Abstract

A strategically important sector of the national economy is agriculture as the basis of the country's food security. The targets set for agriculture are difficult to implement without government support. The proposed differentiation principle based on the average performance of enterprises is fundamental in allocation of budgetary funds. In these conditions, the activities of economic entities of the agricultural sector are recognized to be most unprofitable. Agricultural enterprises are forced to cover their current needs through late repayment of accounts payable due to the lack of working capital forces. The lack of current assets adversely affects solvency and does not yield positive financial results. In this case, it is relevant for agricultural enterprises to attract additional funds from external sources. Credit use poses various difficulties, especially for medium and small agricultural enterprises. Banks set high requirements for agricultural enterprises when granting a loan. First of all, the interest rates are high due to significant risks during agricultural activities. Borrowed funds help to expand the economic activities of enterprises. Farmers expect to receive a soft loan, but the conditions of banks are difficult to fulfill for most enterprises due to the above-described trends in the financial development of businesses. The study emphasizes that the use of guarantee funds can have a beneficial effect on the development of the agricultural sector. The funds can assist to obtain necessary funds through guarantees under leasing agreements and credit agreements.

Keywords: Agricultural enterprisesbudgetunprofitabilityloansaccounts payableinsurance

Introduction

In recent years, the food embargo and sanctions imposed by the United States and Europe and the fall in oil prices among other things have contributed to the growth of agriculture in the Russian Federation (Naminova, 2018).

Agriculture developed under conditions of substantial government support in accordance with the following targets (Russian Government, 2012):

- insurance of food independence of the country;

-improvement of the competitiveness of Russian agricultural products in the domestic and foreign markets as part of Russia's accession to the WTO;

- improvement of the financial stability of producers of the agro-industrial complex;

-sustainable rural development; reproduction and increased efficiency of agricultural lands and other resources and greening of production.

Fulfillment of all the goals set is not possible without government support; moreover, the problem of bankruptcy of the whole industry can be of genuine concern. The principle of differentiation of budgetary amounts remains in effect. When allocating, the average indicators of agricultural enterprises are considered.

Over the years, the share of expenditures on agriculture in the total amount of expenditures is insignificant: in 2015 – 1.22%, in 2016 – 1.06%, in 2017 – 1.06% (Table

The data in Table

A group of authors under the direction of Bobyleva (2013) notes in their study that in foreign countries and CIS countries this figure varies in the range of 8–32% (USA–32%, Denmark–16%, Ireland–10%, Great Britain–8% , Azerbaijan–13%, Belarus–11%, and Kazakhstan–9%).

Despite these totally different figures, the budget is the main source of financing agricultural expenditures. Along with this, each region of the country participates in supporting agriculture based on revenues that form the budgets of the subjects.

Problem Statement

The study is of current relevance since it addresses the problem of identification of the features of financing of Russian agricultural enterprises, which are closely dependent on features of agricultural production. Agriculture that provides food security of the country, like no other industry, requires budgetary support. Unprofitable agricultural enterprises, lack of working capital, reduced solvency and lack of an organized system of agricultural risk insurance makes this problem urgent in the activities of agricultural enterprises. At the same time, the study results obtained show ineffectiveness of the measures taken by the government.

Research Questions

The identified problems related to agricultural financing make it possible to search for additional sources. The authors emphasize that risky activities can be mitigated by means of the agricultural risk insurance mechanism and a guarantee mechanism through guarantee funds.

Purpose of the Study

The study provides analysis and evaluation aimed to identify problems in agricultural financing.

Research Methods

The analysis and evaluation of agricultural financing were performed using official data from the Federal State Statistics Service of the Russian Federation were used. The methods employed included economic statistical and graphical methods.

Findings

The current state of the agricultural industry shows positive development trends. High quality domestic products become competitive. All of the above confirms the need to further develop the process of expanded reproduction.

The share of unprofitable agricultural enterprises in the Russian Federation tends to decrease every year. This happens simultaneously in the context of a decreased number of agricultural enterprises (Table

The highest share of unprofitable agricultural enterprises was observed in 2013 – 30.4%, and in 2017, this number attained 16.8% of the total number of enterprises, which can be attributed to the disparity of prices for agricultural products, high deterioration of the main types of agricultural machinery, late replacement of obsolete fixed assets by state of the art ones.

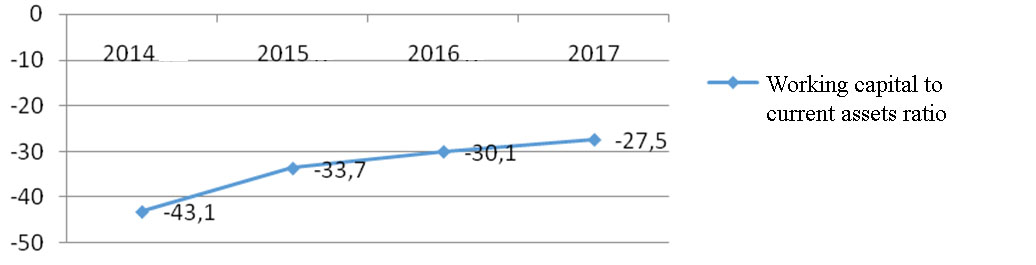

The practices of Russian agricultural enterprises show complete lack of working capital in the industry (Figure

It is a fair assumption to say that agricultural enterprises cover their current needs through late payment of accounts payable, which is confirmed by the following data: in 2017, overdue accounts payable amounted to 17816 mln rub, which is 7777 mln rub less than that in 2014 (Finance of Russia, 2018). At the same time, the size of overdue accounts payable in economic entities of agriculture, hunting and forestry is high.

These conditions and specific features of agricultural production manifested in a low rate of capital turnover, and hence, the lack of current assets show the need for bank loans in agricultural enterprises, especially in small and medium-sized enterprises. This is important due to the fact that working assets are essential indicators of the financial responsibility of an agricultural enterprise. When granting a loan, banks set high requirements for agricultural enterprises. First of all, banks charge high interest rates due to significant agricultural risks.

In 2017, the total amount of loans of agricultural enterprises increased by more than 1.5 times compared to that in 2011. A positive aspect is the reduction of overdue payables throughout the analyzed period (Table

Mikhailova (2018) emphasizes

a limited number of banks which provide loans to agricultural enterprises; the procedure for receiving a soft loan is prolonged due to its multi-stage nature; in some cases, the effectiveness of subsidized assistance is still not taken into account, a low level of control does not allow assessment of the targeted use of allocated state funds. Another important to receive a soft loan is the absence of arrears of taxes, salary and previously received loans (para. 5).

Conclusion

Thus, based on the above, we have focused on the problems associated with the difficulty of obtaining loans for agricultural enterprises:

1. insignificant share of consolidated budget expenditures on agriculture and fisheries in the total volume of expenditures;

2. lack of sufficient working capital, which leads to failures of business entities;

3. overdue payables.

At the same time, we assume that another important problem is the insufficiently developed system of agricultural insurance, which limits the loan possibilities for agricultural enterprises.

It should be emphasized that the regulatory and legal framework for this insurance segment is poorly developed. In addition, Russia’s accession to the WTO requires new approaches to ensuring the assessment of agricultural risks (existing methods either hardly work or do not work at all for certain reasons) and to defining agricultural damage due to the number of agricultural sectors (Naminova, 2016).

The problem is obvious, and it implies not only the number of adopted laws, decrees and orders, but also their effectiveness.

A special law dated July 25, 2011 No. 260-FZ On State Support in the Field of Agricultural Insurance and on Amendments to the Federal Law On the Development of Agriculture (with amendments and additions) in Article 2 Basic concepts ... provides the following definitions: beneficiary, forced slaughter of farm animals, death of farm animals, association of insurers, agriculture insurance supported by the government, crops, farm animals, policy holder, insurance provider, authority, the authority of the Russian Federation) yield of crops, loss (failure) of crops, loss (mortality) of perennial plantings, loss (death) of farm animals, and parties to agricultural insurance.

The definition of the concept of "agricultural risk insurance" is not presented here. How is the concept of "agricultural risk insurance" interpreted by law? Initially, it is necessary to define the concept "risk", but this causes another problem. The problem states that the regulations and insurance regulatory frameworks – the Civil Code, the Federal Law On the Organization of Insurance in the Russian Federation dated November 27, 1992 No. 4015-1 (with amendments and additions) – do not provide a complete and accurate definition of the concept. Thus, in the Federal Law On the Organization of Insurance in the Russian Federation, insurance risk is interpreted as "insurance of the expected event." That is, the concept of "insurance risk" is interrelated with the concept of "insurance event." The Civil Code of the Russian Federation also manifests the problems associated with the interpretation of insurance terminology.

According to the authors, the guarantee mechanism implemented through warranty funds will be relevant. Currently, there are about 80 warranty funds. The warranty funds in Russia are supervised by the Ministry of Economic Development of the Russian Federation, SME Corporation, and regional executive authorities. The funds provide assistance for small and medium-sized enterprises, including agricultural ones, in obtaining funds through the provision of guarantees under leasing agreements, credit agreements, and bank guarantee agreements.

According to the results of the study, we highlighted the main problems encountered by agricultural enterprises. The provided assistance had a positive impact on the development of the industry, however it is still ineffective.

References

- Bobyleva, A. S. (2013). Methodology and mechanisms for the formation of an integrated financial policy for the development of agricultural enterprises: monograph. Moscow: Creative Economy.

- Mikhailova, N. S. (2018). Finance and credit mechanism for the support and development of agricultural enterprises. Retrieved from: http://www.vectoreconomy.ru/images/publications/2018/2/ financeandcredit/MIKHAYLOVA.pdf

- Naminova, K. A. (2018). State support and investment in agriculture of the Republic of Kalmykia. In Regional Russia: history and modernity: Proceedings of the All-Russian (national) scientific and practical conference. Komsomolsk-on-Amur.

- Naminova, K.A. (2016). Risk insurance in agricultural enterprises (theory, practice). Astrakhan: Astrakhan State University, Astrakhan University Publishing House.

- Rosstat. (2012). Russia in figures. Collected articles. Russian Federal State Statistics Service (Rosstat). Moscow.

- Rosstat. (2013). Russia in figures. Collected articles. Russian Federal State Statistics Service (Rosstat). Moscow.

- Rosstat. (2014). Russia in figures. Collected articles. Russian Federal State Statistics Service (Rosstat). Moscow.

- Rosstat. (2015). Russia in figures. Collected articles. Russian Federal State Statistics Service (Rosstat). Moscow.

- Rosstat. (2016). Russia in figures. Collected articles. Russian Federal State Statistics Service (Rosstat). Moscow.

- Rosstat. (2017). Russia in figures. Collected articles. Russian Federal State Statistics Service (Rosstat). Moscow.

- Rosstat. (2018a). Russia in figures. Collected articles. Russian Federal State Statistics Service (Rosstat). Moscow.

- Rosstat. (2018b). Russia in figures. Collected articles. Russian Federal State Statistics Service (Rosstat). Moscow.

- Russian Government (2012). Government Decree No. 717 of July 14. On the State Program for the Development of Agriculture and Regulation of Agricultural Products, Raw Materials and Food Markets for 2013–2020. Collection of Legislation of the Russian Federation of August, 6, 32.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2019

Article Doi

eBook ISBN

978-1-80296-075-4

Publisher

Future Academy

Volume

76

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3763

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Naminova*, K., Makaeva, K., Bakinova, T., Boldyreva, S., & Darbakova, N. (2019). Features Of Agricultural Financing In Russia. In D. Karim-Sultanovich Bataev, S. Aidievich Gapurov, A. Dogievich Osmaev, V. Khumaidovich Akaev, L. Musaevna Idigova, M. Rukmanovich Ovhadov, A. Ruslanovich Salgiriev, & M. Muslamovna Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism, vol 76. European Proceedings of Social and Behavioural Sciences (pp. 2393-2398). Future Academy. https://doi.org/10.15405/epsbs.2019.12.04.320