The Role Of Islamic Financing In The Green Community In Attaining Sustainable Development Goals 2030

Abstract

A clean environment and sustainable energy are among the Sustainable Development Goals (SDGs) that all nations need to achieve by 2030. Community well-being can be achieved when environmental issues involving greenhouse gases, global warming, thinning and ozone depletion is strengthened. Green energy exploration has contributed to the effort of sustaining the environment. Renewable energy is an alternative source of natural resources. The aim of this paper is to discuss the role of Islamic financing in enhancing the green energy initiatives in Malaysia. The study employs the doctrinal legal method of perusing legal documents and Islamic contracts. Findings of the study showed that green energy is part of the human and environmental needs that need to be preserved to continue living in this world. In addition, comprehensive legal framework plays an important role in ensuring the achievement of SDGs 2030. Accordingly, green technology is seen as a tool to help people maintain environmental sustainability. This green technology will also drive the development of the country both locally and globally. Hence, the initiative to promote green technology development must be realized through an Islamic financing scheme which helps and encourages its participants to venture into business.

Keywords: Islamic Financinggreen energyrenewable energygreen communitysustainable development goals

Introduction

A clean environment run on sustainable energy are among the Sustainable Development Goals (SDGs) that all nations need to achieve by 2030. Community well-being can be achieved when environmental issues involving global warming, ozone thinning and ozone depletion is strengthened. In 1997, the Kyoto Protocol was ratified by more than 160 countries which prioritised the weakening the green house emission (Grubb, Vrolijk, & Brack, 1997). Green community relates to the implementation of low carbon city concept in attaining a sustainable environment. The concept embraces the principle of high-level energy efficiency with low carbon energy resources as well as production technologies. In other words, it enhances a pattern of consumption and behaviour that are consistent with low levels of greenhouse gas emissions in urban areas (Ho, Matsuoka, Simson, & Gomi, 2013).

As a universal religion, Islam appreciates personal and environmental cleanliness (Hassan, Salamon, & Rahman, 2016) and as such, contemporary issues of climate change and environment were addressed 1400 years ago. This is evidenced by the requirement of personal and environmental cleanliness like the practice of using clean water for daily routines from clean rivers (Huma, 2018). Hence, it is pertinent that Islamic financial institutions consider the environmental factor in the decision making process.

Problem statement

Green energy is closely related to renewable energy and technologies. Renewable energy is still in its infancy in Malaysia and involves three major sources; hydropower, solar energy and biomass energy (Renewable Energy Policy Network for the 21st Century, 2014). Taking lessons from past failures, external experience and religious views, Malaysia has developed the Feed-in Tariff System as a step towards developing renewable energy sources in Malaysia (Markom & Hassan, 2018). Without the aid of technology, humans may not be able to cooperate in preserving nature. Islam encourages the exploration of relevant knowledge to be used as a stimulant and auxiliary to deal with issues related to nature. This exploration of science will drive the rapidity of technology created to help people. This can be seen through the development of green technology instituted by the government. However, one of the challenges is to provide project funding that is environmentally and socially responsible through corporate social responsibility.

Purpose of the Study

In general, the purpose of this study is to discuss the importance of green energy to achieving community and environment sustainability. Specifically, the study explains the concept of green energy in the context of society and states. Then, it examines government policies and laws on green technologies initiatives. Finally, it analyses the potential of Islamic finance in enhancing environmental SDGs. Findings of the study addressed the issue of identifying the legal framework in place in Malaysia for furtherance of SDGs 2030 and its suitability with Islamic financing.

Research Methods

The study employs doctrinal legal method of perusing legal documents and Islamic contracts. The analysis includes National Government Policies on Energy as well as the strength and weaknesses of Malaysian Energy Efficiency Improvement program (MIEEIP), Small Renewable Energy Power Program (SREPP) and Green Technology Financing Scheme. Accordingly, Islamic contracts were examined which suit the needs of green financing that is environmentally sustainable and socially responsible.

Findings

Green Energy

Green energy and renewable energy refer to efforts to harness the energy of nature. There are various types of renewable energy sources such as biogas, biomass, small hydro power, solar photovoltaics, sea, wind and heat.

Table

Legal Framework of Green Energy

The comprehensive legal framework plays an important role in ensuring the achievement of SDGs 2030. Various green energy policies have been enacted since 1979 to date. The New Energy Act was enacted in 2011 to illustrate that renewable energy and the incentive tariff system are important to Malaysia. This Act has encouraged many investors to invest in electricity generation due to the presence of the Tariff System which obligates Malaysia’s National Power Incorporated known as

Table

Table

Green Technology

Green technology is the catalyst for renewable energy development which began with the establishment of the National Green Technology Council and Climate Change responsible for drafting the National Green Technology Policy. This effort continues through the adoption of green technology in four main sectors - energy, building, water and waste management and transportation. In order to ensure a smooth implementation of the National Green Technology Policy, the involvement of several key institutions has been identified. These include the Ministry of Energy, Green Technology and Water (KeTTHA), the Green Foundation of Malaysia (YaHijau) and the Malaysian Green Technology Corporation (MGTC) responsible for regulating green technology implementation (Ruzian, 2018). Finally, various programs, projects and promotions have been implemented to empower green energy and technology in life.

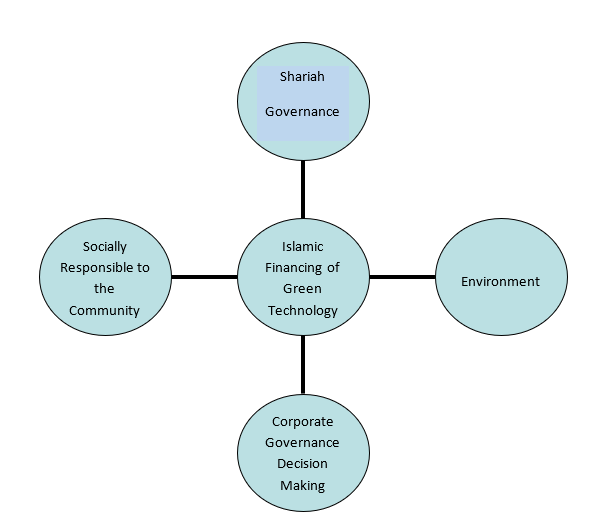

Islamic Financing of Green Technology

Malaysia as an Islamic financial hub is moving forward to the next level of growth that is sustainable, with clear value proposition. (Bank Negara Malaysia, 2018) It is driven by long term and wider objectives including profit, people and planet. Accordingly, Islamic financing of green technology is an alternative to conventional financing. In realizing Islamic financing schemes, the fundamental principles of

) must be adhered to and emphasized. According to Islamic financing principles, the contract must be consented to by both parties as well as be free from the elements of interest (

Conclusion

In general, green energy and technology have great potential in Malaysia. This is clearly shown in various efforts and commitments shown by the government in making Malaysia a Green State. In order to further strengthen the development of green energy and green technology, it is proposed that the financial industry including banks provide Islamic-based green energy financing, create green school programs at various levels of education, set up green banks, implement green ICT in all government and private sectors and emphasize Environmental Management Accounting (EMA) in public and private sector management.

Acknowledgements

The authors wish to extend their gratitude to Universiti Kebangsaan Malaysia for awarding a research grant GGPM/2012/4 to complete the project.

References

- Bank Negara Malaysia (2018). Value-based Intermediation: Strengthening the Roles and Impact of Islamic Finance. Kuala Lumpur: Bank Negara Malaysia.

- Bank Negara Malaysia (2017). SRI & Green Sukuk: Challenges and Prospects. Retrieved from http: www.mifc.com on 15 November 2018

- Grubb, M., Vrolijk, C., & Brack, D. (1997). The Kyoto protocol: a guide and assessment. Royal Institute of International Affairs Energy and Environmental Programme: London

- Hassan, N., Salamon, H., & Rahman, H. A. (2016). Sumbangan Teknologi Hijau Dalam Ketamadunan Islam. [The Role of Green Technology in Islamic Civilization], Sains Humanika, 8(3-2), 29–37.

- Ho, C. S., Matsuoka, Y., Simson, J., & Gomi, K. (2013). Low carbon urban development strategy in Malaysia – The case of Iskandar Malaysia development corridor. Habitat International, 37, 43-51.

- Huma, Z. (2018). Islam and the environment. Retrieved from https://dailytimes.com.pk/240049/islam-and-the-environment/

- Julia, T., Rahman, M. P., & Kassim, S. (2016). Shariah compliance of green banking policy in Bangladesh. Humanomics, 32(4), 390-404.

- Markom, R., & Hassan, N. (2018). Polisi pengurusan Tenaga Hijau [Management Policies for Green Technology]. Bangi: UKM Press.

- Markom, R., & Ismail, N. (2009). The Development of Islamic Banking Laws in Malaysia: An Overview. JUUM, 9, 191-205.

- RFI Foundation (2018). Environmental Impact in Islamic Finance. London: RFI Foundation.

- Riaz Ansari, Salma Sairally, Farukh Habib, & Hafas Furqani (2017). Islamic Finance and Sustainable and Responsible Investment: An Ethical Dimension. Petaling Jaya: ISRA.

- Renewable Energy Policy Network for the 21st Century (REN21). (2014). Retrieved from http://www.ren21.net/Portal/documents/GSR/REN21_GSR2011.pdf (15 November 2018)

- Syed Azman, S. M. M., & Ali, E. R. A. E. (2016). Potential Role of Social Impact Bond and Socially Responsible Investment Sukuk as Financial Tools that Can Help Address Issues of Poverty and Socio-Economic Insecurity. Intellectual Discourse, Special Issue (2016), 343–364.

- Thomson Reuters (2017). ICD-THOMSON REUTERS Islamic Finance Development Report. Retrieved from http://www.icd.ps.org

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

16 October 2019

Article Doi

eBook ISBN

978-1-80296-069-3

Publisher

Future Academy

Volume

70

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-299

Subjects

Environment, international environmental law, business, sustainability, environment, green business, environmental issues

Cite this article as:

Markom*, R., & Hassan, N. (2019). The Role Of Islamic Financing In The Green Community In Attaining Sustainable Development Goals 2030. In H. Kamaruddin, S. Tan, & R. X. Thambusamy (Eds.), Law, Environment and Society, vol 70. European Proceedings of Social and Behavioural Sciences (pp. 51-57). Future Academy. https://doi.org/10.15405/epsbs.2019.10.5