Modeling Of The Projects Investment Attractiveness Implemented Under Conditions Of Project Financing

Abstract

In this paper, an assessment was made of the dependence of the volume of project financing attracted by projects in the world from two factors characterizing the economic sustainability and investment climate of these countries - the volume of gold reserves and the net inflow of foreign direct investment. The analysis was based on data from Thomson Reuters and the World Bank for the period 2007-2017. Differences in the amount of funding received by neighboring countries, countries with different international weight in political and economic terms, generally indicate the uneven distribution of resources of project finance funds. In our opinion, the investment attractiveness of projects implemented on the terms of project financing depends largely on the country in which the relevant projects are being implemented. The presence of significant foreign exchange reserves will indicate the sustainability of the economic and socio-political system of the state, which in practice should lead to simplification of the project management system, implemented on the terms of project financing, as well as reducing the complexity of the system for allocating project risks. The constructed regression model of dependence of the volume of project financing on the volume of the country's gold and foreign exchange reserves and on the net inflow of foreign direct investment is significant at a high level. According to the results of the analysis, it was concluded that in modern conditions project financing is more often carried out in regions that are prosperous from an economic point of view.

Keywords: Influence on the project of the organizing countryinvestment attractivenessproject financingregression model

Introduction

Project finance in this article is a special way to implement projects, the difference of which is to raise funds on a limited recourse on the assets of the project initiator or on a completely non-regressive basis for financing an economically separate investment project, when the source of loan servicing and investment income is exclusively cash flows created during the project.

The problem of studying certain aspects of project financing at the present stage should recognize the limited information on such projects and the practical absence of empirical research in this area of the project.

The problem of studying certain aspects of project financing at the present stage should recognize the limited information on such projects and the practical absence of empirical research in this area of the project.

The advantages of applying the method of project financing are traditionally considered by researchers from the perspective of the initiator or creditor of the project. It is necessary to single out a number of models explaining the effectiveness of project financing:

Shah and Thakor (1987) as an advantage of this technique distinguish the cost reduction of lenders to collect information about the borrower. The use of project financing interferes with the combined assessment of the project being credited and the assets of its initiator.

Chemmanur and John (1996) explain the attractiveness of using project finance techniques by the property of projects to bring management benefits to their managers. Projects with less benefit from management are more profitable to implement on the terms of project financing.

John and John (1991) as an explanation of the attractiveness of the use of project finance, consider the ability of management structures formed in this process to minimize the impact of agency conflicts on a project.

At the same time, the study of the role of the state in the implementation of project financing is becoming increasingly relevant in modern conditions. Kayser (2013), analyzing scientific publications for the period 2009 - 2013. As one of the four main areas of research in the field of project finance, it highlights the study of the problems of globalization of project development and the difficulties of cross-border investment. This is due to the fact that project finance is often applied to projects implemented in state-regulated sectors, and in many countries government firms or government agencies are often counterparties to such projects (Finnerty, 2015; Esty, 2002).

Problem Statement

For the host country, encouraging the use of project finance in its territory can be valuable for the following reasons:

Firstly, it allows overcoming resource limitations in the creation and radical modernization of production, which is important for the innovation economy.

Secondly, the use of project financing in conjunction with the mechanism of public-private partnership can be considered one of the promising areas for the implementation of the most important priority programs of the socio-economic development of the state.

At the same time, in the period 2007 - 2017 the list of countries leading in terms of attracting project financing remained fairly stable (Table

It seems that this is due to the fact that important factors for attracting project financing to the economy of a country are indicators of the stability of the conditions of the project. Since all its parameters can be somehow settled and accepted by the parties at the pre-project development stage, changing the conditions entails the risk of violating the agreements reached, which even for such stress-resistant structures like the structure of project financing can have negative consequences, even refusal project implementation.

At the same time, the role of the host country, even with its maximum passive participation, has the basis of an active influence on its implementation. And they can be implemented to one degree or another at any time.

You can say that any international project is inherent risk associated with the activities of the host state. This is the risk of losses for the project as a result of the realization of events that, to varying degrees, can be controlled and managed by government mechanisms, but are not subject to management by the project’s private investors. And the investment attractiveness of projects implemented on the terms of project financing, can be determined by the conditions of the project, characteristic of its host country.

Research Questions

It seems that the negative impact of the host country on the implementation of the project is inherent in the first place to developing countries. At the same time, a specific feature of the project financing technique is the formation of a special, rather complex project implementation structure, which should minimize the risk of any adverse events around such a project. With regard to the risk of government intervention in the implementation of the project, this acts as follows:

Prior to the start of the project, the initiator and the host government of the project sign a special agreement on the protection of international investments.

To manage the implementation of the project, a special project company is created to ensure the fullest possible disclosure of information. Such a company does not have an economic history, so any form of possible government intervention in the project will be clearly manifested.

The project is protected from the nationalization of its assets also through the formation of the capital of the project company with the highest possible share of borrowed funds - at least 60% and up to 90% of the project capital. This does not allow the company to increase capital due to possible super-profits, which, in turn, reduces the potential economic effect of changes in the ownership structure of project assets.

Another way to protect against government intervention in the implementation of the project is to involve in the financing of influential international credit institutions, including the largest development banks, export credit agencies of economically developed countries, the International Finance Corporation (IFC), the World Bank, etc. The need for further cooperation with such organizations can deter state officials from the unfriendly impact on projects with such multilateral participation.

However, the negative impact of the host country on its territory can also manifest itself without targeted influence from the government. The conditions of the project may change due to the development of crisis trends in the state economy for objective reasons. Thus, for example, the dynamics of the volumes of the global market for project financing over the past 11 years indicates a marked decrease in 2009 and then in 2012–2013. But, it can be argued that, despite this, projects on the terms of project financing, in the world, nevertheless continued to be implemented, but there was a redistribution of the relevant funds in more attractive countries for investment

Accordingly, it can be said that projects in countries more prepared for the crisis, having a more stable national economy and implementing a more effective policy of attracting investments, in the conditions of the crisis, gained an advantage over projects in other countries (Lua, Peña-Moraa, Wanga, Shena, & Riaza, 2015).

Thus, of interest is the question of the extent to which the choice of the method of project financing is directly influenced by the country in which the project will be implemented.

It seems that many aspects of state influence on project implementation considered here using the method of project financing can be taken into account when considering the following two factors:

value of the country's foreign exchange reserves;

net inflow of foreign direct investment in the country's economy.

Thus, the presence of significant gold and foreign exchange reserves will indicate the sustainability of the economic, and to a large extent, socio-political system of the state, which potentially should lead to a simplification of the project management system under the terms of project financing and the system for distributing project risks.

Inflow of foreign direct investment should also be considered as a favorable factor in assessing the investment attractiveness of projects in the respective country. It will characterize the degree of investor confidence in the economy of a given country, the comfort of conditions in terms of the protection of property rights, the predictability of the legal system, the profitability of doing business in the relevant jurisdiction.

Purpose of the Study

It seems that the observed changes in the project financing market indicate that significant changes have occurred and are constantly occurring in approaches to the evaluation of projects when choosing the form of their implementation. Since the grouping of projects by their host countries has become widespread, this becomes quite clear.

It seems appropriate to analyze, on the basis of actual data, the interrelation and mutual influence of individual factors characterizing the investment climate and the stability of the state’s economy, as well as their influence on the amount of project financing attracted by projects in the territory of this state.

This should take into account the fact that such influence may be reversed. Thus, the effective implementation of large, socially significant projects on the terms of project financing will contribute to the growth of the budget revenue of the host country, strengthen its position in the international financial community, increase the investment attractiveness of national assets in the eyes of foreign investors, and improve the international rating.

Research Methods

We conducted a correlation-regression analysis of the following statistical indicators:

amount of project financing in the world;

foreign exchange reserves of the country;

net inflow of foreign direct investment in the world.

The analyzed sample included 511 observations of the ratio of the studied indicators for 109 countries for the period from 2007 to 2017. Some countries, such as, for example, the United States or the Russian Federation, annually attracted project financing. Others, such as, for example, the Syrian Arab Republic or Montenegro, were only once involved in the implementation of projects under the terms of project financing for the period under review. The main selection criterion was the availability for a country of complete data on all three analyzed indicators.

Information on the volume of project financing was obtained on the basis of data from annual reviews of project financing, published by the Thomson Reuters news agency and published on its website.

Statistics on foreign exchange reserves and net inflows of foreign direct investment in the countries of the world were obtained through the use of the DataBank analysis tool, which is freely available on the World Bank website.

The analysis was performed using the IBM SPSS Statistics 23 statistical software package (Kleimeier & Megginson, 2001).

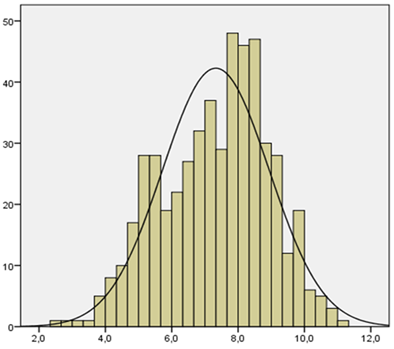

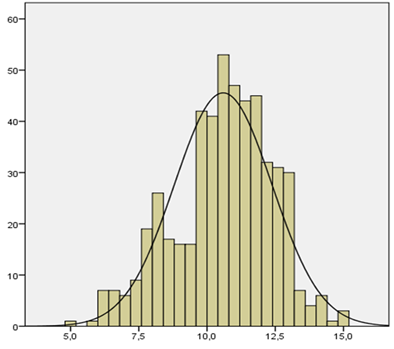

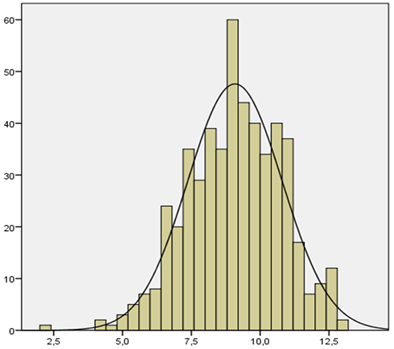

As a result of the analysis of the distribution of histograms of the selected traits, it was concluded that their distribution strongly deviates from the normal distribution. Since they all had positive asymmetry, their logarithmic transformation was carried out. The histograms of the distribution of the selected traits after normalization are presented in Figure

Also, on the basis of the scatterplot data, outliers were filtered. In particular, data on the Netherlands in 2008 were deleted from the sample due to the extremely high value of foreign investment, as well as all data on Ireland.

Findings

Correlation analysis

Conducted correlation analysis (Table

It should be noted that there is also a strong correlation between the gold reserves of the country and the net inflow of foreign direct investment, but there is no multicollinearity effect, since the sample predictor linear correlation coefficient does not exceed 0.8.

The results suggest that there is a statistically significant relationship between the amount of project financing, the country's gold and foreign exchange reserves and the net inflow of foreign direct investment. Therefore, predicting the change in these indicators, it is possible to predict their impact on the change in the volume of project financing attracted to the projects of the host country.

For example, the growth of the gold and foreign exchange reserves of a state will signal that these regions are becoming more attractive in terms of the implementation of projects on their territory on the terms of project financing. As a result, this may lead to the receipt of loans by such projects on more favorable terms, reducing the time frame for the formation of project management structures.

The influx of foreign direct investment into the country should also be considered a favorable factor when organizing project financing of economic facilities in its territory. And this can be a multiplying factor when the implementation of new projects will lead to an increase in the provision of loans in the country’s territory for project financing and stimulate additional economic growth

The construction of the regression equation

We also constructed a model of multiple linear regression explaining the dependence of the natural logarithm of the amount of project financing on two predictors - the natural logarithm of gold reserves and the natural logarithm of net foreign direct investment. In Table

b.Predictors: (Constant): Natural logarithm of net inflows of foreign direct investment, Natural logarithm of gold reserves

Thus, the regression model of the dependence of the volume of project financing on foreign exchange reserves and the net inflow of foreign direct investment in the host project will take the following form:

lnPF=0.886+0.225*lnRES+0.447*lnPII (1)

where

It can be concluded that the predictors chosen by us are statistically significant at a sufficiently high level. This allows you to save both predictors in the regression model. The obtained value of the Fisher criterion, equal to 220.621, indicates the significance of this model at a high level, not worse than 0.0005.

From the presented econometric model, it follows that in 2007–2017 the volume of project financing attracted by one or another country was characterized by the following elasticity coefficients: 0.225 for gold and foreign exchange reserves and 0.447 for the net inflow of foreign direct investment. In accordance with the proposed model, an increase in the value of the country's gold and currency reserves by one percent on average provides an increase in resources provided under the terms of project financing for projects implemented in the territory of this country by 0.225%. An increase of one percent in the net inflow of foreign direct investment on average ensures a 0.447% increase in the volume of project financing in the country.

As follows from Table

Conclusion

It can be argued that projects implemented under the terms of project financing may be of value to their host country. Thus, in the short term, the implementation of a large international project may bring certain political dividends to the ruling elite, and stimulate the inflow of foreign direct investment. In the long term, the development of energy, transport infrastructure, telecommunications and other areas of project finance will definitely contribute to enhancing the sustainability of the national economy, increasing political stability, increasing public satisfaction by increasing competition and increasing access to social and infrastructure services.

As a result, the government of the host country in one way or another can create conditions for the effective implementation of projects, and assume some of the project risks. The organizing country may act in the project management structure on the terms of project financing in the following capacity:

as an investor in the assets of the project company,

as a lender,

provide guarantees for a project loan,

as a buyer of products or services of the project being implemented.

Provide other support, including a favourable customs regulation regime, a favourable tax regime, etc.

The range of participants in a project can vary in many respects, while a project developed in one country and for the conditions of this country cannot easily change the place of its implementation. Therefore, the conditions of the project, depending on the host country, are crucial in assessing the investment attractiveness and justify the feasibility of applying the methodology of project financing.

References

- Chemmanur, T. J., & John, K. (1996). Optimal incorporation, structure of debt contracts, and limited-recourse project financing. Received April 17, 2018, from https://www2.bc.edu/thomas-chemmanur/paper/JFI_1996.pdf

- Esty, B. C. (2002). When Do Foreign Banks Finance Domestic Investment? New Evidence on the Importance of Legal and Financial Systems. Received August 7, 2018, from http://www.people.hbs.edu/besty/esty%20foreign%20banks%203-9-03.pdf

- Finnerty, J. D. (2015). Project financing: asset-based financial engineering (3rd Edition). Hoboken, New Jersey: John Wiley & Sons, Inc.,. Received August 17, 2018, from https://www.wiley.com/en-ru/Project+Financing:+Asset+Based+Financial+Engineering,+3rd+Edition-p-9781118394106

- John, T. A., & John, K. (1991). Optimality of Project Financing: Theory and Empirical Implications in Finance and Accounting. Received August 21, 2018, from https://link.springer.com/ article/

- Kayser, D. (2013). Recent Research in Project Finance – A Commented Bibliography. Received August 13, 2018, from https://www.researchgate.net/publication/257719838_Recent_Research_in_Project _Finance_-_A_Commented_Bibliography

- Kleimeier, S., & Megginson, W.L. (2001). An empirical analysis of limited recourse project finance. Received May 29, 2018, from https://cris.maastrichtuniversity.nl/portal/files/813068/guid-dbd1c605-a4e0-4a20-994c-754cdc707367-ASSET1.0

- Lua, Z., Peña-Moraa, F., Wanga, X. R., Shena, C.Q., & Riaza, Z. (2015). Social impact project finance: An innovative and sustainable infrastructure financing framework. Received May 30, 2018, from https://www.sciencedirect.com/science/article/pii /S1877705815031951

- Shah, S., & Thakor, A.V. (1987). Optimal capital structure and project financing. Received May 13, 2018, from http://apps.olin.wustl.edu/faculty/thakor/Website%20Papers/Optimal%20Capital%20 Structure%20and%20Project%20Financing.pdf

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Ilin, I., Sokolova, N., Bardovskii, V., Zviagintceva, Y., & Legostaeva, S. (2019). Modeling Of The Projects Investment Attractiveness Implemented Under Conditions Of Project Financing. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 610-619). Future Academy. https://doi.org/10.15405/epsbs.2019.04.65