Abstract

Mine production constrained including shutdowns and mine depletion in combination with expanded demand for natural uranium following an increase in nuclear power capacity worldwide push the price for natural uranium up and form new challenges for market players by making it very important to measure a contribution of modern reactor types to the minimization of fuel component in the total cost of energy produced by NPP. The study carries out a comparison analysis between Generation IV Nuclear Reactors using a step-by-step algorithm for calculation of fuel component in the total cost of nuclear energy produced by NPP to show which reactor design the policy makers should choose if they want to minimize the expenses for nuclear fuel. Research shows that one of the apparent advantages of Russian reactor design VVER1200 in comparison with EPR, APR1600 and AP1000 reactor types is low expenses on the nuclear fuel. It will allow NPP equipped with VVER1200 to receive the leverage in competing in the world market for nuclear power technologies. The results of the study can be used by countries which already have, develop or have intention to develop nuclear power in order to make the decision which reactor design to employ for the national nuclear power industry.

Keywords: Closed nuclear fuel cyclefuel component in the total cost of energyfuel recyclingGeneration IV Nuclear ReactorsREMIX-fuel

Introduction

The situation in the market for natural uranium. Demand side

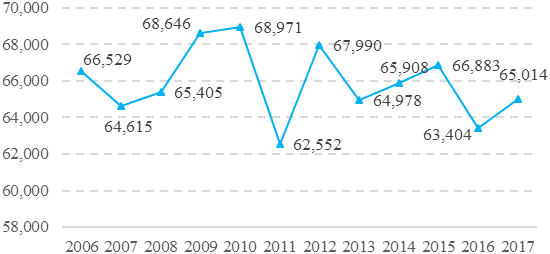

As we can see from Figure

According to Ux Consulting Company, LLC (UxC) estimates, in 2030 annual demand for natural uranium (including inventory build) will skyrocket by more than 50% from 2017 level. Such an optimistic forecast is drawn from countries’ data on reactors in operation, under construction and planned or proposed published by World Nuclear Association (WNA). WNA reports 453 reactors in operation and 55 new ones under construction worldwide including 15 reactors being built in China, nine – in Russia and seven - in India as of date September 2018 (Why the uranium prices must go up, 2018). China's National Development and Reform Commission intends to raise the percentage of electricity produced by nuclear power to 6% by 2020 from the current 2% as part of an effort to reduce air pollution from coal-fired plants. Ultimately, uranium demand will triple inside six years. In India, the government is expected to spend nearly $150 B to develop nuclear power over the next 10-15 years. India now has nuclear energy agreements with about a dozen countries and imports primarily from France, Russia and Kazakhstan. Japan has currently nine reactors back into operation after their shutdown for the safety checks due to the accident at Fukushima Daiichi plant in 2011. In addition to car producers’ plans to invest more than 140 billion dollars in electric vehicles (EV’s) industry it means that demand for uranium will continue to grow in order to meet the expected capacity for nuclear power.

The situation in the market for natural uranium. Supply side

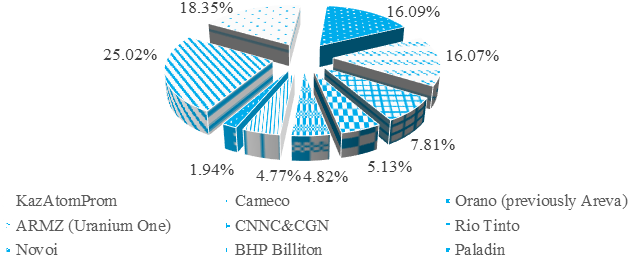

Figure

The leader in the market for natural uranium - state-owned company KazAtomProm - has recently announced it will cut 20% of its production over next three years. Cameco Corp. closed its Rabbit Lake mine in 2016 and put on hold operations at McAthur River and Key River mines in 2017. Paladin Energy closed its Langer Heinrich mine due to its depletion. For the same reason Rio Tinto has plans to shut down Ranger mine in 2026. As a result, the mine production has been declining since 2016. Last year UxC claims a 5.5% decrease in the world production of natural uranium in comparison with 2016. The main reason for constrained mine production is low price for natural uranium in the world market which is below the production costs. For the producers is more profitable to buy uranium in the spot market to fulfill their obligations for the long-term contracts with utilities than to mine uranium. This year expected production level will decline by further 12.5% and fall far behind demand driving up the price for natural uranium in the world market as soon as spot market runs out of its supply (Why the uranium prices must go up, 2018).

Problem Statement

In the light of growing prices for natural uranium in the world market the transfer to fuel recycling is getting appealing for national nuclear power industry in many countries. The choice between direct disposal and reprocessing of spent fuel – so-called open and closed nuclear fuel cycle – is predetermined by spent fuel management policy in a certain country. The most advanced direct disposal technologies of spent fuel are used in the USA, Canada, Sweden and Finland. Partially closed nuclear fuel cycle is operated in Russia, France, Japan, England, and China. In France, in particular, the MOX fuel (oxide mixture of reprocessed uranium, plutonium, and depleted uranium) is used in recycling process. The alternative approach which is based on the fuel fabrication using a REMIX-fuel (regenerating mixture of uranium and plutonium oxides) for reuse in the same thermal reactors which generate the spent nuclear fuel has been developed in Russia. Using of REMIX fuel in the nuclear fuel cycle of thermal reactors makes possible multiple recycling of plutonium and uranium total amount regenerated from spent nuclear fuel; reduction in the accumulated spent nuclear fuel amount as well as in the amount of consumed natural uranium (Fedorov et al., 2013).

Generation IV nuclear power reactors are designed for use in both nuclear fuel cycles. Most of them are light water reactors (LWR) which are still at the early stages of development, but they play an essential role in the nuclear power perspective due to its improved safety features and increased efficiency. The data on reactors used in the study are shown in the Table

High prices for natural uranium in the world market make it very important to measure a contribution of modern reactors’ types to the minimization of fuel component in the total cost of energy produced by NPP. It is becoming a benchmark for making decision about their application in the open and closed nuclear fuel cycle.

Research Questions

Which reactor design the decision makers should choose if they want to minimize the expenses for nuclear fuel and fully utilize the safety and efficiency features of Generation IV reactors.

Purpose of the Study

Many countries have plans to develop nuclear power and pay a close attention to the economics of nuclear power cycle as well as safety features of Generation IV reactors. In order to identify the reactor which will allow to minimize the expenses for natural uranium the comparison analysis of several Generation IV reactors is carried out.

The results of the study can be used by countries which already have, develop or have intention to develop nuclear power in order to make the decision which reactor design to employ for the national nuclear power industry.

Research Methods

For the research purpose, the author used data for Generation IV Nuclear Reactors according to WNA classification on four reactor designs under construction to identify pros and cons of each type in terms of electricity production cost (US$/kg), and more specifically – fuel component in the production cost of energy (¢/kWth).

In order to make assessment of the fuel component in the total cost of energy produced by each type of reactors under consideration the author employed a step-by-step algorithm described in (Osetskaya, Ukraintsev, & Galkovskaya, 2017; Galkovskaya, 2018) for fuel component calculation and current world prices for nuclear fuel cycle stages published by UxC which are provided in the Table

Findings

The summary of the results is presented in the Table

As we can see from the table above the lowest fuel component in the total cost of energy we have for VVER1200 design. In case of direct disposal, it is 18.9%, 1.9% and 0.7% lower than similar indicator for APR1400, EPR and AP1000 accordingly. In case of SF retreatment, the numbers mirror previous results with 19.4%, 1.8% and 0.7% respectively.

Conclusion

Nuclear power industry is a dynamic industry driven by new challenges in the market for nuclear power technologies which all market players must undertake. Despite the industry complexity one of the apparent advantages of Russian reactor design VVER1200 is low expenses on the nuclear fuel. The situation with growing prices for natural uranium makes this advantage crucial for the policy makers responsible for choosing the reactor designs for national nuclear power.

Study results show that in case of direct disposal fuel component of 1 kWth of energy cost produced by APR1400 reactor type exceeds fuel component of 1 kWth of energy costs produced by VVER1200 by 0.09 ¢, for EPR and AP1000 it is 0.007 ¢ and 0.003 ¢ respectively. In case of spent fuel reprocessing the fuel component of 1 kWth of energy cost produced by APR1400 reactor type exceeds fuel component of 1 kWth of energy costs produced by VVER1200 by 0.10 ¢, for EPR and AP1000 it is 0.008 ¢ and 0.003 ¢ respectively.

Acknowledgments

I would like to thank my academic advisor Maria Osetskaya (Project Leader, Rosatom Technical Academy) for her valuable comments and ideas for the research.

References

- Galkovskaya, V. E. (2018). Evaluation of the effect of recycle numbers on the fuel component of the cost of different reactor types. Journal Vestnik IGEU, 2, 67-75.

- Fedorov, Yu. S., Bibichev, B. A., Zilberman, B. Ya.; Baryshnikov, M. V., Kryukov, O. V., & Khaperskaya, A. V. (2013). Multiple recycle of REMIX-fuel based on reprocessed uranium and plutonium mixture in thermal reactors. In Nuclear Energy at a Crossroads: Proceedings of International Nuclear Fuel Cycle Conference (GLOBAL 2013) (pp. 491-495). Salt Lake City, USA: Curran Associates.

- Lewis, B. J., Onder, E., Nihan, P., & Prudil, A. A. (2017). Fundamentals of Nuclear Engineering. Canada: John Wiley & Sons.

- Market share of the world’s largest uranium producing companies in 2017 (2018). Retrieved October 12, 2018, from: https://www.statista.com/statistics/259894/market-share-of-the-worlds-largest-uranium-producers/

- Osetskaya, M. M., Ukraintsev, V. F., & Galkovskaya, V. E. (2017). Management of the fuel component (of the initial and final stages of the nuclear fuel cycles) of the electric power cost in developing a production plan for the Russian nuclear power plants. Journal of economics and entrepreneurship. 2017. Vol. 4–2(81–2), (pp. 590–599).

- UxC nuclear fuel price indicators, (2018). Retrieved October 12, 2018, from: https://www.uxc.com/p/prices/UxCPrices.aspx.

- Why the uranium prices must go up (2018). Retrieved October 12, 2018, from: https://www.streetwisereports.com/article/2018/08/13/why-the-uranium-price-must-go-up.html

- World Nuclear Power Reactors & Uranium Requirements (2018). Retrieved October 12, 2018, from: http://www.world-nuclear.org/information-library/facts-and-figures/world-nuclear-power-reactors-and-uranium-requireme.aspx.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Galkovskaya, V. (2019). New Challenges In The World Market For Nuclear Power Technologies. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 718-724). Future Academy. https://doi.org/10.15405/epsbs.2019.04.77