Abstract

Logistics activities executed in the global supply chain demands high logistics performance from a country which becomes a host of these operations. The conditions to perform logistics operations influence the speed and efficiency of maintaining the flow of goods, thus the management of the supply chain and overall economy of the enterprises. The expectancy from the European countries is rather high because of the leading role of this continent in setting worldwide standards. Leaders of The World Bank logistic performance index rankings can be easily found in Europe. Fundamental for creating European Union economic policy was decreasing barriers in trade and maintaining free movement of people, goods and capital. Years of fruitful cooperation inside the EU establish European supply chains which using these conditions as an advantage in global competition. The goal of this paper is to examine the potential effects of a Brexit influencing UK’s logistics performance. Brexit changed basics conditions for logistics operations. The expectations of enterprises and building uncertainty influenced the behavior of logistic services even before the critical date of Brexit. As data shows, the correlation between the development of European and UK logistics performance weakens, threatening simultaneously business allocated on both sides of the English Channel.

Keywords: Logistic performanceBrexitmanagement of supply chains

Introduction

As a country representing years of tradition and successful business cooperation in an international scale, it is no wonder to allocate UK with a high ninth place in the ranking prepared by the World Bank measuring logistic performance index (LPI). Unfortunately, this placement changed in the recent researched period. In the year 2016, it was better- eighth place among 167 countries in the world. Logistics performance measured by LPI index is, in fact, several criteria describing the ability of a given region to carry out logistics activities efficiently. In general better logistic performance supports supply chain management and strategic management of the business units. Additionally, it is observed that a low level of logistic efficiency usually means higher logistics costs (Blaik, 2016, p.59). Therefore worsened index of Logistic Performance is a warning signaling change in performance of cooperating business entities.

Literature Review and Theoretical Framework

Logistics performance of UK

The weighted average of the results describing the level in the six impact zones brings in the final LPI index for a given area:

1. Customs operations

2. Infrastructure

3. International shipments

4. Logistic competences

5. Tracking & Tracing

6. Timeliness (Country Score Card…, 2018)

The efficiency of customs operations is crucial for international supply chains combining manufacturing operations in many spatially distributed nodal points. The ability to efficiently cross borders is about making investment decisions in economically attractive locations that at the same time facilitate the flow of products across national borders. For this reason, this criterion takes into account: the speed of customs service, the intelligibility of the customs law system as well as the predictability of formal activities of the customs service agency. This enables better planning of logistics activities and harmonization of the implementation of plans and international agreements. The next criterion is the advancement of logistics infrastructure. The quality of roads, railways, airports, and ports determines the efficiency of transport operations. This criterion is one of the most expensive and the most difficult to improve, especially in the short term. Structural investments require significant resources and time necessary to carry out transport construction projects. The availability of many types of transport increases the flexibility of transport and ensures better optimization of these processes. At the same time, there are increasing requirements for ensuring the proper condition of various communication routes and transshipment stations enabling logistics operations and intermodal connections. The third criterion of logistic efficiency is the ease of organizing international shipments. Competitive prices resulting from attractive freight rates depend on the availability of many logistics operators. Depending on the region of the world, the level of competition in the logistics operators sector can be variable, and this affects logistics efficiency in a given area. The criterion of competence of these entities is related to the availability of professional logistic services. Advanced procedures enabling entrepreneurs to operate in predictable conditions definitely help to carry out operations in the international supply chain. The high level of competence means that the remaining conditions, including the high level of infrastructure, are appropriately used to the benefit of the efficiency of the supply chain. The criterion of tracking & tracing of shipment reflects the trend of the virtualization of the economy. Widely used ITC tools allow more and more control over the company's resources. For this reason, enabling companies to access location data by means of the mentioned identification and track & trace services means increasing the level of control over logistic operations. The criterion for closing the LPI rating for a given country is the timely delivery of shipments. The assurance of timely delivery of a specific load enables precise management of resources in the supply chain. Increasing the percentage of future deliveries is beneficial for the synchronization of partner activities in the supply network. This is particularly important in the international dimension where delivery times increase significantly with the distance covered. In Table

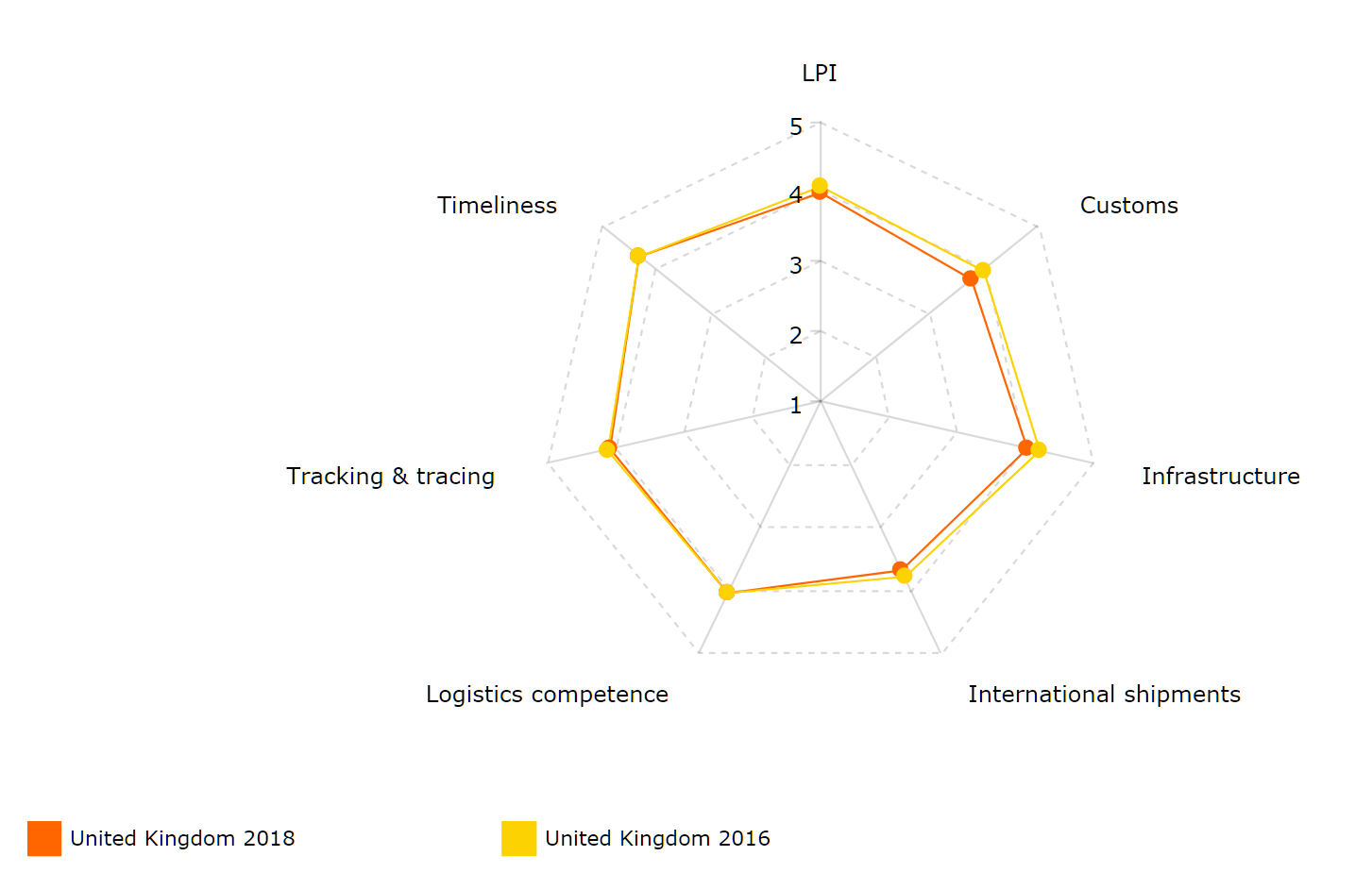

The presence of the United Kingdom in the first EU accession group means that economic ties between businesses located on the continent and the British Isles have benefited from the privileged conditions for trade in goods for 44 years. This is the most extended period of shaping European supply chains just after the EU's founding countries. That time was well used in the process of building European supply chains (Bentyn, 2018a). Relations among European enterprises transform into reliable supply chain honed over the years to a higher efficiency thanks to the favorable business environment. What is visible in the chart (Fig 01) may represent a possible deviation from the path of growth represented by the UK’S LPI index.

What are thoughts provoking is that deviation above is represented by the subfactors dependent on the state regulations and investment plans: Customs, Infrastructure, International Shipments, and Tracking and Tracing. The Timelines and Logistic Competence depend instead on the level of logistic services and ability to carry on the logistical task. Therefore they represent an outcome than the cause of changes in performance rather. If this statement is true, the real changes in subfactors of LPI index: Timeliness and Logistic Competence may be visible in two years of the next researched period.

No deal Brexit consequences

In a particular country business environment, it is essential to achieve a certain level of logistic performance and maintain it or improve it in the future. Such conditions are profitable to build and develop international exchange and cooperation in the supply chain. The horizon of positive changes may increase the attractiveness of a country as a location to invest and increase manufacturing and logistics operations. Unfortunately, it would be challenging to include Brexit as a positive factor influencing the efficiency of European supply chains. The period before once set a critical date of 29.03.2019 and now prolonged to 31.10.2019 was marked with building uncertainty over maintaining the usual level of logistics operations. Even after the effective Brexit date, there will be a transition period or “the implementation period” which is due to finish on 31 December 2020. Although the UK's relationship with the EU should stay largely the same enterprises on both sides of a new border will have to implement plans to maintain the current level of cargo flow. A possibility of entering those dates with the “no deal” option becomes a viable risk for the industry which will have to endure hard Brexit conditions. Thanks to governmental instructions pointing out what to expect if there will be no Brexit deal it is possible to enlist potential consequences for hard Brexit scenario (Trading with the EU…, 2018):

1. Businesses will have to apply the same customs and excise rules to goods moving between the UK and the EU as currently apply in cases where goods move between the UK and a country outside of the EU. Moreover, customs duty may also become due to imports from the EU.

2. Customs declarations will be needed when goods enter the UK (an import declaration), or when they leave the UK (an export declaration).

3. Separate safety and security declarations will have to be prepared by the carrier of the goods. Additional activities for logistics or transport operators: the hauler, airline or shipping line.

4. The EU is applying customs and excise rules to goods it receives from the UK, in the same way, it does for goods it receives from outside of the EU. That means that the EU would require customs declarations on goods coming from, or going to, the UK, as well as requiring safety and security declarations.

5. In the movements of excise goods, the Excise Movement Control System (EMCS) would no longer be used to control suspended movements between the EU and the UK. This will mean that immediately on Importation to the UK, businesses moving excise goods within the EU, including in duty suspension, will have to place those goods into UK excise duty suspension. Otherwise, the duty will become payable.

6. Carriers will have to submit an Entry Summary Declaration at the appropriate time.

7. Enterprises will submit export declarations, including whether to engage a customs broker, freight forwarder or logistics provider. If that will be arranged by the business entities alone, they will need to acquire the appropriate software and secure the necessary authorizations from HMRC what will come at a cost.

8. Businesses may also need to apply for an export license or provide supporting documentation to export specific types of goods from the UK, or to meet the conditions of the relevant customs export procedure.

Such conditions will in fact immediately restore of a border between the European Union and Great Britain. Additionally to import and export declarations which must be check by the appropriate services there will be another risk of delays I form of potential customs controls. They may include phytosanitary inspection, certification of the goods and import licenses. All these procedures will be implemented during normal operations of supply. Expectations to seamlessly implement new rules are rather low. The time-related positioning of many resources will be disturbed, and suppliers and even more essential customers will have to endure the consequences. It is important to stress that most of the aforementioned legal obligations will have to be prepared in advance. That will increase the list of activities in the logistic processes which are essential in maintaining the flow of cargo. Any mistakes or overlooking’s will have dire consequences. Capabilities of computer systems and services involved in the processes are not endless. The new IT system of customs services, replacing the current one – more than 25 years old, planned for implementation before 29/03/2019 - the date of the potential Brexit, was made for a specific calculation potential defined for 60 million customs operations a year. In 2015, around 55 million customs declarations were made by 141,000 traders. The UK’s exit from the EU will increase the number of customs declarations which HMRC must process each year fivefold to 255 million (Preez, 2018). The head of the government's customs agency has determined that adaptation of the system to the new requirements may take two to five years (Thompson, 2018). Assuming a continuous lack of information on procedures for customs clearance, it seems right to define this area as a significant risk of delays for international supply chains. The chair of the Public Accounts Committee Meg Hillier warns that a failed customs system could lead to massive disruption for businesses. Delays may be causing massive queues at Dover which will result in food being left to rot in trucks at the border (Johnstone, 2018).

Research Method

Repetitive observations and recent findings indicate that the British industries are not resilient in dealing with uncertainty. Awaiting changes for worse of many business relations, including logistics operations, increase the risk of operations and force a business to prepare contingency plans. That induces additional cost of operations and actions to take before the critical dates. Inability to assess the certainty of no deal Brexit will not release business entities from responsibility to be prepared. That may lead to massive preparations especially in the industries heavily relying on efficient logistics operations. The end customers create recently an increasingly demanding market where delivery on time becomes a significant advantage (Kauf, 2017). Time plays here a decisive role and makes the leading cause of creating time-based competitiveness of a particular industry. Thanks to the survey of 236 firms, representing 101 large companies and 135 SMEs, conducted by Confederation of British Industry it is shown that uncertainty is draining investment from the UK, with Brexit having a negative impact on 8 in 10 businesses. Carolyn Fairbairn CBI Director-General offers examples of a multinational plastics manufacturer which has canceled a £7 million investment, to a fashion house shelving £50 million plans for a new UK factory. He underlines these as grave losses to UK’s economy (Fairbairn, 2018). The survey data brings depressing news in the form of the necessity of contingency plans for the majority of businesses.

• 58% of businesses surveyed have already formulated contingency plans. 41% of businesses surveyed have carried out some of those contingency plans. Only 2% of businesses surveyed have carried out all of their contingency plans.

• 56% of businesses with contingency plans intend to adjust their supply chains outside the UK, and 20% of those have already carried these out.

• 44% of businesses with contingency plans intend to stockpile goods, 15% have already carried these out.

• 30% of businesses with contingency plans intend to relocate production and services overseas, 9% have already carried these out.

• 15% of companies with contingency plans intend to move jobs, 3% have already carried these out (Fairbairn, 2018).

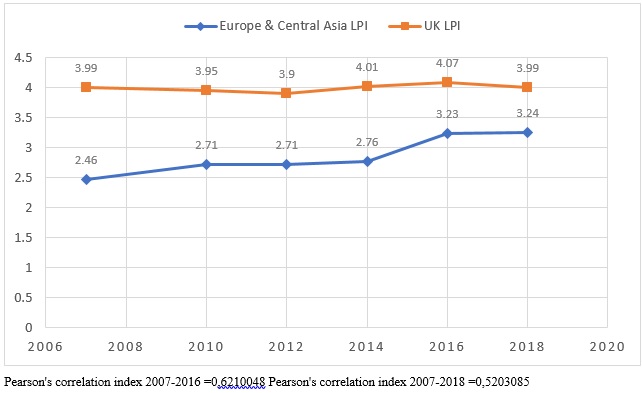

These actions and plans are reflected in the decrease of the Logistic Performance index. It is particularly visible when comparing a correlation between two sets of data — time-related change of LPI index in the region of Europe Central Asia and UK. The year 2018 may draw the beginning of an unfavorable change. In the year 2016 correlation of Pearson's coefficient was r = 0.62 and thus revealed a positive relationship between the United Kingdom LPI index and the LPI index of the region of Europe and Central Asia (Bentyn, 2018b). The strength of this dependence is moderate, as evidenced by placing the result in the range [0.4-0.7]. The recent year comparison decreases correlation leaning towards week dependency between those sets of data (Fig. 3).

A positive correlation between changes in logistics efficiency of both regions proves the long-term economic links of the United Kingdom entities with the area of Europe. They are particularly crucial for the area of Blue Banana's special logistic activity. Undoubtedly, the United Kingdom also plays a vital role in the other key EU economies as an area gathering economic entities focused on the production and supply of highly specialized products for the needs of continental consumers.

Observed in 2018 change in Pearson’s correlation index indicate the adverse effect of logistic performance in the region of the UK. That change may be an effect of uncertainty and implementation of contingency plans aiming in securing the supply chains against sudden disruptions. The real tendency to grow of logistic performance index in the Eurasian area is a positive sign for the future development of international commerce and logistics operations in an international context. A mentioned negative change in correlation between the UK and Eurasian area may be a warning for business as the conditions of the business environment change for the worse. Further observation of this tendency may bring another development depending on the status of Brexit and additional conditions for enterprises adjusting their logistics operations.

Findings

Many business entities may expect an increase in the costs of logistics. There are two significant reasons for that outcome of Brexit:

1. Delays in the movement of goods

2. Warehouses cost and location

It is expected that the most important from the European perspective marine port Dover will increase congestion. Administrative procedures will increase the time of border check and delay duty controls. By now it is unknown how severely will it impact the supply chain because the negotiations may change it for better or worse. The traffic is expected in the area of the port, and that may influence the transportation of perishables and decrease customer service. The time-based competitiveness is nowadays an essential factor in shaping modern supply chains (Majchrzak-Lepczyk, 2014). Cooperation between enterprises on both sides of the English Channel will have to take these delays under consideration as they will plan manufacturing schedules and delivery to the final customers. Seasonal variations of transport operations may also influence delays, and increase amount of cargo stopped during logistic operations. Logistic competence means to provide structure and maintain the expected level of services, especially in the time of uncertainty (Matwiejczuk, 2017). The increase of warehousing operations usually compensates such uncertainty in providing reliable transport operations.

Warehousing is an activity criticized for holding goods during the processes of creating value in the supply chain. It would be advised to minimize the stocked amount of goods as they represent frozen assets. Restored by Brexit border checks will act against this advice. The obvious countermeasure will be to increase stocks of subparts and other resources to smoothen out delays in deliveries. To do that many enterprises may need additional storage space and that will affect the cost of the warehousing. Another issue is the choice of location for warehousing location. To maintain an awaited level of customer service, it is essential to secure the availability of products (Witkowski, 2010). If the border crossing will be the leading cause of unexpected delays than it will become critical to moving localization of warehousing operations closer to the customers. In this case, a new border will create division and additional need for more warehousing space. That is precisely opposite to the rationalization of European supply chains relying on fewer and better-equipped distributions center which may deliver to the higher numbers of customers. Chief executive of The UK Warehousing Association (UKWA) Peter Ward summed up the forthcoming period as “a perfect storm in the warehousing and logistics industry.” He referred to the data about three-quarters of UK warehouse owners saying that their space is full. Additionally, labor and skills shortage caused raising storage cost up to 25% (Ward, 2019).

These two main activities of logistics: transport and warehousing will increase cost in the European supply chains alike in the UK as in EU. After Brexit negotiations, almost two-thirds (65%) of UK businesses have seen their supply chains become more expensive, as a result of a weakened pound against a strong euro. As consequences, almost a third (32%) of these businesses have admitted that they are looking to replace their EU suppliers. The same reasons push nearly half (46%) of EU suppliers to do the same in order to make the supply chain more efficient (EU Business News…, 2018). It is expected that the negative effect of Brexit on trade would increase over time. Rising trading costs will influence decisions in the international supply chain concerning souring and export-oriented inward foreign direct investment (Kierzenkowski, Pain, Rusticelli, & Zwart, 2016). Consequently, in the long run, reduced trade relations lowers productivity. That may lead to an increase in the cost of Brexit estimated to a 6,3% to 9,5% of GDP (Dhingra, Ottaviano, Sampson, & Reenen, 2016).

Conclusion and Discussions

Thanks to the extended period of negotiation and prolonged date of applying new rules of Brexit the logistics industry and business enterprises may receive additional time to adapt to expected changes in normal operations. Employing contingency plans already started to secure logistics service levels and create more resilient supply chains. Unfortunately, the uncertainty of future solutions may build distrust and increase of risk for investors. That is the main factor influencing the logistics performance index deviating negatively from a path of growth. That may help in future separate UK development in logistics performance from the increase in the Eurasian region and be even more visible in the next researched period of the World Bank’s LPI index. Right now it threatens to decrease the attractiveness of the business environment and influence trading relations. Managers of the international supply chain may expect disruptions in the flow of supply and rising logistic cost of operations. Potentially decreasing UK's Logistic Performance will affect managing processes of the international supply chain.

Researchers should cover the case of Brexit with attention as a particular case of breaking integration processes influencing the management of global business. Applying barriers and disrupting logistics activities in the supply chain will come at a cost for business entities and customers expecting speed, efficiency, and reliability.

References

- Bentyn, Z. (2018a). Potencjalny wpływ Brexitu na zmianę wydajności logistycznej Zjednoczonego Królestwa. [The potential impact of Brexit on changing the logistical performance of the United Kingdom]. A. Szpulak ed. Economic Sciences in the 21st Century – Challenges, Questions and Prospects, Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu, nr 407, Wrocław, Wydawnictwo Uniwersytetu Ekonomicznego we Wrocławiu.

- Bentyn, Z. (2018b). Strategie europejskich łańcuchów dostaw zmierzające do redukcji negatywnych konsekwencji realizacji Brexitu. [Strategies of European supply chains aiming at reducing the negative consequences of Brexit implementation] in: Drelich-Skulska B., ed. World Economy of 21st Century – Challenges and Perspectives, Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu, nr 523, Wrocław, Wydawnictwo Uniwersytetu Ekonomicznego we Wrocławiu.

- Blaik, P. (2016). Identyfikacja poziomu kosztów logistyki w skali światowej a ranking logistics performance index (LPI). [Identification of the level of logistics costs on a global scale and the logistics performance index (LPI) ranking] in: Bentyn, Z., Szymczak, M. (ed), Logistyka i zarządzanie łańcuchem dostaw wobec wyzwań gospodarki światowej, Poznań, Wydawnictwo UEP.

- Country Score Card: United Kingdom 2016- 2018 (2018). Retrieved from https://lpi.worldbank.org/international/scorecard/radar/254/C/GBR/2018/C/GBR/2016

- Dhingra, S., Ottaviano, G. I., Sampson, T., & Reenen, J. V. (2016). The consequences of Brexit for UK trade and living standards. CEP BREXIT Analysis No.2 (CEPBREXIT02). London School of Economics and Political Science, CEP, London, UK.

- EU Business News - Brexit: Preparing the supply chain for the imminent changes (2018). Business-news.eu. Retrieved 27 October 2018, from https://www.business-news.eu/2018-brexit-preparing-the-supply-chain-for-the-imminent-changes

- Fairbairn, C. (2018). 8 out of 10 businesses say Brexit hits investment as speed of talks outpaced by reality firms face on ground, Confederation of British Industry Press. Retrieved from http://www.cbi.org.uk/news/8-out-of-10-businesses-say-brexit-hits-investment-as-speed-of-talks-outpaced-by-reality-firms-face-on-ground

- Johnstone, R. (2018, 07, 19). Public Accounts Committee issues warning about HMRC Brexit customs preparations, Civil Service World. Retrieved from https://www.civilserviceworld.com/articles/news/public-accounts-committee-issues-warning-about-hmrc-brexit-customs-preparations

- Kauf, S. (2017). Przedsiębiorstwo i Zarządzanie, Wydawnictwo [Smart Logistics and Customer Orientation]. SAN, Tom XVIII, Zeszyt 8, Ch. 1, p.128.

- Kierzenkowski, R., Pain, N., Rusticelli, E., & Zwart, S. (2016). The economic consequences of Brexit. OECD Economic Policy Papers.

- Majchrzak-Lepczyk, J. (2014). Obsługa klienta w wymiarze logistyczno-marketingowym [Logistics and marketing customer service]. Gospodarka Materiałowa i Logistyka. Warszawa: PWE.

- Matwiejczuk, R. (2017). Logistics Competences within World Class Supply Chains Concept, Przedsiębiorstwo i Zarządzanie, Wydawnictwo SAN, Tom XVIII, Ch. 8, P. 1, p. 230.

- Preez, D. (2018,08,17). HMRC launches new Customs Declaration Service – but doesn’t mention Brexit, Diginomica. Retrieved from https://government.diginomica.com/2018/08/17/hmrc-launches-new-customs-declaration-service-but-doesnt-mention-brexit/

- Thompson, J. (2018). Getting ready for the Customs Declaration Service, HM Revenue & Customs. www.gov.uk, 31 January 2018.

- Trading with the EU if there's no Brexit deal (2018). Retrieved from https://www.gov.uk/government/publications/trading-with-the-eu-if-theres-no-brexit-deal/trading-with-the-eu-if-theres-no-brexit-deal

- Ward, P. (2019), UKWA CEO warns that Dover is catastrophically unprepared for Brexit. Retrieved 25 March 2018. Retrieved from: ukwa.org.uk

- Witkowski, J. (2010). Zarządzanie łańcuchem dostaw [Supply chain management]. Warszawa: Wydawnictwo PWE.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 October 2019

Article Doi

eBook ISBN

978-1-80296-070-9

Publisher

Future Academy

Volume

71

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-460

Subjects

Business, innovation, Strategic management, Leadership, Technology, Sustainability

Cite this article as:

Bentyn*, Z. (2019). Influence Of Brexit On Uk Logistics Performance. In M. Özşahin (Ed.), Strategic Management in an International Environment: The New Challenges for International Business and Logistics in the Age of Industry 4.0, vol 71. European Proceedings of Social and Behavioural Sciences (pp. 92-100). Future Academy. https://doi.org/10.15405/epsbs.2019.10.02.9