Abstract

The behavior of dividend policy is one of the most debatable issues in corporate finance literature and still keeps its prominent place both in developed and emerging markets. This paper compares the evolution of banking dividend policy in Russia and China. The purpose of the work is to develop recommendations for improving the dividend policy to ensure the stable development of companies and increase their value based on comparison of the best Russian practices. The article examines the need for a sound and effective dividend policy of a bank. The author identifies a number of features characteristic of modern Russian banks. The point out that a key element in the bank's dividend policy is the proportion between the part of the profits channeled to the reserve funds for the purpose of development and the one of dividend payments. The authors also identify a number of factors affecting this ratio. Considering that banks are subject to monitoring and surveillance of regulator about their operation and riskiness in addition to the pressure form capital market, dividend policy of banks would be more closely associated with their riskiness than other types of industries. The research design was based on banks. Future researches can be carried out on other financial institutions in Russia and China (also can be included other countries of BRICS).

Keywords: Dividend policybanking sectorfinancial institutionsRussian economyChinese economy

Introduction

Dividend payout policy is one of the most debated topics in the corporate finance. The profits generated by the bank are distributed for investment and consumption purposes in accordance with the dividend policy. The term "dividend policy" is associated with the distribution of profits in joint stock companies. In a broader sense, the term "dividend policy" can be understood as a mechanism for the formation of the share of profits paid to the owner, in accordance with the share of his contribution to the total amount of the company's own capital. Based on this, the notion of dividend policy can be formulated as the following: dividend policy is a mechanism for the formation of own investment resources, ensuring the optimization of the proportions between consumed and capitalized by its parts in order to maximize the market value of the enterprise (Ahmadulina, 2017; Baker, 1985)

Despite the abundance of publications devoted to this topic, both in Russia and abroad, the situation has not changed since 1976, when F. Black stated that “the harder we look at the dividend picture, the more it seems like a puzzle”.

There are many theories and empirical evidences, and each theory has its own opinion on dividend distribution. There is no the only correct opinion so the issue is still unresolved and open for further discussion.

Dividend is the distribution of earnings shareholders gain from the company. The dividend policy of a company depends on its development plan and the shareholders’ trade-off analysis between the immediate interests and the future development of the company. Dividend policy is a very important decision of listed companies because it plays a vital role in the operation and development of the company. Reasonable dividend policy can set up a good image for the company, attract more investors, and provide financial support for the development of the company. Therefore, when making the dividend policy, the listed companies usually have a comprehensive consideration, so as to choose an appropriate dividend policy for the development of the company (Gurianov, 2015; Kogdenkov, 2017).

Problem Statement

This work examines the theory of dividend distribution in the banking and also gives Russian and Chinese examples of the most important banks of these countries.

Research Questions

There are various approaches to analyzing the propensity of managers to pay dividends. Dividend policy that implies large payouts to shareholders leads to a decrease in free cash flow and can be aimed at inefficient projects with a negative net present value. However, some managers to smooth out conflicts with shareholders use dividend policy. Managers may not be inclined to reduction of dividends, but rather - to maintain them on a certain stable level. They are even ready to resort to external borrowing to support the payment of dividends to avoid any conflicts (Boytsun, 2018).

Finance specialists both in Russian and in China have made a detailed study of the dividend policy influence factors (Chemizov, 2016; Theis, 2009). They have highlighted three main groups of dividend distribution theories.

First group is headed by Miller and Modigliani. They suppose that the profit distribution by a company does not affect the company´s market value. Shareholders will receive at least the same amount through the increase of their share’s value in the market with the condition that the profits are not been distributed but reinvested in the company. In fact, every dollar paid today in the form of dividends reduces the amount of retained earnings that can be invested in new assets, and this reduction should be offset by the issue of shares. In this theory it is supposed that the investors´ behavior is rational.

The second group of researches is leaded by Gordon. In the theory the profit distributed by a company would reduce its investor’s uncertainty. According to this theory, rational investors would prefer to receive their share in the company’s profits today than to wait some gains in future. There is an assumption that dividend payments minimize the Agency Conflict. It can be explained by the fact that they reduce the free cash flow under the manager’s disposal. According to the agency theory of dividends, the payment of dividends is one of the measures for managers to control behavior of agents. It is proposed that by inducing external monitoring, dividends can reduce agency costs. However, the transaction costs associated with raising external funds would be increased. Agency costs are defined as the loss to shareholders of controlling agency behavior, through measures taken by them and by managers as well as the costs from any agency behavior that has not been controlled. The agency cost theory suggests that, dividend policy is determined by agency costs arising from the divergence of ownership and control. Managers may not always use a dividend policy that maximizes value for shareholders, but they definitely choose a dividend policy that maximizes their own private benefits. Thus, it should be carefully examined that managers maximize the wealth of shareholders rather than use the funds for their private benefits. As a result, dividend payments would have a positive effect in the company’s market value.

In the oppose to that, we have the third group of thought, based in the studies presented by Brennan. Their studies show that given the same risk level, investors require a greater return as the dividend rate paid by the company increases. The Pecking Order Theory is a good combination of the capital structure with the dividend policy theories. Under this theory, the managers would prefer to finance their investments with internal sources of capital (profit reinvestments). It is reasonable because they are not subjected to external monitoring by the market. When they need outside funding, they would prefer to issue debt instead of equity, to avoid the risk of the company being under valuated by the investors. The Signaling Theory makes connection between the dividend policy and the information asymmetry. Signaling theory is based on the assumption that the value of a dividend per ordinary share in circulation affects its market value. At the same time, an increase in the level of dividends causes a corresponding increase in the market value of the share, as a result of which shareholders receive:

1) increased interest income (in the form of dividends);

2) increased earnings from the increase in the market value of shares.

The increase in the level of dividends signals to existing and potential shareholders that the company is working successfully and is counting on an increase in profits in the future period.

The signaling theory assumes a high transparency of the securities market, due to which promptly obtained information about dividends affects the market value of shares. Moreover, the dividend policy is strongly related to the investment policy.

For the Residual Dividend Theory, the company makes better to its shareholders when it holds profits and invests them in opportunities with a better relationship risk and return than the investors could get investing by their selves.

There are other theories that are popular for some industries. For example, the theory of minimization of dividends (tax preferences) is based on the assumption that the effectiveness of the dividend policy is determined by minimizing tax payments on the distributed part (in the form of dividends among shareholders) and capitalized part. The cost of tax payments in the current period exceeds the cost of tax payments in a future period, since with time money changes (decreases) its value. In this regard, it is advisable to reduce the number of dividends in order to reduce tax payments on them and increase the amount of the capitalized portion of the profits in order to increase future tax payments on them, the cost of which will decrease with time. Thus, the total expenditure on the payment of taxes is significantly reduced. The clientele theory is based on the assumption that dividing-up policies are influenced by the preferences of the majority of shareholders. If most shareholders prefers:

1) the payment of dividends, most of the net profit is sent on the payment of dividends;

2) capitalization, most of the net profit is directed to capitalization.

Shareholders who disagree with the decision of the majority can sell their shares and invest the funds received in the activities of other enterprises.

It should be noticed that no model offers a universal rule for the implementation of dividend policy in practice and does not allow an unequivocal conclusion about impact of the implemented model on the value of the company.

In world practice, there are the following types of dividends:

- regular dividends paid on a periodic or permanent basis;

- additional dividends, for example, in the case of obtaining super profits in the period;

- special dividends (additional one-time dividend payments);

- liquidation dividends paid in case of liquidation of the enterprise.

In most countries, the law allows one of two schemes for dividend payment- dividend payment may be paid either only from profit (profit of the reporting period and retained earnings of previous periods), or profit and equity income. For example, in the US and the UK there are three rules directly related to dividend policy: the rule of net profits, the rule of non-erosion capital and the rule of non-insolvency. According to the first rule, dividends can be paid only from current and past profit. However, interpretations of this rule in the US and the UK are different (Weigand, 2013). So according to British company law share premium enters in the number of undistributed reserves and cannot be used to pay dividends; in the US there is no such limit. The second rule closely corresponds with the first: it is forbidden the payment of dividends at the expense of authorized capital (the result of multiplication of the nominal value of shares and the number of shares outstanding). According to the third rule, the company cannot pay dividends, if it is insolvent (under insolvency refers to the situation when the amount of liabilities to creditors exceeds the value of real assets).

Dividends can be paid in various forms:

- cash payments;

- automatic reinvestment (using part of the joint-stock company's profit received by shareholders in the form of dividends to replenish the company's capital; one of the forms of profit capitalization);

- payment of shares;

- stock split;

- repurchase of own shares.

The information about the dividend policy of companies is closely monitored by analysts, managers, brokers. Failure to pay dividends and any undesirable deviations from the current practice in the company can lead to a decrease of the company’s shares. Therefore, a commercial organization is often forced to maintain its dividend policy at a fairly stable level, despite some possible fluctuations on the market. The degree of stability of the dividend policy for many inexperienced shareholders serves as a kind of indicator of the success of the company.

At the global level, banking regulation is based on a policy defined by the Basel Committee on Banking Supervision. This Committee, established in 1974 by the leaders of the Central Bank from the G8 countries, contributes to a discussion forum on topics that are aimed at improving the quality of banking supervision. The capital clause required to cover the risks to financial institutions is gradually determined by the Basel Committee. Increased risk control could have a definite impact on the distribution of profits by financial institutions, since new standards for capital requirements limit their financial leverage. Banks have to increase their capital if they want to have more operations, as their risks will increase. A company could increase its capital in two main ways: by reinvesting profits instead of distributing them to shareholders or by raising capital from new or existing investors. According to the Pecking Order Theory, the first would be preferable.

Purpose of the Study

The purpose of the work is to develop recommendations for improving the dividend policy. This should ensure the stable development of companies. The Dividend Policy of Russian banks has been developed in accordance with applicable legislation of the Russian Federation, recommendations of the Corporate Governance Code approved by the Bank of Russia, Bank's Articles of Association and internal regulations. The main purpose of the Policy is to provide shareholders and stakeholders with the maximum possible transparency to make optimum decision on the declaration of the dividends, dividend amount, and payout procedure. The dividend policy defines the company’s approach for the Bank General Shareholders' Meeting regarding profit distribution, including dividend payout. The Bank Dividend Policy should be based on achieving a balance between the interests of the bank management and the interests of its shareholders when determining the dividend amount.

Conditions for dividend payout to the Bank's shareholders are as follows:

positive net profit of the Bank over the reporting fiscal period;

the absence of restrictions on dividend pay-out stipulated by applicable legislation of the Russian Federation;

zero retained loss for the previous periods;

decision of the Bank's Board of Directors regarding the number of dividends on shares in each category (type) recommended to the General Shareholders' Meeting;

decision of the Bank's General Shareholders' Meeting to pay out (declare) dividends.

The Bank can make relevant decisions on the payment of dividends in accordance with its results in the first quarter, first half, nine months of the financial year and / or in the financial year. The decision to pay dividends (issue of the declaration) is made within three months after the end of the relevant period.

Research Methods

In their research the authors have used classical methods of integrated and system analysis as well as specific research methods: the concept of comparative analysis that enabled to examine the correlation of key financial results and dividend payments.

Traditionally emerging markets are not considered by investors as a source of current income (dividend). However, a comparative analysis with developed markets shows that dividend yield for a number of industries in developing countries is attractive for investors.

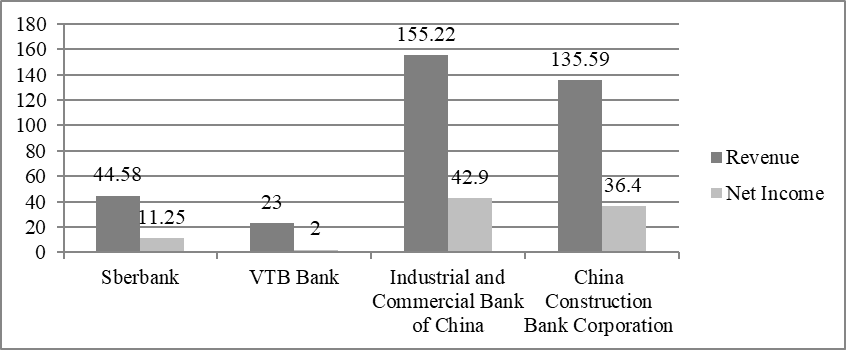

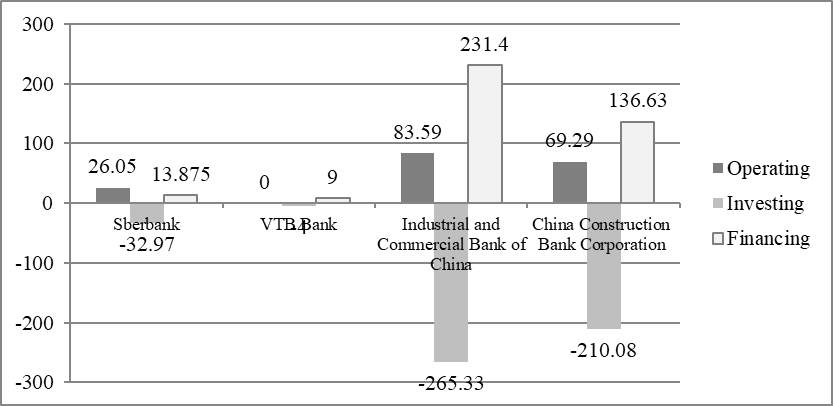

There are four banks in the sample: Industrial and Commercial Bank of China, China Construction Bank Corporation, VTB Bank, Sberbank. All these banks have leading role in their countries and their positions are strong on the market.

It is important to stress some features of the dividend policy of modern Russian banks:

impossibility to form a long-term stock policy;

unwillingness of not only small, but also large shareholders to minimize dividends in order to increase the financial capacity of the bank;

systematic use of special schemes that allow minimizing the amount of official, therefore taxable dividends.

The dividend policy of the should be based on the following basic principles:

- Transparency, which implies the determination and disclosure of information about the duties and responsibilities of the parties involved in the implementation of the Dividend Policy, including the procedure and conditions for making decisions about the payment and the number of dividends;

- timeliness, which implies the establishment of temporary boundaries in the implementation of dividend payments;

- reasonableness, which implies that the decision on the payment and the number of dividends can be made only if the Bank achieves a positive financial result, taking into account the development plans of the Bank and its investment program;

- justice, which means ensuring the equal rights of shareholders to receive information on the decisions to be made on the payment, the amount and procedure for paying dividends;

- consistency, which implies strict implementation of the procedures and principles of the Dividend Policy;

- development, which implies its continuous improvement in the context of improving corporate governance procedures and revising its provisions due to changes in the Bank’s strategic goals.

- sustainability, which implies the Bank's desire to ensure a stable level of dividend payments.

According to the Russian legislation (Article 43 of the Tax Code of the Russian Federation), any income received by a shareholder (participant) from an organization when distributing profits remaining after taxation (including interest on preferred shares) on shares owned by the shareholder (participant) is recognized as a dividend.

It should be also noticed that in many countries, the number of dividends paid is regulated by special contracts in the case when a commercial organization wants to get a long-term loan. In order to ensure the servicing of such debt, the contract, as a rule, stipulates either a limit below which the value of retained earnings cannot fall, or the minimum percentage of reinvested profits. However, in Russia and China, there is no such practice.

In the economic literature, there is one phenomenon that is known as the “stickiness effect” {dividend smoothing). It means that managers change the rate of ordinary dividends only with a serious change in the company's revenue potential. So, a change in this rate is a fairly reliable indicator of that how things will go with the company in the future. In other words, it can be assumed that changes in dividends are a signal that the current profit growth will be steady or not. However, the signal can be interpreted in two ways. For example, a decrease in dividends, on the one hand, can characterize that the company has any kind of trouble and has lack of funds for payments to owners (a direct negative signal). On the other hand, a reduction in dividends may mean that the company has found good investment opportunities, and that the management has managed to overcome the problem of mature companies that cannot find effective use of free cash.

This study was limited to four publicly listed banks in Russia and China. Therefore, the findings of this study can only be generalized to other companies in banking. To evaluate the management’s dividend policy and compare these four banks, we have examined their annual financial reports for the year 2017, data from Reuters and Bloomberg.

Findings

As we see in the table

Because of greater volumes of cash flow, Chinese banks show greater figures of Revenue and Net Income. The same situation can be seen in cash flow statement of the examined banks.

It is worth to note that the situation with Sberbank and VTB is different. Both banks adhere to the position that the payment of dividends should be calculated on the net profit of the group in accordance with International Financial Reporting Standards (IFRS), and not under Russian Accounting Standards (RAS). However, if VTB has a very different profit in RAS and IFRS, then Sberbank's results usually coincide.

In addition, banks have different dividend policies. At VTB, it is not limited to a specific period and provides for the payment of dividends in the range of 10-20% of group profits under IFRS. Last year, VTB allocated for dividends 15% of net profit under IFRS, or 15 billion rubles.

Comparing the dividend payments for the year 2017, the management should consider the bank’s profitability, indicators such as ROE and ROA, pattern of past dividends and investment opportunities (fig. 2).

Source: data calculated by the authors from web-site https://www.bloomberg.com.

Conclusion

This research has provided the better understanding of profit distribution. The efficient management of dividend policy is an important task. The aim of dividend policy is to increase the bank's own capital. During the work it was revealed that each bank has its own dividend management strategy. The results of the study show that commercials banks should consider some important indicators: their profitability, shareholder’s expectations, pattern of past dividends, tax position of shareholders, investment opportunities, capital ownership structure and access to capital markets. Moreover, the authors also recommend carefully consider the financial needs of the firms when designing the dividend payout policy. It is vital to recognize the importance of retained earnings as means of financing the company’s investment decisions of. Besides, when the company faces the question of the payment of dividends, the management should make sound decisions on whether to pay cash dividends so as not to create liquidity constraints in the companies. In a developed market, an important task for banks is to develop a stable dividend policy. When the share of dividends is maintained at a relatively constant level, investors consider them as fairly stable incomes and the bank looks more attractive to them.

The decisive factor affecting the bank’s management decision on an acceptable share of profit retention and dividends is the planned growth of assets. A bank cannot prevent an excessive decrease in the ratio of equity to total assets. In other words, it is necessary to calculate how quickly the bank’s profits should grow in order to ensure a constant ratio of equity to assets, if the bank continues to pay dividends to its shareholders at a fixed rate.

The research design was based on banks. Future researches can be carried out on other financial institutions in Russia and China (also can be included other countries of BRICS). The study limited itself to the banking sector, future research can be carried out and include other industrial sectors in the study and other countries. Future studies should focus and compare on relationship between dividend payout and market value of a firm for longer periods.

References

- Ahmadulina, A. (2017). The effect of dividend payments on the value of the company. Economy and entrepreneurship, 2, 828-831.

- Baker, H. (1985). A Survey of Management View on Dividend Policy. Financial Management, 4, 78-84.

- Boytsun, A. (2018). Corporate conflicts: conflicts between managers and owners (shareholders). Alley of science, 4, 347-349.

- Chemizov, O. (2016). Investigation of external factors influencing the dividend policy of the bank. The view of the young people on the problems of the regional economy, 21, 218-222.

- Gurianov, P. (2015). Dividend policy and major shareholding profitability. Metallurgical and mining industry, 7, 101-106.

- Kogdenkov, V. (2017). The methods of analysis of distribution policy of the company. International accounting, 16, 948-961.

- Theis, J. (2009). Explanatory Factors of Bank Dividend Policy: Revisited. Managerial Finance, 6, 501-508.

- Weigand, R. (2013). The recovery of US commercial banking: an analysis of revenues, profits, dividends, capital and value creation. Banks and bank systems, 3, 73-85.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Shchurina, S., & Prunenko, M. (2019). The Dividend Policy For Banking Sector: Examples Of Russian And Chinese Banks. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 990-1000). Future Academy. https://doi.org/10.15405/epsbs.2019.03.99