Abstract

The article, composed of two parts, is devoted to the assessment of the shadow economy of the Republic of Dagestan. The scientific base was the methods of problem-situational monitoring and control. Taking into account the specifics of the observed social and economic processes in a dynamic and comparative form made it possible to assess the state of both the regional economy as a whole and its individual sectors. On the basis of our collection, processing and analysis of information based on a system of indicators characterizing the state of the shadow economy of the republic of Dagestan, and as a result of the study the authors conclude that the scale of the shadow sector of the republic of Dagestan is very significant. But at the same time the authors note that the republic also has a significant tax potential that can be realized through the legalization of the shadow economy of Dagestan, when transferring the economy of Dagestan into a model of the stable development and the security of the budget self-sufficiency.

Keywords: Regionshadow economysocial and economic system

Introduction

Realizing the fact that the shadow economy is a real threat to the economic development of both individual regions and the country as a whole, it becomes very important to assess its scale. At the same time it should be noted that an objective assessment of the scale and other parameters of the shadow economy is a very difficult task, since the very essence of the shadow economy involves hiding from accounting, control and registration. At present there is no single method of shadow economy assessing, and there is no statistical information which can allow taking into account the size of the shadow sector of the Russian economy to the full extent. However, the shadow economy existence is an indisputable fact that must be reckoned with and the scale of which must be comprehended.

Problem Statement

The presence and growth of the uncontrolled shadow sector of the economy is a serious problem for the socio-economic development of the entire state and its regions. At present there are no generally acknowledged universal methods of studying the shadow economy scale. Under these conditions the need for the formation of a monitoring system of the state shadow economy of the Russian Federation, the development of indicators of its systematic assessment and analysis increases in order to improve the tools and mechanisms to counter its manifestations. In our opinion, only a combination of several methods of analysis of the shadow economy scale will solve the problem of alternative methods of determining the shadow economy scale. In the modern Russian economy the methodology for determining the shadow economy scale should be based on data given by Russian statistics, tax reporting data, as well as materials of various investigations, including sociological studies. And the final stage should be an expert procedure for analyzing and coordinating the information provided.

Research Questions

Based on the analysis of existing approaches to the assessment of the shadow sector of the economy and for the regional monitoring of the shadow economy, it is necessary to systematize the socio-economic indicators of the development of the subject of the Russian Federation and data on trends in the development of the shadow economy in it (Shadow Of Dagestan, n.d.; The shadow economy of Dagestan: size matters, n.d.). This implies the following stages: 1. Analysis of the main indicators of socio-economic development of the Republic of Dagestan; 2. The determination of monitoring objects - the subjects of the shadow economy in the Republic of Dagestan, the identification of growth factors of the shadow economy in the Republic of Dagestan.

Purpose of the Study

The purpose of two parts research is to determine the scale of the shadow economy of the Republic of Dagestan, to develop recommendations to counter the expansion of the shadow economy of the region, as well as the withdrawal of the shadow economy of the region into the legal sphere.

Research Methods

Since the monitoring of the shadow sector can only be evaluative, then our study of the regional shadow economy of the Republic of Dagestan will be based on the use of methods of problem-situation monitoring and control over the objects of the shadow economy, taking into account the specifics of the observed socio-economic processes in dynamic and comparative forms, within the framework of the unified socio-economic system of the Republic of Dagestan (Strategic threats to the economy, n.d.; Taran, Berezhnoy, Berezhnaya, & Churakova, 2017; Taran & Pilipenko, 2015).

Findings

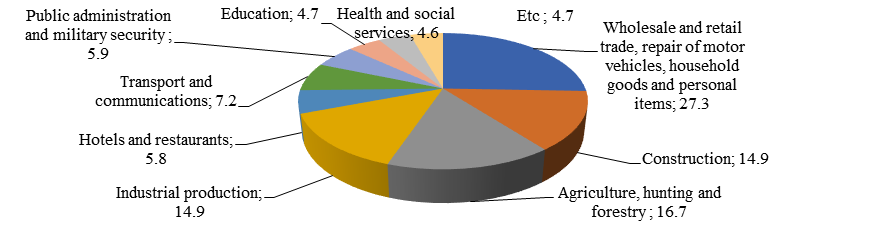

Based on the analysis of the main indicators of social and economic development of the Republic of Dagestan for 2016-2017 and the forecast of social and economic development of the Republic of Dagestan for 2018-2020, it is clear that in the structure of the GRP of the Republic of Dagestan the largest share falls on the areas shown in Figure

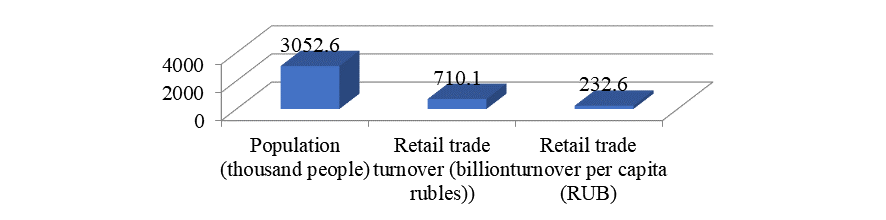

Unfortunately, we cannot clearly identify the contribution of each sector in the shadow economy of Dagestan and place them on the rating, as the official statistics and any account in the context of the regional economy is not conducted, but to judge the contribution of sectors in the shadow economy, it is possible on the basis of available official data. In order to more accurately identify the objects of monitoring-the subjects of the shadow economy of the Republic of Dagestan, we will compare the Republic of Dagestan on individual indicators with the Stavropol region, which is also part of the NCFD and has comparable characteristics for comparison in the structure of the economy, area, population, etc. In the structure of the economy of the Republic of Dagestan, the largest share belongs to such activity as "Wholesale and retail trade; repair of motor vehicles, motorcycles, household goods and personal items", the share of which in GRP is more than 27%. The structure of retail trade turnover is shown in Figure

In the structure of retail trade turnover of the Republic of Dagestan for 2017, the share of food products is 47.4%, non-food - 52.6%.

Dagestan is in first place among the subjects of the North Caucasus Federal district by the volume of retail trade turnover on average per capita, which is understandable, since the population of Dagestan is also in first place among the subjects of the North Caucasus Federal district, but the share of tax revenues for this type of activity remains extremely low and the report (No. 1-MR.) Department of the Federal tax service of the Republic of Dagestan for the year 2016, tax revenues at all levels of budgets by type of activity "Wholesale and retail trade; repair of vehicles, motorcycles, household goods and personal items" amounted to 2263506.0 thousand rubles, which is 6.4 times less than in the Stavropol territory (14551007.0 thousand rubles). For both regions, agriculture is one of the key sectors, however, the volume of agricultural production in the Republic of Dagestan lags behind the Stavropol territory 1.7 times (according to the report for 2016 – 1.9 times).

At the same time, the receipt of taxes at all levels of budgets for the type of economic activity "agriculture, hunting and provision of services in these areas" (according to the report for 2016 – 109754.0 thousand rubles) is 42 times lower than in the Stavropol region (4636585.0 thousand rubles).

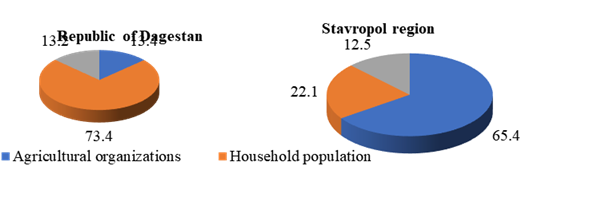

In the total volume of agricultural production, the share of agricultural production is 13.4 % (in the Stavropol region – 65.4 %), peasant (farm) farms – 13.2%, households – 73.4% (in the Stavropol region – 22.1%) (Figure

It should be noted that the volume of agricultural production of the Republic of Dagestan lags behind the Stavropol region in 9.2 times (RD – 15017.8 million rubles, SK – 137973.4 million rubles).

The volume of agricultural production in the Republic of Dagestan for 2018 per capita is planned at a rate of 44.5 thousand rubles, in the Stavropol region at a rate of 84.3 thousand rubles, which is 1.9 times more.

The receipt of taxes in all levels of budgets by the type of economic activity “agriculture, hunting and the provision of services in these areas” is 42 times lower than in the Stavropol region; (in Stavropol region - 65.4%), peasant (farmer) farms - 13.2%, households - 73.4% (in Stavropol region - 22.1%). Such official figures can only indicate that the overwhelming part of Dagestan’s agriculture is in the shadows and, according to our estimates, the share of the shadow sector is about 50-60%.

Other leading sectors of the economy of Dagestan - industrial production and construction, which account for 14.9% of the gross regional product (GRP), also function predominantly in the shadow sector, evading taxes and non-tax payments.

According to experts in the field of industry up to 90% of the volume of production of alcoholic beverages (unlicensed production of wine and vodka products from contraband alcohol, as well as the production of counterfeits under well-known trademarks) is in the shadow sector. This fact is also confirmed by the financial results of 2017, when alcohol excises for the targets were fulfilled by less than 87%. At the same time, within the framework of the adoption of the budget for 2018, a forecast was laid for the collection of excise taxes on alcohol products - 1 billion 372 million rubles (based on the expected sales volumes at current rates). With that, in 2017 they had to collect 1 billion 383 million in the form of "alcoholic" excise taxes. The decline in the forecast in the government of the Republic of Dagestan is explained by the fact that in 2018 the licenses for the production of excisable products of the largest wine and brandy plants in Dagestan – "Izberbashsky", "Derbentsky", "Kizlyar" and others expire; while 14 enterprises of the Republic of Dagestan have the production licenses. Another reason that was discovered in the government is the undervaluation of excise goods on wines and sparkling wines (including champagne) with a protected geographical indication.

As Alexander Khloponin supervising the alcohol industry noted in 2017– "the largest enterprises simply hide part of the products from control. Refusal of the license and bankruptcy of distilleries in the North Caucasus – this is the "technology" of tax evasion. For example, the equipment (production lines) is transported to another enterprise, newly opened, (often with the same physical address). And you can’t even transport this- the plant deprived of a license, just continues to produce finished products, without reporting to anyone. After all, according to documents, the enterprise doesn't work" (Kuda uhodyat akcizy, n.d.).

In the region, according to the data cited by the Ministry of Economy of the Republic of Dagestan, 60-70% of enterprises producing construction materials is in the shadow sector, 90% of the turnover of construction materials, up to 70% of the volume of construction and installation works and more than 90% of construction and repair of housing fall out of the account, and according to the data cited by the Ministry of Economy of the Republic of Dagestan, over 90% of construction, about 70% of capital construction projects have not been commissioned in the region, so only 30% of capital construction objects is taxed , besides the region almost no records the construction in progress, which in general not only distorts the statistical information, but also reduces the tax base.

There are also problems in the fishing industry, according to experts, about 70% of the fishing in the Caspian Sea, caviar production and sturgeon fish is in the shadow economy. There are problems with unlicensed production and sale of petroleum products, shadow production of footwear, fur coats, etc.

Also, the problem of registration and accounting of self-employed individuals, small and medium-sized enterprises for the purposes of taxation looks very important. According to official data, in 2016 the number of small and medium-sized enterprises was 7844 units in the Republic of Dagestan, at the beginning of 2017 50.9 thousand self-employed individuals were registered in the Republic. The small business turnover in 2016 was 203.8 billion rubles, which is 17.7% less than in 2015. This situation also demonstrates the large amount of the informal sector.

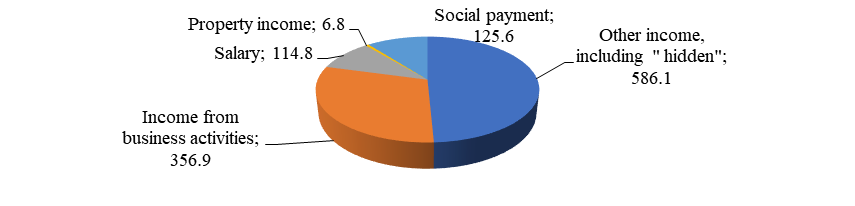

A significant problem is the accounting of employees in the economy and the Wage Tax, as many citizens are employed in the unregistered sector, and their shadow incomes are not taken into account for tax purposes (More than half of Dagestan works illegally, n.d.). Very often, concealment schemes are used — an understatement of official wages.

In the forecast of social and economic development of the Republic of Dagestan for 2018-2020 it is noted, that the cash income of the population will be 1190148.3 million rubles in 2018, while in the structure of cash income of the population, wages is 9.6 % (in 2017 this figure was 9.9%), income from business 30 % (in 2017 this figure was 29.2%) (Figure

The analysis shows that the information provided by economic entities to the statistical bodies, contain incomplete information about the payroll and most of the payroll of the Republic of Dagestan is still in the "shadow" and this despite the fact that in the framework of priority development projects of the Republic of Dagestan ("Whitewashing of the economy", "Creation of points of growth", "New industrialization", "Effective agro-industrial complex ") implemented in the region for more than one year among the main tasks are the legalization of " shadow wages», monitoring of wages to prevent "grey" wage schemes, ensuring dynamic economic growth and increasing employment ("Whitewashing the economy" - what is it?, n.d.; Whitewashing the economy, n.d.).

Conclusion

On the basis of our collection, processing and analysis of information based on a system of indicators (indicators) characterizing the state of the shadow economy of the republic of Dagestan, and as a result of the study we can conclude that the scale of the shadow sector of the republic of Dagestan is very significant and we fully agree with the estimates of various experts that the volume of the shadow economy of Dagestan varies by industry and field of activity and ranges from 40% to 90%, but at the same time we note that the republic also has a significant tax potential that can be realized through the legalization of the shadow economy of Dagestan, which should be the primary strategic task of the economic policy of the republican authorities when transferring the economy of Dagestan into a model of the stable development and the security of the budget self-sufficiency.

References

- Kuda uhodyat akcizy. (n.d.). Retrieved July 20, 2018, from: http://dagestananticorruption.ru/2018/01/10/куда-уходят-акцизы/.

- More than half of Dagestan works illegally (n.d.). Retrieved July 20, 2018, from: https://www.stav.kp.ru/daily/26858.7/3899971.

- Shadow Of Dagestan (n.d.). Retrieved July 20, 2018, from: https://dag.life/2017/02/17/tenevoj-dagestan/

- Strategic threats to the economy. (n.d.). Retrieved July 20, 2018, from: https://www.eg-online.ru/article/357986/.

- Taran, O. L., & Pilipenko, D. A. (2015). Analysis of the main parameters of tax revenues of the consolidated budgets of the regions and their differentiation. International scientific publication "Modern fundamental and applied research", 2(17), 99-106.

- Taran, O. L., Berezhnoy, V. I., Berezhnaya, O. V., & Churakova, M. M. (2017). Asymmetry and spatial polarization of regional socio-economic systems development: monograph. Moscow: Publishing House: Rusyns.

- The shadow economy of Dagestan: size matters. (n.d.). Retrieved July 20, 2018, from: https://chernovik.net/content/politika/tenevaya-ekonomika-dagestana-razmer-imeet-znachenie

- Whitewashing the economy (n.d.). Retrieved July 20, 2018, from: http://мо-кизилюрт.рф/obelenie-ekonomiki.

- "Whitewashing the economy" - what is it? (n.d.). Retrieved July 20, 2018, from: http://priord.ru/index.php/smi/item/8-obelenie-ekonomiki-chto-eto.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Taran, O., Taran, I., & Adzhienko, V. (2019). Social And Economic Development Of Dagestan And The Shadow Economy (Part 1). In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 1065-1071). Future Academy. https://doi.org/10.15405/epsbs.2019.04.117