientific rationale for some major funding sources available for small companies, based on an empirical study of financial flows that need to be established. It proposes some methodical guidance on design and operation of the strategy for SME financial flows, based on analysis of advantages and disadvantages of long-term funding sources for SMEs to run business. The paper explores theoretical aspects of digital platforms being established for monitoring and analyzing financial flows of SMEs. They provide the possibility to identify problem areas and develop guidance on the design and establishment of effective strategy for financial flows. Small companies specializing in services may become the main segment of SME growth in Russia. Developed countries provide substantial support to small business and benefit from them in the form of taxes, development of innovations, and employment of the population. Small business abroad is at a higher level than in Russia. It is necessary to address the challenge of choosing financing instruments to ensure sustainable economic development in conditions of digital transformation.

Keywords: Analysisfinancingsmall and medium-sized enterprisesdigital economyinvestment

Introduction

The criteria for classifying enterprises as small and medium enterprises in most countries involve the number of people employed or the volume of turnover. The self-governance of such enterprises is entailed by the form of ownership, and self-financing – by the sources providing production and financial activity. Business leaders, mostly joint-stock companies, are more likely to obtain loan capital. However, for SMEs to be set up and nourished, it is the other way around.

The frequent phrase “lack of equity” in SMEs is due to the fact that they can participate in their own financing only within narrow boundaries, since private opportunities, for example, for family businesses, are limited. Besides, it is undesirable to receive financial resources from external participants. All this combined, make entrepreneurs to be unwilling towards such a business. On the one hand, the involvement of many new entrepreneurs who provide capital is unprofitable, because their right to equity can change the nature of that same family business. On the other hand, potential investors, like small and medium entrepreneurs themselves, face the problem of information asymmetry that implies being not sufficiently aware of the benefits of a particular form of financing. This is compounded by the fact that entrepreneurs are wary of risks that their business, for example, by way of stocks that can be bought up on the stock exchange, is subject to high risk, which also creates a problem for the new investors themselves. The article (Beck et al., 2018) emphasizes the effectiveness of payment instruments for small businesses as they grow and get access to credit in developing countries where financial constraints are getting increasingly tight.

A wide range of measures to stimulate the development of various funding sources for SMEs within integration unions, countries, the European Union, and development institutions encompasses numerous areas and differs subject to many problem situations. Different definitions with the same nature of SMEs in different countries significantly complicate for entrepreneurs the access to funding sources. The development of SMEs with these aspects in view – not only technically – should be simplified. Discussion and information are viewed to be priority objectives. However, it should be clear that the consolidation of capital, for example, when merging small enterprises, should not be invoked to diminish the financial position of entrepreneurs. Despite being most vulnerable to adverse economic factors leading up to their decreased share in developing economies, SMEs are constantly making their way to the market. Key factors that make this happen involve low start-up investments and poor ability to be in line with the market needs.

The authors (Tsai & Kuo, 2011) emphasize the crucial contribution of small and medium-sized enterprises to job creation and, following a study, show that the proposed strategy provides for the most effective solution to reach out to individuals to evaluate and choose possible options for entrepreneurship policy. Arising from budget constraints, the emphasis was placed on the three alternatives, namely: an incubator center, financial aid, and a platform for sharing knowledge.

In the aftermath of major financial crises, proposals tend to be replete with attempts to create renewed monetary and financial instruments with a view to “acting differently” (Ansart & Monvoisin, 2017).

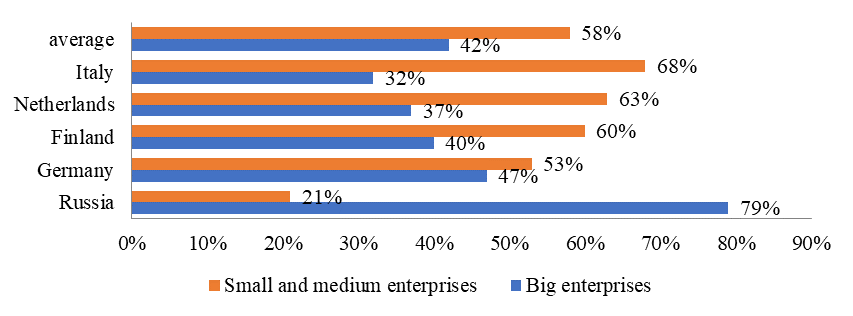

A significant SME impact on the economy is confirmed by global statistics. Thus, the share of small and medium enterprises in the GDP of such countries as Italy, the Netherlands is almost twice the share of large enterprises, 68%; 32%; 63%; 37%, respectively. In Finland and Israel, it accounts for 60% (Russian Venture Company). In Germany, where small business is most actively developing, their share makes up 52%. In Russia, the share of large business is still 79%, with average share of SMEs in different countries to amount to 58% (Fig. 1). Over 20 millions of small enterprises in the US employ half of the workforce of the country, with the share of such enterprises accounting for more than 40% of GDP. If in America every third family has something to do with business, in the EU countries over half of the population works in this area.

Среднее по странам – average share, Italy, the Netherlands, Finland, Germany, Russia, малые и средние предприятия – small and medium enterprises, крупный бизнес – large business

Problem Statement

Many domestic and foreign scientists address the challenges related to financing SMEs. However, today a pressing need remains for further empirical analysis of the search and rationale for funding sources relevant for SMEs in the context of digital economic transformations. It is necessary to take into account their unique qualities and role in tackling the strategic tasks needed to implement national projects, boosting their potential to budgetary targeting at appropriate levels. Establishing and ensuring operability of highly efficient, from the economic point of view, strategies for SME financial flows on a digital basis is one of the significant aspects of the majority of small and medium-sized businesses. Insufficiently elaborated solutions to the formation of a unified methodological basis for deciding on the funding sources relevant for SMEs brings about a managerial problem. It implies the discrepancy between the existing guidance to justify an approach to an empirical study of cash management and the desired state of governance based on a uniform set of recommendations for SMEs, which is indispensable for socio-economic and other functioning of a business on a digital platform.

Research Questions

The measures currently in place to provide financial support to entrepreneurs increasingly empower them to establish and develop new SMEs. However, the requirements of economic digitalization put forward new challenges due to the changes in the conditions, nature, and scale of activity of small and medium enterprises. Strengthening the role of SMEs in establishing a competitive environment, creating jobs, improving employment rate proves the relevance and need for scientific substantiation of ways and methods to justify decisions on the choice of financing sources for SMEs, as shown by the experience of more developed countries in terms of entrepreneurship support. This predetermined the choice of the topic.

Purpose of the Study

The study aims to carry out an empirical analysis of sources of financial support to SMEs and to propose solutions to the challenge of justifying sources of financing, taking into account business development priorities and requirements of economic digitalization.

Research Methods

Empirical analysis of funding sources for SMEs is based on the use of such methods as observation, system analysis, comparative analysis, and modeling. The findings lead to some guidelines for the justification of funding sources and grouping them in a financial flow strategy developed by the authors following long-term funding sources. The practical output of the study is that the application of the proposed strategy for SME financial flows upon the sources of their formation improves the reliability of decisions on the sources of investment financing. Likewise, within digital platforms and the necessity to select sources of financing, it is possible to improve the reliability of the initial information assessment when planning the amount of financing, investment efficiency, etc., to streamline the use of financial resources by improving the equity-borrowed ratio and increasing solvency and financial sustainability of a business.

Findings

Analyzing statistical data in recent years enables to reveal some positive trends in macroeconomic conditions reflected in the extent and framework of financial support for SMEs. This is due to the respective legislation, the interaction of SMEs with financial organizations that actualize financial conditions created for their involvement in import substitution policy.

Reproduction movement of capital and other resources as a necessary condition for advancing the development of small and medium-sized businesses is an integral part of the Digital Economy Program of the Russian Federation. The Program is aimed at addressing a pressing challenge that implies creating a modern information and communication platform for interaction in the framework of domestic and export-import relations mediated by financial flows (Government of Russia, 2017).

Despite the fact that there is favorably managed entrepreneurship like participatory companies that are invested through an over-the-counter method of distributing shares, limited liability companies, limited partnerships, there is an ongoing demand for risky capital among small and medium-sized entrepreneurs. This is due to the most common SME financing impediments that are identified and arranged by the authors based on an analysis of SMEs in various areas. They are as follows:

Entrepreneurs who sign agreements to provide for unforeseen risks that are likely to arise need government support viewed as a potential for making a profit or reducing losses. The effect of such support in the form of subventions is necessary to generate resources, since government assistance, for example, in management, regulation, guidance, etc. contributes to the effective business strategy. Nonetheless, the question arises as to whether the level of the country’s social development somehow affects the effectiveness of entrepreneurial activity. The implementation of policy to support entrepreneurs is effective provided that they are aware of the nature and purpose of restrictions.

State-built “rigid” types of taxes, fees and imposts can impede the effectiveness of SMEs.

Missing or inadequate investments in infrastructure and education that can be built in such a way as to cause public damage to business or infringe on business interests.

There is insufficient international comparison between SMEs without relevant consideration of their results. It is reasonable to consider investment management methods in certain business areas of different countries. International issues, including the ability to compete, employment increase, stabilization of the living standard and social system, call for the high competence of managers and the entrepreneur as such.

Market opportunities related to risks should be addressed in view of their relationship with the problems of socialization.

To cope with the above difficulties that are often unavoidable, the following measures are proposed:

removing bottlenecks as a long-term challenge of digitalization, which tends towards the safety of assets and their rational use. This calls for an economically viable structure to address social issues and avoid a reduction in the employer’s contributions to the social insurance (social security) fund;

introducing incentives to encourage preferential taxation. A fee should be paid according to the results of entrepreneurship at a local, regional or national level; there should be no discrimination in taxation, self-financing, business start-ups, the use of risk financing, and directly through subvention of alternative money forms and deposits;

providing regular assessment of the need to contribute “support” to the information and educational infrastructure that is also needed for the establishment and management of entrepreneurship. It is financing of SMEs that, among others, facilitates the acquisition of missing and full-fledged market-related knowledge and tools;

challenging government activity in the field of SME support should not lead to a risky financing of the foundation and functioning of small and medium-sized businesses. SMEs still face problems with regard to, on the one hand, the conflict between the innovative foundations of entrepreneurship and increased competition in this area and, on the other hand, the management of investments in knowledge and wasteful competition of production factors. However, in some cases it is possible to come to a consensus in the conflicts listed, or, at least, to change financing mechanisms including limited financial preferences to ensure the initial start-up capital for SMEs.

This paper (Mejri, MacVaugh, & Tsagdis, 2018) discusses the configurations of knowledge, i.e. combinations of knowledge and sources, between enterprises of knowledge-intensive small and medium-sized enterprises (SMEs) in a developing economy with the knowledge to be depicted as a key to theorizing. It actuates viable ways for further research focused on a specific context and practice.

Let us give an example of the maximum possible favourable conditions for SMEs using a digital platform of a bank.

Sovcombank: The “Minimum Rate Guarantee” service of 11.9% per annum for the majority of loans issued by Sovcombank. The service brings the benefit of reduing the percentage of the current loan to 11.9%. To get the “Minimum Rate Guarantee”, you should:

provide proof of income;

at the time of applying for a loan, activate the “Minimum Rate Guarantee” service (service activation is a percentage of the loan accrued);

avoid delinquencies on the loan during the whole term, make payments without early repayment;

at full repayment of the loan, interest is recalculated on the “Minimum Rate Guarantee” of 11.9%, and the difference is returned to the customer’s account.

One of the reasons that restrain investments in the fixed capital of SMEs is that it takes long to set up modern production during which investors do not receive income. Accordingly, long-term extraction of funds from the turnover or the possibility of long-term borrowing is necessary (Schemelev & Shumaeva, 2018).

An important trend of modern digital economy is the development of technology that allows a small company to produce high-tech products that were previously available only to well-equipped large enterprises. In particular, 3D printing, computer-aided design can be a mainspring for the development of SMEs in Russia. From an international practice standpoint, an important element of the SME support is technology parks that provide their residents access to modern production equipment (multi-axis processing centers, etc.).

The use of industry best practices, reliance on key trends and growth of the service sector are necessary conditions for successful integration of SMEs into the global economy. This is typified by the Finnish city Oulu – a modern high-tech center that features a developed small business that relies on the interaction of business managers and local university scientists. Scientists analyzed the factors affecting the business results and established the following ratios: the capacity and expertise of the management team predetermine the success of high-tech companies by 50-60%; market selection and demand – by 20-30%; technology – by 10-20%; financing – by 5-10%. For Finland, the funding factor is 10-20% (Skolkovo Consortsium, 2012).

Medium-sized business: in developed countries, the share of such companies specializing in the service sector is about 50%. Likewise, there are far more production companies – up to 20%, on average, regardless of the level of economic development in the corresponding sector.

A major barrier to the development of SMEs is that financing costs for SMEs are often higher than for large companies. This is associated with a high risk of financing, and not all financial constraints are imposed from the outside. Risks may arise due to the relationship of business owners. Many of them are not willing to consider attracting financing through new issues of common stock to third-party investors, since this entails a dilution of control over the business.

The proposed empirical approach and synthesis of the experience of financial support for entrepreneurship resulted in a model of the most important sources of financing for SMEs (Fig. 2).

To put the proposed model to use at the level of SMEs, it is necessary to gradually perform the following actions: to analyze the current schemes of cash inflows and outflows at the enterprise; to develop an algorithm for calculating financial indicators; to create a system for budgeting financial flows; to consolidate the management of financial flows for the units within the existing organizational structure; to organize a system to control the use of financial resources (Gilmiyarova, 2015).

To ensure flexible management of processes, production and production lines, a predictive approach is necessary (with large amounts of data on the use of financial flows). In this case (intellectual production, the increasing complexity of machines and technologies) the focus is on employee knowledge, professional and engineering skills (Rachkovskaya, 2018).

Conclusion

In the course of empirical analysis of SME financing, the main barriers for entrepreneurship include:

inadequate financial management skills to comply with digital economy that do not allow developing robust business plans that follow up investors’ requests;

poor awareness (lack of knowledge) of available long-term financing sources;

lack of satisfactory security;

insufficient experience in using evaluation criteria (for example, a favorable credit history over five years);

bureaucratized approach to the selection of applications and applicants for credit.

Following the results of an empirical analysis, the areas of financial assistance for SMEs are proposed, which should be considered as the cornerstone for determining funding sources:

A program to support small and medium-sized businesses as a whole (with integration into environmental protection concepts and programs, regional requirements, foreign interactions, liquidity).

The buildup of the requirements to underpin programs for SME set up for persons who become independent entrepreneurs.

Innovation development with human capital involvement.

Risk capital and share capital (promotion of innovative development).

Surety commitment (guarantees).

Financial benchmarking (by sources) as the basis for creating new jobs, developing new types of activities, particularly in the field of innovative industries, is a necessary condition for the success of SMEs. In order to accomplish this task, SMEs review their schemes and sources of funding, focusing on the scientific rationale of accessible, costly funding sources and financial flow approaches that, despite being mostly shaped, do not address the increased empowerment to attract long-term funds. This happens due to the lack of systematic research into an integrated approach to creating and managing a model of financial flows on a digital platform for SMEs. Affluent, fast-growing small businesses are an attractive target for a takeover by large companies. Therefore, the share of medium-sized companies, with a staff of 50 to 250 people, is relatively small worldwide and amounts to 2-5%. The sectoral structure of small businesses with up to 10 employees is determined, as practice shows, by the macroeconomic environment: in developed countries, almost 60% of such companies specialize in services. This is due to the high solvency of the population. In developing countries, the share of small businesses in the service sector is 40%.

Establishing and ensuring operability of highly efficient, from the economic point of view, strategies for SME financial flows on a digital basis is one of the significant aspects of the majority of small and medium-sized businesses.

References

- Ansart, S., & Monvoisin, V. (2017). The new monetary and financial initiatives: Finance regaining its position as servant of the economy. Research in International Business and Finance, 39, 750–760.

- Beck, T., Pamuk, H., Ramrattan, R., & Uras B. R. (2018). Payment instruments, finance and development. Journal of Development Economics, 133, 162–186.

- Gilmiyarova, M. R. (2015). Development of Cash Flow Management in the Corporate Structure Perm University Herald/ ECONOMY, 3(26), 115–125.

- Government of Russia (2017). Program Digital Economy of the Russian Federation Retrieved from: http://static.government.ru/media/files/9gFM4FHj4PsB79I5v7yLVuPgu4bvR7M0.pdf

- Mejri, K., MacVaugh, J. A., & Tsagdis, D. (2018). Knowledge configurations of small and medium-sized knowledge-intensive firms in a developing economy: A knowledge-based view of business-to-business internationalization. Industrial Marketing Management, 71, 160–170.

- Rachkovskaya, I. A. (2018). Industry 4.0: Prospects for the Development of Intellectual Logistics Logistics: Current Development Trends. In V.S. Lukinsky et al. (Eds.), Proceedings of the XVII International scientific-practical conference April 12–3, 2018. Part 2: material of the (pp. 38–41). St. Petersburg: Publishing House of Admiral Makarov State University of Maritime and Inland Shipping.

- Schemelev, S. N., & Shumaeva, S. I. (2018). Investment Activity as a Condition for Modernization of the Russian Economy Digital Revolution in Logistics: Effects, Conglomerates and Points of Growth. In Proceedings of the International scientific-practical conference. XIV South-Russian Logistics Forum (pp. 325–328). Rostov on Don: Publishing and Printing Complex of RSUE.

- Skolkovo Consortsium (2012). Paper on the Technopolis Network (Finland). Retrieved from: https://sk.ru/news/b/press/archive/2012/04/16/statya-o-seti-tehnoparkov-technopolis-finlyandiya-na-osnovanii-intervyu-s-ee-osnovatelem-pertti-huuskonenom-i-sozdatelem-tehnoparka-otaniemi-finlyandiya-mervi-keki.aspx

- Tsai, W.-H., & Kuo, H.-Ch. (2011). Entrepreneurship policy evaluation and decision analysis for SMEs. Expert Systems with Applications, 38(7), 8343–8351.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2019

Article Doi

eBook ISBN

978-1-80296-075-4

Publisher

Future Academy

Volume

76

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3763

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Bashirzade*, R., Garibov, R., Odintsova, T., Pakhomova, A., & Glushkova, Y. (2019). Empirical Research Of Financial Assistance For Enterprises In Digital Econom. In D. Karim-Sultanovich Bataev, S. Aidievich Gapurov, A. Dogievich Osmaev, V. Khumaidovich Akaev, L. Musaevna Idigova, M. Rukmanovich Ovhadov, A. Ruslanovich Salgiriev, & M. Muslamovna Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism, vol 76. European Proceedings of Social and Behavioural Sciences (pp. 243-251). Future Academy. https://doi.org/10.15405/epsbs.2019.12.04.34