Abstract

The emergence of new views on the effective organization of financial control in the financial management system of corporations has required managers to search for new ways to implement control measures. In this vein, the use of accounting and analytical information as the basis for the implementation of financial control allows the manager to control financial flows by selecting key indicators, the analysis of which will allow an assessment of the targeted use of financial resources and lost profits in the event of irrational investment. This article is devoted to the study of the possibility of practical combination of the theory of financial control with the practical aspects of its implementation in the conditions of the volatility of the Russian economy. The article provides a comparative analysis of instruments for the implementation of control measures, which will allow you to select key financial indicators necessary for financial control. The authors identified the functional relationships of the financial and accounting services in the corporation, as a result, it is possible to consider each financial flow as an object of control, synthesize the obtained analytical information on the totality of financial flows and interpret the data in the framework of the expert opinion. Thus, the central problem of the article is the problem of choosing a methodology for the effective implementation of financial control, the solution of which the authors see in its systematic organization based on the choice of key financial indicators and effective interaction of the financial and accounting services.

Keywords: Accountingaccounting and analytical informationfinancial controlfinancial flowsfinancial indicatorsfinancial service

Introduction

The study of financial control in the conditions of the volatility of the Russian economy is of particular importance. The definition of “control points” in the implementation of monitoring of financial and economic activities contributes to improving the quality of corporate finance management. Internal financial control in the Russian economic conditions in parallel carries out two functions. The function of financial accounting based on financial statements and the function of financial administration (Braley & Myers, 2012; Charaeva, 2013). At the same time, the choice of indicators that are used as a tool for financial control (Zhukov, 2014) is important for the reliability and effectiveness of control procedures. The most pressing issue in this direction is the organization of accounting and analytical support and its adaptation for the implementation of the control function in the corporate finance management system.

Problem Statement

In the current economic conditions, the need for a systematic organization of financial control, including the choice of accounting and analytical support as a basis for making management decisions and choosing methods for exercising financial control, is being updated. At the present stage of the study of financial control and information systems to ensure it, insufficient attention is paid to basic information necessary for the analysis of financial and economic activities in the implementation of certain measures of financial control. The reduction in the importance of basic information is comparable to the decrease in the role of financial control as one of the functions of financial management (Zhukov, 2015; Ilyin & Zhukov, 2013). The proposed article presents a methodology developed by the authors to provide basic accounting and analytical information for the corporate finance management process, which includes three stages: information identification; the selection of analytical indicators necessary for objective financial control; organization of information flows between the financial and accounting services in the corporation.

Research Questions

3.1. What information is needed for effective financial control?

3.2. What indicators should be used in the implementation of control measures?

3.3. How to organize the interaction between the financial and accounting services in the corporation to provide the controller with the necessary information?

Purpose of the Study

The study was conducted in three stages, in accordance with the objectives outlined at each stage:

at the first stage – a theoretical study was made of the existing methodological approaches to the implementation of financial control, based on the analysis of research papers on this issue, as well as the theory and methodology for conducting a comparative analysis of the concepts of control measures implementation, including the selection of the necessary analytical information and its correlation with the needs of external and internal users.

at the second stage – problems were identified that limit the effectiveness of financial control from the standpoint of insufficient methodological tools that allow an objective assessment of the effect of financial control, on the basis of which a number of financial indicators were used to effectively implement control measures.

at the third stage – information flows were clarified in the interaction of financial and accounting services in the corporation to provide the controllers with the necessary information.

Research Methods

In the process of research, the following methods were used: theoretical (analysis; synthesis; specification; generalization; analogy method); diagnostic (method of problems and tasks); empirical (the study of regulatory documents and the experience of Russian enterprises in managing their own capital); experimental (stating, shaping); methods of graphing images of the results. Each of the methods was used in accordance with its functionality, which made it possible to substantiate the research results and to ensure the reliability of the conclusions and provisions.

Findings

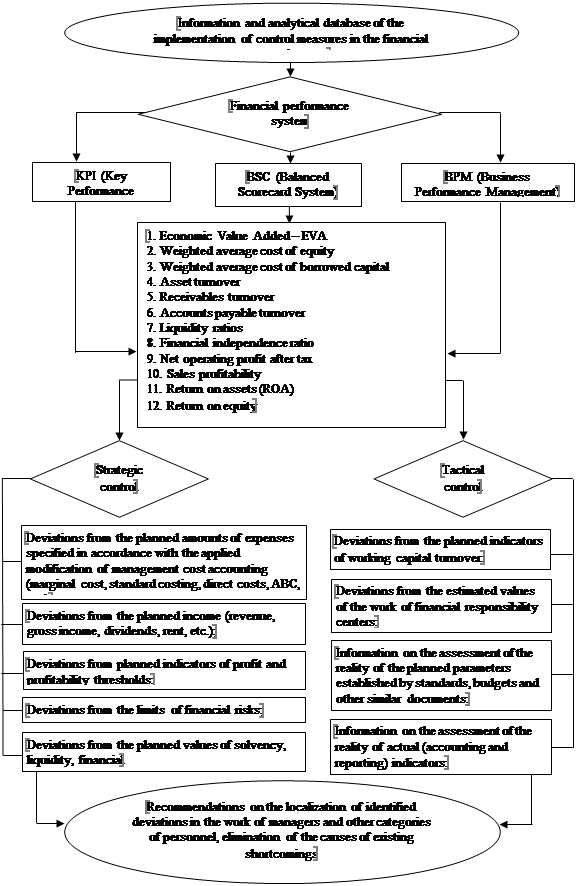

For effective financial control of the subject of financial and economic activity, it is necessary to formalize the concept of information resources used within its framework. It is proposed to understand such resources as analytical information, which is a complex of information that reliably characterize the state of financial management objects required for confirmation, coordination and rationalization of management decisions. The content of analytical information in the context of implementation with the regulatory role of financial control is dictated by the significance of the goals set and the time allotted for their achievement. For the organization of accounting and analytical support and its adaptation for the implementation of the control function in the corporate finance management system, a structural-logical model of financial control at the strategic and tactical levels is proposed (Figure

The information and analytical base for the implementation of control measures in the financial control system is formed on the basis of management and accounting data.

Based on the information and analytical database, the system of financial indicators is calculated by systems KPI, BSC, BPM.

Key Performance Indicators (KPI) were first proposed by D. Parmenter and are indicators that allow to objectively determine the degree of efficiency of the business process. The logic of the formation of KPI is subject to a number of requirements: objectivity, ease of calculation, regularity and high frequency of measurements, attainability of the planned KPI value (Parmenter, 2009).

Balanced Scorecard (BSC) was first proposed by Kaplan and Norton (Kaplan, 2006). Then, it has been developed in the works of Sveiby (1998) and Edvinsson (2000). It is a strategic management tool based on measuring a set of indicators characterizing all aspects of an enterprise’s activities (financial, production, logistics, sales, investment, management, etc.). As part of this tool, the goals of the company's strategic development and its operations are integrated into a single system (Rodov, 2002).

Business Performance Management (BPM) is a method of rationalizing the process of implementing a general development strategy for an economic entity and consists of a complex of analytical and cyclical processes that take into account financial and operational information. The use of this technique allows to formalize the performance indicators of the company aimed at achieving the goals set by the general strategy of the company. The most important financial aspects in managing business performance are planning, consolidation and reporting, analysis of key performance indicators and their distribution within the organization (Gens, 2005).

Based on the calculations made, deviations of the normative values of the control financial indicators of the strategic and tactical level are determined, recommendations are given on localizing the identified deviations in the work of managers and other categories of personnel and eliminating the causes of the existing shortcomings.

Conclusion

The proposed structural-logical model of financial control at the strategic and tactical levels allows the management to focus on key points of meeting the goals and objectives of the company's financial strategy, as well as combine the functions of accounting (financial) and the financial management function of companies by applying a system of key performance indicators, balanced scorecard system and business performance management system, thus synchronizing information flows of accounting and analytical support to improve the implementation of control function in corporate finance management.

References

- Braley, R., & Myers, S. (2012). Principles of corporate finance. Moscow: Olymp Business.

- Charaeva, M. V. (2013). Management of cash flows of the enterprise on the basis of their distribution by functional basis. Finance and credit, 41, 36-41.

- Edvinsson, L. (2000). Some perspectives on intangibles and intellectual capital. Journal of Intellectual Capital, 1(1), 12-16.

- Gens, G. (2005). Business performance management. Business Performance Management Concept. Moscow: Alpina Publisher.

- Ilyin, V. V., & Zhukov, V. N. (2013). Current trends in corporate finance management. Financial analytics: problems and solutions, 32, 11–17.

- Kaplan, S. R. (2006). Balanced scorecard. Moscow: Olymp Business.

- Parmenter, D. (2009). Key performance indicators. Moscow: Olymp Business.

- Rodov, Ph. L. (2002). FiMIAM: financial method of intangible assets measurement. Journal of Intellectual Capital, 3(3), 323-336.

- Sveiby, K. E. (1998). Wissenskapital. Das unentdeckte Vermögen. Landsberg/Lech: Verl. Moderne Industrie.

- Zhukov, V. N. (2014). On the subject and method of internal financial control // Financial analytics: problems and solutions, 29(215), 28-32.

- Zhukov, V. N. (2015). The concept and methodology of systemic financial control in the corporation management. Moscow: Infra-M.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Evstafyeva, E., Charaeva, M., Krohicheva, G., & Kiryanov, E. (2019). Account-Analytical Ensuring Of Economic Entities For The Development Of Financial Control. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 167-172). Future Academy. https://doi.org/10.15405/epsbs.2019.04.19