Abstract

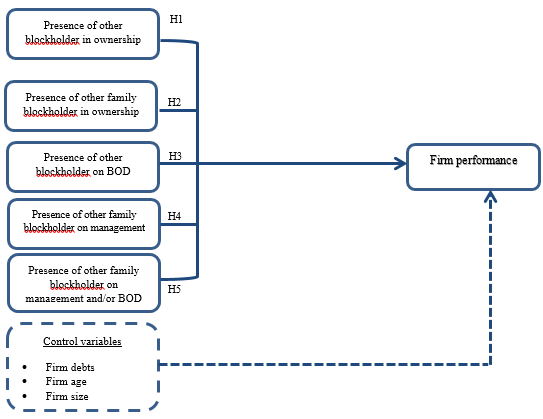

The collapse of many family and non-family companies around the world has developed significant questions regarding the control and expropriation behaviour of the dominant shareholders, and the role of the other blockholders in the business. Although there are number of attempts to answer questions of the role of other blockholders, theoretical and empirical studies are limited and inconsistent. Literally, it has been argued that the involvement of other blockholders in the family businesses would be able to tackle the problem. Such argument failed to express which type of other blockholders (family or non-family) and to what extend their involvement is beneficial? The attempt in this paper is thus different from other work that has sought to propose a conceptual framework to uncover the role of other family and non-family blockholders in firms’ ownership, management and board of the directors to eliminate agency problems and, consequently, it supports firms’ performance. From the review of literature, number of factors has been identified and research hypotheses are developed.

Keywords: Other blockholdersfirm performancefamily firmsagency theorycorporate governance

Introduction

In this time of global corporations, multinational forces and board-dominated corporate elements, many firms are owned by families and the ownership structure of businesses on a global scale is based on the family (Bhaumik & Gregoriou, 2010). It is not difficult to ignore the fact that a large number of the thriving companies is family businesses, which are the most pioneering kind of business in the world, and the most common existing type of business in industrialized as well as developing countries (Astrachan & Shanker, 2003; Zahra & Sharma, 2004) implying their positive significance in the overall economy and global market. Studies around the world also evidence the same findings (Anderson & Reeb, 2003; Martinez, Stohr, & Quiroga, 2007; Saito, 2008).

Surprisingly, while global evidences advocating the general notion that family businesses outperform their non-family counterparts, two huge diversified commercial trading family-owned Saudi Business groups – the Al-Gosaibi Group and the Saad Group were suffering from financial crises and threatened by local and regional authorities. The collapse of the aforementioned groups has developed significant questions regarding the control and expropriation behaviour of the dominant family shareholders, and the role of the other blockholders in the business.

Literarily, such problem between dominant family shareholders and other family blockholders may arises because of what so called by Young, Peng, Ahlstrom, and Bruton (2002) the “horizontal agency cost” as stated by Filatotchev, Lien, and Piesse (2005) or as termed by Villalonga and Amit (2006) “agency problem II” or principal-principal problem. In fact, these three terms are more appropriate to explain the agency costs in businesses which its ownership structures are concentrated by non-family blockholders. But, in terms of family businesses, “family-family agency problem” may in fact be the more appropriate term to describe the agency problem that may arises in situations wherein dominant family shareholders are inclined to expropriate other family minority shareholders (Maury, 2006) through their firm’s influence to acquire monetary and other private benefits and appropriating resources to their own companies (Hwang & Hu 2009, Claessens, Djankov, & Lang, 2000; Faccio & Lang, 2002; La Porta, Lopez-de-Silanes, & Shleifer, 1999; Schulze, Lubatkin, Dino, & Buchholtz, 2001; Villalonga & Amit, 2006). It has been argued that the involvement of other blockholders in the family businesses would be able to tackle the problem (Isakov & Weisskopf, 2009). Such argument failed to express which type of other blockholders (family or non-family blockholders) and to what extend their involvement is beneficial?

However, even though there are number of attempts from family business scholars to fill the many gaps that remain in our understanding through delving into the role of other blockholers and their influence on firm performance, empirical findings are limited and inconsistent (Sacristan-Navarro, Gomeze-Anson, & Cabeza-Garcia, 2011). For instance, Lehman and Weigand (2000), and Sacristan-Navarro et al. (2011) revealed that the existence of other blockholders affects the firm’s profitability positively and that it can be considered as a method to protect minority shareholders from manipulation by the controlling family owners and hence improve firm performance (Lopez-de-Foronda, Lopez-lturriaga, & Santamaria-Mariscal, 2007). In contrast, Maury and Pajuste (2005) revealed that the existence of second family shareholders in the ownership of family firms affects the performance in a negative way while higher voting rights by another large non-family shareholder improves the valuation of the firm. These contradict results and lack of research on the cumulative role of the other family and non-family blockholders in ownership, management, and board of directors represent one of the significant gaps in our understanding that are exist as stated by Collins and O’Regan (2011) and worthy to be considered by researchers.

Problem Statement

Presence of other blockholders in ownership

Berle and Means’s (1932) influential work illustrates the typical principal-agent problem that Villalonga and Amit (2006) referred to as “agency problem I”. Among the many who were influenced by the work of Berle and Means are Jensen and Meckling (1976) who state that the separation of ownership and management facilitates managers to extract self-interests, hence compromises shareholders’ wealth and eventually affects the firm value negatively. Stated differently, firms with CEOs possessing greater equity holdings are predicted to possess lower agency cost, as the manager’s incentives are consistent with those of the shareholders. Hence, the agency cost decreases as managerial ownership increases (Fama & Jensen, 1983; Morck, Shleifer, & Vishny, 1988).

In the context of family firms, the family’s position as a large shareholder may have a significant impact on the agency problems rectification (Jensen & Meckling, 1976) owing to the overlapping elements of family, ownership, and management systems along with several functions that family shareholders carry out. Among these functions is the monitoring function, which makes management incentives consistent with the desire of the family shareholders (Allouche, Amann, Jaussaud, & Kurashina, 2008). However, viewed through the stewardship perspective, family managers are stewards (Davis, Schoorman, & Donaldson, 1997) and are emotionally linked to the family (Miller & Le Breton-Miller, 2006). As a result, they display better performance than that of non-family managers. The stewardship behaviour of family managers facilitates the alignment of family and organizational interests and attempts to safeguard family wealth rather than maximize their personal utility, which, ultimately, enhances firms’ value (Howorth, Rose, Hamilton, & Westhead, 2010).

Researchers are, however, of the consensus that the classical principal-agent agency problem is inapplicable to most family firms (Sacristan-Navarro et al., 2011) and it no longer prevails outside the U.S. and the U.K. The problem is rather a principal-principal conflict termed by Villalonga and Amit (2006) as “agency problem II”. This agency problem arises in situations wherein dominant blockholders are inclined to expropriate minority shareholders (Maury, 2006) through their firm’s influence to acquire monetary and other private benefits and appropriating resources to other family companies (Claessens, Djankov, & Lang, 2000; Faccio & Lang, 2002; La Porta et al., 1999; Schulze et al., 2001; Villalonga & Amit, 2006). It has been argued that the existence of other large shareholders in the organizational ownership would be able to tackle the problem (Isakov & Weisskopf, 2009).

Hwang and Hu (2009) refer monetary private benefits as “… private benefits that can be stated in monetary terms”, for instance, extraordinarily high salary or misappropriation of resources. Additionally, non-monetary private benefits are defined as those that cannot be expressed in monetary terms, for instance, the pride of a large owner, being part of the business network, interacting with well-known businessmen, politicians, and celebrities and achieving recognition, fame and prestige owing to one’s increased social status.

According to La Porta, Lopez-de-Silanes, Shleifer, and Vishny (1998), dispersed ownership structure is more prevalent in economies characterized as having high legal protection for minority shareholders. However, in countries with a weak legal protection, concentrated ownership by family is an alternative form of external monitoring (La Porta et al., 1998). The argument holds that the role of the corporate control market of the country is a technique that reduces the agency problem within a firm. In the context of the U.S., dispersed ownership structure and the possibility of conflict may occur between the manager and shareholders owing to the considerable gap between both parties’ interests. In Saudi Arabia, concentrated ownership structure is prevalent (Paul, Munajjed, & Alacaklioglu, 2006; Qobo & Soko, 2010), and, as such, owners are desirous to maintain control over their firms, making firms vulnerable to agency problems. Agency problems that may arise between dominant shareholders and minority owners are increasingly becoming a big issue (Sacristan-Navarro et al., 2011).

In order to reduce agency problems and to protect investors’ wealth in family firms, studies concerning corporate governance recommend several mechanisms to ensure that directors act in ways that benefit the firms’ owners. One of the recommendations is to include other large blockholder in the firms’ ownership (Firth, Fung, & Rui, 2006; Sacristan-Navarro et al., 2011; Seifert, Gonenc, & Wright, 2005). It is argued that owing to their power, dominant family shareholders can acquire private benefits from the company (Maury & Pajuste, 2005) and this expropriation behaviour of family owners has been evidenced in both publicly listed companies (Miller et al., 2007) and Small and Medium Enterprises (SMEs) (Arosa, Iturralde, & Maseda, 2010). It follows that the existence of large blockholders can work effectively in monitoring family shareholders (Isakov & Weisskopf, 2009) who are inclined to use their clout, and, in so doing, compromise the minority shareholders (La Porta et al., 1999). Similarly, Anderson and Reeb (2003, 2004) recommended that other large blockholders like institutional shareholders should be involved in an attempt to monitor and discipline family managers despite their considerable power. As a result, this will lead to superior organizational performance and improved firm value.

However, the misalignment of family goals with the goals of large shareholders (whether they may be economic or non-economic) may result in a conflict of interest between the two parties, particularly in publicly listed firms (Corbetta & Salvato, 2004), which will consequently impact the firm performance and value in a negative manner (Lopez-de-Foronda et al., 2007). Although conflicts arising between majority and minority shareholders have been handled by some academic researchers (Maury, 2006), until now, there has been a limited discussion regarding them (Sacristan-Navarro et al., 2011).

Researchers have attempted to explain the relationship between the presence of large shareholders and firm performance. However, so far, the results have been inconsistent and ambiguous. Sacristan-Navarro et al.’s (2011) analysis of the Spanish Stock Exchange to examine the impact of the presence of another large shareholder upon the profitability of a firm revealed a significant positive relationship notwithstanding the econometric technique utilized. Their stance on the matter based on their findings is that the existence of another large shareholder moderates agency problem II, which leads to improved firm performance.

A related study was conducted by Isakov and Weisskopf (2009) in an attempt to investigate the impact of the existence of another shareholder on firm performance. Their observation on the Swiss listed companies in the years 2003-2007, revealed that family firms having a second blockholder that holds between 5% to 10% of voting rights outperform other non-family firms based on their ROA and Tobin’s Q. This is attributed to the reduction of agency cost I and II through the monitoring of the dominant blockholders and challenging the extraction of private benefits. However, a contradicting finding was revealed by Villalonga and Amit (2006) who found a negative relationship between other non-family blockholder ownership and firm value, using Tobin’s Q as a proxy. This is especially true for non-family firms compared to family firms.

Similarly, in the context of Finland, Maury and Pajuste (2005) investigated the impact of other large shareholders on firm performance through the involvement of 136 non-financial firms over a period of eight years. They revealed that family firms having to contend with another large shareholder of another family displayed negative firm value. However, firms with other non-family blockholders enhance firm value. Hence, it can be deduced that two families sharing ownership destroy firm value instead of enhance it.

Earle, Kucsera, and Telegdy (2005) examined the effect of ownership concentration on firm’s performance. By using different measurements of ownership concentration they found that the results substantially differ. Specifically, dominant blockholder positively impact firm’s performance as measured by return on equity (ROE) and operating efficiency (OE). However, when second largest shareholding combined into the percentage of the shares that owned by the dominant one, the impact remind positive but smaller in magnitude, which indicates to the negative role of the other blockholders in supporting the outperformance of the firms.

As for the possibility of the family generation effect, Her and Williams (2002) presented detailed findings; they revealed that descendant-controlled firms in which the descendants representing a major proportion of the board and having top managerial positions with the absence of external blockholders perform poorly compared to those family firms overseen by founders. This underperformance is associated with the entrenchment and tunnelling behaviours of the descendants, especially in economies with a low legal protection. Based on the above discussion, we hypothesize the following:

Hypothesis 1: The presence of other blockholders in the ownership structure has a positive impact on the firm performance.

Hypothesis 2: The presence of other family blockholders in the ownership structure has a positive impact on the firm performance.

Presence of other blockholders on board of the directors and management

Presence of other family blockholders on board of the directors and/or management can be seen from two different perspectives: agency theory and stewardship theory. From agency theory perspective, the theorists postulate that non-family directors are more professional in terms of monitoring managers relative to their inside counterparts (Fama & Jensen, 1983). In addition, they are better advisors (Coles, Daniel, & Naveen, 2008) and they play a critical role in minimizing conflict between the majority and minority shareholders (Anderson & Reeb, 2004). This is also owing to the owner’s perception of managers; according to the agency theory, managers of organizations cannot be trusted (Ramachandran & Jha, 2007). Based on this argument, managers may not act in the principal’s best interests but in their own at the expense of the former.

A contrasting view from the stewardship theory implies the opposite whereby managers are considered to be trustworthy stewards, and, therefore, their goals are primarily aligned with those of the shareholders (Donaldson & Davis, 1991; Davis et al., 1997). In other words, the stewardship theory postulates that the board should comprise a majority of family directors as opposed to non-family ones to guarantee effective and efficient decision making as the former is privy to the business goals and they act in the interests of the firm and must be more competent in achieving higher profits compared to their external counterparts (Donaldson & Davis, 1991).

Empirically, Anderson and Reeb (2004) found that exceeding presence on the board by family directors in the U.S. increases the possibility to expropriate minority shareholders’ wealth and thus affect negatively firm’s value. They suggested that vast majority of the directorship in family firms is preferably to be held by non-family directors. Accordingly, it can be concluded that presence of more than one family on the board of directors may cause arising potential conflicts in the interests of different monetary and non-monetary family objectives. Such divergence in the interests affect adversely firm’s value and growth. Based on the above discussion, the following hypotheses are postulated:

Hypothesis 3: The presence of other blockholders on the board of directors has a positive impact on the firm performance.

Hypothesis 4: The presence of other blockholders on the management team has a positive impact on the firm performance.

To analyze the influence that other blockholders exercise on the role played by the dominant shareholder, it is useful to distinguish between the family and non-family other blockholders. Maury and Pajuste (2005) stated that the relationship between other blockholders and firm performance might not always be positive as these hinges on the blockholder’s identity and the size of their shareholdings. Nevertheless, they revealed that a second family shareholder negatively affects the performance of a firm while a second non-family shareholder improves its performance. This stems from the fact that the dominant family shareholders are answerable to other non-family shareholders who are capable of minimizing the managerial cost of private extraction by the major family shareholders through their monitoring influence, and, hence, improving firm performance.

From the context of the U.S., Miller et al. (2007) provide empirical evidence on the question of the effect of presence of multiple family shareholders. They revealed that if multiple family shareholders present in the firm, the superior value of family firms disappears. In other words, a family firm with a single-family owner (founder) holds the position of a chairman, or a CEO or both perform better than others.

Ruiz-Mallorqui and Santana-Martin (2011) in their study confirm that exercising greater control by second and third blockholders may help or adverse effect firm value and this depends entirely on who is the dominant blockholder and what is the type of other blockholders. They found that a firm where the dominant blockholder and the second and third blockholders are banks achieves low firm value. However, firm value increases as the dominant shareholder is investment fund and also the second and third blockholders have similar interests (i.e., investment funds). Further, they demonstrated that presence of other blockhlders, irrespective of their identity, is good when the dominant blockholder is a banking institution, while it is disruptive when investment funds are controlling shareholders. Thus, from a theoretical view, the impact of presence of other significant blockholders on firm performance differs notably on their identity. This discussion leads us to the following testable hypothesis:

Hypothesis 5: The presence of other family blockholders on the management and/or board of directors has a positive impact on the firm performance

Conclusion

Based on the previous arguments, the proposed framework as shown in Figure

References

- Allouche, J., Amann, B., Jaussaud, J., & Kurashina, T. (2008). The Impact of Family Control on the Performance and Financial Characteristics of Family Versus Nonfamily Businesses in Japan: A Matched-Pair Investigation. Family Business Review, 21, 315-329.

- Anderson, R. C., & Reeb, D. M. (2003). Founding-family ownership and firm performance: Evidence from the S&P 500. Journal of Finance, 58, 1301-1328.

- Anderson, R. C., & Reeb, D. M. (2004). Board Composition: Balancing Family Influence in S&P 500 Firms. Administrative Science Quarterly, 49, 209-237.

- Arosa, B., Iturralde, T., & Maseda, A. (2010). Outsiders on the board of directors and firm performance: Evidence from Spanish non-listed family firms. Journal of Family Business Strategy, 1, 236-245.

- Astrachan, J., & Shanker, M. (2003). Family businesses' contribution to the U.S. economy: A closer look. Family Business Review, 16, 211-219.

- Berle, A. A., & Means, G. C. (1932). The modern corporation and private property, Transaction Pub.

- Bhaumik, S. K., & Gregoriou, A. (2010). “Family” Ownership, Tunneling and Earnings Management: A Review of The Literature. Journal of Economic Surveys, 24(4), 705–730.

- Claessens, S., & Djankov, S. (1999). Ownership Concentration and Corporate Performance in the Czech Republic. Journal of Comparative Economics, 27, 498-513.

- Claessens, S., Djankov, S., & Lang, L. H. P. (2000). The separation of ownership and control in East Asian Corporations. Journal of Financial Economics, 58, 81-112.

- Collins, L., & O'Regan, N. (2011). Editorial: The evolving field of family business. Journal of Family Business Management, 1(1), 5-13.

- Coles, J. L., Daniel, N. D., & Naveen, L. (2008). Boards: Does one size fit all? Journal of Financial Economics, 87, 329-356.

- Corbetta, G., & Salvato, C. (2004). Self-Serving or Self-Actualizing? Models of Man and Agency Costs in Different Types of Family Firms: A Commentary on "Comparing the Agency Costs of Family and Non-Family Firms: Conceptual Issues and Exploratory Evidence". Entrepreneurship Theory and Practice, 28, 355.

- Davis, J. H., Schoorman, F. D., & Donaldson, L. (1997). Toward a stewardship theory of management. Academy of Management. The Academy of Management Review, 22, 20-47.

- Donaldson, L., & Davis, J. H. (1991). Stewardship Theory or Agency Theory: CEO Governance and Shareholder Returns. Australian Journal of Management, 16, 49-64.

- Earle, J. S., Kucsera, C., & Telegdy, Á. (2005). Ownership Concentration and Corporate Performance on the Budapest Stock Exchange: do too many cooks spoil the goulash? Corporate Governance: An International Review, 13, 254–264.

- Faccio, M., & Lang, L. H. P. (2002). The ultimate ownership of Western European corporations. Journal of Financial Economics, 65, 365-395.

- Fama, E. F., & Jensen, M. C. (1983). Separation of Ownership and Control. Journal of Law and Economics, 26, 301.

- Filatotchev, I., Lien, Y. C., & Piesse, J. (2005). Corporate Governance and Performance in Publicly Listed, Family-Controlled Firms: Evidence from Taiwan. Asia Pacific Journal of Management, 22, 257-283.

- Firth, M., Fung, P. M. Y., & Rui, O. M. (2006). Firm Performance, Governance Structure, and Top Management Turnover in a Transitional Economy. Journal of Management Studies, 43, 1289-1329.

- Her, M. M., & Williams, T. G. E. (2002). Founders Versus Descendants: Evidence of The Taiwanese Publicly Traded Firms. International Business & Economic Research Journal, 1.

- Howorth, C., Rose, M., Hamilton, E. & Westhead, P. (2010). Family firm diversity and development: An introduction. International Small Business Journal, 28, 437-451.

- Hwang, J. H., & Hu, B. (2009). Private Benefits: Ownership versus Control. The Journal of Financial Research, 32, 365-393.

- Isakov, D., & Weisskopf, J.-P. (2009). Family Ownership, Multiple Blockholders and Firm Performance. SSRN eLibrary.

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics, 3, 305-360.

- La Porta, R., Lopez-De-Silanes, F., & Shleifer, A. (1999). Corporate ownership around the world. Journal of Finance, 54, 471-517.

- La Porta, R., Lopez-De-Silanes, F., Shleifer, A., & Vishny, R. W. (1998). Law and finance. The Journal of Political Economy, 106, 1113-1155.

- Lehmann, E., & Weigand, J. (2000). Does the Governed Corporation Perform Better? Governance Structures and Corporate Performance in Germany. European Finance Review, 4, 157-195.

- López-De-Foronda, Ó., López-Iturriaga, F. J., & Santamaría-Mariscal, M. (2007). Ownership Structure, Sharing of Control and Legal Framework: international evidence. Corporate Governance: An International Review, 15, 1130-1143.

- Martinez, J. I., Stohr, B. S., & Quiroga, B. F. (2007). Family ownership and firm performance: Evidence from public companies in Chile. Family Business Review, 20, 83-94.

- Maury, B. (2006). Family ownership and firm performance: Empirical evidence from Western European corporations. Journal of Corporate Finance, 12, 321-341.

- Maury, B., & Pajuste, A. (2005). Multiple large shareholders and firm value. Journal of Banking & Finance, 29, 1813-1834.

- Miller, D., & Le Breton-Miller, I. (2006). Family Governance and Firm Performance: Agency, Stewardship, and Capabilities. Family Business Review, 19, 73-87.

- Miller, D., Le Breton-Miller, I., Lester, R. H., & Cannella, A. A. (2007). Are family firms really superior performers? Journal of Corporate Finance, 13, 829-858.

- Morck, R., Shleifer, A., & Vishny, R. W. (1988). Management Ownership and Market Valuation: An Empirical Analysis. Journal of Financial Economics, 20, 293.

- Paul, J., Munajjed, Z. A. & Alacaklioglu, H. (2006). Saudi Arabia. In W. F. Kaslow. Handbook of family business and family business consultation: A global perspective. International Business Press.

- Qobo, M. & Soko, M. (2010). Saudi Arabia as an Emerging Market: Commercial Opportunities and Challenges for South Africa. South African Institute of International Affairs (SAIIA).

- Ramachandran, K., & Jha, R. (2007). Relevance of Agency and Stewardship Arguments in Family Business Context. Working Paper.

- Ruiz-Mallorquí, M. V., & Santana-Martín, D. J. (2011). Dominant institutional owners and firm value. Journal of Banking & Finance, 35, 118-129.

- Sacristan-Navarro, M., Gomez-Anson, S., & Cabeza-García, L. (2011). Large shareholders' combinations in family firms: Prevalence and performance effects. Journal of Family Business Strategy, 2, 101-112.

- Saito, T. (2008). Family firms and firm performance: Evidence from Japan. Journal of the Japanese and International Economies, 22, 620-646.

- Schulze, W. S., Lubatkin, M. H., Dino, R. N., & Buchholtz, A. K. (2001). Agency Relationships in Family Firms: Theory and Evidence. Organization Science, 12, 99-116.

- Seifert, B., Gonenc, H., & Wright, J. (2005). The international evidence on performance and equity ownership by insiders, blockholders, and institutions. Journal of Multinational Financial Management, 15, 171-191.

- Villalonga, B., & Amit, R. (2006). How do family ownership, control and management affect firm value? Journal of Financial Economics, 80, 385-417.

- Young, M. N., Peng, M. W., Ahlstrom, D., & Bruton, G. D. (2002). Governing Thecorporation in Emerging Economies: A Principal-Principal Perspective. Academy of Management Proceedings, 2002(1), E1–E6.

- Zahra, S. A., & Sharma, P. (2004). Family business research: A strategic reflection. Family Business Review, 17, 331-346.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 August 2019

Article Doi

eBook ISBN

978-1-80296-064-8

Publisher

Future Academy

Volume

65

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-749

Subjects

Business, innovation, sustainability, environment, green business, environmental issues

Cite this article as:

Al-Dubai, S. A. A. (2019). The Role of Other Blockholders: A Conceptual Framework. In C. Tze Haw, C. Richardson, & F. Johara (Eds.), Business Sustainability and Innovation, vol 65. European Proceedings of Social and Behavioural Sciences (pp. 428-436). Future Academy. https://doi.org/10.15405/epsbs.2019.08.43