Abstract

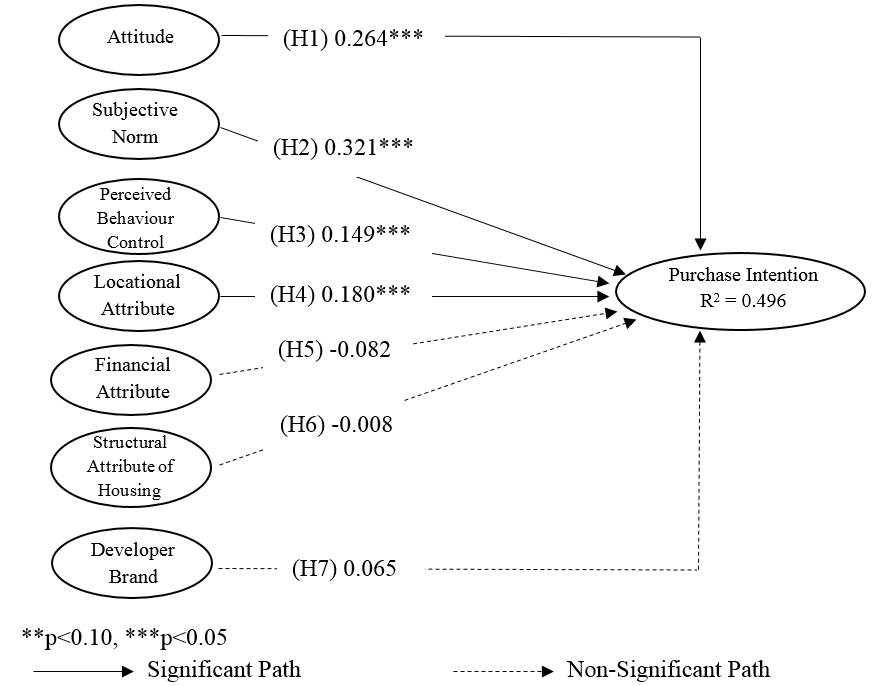

This study aims to investigate the determinants, which influence the purchase intention of affordable housing among Generation Y in Penang, Malaysia. This study extended Theory of Planned Behaviour in which three additional attributes (i.e. locational, financial and structural) and developers’ brand are included. A self-administered questionnaire using purposive sampling was adopted. A total of 181 completed surveys were returned and utilised for data analysis. Multiple regression analysis using SPSS software was employed for hypothesis testing. Accordingly, attitude, subjective norm, perceived behavioural control and locational attribute were affirmed to positively affect the purchase intention of affordable housing among Generation Y in Penang, Malaysia. Surprisingly, financial attribute, structural attribute and developers’ brand were confirmed to be insignificant towards the purchase intention of affordable housing among Generation Y. This study provides several implications which are important to the local state government in planning the affordable housing scheme in Malaysia. Implications, limitations and suggestions for future study were discussed.

Keywords: Affordable housingPurchase IntentionGeneration YMalaysia

Introduction

The property market in Malaysia has constantly been an important sector of the domestic economy. Housing is a need for all people. Homeownership provides privacy, security and independence. Homeownerships are important for residents in terms of wealth creation and stability of family life (Rahman, 2010). Over the few decades, the housing market has experienced a drastic change in house prices, especially in major cities. Many studies have been conducted focusing on housing affordability among different income groups, such as Abd Aziz et al. (2011), who studied on affordability in the major cities and towns in Malaysia. The acceptable price range for affordability of Penang, Kangar, Alor Setar, Melaka, Johor Bahru, Kuantan, Kota Bharu, Kuching and Kota Kinabalu is between RM120,000 and RM150,000 and between RM180,000 and RM200,000 for Kuala Lumpur. In another study (Salfarina et al., 2010), the respondents felt that houses in Malaysia were too expensive and beyond their affordability. Owing to the scarcity of land for development and the increase in demand for housing, major urban areas in Malaysia, such as Kuala Lumpur, Selangor, Penang and Johor Bahru, have turned to high-rise and high-density residential schemes (Thaker & Sakaran, 2016). Many researchers claimed that housing affordability is influenced by the distributions and levels of household incomes, home prices and the structure costs (Abd Aziz et al., 2011). Housing affordability is also defined by the access to mortgage finance (Wilcoz, 2003 cited in Abd Aziz et al., 2011).

In Penang, twelve projects are to be developed by the Penang state government whilst 17 projects by the private sector (The Star, 2016). Affordable housing is classified as houses purchased below RM250,000 on the mainland and RM400,000 on the island (The Star, 2015). Certain requirements are set by the state government to gain the title as an eligible buyer of affordable housing, such as Malaysian citizen, Penang voter, aged 21 years and above as of the date of application, and total household income (husband and wife) not exceeding RM12,000 per month (Penang Property Talk, 2018). In February 2014, the Penang government introduced new housing rules to ensure that public and affordable housings are bought by first-time house buyers and lower- and middle-income groups as Penang’s protection from the effect of the property bubble. Under the new rule, affordable housing is priced below RM250,000 on the mainland and RM400,000 on the island (The Star, 2015). The affordable housing projects are a collaboration between private developers and state government, whereby the projects are built by private developers and the list of eligible buyers provided by the state government (The Star, 2013).

Problem Statement

To overcome the affordability and house ownership issues, especially for the young first-time buyers, the government has introduced Malaysia’s People Housing Act (PRIMA) 2012. Under the ‘My First Home Scheme’, the young starters are offered a house between RM100,000 and RM400,000 (Thaker & Sakaran, 2016). Moreover, certain incentive schemes were also provided to ease the entry costs of purchase for the first-time home buyers, such as 50.0% stamp duty exemption on loan stamp duty (National Property Information Centre; 2018). A few types of research on housing exist but with limited focus on affordable housing category; most studies are investigating on general housing category, regardless of the low-cost, medium- or high-range categories of housing (Han & Kim, 2010; Saw & Tan, 2014; Tan, 2012; Tan, 2013; Md Razak et al., 2013; Sangkakoon et al., 2014; Al-Nahdi et al., 2015a; Al-Nahdi et al., 2015b; Nasar & Manoj, 2015; Chia et al., 2016; Thaker & Sakaran, 2016). As such, this study focused on affordable housing category to be specific and defined.

Research Questions

Owing to property price hike, one main question commonly raised nowadays is as follows: Can the generation Y afford and buy their own house in Malaysia? Thus, this study attempts to answer the following research questions: (1) Does the Generation Y buyers’ attitude is positively influenced the Generation Y buyers’ purchase intention towards affordable house in Penang, Malaysia? (2) Does the Generation Y buyers’ subjective norm is positively influenced the Generation Y buyers’ purchase intention towards affordable house in Penang, Malaysia? (3) Does the Generation Y buyers’ perceived behaviour control is positively influenced the Generation Y buyers’ purchase intention towards affordable house in Penang, Malaysia? (4) Do locational attribute, financial attribute and situational attribute are positively influenced the Generation Y buyers’ purchase intention towards affordable house in Penang, Malaysia? (5) Does the developers’ brand is positively influenced the Generation Y buyers’ purchase intention towards affordable house in Penang, Malaysia?

Purpose of the Study

This study aims to determine the perception of Generation Y buyers on the affordable housing. Specifically, this study intends to determine whether attittude, subjective norm, perceived behavioural control, locational attribute, financial attribute, strucrtural attribute and developers’ brand have any significant relationship with the affordable housing purchase intention in Penang, Malaysia.

Purchase intention

Purchase intention can be defined as a plan to purchase a particular good or service in the future (Md Razak et al., 2013). It can also be defined as a consumer’s attitude towards a product, specifically referring to the person’s belief, feeling and purchase intentions for the product (Md Razak et al., 2013). Ajzen (1991) corroborate that a person’s behaviour is determined by his/her intention to perform that behaviour. Intention represents the motivation of a person’s conscious plans and decisions. Theory of Planned Behaviour (TPB) was extensively employed to clarify and examine purchase intention. For instance, purchase intention was analysed in the studies of purchase luxury fashion goods by Jain et al. (2017), counterfeit luxury goods by Ting et al. (2016) and energy efficient appliances by Tan et al. (2017).

TPB is the successor of Theory of Reasoned Action of Ajzen and Fishbein (1980). According to this TPB, human action is guided by three types of considerations, namely, behavioural, normative and control beliefs (Ajzen, 1991). Behavioural beliefs produce a favourable or unfavourable attitude towards behaviour. Normative beliefs result in perceived social pressure or subjective norm (Ajzen, 1991). Moreover, control beliefs are related to perceived behavioural control (Ajzen, 1991). These variables form a behavioural intention towards a certain action in this study, which is the intention to purchase affordable housing. Given its successful prediction of intentions, TPB has been used by many researchers for the past decades.

In the context of housing, TPB was utilised to predict the purchase intention of green and sustainable homes by Tan (2013) and purchase real estate by Al-Nahdi et al. (2015a) and Al-Nahdi et al. (2015b). TPB also previously investigated the factors influencing consumers to purchase residential units (Phungwong, 2010; Si, 2012), and it earlier studied the factors influencing home purchase intentions (Phungwong, 2010; Numraktrakul et al., 2012). TPB looks at the connections between a person’s attitude, subjective norm and perceived behavioural control towards a behaviour regarding the outcome of the conduct (Ajzen, 1991). In this study, these variables form a behavioural intention towards certain action (intention to purchase an affordable housing). Generally, if a person’s attitude is in favour of the affordable housing if purchasing an affordable house is the perceived social norm and the person accepts the behaviour of buying an affordable house as easy or accessible, then the person’s intention to purchase an affordable house must increase.

TPB allowed for adjustment by including additional indicators and modifying the paths in the model, presuming that the modified model could be the strong extent of the variation in the behavioural intention and actual behaviour in the traditional TPB model (Ajzen, 1991). In a study by Saw and Tan (2014), locational, financial and structural attribute factors were proven significant in affecting the purchase decision of investors in Malaysia’s residential property market. In the research of purchasing intention towards real estate development in Setia Alam, Shah Alam by Md Razak et. al., (2013), the image of property developer and the structural soundness and proximity of the property to amenities, such as transportation, schools and shops, were important factors to be considered before making decision to buy a property. In addition, factors affecting homeownership among Generations X and Y in Hong Kong, quality of housing, income and housing prices, facility and location of housing were part of the determinants (Li, 2015). Thaker and Sakaran (2016) validate that pricing is the most important attribute in buying a residential property followed by community amenities, location, financing, structural factor, home amenities and developer. In a study by Cheng and Cheok (2008), brand awareness and the brand personality traits of property developers were proved to be significant in the buying decision of property buyers. Subsequently, these four dimensions (locational, financial, structural and developer brand) were added and applied to the purchase intention of affordable housing in this study.

Attitude, subjective norm and perceived behaviour control

Attitude and purchase intention in the past studies have been proven to have a positive relationship (Han & Kim, 2010; Sangkakoon et al., 2014; Al-Nahdi et al., 2015a; Al-Nahdi et al., 2015b). Ajzen (1991) contends that people will reinforce a positive attitude towards a conduct if they have confidence that the demonstration of that particular conduct will build a decent result. Consumers’ perception of social pressures put on them by others affects the purchase of a product (Phungwong, 2010). Few researchers validated that subjective norm has a significant positive relationship towards intention (Han & Kim, 2010; Sangkakoon et al., 2014; Al-Nahdi et al., 2015a; Al-Nahdi et al., 2015b). In this study, the groups of spouses, children and parents are categorised as family members. Control beliefs are a person’s beliefs towards factors present, which facilitate or prevent the performing of a behaviour (Ajzen, 1991). Han and Kim (2010), Sangkakoon et al. (2014), Al-Nahdi et al. (2015a), and Al-Nahdi et al. (2015b) found a similar positive relationship between perceived behavioural control with intention. Therefore, hypothesis 1, 2 and 3 can be postulated that:

H1: Attitude positively affects the purchase intention of affordable housing.

H2: Subjective norm positively affects the purchase intention of affordable housing.

H3: Perceived behavioural control positively affects the purchase intention of affordable housing.

Locational attribute, financial attribute and situational attribute

Locational attribute is related to the distance of travelling. In many studies, distance from the house to the workplace and amenities is one of the highest considerations when choosing to buy or invest on a property. Few researchers have proven that locational attribute plays an important role when deciding to buy a property (Md Razak et al., 2013; Saw & Tan, 2014; Li, 2015; Nasar & Manoi, 2015; Thaker & Sakaran, 2016). Other than location, financing is also one of the main factors the property buyers must consider. The financial attribute includes house price, mortgage interest rates and mortgage instalment scheme, which play an important role in the decision making of the property buyer (Saw & Tan, 2104). Similar findings from research have corroborated that financial attribute has positive and significant influence on house purchasing intention (Kupke, 2008; Kupke & Marano, 2003; Md Razak et al., 2013; Saw & Tan, 2014; Li, 2015; Nasar & Manoi, 2015; Al-Nahdi et al., 2015a; Chia et al., 2016; Thaker & Sakaran, 2016). Physical conditions and quality of a property are also considered by property buyers. Several bedrooms, size of the unit and size of living and dining halls are considered for potential home buyers. According to a few researchers, a positive relationship exists between structural attribute with purchase intention (Md Razak et al., 2013; Saw & Tan, 2014; Maoludyo & Aprianingsih, 2015; Li, 2015; Chia et al., 2016; Thaker & Sakaran, 2016). Therefore, this discussion led to the formulation of the following hypotheses:

H4: Locational attribute positively affects the purchase intention of affordable housing.

H5: Financial attribute positively affects the purchase intention of affordable housing.

H6: Situational attribute positively affects the purchase intention of affordable housing.

Developers brand

Developer branding projects a developer’s image, service and trust. Developer brand is usually considered by home buyers to avoid buying abandoned projects, late delivery projects and poor quality of workmanship. Research by Cheng and Cheok (2008) affirms that home buyers rank developer brand as the top. However, the findings of other research (Chia et al., 2016) show no significant relation between developer brand and house purchase intention. Thus, hypothesis

Research Methods

The unit of analysis of this study comprises the young individuals from the Generation Y age cohort (born between 1980 to 1994) and purposive sampling is chosen. A total of 35 measurement items were adapted from past studies and five-point Likert-scale (1 = strongly disagree to 5 = strongly agree) was used. The variable of attitude and subjective norm comprised four items, whereas the variable of perceived behavioural control and purchase intention consisted of five items and all four variables were adapted from Al-Nahdi et al. (2015a) study. Meanwhile, locational attribute comprised five items and both the financial and structural attributes consisted of four items and all three variables were adapated from Saw and Tan (2014) study. Lastly, developer brand consisted of four items and was adapted from Chin et al. (2016) study. The data collected were then analysed using SPSS software, and multiple regression analysis was employed to test the proposed hypotheses (Field, 2013). Gpower 3.1.9.2 software was utilised in determining the minimum sample size. The study chose the Gpower method owing to the lack of a full list of young Malaysian individuals from Generation Y. The effect size of 0.15 was chosen in this study, which is greater than Becker et al. (2016)’s suggestion. Hence, the minimum sample size required for this study is equal to 153. A total of 750 questionnaires were distributed via online (emails, Facebook, social network channel and messenger through Google Forms). A total of 228 completed responses were collected back and only 181 completed online questionnaires were useable.

Factor analysis

Two stopping rules were utilised in conducting the factor analysis. The first stopping rule was the elimination of item, with loading below 0.5 for the diagonal variables of the Anti-Image Correlation (Field, 2013). The second stopping rule was the elimination of item with the main loading below 0.50 and cross loadings of more than 0.35 in the Rotated Component Matrix (Field, 2013). The results of factor analysis for the independent variables, which served as factors influencing purchase intention of affordable housing, the KMO measure of the sampling adequacy is 0.872, which is above the acceptable limit of 0.8 (Hutcheson & Sofronious, 1999 cited in Field, 2013). Bartlett’s test of sphericity would render it significant (p < 0.01), which must be less than 0.05. This finding proves that no intercorrelation matrix involving these seven variables exists in an identity matrix (Field, 2013). Both these tests also confirm that the data used for this study are suitable for structure detection. From the seven independent variables, the total variance explained is 73.520% for the eigenvalues of more than 1. In term of the purchase intention as the dependent variable, the KMO measure of the sampling adequacy is 0.877, which is above the acceptable limit of 0.8 (Hutcheson & Sofronious, 1999 cited from Field, 2013). Bartlett’s test of sphericity would render it significant (p < 0.01), which must be less than 0.05 (Field, 2013). Both these tests prove that the data used in this study are suitable for structure detection. The total variance explained is 80.970% for the eigenvalues of more than 1.

Reliability Analysis

After conducting a factor analysis, the next step was to conduct a reliability analysis. This analysis was important as it uses Cronbach’s alpha to objectively measure the reliability and internal consistency of the factor analysis. The result showed that all Cronbach’s alpha values for the all the variables are above the minimum acceptable limit of 0.8 (Kline, 1999). In conclusion, the reliability analysis was satisfied.

Multiple regression analysis

Finally, Figure

Findings

This study has identified numerous major findings related to the proposed relationship of the study variables. Four hypotheses are proven to be supported. Specifically, attitude, subjective norm, perceived behavioural control and locational attribute positively affect the affordable housing purchase intention among the Generation Y in this study. Surprisingly, another three hypotheses are unsupported. The relationship of the financial attribute, situational attribute, developers’ brand and affordable housing purchase intention is insignificant. Attitude positively affects the affordable housing purchase intention, thereby supporting Hypothesis 1. Attitude is the way people show that they like or dislike a thing. Accordingly, Penang young people are shown to likely accept and purchase the affordable housing from this study. The more positive or favourable the attitude of Penang young people towards the affordable housing, the more likely they will purchase the houses.

In this study, Hypothesis 2 is also supported in which subjective norm positively affects the affordable housing purchase intention. Penang young people are likely being influenced by family members in purchasing an affordable house. This finding is apparent because more than 50% of the respondents from this study have more than two family members. Moreover, the opinions of these family members become significant to them, especially towards purchasing an affordable house. The relationship between perceived behavioural control and affordable housing purchase intention is affirmed to be positively significant in this study, thereby supporting Hypothesis 3. The respondents felt strongly that, if they are given adequate opportunity, time, money and knowledge regarding the affordable house, their purchase intention tends to be strong. This similar finding is also apparent in the study by Tan (2013). When opportunities and resources are readily available, house buyers tend to buy green and sustainable homes (Tan, 2013).

Moreover, locational attribute positively affects the affordable housing purchase intention. Hence, Hypothesis 4 is supported. Affordable house buyers will look into certain criteria, such as access to retail centres, shops, schools and work places before deciding to purchase an affordable house. The location has been a very important criterion when considering on a residential property purchase. Tan (2012) confirms that distance to schools, workplace and retail outlets are significant to home owners. The government shall target areas established with employment opportunities and infrastructure for housing development (Tan, 2012). Owing to the absence of a decent environment for families, many public housing developments have failed (Tan, 2012). Therefore, the locational attribute is important to provide a decent environment for families and for the improvement of the quality of life, especially in the city areas.

Surprisingly, the present study has not found any significant relationship between financial attribute and affordable housing purchase intention. Therefore, Hypothesis 5 is unsupported. One possible explanation could be the different financial terms being used, which the lay people found difficulty understanding. Financial terms, such as Base Lending Rate, Mortgage Loan to Value Ratio, Real Property Gains Tax and property cooling measures, might be new to the respondents. In addition, the relationship between structural attribute and affordable housing purchase intention is also insignificant, thereby confirming that Hypothesis 6 is unsupported. The structural attribute of housing and the purchase intention of affordable housing were affirmed to be negative and insignificant. This finding could be because Penang young buyers do not emphasise the house features, house design and the house appearance. Another probable reason is that the built-up range and size of an affordable house in Penang have been determined by the state government, thereby leaving the consumers with no option when deciding the preferred sizes.

Lastly, the developer brand does not have any influence towards the affordable housing purchase intention among the Generation Y in this study. Hence, Hypothesis 7 is rejected. Penang young buyers did not perceive the image or brand of the developers as important. This finding could be due to the limited developers that develop an affordable housing in Penang. Consequently, the buyers have limited choices when purchasing an affordable house.

Implication of the study

From this research, several practical implications can be drawn. The findings of this study have contributed a few valuable information for customers, marketers, developers, government, NGOs and researchers. For developers, the findings are useful for marketing strategy purposes. For instance, the family plays an important role in influencing the young buyers’ decision to purchase an affordable house. Therefore, the developers shall plan family-related marketing events that will encourage the potential buyer to bring their families along with them. This possible scenario might help the developers’ close additional sales with the support and appearance of family members. Considering that developer brand is not a key factor in determining the intention to purchase an affordable house, the developers may spend less in branding marketing and advertisement. Developers shall concentrate further on how to influence the potential buyers in the context of family, confidence and accessibility to obtain information on the housing projects and the location of the housing projects. For the Penang government, the findings are beneficial as a reference for the government regarding the factors that will affect the intention to purchase among the young buyers of Penang. From the study, location is a significant factor that contributes to the decision making. Therefore, the government must determine a good location to be developed for affordable housing. If the affordable houses are not located in the ideal location, then no demand for affordable housing by the young people will occur. In addition, the extended theory of TPB by applying four additional dimensions (locational, financial, structural and developer brand) to the purchase intention of affordable housing in this study may serve as a literature reference for housing researchers and scholars.

Conclusion

This study aims to identity the determinants affecting the affordable housing purchase intention among Generation Y buyers in Penang, Malaysia. All the three variables of TPB are confirmed to positively affect the purchase intention of affordable housing among Generation Y in Penang, Malaysia. The locational attribute also proved to be significantly important in this study. In term of limitation, first, this study might not be able to generalise all the different types of age cohorts in Malaysia with regard to the affordable housing purchase intention as the respondents are from generation Y (born between 1980 to 1994). Second, the generalisation of these study findings only limit to Penang states of Malaysia. Therefore, future research could extend to other age groups, such as the Generation Z in view of the potential generational differences, which might influence their purchase intention of affordable housing. In addition, this study should extend to all the states in Malaysia because this affordable housing scheme has constantly been one of the main concerns by the federal and state governments in improving the living standard of the people in Malaysia.

References

- Abd Aziz, W. N. A. N., Hanif, N. R., & Singaravello, K. (2011). A Study on affordable housing within the middle-income households in the major cities and towns in Malaysia. Journal of Basic and Applied Science, 258-267.

- Ajzen, I. (1991). The theory of planned behaviour. Organizational behaviour and human decision processes, 50(2), 179-211.

- Ajzen, I., & Fishbein, M. (1980). Understanding attitudes and predicting social behaviour. Englewood Cliffs, NJ: Prentice-Hall.

- Al-Nahdi, T. S., Habib, S. A., Abu Bakar, A. H., Bahklah, M. S., Ghazzawi, O. H., & Al-Attas, H. A. (2015a). The Effect of Attitude, Dimensions of Subjective Norm, and Perceived Behaviour Control, on the Intention to Purchase Real Estate in Saudi Arabia. International Journal of Marketing Studies, 7(5), 120-131.

- Al-Nahdi, T. S., Nyakwende, E., Banamah, A. M., & Jappie, A. A. (2015b). Factors Affecting Purchasing Behaviour in Real Estate in Saudi Arabia. International Journal of Business and Social Science, 6(2), 113-125.

- Becker, T. E., Atinc, G., Breaugh, J. A., Carlson, K. D., Edwards, J. R., & Spector, P. E. (2016). Statistical control in correlational studies: 10 essential recommendations for organizational researchers. Journal of Organizational Behavior, 37(2), 157-167.

- Chia, J., Harun, A., Kassim, A. W. M., Martin, D., & Kepal, N. (2016). Understanding factors that influence house purchase intention among consumers in Kota Kinabalu: an application of buyer behaviour model theory. Journal of Technology Management and Business, 3(2), 94-110.

- Cheng, F. F., & Cheok, J. (2008). Importance of branding for property developers in Malaysia. Sunway Academic Journal, 5, 65-81.

- Field, A. (2013). Discovering statistics using IBM SPSS statistics (4th ed.). London: Sage.

- Han, H., & Kim, Y. (2010). An investigation of green hotel customers’ decision formation: Developing an extended model of the theory of planned behaviour. International Journal of Hospitality Management, 29(4), 659-668.

- Jain, S., Khan, M. N., & Mishra, S. (2017). Understanding consumer behavior regarding luxury fashion goods in India based on the theory of planned behavior. Journal of Asia Business Studies, 11(1).

- Kline, T. J. (1999). The team player inventory: Reliability and validity of a measure of predisposition toward organizational team-working environments. Journal For Specialists in Group Work, 24(1), 102-112.

- Kupke, V. (2008). Factors important in the decision to buy a first home. Pacific Rim Property Research Journal, 14(4), 458-476.

- Kupke, V., & Marano, W. (2003). Job Security and First Home Buyers. Pacific Rim Property Research Journal, 9(4), 409-424.

- Li, R. Y. M. (2015). Generation X and Y’s demand for homeownership in Hong Kong. Pacific Rim Property Research Journal, 21(1), 15-36.

- Maoludyo, F. T, & Aprianingsih, A. (2015). Factors influencing consumer buying intention for housing unit in Depok. Journal of Business and Management, 4(4), 484-49.

- Thaker, H. M. T., & Sakaran, K. C. (2016). Prioritisation of key attributes influencing the decision to purchase a residential property in Malaysia: An analytic hierarchy process (AHP) approach. International Journal of Housing Markets and Analysis, 9(4), 446-467.

- Nasar, K. K., & Manoj, P. K. (2015) Purchase Decision For Apartments: A Closer Look Into The Major Influencing Factors. International Journal of Research in Applied, Natural and Social Sciences, 3(5), 105-112.

- National Property Information Centre. (2018). Property market report 2017. Retrieved 2 May 2018, from http://napic.jpph.gov.my/

- Numraktrakul, P., Ngarmyarn, A., & Panichpathom, S. (2012). Factors Affecting Green Housing Purchase. In 17th International Business Research Conference. Toronto, Canada.

- Penang Property Talk. (2018). Am I Eligible for Affordable Housing? Retrieved 22 April 2018 from http://www.penangpropertytalk.com/affordable-housing/am-i-eligible-for-affordable-housing/

- Phungwong, O. (2010). Factors influencing home purchase intention of Thai single people. Published dissertation. International graduate school of business, University of South Australia, Adelaide, Australia.

- Rahman, M. M. (2010). The Australian housing market–understanding the causes and effects of rising prices. Policy studies, 31(5), 577-590.

- Md Razak, M. I., Ibrahim, R., Abdullah, N. S. H., Osman, I., & Alias, Z. (2013). Purchasing intention towards real estate development in Setia Alam, Shah Alam: Evidence from Malaysia. International Journal of Business, Humanities and Technology, 3(6), 66-75.

- Salfarina, A. G., Nor Malina, M., & Azrina, H. (2011). Trends, problems and needs of urban housing in Malaysia. International Scholarly and Scientific Research & Innovation, 5(2), 227-231.

- Sangkakoon, P., Ngarmyarn, A., & Panichpathom, S. (2014). The influence of group references in home purchase intention in Thailand. In 21st Annual European Real Estate Society Conference in Bucharest, Romania. Retrieved from http://eres. scix. net/cgi-bin/works/Show.

- Saw, L. S., & Tan, T. H. (2014). Factors affecting the purchase decision of investors in the residential property market in Malaysia. Journal of Surveying, Construction and Property, 5(2), 1-13.

- Si, P. T. (2012). Key factors affecting house purchase decision of customers in Vietnam. Unpublished master thesis. University of Economics Ho Chi Minh City, Ho Chi Minh City, Vietnam.

- Tan, C. S., Ooi, H. Y., & Goh, Y. N. (2017). A moral extension of the theory of planned behavior to predict consumers’ purchase intention for energy-efficient household appliances in Malaysia. Energy Policy, 107, 459-471.

- Tan, T. H. (2012). Meeting first-time buyers’ housing needs and preferences in greater Kuala Lumpur. Cities, 29(6), 389-396.

- Tan, T. H. (2013). Use of structural equation modeling to predict the intention to purchase green and sustainable homes in Malaysia. Asian Social Science, 9(10), 181.

- The Star (2013). Young professionals struggle to own property. Retrieved April 14, 2017, from http://www.thestar.com.my/news/nation/2013/07/14/dad-dont-kick-me-out-yet/

- The Star (2015, June 22). Penang affordable housing glut? Retrieved April 22, 2017, from http://www.thestar.com.my/business/business-news/2015/06/22/penang-affordable-housing-glut/

- The Star (2016, April 9). Lessons from Penang affordable housing. Retrieved April 2, 2017, from http://www.thestar.com.my/business/business-news/2016/04/09/lessons-from-penang-affordable-housing/

- Ting, M. S., Goh, Y. N., Mohd Isa, S. (2016). Determining consumer purchase intention towards counterfeit luxury goods in Malaysia, Asia Pacific Management Review, 21(4), 219-230.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 August 2019

Article Doi

eBook ISBN

978-1-80296-064-8

Publisher

Future Academy

Volume

65

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-749

Subjects

Business, innovation, sustainability, environment, green business, environmental issues

Cite this article as:

Ho, G., Goh, Y., & Ting, M. (2019). The Determinants of Affordable House Purchase Intention Among Generation Y in Malaysia. In C. Tze Haw, C. Richardson, & F. Johara (Eds.), Business Sustainability and Innovation, vol 65. European Proceedings of Social and Behavioural Sciences (pp. 89-99). Future Academy. https://doi.org/10.15405/epsbs.2019.08.10