Abstract

The transformative roles of Blockchain technology in the financial sectors are causing revolutions and disruptions to the traditional financial system. A few international leading Stock Exchanges have been preparing and are readying themselves urgently to embrace this new technology that is likely to have colossal effect in the commercial world. However, Malaysia is not able to capitalise and adopt this technology in such short space of time in the interest of its investors due to its lack of the applicability comprehension of this newest technology’s capabilities. Moreover, limited research has been conducted to delineate the importance of this Blockchain technology in relation to the fundamental analysis namely the fibers pertaining to investment decision making amongst the investors in general. The paramount objective of this study is to highlight the impacts of this revolutionary Blockchain technology, namely its super efficiency in asset transfer, data accuracy, irreversible transaction and transparency in fundamental analysis that could significantly implant greater confidence amongst potential investors. With greater availability and access of and to data and information transparency, investment decision making can be elevated to a higher platform which could stimulate market liquidity. However, not all investors conduct their own fundamental analysis when making investment decision, they may still be susceptible to psychological bias such as herding.

Keywords: Blockchain TechnologyFundamental AnalysisHerdingInvestment Decision

Introduction

The risk-taking participation and investment decision making in the market can be observed by examining the crashes and bubbles of a share market. A bubble occurs when the market prices rise too high, beyond the rational suggestion of stock analysts, a crash is a significant plunge in the market-wide values (Bradford, Miller, & Dolvin, 2015). For instance, both the crashes of October 1987, which is known as “Black Monday” in the US, and the crash of the Japanese Nikkei Index in 1990 reflected excessive and irrational risk-taking behaviour of the investors in these countries (Shiller, 2000; Shiller, Konya, & Tsutsui, 1996).Thus, it is imperative that liquidity of the market ought to be elevated to reduce the transaction costs as well as to increase market resilience from market crash due to anomaly. One of the drivers that impacts market liquidity is market transparency. Market transparency increases the efficiency of markets. Accurate, relevant and timely reliable data on the market situation helps market participants reduce uncertainty and hence reduce irrational risk-taking participation in the market that contribute to a market crash.

The block chain technology is a technology that can offer improvements in the area of financial data record keeping as it creates immutability in the repository for any data in documents, contract and asset while enabling decentralisation of all types of transactions among all participants on a global network (Swan, 2015). Stock Exchanges around the world such as Nasdaq; Security Exchange in Australia (ASX); Stock Exchange in Shanghai, Hong Kong and India have been exploring the possible application of Blockchain technology (BBC News, 2017; Suberq, 2017; Manning, 2017; Shekhar, 2018).

Problem Statement

Numerous local as well as international reports have concluded that the participation of individual investors in the share market are declining with no improvement in sight. Bursa Malaysia (2015), Kenanga (2015), The Edge Malaysia (2015), and World Bank (2015) directly or indirectly indicated that to a certain extent the retail or individual participation in the share market is rather disappointing and lagging behind as compared to that of their counterparts in neighbouring countries. From the records gathered the percentage of investors, in terms of the percentage of average daily value traded has declined from 37 per cent in 2007 to 24 per cent in 2008, then increased to 33 per cent in 2009, fell to 22 per cent in 2013 before increasing to 26 per cent in 2014 (The Business Times (Singapore), 2014). As of March 2015, the official statistics compiled by Bursa Malaysia indicated that individual investors’ participation in Malaysia has further declined to 19 per cent. In 2015 institutional and individual investors accounted for 81 per cent and 19 per cent of the local share trade, respectively (Bursa Malaysia, 2015) and retail participation stands at 14.6 percent as of January 2018, (The Edge Malaysia, 2018). Besides this, the vibrancy of Bursa Malaysia is falling behind its Asian counterparts, like Hong Kong and Singapore (Bursa Malaysia, 2015). Low vibrancy reflects the low liquidity that will lead to increase transaction costs. Investment decision making is closely associated with the risk-taking behaviour of investors.

The adoption of Blockchain technology in the stock market would greatly improve the quality of financial data. As accuracies in financial reports, historical data, financial statements and current information are vital for fundamental analysis in decision making, Blockchain can enhance the fundamental analysis as well as the market transparency which would attract more participation from both local and foreign investors. Recent studies have indicated many potential benefits of Blockchain applications in various sectors which includes the financial sector (University of Cambridge, 2018). However, Blockchain technology is still at a conceptual stage in Malaysia as the financial sector lacks the applicability comprehension of this newest technology’s capability. Moreover, the adoption of this technology is further impeded by excessive regulatory control and unclear directives about this technology by the authorities. Although, fundamental analysis assist informed rational investment decision to be made, not all investors possess the sufficient level of financial literacy and interpretation skills to conduct their own fundamental analysis before they trade. Many of them trade under the influence of psychological factors. Even the smartest investors who conduct sophisticated fundamental analysis could still be influenced by psychological factor such as herding.

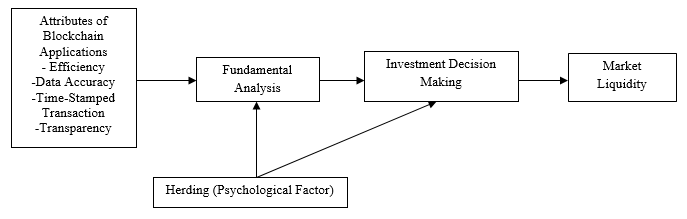

Hence, the objective of this study is to propose a conceptual framework to highlight how the attributes of Blockchain technology such as efficiency in asset transfer, data accuracy, time-stamped transaction and transparency can influence and impact the fundamental analysis that will affect the investment decision making of investors. This paper also investigates the influence of herding on fundamental analysis in investment decision making.

Research Questions

Fundamental analysis is essentially looking at the fundamentals and underlying economics of the companies to discover their actual worth in value (Borowski, 2014; Edirisinghe & Zhang, 2008; Hong & Wu, 2016; Krzywda, 2010; Petrusheva & Jordanoski, 2016; Pomykalska & Pomykalski, 2008). In view of this, the accuracies in financial reports, historical data, financial statements and current information are vital for fundamental analysis. While the integrity as well as judgement from auditors and manager are required in disclosing accurate information in financial statements, any inaccuracies in the information cannot be detected by the users. Blockchain technology is able to provide alternative solution to heavy reliance on the audit industry in generation of financial statements which may subject to moral hazard (Cunningham, 2006). This paper seeks to capitalise on the potential benefits offered by Blockchain technology with regards to relevant financial data used in fundamental analysis for investment decision making. Therefore, the research questions that are needed to be addressed are as follows:

1. How do the attributes of blockchain applications (efficiency in asset transfer, data accuracy, time-stamped transaction and transparency affect fundamental analysis?

2. How does herding affect fundamental analysis?

3. How does herding affect investment decision making?

Purpose of the Study

Essentially this study seeks to propose a conceptual framework to highlight how the attributes of Blockchain technology can influence and impact the fundamental analysis that will affect the investment decision making of investors. Specifically, the following objectives are established to help meeting the aims of this study.

1. To determine relationship between the attributes of blockchain (efficiency in asset transfer,

data accuracy, time-stamped transaction and transparency) and fundamental analysis.

2. To examine the effects of herding behaviour in fundamental analysis.

3. To investigate the herding behaviour in investment decision making.

Research Methods

A framework and the following propositions which are conceptualised on the attributes of blockchain applications are as shown in figure

Proposition 1: Attributes of blockchain applications have positive effects on fundamental analysis.

1a: Efficiency in Asset Transfer has a positive effects on fundamental analysis.

1b: Data Accuracy has a positive effects on fundamental analysis.

1c: Time-Stamped Transaction has a positive effects on fundamental analysis.

1d: Transparency has a positive effects on fundamental analysis.

Proposition 2: Herding is significantly affecting fundamental analysis.

Proposition 3: Herding is significantly affecting investment decision making.

Findings

6.1. Attributes of Blockchain Technology in Assisting Investment Decision Making

Convenience and Efficiency

There are many applications in Blockchain technology with embedded information and instructions. Nasdaq first experiment with Blockchain within its own operation was the running of a pilot within the Nasdaq Private Market in which it allows the private companies to execute and document private securities issuance on the Blockchain without involving third parties. This makes the transfer of shares easier and also to remove the onus for the need of paper and certificates as well as simplifying the whole process. When investors are able to buy and sell stocks through a decentralized peer-to-peer network that is easy to use and fast, this would contribute to higher level of efficiency in the stock market. With greater efficiency, Blockchain technology application would promote greater participations and increase liquidity of the market which could reduce transaction costs as well.

Data Accuracy

Apart from convenience and efficiency, the benefit of adopting Blockchain technology is that it would significantly affect investors’ investment decision making. As stated earlier, fundamental analysis make investment decision based on financial statements and reports made through the auditability and integrity of authorities. If the accuracy of the financial statements and reports are questionable it would definitely result in bad or poor investment decision based on that disclosed information.

With Blockchain technology, company is able to organize and record its own financial statements which convey the real-time financial activities and conditions of its business or entity. In NASDAQ, cloud based management tool (called LINQ) is being used together with the adoption of Blockchain technology for financial record keeping in their private market. LINQ is designed to manage pre-IPO (Initial Public Offering) interactions (Miraz & Maaruf, 2018). With LINQ, company need not rely on the auditing industry. Records, raw data and inputs about the companies for depreciation, fair value marking of assets for earnings in financial reporting can be assessed by investors. Thus, the opportunities for manipulation of financial records and attempts for value destroying activities can be greatly reduced (Yermack, 2017). With the real-time, accurate and relevant financial information, this would provide the true and actual financial position, performance (profitability) of a company in which it allow investors to make informed, logical and rational investment decision. With informed rational investment decision, investors have more confidence in the targeted company as well as in the stock market overall. It will increase the market participation and increase liquidity of the market.

Irreversible, Time-Stamped Transaction

Real-time accounting can be offered by LINQ and applications by Blockchain that enables time-stamped transactions. Backdatings strategies for contracts and earnings management are hindered with the adoption of Blockchain. This will subsequently reduce misalignment in firms’ investment policies (Yermack, 2017). Besides this, suspicion on any transfer of asset or transactions that could implicate conflicts of interest could be observed and detected instantly using real-time accounting by Blockchain applications. Disclosure of related party transaction is dependent on the management report which maybe reported inaccurately or distorted. This would provide the true and actual financial position and performance of a company. Investors can make informed investment decision based on the information derived from irreversible, time-stamped transaction.

Transparency

Part of the functions of LINQ is to provide a cap-table management dashboard with information such as valuation, share prices and share options. The shares are represented in coloured blocks for easy reference. This is called the ‘Equity TimeLine View’ which represent the ownership in shares in flowchart form. (Rizzo, 2015). As a decentralized distributed ledger system, LINQ facilitates auditing and transfer of ownership by creating a comprehensive historical record of each transfer of securities among private users of the Blockchain applications. Hence, it provides a perfect record of ownership which will inevitably lead to the increase in transparency of the market. The increased transparency of Blockchain share registration allows investors to observe investors’ ownership position as well as other transactions (Edmans, Levit, & Reilly, 2016). The ability to observe records of ownership and transactions is that to allow investors to draw a more accurate inference about the movement of shares.

Adena Friedman, CEO at Nasdaq stated that:

“This new payment capability marks a milestone in the global financial sector and represents an important moment in the commercial application of blockchain technology, through this effective integration of blockchain technology and global financial systems, we can realize greater operational transparency and ease of reconciliation, which can have profound implications for outdated administrative functions in the capital markets.” (Groenfeldt, 2017).

The core of Blockchain technology not only introduces disruptive innovation into the financial market but also highlight the importance of transparency in financial reporting that significantly affects investment decision making. A company's attractiveness to the investors is very much affected by its transparency besides the willingness as well as the ability of management to correct any informative for market investors (Mohammadi & Nezhad, 2015). However, companies are reluctant to voluntarily disclose all information on their own due to limitation such as costs associated with collecting, processing and disclosure of information (Kaufmann, 1999).

The Blockchain technology is able to provide a much higher degree of transparency in financial reporting. The benefits of full disclosure and financial reporting include greater reliability management, more long-term investors, increase transaction, greater liquidity, less volatility, better access with lower costs and improve relationships with the investment community (Madhani, 2009). When managers, investors and market participants are able to make better decision in their investment, the efficiency of the real economy as a whole will be improved as well.

In short, Blockchain applications could enhance the quality of the financial data which is essential for fundamental analysis. Fundamental Analysis assist informed rational investment decision to be made. Market transparency would significantly increase the market participation and increase liquidity of the market.

6.2. Herding in Investment Decision Making

Investors in Malaysia hardly seek investment advice from experts and rely heavily on their family and friends instead (Digital News Asia 2014). When these investors follow other investors or their advice without realising their biasness when investing, they will expose themselves to more risks when the market is performing well. This is an example of a negative aspect of herding. There are also positive effects attributed to certain types of herding in the risk-taking behaviour of investors that could be used to encourage their participation in the market. For instance, there is evidence of reputational herding among asset managers in Germany to obtain more incentives (Lütje 2009). This study also documented evidence of risk aversion, loss aversion, and the disposition effect in investment decisions among asset managers. However, in tournament scenarios, the fear of “falling out of the herd” induces their willingness to assume more risks if they find themselves to have performed below par. Hence, it is possible to make profits just by mimicking the trading behaviour of an asset manager. In Malaysia, Wahab and How (2008) suggest that prominent local institutional investors exert a great impact on the stability of the stock market, while Ajina, Lakhal, and Sougné (2015) contend that institutional investors affect the stock market liquidity. Hence, if individual investors could follow institutional investors when investing, the liquidity in the market could be increased.

Herding is not necessarily always deemed to be an irrational or negative factor. Investors who are affected by herding may still be able to invest in a rational manner and make a profit. With greater transparency in information and better data quality offered by Blockchain applications, herding behaviour by institutional investor could improve the stock valuation as well as the stock market fundamentals. These could be utilised by individual investors to make better and informed decision for stock picking. This is only applicable to reputational herding. Herding that is based on family and friends’ investment advice although may increase market participation, but it does not increase market transparency. Investment decision made based on unreliable information would increase risk-taking participation. Risk-taking participation tend to push market prices rise too high, beyond the rational suggestion of stock analysts and hence could result in market bubble and crash. These are due to excessive risk-taking participation in the market without referring to economic factors and fundamental values of the company.

Conclusion

Blockchain technology is here to offer great benefits to assist the potential investor to evaluate and make better, rational, informed investment decision. This study has highlighted the possible impacts of this Blockchain technology, namely its convenience and efficiency in asset transfer, data accuracy, irreversible transaction and transparency in fundamental analysis that could significantly instill greater confidence among potential investors and assist them to make information, logical, informed investment decision. As Blockchain technology is still considered a new technology, the potential benefits may not be fully comprehended by the industry stakeholders. Thus, the proponents of Blockchain technology need to be more proactive in promoting this new technology by creating greater awareness among the industry stakeholders. Though, with greater real-time data and information transparency, the quality of decision making can be enhanced while stimulating the investors’ participation and market liquidity when not all investors are equipped with the knowledge and sufficient level of financial literacy to conduct their own fundamental analysis in their investment decision making. Investors may still be susceptible to psychological bias such as herding behaviours in which they tend to mimick the actions or decisions of the other investors. Although herding stimulate market participation, increase liquidity, herding produce emotional, irrational risk-taking investment decision which contributes to market failure and crashes.

References

- Ajina, A., Lakhal, F., & Sougné, D. (2015). Institutional investors, information asymmetry and stock market liquidity in France. International Journal of Managerial Finance, 11(1), 44-59. doi: doi:

- BBC News. (2017). Australian stock exchange to move to blockchain. Retrieved 25 August 2018 https://www.bbc.com/news/business-42261456

- Borowski, K. (2014). Analiza fundamentalna. Metody wyceny przedsiębiorstwa (Fundamental Analysis. Company Valuation Methods). Difin SA, Warszawa.

- Bradford, J., Miller, T., & Dolvin, S. (2015). Fundamentals of investments: Valuation and management (7th ed.). New York: McGraw-Hill.

- Bursa Malaysia. (2015). Corporate history. Retrieved 15 July 2015 http://www.bursamalaysia.com/corporate/about-us/corporate-history/

- Cunningham, L. (2006). Too big to fail: moral hazard in auditing and the need to restructure the industry before it unravels. Columbia Law Review, 106, 1698–1748.

- Digital News Asia. (2014). Malaysia investors among most vulnerable in Asia: Manulife survey. Retrieved 3 September 2014 http://www.digitalnewsasia.com/digital-economy/malaysia-investors-among-most-vulnerable-in-asia-manulife-survey

- Edirisinghe, N. C. P., & Zhang, X. (2008). Portfolio Selection under DEA-Based Relative Financial Strength Indicators: Case of US Industries. Journal of the Operational Research Society, 59(6), 842-856.

- Edmans, A., Levit, D., & Reilly, D. (2016). Governing multiple firms. London Business School and University of Pennsylvania.

- Groenfeldt, T. (2017). Blockchain Moves Ahead with Nasdaq-Citi Platform, Hyper Ledger and Ethereum Growth. Retrieved 8 August 2018 https://www.forbes.com/sites/tomgroenfeldt/2017/05/22/blockchain-moves-ahead-with-nasdaq-citi-platform-hyperledger-and-ethereum-growth/#7f25fdce7333

- Hong, K., & Wu, E. (2016). The Roles of Past Return and Firm Fundamentals in Driving US Stock Price Movements. International Review of Financial Analysis, 43, 62-75.

- Kaufmann, V. (1999). Towards Transparency in Finance and Governance (Working Papers of the World Bank).

- Kenanga. (2015). Declining foreign participation in local equities normal. Retrieved 2014, 9 October http://www.mysinchew.com/node/102395

- Krzywda, M. (2010). GPW II. Akcje i analiza fundamentalna w praktyce (Shares and Fundamental Analysis in Practice). Wydawnictwo Złote Myśli, Gliwice.

- Lütje, T. (2009). To be good or to be better: asset managers’ attitudes towards herding. Applied Financial Economics, 19(10), 825-839. doi:

- Madhani, P. (2009). Role of Voluntary Disclosure and Transparency in Financial Reporting. The Accounting World, 63-66.

- Manning, J. (2017). How Stock Exchanges Are Utilising Blockchain Technology. Retrieved 6 August 2018 http://internationalbanker.com/brokerage/stock-exchanges-utilising-blockchain-technology/

- Miraz, M. H., & Maaruf, A. (2018). Applications of Blockchain Technology beyond Cryptocurrency Annals of Emerging Technologies in Computing, 2(1), 1-6.

- Mohammadi, S., & Nezhad, B. M. (2015). The role of disclosure and transparency in financial reporting. International Journal of Accounting and Economics Studies, 3(1), 60-62.

- Petrusheva, N., & Jordanoski, I. (2016). Comparative analysis between the fundamental and technical analysis of stocks. Journal of Process Management – New Technologies, International 4(2), 26-31. doi:

- Pomykalska, B., & Pomykalski, P. (2008). Analiza finansowa przedsiębiorstwa (Financial Analysis of a Company). Wydawnictwo Naukowe PWN, Warszawa.

- Rizzo, P. (2015). Hands on with Linq, Nasdaq’s Private Market Blockchain Project. Retrieved 22 July 2018 https://www.coindesk.com/hands-on-with-linq-nasdaqs-private-markets-blockchain-project/

- Shekhar, S. S. (2018). How blockchain will change the way you trade in stock markets Retrieved 20 August 2018 https://economictimes.indiatimes.com/markets/stocks/news/how-blockchain-will-change-the-way-you-trade-in-stock-markets/articleshow/62161610.cms

- Shiller, R. J. (2000). Measuring Bubble Expectations and Investor Confidence. Journal of Psychology and Financial Markets, 1(1), 49-60. doi:

- Shiller, R. J., Konya, F., & Tsutsui, Y. (1996). Why did the Nikkei crash? Expanding the scope of expectations data collection. Review of Economics and Statistics, 78(1), 156-164.

- Suberg, W. (2017). World’s Fourth-Largest Stock Exchange Eyes Blockchain Use in Securities Transactions. Retrieved 30 August 2018 https://cointelegraph.com/news/world-s-fourth-largest-stock-exchange-eyes-blockchain-use-in-securities-transactions

- Swan, M. (2015). Blockchain Blueprint For a New Economy Sebastopol, CA O’Reilly.

- The Business Times (Singapore). (2014). Wooing retail investors in Malaysia. Retrieved 5 November 2015 http://cgmalaysia.blogspot.com/2012/04/wooing-retail-investors-in-malaysia.html

- The Edge Malaysia. (2018). Bringing retailers back to Bursa Malaysia. Retrieved 15 September 2018 http://www.theedgemarkets.com/article/cover-story-bringing-retailers-back-bursa-malaysia

- University of Cambridge. (2018). Global Blockchain. Retrieved 15 August 2018 https://www.jbs.cam.ac.uk/faculty-research/centres/alternative-finance/publications/global_blockchain/#.W7cioXszbIV

- Wahab, E. A. A., & How, J. (2008). Corporate Governance and Institutional Investors: Evidence from Malaysia. Asian Academy of Management Journal of Accounting and Finance (AAMJAF), 4(2), 67-90.

- World Bank. (2015). Statistics for stock market total value traded as a percentage of GDP [Data file, Stock market total value traded (% of GDP), 1996-2011. Available from World Bank World Development Indicators Database Retrieved 1 March 2015 http://databank.worldbank.org/data/views/reports/tableview.aspx

- Yermack, D. (2017). Corporate Governance and Blockchains. Review of Finance, 7–31.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

17 May 2019

Article Doi

eBook ISBN

978-1-80296-061-7

Publisher

Future Academy

Volume

62

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-539

Subjects

Business, innovation, sustainability, environment, green business, environmental issues

Cite this article as:

Li Chin, A. L., & Wai Wai, W. (2019). Harnessing Blockchain Technology In Fundamental Analysis For Investment Decision Making. In M. Imran Qureshi (Ed.), Technology & Society: A Multidisciplinary Pathway for Sustainable Development, vol 62. European Proceedings of Social and Behavioural Sciences (pp. 18-26). Future Academy. https://doi.org/10.15405/epsbs.2019.05.02.3