Moderating Effect of Corporate Governance Between Recapitalization and Bank’s Performance: Conceptual Framework

Abstract

The purpose of this study is to primarily evaluate the existing studies on the relationship between recapitalization on bank’s performance by using corporate governance as a moderator. Many studies examine the relationship between recapitalization and bank’s performance. However, the nature and existence of this potential relationship are found to be mixed and inconclusive (i.e., positive, negative, or no relation at all). These have prompted scholars, experts, and authorities to re-examine the relationship between recapitalization and the bank’s performance. Accordingly, questionnaires will be distributed to regional manager, branch manager or any senior manager in the selected banks of Nigerian banking sector. Partial Least Square Structural Equation Modelling (PLS-SEM) and SPSS software will be used to analyse the data. This study addresses the research deficit and proposes a conceptual and theoretical framework for measuring the effectiveness of recapitalization and bank performance, which could be used by banks and other regulatory bodies. Furthermore, a recommendation for future research in the area are also suggested.

Keywords: Recapitalizationmerger & acquisitionequity issueinterventionbanks performancecorporate governance

Introduction

The global financial crisis (GFC) of the last decade has been described as the most serious crisis since the Great Depression of 1940 (Fernandes, Farinha, Martins, & Mateus, 2016). Given that the failure of many banks was imminent and governments all over the world enacted a variety of rescue operations to prevent wide-scale financial collapse with many means of government interventions which included (i) direct capital injections, (ii) liquidity support to banks, (iii) purchases of distressed assets by the government e.g. ‘toxic’ assets (Fernandes et al., 2016). Bank regulators believe that by having higher capital levels can be able to reduce its insolvency and risk that is to increase its loss absorbance capacity and increase the chances of banks’ survival probabilities (Berger & Bouwman, 2013). In agreement with Basel capital requirements most of the empirical studies in this regard, suggests that banking recapitalization improves banking efficiency, role of traditional lending of banks and allows banks to increased ability to withstand economic pressures, thereby providing stability for international banking system and international businesses (Berger & Bouwman, 2013; Francis, Hasan, & Wu, 2012; Repullo & Suarez, 2013).

Additionally, different countries either developed or developing had various experiences and method for approaching their banking recapitalization and how its affect banks performance. For example, the banks recapitalization experiences of Malaysia, Indonesia and Thailand were directly affected by the 1997 Asian financial crises (Ernovianti & Ahmad, 2017; Etri, Nor, & Mazlan, 2016; Sufian & Shah Habibullah, 2013), while other European countries and USA banking recapitalization was as a direct response to the 2007 to 2008 GFC (Georgakopoulos, 2017; Tomec & Jagrič, 2017). Despite the full implementation of Basel regulatory capital requirement by most countries, but still is not clear if such measures were able to achieve the desired results for stability in the most of the country’s banking sector (Tahir, Adegbite, & Guney, 2017).

Similarly, in Nigeria, it was emphasized that the poor corporate governance practices and poor managerial performance were notably contributed to the problem of banks recapitalization (Adegbite, 2015; Shehu, Zuriana, Jamil, & Mohamed, 2014; Yakasai, 2001). Specifically in the banking industry it was observed that, the poor performance and poor CG had been recognized as the major culprits of the baking distress in Nigeria, which led to the commercial banks recapitalization reform in 2004 and specialized banks recapitalization in December 2007(Acha, 2012; CBN, 2010; Sanusi, 2010). However, in July 2009 CBN and Nigeria Deposit Insurance Corporation (NDIC) carried out a special examination of all 24 universal banks in Nigeria, with the aim of assessing their state of health, with particular focus on capital adequacy, risk management, liquidity and corporate governance practices (Chiakelu, 2010; NDIC, 2011; Oleka & Mgbodile, 2014). In addition, Ten banks were adjudged to be in grave states with deficiencies in capital adequacy and eight out of them also had significant deficiencies in risk management practices, liquidity, and corporate governance policies whereas, the aggregate of a non-performing loan of these banks was 40.81% (CBN, 2010; Sanusi, 2011). Moreover, the Executive Directors (ED) of these eight banks were immediately replaced, and all the 10 banks were bailed out by the injection of fresh capital totalling to N620 billion, in the form of Tier two Capital intervention by the CBN (Alford, 2011; CBN, 2010; Sanusi, 2010; Shehu et al., 2014).

Even with the importance of the banking sector in regulating and stabilizing the economy, many empirical studies concerning the relationship between recapitalization and the performance of banks in both developed and developing economies appeared to be mixed, inconsistency, contradiction and couple with weak findings. For instance, in the studies of (Beccalli & Frantz, 2016; Bhagat, Malhotra, & Zhu, 2011; Bhaumik & Selarka, 2012; Ding, Wu, & Chang, 2013; Donou-Adonsou & Sylwester, 2017; Ernovianti & Ahmad, 2017; Etri et al., 2016; Nicholson & Salaber, 2013; Yusupov, 2012) found positive and (Aybar & Ficici, 2009; Beccalli, Frantz, & Lenoci, 2016; Bertrand & Betschinger, 2012; Bibi, Balli, Matthews, & Tripe, 2018; Forssbaeck & Nielsen, 2016; Tomec & Jagrič, 2017) found negative while (Adedeji, Babatunde, & Adekanye, 2015; Liao & Williams, 2008) found Neither positive nor negative (no relation). Furthermore, most researches conducted globally and Nigeria in particular, are having some other kind of shortcomings which results in usual conflicting findings, inconsistency, limited scope and inconvenience samples, and usually focused mainly on the direct relationships between a single strategy or approach of recapitalization and performance, thus neglecting the indirect path through roles and strategic initiatives.

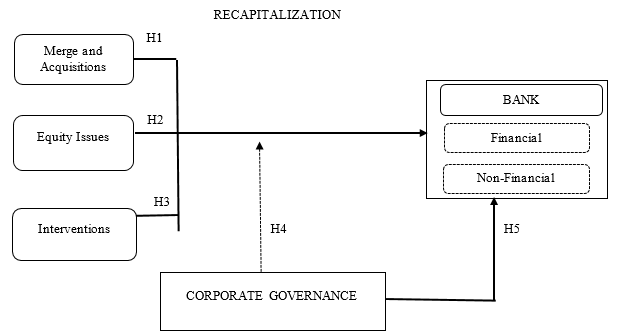

This study is hence at proposing a framework that selects the most appropriate variables best address recapitalization and banks’ performance problems peculiar to Nigeria, and introducing a moderation variable (CG) that will strengthen the inconsistency and weak relationship between recapitalization and banks performance as suggested by (Baron & Kenny, 1986; Fairchild & MacKinnon 2009; Hair et al., 2017; Rezaul Kabir, 2017).Similarly, This paper, posit as a primary relationship association between recapitalization and bank’s performance and then examine whether corporate governance moderates this relationship. It is widely acclaimed that a better corporate governance practice enhances firm’s performance (Adams & Mehran, 2012; Brickley & James, 1987; Chung, Wright, & Kedia, 2003; Francis et al., 2012). In spite of the generally accepted notion that good corporate governance enhances firm performance, other studies have reported negative relationship (Hutchinson, 2002; Pathan & Faff, 2013; Shahwan, 2015) while some studies found no any relationship between CG and performance (Park & Shin, 2004; Wintoki, Linck, & Netter, 2012). However, Gani and Jermias (2006) reported that the restrictive used of single dimensional financial based measures contributed to inconsistency in the relevance findings.

To address the abovementioned problems, it was recommended that, the CG and its correlation with firm performance should take a multivariate approach (multidimensional) to sharpen the relationship (Kyereboah-Coleman, 2008). This study adds to the literature by employing both financial and non-financial measures of performance as suggested by (Hussain & Hoque, 2002; Kaplan & Norton, 2001) more especially those recommended, fit and selected for performance evaluation in banking through expert questionnaires (Wu, Tzeng, & Chen, 2009).

Conclusively, this paper adopts the agency and resource dependence theories as integrated by (Hillman & Thomas, 2003). Agency theorists sees the primary function of CG characteristics as monitoring the actions of agents “managers” to protect the interests of principals “shareholders” (Eisenhardt, 1988; Jensen & Meckling, 1976). Moreover, Berle and Means (1933) explored that, the theoretical underpinning of CG monitoring functions derived from agency theory while Empirical studies in the resource dependence theory have shown the relationship between capital provision and firm’s performance. However, among the common methods of measuring recapitalization, to the authors are going to use a reputation index (Islam, Ahmed, & Hasan, 2012; Moskowitz, 1972) to measures recapitalization in Nigeria. The authors will have to develop a questionnaire and ask the knowledgeable observer to rate the firm on three dimensions of recapitalization and 23 items of financial and non-financial performance in banking as suggested (Wu et al., 2009). Additionally, the outcome of this paper shall be of immense importance to academics, regulators, shareholders, and policymakers as it will reveal the contribution in strengthening the functions of recapitalization approaches in ensuring good banks’ performance. The paper is subdivided into four parts from the introduction, literature review, conceptual framework, conclusion, and reference.

Literature Review

The Meaning of Recapitalization

Etri, Nor and Mazlan (2016) described recapitalization as a rescue plan by the central bank of a country through capital injections and acquisitions of weaker banks by stronger banks. Recapitalization has been defined as a change in the capital structure of a company or an organization (Aduloju, Awoponle, & Oke, 2008). According to Petrovic and Tutsch (2009) suggested that the distressed banks with a view to capital restructuring can involve in either private or public recapitalization in other to be recapitalized. Similarly, Beccalli and Frantz (2016) have extensively discussed the main motivation for private recapitalizations which is to reduce risk-taking hypothesis through solvency risk to achieve the existence of better operating performance. However, the motivation for banks public recapitalization is associated with larger size, lower liquidity, and higher growth at the bank level but lower growth at the country level, additionally, the authors further revealed that, the state intervention happens in more difficult situations where private recapitalization solution are difficult to achieved.

However, according to Beccalli et al. (2016) revealed that, the empirical studies on the effects of recapitalizations on bank performance has many dimensions which include, systemic risk, business model and profitability, while a large growing number of bank literature on the determinants of bank recapitalization are devoted to bank capital, market effects of bank recapitalizations, effect of capital regulation on performance and profitability. It is also revealed that capital helps small banks to increase their market share and probability of survival at all times (Berger & Bouwman, 2013). Ameur and Mhiri (2013) reported that bank recapitalization have a positive and significant effect on the bank performance and their empirical results show a high degree in determining the bank performance by using Return on Asset (ROA), Return on Equity (ROE), and Net Interest Margin as proxies for evaluating bank performance.

Recapitalization Approaches

Based on the discussion of the previous literature Adedeji, Babatunde, and Adekanye (2015) also reported that the strategies in recapitalization include mergers and acquisitions which will lead to the external growth of a company. However, According to Coates and Scharfstein (2009) reported that the bank's recapitalization has three basic approaches, through either equity issue which comprised public offering and private placement, intervention, and sales of banks (M&As) as shown in table 2.1 below.

Merger and Acquisition Approach

One of the most notable developments at the global level affecting the banking industry for the last couple of decades has been the unprecedented level of merger & acquisition (M&A) activity (Altunbaş & Marqués, 2008). Delong (2001) argued that bank mergers that are concentrating (in terms of activity and geography) produce superior bank performance relative to those that are diversifying. For instance, banking recapitalization has been a trend in the United States of America since in the mid-1980s for poorly performing banks but merged and still continued even after the banking industry returned to discover profit in 1992 (Delong, 2001). Delong and Deyoung (2007) reported that 216 M&A of the USA banking companies that started between 1987 and 1999 has a long-term effect on financial performance and found that the merger increased long-term ROA and improved efficiency.

Recapitalization of banks through mergers and acquisitions has been enhancing the development of the banking industry and remained a viable option for the survival of banks and for companies to remain in business. In addition, the increase of globalization brought about by recapitalization through M&As are growing popular as means of speedily achieving the size-related economies of scale and scope as well as global reach (Belcher & Nail, 2000). According to Christine and Jagongo (2018) defined merger as the combination of two or more companies, generally by offering the stockholders of one company securities in the acquiring company in exchange for the surrender of their stock where one company or both loose entity. However, Halpern (1983) interpreted mergers as when an acquiring firm and a target firm(s) agree to combine under legal procedures established in the states in which the merger participants are incorporated. In recent years and most of the time, the term “Merger and Acquisitions” are often used interchangeably (Christine & Jagongo, 2018). Some companies are operationalized by assessing the company’s performance which leads to the influence M&As, while large and profitable companies that have better access to financial resources that are needed to acquire other company are expected to engage in diversifying M&As as there are opportunities to grow in their own industry.

Importance of Mergers and Acquisitions

The importance of merger and acquisitions has been identified in the previous literature. Some of these literature found that merger and acquisitions may increase efficiency (Mcguckin, 1995), improve market power (Kim & Singal, 1993), enhance the management of resource dependency (Casciaro & Piskorski, 2005; Pfeffer, 1972), reduce transaction costs (Williamson, 1985) and operating costs King, Slotegraaf, & Kesner, 2008).

Equity Issues

Firms with a higher growth rate that face capital constraints will go for equity issue, these transaction types give the firm, its managers, and investors access to public capital markets (Poulsen & Stegemoller, 2008). According to Coates and Scharfstein (2009), for this approach of recapitalization, banks can issue equity to the private investors, and it is possible for the banks to raise a significant amount of capital through equity issues, whether as initial public offerings (IPO) or private placements. Additionally, equity issue could be structured as a rights issue in which the current shareholders are given the right to acquire more equity at given price, at a discount market or fair value in other to encourage new investment. Additionally, the authors revealed that existing creditors are the immediate beneficiaries of equity issue because the creditors have a prior claim on asset and for the IPOs to be attractive to the new investor it has to be priced low enough for compensation. In this case, it is necessary for the bank to recapitalize which is clearly in the collective interest of the bank or turn out to be insolvent (Coates & Scharfstein, 2009).

Initial Public Offerings (IPO)

Initial public offering (IPO) is the new issue (first sale) of stocks issued by a private firm to raise capital in the capital market by which the issuer firm is transformed into a public company (Boonchuaymetta & Chuanrommanee, 2013; Carter & Manaster, 1990). The decisions relating to the financing of a firm is always very complex to evaluate, but normally its depend on the availability of instruments, sources, and methods of financing (Ragupathy, 2011). Raising capital via IPOs and the current financial ecosystem provides many opportunities for company owners to raise resources in multiple capital markets (Sundarasen, Goel, & Zulaini, 2017). However, Bateni, Roodposhti, Poorzamani, and Asghari (2014) reported that the Public offering of securities has the following advantages for the disseminators.

Gaining capital for growth & development of activities

Gaining useful information via the expert analyst.

Increasing the company's performance.

The suppliers of financial sources & investors will trust more.

Carter and Manaster (1990) suggested that, a reputed investment banker with industry expertise reduces the under-pricing problem, which will reduce the information asymmetry, thereby maximizing the profits for the firm, although the purpose of assigning investment bankers is to help the firm to sail through the new issues process, which involves government and regulatory requirements. Similarly, Loughran and Ritter (1995) documented that, a reputable underwriter reduces the long-run underperformance associated with IPO. Ahmed and Doski (2014) reported that going to the public is considered a very vital decision for a company.

However, the idea of recapitalization through IPOs is now developing even among some the deloped micro-finance banks in some countries. For instance, Lieberman, Anderson, Grafe, Campbell, and Kopf (2015) reported that four leading MFIs which includes Bank Rakyat of Indonesia, BRAC Bank of Bangladesh, Banco Compartamos of Mexico, and Equity Bank of Kenya are now listed on national stock exchanges. The authors further revealed that, four institutions are well known throughout the microfinance industry for their robust financial performance, exceptional growth, and their ability to scale-up their outreach to the working poor. Additionally, the authors revealed that, like any business going public, the IPOs and listings have allowed the four institutions to tap into the mainstream investor community and to take advantage of new opportunities. The capital markets have signaled that the microfinance banking sector is a potential source of profitable investment.

Private Placement

Private placement has a considerable advantages in the public market because of the lower cost of raising capital and in terms of dealing with single, small group or a big group of investors (Ragupathy, 2011). Taylor and Taylor (1998) define private placement as equity or debt security transaction that is exempted from registration under the Securities Act of 1933. Moreover, the authors also reported that a sale qualifies as an exempted private placement if there is a limited number of purchasers and have access to all important information about the issuer and the issue. The empirical study found that large shareholders participated in private placement for capital operation they have restrained the issuance of low pricing, protected the interests of small and medium-sized investors, balanced the interests of large shareholders, in the meantime also promoted the long-term development of the enterprise (Ruan, Song, & Zheng, 2018).

However, raising capital through private placements comes at the cost of diluting the economic and voting interests of retail investors who are legally prevented from participating in the issue (Brown, Ferguson, & Stone, 2008). Lee, H., Kocher (2001) identified the characteristics of firms making private placements and analyzed six determinants factors of the private placement which includes dividends, firm size, free cash flow, growth opportunities, overvaluation and ownership fraction. Similarly, from the prior literature Brown et al. (2008) also identified eight firm characteristics for private placement: growth and investment opportunities, profitability, liquidity, cash holdings, dividend behavior, leverage, shareholder structure, and overseas exchange listing. However, the authors emphasized that firm size is being a control factor in many of the analysis.

Intervention

Laeven and Fabia Valencia (2013) define government intervention as a Significant banking policy measures in response to significant losses in the banking industry. According to Coates and Scharfstein (2009) reported that one of the major approaches to recapitalize the banks is through intervention. The global financial crisis has onwards spread around the world and impacted the performance of banking sector in major economies and drew the attention of several governments to have used a variety of intervention to recover their financial systems. This trends of GFC had long started in 1929 when financial system of U.S.A collapsed, in less than two weeks more than 300 billion USD worth of wealth disappeared while crisis spread to other economies, resulting in the Great Depression (Ding et al., 2013). Similarly, the authors further revealed that nearly after 80 years, another financial tragedy began in 2007 because of the sub-prime mortgage crisis in U.S.A resulted in a snowball that continued to hurt financial system in many developed and developing countries.

Moreover, recapitalization through the government intervention in Nigerian banking industry can be traced to the GFC which began in the United States of America and Europe and then moved over to several nations in which Nigeria fell among (Shehu et al., 2014). Consequently, another set of banking sector intervention program being introduced to ensure stability and prevent banking distress. The CBN and the Nigeria Deposit Insurance Corporation (NDIC) in July 2009, conducted a joint special examination of all deposit banks in Nigeria, with the purpose of evaluating their health, with a special focus on capital adequacy, liquidity, and Corporate Governance practices. Furthermore, the authors also reported that, the outcome was announced by the governor of CBN who declared ten banks of the Nigerian banking sector as being distressed due to excessive level of non-performing loans which was attributable to poor corporate governance practices and bad liquidity position. Consequently, a bail-out of N620 billion was injected to rescue the affected banks which improved performance (NDIC, 2011; Sanusi, 2010, 2011; Shehu et al., 2014).

Laeven and Fabia Valencia (2013) study comprehensive banking crises from 1970 to 2011 used six items to measure bank intervention which includes deposit freezes, significant bank nationalizations, bank restructuring gross costs, extensive liquidity support, significant guarantees put in place and significant asset purchases. However, in another study (Ding et al., 2013) they measured the government intervention on banks performance in five major Asian economies, Hong Kong, Japan, Singapore, South Korea and Taiwan by using total deposits/total assets, total deposits/total funding, total allowance for bad debt/total loans, loan loss reserves/non-performing loan, ROA and growth rate of assets (GRA) as performance proxies and the authors measured intervention with government guaranteed, debt issuance programs and direct equity injections. Additionally, the authors reported that bank performance regarding profitability, solvency, and credit risk, improves after government intervention. Moreover, they suggested that the influence of government intervention on bank performance depends on the evaluative financial indicators.

Performance

Performance of an organization can be defined in many ways. For instance, Antony and Bhattacharyya (2010) defined performance as the measures that is used to assess and evaluate the success of an organization to create and deliver the values to its external as well as internal customers. Furthermore, Simons (2013) defined firm performance as a company’s activities interacting with different market mechanisms (financial factors and customers). Various approaches were used to measure performance. For instance, Kaplan and Norton (2001) suggested that performance measures in multiple forms ought to be multidimensional to cover the financial and non-financial measures. Many researchers also such as (Akbari, Shaverdi, & Fallah Tafti, 2011; Stankevičienė & Mencaitė, 2013) have stressed that in the service sector, like the banking industry, it is necessary to make use of multidimensional performance measurements. The perception of non-financial measures are better for forecasting of a long run firm’s performance, as well the business leaders to monitor their company's efficiency effectively (Hussain & Hoque, 2002; Kaplan & Norton, 2001).

The traditional performance measures of banks performance were based on simple and consistent factors such as financial returns, returns on earning (ROE) and returns on asset (ROA). Non-financial criteria can be vital to a bank’s winning strategy, because using only ROE or ROA for performance ranking may not determine which institution offers the highest returns to the investors or prove which one is most profitable (Akbari et al., 2011). However, this current study will adopts the Balance scorecard (BSC) model for bank’s performance evaluation which was developed by ( Kaplan & Norton, 1992). The Balanced Scorecard (BSC) is an extensive performance evaluation tool which can adequately control and plan an organization so that it can accomplish its goals (Davis & Albright, 2004). The BSC breaks the traditional limitations of performance evaluation from the four (one financial and three non-financial perspectives (customer, internal business process and learning & growth ( Kaplan & Norton, 1996). It emphasizes both aspects of financial and non-financial performance, internal and external business measures, long-term and short-term strategies. According to Kim and Davidson (2004) the BSC is also utilized as a framework to develop a performance evaluation indicators for banks. In conclusion, this study will adapt the 23 evaluation indexes that are selected as being suitable for banks performance in terms of BSC perspectives through the expert questionnaires (Wu et al., 2009).

Corporate Governance

Corporate governance in financial institutions especially banks, is unique when compared to non-bank financial institutions (Bastomi, Salim, & Aisjah, 2017). The behaviour of managers and bank owners became a major factor that needs attention in the implementation of corporate governance which shows that improving the implementation of corporate governance can reduce credit risk and operational risk and increase financial performance (Bastomi et al., 2017). If sound corporate governance is not in place, banking supervision cannot be well- functioning (Nworji & Olanrewaju David, 2011). Moreover, agency theory suggests that strong corporate governance leads to better accounting outcomes and improves performance (Jensen & Meckling, 1976). So basically, poor corporate governance can lead a bank to lose the ability to manage its deposits, assets, and liabilities which could, in turn, trigger a bank to run in a liquidity crisis.

These arrangements have been used universally so that they are applicable to all countries or companies and also harmonizes with the rules, values and legal system prevailing in their respective states (Bitar, Pukthuanthong, & Walker, 2017). The main principles of governance offered by OECD are independence, disclosure/transparency, responsibility, fairness, and accountability (OECD, 2017).

As indicated earlier this study aims at the strengthen the relationship between recapitalization and banks performance and introduced corporate governance as a moderator variable as suggested by Baron and Kenny (1986), Frazier, Tix, and Barron (2004) Fairchild & MacKinnon (2009) to analyzed the moderation effect as a test whether the prediction of a dependent variable affects the strength or direction of the relation between a predictor and an outcome by changing, reducing, or enhancing the influence of the predictor.

3 conceptual Framework of recapitalization, bank performance, and corporate governance are shown below in figure

Conclusion

The research finding depends on the results of hypotheses test. However, this study review and theoretically examine the relationship between recapitalization strategies (merger and acquisitions, equity issues, and intervention) and bank performance (financial and non-financial) with the interaction effect of corporate governance between the two variables. Moreover, CG influence of performance measurement in providing adequate information to support the CG of banks who have the function of advising the managements’ overall strategic system of control and monitoring which will result in a better banks performance. Also, having an understanding on how the importance of recapitalization relates with bank performance, it will enable the various parties such as regulatory authorities (e.g., CBN, NDIC) board of directors, and management of banks to formulate policies, make appropriate decisions and implementation of strategies. More so, intended scholars in this area of research can empirically provide evidence(s) on the established relationship between the variables selected in this study and add other additional control variables such as bank size, bank age, etc. can be considered by future researchers.

References

- Acha, I. (2012). Microfinance banking in Nigeria : Problems and prospects. International Journal of Finance and Accounting, 1(5), 106–111.

- Adams, R. B., & Mehran, H. (2012). Bank board structure and performance: Evidence for large bank holding companies. Journal of Financial Intermediation, 21(2), 243–267.

- Adedeji, L. O., Babatunde, M. A., & Adekanye, T. (2015). Recapitalization policy and performance of banks in Nigeria (2006 - 2013). International Journal of Economics, Commerce and Management, III(4), 1–12.

- Adegbite, E. (2015). Good corporate governance in Nigeria: Antecedents, propositions and peculiarities. International Business Review, 24(2), 319–330.

- Aduloju, S. A., Awoponle, A. L., & Oke, S. A. (2008). Recapitalization, mergers, and acquisitions of the Nigerian insurance industry. The Journal of Risk Finance, 9(5), 449–466.

- Ahmed, S., & Doski, M. (2014). The effect of initial public offering on company performance a case study on Asia cell in Kurdistan region. Research Journal of Finance and Accounting, 5(18), 103–117.

- Akbari, M., Shaverdi, M., & Fallah Tafti, S. (2011). Combining fuzzy MCDM with BSC approach in performance evaluation of Iranian private banking sector. Advances in Fuzzy Systems, 21(3), 1–12.

- Alford, D. (2011). Nigerian banking reform: Recent actions and future prospects. Abuja.

- Altunbaş, Y., & Marqués, D. (2008). Mergers and acquisitions and bank performance in Europe: The role of strategic similarities. Journal of Economics and Business, 60(3), 204–222.

- Ameur I. G. B., & Mhiri, S. M. (2013). Explanatory factors of bank performance evidence from Tunisia. International Journal of Economics, Finance and Management, 2(1), 143–152.

- Antony, J. P., & Bhattacharyya, S. (2010). Measuring organizational performance and organizational excellence of SMEs-Part 1: A conceptual framework. Measuring Business Excellence, 14(2), 3-11.

- Aybar, B., & Ficici, A. (2009). Cross-border acquisitions and firm value: Multinationals of emerging-marketnd firm value. Journal of International Business Studies, 40(8), 1317–1338.

- Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182.

- Bastomi, M., Salim, U., & Aisjah, S. (2017). The role of corporate governance and risk management on banking financial performance in Indonesia. Jurnal Keuangan Dan Perbankan, 21(040), 589–599.

- Bateni, L., Roodposhti, F. R., Poorzamani, Z., & Asghari, F. (2014). The relationship between IPO price and liquidity: Empirical evidences from Iran. International Journal of Economics and Finance, 6(6), 226–233.

- Beccalli, E., & Frantz, P. (2016). Why are some banks recapitalized and others taken over? Journal of International Financial Markets, Institutions and Money, 45(2), 79–95.

- Beccalli, E., Frantz, P., & Lenoci, F. (2016). Hidden effects of bank recapitalizations. London School of Economics, 44(1), 1–38.

- Belcher, T., & Nail, L. (2000). Integration problems and turnaround strategies in a cross-border merger: A clinical examination of the Pharmacia-Upjohn merger. International Review of Financial Analysis, 9(2), 219–234.

- Berger, A. N., & Bouwman, C. H. S. (2013). How does capital affect bank performance during financial crisesα. Journal of Financial Economics, 109(1), 146–176.

- Berle, A. A., & Means, G. C. (1933). The modern corporation and private property. The Yale Law Journal, 28(184), 477–479.

- Bertrand, O., & Betschinger, M. A. (2012). Performance of domestic and cross-border acquisitions: Empirical evidence from Russian acquirers. Journal of Comparative Economics, 40(3), 413–437.

- Bhagat, S., Malhotra, S., & Zhu, P. C. (2011). Emerging country cross-border acquisitions: Characteristics, acquirer returns and cross-sectional determinants. Emerging Markets Review, 12(3), 250–271.

- Bhaumik, S. K., & Selarka, E. (2012). Does ownership concentration improve M & A outcomes in emerging markets? Evidence from India. Journal of Corporate Finance, 18(4), 717–726.

- Bibi, U., Balli, H. O., Matthews, C. D., & Tripe, D. W. L. (2018). New approaches to measure the social performance of microfinance institutions (MFIs). International Review of Economics and Finance, 53(2), 88–97.

- Bitar, M., Pukthuanthong, K., & Walker, T. (2017). The effect of capital ratios on the risk, efficiency and profitability of banks: Evidence from OECD countries. Journal of International Financial Markets, Institutions & Money.

- Boonchuaymetta, E., & Chuanrommanee, W. (2013). Management of the IPO performance in Thailand. Journal of Multinational Financial Management, 23(4), 272–284.

- Brickley, J. A., & James, C. M. (1987). Takeover market, corporate board composition, and ownership structure: The case of banking. University of Chicago Press Journal, 30(1), 161–180.

- Brown, P., Ferguson, A., & Stone, K. (2008). Share purchase plans in Australia : Issuer characteristics and valuation implications. Australian Journal OfManagement, 33(4), 307–332.

- Carter, R., & Manaster, S. (1990). Initial public offerings and underwriter reputation. The Journal of Finance, XLV(4), 1045–1067.

- Casciaro, T., & Piskorski, M. J. (2005). Power imbalance, mutual dependence, and constraint absorption: A closer look at resource dependence theory. Sage Publications, Inc., 50(2), 167–199.

- CBN (2010). Cbn scope, conditions & minimum standards for specialized institutions regulations No. 03. Abuja.

- Chiakelu, E. (2010). Recapitalization of the banks in nigeria. Aprica Political and Economic Strategic Centre.

- Christine, O., & Jagongo, A. (2018). Mergers and acquisitions on financial performance among selected commercial banks, Kenya. International Academic Journal of Economics and Finance, 3(1), 1–23.

- Chung, K. H., Wright, P., & Kedia, B. (2003). Corporate governance and market valuation of capital and R&D investments. Review of Financial Economics, 12(2), 161–172.

- Coates, J. C., & Scharfstein, D. S. (2009). Lowering the cost of bank recapitalization. Yale Journal on Regulation, 26(2), 372–389.

- Davis, S., & Albright, T. (2004). An investigation of the effect of Balanced Scorecard implementation of financial performance. Management Accounting Research, 15(2), 135–153.

- Delong, G. L. (2001). Stockholder gains from focusing versus diversifying bank mergers. Journal of Financial Economics, 59(2), 221–252.

- Delong, G., & Deyoung, R. (2007). Learning by Observing: Information Spillovers in the Execution and Valuation of Commercial Bank M&As. American Finance Association, 62(1), 181–216.

- Ding, C. G., Wu, C. H., & Chang, P. L. (2013). The influence of government intervention on the trajectory of bank performance during the global financial crisis: A comparative study among Asian economies. Journal of Financial Stability, 9(4), 556–564.

- Donou-Adonsou, F., & Sylwester, K. (2017). Growth effect of banks and microfinance: Evidence from developing countries. Quarterly Review of Economics and Finance, 64(4), 44–56.

- Eisenhardt, K. M. (1988). Agency- and institutional-theory explanations: The case of retail sales compensation. The Academy of Management Journal, 31(3), 488–511.

- Ernovianti, E., & Ahmad, N. H. (2017). Influence of external forces on bank recapitalization : An evidence of banks in IMT-GT economic region. Journal of Accounting and Finance in Emerging Economies, 3(2), 123–130.

- Etri, E., Nor, H., & Mazlan, R. A. (2016). Recapitalization effectiveness and performance of banks in Malaysia. Information Management and Business Review, 8(4), 6–12.

- Fairchild, A. J., & MacKinnon, D. P. (2009). A general model for testing mediation and moderation effects. Prevention Science, 10(2), 87–99.

- Fernandes, C., Farinha, J., Martins, F. V., & Mateus, C. (2016). Supervisory boards, financial crisis and bank performance: Do board characteristics matter? Journal of Banking Regulation, 18(4), 310–337.

- Forssbaeck, J., & Nielsen, C. Y. (2016). TARP and market discipline : Evidence on the moral hazard effects of bank recapitalizations (10 No. 2016). Lund, Sweden.

- Francis, B. B., Hasan, I., & Wu, Q. (2012). Do Corporate Boards Affect Firm Performance? New Evidence from the Financial Crisis. SSRN Electronic Journal, 26(7), 1–58.

- Frazier, P. A., Tix, A. P., & Barron, K. E. (2004). Testing moderator and mediator effects in counseling psychology research. Journal of Counseling Psychology, 51(1), 115–134.

- Gani, L., & Jermias, J. (2006). Investigating the effect of board independence on performance across different strategies. International Journal of Accounting, 41(3), 295–314.

- Georgakopoulos, N. L. (2017). PIRG doldrums: Exit via overrecapitalization. European Journal of Law and Economics, 43(2), 317–332.

- Hair, J. F., Hult, G. T., & Ringle, M. C. M. (2017). A primer on partial least squares structural equation modeling. Los Angeles: SAGE Publications, Inc.

- Halpern, P. (1983). Corporate acquisitions: A theory of special cases? A review of event studies applied to acquisitions. The Journal of Finance, 38(2), 297–317.

- Hillman, A. J., & Thomas, D. (2003). Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Academy of Management, 28(3), 383–396.

- Hussain, M., & Hoque, Z. (2002). Understanding non‐financial performance measurement practices in Japanese banks. Accounting, Auditing & Accountability Journal, 15(2), 162–183.

- Hutchinson, M. (2002). An analysis of the association between firms’ investment opportunities, board composition and firm performance. Asia-Pacific Journal of Accounting & Economics, 9(1), 17–38.

- Islam, Z., Ahmed, S. U., & Hasan, I. (2012). Corporate social responsibility and financial performance Linkage: Evidence from the banking sector of Bangladesh. Journal of Organizational Management, 1(1), 14–21.

- Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior , agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

- Kaplan, R. S., & Norton, D. P. (1992). The balanced scorecard –measures that drive performance. Harvard Business Review.

- Kaplan, R. S., & Norton, D. P. (1996). The Balanced Scorecard: Translating Strategy Into Action. Proceedings of the IEEE (Vol. 85). Boston, Massachussees: Harvard Business School Press.

- Kaplan, R. S., & Norton, D. P. (2001). Transforming the balanced scorecard from performance measurement to strategic management: Part I. Accounting Horizons, 15(1), 87–104.

- Kaplan, R., & Norton, D. (2001). Transforming the balanced scorecard from performance measurement to strategic management: Part II. Accounting Horizons, 15(2), 147–160.

- Kim, C. S., & Davidson, L. F. (2004). The Effects of IT Expenditures on Banks ’ Business Performance: Using a Balanced Scorecard Approach. Managerial Finance, 30(6), 28–45.

- Kim, H. E., & Singal, V. (1993). Mergers and Market Power : Evidence from the airline industry. American Economic Association, 83(3), 549–569.

- King, D. R., Slotegraaf, R. J., & Kesner, I. (2008). Performance implications of firm resource interactions in the acquisition of R & D-intensive firms. Organization Science, 19(2), 327–340.

- Kyereboah-Coleman, A. (2008). Corporate governance and firm performance in Afica : A dynamic panel data analysis. In Studies in Economics and Econometrics (Vol. 32, pp. 1–24).

- Laeven, L., & Valencia, F. (2013). Systemic banking crises database. IMF Economic Review, 61(2), 225–270.

- Lee, H., & Kocher, C. (2001). Firm Characteristics And Seasoned Equity Issuance Method- Private Placement Versus Public Offering. Journal of Applied Business Research, 17(3), 23–36.

- Liao, A., & Williams, J. (2008). Do win-win outcomes exist? A study of cross-border M&A transactions in emerging markets. Journal of Economic Literature, 50(2), 274–296.

- Lieberman, I. W., Anderson, A., Grafe, Z., Campbell, B., & Kopf, D. (2015). Microfinance and capital markets: The initial listing/public offering of four leading institutions. Moving Beyond Storytelling : Emerging Research in Microfinance, 9(2), 31–80.

- Loughran, T., & Ritter, J. R. (1995). The new issues puzzle. The Journal of Finance, L(1), 23–51.

- Mcguckin, R. H. (1995). On productivity and plant ownership change: New evidence from the longitudinal research database. The RAND Journal of Economics, 26(2), 257–276.

- Moskowitz, M. (1972). Choosing socially responsible stocks. Business and Society, 1, 71–75.

- NDIC. (2011). Resolution of failing banks through the establishment of bridge. Lagos.

- Nicholson, R. R., & Salaber, J. (2013). The motives and performance of cross-border acquirers from emerging economies: Comparison between Chinese and Indian firms. International Business Review, 22(6), 963–980.

- Nworji, I., & Olanrewaju David, A. (2011). Corporate governance and bank failure in Nigeria: Issues, challenges and opportunities. Research Journal of Finance and Accounting, 2(2), 2222–2847.

- Oecd. (2017). Oecd corporate governance factbook 2017. United States of America.

- Oleka, D. C., & Mgbodile, C. C. (2014). Recapitalization Reform and Banks Performance - Empirical Evidence from Nigeria. Research Journal of Finance and Accounting, 5(6), 96–101.

- Park, Y. W., & Shin, H. H. (2004). Board composition and earnings management in Canada. Journal of Corporate Finance, 10(3), 431–457.

- Pathan, S., & Faff, R. (2013). Does board structure in banks really affect their performance? Journal of Banking and Finance, 37(5), 1573–1589.

- Petrovic, A., & Tutsch, R. (2009). National rescue measures in response to the Current financial crisis (No. ID 1430489). SSRN eLibrary. Frankfurt.

- Pfeffer, J. (1972). Size and composition of corporate boards of directors: The organization and its environment. Sage Publications, Inc., 17(2), 218–228.

- Poulsen, A., & Stegemoller, M. (2008). Moving firms from private to public ownership: Selling out to public firms vs. initial public offerings. Financial Management, 37(706), 81–101.

- Ragupathy, M. B. (2011). Initial Public Offering: A Critical Review of Literature. The IUP Journal of Behavioral Finance, 8(3), 41–51.

- Repullo, R., & Suarez, J. (2013). The procyclical effects of bank capital regulation. Review of Financial Studies, 26(2), 452–490.

- Rezaul Kabir, H. M. T. (2017). Does corporate governance shape the relationship between corporate social responsibility and financial performance? Pacific Accounting Review, 29(2), 227–258.

- Ruan, Y., Song, X., & Zheng, K. (2018). Do large shareholders collude with institutional investors? Based on the data of the private placement of listed companies. Physica A, 5(12), 22–35.

- Sanusi, L. (2010). The Nigerian banking industry : What went wrong and the way forward. Abuja.

- Sanusi, L. (2011). Global financial meltdown and the reforms in the Nigerian banking sector. Journal of Applied Statistics, 2(1), 93–108.

- Shahwan, T. M. (2015). The effects of corporate governance on financial performance and financial distress: evidence from Egypt. Corporate Governance: The International Journal of Business in Society, 15(5), 641–662.

- Shehu, N., Zuriana, C., Jamil, M., & Mohamed, R. (2014).The mediating role of management control system in the relationship between corporate governance and the performance of bailed-out banks in Nigeria. Procedia - Social and Behavioral Sciences, 164(August), 613–620.

- Simons, R. (2013). Performance Measurement and Control Systems for Implementing Strategy Text and Cases (Fourth). New Jersey, USA: Pearson education limited.

- Stankevičienė, J., & Mencaitė, E. (2013). The evaluation of bank performance using a multicriteria decision making model : A case study on Lithuanian commercial banks. Technological and Economic Development of Economy, 6(September), 37–41.

- Sufian, F., & Shah Habibullah, M. (2013). Financial sector consolidation and competition in Malaysia. Journal of Economic Studies, 40(3), 390–410.

- Sundarasen, S., Goel, S., & Zulaini, F. A. (2017). Impact of investors’ protection, transparency level and legal origin on initial public offering (IPO) initial returns. Managerial Finance, 43(7), 738–760.

- Tahir, S., Adegbite, E., & Guney, Y. (2017). An international examination of the economic effectiveness of banking recapitalization. International Business Review, 26(3), 417–434.

- Taylor, L. W., & Taylor, L. W. (1998). Raising capital through private placements. Journal of Business Strategy, 9(4), 62–64.

- Tomec, M., & Jagrič, T. (2017). Does the amount and time of recapitalization affect the profitability of commercial banks? Czech Journal of Economics and Finance, 67(4), 318–341.

- Williamson, O. (1985). The economic institutions of capitalism (First). New York: The Free Press.

- Wintoki, M. B., Linck, J. S., & Netter, J. M. (2012). Endogeneity and the dynamics of internal corporate governance. Journal of Financial Economics, 105(3), 581–606.

- Wu, H., Tzeng, G., & Chen, Y. (2009). A fuzzy MCDM approach for evaluating banking performance based on balanced scorecard. Expert Systems With Applications, 36(6), 10135–10147.

- Yakasai, A. G. A. (2001). Corporate governance in a third world country with particular reference to Nigeria. Corporate Governance: An International Review, 9(3), 238–253.

- Yusupov, N. (2012). Microcredit and development in an occupational choice model. Economics Letters, 117(3), 820–823.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 August 2019

Article Doi

eBook ISBN

978-1-80296-064-8

Publisher

Future Academy

Volume

65

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-749

Subjects

Business, innovation, sustainability, environment, green business, environmental issues

Cite this article as:

Dikko, U. M., & Alifiah, M. N. (2019). Moderating Effect of Corporate Governance Between Recapitalization and Bank’s Performance: Conceptual Framework. In C. Tze Haw, C. Richardson, & F. Johara (Eds.), Business Sustainability and Innovation, vol 65. European Proceedings of Social and Behavioural Sciences (pp. 455-468). Future Academy. https://doi.org/10.15405/epsbs.2019.08.46