Abstract

The collapse of major corporates due to accounting scandals had drawn the public attention and created doubts on the traditional risk management and corporate governance mechanism. These scandals also destroyed a certain level of trustworthiness of an organization towards its stakeholders. Therefore, this study is aimed to examine the impact of corporate risk disclosure on business performance with board gender diversity as a moderator. The study uses secondary data gathered from year 2016 annual reports. Random sampling is chosen to collect data from 130 public listed companies on Main Board of Bursa Malaysia. Structural equation modelling is applied. The results demonstrate that corporate risk disclosure does influence business performance significantly and positively which is consistent with prior studies. However, the moderating effect is found to be insignificant although the relationship between corporate risk disclosure and business performance is slightly strengthen with the existence of female on board. This study is hoped to fill in the research gap on how gender proportions on corporate board playing a role in moderating the relationship between corporate risk disclosure and business performance.

Keywords: Corporate risk disclosureboard gender diversitybusiness performance

Introduction

The overall business performance of Malaysia is expected to have a decline of 6.9 per cent in the first quarter of 2017 (Department of Statistics Malaysia, 2016). This poor business performance within Malaysia shed the light to the publics about the urgency and importance on the current economic environment. Corporate governance practices and disclosure is believed to be able to improve business performance. Although the government of Malaysia is setting up laws and regulations to improve the corporate governance practice of Malaysian companies, it is still believed that the management of an organization may not fully disclose the risk information because they do not have enough information on their risk or they do not want to reveal their credibly and prevent commercial harm from the competitors (Dobler, 2008). This is due to the fact that disclosure of risk information could bring potential harm to the company as the information is not only publishes to the potential investors, but also for its competitors according to Theory of Proprietary Costs. Furthermore, according to Said and Mellett (2013), there is a need to further identify the nature of risk reporting especially for emerging economy countries due inadequate risk disclosure.

In addition, the culture of Malaysian companies, especially for top management and corporate boards, is still lean towards homogeneous management where there is lesser female to hold higher position in the management team. Although the influence of a diversified corporate board towards the business performance is still remained inconclusive based upon the prior scholars (Wagana & Nzulwa, 2016), undoubtedly, participation of women in the corporate boards is still beneficial to the organization in a certain extent. From the perspective of psychological, women are often seen as the risk averse in comparison to the males and hence, the ladies are believed to be more conservative and cautious in relation to the corporate risk issues as the men tends to be more inclined to pick up a risk (Martin, 1987; Eckel & Grossman, 2002). Therefore, this study is aimed to look in depth of how gender moderates the association between corporate risk disclosure and business performance in Malaysia context as one of the developing country.

Corporate risk disclosure

Overall, corporate risk can be referred as the possibility of loss that will impact the company’s future financial position or business performance (Domínguez & Gámez, 2014). The release of risk information in the annual reports is playing an important role to drive the decision making process of the managements according to the Agency Theory (Jensen & Meckling, 1976). Besides that, better risk disclosure is frequently being argued that it will reduce the “conflict of interest” between stakeholders and agents and improve organizational performance (Jensen & Meckling, 1976; Nahar, Azim, & Jubb, 2016).

Risk is actually an inescapable component from any nature of business and hence, stakeholders prefer the risk information to be reported and disclosure in a timely basis (Amran, Manaf Rosli Bin, & Che 2008). Furthermore, Oliveira, Rodrigues, and Craig, (2011) have proved that risk disclosure helps an organization to stabilize its operational system, market discipline effectiveness as well as sustaining the social support of the company’s stakeholders. An effective risk disclosure is needed to enhance the continuous business growth and profitability (Hanim, Abdul & Omar, 2011).

Risk disclosure research is widely discussed in the developed countries, yet, an interesting question is that do risk governance as important to the developing countries also (Nahar et al., 2016). Besides that, the researchers further pointed out that the past studies the associations of risk governance variables such as risk disclosure with the accounting based of performance. Therefore, this study is aimed to look into the depth of how corporate risk disclosure could impact the business performance of the Malaysian organization.

Board Gender Diversity

In general, board gender diversity is defined as the presence of women on corporate boards (Julizaerma & Sori, 2012). In the recent years, some countries are encouraging for greater participation of women in the corporate board which is particularly male-dominated currently (Horak & Cui, 2017). The topic of gender diversity on corporate boards is broadly discussed in the past academic studies. For instances, The Lord Davies Report 2011 which developed by the British Government noted that European companies tend to grow faster and outperform their rivals because of the higher proportion of women in the senior management teams (Horak & Cui, 2017).

Nevertheless, according to European Corporate Governance Report 2011, there is only 14 per cent of the European board seated by women representatives (Mensi-Klarbach, 2014). Then, based on Joy (2008), there is only 9.6 per cent of Fortune 500 board seats are held by women and increased to 14.6 per cent by year 2006. She concluded that it would take at least 70 years for the ladies to reach parity with men with this slow growth rate. Moreover, an international report shown that there are 10.3 per cent of the Fortune 500 companies had no female representative in the corporate boards (Lenard, Yu, York, & Wu, 2014).

On the other hand, gender diversity is also used by prior literatures to find out how the presence of women on boards will impact corporate disclosure in general. Campbell and Minguez-Vera (2008) argued that gender composition of a corporate board can influence the monitor role and the financial reporting quality. Gul, Srinidhi, and Ng, (2011) confirmed that a gender-diverse board is better in monitoring and thus helps to improve the quality of accounting disclosure. In addition, Lenard et al. (2014) reported with evidence that gender diversity of the board really makes a difference and proved that a higher proportion of women in corporate boards is correlated with a lower variability of stock market return and leads to better corporate performance.

Although the interest is rising on the board gender diversity throughout these decades, however, there are still limited studies that investigated on how gender proportions might act as a moderator in the relationship between corporate risk disclosure and business performance. From the standpoint of Agency theory, it is inconclusive whether participation of women in boards retracts corporate governance and consequently, the company’s profitability (Arayssi, Dah, & Jizi, 2016). In addition, although there are existing literatures that indicated the relationship among corporate disclosure, gender diversity and business performance, yet, most of the studies have largely placed and drawn from the developed countries and it is limited and scarce for developing countries.

Problem Statement

Corporate risk disclosure had been studied by some researchers previously based on empirical evidences from western countries (Lajili & Zéghal, 2005; Linsley & Shrives, 2006; Abraham & Cox, 2007); French and Latin regions (Beretta & Bozzolan, 2004); Asia Pacific areas (Amran et al., 2008) and Arab countries (Hassan, 2009). Somehow, the quantitative risk disclosure and practices is still vague and infancy (Roulstone, 1999; Solomon, Solomon, Norton, & Joseph, 2000). Basically, corporate risk disclosure can be categorized into two types which are mandatory and voluntary disclosure (Hassan & Marston, 2010). These financial reporting and disclosure are playing an important role as they are the tools of management to communicate with external investors (Qu, Leung, & Cooper, 2013).

According to the Business Tendency Survey which conducted by Department of Statistics Malaysia, the business performance of Malaysia is expected to decrease in the first quarter of 2017. The overall business performance of Malaysia is expected to have a decline of 6.9 per cent in the first quarter of 2017. Hence, the overall poor business performance within Malaysia shed the light to the publics about the urgency and importance on the current economic environment within Malaysia. Corporate governance practices and disclosure is believed to be able to improve business performance.

One the other hand, the culture of Malaysian companies, especially for top management and corporate boards, is still lean towards homogeneous management where there is lesser female to hold higher position in the management team. Although the influence of a diversified corporate board towards the business performance is still remained inconclusive based upon the prior scholars (Wagana & Nzulwa, 2016), undoubtedly, participation of women in the corporate boards is still beneficial to the organization in a certain extent. From the perspective of psychological, women are often seen as the risk averse in comparison to the males and hence, the ladies are believed to be more conservative and cautious in relation to the corporate risk issues as the men tends to be more inclined to pick up a risk (Martin, 1987; Eckel & Grossman, 2002).

Research Questions

Based on the problem statement above, this study strives to answer the following research questions:

Does corporate risk disclosure influence business performance?

Does board gender diversity moderate the relationship between corporate risk disclosure and business performance?

Purpose of the Study

Overall, the main objective for this study is to examine the association between corporate risk disclosure and business performance of the selected public listed companies on Main Board of Bursa Malaysia. This study also aims to investigate on the potential role of gender diversity in the relationship between corporate risk disclosure and business performance.

Research Methods

Sample description

The population of this study are all the public listed companies on the Main Board of Bursa Malaysia. The total population of public listed companies on Main Board of Bursa Malaysia in year 2016 is 806 while there are seventeen companies categorized under PN17. Then, there is a sum of fifty companies found in Finance, REIT and Closed-End Fund sector, which are 31, 18 and 1 company respectively. Lastly, Hotels, Mining, IPC and SPAC sectors were contributed a total of twelve companies only and thus they are removed from data collection for this study as well. As a result, the final population is 727 companies. There are fourteen sectors listed within Main Market of Bursa Malaysia but only seven sectors were selected by filtering out the sectors as above which were provided large scale and higher number of main market players. The sample size of this study is 130 listed companies.

Measurement of variables

The dependent variable, business performance, is measured using return on equity (ROE) as being used in most of past studies such as Solakoglu and Demir (2016). Whereas for the independent variable, corporate risk disclosure, is being categorized into six sub-components (i.e. financial risk, operational risk, empowerment risk, information processing and technology, integrity risk and strategic risk). The extent of corporate risk disclosure is then calculated using content analysis of the annual reports as per suggestion of Amran et al. (2008).

As for the moderator, board gender diversity, this study using dummy measurement, if women is present on the board, then this it is coded with “1” and “0” if otherwise (Tantri & Sholihin, 2012; Solakoglu & Demir, 2016).

Firm size, firm age and board size were selected as the control variables in this study. Firm age is measured using the years from the establishment date (Solakoglu & Demir, 2016). Firm size by natural logarithm of the total assets (Ng, Chong, & Ismail, 2013), and board size will be measured by the number of board members as suggested by Solakoglu and Demir (2016).

Findings

Descriptive analysis

Descriptive analysis is used in this study to provide a summary of characteristics towards all the studied variables because this statistics will be able to give a breakdown of analysis in terms of mean and standard deviations of all the variables. Table

Based on Table

Hypothesis testing for the Direct Effect

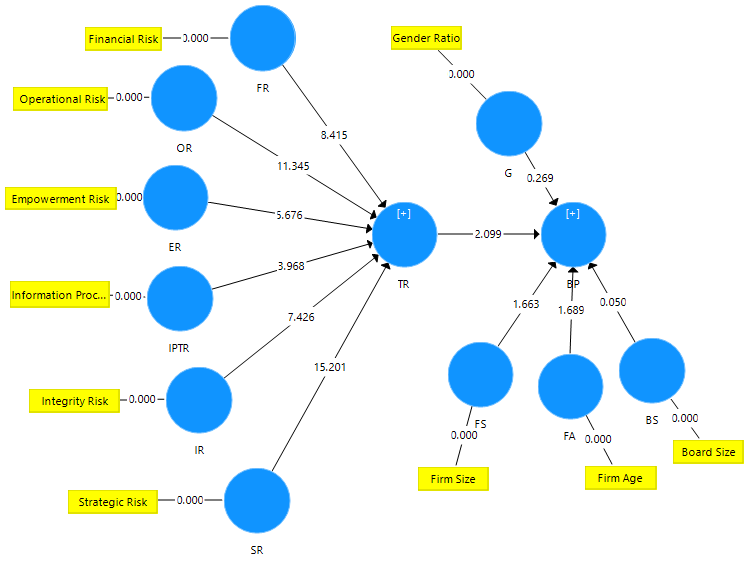

Path analysis is employed to test the hypothesis developed for the model. As PLS assumes that the data is not normally distributed, thus, it relies on a nonparametric bootstrap procedure to test and validate the significance of estimated path coefficients. Generally, the process of creating a subsample is repeated 5000 times to estimate the proposed model and hence, the subsample for this study is created after running the process for 5000 times for a one-tailed test at the significant level of 0.05.

R-squared (R2) is widely used to measure the goodness of fit for a model by giving an explanation on model quality in a suggested model. Based on Cohen (1992), an acceptable R2 is 0.02 for weak, 0.13 for moderate and 0.26 for substantial. The calculated R2 value of Business Performance (ROE) at 0.171 which signifies that 17.1% of the variation in business performance can be explained by corporate risk disclosure (TR). According to Cohen (1992) on R2, the value of 0.171 is considered moderate for this model.

For the purpose of hypothesis testing, the determinant of t-value on a one-tailed test of statistical significance must be greater than 1.645 when tested at 0.05 level of significance. Figure

Hypothesis H1 predicts that corporate risk disclosure is significantly influencing business performance. The result of analysis shows that H1 is statistically significant at p<0.05 and positively related (path coefficient = 0.262, t-value = 2.099), hence, hypothesis H1 is fully supported.

The findings are consistent with several past studies where the results showed that when the companies decided to disclose as much corporate risk information in their annual reports, it would lead to better business performance of the companies. Agency theory which developed by Jensen and Meckling (1976) proved that the release of risk information drives the decision making process of the managements.

Moreover, with the better disclosure of risk information in the annual report, it is believed to reduce the impact of conflict of interest between the stakeholders and agents as well as improve operational performance (Jensen & Meckling, 1976). Amran et al. (2008) also proved that the stakeholders preferred the risk information to be published and disclosed in timely basis. An effective risk disclosure is needed to enhance the continuous business growth and profitability (Hanim et al., 2011). Therefore, it can be concluded that a good risk reporting and disclosure practice can lead to the better business performance of an organization according to the researchers. The findings of this study are proved to be consistent with the view of the previous scholars too.

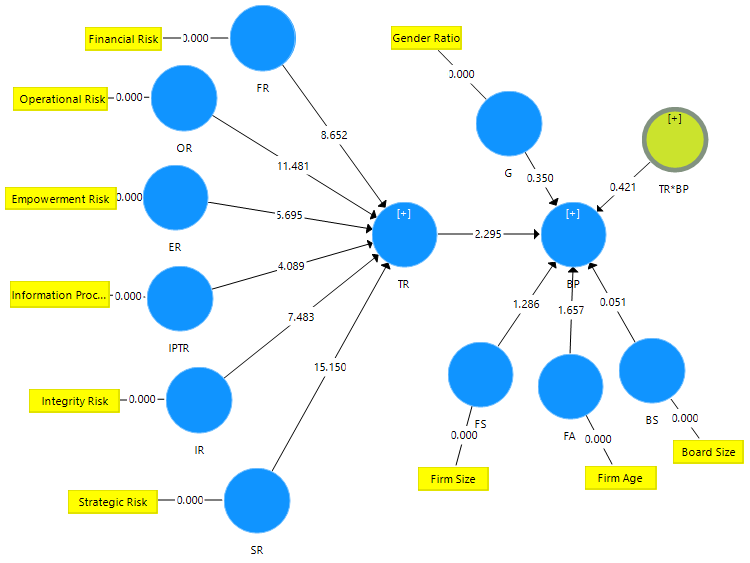

Hypothesis testing for the Moderating Effect

Moderating effect, also recognized as Interaction effect, is activated by variables that influence the strength of a relationship between independent and dependent variable. In other words, a moderator raises the influences towards the effects of an antecedent based on the results. In this study, gender is served as the moderating variable that might influence the effect of corporate risk disclosure on business performance. Figure

Investigation of the moderating effect of gender on the relationship between corporate risk disclosure and business performance is not supported by the findings in this study. With respect to gender diversity in corporate boards, there is a big question whether or not women in management contributed economically to an organization. Although there are many empirical studies on corporate governance perspective, however, the relationship between gender diversity and business performance is still inconclusive. Some scholars found that there is positive correlation between gender diversity and business performance (Miller & Triana, 2009; Smith, Smith, & Verner, 2006; Carter, Simkins, & Simpson, 2003) while other studies rejected the positive relationship (Naranjo‐Gil, Hartmann, & Maas, 2008; Rose, 2007).

There are researchers that found no clear and significant relationship too (Horak & Cui, 2017). From the standpoint of Agency theory, it is inconclusive whether participation of women in boards retracts corporate governance and consequently, the company’s profitability (Arayssi et al., 2016). In addition, although there are existing literatures that indicated the relationship among corporate disclosure, gender diversity and business performance, yet, most of the studies have largely placed and drawn from the developed countries and it is limited and scarce for developing countries (Table

Therefore, the result and findings for this study is showed that gender diversity slightly moderated the relationship between corporate risk disclosure and business performance. Unfortunately, the moderating effect is insignificant in Malaysia context. Although the awareness of gender equality is risen around the globe in the recent decades, the corporate board is still dominated by the male directors currently especially in the Malaysia context. The result of insignificant moderating effect of gender is actually aligned with past academic studies. For instances, there is only 14 per cent of the European board seated by women representatives (Mensi-Klarbach, 2014). She concluded that it would take at least 70 years for the ladies to reach parity with men with this slow growth rate.

Conclusion

The results of this study show that corporate risk disclosure tends to be positive and significantly associated with business performance. Therefore, the findings in this study support prior literature argument on disclosing potential risks to the stakeholders would provide appropriate signals to them and lead them to better strategize the company in order to come out with a wiser decision (Linsley & Shrives, 2006; Beretta & Bozzolan, 2004).

Basically, corporate risk disclosure has often been overlooked in the research arm of corporate governance. This study has established a connection between corporate risk disclosure and business performance based on the risk categorization. As the stakeholders preferred to engage with companies that are actively disclose more corporate and risk information to the public (Amran et al., 2008), the companies are expected to be more conscious in terms of their information disclosure. As a result, many companies begin to believe that corporate risk disclosure consists of more than just value, but also as one of the most important economic factors because it is believed that operational performance would improve with a better disclosure on the corporate risk information (Jensen & Meckling. 1976).

Unfortunately, the moderating effect of gender is insignificant towards the relationship between corporate risk disclosure and business performance. A possible explanation on this finding is that Malaysian companies are still dominated by male directors and the sample size for this study is limited. Therefore, it is suggested the future research to conduct this study in a longitudinal investigation to help draw a more meaningful picture on the impact of gender diversity.

This study has extended existing research on several levels. Overall, it adds to the pool of literature by providing empirical evidence of applicability of existing corporate risk disclosure and business performance within the Malaysian context. Then, this study also adds to literature the supporting evidence of gender acting as a moderator, but it needs to be confirmed if such moderation effects also exist in other contexts.

References

- Abraham, S., & Cox, P. (2007). Analysing the determinants of narrative risk information in UK FTSE 100 annual reports. The British Accounting Review, 39(3), 227-248.

- Amran, A., Manaf Rosli Bin, A., & Che Haat Mohd Hassan, B. (2008). Risk reporting: An exploratory study on risk management disclosure in Malaysian annual reports. Managerial Auditing Journal, 24(1), 39-57.

- Arayssi, M., Dah, M., & Jizi, M. (2016). Women on boards, sustainability reporting and firm performance. Sustainability Accounting, Management and Policy Journal, 7(3), 376-401.

- Beretta, S., & Bozzolan, S. (2004). A framework for the analysis of firm risk communication. The International Journal of Accounting, 39(3), 265-288.

- Campbell, K., & Mínguez-Vera, A. (2008). Gender diversity in the boardroom and firm financial performance. Journal of business ethics, 83(3), 435-451.

- Carter, D. A., Simkins, B. J., & Simpson, W. G. (2003). Corporate governance, board diversity, and firm value. Financial review, 38(1), 33-53.

- Cohen, J. (1992). A power primer. Psychological bulletin, 112(1), 155.

- Department of Statistics Malaysia (2016). Salaries & Wages Survey Report 2016. Department of Statistics Malaysia.

- Dobler, M. (2008). Incentives for risk reporting—A discretionary disclosure and cheap talk approach. The International Journal of Accounting, 43(2), 184-206.

- Domínguez, L. R., & Gámez, L. C. N. (2014). Corporate reporting on risks: Evidence from Spanish companies. Revista de Contabilidad, 17(2), 116-129.

- Eckel, C. C., & Grossman, P. J. (2002). Sex differences and statistical stereotyping in attitudes toward financial risk. Evolution and human behavior, 23(4), 281-295.

- Gul, F. A., Srinidhi, B., & Ng, A. C. (2011). Does board gender diversity improve the informativeness of stock prices? Journal of Accounting and Economics, 51(3), 314-338.

- Hanim Tafri, F., Abdul Rahman, R., & Omar, N. (2011). Empirical evidence on the risk management tools practised in Islamic and conventional banks. Qualitative Research in Financial Markets, 3(2), 86-104.

- Hassan, M. K. (2009). UAE corporations-specific characteristics and level of risk disclosure. Managerial Auditing Journal, 24(7), 668-687.

- Hassan, O., & Marston, C. (2010). Disclosure measurement in the empirical accounting literature-a review article (No. 1004). Accountancy Research Group, Heriot Watt University.

- Horak, S., & Cui, J. (2017). Financial performance and risk behavior of gender-diversified boards in the Chinese automotive industry: initial insights. Personnel Review, 46(4), 847-866.

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3(4), 305-360

- Joy, L. (2008). Women board directors in the United States: An eleven year retrospective. Women on corporate boards of directors: International research and practice, 15-23.

- Julizaerma, M. K., & Sori, Z. M. (2012). Gender diversity in the boardroom and firm performance of Malaysian public listed companies. Procedia-Social and Behavioral Sciences, 65, 1077-1085.

- Lajili, K., & Zéghal, D. (2005). A content analysis of risk management disclosures in Canadian annual reports. Canadian Journal of Administrative Sciences/Revue Canadienne des Sciences de l'Administration, 22(2), 125-142.

- Lenard, J. M., Yu, B., Anne York, E., & Wu, S. (2014). Impact of board gender diversity on firm risk. Managerial Finance, 40(8), 787-803.

- Linsley, P. M., & Shrives, P. J. (2006). Risk reporting: A study of risk disclosures in the annual reports of UK companies. The British Accounting Review, 38(4), 387-404.

- Martin, C. L. (1987). A ratio measure of sex stereotyping. Journal of Personality and Social Psychology, 52(3), 489.

- Mensi-Klarbach, H. (2014). Gender in top management research: Towards a comprehensive research framework. Management Research Review, 37(6), 538-552.

- Miller, T. & Triana, M. C. (2009). Demographic diversity in the boardroom: mediators of the board diversity-firm performance relationship. Journal of Management Studies, 46(5), 755-786.

- Nahar, S, Azim, M., & Anne Jubb, C. (2016). Risk disclosure, cost of capital and bank performance. International Journal of Accounting & Information Management, 24(4), 476-494.

- Naranjo‐Gil, D., Hartmann, F., & Maas, V. S. (2008). Top management team heterogeneity, strategic change and operational performance. British Journal of Management, 19(3), 222-234.

- Ng, H. T., Chong, L. L., & Ismail, H. (2013). Firm size and risk taking in Malaysia's insurance industry. The Journal of Risk Finance, 14(4), 378-391.

- Oliveira, J., Lima Rodrigues, L., & Craig, R. (2011). Risk-related disclosures by non-finance companies: Portuguese practices and disclosure characteristics. Managerial Auditing Journal, 26(9), 817-839.

- Qu, W., Leung, P., & Cooper, B. (2013). A study of voluntary disclosure of listed Chinese firms–a stakeholder perspective. Managerial auditing journal, 28(3), 261-294.

- Rose, C. (2007). Does female board representation influence firm performance? The Danish evidence. Corporate Governance: An International Review, 15(2), 404-413.

- Roulstone, D. T. (1999). Effect of SEC financial reporting release No. 48 on derivative and market risk disclosures. Accounting Horizons, 13(4), 343-363.

- Said Mokhtar, E., & Mellett, H. (2013). Competition, corporate governance, ownership structure and risk reporting. Managerial Auditing Journal, 28(9), 838-865.

- Smith, N., Smith, V., & Verner, M. (2006). Do women in top management affect firm performance? A panel study of 2,500 Danish firms. International Journal of productivity and Performance management, 55(7), 569-593.

- Solakoglu, M. N., & Demir, N. (2016). The role of firm characteristics on the relationship between gender diversity and firm performance. Management Decision, 54(6), 1407-1419.

- Solomon, J. F., Solomon, A., Norton, S. D., & Joseph, N. L. (2000). A conceptual framework for corporate risk disclosure emerging from the agenda for corporate governance reform. The British Accounting Review, 32(4), 447-478.

- Tantri, S. N., & Sholihin, M. (2012). Examining the Moderating Effect of Demographic Factors of Board of Directors on the Association between Corporate Governance and Earnings Management. Journal of Indonesian Economy & Business, 27(1), 98-110.

- Wagana, D. M., & Nzulwa, J. D. (2016). Corporate Governance, Board Gender Diversity and Corporate Performance: A Critical Review of Literature. European Scientific Journal, ESJ, 12(7), 221-233.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 August 2019

Article Doi

eBook ISBN

978-1-80296-064-8

Publisher

Future Academy

Volume

65

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-749

Subjects

Business, innovation, sustainability, environment, green business, environmental issues

Cite this article as:

Fun, L. S., & Hashim, F. (2019). Corporate Risk Disclosure and Business Performance: Does Board Gender Diversity Matters?. In C. Tze Haw, C. Richardson, & F. Johara (Eds.), Business Sustainability and Innovation, vol 65. European Proceedings of Social and Behavioural Sciences (pp. 249-259). Future Academy. https://doi.org/10.15405/epsbs.2019.08.25