Abstract

The article's cognitive goal is to derive consistency and guidance on the application of supply chain finance (SCF) based on critical literature review. In the authors' opinion, there is a need to systematize and critically evaluate current research into the finances of supply chains. The article consists of an outline of the concept of supply chain finance and leading methods of managing the supply chain finances such as reverse factoring, e-crediting, accounting engineering, variant accounting, crowdfunding and venture capital. Subsequently there is presented analysis of the selected SCF performance measures developed so far. Summing up the considerations, the authors suggest directions for further research. The proposed methods of assessing the results of supply chain finance presented in the article are: the EVA index (Economic Value Added), a cube of supply chain finance, so-called SCF Cube proposed by H. Ch. Pfohl, as well as a C2C (Cash-to-Cash Cycle, cash conversion cycle).

Keywords: Supply chain financeSCFsupply chain management; performance measures

Introduction

The importance of integrated supply chain flow management seems to be widely recognized by the management nowadays. As noted by Pfohl (2006), we are dealing with a new trend - the management of finance flows between the chain links is beginning to be perceived as an added value that determines competitiveness. The cooperation of chain-related enterprises in the area of finance is particularly important for small and medium-sized enterprises, most exposed to loss of financial liquidity and difficulties in accessing capital, which became very evident during the recent financial crisis. Nevertheless, many enterprises still do not measure the impact of logistics on goodwill and shareholder value, and do not set financial goals for logistics. An important issue is therefore the selection of appropriate financial tools, enabling the concept of supply chain finance in economic practice, and then measuring the effects of activities.

Literature Review and Theoretical Framework

According to Pfohl (2006), there are two approaches to cash flow between supply chain links. The first one is referred to as "supply chain funding", i.e. a full range of activities associated with transactions and cash flow between entities. Its main purpose is to improve efficiency of cash flow. The second approach, being the subject matter of this paper, is supply chain management (SCM), which is based on rationalization of finances by creating cooperation between producers, suppliers, clients and logistic intermediaries. Its aims are to generate benefits and maximize the market value added for all network participants. De Boer et al., (2017) define supply chain finances (SCF) as optimisation of cash flow and allocation of financial resources in supply chain in order to increase the value, which requires cooperation of at least two major entities in this chain. Cooperation between entities based on mutual benefits is possible through appropriate coordination of cash flow in supply chain. This cooperation relies on better mutual adaptation or a thoroughly new concept of financing in combination with modified role or task sharing between the entities belonging to the chain (Gelsomino, de Boer, & Steeman, 2017). Management of cash flow optimisation and allocation of financial resources may be performed autonomously by an individual business entity. Yet, it is usually associated with participation of subcontractors, as part of solutions implemented by financial institutions (Camerinelli, 2009) or providers of technologies (Lamoureux & Evans, 2011).

Nowadays there are a few methods of financial management of supply chain. They can be described as relatively new ways of value generation for entities cooperating with each other. It should be noted that they have been developed for scientific purposes in the field of finances, yet they may be applied for creation of values in logistics domain. These methods include:

reverse factoring (Popa, 2013),

e-crediting (Popa, 2013),

accounting engineering (Michalczyk, 2013),

variant accounting (Michalczyk, 2013),

crowdfunding (Król, 2013),

venture capital (Metrick & Yasuda, 2010).

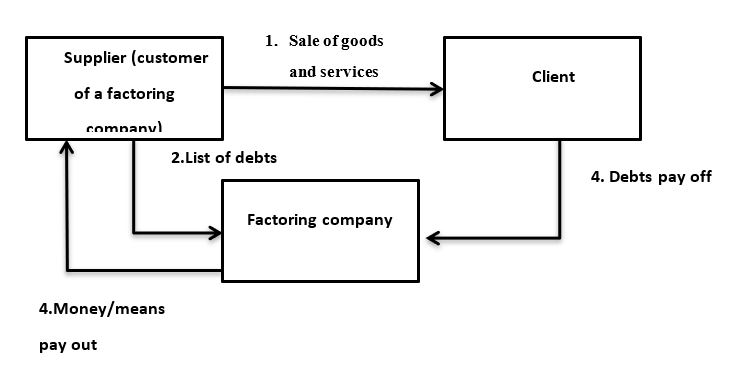

Reverse factoring is dedicated to suppliers and thanks to this service an entrepreneur gains additional time to pay liabilities. Factor institution delivers the major part of receivables as advance payment. The buyer of goods and services pays their liabilities to a factoring company and not directly to a provider (Fig. 1). The assessment of financial capabilities of the buyer serves as a basis to determine limit amount, within which a factor shall pay customer's debts.

Depending on the due date there are two types of reverse factoring (Grudniewski, 2012). The first one refers to the situation in which a supplier receives their receivables before the date originally declared and a client of a factoring company may negotiate discount in this respect. This process is defined as discount reverse factoring. In this case the party benefiting from funding is a supplier and a buyer gains the possibility to obtain a discount thanks to an early payment of liabilities. In the second type, referred to as a payable reverse factoring, factoring entity pays liabilities of their client in a due date and thus the client pays debts later than originally arranged with the supplier (Wawryszuk-Misztal, 2013).

The results of funds flow are benefits for all involved entities. Liquidity increases, which is the element of funds inflow acceleration. Retained financial capital may be used for other purposes than settlement of liabilities. Moreover, debts conversion cycle extends and cash conversion cycle shortens, which leads to lower demand for the capital financing a current activity. Apart from quantitative advantages one can observe positive qualitative results; improved and strengthened relations with suppliers, greater competitiveness, stronger image as a reliable entity and a trustworthy business partner.

The second group of the methods associated with supply chain financial management is connected with e-banking, in particular, based on an online platform for activity co-financing (Popa, 2013). The tool based on e-banking serves two major functions. Firstly, it is used to search for and choose the sources of crediting for economic enterprises. Network participants, apart from comprehensive current account management, may seek crediting solutions together within the developed customer data bases. This approach results in facilitated co-funding and increased liquidity leading to higher incomes. Secondly, this tool automates financial processes between suppliers, clients and mediating institutions (e.g. banks) by performing financial transactions, data base management and information exchange between financial - accounting systems. Transparency of operations strengthens cooperation and fastens money-goods exchange, which in turn builds trust among business entities.

Also, for supply chain financial management other accounting concepts can be applied. In this domain Michalczyk (2013) introduced two approaches deriving from the paradigm of behavioural finances, i.e. accounting engineering and variant accounting.

Accounting engineering is a set of accounting actions that enable the company management to designate actions appropriate for stakeholders' goals. This method, in particular, stresses the compatibility of the results of financial actions with economic goals. The concept of accounting engineering derives from

This method may be used by supply chain partners and its advantage is the potential precipitation of the date of profit and loss report. It is manageable due to the fact that the time of classification of expenses as tax deductible costs may be controlled. This results in adequate level of dividends payed to shareholders, accumulated profit value or the value of the company itself.

Variant accounting is defined as a set of alternative solutions in Polish accounting law. The main idea behind this method is the need of a company management to maximize operating profits. This approach extorts constant analysis and evaluation of economic environment, including the manners of capital acquisition, the level of tax burdens and creation of development variants, e.g. through winning contracts within bidding procedures.

Additionally, optional booking of the same economic activities affects the evaluation of the quality of operations performed by a company and its partners. Individual entities strive for profit maximization as well as above-average return on invested capital, which is gauged by the achieved financial result. Consequently, another applied accounting method brings a different result and thus, choosing an accounting option appears to be crucial, as it affects the company image as well as the market value of a supply chain.

Another method of financial management that may be applied to logistics is crowdfunding (Crowdfunding in Polish language is sometimes referred to as “community financing”. However, some authors, e.g. Malinowski and Giełzak (2015) consider this term to be imprecise.) , defined as the means to gather and transfer the capital for the benefit of a particular project development in return for consideration paid using information technology and with a lower barrier to entry and more convenient transaction method than the ones generally available on the market (Król, 2013). This method involves making a great number of minor payments made by the persons involved in the project. The motives behind co-funding of the project is the willingness to participate in profits and strengthen the image and financial reliability among business partners.

Crowdfunding, as the new mechanism to obtain financial means, is characterised by virtual actions as all activities take part with the use of information and communication tools. This allows for elimination of the costs associated with intermediation of financial institutions that perform a transfer of means (e.g. from buyers, distribution centres) to entities (e.g. producers). In return for the delivered means an investor usually obtains return consideration, in form of financial means, services, assets or shares in an investment business. It should be stressed that crowdfunding, as a substitute for traditional funding sources (Agrawal, Catalin, & Goldfarb, 2014) is designated for investments and projects at their early stage. This mainly results from low costs of implementation, i.e. crowdfunding platform charges in Poland range from 2.5% to 11% of the obtained capital (Gostkowska-Drzewicka, 2016).

Raising funds within crowdfunding has four forms:

donation model,

model with rewards for participants, also called a sponsor model,

loan model,

shareholding model (Dziuba, 2012).

All the above may be used in a supply chain and a donation model is characterised by the lowest utility. It is of charitable nature, as there are no return considerations.

The most popular model involves rewards for participants, i.e. in form of tangible or intangible considerations. According to Mollick (2014) in this case a financing person makes advance payment in consideration for acquiring a particular product or service. Loan crowdfunding is based on loans drawn directly from Internet platform users. Usually they are repaid within a short period of time with due interest.

In logistics, a particularly useful type of crowdfunding is a shareholding model. Ahlers, Cumming, Günther and Schweizer (2015) define it as the method of project financing where a particular number of company shares is resold to individual investors as

Application of crowdfunding in supply chain may generate benefits both for financing party as well as an enterprise owner. The following advantages may be distinguished from an investor's point of view:

low entry barriers (low amounts designated for investments),

low transaction costs,

risk sharing through diversification of activities,

investment transparency,

retaining control over the investment.

Shareholding crowdfunding enables the owner to launch investment, which may correlate with company increase in value and with its competitiveness.

The concept of venture capital is also useful in supply chain financial management. It involves financing the economically attractive enterprises that are characterized by a high potential of profit and risk (Metrick & Yasuda, 2010). In some cases financial support is associated with counselling with regard to the manner of management, logistics or accounting. Venture capital may refer to both already existing processes in a given company as well as to new enterprises. There are three major types of investment within the concept of venture capital (Lewandowska, 1999, p. 110). The first one, considered to be the most difficult one, is associated with a company start-up. The second one refers to enterprise initiation, i.e. expansion on the market or a new distribution channel. Finally, the third type of investment applies to companies entering the stock exchange.

In case of venture capital investors expect profits that compensate the high risk. The contracts between participants of a particular enterprise precisely determine the manners of invested capital recovery in case of a profit and a loss. There might be also records of investor's objection concerning sale of the owned shares at any time or the right to assume senior positions in a company management. Within venture capital there could be a goal fund, where the company collects capital to buy out investor's shares. This concept is particularly recommended for small and medium companies that possess limited financial means, which hampers investments. Thanks to venture capital companies may develop technologies, modernize their fleet and process greater numbers of orders for larger contractors.

The above presented methods of finance management in a supply chain do not constitute a closed set. These methods have been chosen for their innovative approach and benefits for the participants of a supply chain.

Findings

Cooperation of the chain's enterprises and appropriate coordination of activities are playing the key role in the supply chain finance management process and the expected effects are achieved through a better allocation of funds within the chain or through better management of financial flows (de Boer et al., 2017). As shown by Pfohl and Gomm (2009), to conceptualize the concept of supply chain finance, it is necessary to examine which assets in a given supply chain are financed by whom and under which conditions. These three dimensions form the framework of the supply chain, which will be the basis for measuring and evaluating SCF results. A matter that needs to be resolved is to find appropriate indicators to assess the management of financial flows in the supply chain. The indicators presented below – EVA, Supply Chain Finance Cube and Cash to Cash Cycle (C2C), are the authors' most noteworthy suggestions for SCF performance measures.

The first indicator is Economic Value Added (EVA), used to measure added value in the context of logistics activities affecting the company's condition. Using it to measure the effects of supply chain finance management results from the evolution of the approach to financial management in the supply chain, from taking into account only the aspect of cost reduction into value oriented. Such an approach proposes, among others Witkowski (2003), defining supply chain management as "flow-oriented and demand-driven optimization that goes beyond the framework of enterprises - network participants that create additional value to realize the sustainable potential of cost reduction and the potential for value growth". The vision of modern supply chains, in which the value orientation is key is called by Blaik "the new school of the supply chain" (2010).

Economic value added is a synthetic measure that reduces the profit by the costs of all the capital invested by the enterprise in accordance with the formula:

EVA = NOPAT - WACC * IC

EVA informs about the company's situation and helps in making correct decisions, also in the area of logistics. It allows proper allocation of capital at various levels of aggregation and disaggregation of activities, and therefore directs actions at individual links in the supply chain. Value of EVA is affected by the working capital management. According to Hofmann and Kotzab (2010), rational management of the supply chain finances enables the supply chain leading company to reduce working capital by up to 40%, as well as significantly reduce capital costs through improved creditworthiness assessment. An appropriate supply chain finance management strategy can therefore have a positive impact on operating income and the economic added value of the chain companies (Coyle, 2003).

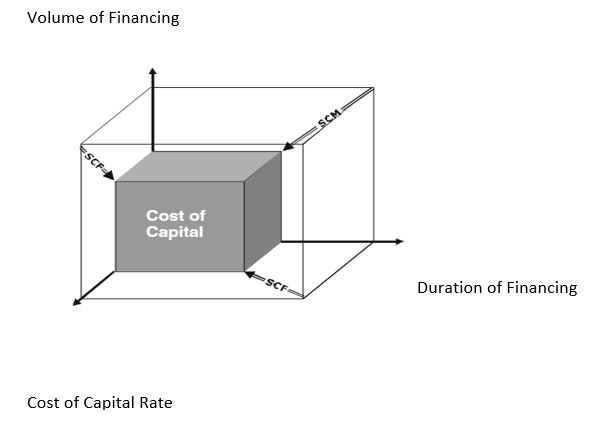

Pfohl and Gomm (2009) note that for the investment to be profitable, the scope of financing should be determined at the planning stage. They also indicate that the aspects analyzed for the purpose of measuring effectiveness by the supply chain finance manager include:

volume (of the resources in which capital will be invested),

capital cost rate,

duration (funding period).

Their analysis can be used to determine the investment profitability threshold in accordance with the formula:

Capital costs (EUR) = volume (EUR) × duration time × capital cost rate over time

The different methods of supply chain finances have an impact on one, two or all of the above aspects (Gelsomino, Mangiaracina, Perego, & Tumino, 2016). The relationship between them can be presented graphically by the so-called "Supply chain finance cube". The gray cube is the capital cost reduced under the influence of SCF and SCM (supply chain management). It should always be smaller than the outer cube representing the initial situation.

Cost of capital rate analyzed in this method depends on the expected return on investment, the company's financing structure, as well as on the risk towards external creditors expected by investors (Pfohl & Gomm, 2009). It is worth noting that the classic methods od supply chain management also have an impact on the supply chain finance cube, through the other two parameters: the funding period and the size of the resources invested (“volume”). For example, the implementation of Just in Time method may have an impact on shortening the financing period and reducing the resources in which capital is invested.

Another measure is C2C cash conversion cycle (working capital cycle, cash-to-cash-cycle), that was proposed among others by Randall and Farris (2009). It is recommended for a more general analysis of the supply chain management efficiency, including the impact of supply chain finance The optimal working capital cycle is recognized as a determinant of proper management of the company's logistics at the operational level, and at the same time a key indicator of the entire chain efficiency and the position occupied by one company in the chain (Hofmann & Belin, 2011).

The C2C cycle can be defined as the average number of days elapsed from investing cash in production factors (materials, raw materials and parts necessary for production) to receive cash as customer receivables. The variables taken into account are receivables, liabilities and inventories. This indicator is calculated on the basis of three values as follows (Gelsomino et al., 2017; Bruska & Pisz, 2016):

C2C = DSO + DIH – DPO , where:

DSO (days sales outstanding) - days from order to cash receipt (repayment period);

DIH (days inventory held) – how many days are kept inventories (both production in progress and finished products);

DPO (days payables outstanding) - days left to payment, liabilities payable in days.

In accordance with the C2C cycle, efficient management of the chain financial flows consists in skillful inventory management, monitoring of payment dates and effective collection of receivables. According to Bruska and Pisz (2016), for an individual company the interpretation of the indicator is relatively easy - the cash conversion cycle should be as short as possible, which means that the company can quickly recover cash. Shortening the cycle of a single company may, however, have negative effects on the remaining links in the chain. Such a threat concerns in particular chains in which there is a disproportion of bargaining power in the system: a strong company shortens the cycle and achieves all the benefits - the bargaining position of the other links deteriorates, which may result in ethical conflicts. A special case is the situation when the indicator has a negative value, which means that the company uses its own liabilities to counterparties to finance operations.

Hausman (2003) notes that this situation is generally conducive to growth, however, provided that there is a phenomenon of external lending, ie counterparties with deferred payment dates do not belong to the chain. Otherwise, it can act to the disadvantage of chain suppliers and consequently reduce the competitiveness of the entire chain. The interpretation of the ratio also depends to a large extent on the nature of the business and the industry.

Hofmann and Kotzab (2010) argue in their research that from the point of view of the entire supply chain finances, relations of the chain links should be characterized by partnership, and the common goal of the participants is to reduce the costs of capital employed and maximize the profit from cash for each of them. We can therefore link the optimization of the cash conversion cycle to the condition that partner relationships exist in the chain. It is worth bearing in mind that partner cooperation in the supply chain can take various forms. The table presents one of the divisions, proposed by Hines (2004, p. 180).

The actual positive impact of the supply chain finances is the greater, the more the relationship between the chain companies take the form of a trust-based strategic alliance. On the other hand, the existence of opportunistic partnerships between links may result in transferring working capital to subsequent links without generating benefits for the whole supply chain.

Hofmann and Kotzab (2010) note that in the supply chain, where cooperation is based on partnership, the C2C cycle of companies with greater bargaining power, and thus with the lowest cost of capital (WACC) will increase. The C2C cycle of other companies with higher financial costs will be shortened. The effect will be improved profitability and financial stability at the scale of the whole chain (Bruska & Pisz, 2016). The key to effective financial management of the supply chain in accordance with C2C is therefore the synchronization of flows along the chain, based on:

establishing partner relationships

mutual recognition of financial strengths

power and the role of the companies that create it.

The key role here is the chain leader who has the relatively best access to capital and accepts the prospect of improving the results of the entire chain, not just its short-term benefits.

Conclusion and Discussions

The measures presented in this article are obviously not the only performance measures of supply chain finances. Hausman (2003) lists features of financial flows, analysis of which may be helpful in assessing the results of implementing chain finance management. These include: credibility of payment methods, predictability of payments for liabilities and receivables, cash flow improvement, information management (compliance of data on the invoice with financial data). An important issue to improve the supply chain financial flows management is therefore a reduction of risk, in particular transactional risk, and an increase in the level of trust. A comprehensive analysis of various types of impacts on the supply chain is also provided by existing scientific studies on specific cases of using SCF successfully, eg in Motorola, by Blackman, Holland, and Westcott (2013). The expected effects of supply chain finance management include, among others, lower borrowing costs, greater borrowing possibilities, especially for small and medium-sized enterprises with no established position, and reduced working capital at the supply chain level. Coyle (2003) notes a number of non-financial effects, such as lower inventory levels, a higher level of customer service (due to higher timeliness and reliability of deliveries), lower transport and storage costs, lower risk in the chain and in supplier companies.

Finance managers in supply chains focus on achieving different outcomes, so there is no single universal method for measuring the performance of supply chain finances. So there is a field for further research, in search of other methods. The supply chain finance cube seems to be the best developed so far measure of supply chain finance efficiency. It should be noted that it is used to measure the impact of SCF on financial results. Therefore, in a more comprehensive analysis, the C2C cycle is worth taking into account. In turn, EVA will be an appropriate tool for those interested in measuring the added value achieved by enterprises of the chain as a result of managing its financial flows. Regardless of the choice of measurement method, managers should strive to strengthen partner relationships between the chain links, which undoubtedly have a positive impact on the performance of supply chain finance management.

References

- Agrawal, A., Catalini, C., & Goldfarb, A. (2014). Some simple economics of crowdfunding. Innovation policy and the economy, 14(1), 63-97. https://dx.doi.org/10.1086/674021

- Ahlers, G. K., Cumming, D., Günther, C., & Schweizer, D. (2015). Signaling in equity crowdfunding. Entrepreneurship theory and practice, 39(4), 955-980. doi:

- Blackman, I. D., Holland, C. P., & Westcott, T. (2013). Motorola's global financial supply chain strategy. Supply Chain Management: An International Journal, 18(2), 132-147.

- Blaik, P. (2010). Logistyka. Koncepcja zintegrowanego zarządzania [Logistics. The concept of integrated management]. 3rd Ed., changed, Warszawa: PWE.

- Bruska, A., & Pisz, I. (2016). Logistyka a zarządzanie cyklem kapitału pracującego – rozwiązania stosowane w skali przedsiębiorstwa [Logistics and practical cycle management - solutions used in the scale of availability]. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu, (425), 24-39.

- Camerinelli, E. (2009). Supply chain finance. Journal of Payments Strategy & Systems, 3(2), 114-128.

- Coyle, J. (2003). The Management of Business Logistics – A Supply Chain Persepctive. USA: Mason.

- de Boer, R., Dekkers, R., Gelsomino, L. M., de Geoij, C., Steeman, M., Zhou, Q., ... & Souter, V. (2017 August). Towards a Theory of Supply Chain and Finance Using Evidence from a Scottish Research Group. Paper presented at 24th International Conference on Production Research, Poznan.

- Dziuba, D. T. (2012). Crowdfunding systems development - models, expectations and circumstances. Problemy Zarządzania, 10 (38), 83-103.

- Gąsowska, M. K. (2014). Kooperacja jako sposób zdobywania przewagi na rynku w świetle badań empirycznych [Cooperation as a way to gain market advantage in the light of empirical research]. Zarządzanie i Finanse, 3(1), 211-226.

- Gelsomino, L. M., de Boer, R., & Steeman, M. (2017 May). Financial futures for service logistics. Presented at Conference IPSERA, Balatonfüred.

- Gelsomino, L. M., Mangiaracina, R., Perego, A., & Tumino, A. (2016). Supply chain finance: a literature review. International Journal of Physical Distribution & Logistics Management, 46(4), 348-366.

- Gostkowska-Drzewicka, M. (2016). Crowdfunding jako źródło finansowania inwestycji w nieruchomości [Crowdfunding as a source of financing real estate investments]. Finanse, Rynki Finansowe, Ubezpieczenia, 79(1), 57-71.

- Grudniewski, J. (2012). Faktoring odwrócony pomysłem na kryzys, Retrieved from http://www.informacjakredytowa.com/faktoringodwrocony-pomyslem-na-kryzys, (access: 20.05.2018).

- Hausman, W. H. (2003). Supply Chain Performance Metrics. In Harrison et al. (Eds.) The Practice of Supply Chain Management: Where Theory and Application Converge, 61-73. Boston, MA: Springer.

- Hines, T. (2004). Supply Chain Strategies. Customer-driven and Customer-focused. Oxford: Elsevier Butterworth-Heinemann.

- Hofmann, E., & Kotzab, H. (2010). A supply chain-oriented approach of working capital management. Journal of Business Logistics, 31(2), 305-330.

- Hofmann E., & Belin, O. (2011). Supply Chain Finance Solutions. Relevance-Propositions-Market Value. Berlin: Springer-Verlag.

- Król, K. (2013). Finansowanie społecznościowe jako źródło finansowania przedsięwzięć w Polsce [Crowdfunding as a source of financing ventures in Poland]. Retrieved from Crowdfunding.

- Lamoureux, J.-F., & Evans, T .A. (2011). Supply Chain Finance: A New Means to Support the Competitiveness and Resilience of Global Value Chains. Working Paper No. 2179944. Social Science Research Network, Rochester, NY.

- Lewandowska, L. (1999). Niekonwencjonalne formy finansowania przedsiębiorczości [Unconventional forms of financing entrepreneurship]. Gdańsk: Ośrodek Doradztwa i Doskonalenia Kadr.

- Malinowski, B. F., & Giełzak, M. (2015). Crowdfunding. Zrealizuj swój pomysł ze wsparciem cyfrowego tłumu [Crowdfunding. Carry out your idea with the support of the digital crowd]. Gliwice: Helion.

- Metrick, A., & Yasuda, A. (2010). Venture capital and the finance of innovation. 2nd Edition, Andrew Metrick and Ayako Yasuda, eds., John Wiley and Sons, Inc.

- Michalczyk, L. (2013). Rola inżynierii rachunkowości w kształtowaniu wyników finansowych przedsiębiorstwa: Rachunkowość wariantowa i odwrócony proces decyzyjny [The role of accounting engineering in shaping the company's financial results: Variant accounting and inverse decision-making]. Warszawa: Wolters Kluwer.

- Mollick, E. (2014). The dynamics of crowdfunding: An exploratory study. Journal of business venturing, 29(1), 1-16. DOI:

- Pfohl, H. Ch. (2006). Finansowe aspekty łańcucha dostaw: zorientowanie na koszt i wartość w logistyce [Financial aspects of supply chain: orientation on cost and value in Logistics]. In T. Janiak (Ed.), Najlepsze praktyki w logistyce. Polski Kongres Logistyczny “Logistics”. Poznań: Instytut Logistyki i Magazynowania.

- Pfohl, H. Ch., & Gomm, M. (2009). Supply chain finance: optimizing financial flows in supply chains. Logistics Research. DOI:

- Popa, V. (2013). The financial supply chain management: a new solution for supply chain resilience. Amfiteatru Economic, 15(33), 140.

- Randall, W. S., & Farris, T. M. (2009). Supply chain financing: using cash-to-cash variables to strengthen the supply chain. International Journal of Physical Distribution & Logistics Management, 39(8), 669-689. DOI:

- Wawryszuk-Misztal, A. (2013). Wykorzystanie faktoringu odwrotnego w zarządzaniu płynnością przedsiębiorstw [The use of reverse factoring in corporate liquidity management]. Zarządzanie i Finanse. Journal of Management and Finance, 11(1-4), 581-595.

- Witkowski, J. (2003). Zarządzanie łańcuchem dostaw [Supply chain management]. Warszawa: PWE.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 October 2019

Article Doi

eBook ISBN

978-1-80296-070-9

Publisher

Future Academy

Volume

71

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-460

Subjects

Business, innovation, Strategic management, Leadership, Technology, Sustainability

Cite this article as:

Pawlicka*, K., & Właszynowicz, M. (2019). Methods And Performance Measures Of Supply Chain Finance. In M. Özşahin (Ed.), Strategic Management in an International Environment: The New Challenges for International Business and Logistics in the Age of Industry 4.0, vol 71. European Proceedings of Social and Behavioural Sciences (pp. 179-189). Future Academy. https://doi.org/10.15405/epsbs.2019.10.02.16