Abstract

In the article, based on the research data from part one, are given recommendations to counter the expansion of shadow economy of the Republic of Dagestan, as well as the withdrawal of the shadow economy of the region into the legal sphere. Dagestan, according to experts, is one of the most corrupt region of the Russian Federation. But the Republic of Dagestan has real tax potential and can become self-sufficient in taking effective actions to legalize the shadow economy and strengthen tax management. Despite certain positive results in tax administration achieved in 2017 within the framework of the priority project of development of the Republic of Dagestan "Whitening of the Economy", they, regretfully, are still rather far from the target. A detailed and comprehensive analysis of the reasons for closing a business is needed, and active work by the authorities and management is needed to understand the negative causes of the Dagestan economy.

Keywords: Regionshadow economysocial and economic system

Introduction

The assessment of the scale of the shadow economy of the Republic of Dagestan is given in the first part of our research, implies elaboration of a set of recommendations to counter the expansion of shadow economy of the Republic of Dagestan; in our opinion, they should be considered in implementation of measures to legalese the shadow economy of the region.

Problem Statement

Taking in to account that the problem of the presence and the expansion of the uncontrolled shadow sector of economy is a serious threat of social and economic development to the entire state and its regions, what is clearly reflected in the first part of our research. We consider that it is very important to assess the problem field of existing measures aimed to counter the shadow economy, as well as to propose the author’s point of view on the need to implement such measures in order to legalize the shadow sector of the regional economy (Taran & Sauvov, 2018).

Research Questions

Assessment of the shadow economy of the Republic of Dagestan as a whole and identification of measures to counter the shadow economy of the Republic of Dagestan.

Purpose of the Study

The purpose of the study, which consists of two parts, is to study the shadow component of the regional economy in the Republic of Dagestan and to develop practical recommendations for the conclusion of the shadow component in the legal economic sphere in order to ensure sustainable socio-economic development of the region.

Research Methods

The methodology of the study of the shadow economy of the Republic of Dagestan was based on the use of the method of problem monitoring, the method of comparative analysis and generalization of statistical data, the method of modeling, synthesis of theoretical and practical material, as well as the methodology of grouping and classification in the processing and systematization of information.

Findings

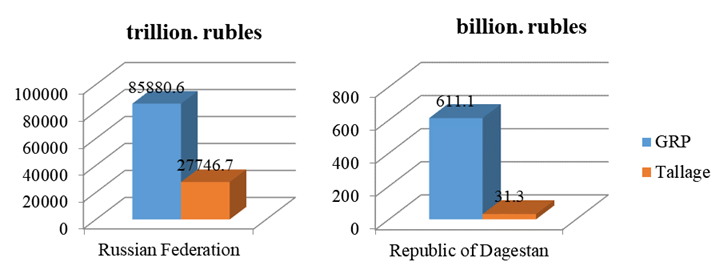

In the Republic of Dagestan many areas are in the shadow mode, which evade paying taxes and non-tax payments (Kuda uhodyat akcizy, n.d.; More than half of Dagestan works illegally, n.d.). Such conclusion of the author is indirectly confirmed by the fact that the share of taxes of the consolidated budget of the Republic of Dagestan (according to the report for 2016) in the amount of GRP is 5.1%, which is 6.3 times lower than the average for the Russian Federation (32.3 %). At the same time, the amount of taxes in GRP is planned assessed at 4.5% under the draft law for 2018, which is at the assessment level of 2017 or below by 2 percentage points to the report for 2016 with a decrease by 2 percentage points to the 2016 report (GRP for 2016 – 611.1 billion). rubles, taxes of the consolidated budget-33.5 billion rubles) (Figure

Based on the above, we can conclude that in such conditions the Republic of Dagestan, at least in the short term for 2018-2019, has no chance to secure a not subsidized budget, and a high share of the shadow economy plays certainly a key role in this. It should be noted that the expert community notes that the Republic of Dagestan has real tax potential and can become self-sufficient in taking effective actions to legalize the shadow economy and strengthen tax management.

In order to counter the expansion of the shadow (hidden) economy in the Republic of Dagestan, an Action Plan was approved by Decree No. 340 of July 4, 2013 of the government of the Republic of Dagestan aimed at implementation of the priority project of the president of the Republic of Dagestan, titled “Whitening of the Economy” (Plan of measures "whitewashing of the economy", n.d.). As a result of implementation of a whole package of relevant measures, directed at increasing tax and non-tax receipts of the budget of the Republic of Dagestan, the volume of tax and non-tax revenues in 2017 against the level of 2012 in absolute terms increased by 10.2 billion rubles, or by 46.7%. At the same time, there remains dependence of the budget of the republic on the federal centre, with the level of the budget subsidizing of the Republic of Dagestan estimated at 56.5%.

Despite certain positive results in tax administration achieved in 2017 within the framework of the priority project of development of the Republic of Dagestan "Whitening of the Economy", they, regretfully, are still rather far from the target (which is bringing out the shadow economy into the legal sphere), as we witness a rather modest growth of the collection rate of taxes and other obligatory payments. This work has to be continued within the framework of implementation of the Programme of financial recovery and social and economic development of the Republic of Dagestan, and also the priority project "Whitening of the Economy". Total checks are necessary in spheres with a low tax load: in construction, trade, etc., and also at alcoholic beverage enterprises reporting slack operation. Sectoral ministries and branch departments, in our opinion, should speed up analytical work with regard to financial and operating performance indicators and to a tax base of enterprises in relevant sectors, bringing the tax load up to the average level across North Caucasus Federal District and Russia, especially in the construction and alcohol production industries; and as regards the budgetary sphere, in terms of increasing the volume of offered paid services.

Dagestan receives the highest number of budgetary transfers among the North Caucasus republics and in terms of receiving such transfers is only second to the Crimea among regions of Russia. The republic basically lives off transfers, and it is clear that they are spent extremely inefficiently. It is also clear that business based on budget money is one of the major sources of shadow income of the elite. One should understand that, unlike in other regions of Russia, there is a certain specific nature of the hidden economy manifestation in the Republic of Dagestan, namely, it is the intertwining of interests of the power and shadow business.

Dagestan, according to experts, is one of the most corrupt region of the Russian Federation. The staff purging currently being conducted in Dagestan is primarily caused by the ineffective spending of subsidies that the republic receives, but how effective these measures will be, how much it will improve the socio-economic situation in the republic - the question is quite controversial.

At the moment, the Head of Dagestan, Vladimir Vasiliev, attaches particular importance to the fight against the shadow economy - he understands how closely the shadow economy is connected with corruption, and all this together leads to social injustice and lawlessness, and ultimately to social discontent in society (The government of Dagestan announced a reduction in the share of the shadow economy to 60%, n.d.).

The head of the republic also understands that the key role in neutralizing the problems of corruption and the shadow economy is played by the “immune system” of society and the state: the law enforcement and security bloc and the judicial system. The report of the Deputy Prosecutor General of the Russian Federation, Ivan Sydoruk, contains alarming notes: corruption in the Republic of Dagestan has become systemic. Russian President Vladimir Putin in March 2018 also spoke about this during his visit to Dagestan. "One of the factors seriously hindering the development of the country is corruption. We know about it. This trouble is not only of Dagestan. The regions in the east, and in the west of Russia, and in the south, and in the north, face this. There is such a problem in the country. And Dagestan also did not avoid this disease. But I am convinced that the republic has all the opportunities to reach a new level of development," the head of state said. In this situation, it is much more important not only to state these and other problems, but to build an adequate strategy and tactics to combat this ailment. And here the key role is played by the decision of the problem of the shadow economy (Putin nazval korrupciyu problemoj ne tol'ko Dagestana, n.d.). However, there is no body in the republic that would deal with the issues of the shadow economy and legalization of the shadow business, since, according to the author, it is the explanatory work, understanding the needs of the business, reducing administrative and other barriers is the key to bringing the shadow economy of Dagestan to the legal sector, although, for the sake of justice, we note that at the moment it is trying to establish a dialogue with the business community in the framework of the priority projects "Whitening of the economy" and "Points of Increase", The Association of Experts and Noncommercial Organization "Unity and Development" organized a meeting with the shoemakers of Dagestan (the "shoemakers" of Dagestan, according to various expert estimates, occupy 20-30% of the market niche of Russian footwear production, production volumes are several billion rubles, and more than 90% in Shadows), the Self-Regulating Organization Association "Builders Guild of the North Caucasus Federal District" organized a meeting with the construction business of the republic (experts estimate the shadow component of about 50-60%), the Independent Drivers and Entrepreneurs Union organized a meeting with transport workers appraisal of experts, the shadow component of about 80%), the Dagestan Union of Entrepreneurs and Industrialists met with an active group of entrepreneurs (Taran & Sauvov, 2018).

Conclusion

Information from open sources about the opinions of entrepreneurs, analysts and experts regarding the functioning of the shadow sector of the republic of Dagestan, as well as the own research, allowed the author to draw a number of conclusions:

1. In each industry or sphere of Dagestan’s economy located in the shadow sector there are different models and ways to go into the shadows, of course with common features, but very specific depending on the industry sector. The common problems that the business of Dagestan speaks can include: a lack of confidence in the authorities in Dagestan - big clan corruption; an increase in the fiscal burden on business and the amount of fines for violating laws in all areas, the rise in the cost of licenses and the complication of the very procedure for obtaining a license, the growth of energy tariffs for businesses; an increase in the amount of compulsory insurance facilities and equipment, the administrative burden on the business, especially in the production section - new mandatory requirements for equipping the PLATON system (vehicle charging system - freight transport), tachographs, alarms (alarm, fire, etc.), DVRs, GLONAS (vehicle monitoring), etc. of business objects. Requirements for maintaining documentation - certificates, environmental passports, safety data sheets, fire safety declaration, safety certificates of production and compliance with its State standard, etc. Requirements for staff - training, certification of workplaces, medical examinations, overalls, etc.; administrations of municipalities, in fact, impede business in obtaining real estate for business and land, the difficulty in obtaining permits documentation.

2. To solve the problem of the legalization of the shadow economy, regional authorities should be aware of the scale of the shadow sector is in each individual sector, what is the specifics of going into the shadows, what does not suit the entrepreneur and, accordingly, how to deal with it - where you can "press" and where you need to act carefully with the use of government incentives, the use of public-private partnership tools, etc.

3. For each industry it is necessary to develop its own unique approach to solving problems that are the basis for leaving into the shadow sector of the economy. The development of such approaches should be based and supported by specific statistical data, that is, in our opinion, the statistical accounting and statistical data processing should be conducted in the context of not only industries, but also sub-sectors and fields of activity, including the strict accounting and control of compliance of official statistics in the context of sub-sectors, with the reinforcement of this information by tax revenues on levels of the budget system.

4. It is necessary to change the mentality prevailing in the republic of Dagestan, and it is such that the legal business here has nothing to do: either go into the shadows, in order to keep up with the competitors, or leave the republic. This, in our opinion, leads to a significant decrease in the motivation and prestige of entrepreneurial activity; moreover, there is an outflow of mostly middle-class people transferring business to neighboring regions. It is necessary to change the mentality and controlling bodies. Their main task is to prevent and restore orders and re-checks, rather than immediately "killing" entrepreneurs with maximum fines, because a closed business usually does not stop its activities, but moves from a legal to a shady business.

5. A detailed and comprehensive analysis of the reasons for closing a business is needed, and active work by the authorities and management is needed to understand the negative causes of the Dagestan economy.

6. The main reason for stimulating the shadow economy in the republic of Dagestan, besides the high clan corruption of the government and administration in the republic, paradoxically, is the regional legislation of recent years. Therefore, a mandatory examination of the adopted and existing regulatory acts of the republic of Dagestan is necessary for stimulating the shadow economy.

7. For the entire implementation period, the project of the republic of Dagestan "whitewashing of the economy" was mainly focused on increasing the collection of taxes and non-tax payments, and not on the problems of leaving of a business in the shadow sector, therefore it is necessary to develop a new program to combat the shadow economy in the republic, to focus on the development of regulations acts governing the sphere of economic activity of the population, since if the grey sectors of legal business and shadow sectors are returned to the legislative field, then the financial problems of the republic of Dagestan also will find their solution.

References

- Kuda uhodyat akcizy. (n.d.). Retrieved July 20, 2018, from: http://dagestananticorruption.ru/2018/01/10/куда-уходят-акцизы/

- More than half of Dagestan works illegally (n.d.). Retrieved July 20, 2018, from: https://www.stav.kp.ru/daily/26858.7/3899971/

- Plan of measures "whitewashing of the economy" (n.d.). Retrieved July 20, 2018, from: http://minec-rd.ru/o-ministerstve/prioritetnye-proekty-razvitiya-respubliki-dagestan/plan-meropriyatiy-obelenie-ekonomiki-

- Putin nazval korrupciyu problemoj ne tol'ko Dagestana (n.d.). Retrieved July 20, 2018, from: https://riafan.ru/1034749-korrupciya-yavlyaetsya-problemoi-ne-tolko-dagestana-putin.

- Taran, O. L., & Sauvov, I. K. (2018). Assessment of the impact of regional policy on the effectiveness of counteraction to the expansion of the shadow sector of the economy in the Republic of Dagestan. In Experience and results of economic activity of socio-economic systems, countries, regions, industries and sectors of the economy Proceeding of Materials III all-Russian scientific-practical 2018 conference (pp. 149-154). Pyatigorsk, Russia: Institute of service, tourism and design (branch) NCFU in Pyatigorsk.

- The government of Dagestan announced a reduction in the share of the shadow economy to 60% (n.d.). Retrieved July 20, 2018, from: https://ria.ru/economy/20180719/1524943459.html

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Taran, O., Taran, I., & Adzhienko, V. (2019). Social And Economic Development Of Dagestan And The Shadow Economy (Part 2). In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 1072-1077). Future Academy. https://doi.org/10.15405/epsbs.2019.04.118