Abstract

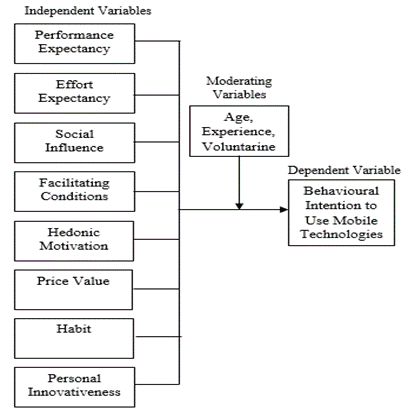

In today's dynamic digital era, critical functions in businesses are being affected by mobile technologies with the ability to collect instant data thus providing valuable insights to managers towards achieving business sustainability. This study examined the determinants of behavioural intention to use mobile technologies in business among insurance agents in Malaysia based on a modified Unified Theory of Acceptance and Use of Technology 2. In addition, this study investigated the impact of age, voluntariness and experience on associations between the determinants and behavioural intention to use mobile technologies. Utilizing online questionnaires survey, a total of 208 usable responses were collected. The results suggested that performance expectancy, facilitating conditions, social influence, hedonic motivation, personal innovativeness and habit are significant in determining the behavioural intention. Nevertheless, effort expectancy and price value do not have any impact. Experience in using mobile technologies moderates the relationship between personal innovativeness and behavioural intention; but age only moderates the relationship between habit and behavioural intention. Interestingly, the effect of habit on behavioural intention to use was found to be influenced by voluntariness. Findings from this study contribute in enhancing the utilisation of mobile technologies at work which subsequently increases the efficacy and business sustainability of insurance industry in emerging economies such as Malaysia.

Keywords: Determinantsbehavioural intentionuse of mobile technologiesinsuranceMalaysia

Introduction

Mobile technologies are found to provide significant strategic implications in organizations with more flexibility in communication, collaboration and information sharing among the workforce as well as with the customers (Berghaus & Back, 2014; Lu, Lin, & Yueh, 2018). Mobile technologies have since becoming a critical strategic tool towards driving organisations towards sustainable business thus changing the key functional departments by providing real-time information to the entire supply chain (Hennig-Thurau et al., 2010). Businesses that have access to accurate real-time information in all aspects are empowered to gain valuable insights (Bellman et al., 2011; Thiangtam, Pongpun & Wilert, 2017). When employees being their own mobile technologies device to work, it will exert notable impacts on organizations; namely higher efficiency, productivity, cost savings and process improvements (Aurelie, 2015). For sales persons’ career development, it has now largely utilizes mobile technologies (Roman, Rodriguez & Jaramillo, 2018). Furthermore, the most important tasks supported by mobile technologies were efficient communication and information access in job-related tasks which increase employees' adoption of mobile technologies (Lu, Li, & Yueh, 2018). However, there are still lack of empirical evidences on the significant factors which influence employees’ behavioural intention to use mobile technologies, particularly in the insurance business in emerging countries such as Malaysia. This study aims to examine determinants of behavioural intention to use mobile technologies in business among insurance agents in Malaysia. This study is important as it uncovers significant factors which influence insurance agents’ behavioural intention to use mobile technologies within the context of an emerging country

Problem Statement

Mobile technologies play vital roles in enhancing business processes across various industries, including the competitive insurance industry in which mobile technologies are utilized to improve efficiency of office employees along with its processes (Visvanathan & Van Der Merwe, 2018). Gowanit, Thawesaengskulthai, Sophatsathit and Chaiyawat (2016) promoted that insurance businesses are able to ride on mobile technologies seamlessly as most of the transactions and processes can be completed electronically; hence mobile technologies has been the most important change in the industry. This is supported by Thiangtam et al. (2017) and Lu et al. (2018) who expect fully electronic-based business models for the insurance industry in the near future, thereby strengthening the role of mobile technologies in insurances businesses. Ernest and Young (2015) reported that technology is the emphasis of insurers and found that almost 80 percent customers favoured using remote and digital channels with their insurers. Thus, in the insurers’ effort to establish relationships with customers, many insurers are investing in mobile and digital platforms and mobile technologies. These technologies enable the insurers to enhance the efficiency of their internal operations and process; while deliver convenience for consumers as well.

In the Malaysian insurance industry where this study is situated, among the first-in-market technology was introduced by AIA Berhad in 2012 whereby the customers are able to be insured just within a day without going through unnecessary hassles. Furthermore, AIA Berhad was also the first insurer globally to implement a standalone point-of-sales system running on an iPad, which is a mobile device. As a result, the insurance agents are able to carry out all-inclusive financial advisory processes with protected automated and digital submission of life insurance policies. This has in turn improves the efficacy of the insurance-purchasing process. While the insurance agents can concentrate on delivering quality financial advice to customers competently via automation and mobility; customers can also acquire insurance coverage as fast as within one day.

It is evident that insurance businesses can utilise mobile technologies to enhance the effectiveness and efficiency at work. Previous research in insurance industry found several determinants that affect such technologies adoption (Liang, Huang, Yeh & Lin, 2007; Gowanit et al., 2016; Yueh, Lu & Lin, 2016); Visvanathan & Van Der Merwe, 2018). However, there are still limited studies conducted to discover determinants that initiate the usage, improve the present usage and advance a constant usage among employees and agents in the insurance industry. In fact, the model used in previous studies has not been able to wholly clarify the users’ behavioural intention to use mobile technologies as a business tool in the context of insurance industry in an emerging country such as Malaysia. Hence, this study attempts to address the gap in the previous literature and investigates the determinants of behavioural intention to use mobile technologies in business among Malaysian insurance agents.

Research Questions

This research aims to answer the following questions:

Do effort expectancy, performance expectancy, social influence, hedonic motivation, facilitating conditions, price value, personal innovativeness and habit affect behavioural intention to use mobile technologies among insurance agents?

Do age, gender, experience and voluntariness moderate the relationships between the determinants and behavioural intention to use mobile technologies in business among insurance agents?

Research Method

Hypotheses Development

This study adapted UTAUT2 model which incorporates three new constructs into the previous UTAUT model, namely hedonic motivation, price value and habit. Besides, UTAUT2 considers individual user differences such as age, gender and experience are being hypothesized to restrain the effects of these constructs on behavioural intention and technology use. Compared to the original UTAUT model, the extensions or modifications proposed in UTAUT2 model produced a significant and huge improvement in the variance explained for behavioural intention and technology use (Venkatesh et al. 2012). The UTAUT2 model improves the percentage of variance explained by 18% and improves the actual use of ICT by 12%.

Performance expectancy reflects the perceived utility associated with using mobile technologies. For this study, performance expectancy is defined as the degree of expected benefits insurance agents expect when using a technology to perform various activities and works which are required for their insurance business purpose. Venkatesh et al., (2003) establish performance expectancy being the strongest construct among all the constructs in his UTAUT model. Taiwo and Downe (2013) found performance expectancy as the only strong relationship among the determinants and behavioural intention to use technology. Likewise, Kaba and Toure (2014) proved that performance expectancy positively influenced intentions to adopt social networking, but this relationship did not hold when gender and age were taken into consideration. Chen and Chang (2013) shows the use of mobile technology services impacts the perceived performance expectancy of innovative technology applications. Yueh et al. (2016) discovered performance expectancy significantly affected mobile technology usage behaviour. Therefore:

H1: Performance expectancy influences behavioural intention to use mobile technologies in business among Malaysian insurance agents.

Efforts’ expectancy explains how much does the person feel comfortable and find it easy to adopt and employ the technology as part of their jobs. The effects of effort expectancy on technology adoption intentions were found weak (Taiwo & Downe, 2013). Carlsson, et al. (2006) establish effort had a straight influence on individual’s intention to use mobile services and devices. Chiu and Wang (2008), Chiu et al. (2010) and Gan, Teoh and Muthuveloo (2017) also found that effort expectancy was positively associated with behavioural intention. Therefore:

H2: Effort expectancy influences behavioural intention to use mobile technologies in business among Malaysian insurance agents.

It has been observed in previous studies that decision of a user can be influenced by others such as peers or instructors (Miller et al., 2015). Social influence on behaviour intent and use of mobile phones was found to be significant (Agrebi & Jallais, 2014). Social influence was found to affect individuals' intentions toward a certain behaviour (Yueh et al., 2016). Berghaus and Back (2014) identified social influence is one of the drivers of mobile business solution adoption in business organization. Gowanit, Thawesaengskulthai, Sophatsathit and Chaiyawat (2016) found external (social) issues affect attitude and behaviour in the adoption of a mobile insurance claim system. Therefore:

H3: Social influence influences behavioural intention to use mobile technologies in business among Malaysian insurance agents.

Facilitating conditions can be explained as the degree to which a user believes that his or her organization is actually providing all the necessary resources related to utilisation of mobile technologies to improve work efficiency. Venkatesh et al. (2003) found that this variable was not significant as a determinant of intention while recent studies such as Kumar et al. (2017) and Yueh et al. (2016) found facilitating conditions to have positive impact on behavioural intention of mobile technology. Therefore:

H4: Facilitating conditions influences behavioural intention to use mobile technologies in business among Malaysian insurance agents.

Hedonic motivation refers to the enjoyment and fun as a results of consuming a technology and has been verified to show a noteworthy role in defining technology acceptance and use (Brown & Venkatesh 2005). Magni et al. (2010) hedonic motivation is related to the essence of psychological and emotive experiences. Song, Sawang, Drennan, and Andrews (2015) established hedonic expectation as one of the determinants affecting users’ intentions to adopt mobile technology. Therefore:

H5: Hedonic motivation influences behavioural intention to use mobile technologies in business among Malaysian insurance agents.

The monetary cost involved in the consumers’ context to use a technology generally has an effect which could influence the consumers’ use of technology. Issues relating to cost have been incorporated to explain the consumers’ behaviour on technology usage in past studies (Chong, 2013). The pros of using this technology outweighs the monetary cost involved provides a positive price value , while most studies find that the price value concept is important in attracting consumers to use a new technology (Zhao et.al, 2012; Gan, Teoh & Muthuveloo, 2017). Therefore:

H6: Price value influences behavioural intention to use mobile technologies in business among Malaysian insurance agents.

Habit refers to the how much people incline to act or accomplish a certain behaviour spontaneously because of learning of the way how it works (Limayem et al. 2007). Ajzen and Fishbein (2005) stated that feedback from previous experiences will influence the users’ beliefs and consequently the future behavioural intention. Limayem et al. (2007) include prior use as a predictor of habit. Therefore:

H7: Habit influences behavioural intention to use mobile technologies in business among Malaysian insurance agents.

Personal innovativeness, being a personality trait has a lasting effect on human behaviour but very few studies explored its effect in a post-adoption of Information System context with strong empirical support (Hong et al., 2011; Sun, 2012). Users who adopt new technology is being known as innovators or actual innovators and this group of users often have specific and identifiable characteristics. Hence, insurance agents with higher levels of personal innovativeness are expected to develop more positive perceptions about the technology and have more positive intentions to use the mobile technologies. Therefore:

H8: Personal innovativeness influences behavioural intention to use mobile technologies in business among Malaysian insurance agents.

Past research found that the age of the users has a direct and important effect on their behaviour (Afarikumah & Achampong, 2010). Stafford, Turan and Raisinghani (2004) identified a positive relationship between the consumers’ age and the probability of them using a new technology. Zaremohzzabieh et al. (2014) did not find a significant path between social influence and intention but once age is being placed as the moderator, the effects has become more pronounced on older respondents. Visvanathan and Van Der Merwe (2018) discovered that younger generation found it easier to adopt mobile technology than the older generation. Experience refers to the degree of experience the user, has with the system that is to be used. Venkatesh et al. (2003) found that the effect of facilitation on technology usage is stronger when the users’ experience increases. Based on the findings from previous research such as Yeh and Teng (2012), it is expected that the experience gained by the insurance agents will moderate the acceptance and intention to use mobile technologies in their insurance business.

Relative to the original conceptualization of UTAUT, voluntariness is defined as the degree to use of the mobile technology is perceived as being voluntary or of free will (Moore & Benbasat, 1991). This study includes voluntariness into the UTAUT2 model as the use of mobile technologies. From the business perspective, insurance companies in Malaysia made it compulsory for new agent recruits to have at least an iPad 3 in order to be an insurance agent. After the new agents have been successfully recruited by the company, it is up to the agents whether they would want to continue using the mobile technologies in their business. Therefore:

H9: Age influences the relationship between habit and behavioural intention to use mobile technologies in business among Malaysian insurance agents.

H10: Experience influences the relationship between personal innovativeness and behavioural intention to use mobile technologies in business among Malaysian insurance agents.

H11: Voluntariness influences the relationship between habit and behavioural intention to use mobile technologies in business among Malaysian insurance agents.

Figure

Findings

This study adopted the cross-sectional quantitative survey method. Using convenience sampling method and snowballing technique, website link of an online survey were emailed to insurance agents in Malaysia identified via business contacts of the researchers. A total of 208 valid and usable questionnaires responses were collected from insurance agents across Malaysia. These responses were then analysed using Partial Least Squares (SmartPLS 3.0) which has been used by researchers in the technology acceptance field. The respondents consist of 51.4% male. Majority of the respondents (32.2%) are in the age group of 26 - 33 years old. A total of 36.1 percent insurance agents who responded to this survey are diploma holders whilst 33.2 percent of the respondents are bachelor degree holders. Most of the respondents (71.6%) have been using mobile technologies for more than 3 years, indicating mobile technologies is not something new to them. Interestingly, 63.5% of the insurance agents responded that they use mobile technologies voluntarily and 36.5% of respondents saying that it is compulsory to use mobile technologies in their insurance business.

In the measurement model assessment (Chin, 1998), the loadings of each item are all above 0.90; AVE are all above 0.80 and CR are all above 0.90. R² of Behavioural Intention was 0.944, indicating 94.4 percent of the variance in behavioural intention to use mobile technologies in business is backed by the independent variables in this study. R² value above 0.2 shows that the intention has been explained in all the constructs. Discriminant validity was verified with the square root of the AVE for each construct whereby the value calculated is higher than the correlations between it and all other constructs (Gall, 2003).

In structural model, the path coefficients (β) and variance (R²) were tested. As shown in Table

Discussion

Adapting UTAUT2 model (Venkatesh et al., 2012), this study aimed to provide significant contributions towards understanding the behavioural intention to use mobile technologies by insurance agents as a sustainable strategic business tool in Malaysia.

Performance expectancy has a positive influence on the use and acceptance of mobile technologies (H1) with a path coefficient of 0.187. This finding is consistent with the previous UTAUT studies discussed in hypotheses development. However, the results shown that the performance expectancy was not the strongest predictor as shown in Venkatesh et al. (2003). Insurance agents were seemed to be rational in their behavioural intention to use of mobile technologies in business by understanding the effectiveness of the technology. This means that insurance agents care about the outcomes of using mobile technologies before using it.

Contrary to expectations, effort expectancy (H2) was not found to have a direct effect. This is not consistent with the result obtained from the past studies which have reported that when users perceive a system is easy and effortless to use, they feel positive attitude toward acceptance of the system (Venkatesh & Morris, 2000; Venkatesh et al., 2003). One explanation for effort expectancy not to affect the behaviour intention to use the mobile technologies is that the sample was drawn from insurance agents with high self-efficacy and education. Majority of the insurance agents have diploma or a degree qualifications. These insurance agents are capable of learning how to operate mobile technologies devices even without a proper training and instructions. Besides that, majority of the insurance agents were considered as Gen-Y who are generally technology savvy people and staffed with technology background. Hence, effort expectancy does not seem to have a significant effect on the behavioural intention to mobile technologies in business.

Social influence (H3) was found to have a positive path coefficient of 0.150. Consistent with previous studies, respondents are concerned about environmental influences such as the opinions of their friends. Their opinions and views will affect the insurance agents’ intention to adopt mobile technologies. Insurance agents are seen to be very likely to develop dependent evaluations and place a huge weight on others’ opinions. Insurance companies can select a few agents who are using mobile technologies and build their reputation by sharing their success strategies with the technology. This will help to build a favourable opinion from other agents on the usage and subsequently influence other agents to use the mobile technologies. Besides that, insurance companies could actually provide incentives such as awards and gifts for insurance agents who are able to influence other insurance agents to use mobile technologies as a strategic business tool.

The results found the effect of facilitating condition (H4) on behavioural intention was significant. The positive impact of facilitating conditions with a path coefficient of 0.122 suggests that it is important for insurance companies to provide the necessary infrastructure and technical support when they are going to adopt such technologies in the insurance business. Insurance agents are concerned about the surrounding environment like having the necessary infrastructures, knowledge and capabilities to influence and support their usage of mobile technologies. This result is consistent with the result obtained by Fuksa (2013) and others.

This study found hedonic motivation (H5) is the strongest determinant with a path coefficient value of 0.221. This result is consistent with the past researches such as Brown and Venkatesh (2005) and Venkatesh et al. (2012). Doing insurance business by using mobile technologies is something new to the insurance agents. They found that using mobile technologies is fun and they enjoying using it in their insurance businesses compare with the brick and mortar way of doing business.

Behavioural intention to use mobile technologies is not affected by price value (H6). This can be due to some insurance agents may have actually purchased a mobile device for their insurance business while some insurance firms may have provided such mobile devices to the insurance agents. Hence, there may be difference in the price value aspect for insurance agents.

Habit (H7) is the second strongest determinant with a path coefficient of 0.189. This is consistent with the result of Venkatesh et al. (2012) and is in partial agreement with the result of Limayem et al. (2007). Both studies confirmed the direct effect of habit on technology use similar to the result obtained. The possible explanation for this finding is the greater the insurance agents’ habit in using mobile technologies in their daily life, the higher is their behavioural intention to use mobile technologies at work.

The influence of personal innovativeness (H8) on the behavioural intention to use mobile technologies has showed significant relationship with a path coefficient of 0.119. This result is similar to Lopez-Nicolas et al. (2008). Individuals with innovative quality are able to handle the uncertainty in adopting a new technology. Having the ability to handle the uncertainty would increase their self-esteem and subsequently have a positive thinking on new innovations. Insurance agents who are more innovative with mobile technologies will have a stronger intention to accept and use the mobile technologies.

This study did not find any influence that age has on any of the determinants except for habit (H9) with a positive path coefficient and the rest of the constructs were not significantly moderated by the age of insurance agents. This is contrary to the literature where it is found that age moderates the behavioural intention to use (eg. Venkatesh et al, 2012). In the context of this study, the older insurance agents with usage experience tend to rely more on habit to drive technology use. The result that we obtained for this study perhaps indicate that age no longer play a significant role in new technology use for other constructs.

This study found that personal innovativeness (H10) tend to increase with the increase in the number of years using the technology consistent with the original UTAUT2 findings. This study also did not find any influence that voluntariness has on any of the determinants except for habit (H11). As habit refers to the degree to which people tend to display a certain behaviour spontaneously, insurance agents will have more intention to use the mobile technologies when the usage has become less voluntarily or in other words being made mandatory. This can be shown by the negative path coefficients for the habit construct.

Conclusion

When more and more insurance companies started to adopt mobile technologies in business and moving away from the brick and mortar way, the Malaysian insurance industry shows advancement into total e-business towards business sustainability in a globalised competition. Insurance companies would not have to spend time considering determinants such as price value and effort expectancy in their mobile technology roadmap as this factor was seen to be not a main concern for insurance agents in adopting mobile technologies. This may be due to the price of mobile devices and the internet has come down drastically in these few years. Besides that, usage of mobile technologies can help to ensure that there would not be any errors in the insurance cases submission and processing compared to the conventional method using ink and paper. The customers and clients are also able to get fast response time from the insurance agents considering that all the information needed are readily available and can be provided to the customers and clients anytime and anywhere.

The results obtained from this study are based on the perceptions of insurance agents who voluntarily chose to respond to the questionnaires given to them in the context of Malaysia. Therefore, the data obtained from the participants may not represent the whole view of all insurance agents as well as countries with a different national culture. Although the sample size has fulfilled the minimum required and involves insurance agents with different insurance companies’ background in Malaysia, a bigger sample size should be obtained to provide larger predictive power. Future studies could consider specific context of mobile technologies such as notebook, tablets, smartphones, and how the insurance agents obtained their mobile devices whether through self-purchase or company provide. This study will be a catalyst for future research in the area of mobile technologies utilisation in the service industry business in particular and all industries in general.

In conclusion, the usage of mobile technologies has become a norm in many businesses including the insurance industry, and has transformed businesses from the conventional brick and mortar way to a totally electronic-based business. It is crucial for insurance industry to adopt and implement mobile technologies as a sustainable strategic business tool to remain sustainable in the market. Before embarking on this mobile technologies journey, insurance companies need to know significant determinants of agents’ behavioural intention to use mobile technologies so that the companies can acquire good return of investment and ultimately attain business sustainability via benefits obtained from usage of such technologies in business. Findings from this study contribute in enhancing the use of mobile technologies in business which ultimately improves the efficacy and business sustainability of insurance industry in emerging economies such as Malaysia.

References

- Afarikumah, E., & Acheampong, A. (2010). Modeling computer usage intentions of tertiary students in a developing country through the Technology Acceptance Model. International Journal of Education and Development using Information and Communication Technology, 6(1), 102-116.

- Agrebi, S., & Jallais, J. (2014). Explain the Intention to use Smartphones for Mobile Shopping. Journal of Retailing and Consumer Services, 22(1), 16-23

- Ajzen, I., & Fishbein, M. (2005). The Influence of Attitudes on Behavior, in The Handbook of Attitudes, D. Albarracín, B. T. Johnson, and M. P. Zanna (eds.), Mahwah, NJ: Erlbaum, 173-221.

- Aurelie, L. (2015). Leaving employees to their own devices: new practices in the workplace, Journal of Business Strategy, 36(5), 18-24.

- Bellman, S., Potter, R. F., Treleaven-Hassard, S., Robinson, J. A., & Varan, D. (2011). The effectiveness of branded mobile phone apps. Journal of Interactive Marketing, 25(4), 191-200.

- Berghaus, S., & Back, A. (2014). Adoption of Mobile Business Solutions and its Impact on Organizational Stakeholders, Proceedings of 27th Bled eConference, June 1 - 5, 2014; Bled, Slovenia, 415-427.

- Brown, S. A., & Venkatesh V. (2005). Model of adoption of technology in households: A baseline model test and extension incorporating household life cycle. MIS Quarterly, 29(3), 399-426.

- Carlsson, C., Joanna, C., Hyvönen, K., Puhakainen, J., & Walden, P. (2006). Adoption of mobile devices/services – Searching for answers with the UTAUT, In: Proceedings of the 39th Annual Hawaii International Conference on System Sciences, Kauia, HI, USA, 4-7 January 2006.

- Chen, K. Y., & Chang, M. L. (2013). User acceptance of ‘near field communication’ mobile phone service: an investigation based on the unified theory of acceptance and use of technology model. The Services Industries Journal, 33(6), 609-623.

- Chin, W. W. (1998). The partial least squares approach to structural equation modeling. Mahwah, NJ: Lawrence Erlbaum Associates.

- Chiu, C. M., & Wang, E. T. G. (2008). Understanding Web-based learning continuance intention: The role of subjective task value. Information and Management, 45(3), 194-201.

- Chiu, C. M., Huang, H. Y., & Yen, C. H. (2010). Antecedents of trust in online auctions. Electronic Commerce Research and Applications, 9(2),148-159

- Chong, A. Y. L. (2013). A two-staged SEM-neural network approach for understanding and predicting the determinants of m-commerce adoption. Expert Systems with Applications, 40(4), 1240-1247.

- Ernest and Young. (2015). 2015 Global Insurance Outlook. EY.

- Fuksa, M. (2013). Mobile technologies and services development impact on mobile Internet usage in Latvia. Procedia Computer Science, 26, 41-50.

- Gall, M. (2003). Educational research: An introduction (7th ed.). Boston: Allyn and Bacon.

- Gan, W. L., Teoh, A. P., & Muthuveloo, R. (2017). Antecedents of Behavioural Intention to Adopt Internet of Things in the Context of Smart City in Malaysia. Global Business & Management Research, 9, 442-456.

- Gowanit, C., Thawesaengskulthai, N. Sophatsathit, P., & Chaiyawat, T. (2016). Mobile claim management adoption in emerging insurance markets: An exploratory study in Thailand. International Journal of Bank Marketing, 34(1), 110-130.

- Hennig-Thurau, T., Malthouse, E., Friege, C., Gensler, S., Lobschat, L., Rangaswamy, A., & Skiera, B. (2010). The impact of new media on customer relationships. Journal of Service Research, 13(3), 311-330.

- Hong, W. Y., Thong, J. Y. L., Chasalow, L. C., & Dhillon, G. (2011). User acceptance of agile information systems: a model and empirical test. Journal of Management Information Systems, 28(1), 235-272.

- Kaba, B., & Touré, B. (2014). Understanding information and communication technology behavioral intention to use: Applying the UTAUT model to social networking site adoption by young people in a least developed country. Journal of the Association for Information Science & Technology, 65(8), 1662–1674.

- Kumar, K. A., Natarajan, S., & Acharjya, B. (2017). Understanding Behavioural Intention for Adoption of Mobile Games. ASBM Journal of Management, 10(1), 6-18.

- Liang, T., Huang, C., Yeh, Y., & Lin, B. (2007). Adoption of mobile technology in business: a fit‐viability model. Industrial Management & Data Systems, 107(8), 1154-1169.

- Limayem, M., Hirt, S. G., & Cheung, C. M. K. (2007). How Habit Limits the Predictive Power of Intentions: The Case of IS Continuance. MIS Quarterly, 31(4), 705-737.

- Lopez-Nicolas, C., Molina-Castillo F. J., & Bouwman, H. (2008). An assessment of advanced mobile services acceptance: contributions from TAM and diffusion theory models. Information Management, 45(6), 359–364.

- Lu, M., Li, W., & Yueh, H. (2018). How Do Employees in Different Job Roles in the Insurance Industry Use Mobile Technology Differently at Work? IEEE Transactions on Professional Communication, 61(2), 151-165.

- Magni, M., Taylor, M. S., & Venkatesh, V. (2010). To play or not to play: a cross-temporal investigation using hedonic and instrumental perspectives to explain user intentions to explore a technology, International Journal of Human Computer Studies, 68(9), 572–588.

- Miller, K., Schell, J., Ho, A., Lukoff, B., & Mazur, E. (2015). Response switching and self- efficacy in peer instruction classrooms. Physical Review Special Topics-Physics Education Research, 11(1), 1-8.

- Moore, G. C., & Benbasat, I. (1991). Development of an instrument to measure the perceptions of adopting an information technology innovation. Information Systems Research, 2(3), 192–222.

- Román, S., Rodríguez, R.and Jaramillo, J.F. (2018). Are mobile devices a blessing or a curse? Effects of mobile technology use on salesperson role stress and job satisfaction. Journal of Business & Industrial Marketing, 33(5), 651-664.

- Song, J., Sawang, S., Drennan, J., & Andrews, A. (2015). Same but different? Mobile technology adoption in China. Information Technology & People, 28(1), 107-132.

- Stafford, T. F., Turan, A., & Raisinghani, M. S. (2004). International and Cross-Cultural Influences on Online Shopping Behaviour. Journal of Global Information Technology Management, 7(2), 70-81.

- Sun, H. S. (2012). Understanding user revisions when using information system features: adaptive system use and triggers. MIS Quarterly, 36(2), 453-478.

- Taiwo, A. A., & Downe, A. G. (2013). The theory of user acceptance and use of technology (UTAUT): A meta-analytic review of empirical findings. Journal of Theoretical & Applied Information Technology, 49(1), 48–58.

- Thiangtam, S., Pongpun, A., & Wilert, P. (2017). A Causal Relationship Model of the Acceptance of Mobile Sales Force Automation of Life Insurance Agents. Advanced Science Letters, 23(1), 345-347.

- Venkatesh, V., & Morris, M. G. (2000). Why Don’t Men Ever Stop to Ask for Directions? Gender, Social Influence, and Their Role in Technology Acceptance and Usage Behavior. MIS Quarterly, 24(1), 115-139.

- Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User Acceptance of Information Technology: Toward a Unified View. MIS Quarterly, 27(3), 425-478.

- Venkatesh, V., Thong, J. I. L., & Xu, X. (2012). Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology. MIS Quarterly, 36(1), 157-178.

- Visvanathan, N., & Van Der Merwe, D. B. (2018). Managers’ perception of mobile technology adoption in the Life Insurance industry. Information Technology & People, 31(2), 507-526.

- Yeh, R. K. J., & Teng, J. T. C. (2012). Extended conceptualisation of perceived usefulness: Empirical test in the context of information system use continuance. Behaviour and Information Technology, 31 (5), 525-540.

- Yueh, H., Lu, M., & Lin, W. (2016). Employees' acceptance of mobile technology in a workplace: An empirical study using SEM and fsQCA. Journal of Business Research, 69, 2318-2324.

- Zaremohzzabieh, Z., Samah, B. A., Omar, S. Z., Bolong, J., & Mohamed Shaffril, H. A. (2014). Fisherman’s acceptance of information and communication technology integration in Malaysia: Exploring the moderating effect of age and experience. Journal of Applied Sciences, 14(9), 873–882.

- Zhao, L., Lu, Y., Zhang, L., & Chau, P. Y. K. (2012). Assessing the effects of service quality and justice on customer satisfaction and the continuance intention of mobile value-added services: an empirical test of a multidimensional model. Decision Support Systems, 52(3), 645–656.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 August 2019

Article Doi

eBook ISBN

978-1-80296-064-8

Publisher

Future Academy

Volume

65

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-749

Subjects

Business, innovation, sustainability, environment, green business, environmental issues

Cite this article as:

Imm, L. P., Ping, T. A., & Muthuveloo, R. X. (2019). Determinants of Insurance Agents Behavioural Intention to Use Mobile Technologies. In C. Tze Haw, C. Richardson, & F. Johara (Eds.), Business Sustainability and Innovation, vol 65. European Proceedings of Social and Behavioural Sciences (pp. 298-309). Future Academy. https://doi.org/10.15405/epsbs.2019.08.30