Abstract

The paper studies the relevance of investment processes at a regional level and features of investment activities in the Republic of Kalmykia. Through methods of economics and statistics analysis, methods of analysis and synthesis of economic information the paper addresses and analyzes investment performance, current investment trends in the region. The organizational support of investment activity of the region does not satisfy all qualifying standards and is presented by technological and financial infrastructure of the investment process, systems of information and staff supply of economic activity. Following results of the study it was defined that the main industries for investment-driven development in the region are as follows: social sphere, agriculture, industry, transport and logistics hub, tourism and recreation complex. It was revealed that low specific weight in the total amount of investments and relatively weak dynamics of investments on account of loans from banks and other organizations justify a considerable potential of this resource for further intensification of the investment process in the region. In general, poor investment potential and high risks are reflected in low estimates of the Republic of Kalmykia in rankings of investment attractiveness of Russian regions. Various measures to increase the investment attractiveness of the region will lead to the growth of economy, improvement of the social sphere, increase of the standard of living of the population in the Republic of Kalmykia. In this regard, further study and analysis of the investment processes of the region presented in this paper are ever more required.

Keywords: Investment activitiesRepublic of Kalmykiaorganizational infrastructure

Introduction

In unstable conditions of the Republic of Kalmykia the measures aimed to develop its investment potential, the analysis of current investment trends of the region and the improvement of investment attractiveness of the republic are especially relevant. The investment activity defines the importance for further development of the social and economic sphere of the region, improvement of its competitive positions.

Insufficient study of organizational aspects of assessment and analysis of investment activities and processes at the regional level predetermined the issues considered within this study.

At the same time there is a need for further analysis of investment indicators, assessment of current investment trends in the region according to all available data obtained from the Territorial Body of the Federal State Statistics Service in the Republic of Kalmykia.

Problem Statement

Through the methods of economics and statistics analysis, methods of analysis and synthesis of economic information the paper addresses and analyzes investment processes in the region and their organizational support.

The Russian economic practice is characterized by the tendency typical for the international practice, namely the shift in the role of the regions (Goryushkina et al., 2018).

Thus, the globalization of world economy led not only to country-wide, but also to regional competition caused by a number of factors:

a region becomes a knot space where the regional policy, subjects of business and investors may interact, and the market of strategic investments takes the central position;

market niches for large enterprises are created based on the integrated regional markets;

there is a need to define the priority value of territorial development of the industry, which alongside with federal authorities and large businesses causes the appearance of high-profile regions mostly attractive to investors;

a set of characteristics of either region affects its investment attractiveness and, as a result, increases its gross regional product (GRP).

Investments are one of the most effective measures of economic recovery. Without investments it is impossible to ensure structural reorganization of the economy, to increase the technological level of production and to improve the competitiveness of domestic production both at domestic and global levels (Generalov, Kuchin, Suslov, Ryabova, & Kurilova, 2019).

Research Questions

The experiment of market relations development showed that investments are the most important source of economic growth, a financial basis of the region’s progress. The objective approach to investments creates the need for evidence-based management mechanisms ensuring the maximum accounting of operating risks, efficiency analysis of undertaken measured and optimal decision making within investment projects.

In our opinion, the investment capital of the region represents the totality of intraregional investments sources: profit of enterprises, assets of regional institutional investors (banks, insurance companies, mutual funds, investment and pension funds), personal savings, state and municipal sources of investments (Khudyakova & Shmidt, 2018).

Purpose of the Study

The purpose of the study is to analyze the current state of investments at the regional level and to assess the investment processes in the Republic of Kalmykia.

Following the above purpose, let us define some necessary tasks:

- to study the organizational infrastructure of investment support in the Republic of Kalmykia;

- to reveal current investment trends in the region;

- to create the investment potential of the region.

The scientific novelty of the study includes the synthesis of organizational regulation of investment processes in the region, analysis and assessment of investment activity in the Republic of Kalmykia.

Research Methods

Through the methods of economics and statistics analysis, methods of analysis and synthesis of economic information the paper addresses and analyzes the problems of investment activity in the Republic of Kalmykia. The method of comparative analysis based on official statistics and the author’s estimates, as well as statistical methods made it possible to define the dynamics of indicators characterizing the current trends of investment activities in the Republic of Kalmykia.

Findings

The investment policy of the Republic of Kalmykia is based on the following:

- development of regional investment legislation and other regulatory base to support businesses;

- development of information transparency of the region;

- creation of specialized market infrastructure fostering the investment process.

In many respects the level of investment attractiveness of the region depends on measures taken by regional authorities to foster a constructive dialogue with the business (Ovsyannikova & Sokolova, 2015).

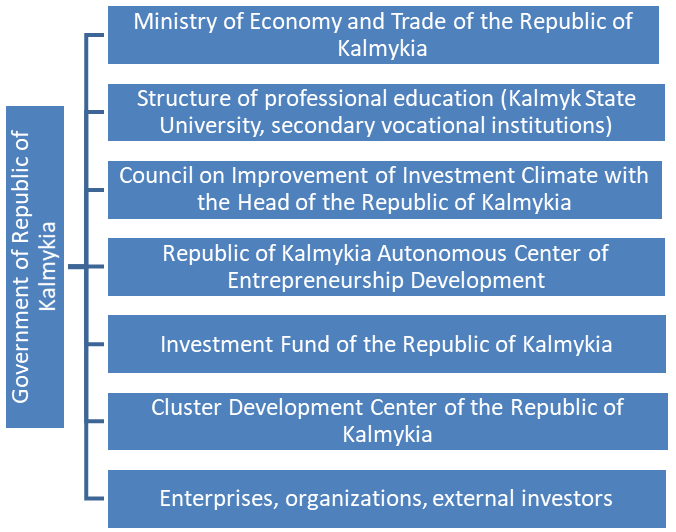

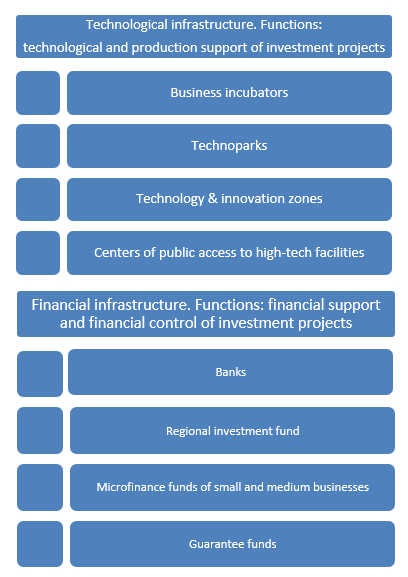

The organizational link of favorable investment policy is presented by technological and financial infrastructure of the investment process, systems of information and staff support of economic activity.

The Republic of Kalmykia has several organizations and associations forming the investment infrastructure. Besides, it shall be noted that the development level of this infrastructure failed to reach its high functional potential (Figure

At present, specific institutes of small innovative ventures (technoparks, business incubators, technology transfer centers, venture funds, etc.) are not created in the republic or are still at their development stage.

The staff supply system is suffering due to lack of clear regional educational strategy and weak relations between business and education (Figure

The overall investment performance in the region is “offset” by its fragmentarity, lack of core development conditions (Zakharov, 2019). Moreover, it shall be highlighted that the current system of investment support in the republic implies limited implementation of the following strategically important functions:

- coordination of short-term and long-term objectives;

- analysis of current investment climate and prerequisites of its functioning;

- developments of mechanisms of objective fulfillment;

- implementation of set objectives and tasks;

- expeditious monitoring of undertaken measures and assessment of their efficiency;

- introduction of amendments in case of discrepancies or deviations of support measures (Hines & Park, 2019).

The investments into fixed capital in the forecast period are characterized by the growth of equity contribution to such types of activity as mining, production and distribution of energy, gas and water, agriculture, hunting and forestry and processing industry, caused by the use of resource-intensive investment projects in these industries throughout the forecast period.

Table

In comparison with the previous year the volume of investments increased by 1.3 billion rubles or 14% in comparison with 2016. The Republic of Kalmykia takes the 78th place across the Russian Federation on the level of capital investments per capita (32,000 rub.). The decrease of this indicator in comparison with 2016 by almost twice indicates inefficient policy of capital investments.

Table

The structure of investments from Russian sources is characterized by the prevalence of investments into private property, investments to the municipal sector are reduced twice in comparison with the previous year.

Table

Having considered the structure of capital investments by types of fixed assets in 2017 (percentage of the total amount of investments) split by the subjects of the Southern Federal District it may be concluded that investments to buildings and structures, land improvement costs prevail in the Republic of Kalmykia (Table

Compared to other regions the distinctive feature of capital investments by types of fixed assets in the Republic of Kalmykia in 2017 (percentage of the total amount of investments) are considerable investments into intellectual property assets amounting to 11.4% of the total amount of investments, which is 4 times more than the average value across the Russian Federation.

In 2019-2020 the positive dynamics of capital investments is predicted due to the following investment projects: feed-lot farm for beef strain with personal food supply in the Oktyabrsky District of the Republic of Kalmykia (LLC Kalmbif), greenhouse facility in the Troitskoye village of Tselinny District, oil production in Yuzhno-Plodovitenskoye field in Plodovitensky District (OJSC RITEK), waste sorting plant and solid household waste facility in the Republic of Kalmykia (LLC SpetsATH), drainage systems from the Iki-Burulsky water supply system with the connection to the North Levokumsky water deposit to supply drinking water to Iki-Burulsky, Priyutnensky, Tselinny settlements, as well as the construction of Astrakhan-Kochubey-Kizlyar-Makhachkala highway (R-215), reconstruction of Yashkul -Komsomolsky-Artezian Highway.

However, the current volumes of investments are obviously insufficient for the revival of the processing industry in the Republic of Kalmykia thus ensuring its modern economic growth.

Conclusion

The statistical dependence of the real GRP growth rates on the dynamics of real investments in the Republic of Kalmykia is less obvious than on average in the Russian Federation. It is caused by relatively large volumes of investments into social infrastructure considering the limited scales of commercial investments.

The priority fields of investment development of economic sectors in the Republic of Kalmykia are as follows:

1) social sphere;

2) agriculture;

3) industry;

4) transport and logistics hub;

5) tourism and recreation complex.

To implement the strategic objectives, ensure the growth of social and economic development of the Republic of Kalmykia, it is planned to solve the following interrelated tasks:

- to achieve material well-being and create conditions fostering the increase in the standard of living of the population by rising the employment rates and gradually reducing the load of personal budgets;

- to achieve sustainable economic growth by increasing the role of the republic in the integration of the Southern Federal District and the Caspian Sea Region thus ensuring the efficiency of finance and investment policy and systematic competitiveness enhancement;

- to ensure stable breakthrough growth of the inflow of investments.

There is a need to create the system ensuring availability of investments for the majority of large and especially small agricultural producers (Zhahov, Krivoshlykov, & Shatokhin, 2017).

Under current conditions related to the capital base deficit the priority investment could be the leasing of equipment with the introduction of the schemes of replacement of value due to giving obsolete machinery for scrap (experience of development programs of domestic automotive industry). It would make it possible to renew the field fleet and to support domestic manufacturers of agricultural machinery.

Relatively weak dynamics of investments on account of loans from banks and other organizations justify a considerable potential of this resource for further intensification of the investment process in the region.

In general, poor investment potential and high risks are reflected in low estimates of the Republic of Kalmykia in the rankings of investment attractiveness of Russian regions. Various measures to increase the investment attractiveness of the region will lead to the growth of economy, improvement of the social sphere, increase of the standard of living of the population in the Republic of Kalmykia.

References

- Generalov, I. G., Kuchin, N. N., Suslov, S. A., Ryabova, I. V., & Kurilova, A. A. (2019). Assessment of regional grain farming development for sustainability. International Journal of Advanced Biotechnology and Research, 10(1), 223–231.

- Goryushkina, N. E., Vakhrushev, I. B., Akhmetova, M. K., Otto, O. V., Pesotskaya, E. V., & Voinova, N. E. (2018). The world hotel market: Current state and development trends. International Journal of Mechanical Engineering and Technology, 9(12), 618–627.

- Hines, J. R., & Park, J. (2019). Investment ramifications of distortionary tax subsidies. Journal of Public Economics, 172, 36–51.

- Khudyakova, T., & Shmidt, A. (2018). The impact of crisis on the performance indicator of Russian enterprises. In International Multidisciplinary Scientific Conferences on Social Sciences and Arts. (pp. 741–748).

- Ovsyannikova, A. V., & Sokolova, I. S. (2015). Role of regional marketing in increase of investment appeal of the region. The Internet magazine "Naukovedeniye", 7, 5. Retrieved from: http://naukovedenie.ru/PDF/64EVN515.pdf (an open entry). DOI:

- Rosstat (2018). Central statistical database. Retrieved from: http://www.gks.ru/wps/wcm/connect/rosstat_ main/rosstat/ru/statistics/publications/catalog/doc_1138623506156

- Zakharov, N. (2019). Does corruption hinder investment? Evidence from Russian regions. European Journal of Political Economy, 56, 39–61.

- Zhahov, N. V., Krivoshlykov, V. S., & Shatokhin, M. V. (2017). Ways of modern agriculture in: specifics and state support. In 30th International business information management association conference - Vision 2020: sustainable economic development, innovation management, and global growth, IBIMA (pp. 3646–3652).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2019

Article Doi

eBook ISBN

978-1-80296-075-4

Publisher

Future Academy

Volume

76

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3763

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Khulkhachieva*, G., Markov, A., Uchurova, E., Pyurveeva, K., & Godzhaeva, E. (2019). Investment Activity Of The Region: Analysis, Problems, Prospects. In D. Karim-Sultanovich Bataev, S. Aidievich Gapurov, A. Dogievich Osmaev, V. Khumaidovich Akaev, L. Musaevna Idigova, M. Rukmanovich Ovhadov, A. Ruslanovich Salgiriev, & M. Muslamovna Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism, vol 76. European Proceedings of Social and Behavioural Sciences (pp. 1660-1667). Future Academy. https://doi.org/10.15405/epsbs.2019.12.04.225