Abstract

The purpose of this study is to enhance the understanding towards consumer purchase decision models for financial services. It starts with a review of Consumer Decision Making (CDM) Models and provides an in-depth review on Consumer Decision Making Model for Financial Services (CDMFS). This paper provides a critique for earlier models. Firstly, most of prior researches are related to tangible nature of goods while a little attention has been given to financial services sectors. Secondly, the concepts of CDM models and their interactions with each others are complex. Since the framework of these models have been developed through various arrangements but are not well addressed to financial services. Thirdly, earlier stduies suggested that most of the consumers’ decisions are made in short timeframes while consumers decisions for financial services may last over longer time frame with a number of failed attempts to purchase. From the indepth review of former studies, it can be conculded that CDMFS is the most comprehensive model among contemporary literature. This model states a continual decision making process for financial services and identifies the key components with relevant elements of financial services; elaborates a framework of three interected componants: consumer decision making input, process and outcome.

Keywords: Consumer Purchase Decision ModelsFinancial Services

Introduction

In contemporary economy with multiple competitors, it is crucial for any organization to recognize consumer wants and desires as a key to success (Kotler, 2001). Consumers constantly makes decisions about the purchase of products and services and these decisions are of greater importance not only for the consumer but for the marketers as well. In order to gain a competitive advantage, organizations need to draft their marketing strategies to incorporate consumer needs. If organization somehow miss the mark to predict how a consumer will react about a specific product and service, the company will have to face losses (Solomon, Dahl, White, Zaichkowsky, & Polegato, 2014) because it is the consumer who actually determine the sales and profits of a firm by making purchase decisions and his/her intentions and actions regulate the economic capability of the organization (Assael, 1984). After reviewing the literature on consumer purchase decision, it is recognized that Consumer Decision Making (CDM) models have been evolved through various forms and special attention has been noticed towards the tangible nature of products while services sector specifically financial services sector is quiet deprived. In the seminal work of (McKechnie, 1992; Byrne, 2005; Harrison, Waite, & White, 2006; Milner & Rosenstreich, 2013) suggested that CDM model for financial services received a little attention and there is a noticeable absence of a conceptual framework that elaborates how consumers make their decisions while dealing in financial services. The notion of consumer decision making has been reframed according to financial services perspective. CDM for financial services has been enlightened slightly different than tangibles products (Milner & Rosenstreich, 2013). Thus, this study will review the former studies of consumer purchase decision and will intend to explain theoretical background of CDM models along with their commonalities, gaps, critiques and implementation in financial services sector.

Problem Statement

Financial services purchase epitomizes a significant risk for consumers and is a foremost factor that plays a crucial role in consumer decision making. Zeithaml (1988) argued that services had better be differentiated from products on the foundation of their sole features for instance intangibility, inseparability, heterogeneity and perishability. A stream of studies (McKechnie, 1992; Byrne, 2005; Harrison et al., 2006; Milner & Rosenstreich, 2013) concluded that CDM models have been developed through numerous arrangements during last four decades and distinctive consideration has been observed towards the tangible products while financial services sector is unobtrusively deprived. Although, CDM models captured a strong recognition however, the existing notion was not fit enough for financial services. In this regard, CDM Models have been reframed according to financial services viewpoint and CDMFS has been progressed by (Milner & Rosenstreich, 2013). Therefore, this study inteded to put an effort to review the previous studies of CDM models and to explain theoretical background of CDM models along with their commonalities, critiques and implementation in financial services sector;

Research Questions

Does previous CDM models cover all the perspectives of financial services area?

How does CDMFS provide a reliable theoretical background for financial services?

Purpose of the Study

The foremost purpose of this study is to explain theoretical background of CDM models along with their commonalities, critiques and implementation in financial services sector and also explain the theoretical context of CDMFS.

Research Methods

This conceptual paper is a qualitative literature review, based on the concept of consumer purchase decision models for financial services. To accomplish the purpose, literature from authentic journals, related books and conference proceedings has been summed up in subsequent part of this paper.

Findings

Consumer Purchase Decision Models

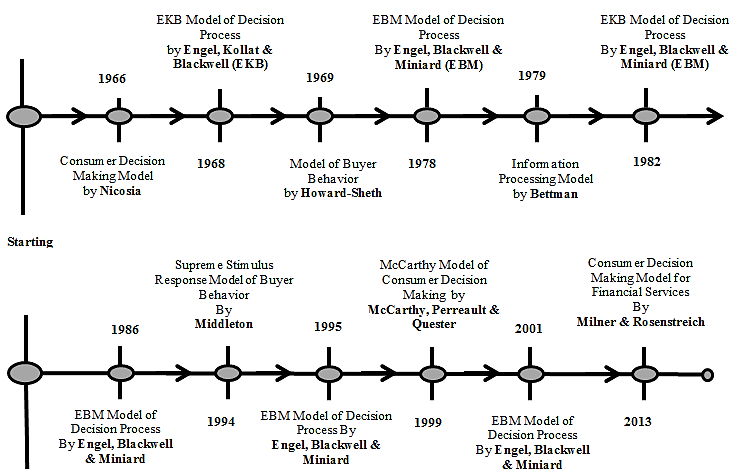

Consumer behaviour has developed by passing through many phases as new approaches and methodologies are being adopted. Most recent phase evolved just after the Second World War around 1950s, though it seems rational but marketers by no means understood this concept earlier. The significance of consumer buying behavior remains in the fact that you can predict the behaviour of your consumer. Understanding consumer behavior is essential for successful marketing. It is vital to reach and connect with consumer to influence their purchasing decision (Fishburn, 1970). Before proceeding towards the literature of CDM models, consumer decision models developments are demonstrated in Figure

Nicosia’s Consumer Decision Making Model (1966)

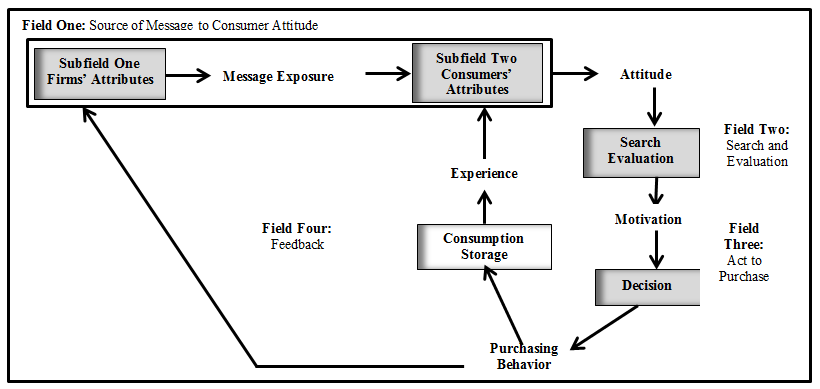

The model comprises of five stages, i.e. firms’ attributes, consumer attributes, search evaluation, purchase, and feedback (See Figure

Field two is a pre-action field. In this field consumer do information searching and evaluates available alternatives and finally get motivated to buy the product. The output of second field is motivation to buy the firms product. However, consumer may reject that particular product after making robust evaluation (Sciffman & Kanuk, 2004). Additionally, Runyon and Stewart (1987) and Loudon and Della (2002) stated that if consumer attitude or reaction from organization communication is encouraging then consumer jump to search and evaluate the available substitutes. It leads towards the purchase of the product that is the third filed of the model. Field three is the decision-making to buy the product or the act of purchase. The evaluation of alternatives could also result in rejection of the brand but the model only illustrates a positive response. That leads to the purchase of the product, the third field of model (Sciffman & Kanuk, 2004). Field four of Nicosia model shows the post purchase behavior, product use, consumption and storage. It mainly consists of two types of feedbacks from the purchase experience. The first type of feedback concerns to the organizations from where the data will gathered and secondly type of feedback relates consumers’ experience, that ultimately leaving him satisfied or dissatisfied. The feedback from the experience is responsible for changing the predisposition and attitudes of the consumer regarding future message from the firm. The output in field four is feedback of consumption and sales to the company (Milner & Rosenstreich, 2013).

Criticism:

CDM explains only the marketers’ perspective rather than consumers, it only explain the consumer’s activities from marketers viewpoint (Tuck & Herriot 1976).

The process of repurchase is important for financial services perspective where, consumers may purchase a wide range of services repeatedly for a longer period of time with high psychological and monetary risk. Therefore, Nicosias’ consumer decision making model requires repurchase expansion for financial sector (Milner & Rosenstreich, 2013).

EKB Model of Decision Process (1968, 2001)

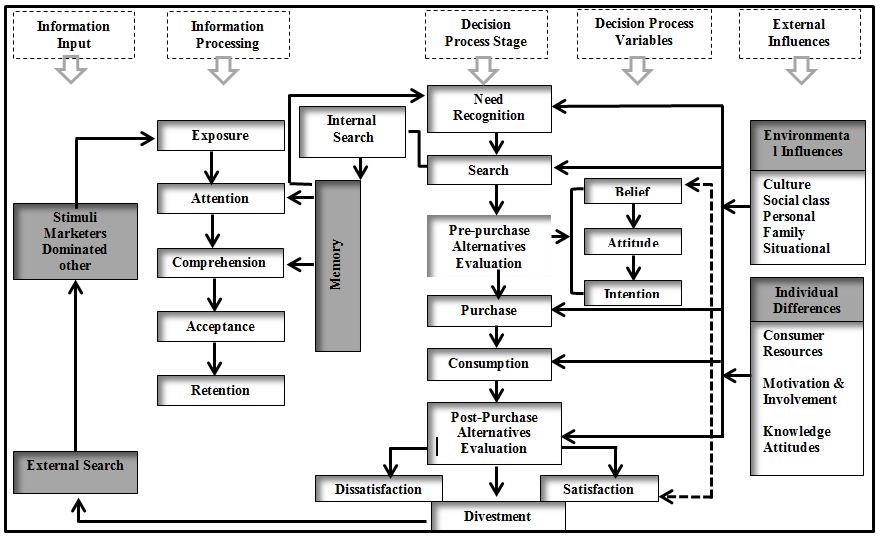

This model has been gone through several amendments; latest publication of EBM model given by Engel, Blackwell and Miniard (2001). The model consist of five stages, i.e. information input, information processing, decision process stage, decision process variables, and external influences (See Figure

The information input includes all kinds of stimuli that a consumer is exposed to and develops certain consumer behaviour that leads to decision making. At this stage the consumer gets information from marketing (advertising, promotion, personal selling, demonstrations, store display, point of purchase stimuli) and non-marketing sources (family, friends, peers), which also influence the problem recognition stage of the decision-making process. Stimuli received in the first stage provide information; this information afterwards is processed into meaningful information. This stage comprises of consumer’s exposure, attention, perception, acceptance, and finally retention of information. At first the consumer is exposed to stimuli, thereafter he/she would interpret and comprehend information, saves it in his short term memory and retains this information by transferring the input to his/her long-term memory.

The EKB decision process is based on the five basic stages, i.e., problem recognition, search, alternative evaluation, choice, and outcomes (post-purchase evaluation and behaviour). But it is not necessary for every consumer to go through all these stages; it depends on whether it is an extended or a routine problem-solving behaviour. The search of information is also affected by environmental influences. After that consumer evaluates the available alternatives; this evaluation helps the consumer to develop his attitude towards different products and services, which in turn affect the purchase intention. Then its choice and purchase stage, which gets influenced by individual differences. Finally the outcome is there; either satisfaction or dissatisfaction. This outcome is actually a feed on the input that impacts the cycle again. Environmental influences, individual differences and social influences, directly and indirectly influence each of the stages of the decision process. Decision process variables stage consists of individual influences that affect all the five stages of the decision making process. Individual characteristics include attitudes, beliefs, demographics, motives, personality, values, lifestyle, etc. The model also explains some environmental and situational influences that affect the decision making process. The environmental influences include Social Influence, like culture, sub-culture, social class, reference groups, family and other normative influences; whereas, situational influences include consumer’s financial condition.

The EKB decision process is based on the five basic stages, i.e., problem recognition, search, alternative evaluation, choice, and outcomes (post-purchase evaluation and behaviour). But it is not necessary for every consumer to go through all these stages; it depends on whether it is an extended or a routine problem-solving behaviour. The search of information is also affected by environmental influences. After that consumer evaluates the available alternatives; this evaluation helps the consumer to develop his attitude towards different products and services, which in turn affect the purchase intention. Then its choice and purchase stage, which gets influenced by individual differences. Finally the outcome is there; either satisfaction or dissatisfaction. This outcome is actually a feed on the input that impacts the cycle again. Environmental influences, individual differences and social influences, directly and indirectly influence each of the stages of the decision process. Decision process variables stage consists of individual influences that affect all the five stages of the decision making process. Individual characteristics include attitudes, beliefs, demographics, motives, personality, values, lifestyle, etc. The model also explains some environmental and situational influences that affect the decision making process. The environmental influences include Social Influence, like culture, sub-culture, social class, reference groups, family and other normative influences; whereas, situational influences include consumer’s financial condition. A summary of all prior models given by Engel, Kollat and Blackwel (EKB) and Engel, Blackwell, & Miniard (EBM) is given in Table

Criticism:

Consumer decision making is inclined by individual and environmental variables but have not been clearly specified in this model. This weakness in the model is particularly relevant for financial services as the service environment has a major impact on consumer decision making, and theses consumer variables are critical especially in the absence of tangible quality cues (Milner & Rosenstreich, 2013). Moreover, it is linear in nature and it predicted that the components of consumer decision making process not essentially happen in an arrangement but may be simultaneously (Phillips & Bradshaw 1993; Brinberg & Lutz, 2012). Moreover, when a solution is required to a problem, consumers search information and set criteria for selection by comparing alternatives and then evaluating these alternatives, but it does not fit in all types of decisions especially in financial services market. This is for the reason that the level of other identified influenced variables and possibility of making decision could be more complex or significantly less so. (Milner & Rosenstreich, 2013).

Howard-Sheth Model of Buyer Behavior (1969)

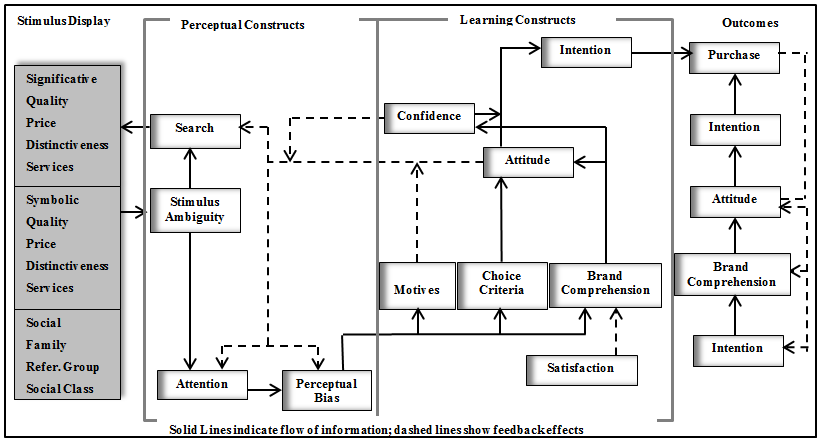

Howard-Sheth Model of Buyer Behaviour shows consumer buying process inputs and also suggests how consumers use these inputs before making his/her ultimate decision (Prasad & Jha, 2014). This was developed by considering both the industrial & consumer products for great understanding about different consumer buying behaviours (Loudon & Della 2002; Sahney, 2017). They did not use consumer behaviour but used buying behaviour instead as the industrial buyers and consumers are related in many characteristics (Loudon & Della, 2002; Sahney, 2017). It also provides a refined assimilation of the psychological, social and marketing influence on consumers’ selection into a rational flow of information processing (Foxall, 1990). Howard model of buying behaviour explains and distinguish between three different levels of learning or decision making via, extensive problem solving, limited problem solving and routinized response behaviour (Sciffman & Kanuk, 2004). See Figure

Criticism:

-

It consists of some exogenous variables not properly defined since it is not perceived to be rightly a portion of the decision-making process but are taken as constant. These influence consumer decision and also impact on efforts of the marketers. These include such variables as: value of purchase for the buyer, the personality traits, membership of a social group, the financial status, the pressure of time (Milner & Rosenstreich, 2013). Owing to the unobservable nature of many intervening/mediating variables and lack of empirical work explicit measurement is difficult (Bray, 2008).

Information Processing Model of Bettman (1979)

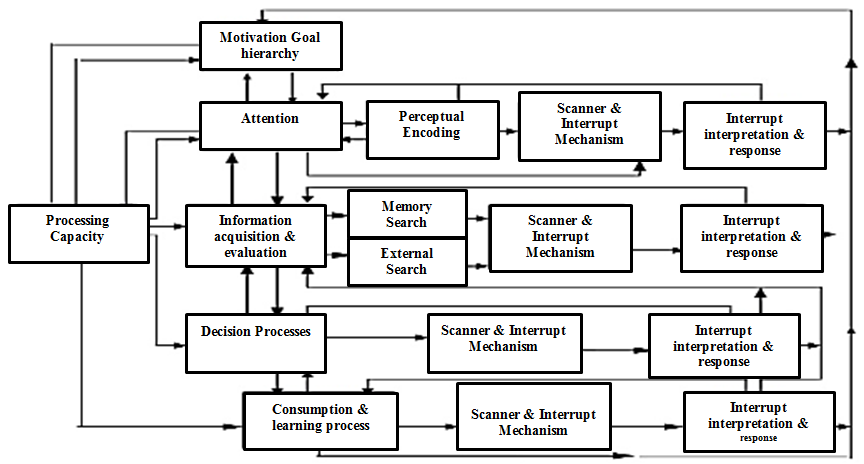

Information processing model is based on a structural notion of general decision-making process of a consumer. Bettman described the decision-making process as an information processing that follows the specified program, controlled by the consumers. Basic Hierarchy (motivation, attention, information search etc.), and intermediate process (perceptual encoding, processing capacity, memory, and interruption) were the basic components of the model see Figure

Criticism:

Model is not directly operational and does not provide quantitative support for marketing decisions.

A complex relationship is involved, empirically not tested and not specified accurately.

McCarthy Model of Consumer Decision Making (1997)

Essentially the McCarthy, Perreault, and Quester, (1997) developed consumer decision making model with minor modifications in EKB model. They added the idea of choice criteria that is an important unpacking of the evaluation task since it identifies that the setting up criteria is rather different than evaluating choices. Like other models, it also displays some of the weaknesses and these weaknesses are noteworthy in the financial services framework.

Criticism:

Portraying linear process and Representing an inadequate influence of situational and social variables

Not noticeably demonstrating the method in which psychological variables can make an influence on decision processes (Milner & Rosenstreich, 2013).

Consumer Decision Making Model for Financial Services (2013)

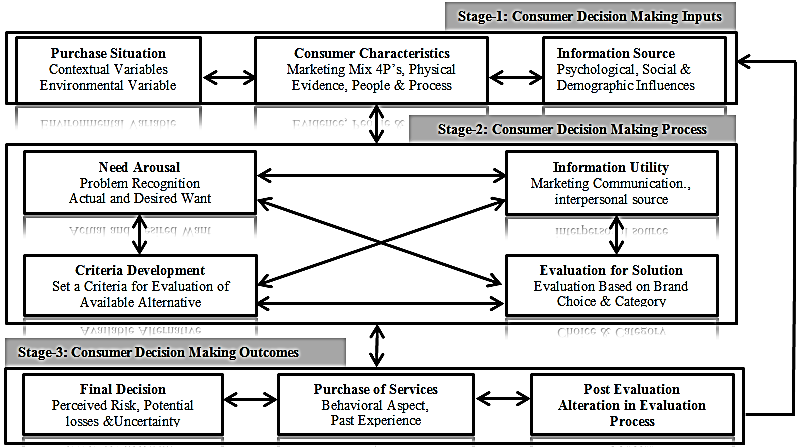

CDMFS comprises on three stages namely: decision making inputs, process and outcomes (Figure

CDM - Stage One: First element of CDMF model is the inputs that further comprises on purchase circumstances, consumer attributes and sources of information. Purchase situation also include contextual, product purpose and environmental constructs. Contextual constructs consist of life events that have a significant influence on consumer decision making specifically on financial services. Product purpose is concerned with product consideration and involvement while environmental factors are related to personal influence, situation and social class. Information source includes marketing mix and other stimuli as core variables, have a significant influence on consumer decision making (McCarthy et al., 1997). In case of financial services, marketing mix consist of physical evidence of consumer, processes and price, place, product and promotion that can transfer an information to the consumers. Consumer characteristics consist of psychological, social and demographic indicators. Sub-factors of this construct include consumer lifestyle, motives, personality, attitude, memory, knowledge, age cohort, and other demographical variables (Milner & Rosenstreich, 2013).

CDM Processes - Stage Two: Second main part of the CDMF is processes which consists of need stimulation, information utility, criteria building and evaluation of available choices. Need stimulation describes whether consumer recognizes the need for a solution. Information Utility refers to consumer’s information need from internal and external sources to resolve their problem. It provides insights that what type of information is needed, from where he/she gathers information and the way he/she uses it. External source includes marketing communication and personal sources while internal source include knowledge, memory, involvement and experience. It is further noted that consumers act limited and they do not necessarily explore all available alternatives.

The information processing aids consumers’ decision making process, especially in case of complex purchase decisions like financial services consumers seeks information to reduce perceived risk. It is possible that consumer may perceive the required information is not at hand or is available but connected at a rate that cannot be paid. Criteria development encompasses between information utility and application of criteria to evaluate other choices. In the traditional consumer decision making models, criteria development is not mentioned as a separate construct, but it is related since it defines decision boundaries (Lee & Marlowe, 2003). This criteria development leads to the formation of evoked set of alternatives. It is evident from literature that consumers who possess less knowledge have smaller choice set that makes it harder for them to differentiate between alternatives (Wirtz & Mattila, 2003). Same is the case with financial services purchase decision, due to the complex nature of financial services products consumers may not be able to differentiate between them. Evaluation of solutions is the most noticeable part of decision making variables (Mata & Nunes, 2010). Evaluating mechanisms are the decision rules, used to evaluate alternative and can differ from consumer to consumer. In this model provides an extension by including substitute products and groups as well. Financial services are highly substitutable in nature as it makes brand selection apparent since it involves a choice of products before going through the decision making process.

CDM - Outcomes: Stage Three: Outcomes consist of decision, purchases and post decision evaluation. Financial services consumers sometimes defer and take longer span of time to make purchase decision, due to the potential loss and perceived risk associated with these services. Purchase is the second last construct in the decision process it is considered associated not only because it is the output to the process but also for its behavioural aspect (Milner & Rosenstreich, 2013). Post-purchase variable is not suitable for financial services as it is tougher for financial services consumers to do post purchase evaluation. So if the decision making process does not lead to a decision, then the post purchase variable for example cognitive dissonance needs to be extended to include feedback (Milner & Rosenstreich, 2013). Before proceeding towards conclusion a summary of all previous models is given in the Table

Conclusion

Most of prior researches of consumer behaviour and consumer decision making are related to tangible nature of goods while a little attention has been given to financial services sectors where researchers make an effort to investigate the significance of consumer purchase decision in intangible services (Howcroft, Hewer, & Hamilton, 2003; Lee & Marlowe, 2003; Brady, Bourdeau, & Heskel, 2005; Harrison et al., 2006; Estelami, 2008; Milner & Rosenstreich, 2013). The concepts of consumer purchase decision making models and their interactions with each others are complex. Since the framework of consumer decision making models have been developed through various arrangements but are not well address to financial services. Another major discrepancy of previous models is that they do not comprise the timeframes as they suggest that most of the consumers’ decisions are made in short timeframes while consumers decisions for financial services may last over several years with a number of failed attempts to purchase. These failed attempts may consider as ‘no decision’ or procedural components are not important, consumer may use this process as a learning experience (McKechnie, 1992; Harrison et al., 2006). Consumer decision making model of financial services identify the key components with relevant elements of financial services. It elaborates a framework of three components: input, process and output. This model states a continual decision making process for financial services consumers by highlighting the role of information relationship with consumer inputs and with decision making process. Another foremost element of this model is that the processes are interacted rather than consumer following linear progression during the steps.

References

- Assael, H. (1984). Consumer behavior and marketing action, Kent Pub. Co.

- Brady, M. K., Bourdeau, B. L., & Heskel, J. (2005). The importance of brand cues in intangible service industries: an application to investment services. Journal of Services Marketing, 19(6), 401-410.

- Bray, J. P. (2008). "Consumer behaviour theory: approaches and models."

- Brinberg, D., Lutz R. J. (2012). Perspectives on methodology in consumer research, Springer Science & Business Media.

- Byrne, K. (2005). How do consumers evaluate risk in financial products? Journal of Financial Services Marketing, 10(1), 21-36.

- Engel, J. F., Blackwell, R.D., Miniard, P. W.(2001). Consumer Behavior, The Dryden Press.

- Estelami, H. (2008). Consumer use of the price-quality cue in financial services. Journal of Product & Brand Management, 17(3), 197-208.

- Fishburn, P. C. (1970). Utility theory for decision making, Research analysis corp McLean VA.

- Foxall, G. (1990). Consumer psychology in behavioral perspective, Beard Books.

- Harrison, T., Waite, K., & White, P. (2006). Analysis by paralysis: the pension purchase decision process. International Journal of Bank Marketing,24(1), 5-23.

- Howcroft, B., Hewer, P., & Hamilton, R. (2003). Consumer decision-making styles and the purchase of financial services. Service Industries Journal, 23(3), 63-81.

- Kotler, P. (2001). Marketing management. Canada, Pearson Education.

- Lee, J., Marlowe J. (2003). How consumers choose a financial institution: decision-making criteria and heuristics. International Journal of Bank Marketing, 21(2), 53-71.

- Loudon, D., Della B. A. (2002). Consumer Behavior, 2002, Tata McGraw-Hill, New Delhi.

- Mata, R., Nunes L. (2010). When less is enough: Cognitive aging, information search, and decision quality in consumer choice. Psychology and aging, 25(2), 289.

- McCarthy, Perreault, W. D., & Quester, P. G. (1997). Learning Aid to Accompany Basic Marketing: A Managerial Approach, Irwin.

- McKechnie, S. (1992). Consumer buying behaviour in financial services: an overview. International Journal of Bank Marketing, 10(5), 5-39.

- Milner, T., Rosenstreich D. (2013). A review of consumer decision-making models and development of a new model for financial services. Journal of Financial Services Marketing, 18(2), 106-120.

- Phillips, H., Bradshaw R. (1993). How customers actually shop: customer interaction with the point of sale. Market Research Society, 35(1), 1-10.

- Prasad, R. K., Jha M. K. (2014). Consumer buying decisions models: A descriptive study. International Journal of Innovation and Applied Studies, 6(3), 335.

- Runyon, K. E., Stewart D. W. (1987). Consumer behavior and the practice of marketing, Merrill Pub. Co.

- Sahney, S. (2017). "Module-5 Consumer Behavior. Vinod Gupta School of Management Indian Institute of Technology Kharagpur, India

- Sciffman, L. G., Kanuk L. L. (2004). Consumer Behavior. Eight Edition, New Jersey: Pearson Education, Inc.

- Solomon, M. R., Dahl, D. W., White, K., Zaichkowsky, J. L., & Polegato, R. (2014). Consumer behavior: Buying, having, and being, Pearson London.

- Tuck, M., Herriot P. (1976). How do we choose?: a study in consumer behaviour, Methuen.

- Wirtz, J., Mattila A. S. (2003). The effects of consumer expertise on evoked set size and service loyalty. Journal of Services Marketing, 17(7), 649-665.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 May 2019

Article Doi

eBook ISBN

978-1-80296-061-7

Publisher

Future Academy

Volume

62

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-539

Subjects

Business, innovation, sustainability, environment, green business, environmental issues

Cite this article as:

Baharun, R., & Mahmood*, C. K. (2019). Consumer Purchase Decision Models: A Revıew Of Financial Services Context. In M. Imran Qureshi (Ed.), Technology & Society: A Multidisciplinary Pathway for Sustainable Development, vol 62. European Proceedings of Social and Behavioural Sciences (pp. 476-489). Future Academy. https://doi.org/10.15405/epsbs.2019.05.02.47