Abstract

In modern conditions of reforming the economy, the issue of effective investment in human capital becomes highly relevant. Therefore, despite the complexity of evaluating the effectiveness of such investments, it is difficult to overestimate the benefits of such costs, since they provide an opportunity to prepare highly qualified personnel capable of exercising high-quality production management, to introduce innovative technologies into technological chains, and therefore ensure the competitiveness of domestic products. So that the performance does not raise doubts, and the costs turn into high profits, new approaches are needed that correspond to modern realities. Economic science, by analogy with the natural science knowledge, is currently following the path of integrating various theories, which serves as a new impetus for its development and complication. Investment processes are part of an open, self-developing and self-organizing economic system, characterized by elements of disequilibrium, instability, irreversibility with many non-linear positive and negative feedbacks. What is successfully studied by such science as synergy. At the same time, universal interdisciplinary approaches do not fully offer a solution to complex economic problems, since many factors are imposed that form the specific conditions for their functioning. In this regard, consideration of institutional manifestations is mandatory. We propose to apply a synergetic-institutional approach, which allows to model the processes of investment in human capital and to predict the results of its further use in the modernization of production and/or restructuring of the real sector of the economy, taking into account possible institutional constraints.

Keywords: Institutionsinvestmentshuman capitalmodelreal sector of economysynergetic

Introduction

One of the key problems of Russia's economic development is the creation of conditions for the country's movement along an innovative path, with an emphasis on knowledge-intensive enterprises, which implies the modernization of the entire real sector of the economy and is largely related to the provision of production processes with personnel of the appropriate level. It is human capital that determines the quality of the decisions made and the adequacy of the methods of managing economic activity at enterprises in the rapidly changing environment of their functioning.

Therefore, the question of the role of investment in human capital in the context of structural economic changes is very important and relevant, since the intensity of intellectual capacity building is directly related to the growth rates and the vector of development of the entire economic complex of the country. Of course, investing in people with the purpose of expanding the range of using their creative abilities and increasing the number of highly qualified specialists in production involves, like any investment activity, high risks, which include: the uncertainty of future incomes due to changes in the economic and political situation in the country; risks of disability due to injury or illness; change of place of work and/or residence, etc. (Shelest, 2015; Benzoni & Chyruk, 2015; Mubarik, Chandran, & Devadason, 2018). However, the development of productive forces and production relations leads to the complication of the system of connections and interactions in the economic space, its structure and composition, which permanently leads to the growth of its internal potential entropy. To overcome these hidden trends, the specialist and the head of the enterprise/organization need a constant inflow of a certain amount and quality of information that allows them to learn the laws and go deeper into economic processes, and also to keep up with current changes. Therefore, the issue of efficiency of investments in human capital is currently being paid much attention not only in Russia due to the restructuring of the economy and the transition to market mechanisms of its functioning, but also in industrially developed countries as an integral component of unstoppable progress (Koerselman & Uusitalo, 2014).

Problem Statement

The question of investing in human capital and assessing their effectiveness at the moment is being addressed in economic theory without taking into account many key points. Among them, the complexity and versatility of this phenomenon. For example, due to the physiological characteristics of a person, the accumulation of professional knowledge, skills and abilities is a process that is repeatedly repeated in time. And the lengthening of the investment period with a rather limited period of work capacity increases the importance of own time spent on training, since it records the decrease of marginal benefits from the accumulation of human capital. In addition, later investments bring less total benefit, because they act on a shorter life span of a person, and against the background of aging of the organism, the return from them eventually decreases (Burns, 2018).

All this necessitates the development of a fundamentally new methodological approach and methods of training of personnel that could create human capital of such a level and quality that will ensure the acceptance of management decisions by qualified specialists, taking into account modern conditions, constantly occurring changes and endlessly developing technologies. Moreover, it will allow to calculate the possible consequences of the actions taken and to correct them in time, depending on the type and level of the system, as well as the manifested laws of their development.

Research Questions

To remove the above issues, the following tasks must be solved:

Propose a new methodological approach to the study of socio-economic systems.

Develop a model of the dynamics of investment in human capital, taking into account the individual characteristics of the human personality in the development of intelligence.

Develop a model for calculating the amount of investment that creates the conditions for triggering a synergistic effect that ensures the effective use of human capital in modernizing the real sector of the economy, taking into account possible institutional constraints.

Purpose of the Study

With the help of the proposed models, it is possible to increase the predictive estimation of the results of using human capital in modernizing production and / or restructuring the real sector of the economy.

Research Methods

In the study we used methods of systemic, institutional approaches and synergetics.

We applied systematicity as a general scientific concept, studying modern phenomena. At the same time, the key moment of the research became the disclosure of the essence of the processes and objects that occur, which represent a set of interrelated components, various relationships and interactions (including interactions with the external environment), and can be called systems that differ: the level of complexity, the number of its subsystems, the degree of openness, etc. That is why system analysis methods give a detailed picture of possible changes, directions of development and results of functioning.

Returning to the management of socio-economic systems, it is obvious that the traditional forms and methods that distinguish the studied object from the conditions of its functioning cannot preserve the unity between itself and the external environment. This leads to the creation of models that are inadequate to the ongoing processes both inside the system and outside it. They are not able (in contrast to models based on a synergetic paradigm) to consider economic systems from the standpoint of such properties as randomness, cyclicity, irreversibility, disequilibrium, emergence, ability to self-organization. It is these properties that determine the dynamics of global transformations, qualitative and quantitative changes in all spheres of economic development, affect the scale of the tasks being set, the state of competitiveness, and the efficiency of the functioning of systems (including investment activities).

From our point of view, one of such approaches is the interdisciplinary management theory, which allows not only to harmonize the systemic links that arise between interacting economic structures, but also to carry out an objective analysis of possible (alternative) options, and the choice of the most optimal ones. The synergetic approach, based on revealing the analogy and regularity of the functioning of systems of different nature, significantly expands the possibilities of the system approach. At the same time, when applied to the economy, it has a number of shortcomings. Thus, it completely ignores the influence of institutions on the dynamics and vector of development of social and economic processes, as well as the emergence of the need to change the functions, composition and structure of the institutions themselves. This distorts the forecast estimate of the researcher, which makes the synergetic approach not required for economic systems.

Studies have shown that when studying economic activity and modernizing the real sector of the economy, it is very important to take into account the influence of institutional factors on the quality of assimilation of innovations by an individual and the degree of their introduction into production in case of its modernization (especially when investing in human capital). The institutional approach is based on the assumption that the consequences of an individual's actions depend on the model of his behavior and the conditions under which he produces them. This makes it possible to make decisions and obtain results in the presence of incomplete information and limited rationality, which, when referring to the neoclassical theory, would be impossible. Institutional theory implies that people's behavior is largely determined by the influence of other individuals and the existing incentive mechanisms reflect repetitive actions. However, they are the result of decisions that are often made by individuals and, as a rule, without taking into account the likely negative consequences for violations of generally recognized rules and requirements.

The coordinating functions of institutions create an effect (coordinating effect), the essence of which is to ensure the reduction of the costs of individuals to study and predict the behavior of other economic agents. When this function is implemented, there is a decrease in the uncertainty and risk of the environment of the functioning of the economic agent. Under conditions of uncertainty in the absence of efficient institutions, the risk of making an unreasonable decision is high. This forces the economic agent in carrying out economic operations to incur additional costs for taking various precautions. In addition, in conditions of uncertainty, the risks of obtaining low benefits from anticipated investments, for example, in modernization of production, are high, which may ultimately lead to the abandonment of planned activities. By providing a reduction in uncertainty, institutions allow us to make forecasts of economic development, and, consequently, to plan and implement long-term investment. Moreover, the means that the economic agent saved on analyzing the possible behavior of competitors, he can also direct to production, thereby increasing the coordinating effect. Simultaneously, the coordination effect can be felt only with the coordinated action of various institutions and, when the rules determine the coincident types of behavior of agents. Otherwise, the uncertainty of the external environment and, consequently, the level of decision-making risk increases.

Findings

When building models of investment in human capital, we proceeded from the fact that the speed of the process of developing intelligence, obtaining knowledge is limited in magnitude and in time. In addition, over time, the acquired knowledge becomes obsolete, and we are forced to update them regularly, going through retraining, and investing in ourselves. The peculiarity of human physiology is that with age our mental, physical, physiological and psychological capabilities are reduced (Burns, 2018; Tikhonova & Karavay, 2018; Wei, Gao, Wang, & Huang, 2018).

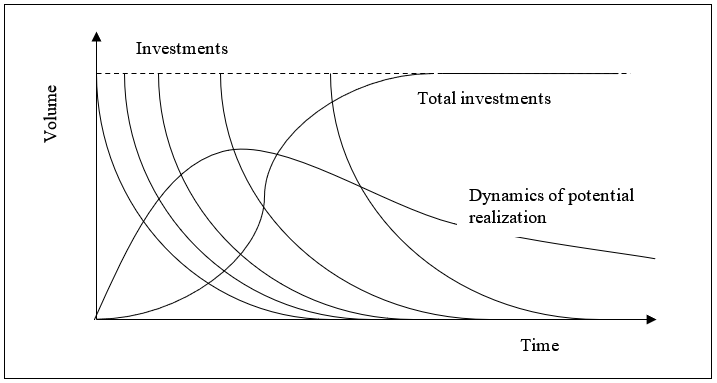

Graphically, everything we said above can be represented as follows (Figure

Then the rate of assimilation of investments will be equal to the rate of growth of human capital:

where

Speed of intellectual resources decrease:

then the dynamics of changes

The solution of equation (3) has the form:

Then, based on the above, we can calculate the amount of investment that creates the conditions for triggering a synergistic effect and ensuring the effective use of human capital in modernizing the real economy:

where - frequency of fluctuation processes; - time interval between investment flows; - resonant amplitude fluctuation, which provides the triggering of the mechanism of synergetic effect ( ); - the numerical value of the criterion determining the degree of coordination of the work of the various units.

To build schemes for reorganization of the real sector of the economy, specific information is needed on its state, processes, goals and tasks that need to be addressed. And although they describe the simulated phenomena, actions and the subject less strictly than the mathematical model, nevertheless, they specify concrete parameters related to the characteristic of the control object. Dependencies in such models are reflected by mathematical symbols through functions without specifying the type of connection:

(Po, t, Ri, Zj, Оm, An (Aopt), f, Ks),

where Po – problem that arose in the course of work; t – time needed to make a decision; Ri – resources needed to make a decision; Zj – many goals that need to be achieved as a result of a made decision; Оm – set of constraints; f – functional dependence between controlled variables and the result obtained; Аn – many alternative solutions; Кs – criteria by which the solution is chosen; Аopt - best of the solutions considered.

The formalized scheme makes it possible to put a general problem, which in the future is concretized with the help of the chosen functional dependence, then the model is described through quantitative expressions and, if necessary, corrected. At the last stage, with its help, the possible solutions are calculated and the most suitable for these conditions are selected, based on the specified criteria.

Conclusion

Mathematical modeling of real processes and complex systems carries a certain level of simplification, since it does not take into account the impact on it of all factors and, consequently, reduces the reliability of forecast estimates. At the same time, when solving a specific task, only those factors that are considered to be the most significant can be used, and the rest can either be completely ignored, believing them to be unimportant under the given conditions, or to influence the model of unaccounted factors and reflect it as an unclear impact. If necessary, to increase the predictive assessment of the results of the use of human capital in modernizing production and/or restructuring the real sector of the economy, mathematical models developed on the basis of a synergetic-institutional approach should be used.

References

- Benzoni, L., & Chyruk, O. (2015). The Value and Risk of Human Capital. Annual review of financial economics, 7, 179-200.

- Burns, S. (2018). Human Capital and Its Structure. Journal of private enterprise, 33(2), 33-51.

- Koerselman, K, & Uusitalo, R. (2014). The risk and return of human capital investments. Labour economics, 7, 154-163.

- Mubarik, M. S., Chandran, V. G. R., & Devadason, E. S. (2018). Measuring Human Capital in Small and Medium Manufacturing Enterprises: What Matters? Social indicators research, 137(2), 605-623.

- Shelest, O. (2015). Risk of Investments in Human Capital and Expected Worker Mobility. International journal of management and economics, 47, 82-106.

- Tikhonova, N. E, & Karavay, A. V. (2018). Dynamics of some indicators of Russians’ general human capital in 2010-2015. Sotsiologicheskie issledovaniya, 3, 84-98.

- Wei, G.W, Gao, H., Wang, J., & Huang, Y.H. (2018). Research on Risk Evaluation of Enterprise Human Capital Investment With Interval-Valued Bipolar 2-Tuple Linguistic Information. Ieee access, 6, 35697-35712.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Shmanev, S., & Shmaneva, L. (2019). The Human Capital Investment In The Modernization Of The Real Economy Sector. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 836-842). Future Academy. https://doi.org/10.15405/epsbs.2019.04.90