Abstract

The purpose of this study is a critical analyze of the current practice of Russian companies in the preparation of non-financial reports to identify factors that can contribute to the development of integrated reporting methodology. Based on the review of different approaches to the conceptual presentation of integrated information, a number of serious problems have been identified that prevent the spread of non-financial reporting, in particular, the high costs of collecting, interpreting and presenting large amounts of reporting information, the predictive difficulties in calculating targets for a long-term perspective period, the imbalance of information interests of various stakeholders. The analysis of the practice of integrated reporting in Russia revealed the structure of reporting companies, taking into account the scale of business and industry. The transparency of non-financial reporting of the largest oil and gas corporations was analyzed, the General condition of which indicates the need in the development of the Institute of verifiability of non-financial reports. To improve the reliability of integrated reporting, some measures to form a unified information base of company development ratings in the form of an Internet portal, where stakeholders will be able to immediate search and compare integrated information about companies were proposed. The structure of non-financial information reporting recommended for Russian organizations has been developed, the use of which will improve transparency and investment attractiveness.

Keywords: Integrated reportingnon-financial statementsfinancial statementsstrategic statementsstockholderstransparency

Introduction

The development of economic relations, globalization and total digitalization processes lead to serious changes in the specifics of the functioning of business entities, including the conceptual presentation of financial and non-financial information in reporting.

Prerequisites for the emergence and development of integrated reporting

Until the 1970s, the disclosure of information about the company's activities in the financial statements was carried out solely on the basis of the characteristics of its property status, features of the formation of results of activity, cash flows and changes in capital. It was only during the wide dissemination of new economic theories in some countries in which the process non-financial information disclosure to users of reporting in terms of the most important management, social, environmental and other issues was observed. Thus, the growth of stakeholders information needs in connection with the globalization of processes and the emergence of institutional investors as their special category led to increase of the importance of integrated information about the features of the activities of business entities disclosure not only in terms of the financial component, but also from strategically important non-financial parties (Efimova, 2013). This change in the conceptual presentation of financial statements was caused, first of all, by a change in the business guidelines from maximizing profits from financial and economic activities to increasing its value, taking into account the strategic aspects of doing business (Roshektaeva, 2016).

In addition, as modern practice shows, the financial statements of a business entity do not always contain information that systematically reflects the real situation of the company and the conditions of its work (Plotnikova & Plotnikov, 2014; Adams, 2015). The global financial crisis of 2008-2009 proofed that even the reporting of the global market leaders, the validity of which was confirmed in the course of the audit, is not always possible to create full strategic picture of the condition of the company and prepare a realistic forecast of its development (Chamonin, 2014). The global financial crisis that has become a powerful impulse for the integrated reporting system development, clearly demonstrating that one of the key causes of the crisis is the serious information insufficiency of financial reporting for stakeholders decision-making (Carroll, 2015).

Contemporary level of the financial statement development

In the current economic situation, it is necessary to disclose in the reporting the essential features of the functioning, in particular, the description of the company's social policy and the system of labor protection, the corporate program of environmental safety and the procedure of resource-saving technologies implementing, the current system of key risks of the business entity and other strategically important aspects of activity (Brown & Dillard, 2014). These circumstances are caused by the fact that the importance of business social responsibility has increased, that why reference point has changed from maximizing profits to the target growth of the company's value not only due to positive financial indicators, but also on the basis of contribution in the creation of a favorable social climate, improving the quality of life of the population by creating jobs and developing the potential of personnel sparing natural resources (Getman, 2014). Thus, the value of the information presented in the integrated reporting is the possibility of a comprehensive assessment of the business entity and the formation of a reasonable opinion on the balance of interests of its stakeholders.

The low level of transparency in financial statements of a significant part of Russian companies and the weak degree of its integration in many areas cause serious damage to the country's economy because of the reducing of investment attractiveness and low competitiveness of subjects and industries in general (Kolk & Tulder, 2010). In addition, one of the key challenges to Russia's scientific and technological development is the increasing pressure of anthropogenic factors on the environment and the problems of natural resource scarcity. That is why the development of a reporting system integrated on the basis of financial, managerial, social, environmental and other relevant information is becoming popular among Russian economic entities (Morros, 2016).

Thus, against the background of the observed global need to increase the information openness of business activities, the presentation of integrated reporting and the growth of its transparency is one of the primary tasks nowadays.

Problem Statement

In the current economic realities, there is a need to develop the methodology of integrated reporting, which involves structuring and improving approaches to the collection, accumulation, systematization of non-financial information and its disclosure, as well as a possible revision of the order of presentation of financial indicators to best reflect the current and future state of the business entity.

Relevant issues of integrated reporting: purpose and indicators composition

In the formation of integrated reporting, a significant part of the researchers comes from the understanding of the financial component as a leading corporate responsibility, which determines the possibility of the company's sustainable development (Kurochkina & Novozhilova, 2016). But there are other important factors, the impact of which cannot be excluded: the environmental component of activities, motivation and development of employees, the use of innovation, risk management, concern for reputation, the size of the occupied market share, etc.

Specialists of the consulting company "Ernst & Young" (2014) as a result of the study of factors influencing on the increase of the business value, identified financial and non-financial drivers, as well as generalized indicators, including a list of indicators. In addition, the report of "Ernst & Young" on integrated reporting structured elements of the company's value, forming its strategic potential: brand reputation, social policy, environmental marketing, external factors, business sustainability and the scope of risks associated with occupational diseases and environmental conditions affecting the health of employees.

Carroll (2015) highlights the long-term vision of business strategy as a basis of business and reporting. Thus, we can come to the conclusion that the presentation of forecast indicators in the integrated reporting is necessary, but for this purpose it is necessary to evaluate not only financial, but also non-financial indicators for the future.

In addition, integrated reporting allows the disclosure of significant aspects of the company's activities, in particular, the significant risks inherent in it, so that investors understand what aspects of the activities require innovation and additional funding (Chamonin, 2014).

The increasing interest of stakeholders as an important aspect of the development of integrated reporting

The next important aspect is that integrated reporting should take into account the balance of interests and information needs of key stakeholders (Simnett & Huggins, 2015). At the same time, specialists involved in the cycle of integration of information indicators and their presentation in the form of elements of consolidated reporting have a question about the specifics and depth of information needs of these users (Alekseeva, 2015). In this regard there is a need for the harmonization of relations with stakeholders through dialogues, round tables, questionnaires and other forms of interaction to obtain a complete picture of the required information, characterizing the external and internal business-environment of the company, as well as for the formation of the balance of their interests.

World practice shows that integrated reporting is a popular tool to attract attention to the company's activities. At the same time, companies spend much time, labor and financial resources on the preparation and presentation of integrated reporting. Therefore, relevant question of rationalizing the amount of the costs on its preparation. In particular, it is proposed to revise the approach (Eccles, Krzus, & Ribot, 2015) to the formation of integrated reporting, conceptually forming it as a set of assessments of the financial component of the company through the prism of ethical considerations, social and environmental responsibility of business.

Thus, the results of studies of domestic and foreign scientists demonstrate serious differences in the fundamental aspects of the integrated reporting methodology. In the activity of companies in the preparation of non-financial reporting there is a confrontation of the desire to comply with the global trend of volume disclosure of non – financial information and focus on the formation of high-quality information product-transparent integrated reporting that allows you to reliably illustrate the totality of financial and non-financial characteristics of the business model for a comprehensive assessment of the potential of the economic entity.

In addition, integrated reporting allows the disclosure of significant aspects of the company's activities, in particular, the significant risks inherent in it, so that investors understand what aspects of the activities require innovation and additional funding.

Research Questions

In accordance with the identified insufficiency in the formation of a categorical position on the methodology of integrated reporting in this study, the following questions were formulated:

What does the experience of Russian companies in the field of integrated reporting practice demonstrate?

What factors will contribute to the development of an integrated reporting methodology?

Purpose of the Study

The aims of current research:

To analyze the practice of integrated reporting in Russia.

To identify the factors contributing to the development of the methodology for the preparation of integrated reporting.

Research Methods

Research hypothesis formulation

Kurochkina & Novozhilova (2016) note in their work that the interest in the non-financial aspects of the companies originated in the last century, however, the first prototypes of integrated reports were prepared by economic entities of Europe in the 70-s of the XX century. In Russia, the first milestone in the emergence of prerequisites for such reporting was the beginning of the 2000s. In the future, the financial crisis of 2008-2009 served as a serious factor that gave impulse to the development of the integrated reporting methodology in Russia, after which the number of companies forming integrated reporting increased significantly. March 30, 2012 was published Directive No 1710p-R13 of the Chairman of the government of the Russian Federation Vladimir Putin, which has established the need for the regular publication of non-financial reports of 22 companies with state participation. In 2017, the order of the government of the Russian Federation of 05.05.2017 No 876-p approved the Concept of development of public non-financial reporting and action plan for its implementation, detailed to 2023 inclusive. Thus, in Russia the process of integrated reporting development is slower than in the world practice, as evidenced not only by the number of non-financial reports, but also by low public activity in this area, which requires research in a number of areas.

Size and industry branch of the company

For companies of different business scales, the importance of integrated reporting varies (Churet & Eccles, 2014). Primarily, reports on sustainable development activities, annual and environmental reports compiled in the Russian practice are considered by financial capital providers as an additional competitive advantage. Therefore, for the large scale of business, the most of the companies will be interested in systematic disclosure of information about its activities to increase investment attractiveness. At the same time, due to the increased importance of extractive industries in the Russian economy, it can be assumed that the main share of the submitted integrated reports falls on the share of companies from this sphere (Cheng, Green, Conradie, Konishi, & Romi, 2014).

In addition, the preparation of integrated reports requires significant financial resources from companies, in particular, to collect information, attract qualified specialists in the field of data analysis and presentation of non-financial reports. Small and medium-sized businesses in Russia in most cases do not have sufficient financial resources to form such reports.

H1: integrated reporting Is of great interest to large enterprises, mainly in the extractive industries.

Transparency of integrated reporting

In 2013 the Russian regional network for integrated reporting examines the reports of Russian corporations on the subject of transparency in corporate reporting. The main objectives of this public organization are: assessment of corporate information openness of the largest economic entities of the Russian Federation, selection of best practices for the implementation of the concept of corporate transparency, including disclosure through reporting mechanisms, ranking of economic entities by levels of corporate transparency.

At the same time, despite the significant costs of many Russian companies for the preparation of integrated reporting, the reports themselves remain too voluminous and information overloaded, while they are not always transparent to the user.

H2 Integrated reports of Russian companies are not always transparent.

The growth of the need for verifiability of non-financial reports

Ensuring the quality control of public non-financial reporting is one of the key factors in its development in terms of improving the quality of disclosed data in order to increase the confidence of stakeholders and improve internal processes. The question arises as to the verifiability of integrated reporting, in particular, whether an audit or any other verification is needed, as well as confirmation of a non-financial report, especially given the ever-growing volume of information. In international and Russian practice, depending on the subject, both internal quality control of public non-financial reporting and independent external evaluation of public non-financial reporting can be applied, which can be carried out at the initiative of the reporting organizations themselves or at the initiative of a third part.

H3: it is necessary to form the Institute of verification of non-financial reports.

Factors determining the structure and composition of integrated reporting indicators

Companies that produce non-financial reports face a serious problem to combine the requirements of the numerous integrated reporting guidelines with the needs of stakeholders, while doing so with a rational amount of costs for the collection and preparation of information. Obtaining a holistic view of the prospects of the economic entity in the long term, the ability to reduce the cost of preparing information to interested users depends largely on the ordering of the structural elements of integrated reporting information. In addition, the modern conditions, when the processing of information is automated, one of the main requirements for information presented in the reporting, it becomes possible to formalize (structuring, division into specific sections) and coding.

H4: the Factors influencing on the content and structure of the integrated reports of the companies have a volatile nature, but the optimization of the cost reporting required structuring of information.

Research methodology

In the process of research the method of chronological analysis, synthesis was applied, modeling and abstraction were used. An analysis of the composition, structure and content of financial and non-financial reporting was also carried out to form an informed opinion on the current practice of integrated reporting and its transparency.

Data collection procedure for the study

The analysis of the composition, structure and content of the reporting of Russian corporations allows to establish the degree of transparency of their reporting, as well as to determine the readiness of the implementation of the practice of integrated reporting in the activities of Russian economic entities. Statistics on the development of reporting in Russia is prepared according to the National register and the Library of corporate non-financial reports.

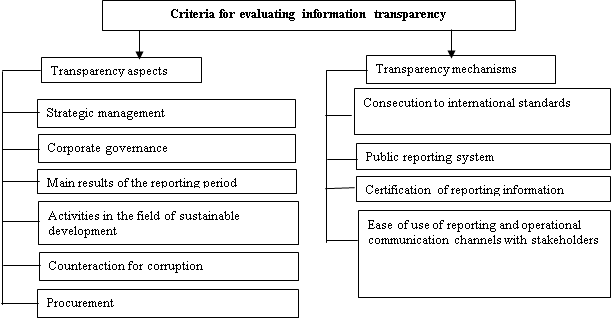

When assessing the transparency of corporate reporting in the process of research by the method of expert assessments, economic entities are awarded points for the depth and completeness of disclosure in their reporting. Points are assigned based on two groups of criteria (Figure

Source: compiled by the authors on the basis ofRussian regional network for integrated reporting. URL: http://www.ir.org.ru/ (датаобращения 05.09.2018).The survey of corporate transparency of Russian companies in 2016. [Electronic resource] / / Russian regional network on integrated reporting - URL: http://transparency2016.da-strateg.ru/page/downloads (accessed 05.09.2018).

On the basis of the points scored, economic entities are distributed according to the transparency levels presented in table

Findings

In the Russian Federation, public non-financial reporting retains the status of a voluntary initiative, especially for large companies, which affects not only small and medium-sized businesses but also public sector organizations to a lesser extent. The National Register of corporate non-financial reports and the Library of corporate non-financial reports of the Russian Union of Industrialists and entrepreneurs (RUIE) contain the most complete information on how many companies in Russia produce non-financial reports and which approaches to its formation.

Thus, at September 13, 2018, 173 companies were included in the national Register of non - financial reports, 881 reports were registered, which were issued in the period since 2000. Among them: reports in the field of sustainable development– 317 (36%), social reports – 316 (36%), integrated reports – 141 (16%), environmental reports – 81 (9%), industry reports – 26 (3%). At the same time, in foreign countries a decrease in the growth rate of the number of non-financial reports: in the first 10 years (since 2000) the growth rate was quite high (100 times compared to the starting year), then after 2011 there is a slowdown in the process (an increase of just over 60%). This fact can be explained by the fact that large companies began to produce stable non-financial reports and the dynamics of their annual growth decreased.

According to the results of the study, the authors found that non-financial reporting remains mainly on the subject of interest of large companies operating at the international level and present in the financial markets, which is confirmed by the results of the ratings. Thus, out of the 10 largest private companies of the Russian Federation included in the rating of Forbes magazine for 2018, 8 companies regularly issue non-financial and integrated reports: LUKOIL, X5 RetailGroup, Surgutneftegas, Tatneft, Evraz, NLMK, NOVATEK, RUSAL.

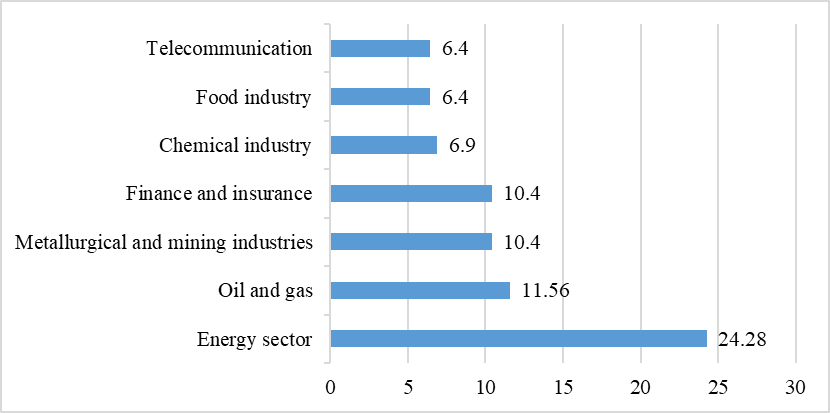

The composition of the industries in which most non-financial and integrated reports are published annually only partially confirms the previously put forward hypothesis. Figure

On the basis of the research data of the Russian regional integrated reporting network, the analysis of the dynamics of transparency of corporate reporting of the largest Russian enterprises of oil and gas industry, branches and representative offices of which operate in the Samara region, for 2014-2016 is carried out.the results of the analysis are given in Table

The number of oil companies forming corporate integrated reporting is increasing every year (from 9 companies in 2013 to 43 in 2016). Companies of the oil industry has average transparency (transmittance for 2015 is 2.35 out of a possible 5). This is due to the lack of system industry mechanisms in the sector to encourage companies to disclose more transparent information in corporate reports on the principles of international standards.

The dynamics of scores, as well as the position of the oil industry organizations in the overall rating indicate an increase in the transparency of the industry. In particular, there is an increase in the number of organizations which reporting corresponds to the I and II levels of transparency (2 companies in 2014(33.3%), 4 companies in 2016 (66.7%)). Reporting of five of the six companies reviewed (83.3%) can be called transparent, as these organizations have introduced elements of a systematic approach to reporting, and apply international standards of corporate reporting (I-III levels of transparency). Among the six analyzed companies in the industry, only one company's reporting is made according to international standards and has passed at least one external certification procedure (level I). Transneft's reporting can be classified as semi-transparent, since, despite the presence of elements of a systematic approach to reporting in this organization, the level of disclosure of reporting information remains lower than that of other companies.

Analysis of the structural elements of reporting surveyed by the authors of the Russian largest corporations in the oil and gas industry showed that the main drawbacks inherent in almost all of the studied reports are:

1. insufficient description of the business model;

2. predominance of descriptive information;

3. lack of balance in the description of the various structural elements;

4. insufficient description of the results of interaction with interested users;

5. the lack of a unified structure of the reports.

According to the authors, the Concept of public non-financial reporting in Russia requires the development of a national standard for the approval of a clear structure of integrated reporting with the inclusion of the following sections:

A. General information (overview of the organization; external environment and industry situation; basic principles of preparation and presentation).

B. Development strategy (development strategy and resource allocation; business model; implementation of the development program for the previous period; innovative development).

C. Environmental and social responsibility (environmental protection; occupational health and safety; personnel; social policy).

D. Corporate governance (the system of governance; opportunities and risks).

E. Review of results of operations (results of operations; prospects for the future).

Conclusion

Leaders in the publication of integrated reports in Russia are large companies, and there is a structure of their industry affiliation for the period 2000-2017. Thus, among the companies that disclose of non-financial information, the predominant are those engaged in the energy sector, oil and gas, metallurgical and mining, as well as financial sectors, that is, there is no clear dominance of extractive industries. At the same time, companies engaged in trade, including the two leaders in the rating of Forbes-2018 "Magnet" and GC "Megapolis", do not show significant activity in the disclosure of non-financial information.

In connection with the lack of transparency of integrated reporting of Russian corporations revealed by the results of the study, it is necessary to develop the Institute of verifiability of non-financial reports. To do this, we propose to develop the idea of forming a unified information base on the ratings of companies development in the form of an Internet portal at the state level, where stakeholders can quickly search and compare integrated information.

The development and implementation at the legislative level of the standard on public non-financial reporting, containing the structure of information presentation, and recommendations on its application will improve the transparency of integrated reports and improve the investment attractiveness of Russian companies.

References

- Adams, C.A. (2015). The International Integrated Reporting Council: A call to action. Critical Perspectives on Accounting, Volume 27, 23-28.

- Alekseeva, I. V. (2015). The development and content of integrated reporting in the context of sustainable development of economy. Scientific Bulletin of the Volgograd branch of Ranepa. Series: economy, 1, 87-91.

- Brown, J., & Dillard, J. (2014). Integrated reporting: on the need for broadening out and opening up. Accounting, Auditing & Accountability Journal, 27, 1120–1156.

- Carroll, A.B. (2015). Corporate social responsibility: The centerpiece of competing and complementary frameworks. Organizational Dynamics, 44, 87-96

- Chamonin N. N. (2014). Integrated reporting and its audit-current state and direction of development. International accounting, 41, 41-49.

- Cheng, M., Green, W., Conradie, P., Konishi, N., & Romi, A. (2014). The International Integrated Reporting Framework: Key Issues and Future Research Opportunities. Journal of International Financial Management & Accounting, 25(1), 90–119.

- Churet, C., & Eccles, R. G. (2014). Integrated reporting, quality of management, and financial performance. Journal of Applied Corporate Finance, 26, 56–64.

- Eccles, R. G., Krzus, M. P., & Ribot, S. (2015). Meaning and momentum in the integrated reporting movement. Journal of Applied Corporate Finance, 27, 8–17.

- Efimova, O. V. (2013). The paradigm of sustainable development: problems of information and analytical support. Innovative development of the economy, 1 (13), 22-31.

- Getman, V. G. (2014). Conceptual framework and structure of the international standard for integrated reporting. International accounting, 44 (338), 2-15.

- Kolk, A., & van Tulder, R. (2010). International business, corporate social responsibility and sustainable development. International Business Review, 19, 119–125.

- Kurochkina, I. P., & Novozhilova, I. V. (2016). About the formation of integrated reporting from the perspective of sustainable business. Social and humanitarian knowledge, Vol.2, 2, 90-101.

- Morros, J. (2016). The integrated reporting: a presentation of the current state of art and aspects of integrated reporting that need further development. Intangible Capital, 12, 336–356.

- Plotnikova, V. S., & Plotnikov, O. V. (2014). the Concept of preparation of financial statements: the concept of consolidated financial statements and the international concept of integrated reporting. Auditor, 10 (236), 42-50. URL: http://lexandbusiness.ru/view-article.php?id=4604

- Roshektaeva, Y. U. (2016). Integrated reporting as a new level of development of corporate statements. Scientific Bulletin of the South Institute of management, 1, 40-44.

- Simnett, R., & Huggins, A. L. (2015). Integrated reporting and assurance: where can research add value? Sustainability Accounting, Management and Policy Journal, 6, 29–53.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Korneeva, T., Potasheva, O., & Tatarovskaya, T. (2019). Integrated Reporting As A New Approach To Characteristics Of The Business-Unit. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 666-676). Future Academy. https://doi.org/10.15405/epsbs.2019.03.66