Abstract

In modern economic conditions, constant development is necessary in order to occupy a leading position. This development can be achieved only by attracting additional funds, or rather investments. The paper studies the features of investing in the regional business sector. In the course of the work, the main macroeconomic indicators by branches were investigated, in particular, the main indicators of the investment activity of the Novgorod region; investments in fixed capital by types of fixed assets and as a percentage of the total. The structure of investments and the sources of investment funds in fixed assets, issues of legislative regulation of investment activities and other significant indicators that determine the priorities of investment activities have been studied in detail. According to the results of the study, a set of recommendations for ensuring the most efficient investment processes in the sectors of the regional economy was presented. The most promising areas of investment from the standpoint of the integrated development of the region are highlighted. So, in order to ensure sustained growth of the gross regional product, it is advisable to give the most attention to investment projects in the field of the production of machinery and equipment, as well as state administration and military security and social insurance. Significant, comprehensive investments in the proposed directions for the development of business sectors, should give a significantly better effect compared to investing in other business areas according to our research.

Keywords: Business sectorsdevelopment forecastingGRP (gross regional product)investmentsregional economy

Introduction

The relevance of this study lies in the need to improve the processes of investing in certain areas of business. Creating a favorable investment environment will help ensure the progressive development of sectors of the regional economy, will provide an opportunity to implement promising economic and social projects. It is the investment climate that affects the economic, investment and financial policies of the regions of Russia. Thanks to a well-constructed investment policy, it is possible to ensure the dynamic development of the economy of the region as a whole, as well as the activities of individual economic entities, primarily entrepreneurial.

Problem Statement

The issue of stimulating investment activity in the context of structural changes in the world economy is more relevant than ever. It is the investment process, its support at the federal and regional levels that is of great interest to all market participants. Today, the investment climate of a specific region of the Russian Federation plays a large role in investment processes. In turn, it represents the set of various socio-economic, natural, environmental, political and other conditions that have developed over the years, determining the scale (volume and pace) of attracting investments in the fixed capital of this region of Russia. Analyzing the attractiveness of investing in individual industries, it is necessary to examine in detail the investment attractiveness of the region as a whole, and the investment activity in specific sectors of the relevant entity. There is a significant causal relationship between these parameters. Thus, investment activity to stimulate the development of specific sectors of regional entrepreneurship directly depends on the investment attractiveness.

Research Questions

The main research questions are the peculiarities of investing in certain branches of business in order to ensure sustained development for the long-term period. The following is necessary to be done to achieve this goal: study of the existing methodology for assessing the investment climate; analysis of the structure and dynamics of the main socio-economic indicators of the regions; study and evaluation of existing investment projects of the Novgorod region; development of proposals and justification of possible areas of investment in the regional business sector in order to ensure the ongoing development for the medium term in the Novgorod region.

Purpose of the Study

The purpose of the research is to study the characteristics of investment in individual branches of regional entrepreneurship and the development of recommendations to stimulate investment activity in order to ensure the ongoing development in the medium and long-term periods. In accordance with the goal, the work assumes a detailed study of the most significant indicators, from the point of view of investment activity and the identification of promising areas for the investment at an appropriate level.

Research Methods

It is necessary to consider, first, that it is not the volume of investments that determines the result, but their structure, specific to a particular branch of business. One can spend a significant amount of resources, but the economic efficiency of the sectoral investment will be minimal or even negative. A number of methods and approaches to assessing investment performance and dependence on the existing investment climate are used to avoid such mistakes (Bottrell & Schoenly, 2018). The following can be listed here: methods of the Institute of Economics of the Russian Academy of Sciences; the methodology of the Council for the Study of Productive Forces (SOPS); the method of Shakhnazarov, Roizman (Borisova, 2017) and other scientific economists; the methodology of the rating agency Expert RA (Rating Agency RAEX, 2018) and other methodological approaches to the determination of investment indicators. But, analyzing the presented works, it can be concluded that not all approaches give equally reliable and accurate results.

It is possible to group the existing approaches in the three most important areas in order to conduct a study of the characteristics of investment in the regional business sector in the context of the economic reorientation of the national economy most successfully.

One of the groups of approaches will be based on the assessment and analysis of large volumes of macroeconomic indicators (Borisova, 2017), which include such indicators as GDP dynamics, nature and distribution of national income and industrial output; the state of legislative regulation of investment activities; proportions of savings and consumption; the course of privatization processes and the development of individual investment markets, including the stock and monetary ones.

Another group of approaches will include an analysis of the interrelationships of such indicators as social and financial factors, organizational, legal and political conditions of managing the relevant territory and the level of maturity of the market environment in the region, etc.

In this case, the sum of the set of weighted average estimates by groups of factors will be a summary measure of the investment climate for the factor analysis (1):

Q =∑Xj × Pj (1)

where

The next group of approaches will be based on risk theories. In this regard, this group will include the values of such indicators as the state of investment potential and investment risks and the level of investment risks and socio-economic potential (Osipov, 2008). Experts from the "Expert-RA" rating agency have been used the first option of a risk-based approach to the analysis of the investment climate in the constituent entities of the Russian Federation over the past few years, and it is intended for a strategic investor. Accordingly, this approach can be applied to assess the investment climate of the Novgorod region from the perspective of risk. In particular, the RAEX rating agency confirmed the credit rating of the Novgorod region at ruBBB level with a stable forecast (Rating Agency RAEX, 2018). The assigned rating gives grounds to apply appropriate standard approaches to the processes of justifying investments in the field of regional entrepreneurship.

Findings

It is necessary to analyze the investment activity in the relevant territory to identify the key areas of investment in the regional business sector.

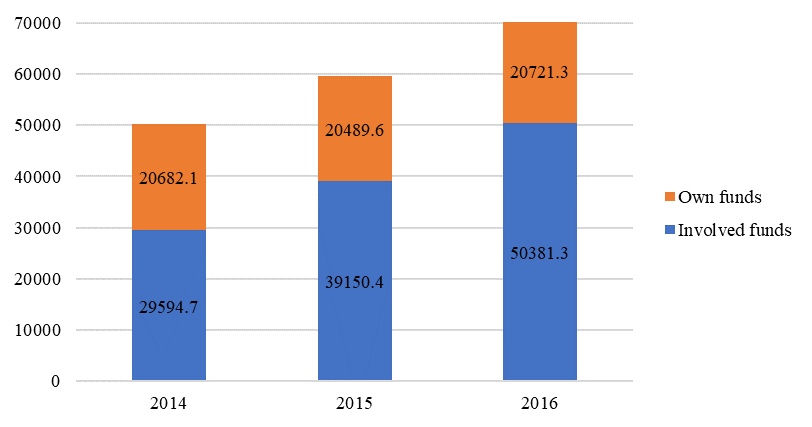

The assessment of investment activity in the Novgorod region shows that, the volume of investments in fixed assets increased by 41.4% over the study period (2014-2016) and amounted to 71,102.6 million rubles at the end of 2016 (table

The goal of the investment policy of the Novgorod region, like of any other region, is to ensure sustainable economic growth. This requires investment in physical capital, primarily in machinery and equipment, and in human capital, in particular, in the knowledge sector.

Investments in human capital are the most significant in terms of the STP. The man is the engine of progress and such investments create the prerequisites for the emergence of scientific and technical innovations.

Analysis of investment processes in the Novgorod region revealed a decline in investment in machinery, equipment, vehicles by more than 2 times, which is an extremely negative factor. This is due both to the influence of the imposed sanctions from Western countries and illiterate investment policies (table

Investments in manufacturing, transport and communications are predominant in the structure of investments of the region (table

The leading enterprises of the processing industry of the Novgorod region include:

JSC Acron (production of mineral fertilizers);

LLC Dirol Cadbury (chewing gum production);

JSC Deka (production of kvass, beer and mineral water);

CJSC Volkhovets (production of interior doors);

OJSC Laktis (production of dairy products);

OJSC “EDB-Planet”" (development and production of electronic equipment and semiconductor optoelectronic devices).

Exploring the dynamics of investment in transport and communications, some implemented projects can be mentioned. For example, a project was implemented in 2016 to connect the public high-speed Internet in six settlements of the Novgorod region (Dubrovka village, StaroyeRakomo village, etc.), as well as projects for the construction of on-site roads on land sites in the villages of Novaya Melnitsa and Sholokhovo.

The highest growth rate of investment was observed in such activities as agriculture, hunting and forestry (123.9%); processing industries (130.4%); transport and communications (182.5%). The highest growth rate was shown by the education sector (376.0%), which, as noted above, is a direct investment in the development of human capital in the region (Zimina, 2017). However, the main indicators of the development of education in the region over the study period (the number of organizations carrying out educational activities, the number of students, etc.) show mostly negative dynamics. Thus, it can be concluded that the investment is either not working effectively or the effect of the investment is expected in the long term.

The increase in investment in agriculture is probably mediated by the approval of the state program “Sustainable development of rural areas in the Novgorod region for 2014-2020”. Also, the governor of the region A. Nikitin constantly notes the priority of this direction of development in his speeches (Omarov, Omarova & Minin, 2018). The positive results of agricultural development in 2017 in the Novgorod region, namely, the leading position in the North-West in the production of potatoes, the second place in the production of vegetables and the third in meat production, once again prove that the industry plays a key role in the economy of the region (Ministry of Investment Policy of the Novgorod Region, 2018).

The greatest decline in investment is demonstrated by such areas as the production and distribution of electricity, gas and water (48.2%); health and social services (64%); building and construction (52.7%); financial activities (28.3%). Investment in hotels and restaurants showed a record decline - 13.7% of the volume of investments in 2014 (Zimina, 2017). This direction is not investment-attractive, since the population of the Novgorod region lives quite poorly. Real disposable incomes of the population according to the Federal State Statistics Service since 2014 are falling, and the consumer price index is constantly growing. In such economic conditions, most of the population can only afford essential goods and services. In addition, hotels and restaurants receive income from the flow of tourists, which directly depends on the degree of development of tourist infrastructure.

Health care and social services are often not interesting for private investors, because they require large investments and have low profitability, therefore, investments in this area are usually neglected.

The decline in investment in building and construction is due to the construction decline in Russia as a whole. This trend in the country was established in 2014, when there was a sharp collapse of the ruble – the population is reluctant to buy housing, besides, mortgage lending is not available to the ordinary citizen (Investment Portal of the Novgorod region, 2018).

Investments in fixed assets increased in 2016 due to an increase in own funds by 0.2% and due to an increase in external funds by more than 70.0%. The main part of investment projects of the Novgorod region during the reporting period was carried out at the expense of external funds. Figure

The following major and significant investment projects of the Novgorod Region will be developed and implemented in 2017 and in 2018-2020 (Investment Portal of the Novgorod region, 2018):

construction of a waste paper recycling shop and purchase of equipment for the production of corrugated cardboard (CJSC “Metalloplasticmass”) in Borovichesky District, worth 1.27 billion rubles;

increase in productivity of the plant for the production of proppants (JSC Borovichesky Refractory Plant) worth 1.3 billion rubles;

construction of a plant for the production of turkey meat with a capacity of 4.3 thousand tons per year in the village of Okladnevo, Borovichesky District (LLC “Novgorod podvorje”) worth 1.7 billion rubles;

construction of a plant for deep processing of crop production for the production of pharmaceutical substances using innovative technologies in Veliky Novgorod (LLC “Grumant”) worth 2.1 billion rubles;

organization of a modern production complex for the production of microwave components and REA (LLC “EDB-Planeta”) worth 1.023 billion rubles;

construction of a forest industry complex in the Novgorod region (LLC “Krestetsky forest industry complex”) worth 5.3 billion rubles;

construction of a furniture factory (LLC Ikeaindustry Novgorod (the Netherlands)), investments will amount to 4,054 billion rubles;

production and processing of rainbow trout and construction of a plant for the production of marketable aquaculture feed (AIICapital, Finland) in the Okulovsky district, investments will amount to 3 billion rubles.

The key point determining the investment climate and potential investment directions is investment legislation. Thus, the regulatory framework of Western countries is primarily aimed at protecting the interests of investors and its implementation involves adherence to a number of principles:

1) the principle of equality of external and regional (internal regional) investments: specific investors should not receive preference, it is necessary to consolidate them;

2) external (foreign) investments contribute to building long-term economic relations, therefore it is necessary to provide guarantees and protection against risks to foreign investors;

3) investment policy should be carried out taking into account the peculiarities of each specific direction of investment activity.

In general, the legal framework in the field of investment activity is quite clearly defined, and investment promotion institutions in the Russian Federation are working. Nevertheless, there are a number of problems: the draft law regulating the contract of the commercial concession with the participation of foreign investors has not yet been implemented; there is no clear and defined mechanism for regulating guarantees of investment risks; high political risk remains for foreign investors (Rashidov, Rashidova, & Shatlkhin, 2010).

The main law of the Russian Federation regulating investment activity is the Federal Law No. 39 “On investment activity carried out in the form of capital investments” of February 25, 1999. In each constituent entity of the Russian Federation, a number of regulatory legal acts of subjects in the field of investment regulation also apply. For example, in the Novgorod region the main governing law is the regional law of 11.06.98 No. 29-03 “On investment activity in the Novgorod region” (Regional Law No. 945-RL, 2016) and other regulatory and legal acts.

Preferential terms for the use of regional property are used as an instrument for regulating investment policy in the Novgorod region. Another equally important tool is subsidizing a part of the interest rate on attracted bank loans (in the amount of 2/3 of the rate). And finally, there is the possibility of obtaining an investment tax credit if there are some grounds.

In addition, the regional laws of the Novgorod region on taxes and fees provide for a number of tax concessions for subjects of investment activity (Table

Thus, the subjects of investment activity have certain tax preferences, but their list is quite narrow. Шt is necessary to expand the set of tools, focusing on foreign countries to stimulate investment activity effectively (Frick & Sauer, 2018). For example, in Latvia there is such a form of support as the return of a part of the income tax for investment projects with an investment volume exceeding 4.3 million euros. Also, since 2014, foreign investors have the opportunity to obtain a residence permit in Latvia.

The presence of special economic zones (SEZ) may be another criterion for assessing the investment attractiveness of a region. SEZs are large-scale projects aimed at the development of regions by attracting direct Russian and foreign investments in high-tech sectors of the economy, import-substituting production, shipbuilding, and tourism (Poroshina, 2014). Such zones are usually created for 49 years. Each zone is endowed with a special legal status, which gives investors a number of tax breaks and customs preferences. There are general tax benefits (reduced income tax rate, tax holidays on property tax from 5 to 10 years, preferences for transport tax, etc.) and additional tax benefits (the right to apply accelerated depreciation and lower rates of insurance premiums, etc..).

However, the experience of creating SEZs in Russia is quite controversial, since it is very difficult to predict in advance which zone will “shoot” and which will turn out to be a waste of budget money. Thus, the Murmansk port economic zone has not justified the expectations. Not a single resident registered there for four years since its creation. In the Kaliningrad region, on the contrary, amendments to the federal law on the Kaliningrad SEZ and amendments to the Tax Code of the Russian Federation stimulated and attracted 13 new residents in a short period of time (Thirteen new residents appeared in the Kaliningrad SEZ, 2018).

A concept of a SEZ of tourist and recreational type “StranaDiv” was developed in 2013 in the Okulovsky district of the Novgorod region. The project included the construction of such infrastructural objects as the recreation center “Okulovskie rosy”; base of active and ecological tourism “Lukozerie”; regional center of rowing slalom; Eco-hotel “Zapovednoe Lake” and roadside service facilities (The concept of creating a special economic zone of tourist-recreational type “Strana Div”, 2018).The implementation of the concept is expected to give impetus to the development of small and medium-sized businesses, transport and information infrastructure, new formats of creative industries; and will also provide a significant multiplier effect in the form of the development of related industries. The project should be fully implemented by 2018. It will be possible to assess the impact of its implementation on the investment climate of the Novgorod region in the coming years 2019-2020. Also, it will be possible to judge about the appropriateness of the creation of the SEZ in our region (Order number 72, 2017). In particular, the implementation of this direction will allow developing the manufacturing industry, stimulating the production of high-tech products and then exporting to other regions.

Conclusion

The results of the study allow making the following generalizations and conclusions. It is advisable to pay the most attention to projects in the field of machinery and equipment production; the production of vehicles and equipment; investment projects in the field of public administration and military security and social insurance in order to ensure sustained growth of the GRP from the investment point of view. Significant, comprehensive investments in the proposed directions for the development of business sectors should give a significantly better effect compared to investing in other business areas according to our research.

The investment attractiveness rating of the Novgorod region was identified at the level of 3B2 by the RAEX agency (Rating Agency RAEX, 2018), which means low potential and moderate risk. Evaluation of investment activity of the Novgorod region shows that the volume of investments in fixed assets increased by 41.4% in 2014-2016 and amounted to 71,102.6 million rubles at the end of 2016 (Ministry of Investment Policy of the Novgorod Region, 2018). However, despite this, the level of investment and GRP is much higher in other regions of Russia, which opens up prospects for significant investments in the business structures of the Novgorod region.

This study analyzed the main indicators and estimated the resources of the Novgorod region, which made it possible to suggest priority areas for investment: development of the forest industry and processing, production of medicines and extracts based on farmed medicinal herbs in the Novgorod region and infrastructure development with the aim of attracting major producers.

The proposed areas of investment in regional industries require the allocation of budgetary funds by the state in fairly large amounts in order to stimulate the active development of the priority areas of regional entrepreneurship. But as a result, the benefit from the economic effect in the long term will significantly improve the position of the region and will contribute to the progressive development of all sectors of business.

References

- Borisova, A. A. (2017). Assessment of the investment climate in the region. Young scientist, 2 (136), 364-366.

- Bottrell, D., & Schoenly, K. (2018). Integrated pest management for resource-limited farmers: Challenges for achieving ecological, social and economic sustainability. The Journal of Agricultural Science, 1, 19.

- Federal State Statistics Service. (2018).Received May 18, 2018, from http://www.gks.ru/bgd/

- Frick, F., & Sauer, J. (2018). Deregulation and Productivity: Empirical Evidence on Dairy Production. American Journal of Agricultural Economics, 100(1), 354-378.

- Investment portal of the Novgorod region. (2018) Received July 6, 2018, from http://econominv.novreg.ru/upload/docs/ru/dokymenty/zakon945.pdf

- Ministry of Investment Policy of the Novgorod region. (2018).Received May 18, 2018, from https://econom.novreg.ru/portret/

- Omarov, M.M., Omarova, N.Yu., & Minin, D.L. (2018). World trends and strategic prospects for the development of agriculture in Russia in the context of economic sanctions. In Lavrikova Yu. G., & Neganova V.P. (Eds.), Food market of the Russian regions: a new vector of development (pp. 17-29). Ekaterinburg, Russia: Ural Branch of RAS.

- Order number 72. (2017). Order of the Economic Development Department of the Novgorod Region No. 72 of August 28, 2017 “On Approval of the Plan for Creating Investment Objects and Infrastructure Facilities in the Novgorod Region for 2017 and the Planning Period of 2018-2020”. Received July 6, 2018, from https://econom.novreg.ru/portret/

- Osipov, P.Yu. (2008). The investment climate of the regions as an object of the impact of regional investment policy. TSU Bulletin, 8(64), 412-416.

- Poroshina, O.V. (2014). The current state of investment activity in the Vologda region. Modern research and innovations, 10, 2. Received April 16, 2018, from http://web.snauka.ru/issues/2014/10/37569

- Rashidov, O.I., Rashidova, I.A., & Shatlkhin, M.V. (2010). Analysis of the relationship of investment and GRP in the regions of the Central Black Soil Region.Economic Sciences, 1(62),169-174.

- Rating agency RAEX. (2018). Received17.05.2018 fromURL: https://raexpert.ru/releases/2017/May25j

- Regional law No 945-RL. (2016). Regional law of March 28, 2016 “On investment activity in the Novgorod region and the protection of investors' rights”. Investment portal of the Novgorod region. Received from http://econominv.novreg.ru/upload/docs/ru/dokymenty/zakon945.pdf

- The concept of creating a special economic zone of tourist-recreational type “Strana Div”. (2018). Received May 18, 2018, from http://tourismnov.natm.ru/

- Thirteen new residents have appeared in the Kaliningrad SEZ. (2018). Russian newspaper. (2018). Received May 17, 2018, from https://rg.ru/

- Zimina, N. (Ed.) (2017). Novgorod region in numbers: statistics digest. Veliky Novgorod

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Minin, D. (2019). Investment’sfeatures In Order To Ensure Sustainable Development In The Longterm. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 579-589). Future Academy. https://doi.org/10.15405/epsbs.2019.04.62