Abstract

In modern conditions of universal development of industrial production and widespread expansion of automation of manufacturing process the environmental influence of the industry is becoming aggressive. Today the Russian system of environmental accounting almost lacks its legal regulation thus reducing performance indicators of nature protection measures at enterprises, exerting direct negative impact on environmental conditions and increasing environmental risks. Environmental tendencies foster the development of adjacent sciences in this area. At the same time principles and fundamentals of ecologization of the accounting system comes to the forefront within economic and environmental studies abroad and in Russia. The system of environmental accounting will make it possible to increase the information security of enterprises, regions and the state concerning the volume of environmental costs and results of various environmental actions, to significantly reduce the growing environmental risks and will strengthen environmental safety at micro, meso- and macrolevels. Besides, another critical problem is the assessment of probability of negative structural environmental changes mainly caused by anthropogenic or other influence, and hence the subsequent leveling of environmental risks becomes one of the most urgent problems these days. In this regard, in terms of theory and practice it is important to study the system of environmental accounting as a leveling tool of environmental risks. It is possible to level any environmental risks only within the multistage information complex, subsequent assessment and analysis of environmental data obtained from economic agents in close interaction with the active nature protection policy at regional and state levels.

Keywords: Environmental accountingenvironmental risksaccountingcostsinformation support

Introduction

Due to strict requirements to the International Financial Reporting Standards and the comprehensive problems of environmental pollution: air, forest, water and recreational resources, agriculture, the accounting of environmental costs and results, the information thus developed in environmental accounting is becoming ever more relevant. These prerequisites almost force the country leaders and economic agents to pay more attention to environmental policy, comprehensive risks minimization program and the action plan on their further implementation.

Problem Statement

The principles of environmental accounting, creation of efficient accounting system of environmental costs and results are being actively developed around the world. At the same time, the works of the Russian scientists do not pay due attention to increased environmental risks in the country and in the world. Besides, Russian enterprises facing environmental problems are aimed at the greatest possible accumulation of capital, growth of profit and profitability without considering environmental requirements. This served the condition for the topic of the study. The main purpose of this paper is to develop theoretical bases and practical aspects of the system of environmental accounting at enterprises that exert negative impact on the environment and environmental safety of the state in general.

Research Questions

For the first time the study of environmental accounting began in the 1970s of the 20th century therefore in nearly 50 years the basic models of environmental accounting and accounting specification options were developed, the principles of environmental accounting of costs regarding the transparency of information, its reliability and timeliness were created.

Joy E. Hecht devoted his works to the issues of environmental accounting. The author believes that the main objective of environmental accounting is cost assessment related to the implementation of nature protection measures by economic agents. Besides, according to the researcher, the implementation of analytical procedures concerning environmental costs and their positive impact on the environment is possible within environmental accounting (Hecht, 1999).

Michael John Jones in his article

The scientists from Nigeria, such as Arowoshegbel and Uniamikogbo (2016), also pay special attention to environmental accounting. They think that the current accounting and reporting methods do not fully disclose financial information on environmental costs despite their high demand among shareholders, nature protection agencies, potential financial investors, etc. Such procedures may be highly efficient within the system of environmental accounting established at an enterprise (Arowoshegbel & Uniamikogbo, 2016).

The scientists of the scientific school of Dr.Econ.Sci., professor Popova, in particular Maslova, Maslov (Popova, Maslova, & Maslov, 2013; Maslov, 2009), Ilyicheva (2008), Alimov (2010, 2012) deal with the problems of environmental accounting in.

According to Maslova, Maslov (Popova, Maslova, & Maslov, 2013) and Ilyicheva (2008), the modern accounting system randomly reflects environmental aspects, there is neither legal regulation concerning environmental accounting, nor complex technique of ecologization, as well as no requirements to environmental information to be included into accounting, management and tax reporting. They treat environmental accounting as a separate, independently developing direction of accounting of the economic agent ensuring the system of accounting with the required information related to ecology. They believe that this subsystem of accounting is not systematized and functions separately from other accounting subsystems.

According to Popova, Maslova, and Maslov (2013), environmental accounting represents a set of methods and ways to present the reliable information on the volume of environmental costs and results from their implementation in the accounting system of an enterprise.

Purpose of the Study

The system of environmental accounting will make it possible to not only increase the information security of enterprises, regions and the state concerning the volume of environmental costs and results of various environmental actions, but also will significantly reduce the growing environmental risks and will strengthen environmental safety at micro, meso- and macrolevels.

Research Methods

The following research methods were used in the study: observation, analytical and comparative methods, comparison method, logical construction, synthesis, methods of scientific classifications, etc.

Findings

At the moment environmental accounting represents the direction of accounting, which is widely studied and is mainly developed abroad.

From the perspectives of leveling of environmental risks the system of environmental accounting within this study is understood as a set of methods and ways of registration, processing and synthesis of information on environmental costs and results, as well as environmental reporting on the basis of the principles of efficiency and high reliability. At the same time, environmental risks represent the probability of negative effects caused by negative environmental factors in the form of economic activity, emergency and technogenic situations.

Today the Russian system of environmental accounting almost lacks its legal regulation thus reducing not only the performance indicators of nature protection measures at enterprises, but also exerting direct negative impact on environmental conditions and increasing environmental risks. Some normative legal acts establish different environmental payments and separately define the procedure of environmental reporting. Data created in the accounting system, namely in synthetic and analytical accounts, serves the information base for management decisions regarding the environment (Alimova, 2014).

Thus, in modern interaction conditions between economic agents, the object of environmental accounting system represents a set of environmental payments and related reporting submitted to nature protection supervisory authorities.

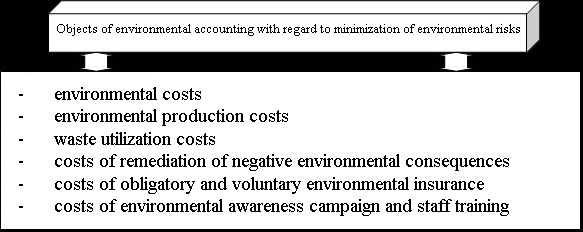

However, in our opinion, within environmental accounting it is necessary to generate information, to carry out current analysis and control the following objects thus considerably increasing the efficiency of accounting and ensuring a favorable effect on the level of environmental risks (Figure

Environmental management reporting is a key tool to achieve environmental safety and level environmental risks since it reflects not only the volume of environmental payments of the business, but also results of nature protection actions and measures (Popova, Alimov, & Alimova, 2016).

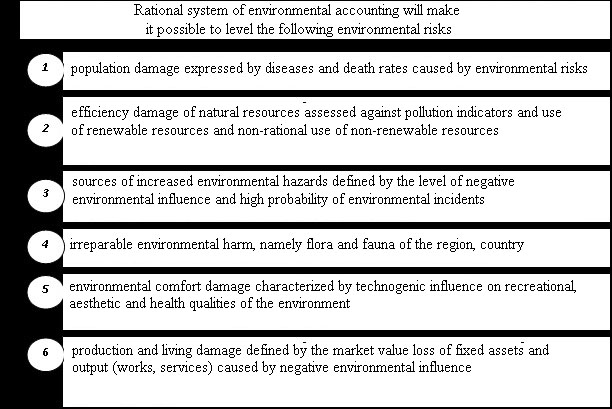

Rationally created system of environmental accounting will allow leveling the following environmental risks (Figure

Thus, it is possible to level any environmental risks only within the multistage information complex, subsequent assessment and analysis of information on environmental measures undertaken by economic agents, environmental problems in interaction with active nature protection policy built at regional and state levels. Today due to lack of legal regulation and accounting techniques for environmental costs and results, as well as algorithms of their assessment and analysis, complexity in defining the efficiency of environmental measures and formation of environmental reporting, the system of environmental accounting becomes a possible solution to environmental problems and minimization of negative environmental impacts by enterprises of various branches of the national economy.

Conclusion

The given paper also proves the need for further study with regard to processes of management accounting and reporting on environmental costs and results to ensure environmental safety at micro-, meso- and macrolevels.

The advanced accounting system will give the chance to develop the information complex covering the environmental impact of enterprises, costs of nature protection activity, environmental risks and ways of their minimization, influence of environmental costs on financial condition of the organization, will allow increasing the competitive advantage of products or goods meeting the requirements of environmental safety and will also create the conditions for environmental risks leveling and achievement of environmental safety at the level of regions and the state.

Acknowledgments

The paper is prepared within the research under the project of the state task in the field of science No. 26.2758.2017/4.6 for 2017-2019 on a topic “The system of analysis of formation and distribution of cost of innovative products on the basis of the infrastructure concept”.

References

- Alimov, S. A. (2010). Technique of managerial analysis of environmental costs. Economic analysis: theory and practice, 29, 17–22.

- Alimov, S. A. (2012). Theoretical fundamental of environmental audit of territorial and economic systems. Economics and humanities, 7, 22–26.

- Alimova, M. S. (2014). Formation of uniform registration space as a factor defining the assessment of added value. Management accounting, 4, 79–85.

- Arowoshegbel, A. O., & Uniamikogbo, E. (2016). Accounting for Social and Environmental Challenges: A Theoretical Perspective. Saudi Journal of Business and Management Studies. Aug-Oct, Issue 3, 143–148.

- Hecht, J. E. (1999). Environmental Accounting. Where We Are Now, Where We Are Heading. Resources for the future. Spring.

- Ilyicheva, E. V. (2008). Reflection of environmental obligations in accounting of an enterprise. Bulletin of Chelyabinsk State University. Scientific journal, 7(108).

- Jones, M. J. (2010). Accounting for the Environment: Towards a Theoretical Perspective for Environmental Accounting and Reporting. Article in Accounting Forum, 34(2), 123–138.

- Maslov, B. G. (2009). Creation of management accounting model of costs in the conditions of integrated data processing. Economics and humanities, 6, 28–34.

- Popova, L. V., Alimov, S. A., & Alimova, M. S. (2016). Characteristics of an administrative component of registration and analytical system of an economic entity. IPB bulletin (Messenger of professional accountants), 5, 19–24.

- Popova, L. V., Maslova, I. A., & Maslov, B. G. (2013). Basic theoretical principles of registration and analytical system. Financial management, 3.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2019

Article Doi

eBook ISBN

978-1-80296-075-4

Publisher

Future Academy

Volume

76

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3763

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Maslova, I., Alimov, S., Alimova, M., & Poshuev, N. (2019). Ecologization Of The Registration System For Environmental Risks Leveling. In D. Karim-Sultanovich Bataev, S. Aidievich Gapurov, A. Dogievich Osmaev, V. Khumaidovich Akaev, L. Musaevna Idigova, M. Rukmanovich Ovhadov, A. Ruslanovich Salgiriev, & M. Muslamovna Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism, vol 76. European Proceedings of Social and Behavioural Sciences (pp. 1241-1246). Future Academy. https://doi.org/10.15405/epsbs.2019.12.04.167