Abstract

More individuals choose a private school, so the government and employers should provide tax facilities. In this paper we aim to identify the perceptions of stakeholders on tax facilities for those who choose private education, analyse whether there is an upward trend in access to private education and which the profile of the person choosing private education is. The results obtained from our research will show for what educational level the private education is preferred and why. More than that, we will analyse, in the antithesis of the main components of the educational environment for both the public and the private system. Starting from this analysis we will identify the main factors and their impact on the decision regarding the choice of one of the two forms of education. Thus we will be able to formulate a series of recommendations for the implementation of the fiscal facilities regarding the educational expenses in relation to the perceptions of the stakeholders.

Keywords: Private educationpublic educationtax facilitieseducational vouchers

Introduction

Education administered by the private, or non-state, sector within the European Union has been subject to an increasing consideration and, in some countries, it has undergone reform. The main reason for enrolling a child in a private school lies in the need to provide a quality education. In general, privately managed schools tend to have more autonomy, better resources, better school climate and better performance levels than publicly managed schools (OECD, 2012, p.18)

Schools’ budgets may come from difference sources: the government, including departments, local, regional, state and national authorities; student fees or school charges paid by parents; benefactors, donations, bequests, sponsorships, and parent fundraising (OECD, 2012, p.20)

Education reforms tend to give more autonomy and authority to parents and students to choose schools that better meet their educational needs or preferences (Heyneman, 2009). Tax policy regarding education has been incorporated into some initiatives to increase the level of participation in education and training. Tax incentives can be defined as those concessions in tax codes that mean a conscious loss of government budgetary revenue because they reduce either the tax base or the tax due. They are a means of encouraging a particular type of behaviour (education and training, in this case). Tax incentives can be categorize in the following (OECD, 2004b, as cited in CEDEFOP, 2009, pp. 20-21):

tax allowances (deducted from the gross income to arrive at the taxable income);

tax exemptions (some particular income is exempted from the tax base);

tax credits (sums deducted from the tax due);

tax relief (some classes of taxpayers or activities benefit from lower rates);

tax deferrals (postponement of tax payments).

These tax concessions can be applied through the main types of taxes: personal income tax (PIT), corporate income tax (CIT) and value-added tax (VAT).

In order to increase the financial incentives for parents to facilitate school choice, some school systems make public funding available so that parents can send their children to private schools. The means to do this is through allocating funding directly to parents (student-based vouchers, scholarships), or to the selected school (through government subsidy). In the following paragraphs we shall try to examine the most common tax facilities offer to parents or schools.

School vouchers (or scholarships), are certificates issued by the government with which parents can pay for their children education. If school vouchers were available for all students, they could promote competition among schools. School vouchers targeting only disadvantaged students is a solution for reducing the school dropout, but we think it has limited effect on expanding school choice and promoting competition among schools overall.

Another important mechanism is tuition tax credits. This allows parents to subtract educational expenses, including private-school tuition, from their taxes. As a result, governments pay the costs of private schools through foregone revenues. Welner (2008) thinks that tuition tax credits can be regarded as a sort of new vouchers “neovouchers”. According to Levin (2002, p.166), the key elements to be considered in designing voucher programmes are: finance, regulation and support services. Levin also states that the evaluation of these vouchers must be made taken in consideration 4 criteria: freedom of choice (the range of institutions, costs and the degree of parents’ decision), productive efficiency (the capacity to produce academic outcomes, above average, with similar costs), equity (availability to all, including students with special needs) and social cohesion (encouraging civic participation).

Estonia, Poland, Portugal and Spain already offer school vouchers and tuition tax credits for lower or upper secondary education in publicly and privately managed schools (OECD, 2011, Table B3.1 and Figure 3.1). According to this report, 10 OECD school systems are classified as voucher systems and 15 OECD school systems are classified as non-voucher systems (OECD, 2011, Column 15 in Table B3.1). The Flemish and French Communities of Belgium, Chile, Estonia, Germany, Israel, Poland, Portugal, the Slovak Republic and Spain are defined as being voucher systems. The Czech Republic, Denmark, England, Finland, Greece, Hungary, Ireland, Italy, Japan, Korea, Luxembourg, the Netherlands, New Zealand, Sweden and Switzerland are defined as being non-voucher systems.

Some states from United States will provide tax breaks for expenses that include textbooks and supplies. The state of Virginia holds tax-free shopping days every August. During these days, you won’t have to pay taxes on the purchase of school supplies, clothing or shoes for children. Romania has a lower VAT (5%) for school textbooks, magazines, publications in general.

It is clear that if we want better schools, private or public, some sort of tax facilities should be implemented.

Problem Statement

More individuals choose a private school, so the government and employers should provide tax facilities. For the government this is a way to provide citizens with quality services, and for employers, a way to attract and to create loyal employees. Analysing the theoretical background and the European trends we identified tax facilities that can be implemented. The main problem that arises is which is best in terms of long term effects. We shall try to identify the perception on different educational tax facilities in order to create a basis for a possible change aimed at increasing the level of education offered in schools, whether public or private.

Research Questions

The main question of the research was: what are the perceptions on tax facilities? Is there a difference in terms of perceptions between those who choose public and private education?

We also wanted to know if there is an upward trend regarding private education and for what level of education.

Purpose of the Study

We aim to identify the perceptions of stakeholders on tax facilities for those who choose public and private education, analyse whether there is an upward trend in access to private education and which is the profile of the person/family choosing private institution for education. Moreover, we will verify that there are correlations between the components of private education and the degree to which they influence the decision of individuals regarding the choice of private education.

Research Methods

A survey based on questionnaire will be applied on 130 stakeholders (parents, employers’ representatives, educators from state and private educational organizations).

To obtain the necessary data to our research we are going to use Google forms and we will analyse the obtained data using SPSS. Moreover gender, age, the level of education and income information was taken in consideration.

Research method

The questionnaire contains 23 questions regarding demographic information, family members information, educational budget, perceptions concerning public and private education (level of trust, educational offer, quality of the teaching materials used in the educational process, quality of human resources, evaluation methods, ICT in educational activities, individualization of the learning process, after school services), trends in accessing private education from the perspective of the availability of financial investment in education, perceptions on tax facilities regarding education.

Questionnaire Respondents

Of the 130 research respondents, 106 were female (81,5%) and 24 male (18,5%). The age of the respondents varies between 18-55 (average age of the respondents were 31 years). Most of the respondents have a bachelor degree. Regarding the working status of the respondents, all of them are: 72,3 % are full time employed, 12,3 % are part-time employed and 15,4 % are self-employed. They are working both in public (47,7 %) and private organisations (41,5 %) and 10,8 % have their own business.

Findings

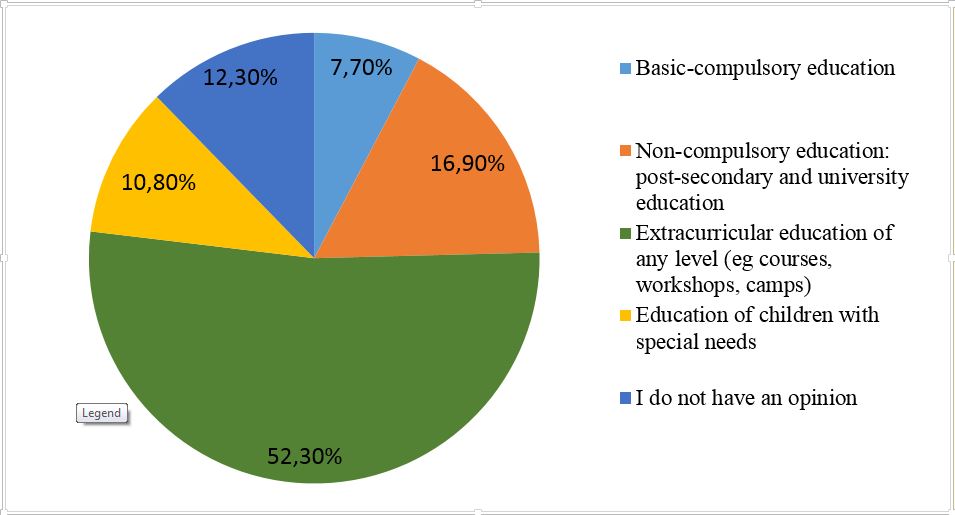

The results reveals the stakeholders perceptions hierarchy on tax facilities for those who choose private education, an upward trend in attending private education. The data shows us that most of the respondents (64,6 %) does not benefit from any tax facilities offered by employers. Most of them would like to benefit from educational vouchers (53,8 %), private scholarships (52,3 %), study credits (38,5 %) and discounts offered at the educational services offered by the employer's partner organizations (35,4 %). Most would like to use educational vouchers for extracurricular activities of any level (see Figure

One of the objectives of the research is to reveal the increased interest in private education. Half of the respondents (49.2%) would choose private education. The statistical processing of the data obtained from the research shows us a close correlation between the incomes obtained and the budget allocated for private education. This highlights the fact that many people would opt for private education if the income were higher or they would benefit from deductions from educational expenses.

Following the interpretation of the results we were able to identify the average value of the budget that they are willing to allocate for private education (about 320 euros / month). From the average family income, these expenses represent a quarter.

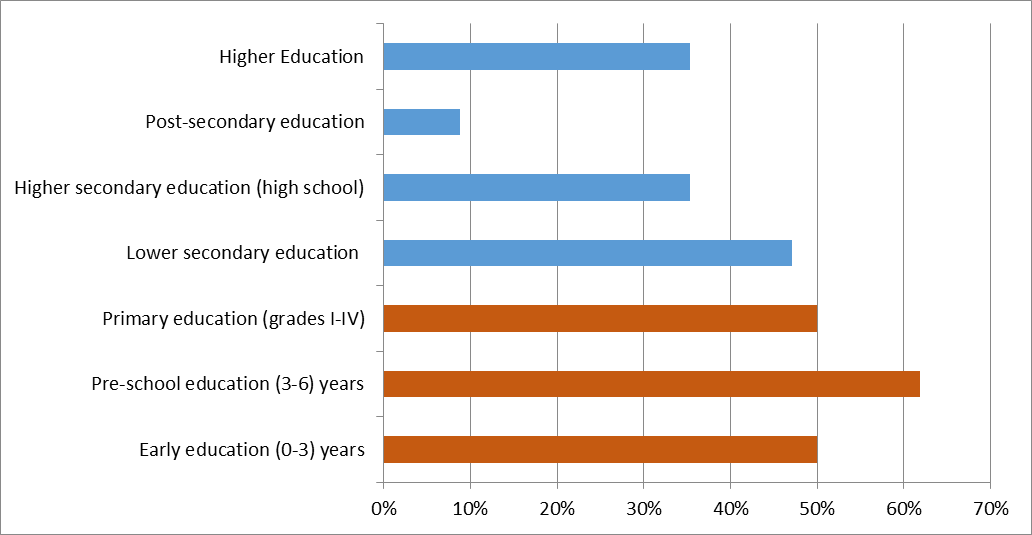

The level of private education that would most choose is preschool (61.8% of options expressed), early education (50% of options expressed) and primary school (50% of options expressed) (see Figure

Even though many respondents choose private education in the case of pre-school education (61.8%), it is noted that a significant number of them (48.7%) are willing to choose private education for the lower secondary school and also 35.7 % for upper secondary school. Regarding higher education, only 34.8% of the respondents would choose the private option.

The results obtained from the research show a high degree of confidence in the private education in the case of the preschool education which gradually decreases, reaching a low level in the case of the higher education. Therefore, the stakeholders should take measures to increase the degree of confidence in private higher education. This level of distrust in the private higher education is also reflected in the recruitment policies of employers who prefer the graduates of the state universities and not those who have chosen a private form for the higher education.

We also focused on the reasons why respondents would choose private education. First of all, private education allows to offer an individualization of the learning by adapting to the needs and requirements of each student. Another reason is the use of ICT resources in teaching activities and the quality of educational materials (see Table

Another component with a high impact on the choice for private education is the quality of the educational materials used by the private educational institutions. The quality but also their diversity allow a much greater focus on the individual needs of each student, thus allowing to obtain high learning results. Therefore, the individualization of learning is one of the most important aspects regarding the educational act, as revealed in our research.

Comparing the components of the public and private system in terms of: level of confidence, educational offer, quality of materials offered, quality of human resource, evaluation methods used, use of ICT in teaching activities, adaptation to individual needs and extended program, we observe a greater appreciation of them in favour of private education (especially regarding the extended or afterschool program).

Starting from the educational components analysed (shown in the table above) we drew the profile of the person/family choosing private education: female, university graduate, working in private sector, but not in an educational organization, with above average income/family members, with low level of trust in public education. Moreover they dislike the quality of educational materials and also the evaluation methods used.

Conclusion

The results of our study shows an upward trend regarding private education. So, in order to strengthen the private education system, tax facilities are a must.

Stakeholders’ perceptions hierarchy on tax facilities revealed the interest for educational vouchers, private scholarships and study credits. The educational vouchers were the most favoured and they must be dedicated to extracurricular activities of any level.

Moreover, we propose measures to be taken in consideration regarding educational and tax facilities policies on both state and private educational organizations.

Following the research, we recommend that the sizing of the expenses made by the private organizations be directly proportional to the budgetary effort that a person or a family would be willing to make (about a quarter of the family's income).

Also, the family's budgetary effort in relation to educational expenses must be supported by fiscal facilities.

For the sustainability of the measures that will lead to an increase in the quality of the educational act, both by granting fiscal facilities and by adopting educational policies oriented in this sense, an important role have all the stakeholders: public or private institutions, employers and employees.

For the government this is a way to provide citizens with quality services, and for employers, a way to attract and to create loyal employees.

References

- CEDEFOP (2009). Using tax incentives to promote education and training. Retrieved from: https://www.cedefop.europa.eu/files/5180_en.pdf

- Heyneman, S. (2009). International perspectives on school choice, in M. Berends, et al. (eds.), Handbook of School Choice, Routledge, London.

- Levin, H. M. (2002). A comprehensive framework for evaluating educational vouchers, Educational Evaluation and Policy Analysis, 24(3), 159-174.

- OECD (2011). Education at a Glance 2011: OECD Indicators. Retrieved from: https://www.oecd.org/education/skills-beyond-school/48631582.pdf

- OECD (2012). Public and private schools: How management and funding relate to their socio-economic profile. Retrieved from: http://www.oecd.org/pisa/50110750.pdf

- Welner, K. G. (2008). NeoVouchers: The Emergence of Tuition Tax Credits for Private Schooling, Rowman & Littlefield, Maryland.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 November 2019

Article Doi

eBook ISBN

978-1-80296-071-6

Publisher

Future Academy

Volume

72

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-794

Subjects

Psychology, educational psychology, counseling psychology

Cite this article as:

Richiţeanu-Năstase, E., Mihăilă, A. R., Enăchescu, V. A., & Ciurel, A. D. (2019). The Future Of Private Education. Stakeholders` Perceptions On Tax Credit Facilities. In P. Besedová, N. Heinrichová, & J. Ondráková (Eds.), ICEEPSY 2019: Education and Educational Psychology, vol 72. European Proceedings of Social and Behavioural Sciences (pp. 206-212). Future Academy. https://doi.org/10.15405/epsbs.2019.11.18