Abstract

Modern realities and prospects for digital trend development focus attention of a scientific community on logic changing in modern business models in all economic sectors that provide goods, products and services. Advanced information technologies, business rhythm continue to accelerate, which means that innovative changes in a banking sector are becoming the most important factor in ensuring the loyalty of account holders and expanding the client base in the situation of economy digitalization. Improving banks activity in digital environment makes the problem of a qualitative change in the interaction model between banks and customers, increasing their competitiveness, modifying customer service tools and expanding the range of banking products and services. Business functioning and development requires from an innovative bank a convenient, comfortable and efficient service system. However, today traditional forms of a bank customer service can no longer provide the required level. All this indicates that banks have to master and apply the latest digital technologies and introduce electronic banking services. This paper reveals basic problems in innovative approaches implementation to transformation of banking structure, forms and methods. Characteristics of different processes ensuring new opportunities realization of a financial sector due to changes in mobile parameters and the quality of banking products and financial services are given. The impact of the main technological factors that accelerate the development and improvement of banking processes, the introduction of new products and services, changes in the organizational structure and management system of modern credit and financial institutions is considered.

Keywords: Banking servicesdigital economyinformation technologyinnovative developmentonline bankingtransformation processes

Introduction

The modern post-industrial world demonstrates innovative acceleration of technological changes every decade. In the coming years, these conditions will determine global trends in the development in all spheres of industrial and social life. Sustainable development of economic systems in a rapidly changing world directly depends on an efficient solution of the problem of accelerated adaptation to the dynamic technological environment requirements, to the complex processes of the digital economy transformation (Vetkina, Kudryashova, Fikhtner, Trifonov, & Zhukova, 2018).

Digital economy is a term used to describe development prospects of any modern state. This is a completely new growth model, combining physical and digital worlds. The adoption of state programs, transfer to virtual environment of various economic, political, educational and other social processes can bring a society closer to complete transformation of common economic ties and pre-existing principles of business organization. The decisive influence of information technologies today is due to broadband Internet access; availability of computers, tablets and smartphones; increased social network penetration; proliferation of digital marketing and e-commerce technologies; growth of mobile and contactless payments market; distribution of P2P format companies and services; block chain technology, Big data, etc. (Pousttchi & Dehnert, 2018).

Digitization and a change in requirements of a large part of the population to financial services efficiency challenge existing banking business models. Banking is one of those areas of business that is most sensitive to new needs of a digital society where information and communication technologies can become super-efficient.

Problem Statement

Bank activity improving in digital environment makes the problem of a qualitative change in the interaction model between banks and customers, increasing their competitiveness, modifying customer service tools and expanding a range of bank products and services. Business functioning and development requires from an innovative bank a convenient, comfortable and efficient service system, as well as an efficient assessment of banking operations. An important aim is that banks have to master and apply the latest digital technologies and introduce electronic banking services.

Economy situation in Russia and the world is constantly changing, banking products and services market is developing and globalizing. These changes have determined not only advanced information technologies, but they also contribute to formation of a special digital environment for all economic agents functioning, which significantly affects modern banking. The client base has significantly increased a requirement level of banking services provided, therefore, new trends in digitalization have emerged on the finance market (Gobareva, Gorodetskaya, & Eremenko, 2018; Jansen & Van Schaik, 2018).

On the one hand, banks’ customers who actively apply digital technologies in their daily activities expect that banks will also not stand aside from this process, and they will offer technologies based on capabilities of the digital environment to serve those financial needs, which arose under the influence of its appearance. On the other hand, the banks themselves are interested in the development of modern technologies, as this allows them to reduce costs of customer services and banking operations, to improve the quality of services and customer satisfaction with them. Banking and in a broader sense – the financial sector – in recent decades has become largely the driving force for technical and marketing innovations and technologies, and their use to attract and serve customers. Thus, the mutual interest of banks and their clients in the opportunities provided by modern technologies formed a good basis for their distribution in the financial sector (Dolgushina, 2014).

The emergence and spread of information technologies cannot but influence modern development of commercial banks, and a prompt response to a change in digital environment may become one of significant competitive advantages. This will allow banks to work with customers depending on their individual preferences, make banking services available at any time, improve services, minimize costs, improve quality of banking services provided and, as a result, strengthen banks’ competitiveness. All this requires considerable attention to the problem of ensuring innovation processes in a banking sector. System analysis can serve to expand understanding of its transformation processes, it allows to predict changes in this area, to carry out identification and orientation in the development trend (Ivanova, 2016).

Research Questions

The main issues for studying the impact of modern digital environment on transformation of customer banking technologies are the following:

What opportunities for financial service providers are opening up with digital environment development?

What impact on banking business development do social networks, e-commerce, artificial intelligence and mobile solutions have?

How are problems of changing the existing banking structures and business processes, their relationships, ways of managing them, introducing new banking products, and improving the existing ones being solved?

How can we ensure business processes optimization to meet requirements of new organizational culture of customer banking and flexible IT solutions that support the speed of banking products launching on the market and the personalization of offers when building a digital bank?

What are the main directions of successful implementation of innovative programs in a banking sector, and what factors slow down bank activity innovation when introducing digital technologies?

Purpose of the Study

The purpose of the study is determined by the current state and transformational possibilities of a banking sector in the conditions of digital economy development.

A scientific approach to substantiating significance of transition to development and implementation of breakthrough technologies in the system of customer banking is very important.

It is necessary to characterize common problems in innovative approaches implementation to the transformation of a structure, forms and methods of banking activities and to identify the target orientation of processes that ensure new market opportunities due to significant changes in mobile parameters and the quality of banking products and financial services.

It is necessary to identify the main trends in qualitative changes of the interaction model between banks and customers.

Comparative analysis of the most progressive range of banking and innovative services, identifying their effectiveness in the digital field presents relevance of the study.

Research Methods

Theoretical and methodological basis of the research is modern works of leading researchers devoted to transformation problems of a bank customer service, as well as results of a scientific research, highlighting the main aspects of the problems under consideration.

The instrumental and methodological apparatus of the study consists of such general scientific methods and techniques as abstract-logical, inductive, structural and comparative analysis methods, grouping, classifying, integrated and process research approaches.

The information and empirical base of the research was formed on the basis of published scientific materials of Russian and foreign authors, analytical data published in the scientific literature and periodicals, as well as information materials on the Internet. The main research hypothesis is made on the paradigm of bank’s innovative development strategy formation on the basis of ensuring its competitiveness in terms of digitalization and rapid growth of telecommunication technologies.

Findings

Banking services in the process of formation and development have come a long way from the simplest operations to a modern complex of necessary market services that satisfy diverse needs of different customers (Krivoruchko & Lopatin, 2016; Usoskin, Belousova, & Kozyr, 2017). Scientific and technological progress is able to meet the growing needs of customers in interactive communication with banks in a post-industrial society (Zaytseva, 2015). Among the most important factors that caused the transformation of traditional banking services are acceleration of the globalization of world economic relations, innovative leap in the field of information and telecommunication technologies, penetration of foreign banks into financial markets of many countries, increased competition between banks, integrated innovative solutions in customer service, etc. (Toloraya & Yarygina, 2017).

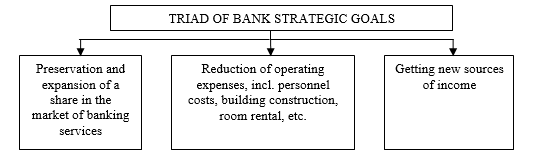

Developing innovative technologies, a bank pursues the following major goals defining its strategy. A triad of strategic goals of a bank is presented in Figure

Among significant advantages of banking electronic services in comparison with well-established traditional services are the following:

attracting a larger number of consumers in the market through various telecommunication networks;

possibility of rapid diversification of services provided in a changing market environment;

convenience for customers;

ability to select in real time an optimal type of service from an intended range of banking products;

possibility of round-the-clock provision of services, etc.

In order to effectively implement an innovative strategy to increase customer loyalty, modern banks are transforming from a classical financial institution into digital organizations.

The digital transformation in a banking sector took place in stages. First, in 1960s new digital channels – ATM networks – developed actively. Later, in early 1990s, an Internet bank and a mobile bank appeared. Over the past few years, leading banks began to change their business development models, becoming entrenched in the virtual space. A new generation of digital technology has come: artificial intelligence, machine learning, big data, contactless payments (such as Android Pay, Apple Pay, Samsung Pay). Thanks to electronic know-how and rapid growth of Internet penetration, digital technologies are becoming increasingly available (Frolov & Revenkov, 2017). Digital banking has changed not only products and channels of communication, but also the very thinking, customers have begun to use actively the proposed innovative solutions.

Retail electronic services that include all types of private services include:

non-cash payments on the basis of payment cards;

customer self-service devices (first of all, ATMs for issuing cash);

electronic payments in retail outlets, which allow to reduce significantly cash flow;

customer service at home, in an office, at other access points, i.e. a client carries out banking operations independently, interacting with an automated banking system;

digital processing and storage of monetary documents (Bettencourt, 1997).

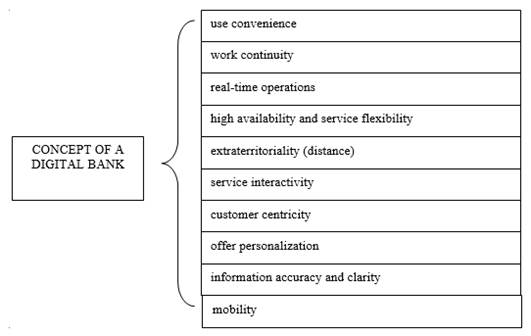

The financial services industry is rapidly moving to an integrated and promising technological system, which with efficient process organization promises financial institutions numerous advantages in terms of client practice, predetermines competitive business results, and also opens up broad opportunities for differentiating services. A digital bank can develop at the rate of changes occurring around, key components of a digital bank concept are presented in Figure

Modern Internet banking should do everything so that a potential client does not need cash, does not need to go to a bank branch, has an opportunity to enter the Bank Interface via any electronic device – a desktop computer browser, all sorts of software versions of smartphones and tablets. In addition, if a client decides to take a loan, documents and a long tedious wait are no longer needed, they become a thing of the past, since the application is generated online. The possibilities of Internet banking are extensive, they allow you to make regular transactions with the help of “a few clicks” or to configure the system to perform automatically ongoing payment transactions (Liang & Ngoc, 2018). A system user should be able to pay services to providers of any type, from mobile operators and the Internet providers to content providers and e-money systems, as well as utilities, transportation services and hotel reservations, payments to government bodies (taxes, fines), etc.

Today new digital products of a bank make their own creative digital teams that combine key competencies of business, IT and marketing. Accordingly, acceleration paths are needed, including partnerships with start-up teams that will ensure development of banking technology systems, transfer of business models to digital and mobile forms or a change in business culture to provide better consumer experience, achieve more promising and cost-effective ways to improve density and quality of interaction with customers (Teece, 2018).

However, a growing pace of digitization of a financial sector in recent years is not yet able to ensure transition to fully digital banks. The previously created IT infrastructures are not very flexible and do not have a high-speed integration with new solutions. However, an increasing number of traditional banks are creating in their structure blocks of digital business and all the time striving to be in trend, introducing individual digital solutions, automating remote banking services (mobile banking).

Conclusion

Emergence of digital environment contributes to a change in a bank activity model and format transformation of their work with clients. Banks do not just use remote channels of interaction with customers in their work but reduce their number in reality. A digital format provides them with an opportunity to accompany clients at all stages of interaction, starting with examining potential needs for financial services, continuing to develop these services and creating a market for their sales, offering services and accompanying services, and ending with receiving a response from the client as a result of acquiring services. Banking services using remote channels – Internet banking, mobile banking, systems such as “Bank-client”, etc. – have become necessary, but not the only element in the complex of interaction measures with a client. It exists along with traditional banking offices, gradually increasing its scale and penetrating all areas of banking. Integration of various distribution service channels with systems and technologies of banking operations requires serious organizational and management changes.

In turn, economy digitalization requires banks to increase the speed of standard banking operations – first of all, money transfers, conversion and credit operations. The other side is integration of a significant number of interrelated and related services in bank package offers, not only the full range of services traditionally offered by banks, but also insurance, accounting, auditing, consulting and others. Moreover, such package offers of services are easily adjusted to the specific features of business and desires of clients, in terms of scale, territory, contractors, etc. As a result, factors for choosing a bank by a client are becoming more and more complex, which requires banks to improve constantly customer service technologies.

We can distinguish the following distinctive features of modern banking services that have arisen under the influence digital environment:

an integrated sales network, including both points of physical presence and a wide range of integrated remote channels;

advanced functionality of remote service channels;

an attractive and intuitive interface;

additional related services based on digital technologies;

a large selection of package offers with the possibility of self-design;

attracting partners from financial and non-financial areas to form comprehensive offers;

constant interaction with customers in order to determine their attitude to a bank and its services, to assess a degree of their satisfaction with services and their promotion;

automation of counseling due to standard questions systematization, training programs creation, robots introduction, etc.

The emerging digital environment is transforming modern banking, helping to transform banks into high-tech companies that use marketing tools actively. Customer attitudes to banks are changing too. A bank is not perceived as a complex and incomprehensible mechanism which is difficult to understand. The client himself manages his service and gets a lot of advantages from it. Thus, under the influence of external and internal factors, banks are constantly improving business models and processes, introducing new products and services, changing an organizational structure and a management system. A remote banking model replaces a traditional banking model.

References

- Bettencourt, L. A. (1997). Customer voluntary performance: Customers as partners in service delivery. Journal of retailing, 73, 383-406.

- Dolgushina, A. Ya. (2014). The impact of Internet banking on banking efficiency. LAP LAMBERT Academic Publishing.

- Frolov, D. B., & Revenkov, P.V. (2017). Cybersecurity in the application of electronic banking systems. Money and credit, 6. Received September 2, 2018, from https://www.cbr.ru/Content/Document/File/26520/frolov_06_16.pdf.

- Gobareva, Y. L., Gorodetskaya, O. Yu., & Eremenko, I. A. (2018). Modern innovative technologies in the banking sector. Banking services, 6, 98-104.

- Ivanova, S. S. (2016). Customer Relationship Management in a large retail bank. Money and credit, 4. Received August 20, 2018, from https://www.cbr.ru/Content//File/26535/ivanova_04_16.pdf .

- Jansen, J., & Van Schaik, P. (2018). Testing a model of precautionary online behaviour: The case of online banking. Computers in human behaviour, 87, 371-383.

- Krivoruchko, S. V., & Lopatin, V. A. (2016). Conceptual and structural features of retail payment services market. Money and credit, 8. Received August 22, 2018, from https://www.cbr.ru/Content/Document/File/26511/krivoruchko_08_16.pdf.

- Liang, C-C, & Ngoc, L.N. (2018). Marketing strategy of internet-banking service based on perceptions of service quality in Vietnam. Electronic commerce research, 18(3), 629-646.

- Pousttchi, K., & Dehnert, M. (2018). Exploring the digitalization impact on consumer decision-making in retail banking. Electronic markets, 28(3), 265-286.

- Teece, D. J. (2018). Profiting from innovation in the digital economy: Enabling technologies, standards, and licensing models in the wireless world. Research policy, Volume 47, Number 8, 1367-1387. https://dx.doi.org/10.1016/j.respol.2017.01.015.

- Toloraya, G. D, & Yarygina, I. Z. (2017). Analysis of the use of new technologies in the global banking practice (problem aspect). Banking services, 11, 48-60.

- Usoskin, V.M., Belousova, V.Yu., & Kozyr, I.O. (2017). Financial intermediation in the development of new technologies. Money and credit, 5. Received August 29, 2018, from https://www.cbr.ru/Content/Document/File/26408/usoskin_05_17.pdf.

- Vetkina, A., Kudryashova, T., Fikhtner, O., Trifonov, V., & Zhukova, E. (2018). The Innovative Potential of Digital Transformation of the Russian Higher Education System: Trends of the Competence Approach. Advances in Social Science, Education and Humanities Research, 198, 198-203.

- Zaytseva, I. G. (2015). Retail banking model transformation under the influence of remote banking. In M. V. Sigova (Ed.), Scientific notes of the International Banking Institute. Volume 12. (pp. 14-15). Saint-Petersburg: Publishing House MBI.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Zaytseva, I., Vetkina, A., Mozul, L., & Alexandrova, O. (2019). Influence Of Digital Environment On The Transformation Of Banking Customer Service Technologies. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 692-699). Future Academy. https://doi.org/10.15405/epsbs.2019.04.74