Abstract

Modern trend in economic life are the formation and development of creative economy as a driver of economic growth. The creative economy includes creative industries and, in particular, the music industry. In developed countries, the branches related to the creative economy, including the music industry, make a significant contribution to the gross national product of states such as the USA and Japan. By the end of 2016, only in the US revenues from the sale of music amounted to almost $ 5 billion. Despite the availability of statistical data on the state of the music industry in the world, there are very few studies of the financial and economic aspects of the functioning of the industry. The relevance of the study is determined by the fact that it examines the financial and economic activities of Russian music industry enterprises. The development of the creative economy in Russia, including the music industry, is influenced by the unfavorable financial situation. For the development of the music industry, the creation of favorable conditions for the financing and promotion of musical projects is crucially important. Practical significance is given by recommendations that allow to determine the sources of financing for the music industry enterprises taking into account the peculiarities of their financial and economic activities and the overall digital transformation of economic relations.

Keywords: Creative economymusic industrydigital transformationfinancial resourcessources of financefintech

Introduction

At present, the financial aspects of the activities of economic entities both abroad and in Russia have become extremely important. No managerial decision in business can be made, and business goals are achieved if they are not provided with the appropriate financial resources. In this regard, the management of financial resources is one of the main tasks facing any enterprise. As a rule, equity and cash flow as a result of current operations are not sufficient to finance expanded reproduction. Therefore, the issues of financing the activities of economic entities, the formation and management of sources of money as financial resources, as well as their effective use are the most important function of financial management. This fully applies to the activities of enterprises and organizations of the creative economy.

Currently, the creative economy is allocated as a separate segment of economic activity, which is understood as human activity in the production and provision of creative goods and services. In Russia, very few studies are carried out to study, systematize and generalize the experience of the economic and, especially, financial aspects of the creative economy, while the results of this activity make a tangible contribution to the gross national product of developed countries.

One of the spheres of creative economy is the entertainment industry, in particular, the music industry. In contrast to economic entities in other sectors, such as industrial production, construction or petrochemistry, the recording industry has significant features related to the specificity of the production of music product (sound recording), its circulation on the market (delivery routes and payment methods) and ways consumers listen to music. These features have a serious impact on the organization of financing, revenue generation, the formation of funds, their redistribution and use to finance economic activities. At present, the revolutionary changes related to the broad penetration of information and telecommunication technologies (ICT) into all spheres of economic activity, which today is called the "digital revolution", have a special impact on the way music industry is financed.

Problem Statement

In Russian Federation, enterprises use different sources, forms and methods (tools) to finance their activities. When choosing one or another source, the financial manager should be well aware of its essence, advantages and disadvantages, the degree of compliance with the goals, etc.

The financial system is understood as a combination of sources of financing and legal forms of the enterprise.

Sources of financing are cash funds and receipts that an enterprise can dispose of in order to generate fixed and working capital, to realize costs related to running current activities, meeting obligations to counterparties, creditors, investors, the state, etc. The current classification of financial sources may include the following characteristics (Lukasevich, 2013):

in terms of property relations: own and borrowed;

by type of owner: state financial resources, funds of legal entities and individuals;

in relation to the object (enterprise): internal and external (attracted);

according to a time-period: Short-term (less than 1 year), long-term and unlimited.

The initial source of finance for the activities of any enterprise is the authorized capital, which is formed from the contributions of the founders (owners).

However, for the conduct and development of business, the share capital or own funds is not enough. There is a need to seek affordable sources of monetary resources for investment, fulfillment of obligations, ensuring social needs or financing other needs. In this case, the legal form of the enterprise has a significant influence on the methods used to attract monetary resources.

Methods of financing are classified as follows:

self-financing;

share or equity financing;

loan financing;

budgetary financing;

special forms of financing (venture, project, etc.);

attraction of foreign capital.

It should be noted that the widespread use of ICT in the music industry has led to the emergence of new ways of monetization, such as paid subscription services, shareware distribution of music on the Internet, etc.

All available sources of financing can be reduced to several basic ones, such as own funds, borrowed funds and budget financing.

Own funds include such internal sources as profit (undistributed profit), amortization, income from the sale of assets, non-operating income and external (attracted) funds through participation in the authorized capital, foreign direct investment, sale of shares, certain types of venture and project financing.

Borrowed funds include the attraction of domestic and foreign bank loans, placement of bonds, leasing, etc.

Budgetary financing is carried out in the form of budgetary credits, allocations from the budget on a gratuitous basis, subsidies, funds of targeted federal programs, investment tax credit, grants, various types of benefits, the receipt of which is associated with individual organizational and legal forms, scales and types of economic activity, and directions of state economic policy of a stimulating nature.

Modern business management is characterized by continuity and high rate of change. In these conditions, the survival, development and prosperity of any enterprise are largely determined by the ability of its management to anticipate possible changes in a timely manner and to make decisions that allow them to adapt to their consequences with maximum efficiency (Kuznetsov & Lukasevich, 2015; Buckley, 2012; Lukasevich, 2011).

The music industry belongs to those types of economic activity that have a high potential for adaptation to the changes taking place on the market.

According to the eMarketer publication, the world turnover of the music industry in 2011 was estimated at $67.6 billion and had a positive trend (Calvert, 2013). By 2014, according to research conducted by the consulting agency Price Waterhouse Coppers (PWC), entertainment business volume reached $1.74 trillion and continues to grow. At the same time, the US market remains the largest with an estimate of $598 billion dollars, according to the report of the US International Trade Association (World Bank, 2016).

Currently, the music industry includes the following economic activities:

production and sale of original master recordings;

organization and conduct of music related events;

production of music for cinema, television and advertising;

production and sale of musical instruments;

production and sale of professional music equipment;

development of professional music software;

production and sale of printed materials (sheet music, books about music, etc.);

transactions on the transfer of related rights.

Along with the production and sale of musical products, the peculiarity of the music industry is the possession and use of copyright and related rights. Today, the market of copyright and related rights to music is estimated at $15 billion US (World Intellectual Property Organization, 2016).

The leading place among music markets is occupied by the US market, followed by the Japanese market and then the German market, which is presented in Table.

A feature of the modern music market is the active dissemination of ICT and the sale of music products through streaming services, whose revenue in 2014 reached $ 1.57 billion, showing an increase of 39% compared to the previous year. The number of people using a paid subscription to streaming services has grown from 28 million in 2013 to 41 million in 2014 (International Federation of the Phonographic Industry, 2015). It is worth noting that the use of ICT-based innovations is not developing at an even pace among the countries in which they are available. So, the leading place by the number of subscribers is occupied by Scandinavian countries, where more than 75% of music consumers prefer using streaming services, rather than buying digital copies. In turn, in countries such as the US, Germany, Australia and Canada, more than 55% of users prefer buying digital media, rather than using streaming services (International Federation of the Phonographic Industry, 2015).

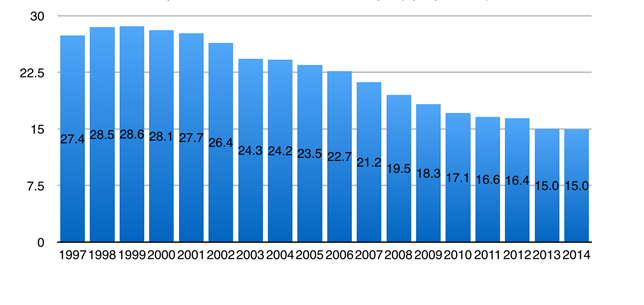

The last 18 years for the music industry market can be described as crisis. The volume of revenues from the sale of music, copyright and related rights has decreased by more than 45% since 1999, as shown in Figure 2, $ 28.6 billion in 1999 to almost $ 15 billion in 2013 (Sheikh, Garcha, Tsuchiya, & Bell, 2014).

There are several views on the causes of such a significant fall. Someone blames the emerging possibility of direct exchange of audio files containing music recordings between users of the Internet without payment to rights holders. Someone blames reputational damage suffered by the right holders due to a large number of legal proceedings against individuals in connection with copyright infringement. Someone blames the lack of proper mechanisms for protecting intellectual property on the Internet by the state. Perhaps the reason is the inability of key business representatives to quickly adapt to the emergence of new technologies and effectively use them for their own interests. It is worth noting that there is still no accurate data on the scale of the illegal (pirated) turnover of music on the Internet, as well as information on the amount of financial damage incurred by the right holders in this regard.

Along with the fall in revenue from the sale of music products, including copyright and related rights, it is important to note that the number of people consuming music has not decreased, but, on the contrary, is growing, which is undoubtedly associated with the active dissemination of "digital" technologies. Countries in which earlier purchases of music records were complicated, for example, due to the lack of interest of the right holders in the distribution of their products in a particular territory, now have access to the consumption of music products via the Internet.

A study conducted by Credit Suisse, a financial institution, showed that about 50% of people who consume music products today do not pay for it (Sheikh et al., 2014). Therefore, together with the growth in the total number of consumers of music products, music industry representatives are given access to a broad, non-monetized audience (International Federation of the Phonographic Industry, 2012).

The changes taking place in the music industry today require new approaches to providing adequate sources of financing for its production and distribution of music products. The rapid development of "digital" technologies not only significantly changes the functioning of the existing system of production and sale of a musical product, but also opens up opportunities for simplifying communication between the producer and the consumer, which allows to significantly reduce costs and increase efficiency.

Therefore, when forming a new model of building a business, an entrepreneur needs an understanding of the financial relations that accompany the movement of cash at all stages of production, sales of music products, income generation and financial result.

Research Questions

The music industry is an integral part of the creative economy. The subject of the study are the music industry enterprises and problems related to the sources of financing their current activities.

The subject of the study includes financial and economic relations regarding the formation, distribution (redistribution) and use of funds and sources of financial support for their development.

Purpose of the Study

The purpose of the study is to develop recommendations for finding sources of financing for music industry enterprises. These recommendations should take into account changes in the music industry, especially those that occur due to the active "digitization" of the economy and the use of new technologies.

Research Methods

The main methods are the collection, study, analysis, generalization, classification and comparison of data obtained from foreign and domestic sources, with the purpose of revealing general trends in the music industry market and problems that hamper its development.

Information sources include domestic and foreign scientific publications, reports of international consulting agencies and public organizations, as well as scientific works of representatives of the Financial University.

Findings

Analysis of sources of financing of the music industry

In the scientific literature the following sources of financing are indicated:

own;

borrowed;

budget subsidies;

Each of them has its own peculiarities within the music industry.

Own sources of financing of the enterprise are divided into internal and external (attracted).

Internal sources of own funds are formed in the course of economic activity of the enterprise. They characterize the enterprise's ability to self-finance. Obviously, an enterprise that can fully cover its financial needs from internal sources has significant competitive advantages by reducing the costs of attracting financial resources from external sources and reducing risks.

Net profit is the main internal source of financing for the enterprise of the recording industry. The own sources of financing also include depreciation charges and income from the sale or leasing of unused assets. But the prevailing practice shows that revenues from the sale of music products are the main source of financing for new projects and business development.

Analyzing the dynamics of the industry's revenues, it should be noted that, since 1999, the revenues of record companies are steadily declining (Figure

M & A processes have led to the departure of large players like EMI, PolyGram, BMG and the entry of the "Big Three Music Labels" into the world arena - Universal Music Group, Warner Music Group and Sony Music Entertainment, which control up to 70% of the music market. This allows them not only to maximize revenues and, consequently, their profits, but also to influence the development of the music industry as a whole. In turn, such a serious consolidation of the music market in the hands of three players led to a confrontation between the "labels" and the processes of "digitization" of the business, which appeared due to the development of ICT. This confrontation was the reason for the active development of methods of illegal distribution of musical products, which strongly affected the turnover of the music market as a whole. The development of ICT led to the emergence of Internet services that began to provide users with new forms of access to music records, tools for "pirated" replication and the sale of music by persons who do not have the rights to produce and distribute these musical materials.

The events taking place on the music market lead to the need to search for new sources of financing by all participants of the record business, as the reduction in revenues from the sale of music products made it difficult to finance new projects and overall business development in an old fashion way.

Another important source of self-financing of enterprises is depreciation. However, depreciation as a source of funding for the activities of music industry enterprises is important only for major players in the music market. For small and medium-sized enterprises this source of financing is of no fundamental importance. This is due primarily to the fact that the cost of equipment used to produce sound recordings is relatively low and depreciation charges do not form a cash flow, which allows to accumulate sufficient funds even for financing current activity. The specificity of the activities of small and medium-sized enterprises is that they rarely have the opportunity and therefore do not seek to purchase fixed assets such as recording studios or special equipment. Much more often they prefer to lease them for a certain period of time and therefore bear the costs associated with rental payments. Earlier incomes allowed them to make ends meet and make a profit that enabled them to stay afloat and deal with current financing issues. Unfortunately, the development task remained unresolved. Although it can not be denied that in carrying out an adequate depreciation policy, enterprises can ease their financial situation.

The advantages of internal sources of financing include:

absence of costs associated with attracting capital from external sources;

preservation of control over the activities of the enterprise by the owners;

increasing financial stability and favorable opportunities for raising funds from external sources.

They can be used by large companies and practically do not affect the activities of medium and small companies.

At present, the shortcomings of this source are fully manifested, which lie in its limited and significant dependence on external market factors such as market conditions, the phase of the economic cycle, changes in demand and prices, and so on. Changes in the music market make it difficult to forecast the possibility of financing economic activity in the required volumes at the expense of own funds.

With a lack of internal funds to finance their activities, music industry enterprises attract funds from external sources.

Enterprises can increase their own funds by attracting additional contributions from founders or issuing new shares.

It is necessary to note the peculiarities of the music industry organizations, where the legal form of joint-stock companies is practically not applied, which makes this source of funding unclaimed.

Therefore, even representatives of the Big Three, who are in need of investments, can not carry out additional public offering through open or closed subscription (among a limited number of investors). The initial public offering of shares (Initial Public Offering - IPO) is a procedure for their implementation in an organized market in order to attract capital from a wide range of investors. According to the Federal Law "On the Securities Market", a public offering is understood as "the placement of securities through an open subscription, including the placement of securities at the auctions of stock exchanges and/or other organizers of trading on the securities market." At the same time, in accordance with the directives of the Federal Financial Markets Service, at least 30% of the total IPO carried out should be placed on the domestic market.

Financing through the issue of ordinary shares has the following advantages:

this source does not require obligatory payments, the decision on dividends is taken by the board of directors and approved by the general meeting of shareholders;

shares are permanent capital that is not subject to "return";

holding an IPO significantly improves the status of the enterprise as a borrower (the credit rating is increased, according to experts, the cost of borrowing loans and debt service is reduced by 2-3% per annum), the shares can also serve as collateral to secure the debt;

circulation of shares of the company on exchanges provides owners with more flexible opportunities to exit the business;

the capitalization of the enterprise increases, a market valuation of its value is formed, more favorable conditions are provided for attracting strategic investors;

issue of shares creates a positive image of the enterprise in the business community.

The disadvantages of an IPO include:

granting the right to participate in the profits and management of the company to a greater number of owners;

In the Russian Federation, "transparency costs" are particularly specific. As a rule, they boil down to the fact that, due to the formed legal environment and established business practices (the predominance of closed deals, "gray" payment schemes and "optimization" of taxation), many enterprises are confident that disclosure can make the company an easy target for absorption with the use of judicial, law enforcement and fiscal bodies. The enterprises of the music industry are no exception in this matter.

As a result, most Russian enterprises, including music industry companies, are not ready for an IPO. This contributes to the fact that Russian enterprises prefer to attract borrowed funds.

The use of loans allows to expand the scope of activities, increase the profitability of equity, and ultimately the value of the firm. In economic terms, any loan is an obligation of the entity to return by a certain date the amount received in debt and pay its owner a percentage for using the funds.

In general, loan financing, regardless of the form of attraction, has the following advantages:

a fixed value and a period, providing certainty in the planning of cash flows;

the amount of payment for use does not depend on the company's income, which allows the excess income to be directed at the disposal of the owners;

raises the return on equity by using financial leverage;

payment for the use of borrowed funds is deducted from the tax base, which reduces the cost of the source involved;

the flexibility of the terms of the provision, which has now been significantly reduced;

a relatively small amount of time and money to attract (from two weeks to two months);

confidentiality of the transaction, absence of strict requirements to disclosure of information about the business;

does not involve interference in the activities of the organization and obtaining rights to manage it.

The general shortcomings of debt financing in Russia include:

obligation to repay and repay the principal amount of debt and interest, regardless of the results of economic activity;

financial risk;

the existence of restrictive conditions that may affect the firm's business policies (for example, restrictions on dividend payments, other borrowing, M&A, pledge of assets, etc.);

requirements for security;

restrictions on the terms of use and amounts of attraction.

The main forms of debt financing are: bank loan, bond issue, lease or leasing.

At present, in Russia, the constraining factors of borrowing are:

high interest rates on loans, the reduction of which is constrained by the policy of the Central Bank of Russia. In particular, the key rate on June 14, 2016 was 10.5% and only as of March 2018 fell to the value of 7.25%;

the lack of "long money" and the inability to attract them abroad.

For the music industry, there are factors that impede the use of borrowed funds, such as collateral and bank guarantees, which today are almost mandatory conditions for the provision of borrowed funds. The composition of assets does not allow them to be used as collateral and receive bank guarantees.

Investment loan, mortgage lending, syndicated loans as a form of borrowing is not available for the music industry. This is determined by the fact that the peculiarities of the activities of the music industry do not meet the requirements that are necessary for lending.

As a rule, the activities of music industry enterprises are of a project nature and the attraction of borrowed funds is necessary, first of all, to finance working capital.

It is not uncommon to use non-traditional approach to attract borrowed funds. To finance its project, the owner receives a consumer loan and puts the money into the implementation of a music project, despite the fact that interest payments in this case will be higher.

Another popular form of debt financing in domestic and world practice is issuance of bonds. Placement of bonds can be carried out only by business entities (LLC, CJSC, JSC) by decision of the board of directors (supervisory board), unless otherwise provided by the charter. At the same time, the nominal value of all issued bonds can not exceed the size of the company's charter capital or the value of its guarantor's net assets.

As it was noted above the organizational and legal forms of the enterprise of the music industry, as a rule, have the minimum possible size of the authorized capital. Therefore, the possible amounts that can be raised through the placement of bonds are not sufficient to ensure the financing of their activities.

The next restriction is due to the fact that the issue of bonds without security is allowed not earlier than the third year of existence of the firm and provided that the two annual balances are properly approved by that time.

In addition, there are restrictions related to the need to comply with a number of legal procedures and incur costs, which include:

tax on transactions with securities - 0,2% (but not more than 100,000.00 rubles) of the face value of the issue;

remuneration of the issuer of the issue - 0.5-0.7% of the volume of the loan;

commission of the exchange - 0,035-0,075% of the volume of the loan;

commission of the depository - 0.1 + 0.075% of the volume of the loan;

remuneration to the paying agent - up to $ 10,000;

presentations for investors - up to $ 20,000, as well as time costs (up to 4 months).

As with the IPO, the bond issue involves disclosure of information about the activities of the enterprise, which is not always acceptable for the Russian music business entities.

This is the reason that the scale of the Russian bond market is significantly inferior to developed countries. For comparison, the total capitalization of the corporate bond market in the US is 3.5 trillion. Up to 80% of the loan financing of American companies falls on bonds. Corporate bond markets of leading European countries exceed Russian by a factor of 30-50.

To meet the needs of enterprises in technical re-equipment, introduction of new technologies, expansion of production of goods and services, a tool such as leasing is used. Legal regulation of leasing is carried out in accordance with the legislation of the Russian Federation. Leasing is a contract under which one party - the lessor (lessor) - transfers to the other party - the lessee (the lessee) the right to use some property (building, equipment) for a certain period and on specified terms.

One of the problems of the music industry is that they need equipment that is almost impossible to find in the financial services market. Leasing companies are not ready to work with such equipment. As a result, music industry enterprises are forced to meet their needs for fixed assets and equipment, purchasing it at best on a lease basis.

It is also impossible to ignore such a form of loan financing as attracting foreign capital. As already noted, at present, attracting significant financial resources for the medium or long term at affordable prices poses a certain problem for Russian enterprises. More recently, one of the ways to solve this problem was to attract foreign capital.

The forms of attracting foreign capital are quite diverse. The most popular are:

direct investments;

loans from foreign banks;

overseas issue of debt securities;

placement of shares on international stock markets, etc.

The attractiveness of obtaining a loan from a foreign bank was determined by the fact that in Russia there are still a few credit institutions that can provide large loans for a period of more than three years. As noted above, the events of late 2014 and the sanctions imposed on Russia made the involvement of foreign capital difficult.

Issuing overseas debt securities (Eurobonds, CLN, or placement of shares on international stock markets (placement of ordinary shares among foreign investors, depositary receipts - ADR, GDR or EDR)) for Russian music industry enterprises is even more exotic for the same reasons as use of similar sources of financing in the domestic market. This is due to the fact that the musical products of domestic companies have extremely limited circulation on foreign music markets and therefore does not represent an interest for foreign credit organizations. Consequently, such forms of attracting foreign capital to finance the activities of musical enterprises have not been extended.

Some representatives of the domestic music industry, which have received recognition abroad, prefer to invest the money received from the sale of musical products and/or events in organizing their production activities outside of Russia. This includes registration of the right to stay in a chosen country, renting a studio with the necessary musical equipment, and, if necessary, attracting local musicians for the production of musical products.

Thus, attracting foreign capital on the territory of the Russian Federation is accessible only to a narrow circle of music industry companies.

The possibilities for obtaining budgetary funds for financing the music industry also have a number of serious limitations.

Recipients of budgetary funds in the Russian Federation can be enterprises of all forms of ownership, participating both in the implementation of targeted state programs, and implementing their own projects. At the same time, they must satisfy the requirements of the state. The conditions and procedure for the provision of budgetary financing, as a rule, presupposes competitive selection in accordance with the legislative acts of the Russian Federation.

The pre-emptive right to receive state support is for projects related to the "growth drivers" of the economy.

Budget financing is carried out in accordance with a number of principles, the most important of which are:

obtaining the maximum economic and social effect with a minimum of costs;

competitive selection of projects for financing taking into account their economic efficiency and priority;

target character of use of budgetary funds;

strict supervision over the use of budgetary funds;

allocation of funds on a returnable and, as a rule, on a fee-for-service basis.

Funds for the provision of state support for various projects are provided for by the budget at the appropriate level.

In some cases, the provision of budgetary investments entails the emergence of the right of state or municipal ownership for an equivalent part of the authorized (collateral) capital and property of the firm.

An obligatory condition for granting budgetary financing is a preliminary check of the financial condition of the recipient of budgetary funds and subsequent strict reporting on their expenditure.

State support can also be provided in the form of state guarantees. State guarantees are provided in the amount of not more than 50% of the amount of borrowed funds necessary for the implementation of the project. The investor, in turn, is obliged to provide counter guarantees, including collateral.

A special form of financing in the presence of the grounds specified in the Tax Code of the Russian Federation is an investment tax credit for income tax, which is a change in the period for payment of tax. The requirements for obtaining it are:

Conducting research or technical re-equipment of its own production, including those aimed at creating jobs for people with disabilities or protecting the environment from industrial waste;

Implementation of innovative activities, including the creation of new or improved technologies, the creation of new types of materials;

Fulfillment of a particularly important order for social and economic development of the region or provision of especially important services to the population.

In the sphere of culture and musical culture, in particular, one can count on subsidies provided by the Ministry of Culture. However, this has to do with different kinds of folk arts and crafts. At the same time, at the moment there are no subsidies to support representatives of the popular music industry.

In general, budget financing in any of its forms leads to a decrease in the cost of the company's capital and is one of the cheapest and most profitable ways of raising funds. But its shortcomings include limitations on terms and volumes, as well as the complexity of access and a rigid reporting system.

The above sources of attracting financial resources for the conduct and development of the music business certainly do not exhaust the whole arsenal of sources available to the modern financial manager. Modern innovations in the financial sector lead to the emergence of new opportunities with the use of new, more flexible tools designed to meet the growing needs of enterprises for financing, to promote the implementation of effective financial policies that are adequate to the ever-growing competition and the increasingly complex economic environment. This creates opportunities for searching and forming new sources of financing for the activities of music industry enterprises.

An analysis of the existing sources of funding for the music industry allows to conclude that traditional sources of funding are practically inaccessible for the music industry, with the exception of a small group of well-known companies. These circumstances hamper the development of the mass market of music products and the possibility of its promotion to foreign markets.

The possibilities of forming sources of financing in new conditions

The driver of the growth of the music industry in Russia should be significant changes in the music market. This is fully associated with the development of digital technologies, which provide unprecedented opportunities for entrepreneurs aimed at doing business in the music industry.

This is manifested in the fact that new technologies:

can significantly reduce the barriers of "entry" to any stages of production and circulation of a musical product;

reduce the number of intermediaries, whose services had to be used and paid to gain access to the music market;

significantly reduce the dependence of producers of the music product on the analog environment and increase the efficiency of their work;

facilitate access to the audience of end consumers of musical products.

Technical solutions based on digital technologies radically change the process of creating a musical product, as well as the material support necessary for its production. This is manifested in organizational and staff changes that allow to reduce the need for production resources (studios, musical instruments, sound recording equipment), engineering and technical staff and changes in the material base of the music production.

Today any entrepreneur interested in selling a music product has the opportunity to directly access the largest distribution sites on terms provided to the largest representatives of the industry. Each musician has the opportunity to post their entries in such trading platforms as the iTunes Store, Google Play, Amazon Music and a number of others with a commission of 30% - in the iTunes Store and Google Play; 15% - in the Amazon Music. Using streaming services on a conditionally-free model or by subscription is realized through access to such services as Spotify, Deezer, Google Play, Apple Music, Amazon Prime, Yandex Music and a number of others that collect payments and distribute income among the participants of the process. The development of paid streaming services can multiply the incomes of producers who sell music in this way. An indicator of the importance of streaming services is the recent access to the exchange of the music service Spotify, estimated at $ 29.5 billion.

Digital technologies provide new opportunities to solve problems of financing the music business through the use of technologies such as crowdfunding and crowd investing. This approach is especially popular among independent entrepreneurs, for whom the problem of initial financing of their activities is a serious problem.

As noted above, the use of digital technology makes it possible to reduce the cost of advertising and promotion of musical product. There is a possibility of using such new advertising methods as advertising on websites, distribution of information about a musical product in social networks, use of "viral marketing", etc.

To realize the opportunities provided by the "digital revolution" and goal-oriented formation of sources of financing it is necessary to:

choose the most effective financing tools;

use digital methods for the sale of music products, in particular digital shops and streaming services;

apply new forms and methods of financing the company's activities, such as crowdfunding and crowd investing;

improve the monetization of copyright and related rights to music in the digital environment, by forming a loyal audience to the brand for the purpose of the subsequent sale of indirect goods such as clothing, accessories, equipment, etc.

Understand the importance of each stage of production and consider the process of creating a musical product holistically.

Conclusion

As noted above, digital technology provides unprecedented opportunities for those who wish to conduct business in the music industry. This is manifested in the fact that new technologies:

reduce the entrance barrier to the music market at all stages of production and sale of a musical product;

eliminate intermediaries;

significantly reduce the dependence of producers of the music product on the analog environment and increase the efficiency of their work;

facilitate access to consumers of music products;

allow the use of digital methods for the sale of music products, such as streaming services;

create new forms of financing the activities of music companies, such as crowdfunding and crowd investing;

change the ways in which copyright and related rights to music are monetized in the digital environment.

The use of "digital" capabilities requires a revision of existing ones and a search for new forms of conducting the music business. At the same time, the use of new technologies should become the foundation for increasing the financial efficiency of the music industry both in the world and in Russia.

References

- Buckley, B.A. (2012). Digital takeover: the reality of music in the twenty first century. Retrieved from: https://spea.indiana.edu/doc/undergraduate/ugrd_thesis2012_bsam_buckley.pdf Accessed:14/09/2018

- Calvert, K. (2013). Profitability in the digital age of music industry. Retrieved from: https://spea.indiana.edu/doc/undergraduate/ugrd_thesis2013_bsam_calvert.pdf Accessed:14/09/2018

- Department of Commerce USA. (2015). 2015 Top markets report: media and entertainment. Retrieved from: http://trade.gov/topmarkets/pdf/Media_and_Entertainment_ Top_Markets_Report.pdf Accessed:07/09/2018

- International Federation of the Phonographic Industry (2012). Recording Industry in Numbers. London, London: IFPI.

- International Federation of the Phonographic Industry. (2015). Digital music report 2015. Retrieved from: http://www.ifpi.org/downloads/Digital-Music-Report-2015.pdf Accessed:07/09/2018

- Kuznetsov, N. I., & Lukasevich, I. Ya. (2015). Development of a financial model of enterprise activity. Finance, 9, 53-57.

- Lukasevich, I.Ya. (2011). Investments. Moscow: Infra-M.

- Lukasevich, I.Ya. (2013). Financial management: a textbook. Moscow, Moscow: National Education.

- Sheikh, O., Garcha, K., Tsuchiya, S., & Bell, S. (2014). Global Music. Retrieved from URL: https://doc.research-and analytics.csfb.com/docView?language=ENG&source=emfromsendlink&format=PDF&document_id=1034433411&extdocid=1034433411_1_eng_pdf&serialid=rCeIEeju3oNvDylSkTNwYGpdkOJ7v5%2fct%2bvLYy%2fPciY%3d Accessed:18/09/2018

- Solovev, S.A. (2016). “Digital revolution" and problems of financing the music industry. In Moiseev E.V. (ed.). IX International Scientific and Practical Conference "Science in the modern information society" (pp. 214-216). North Charleston, SC: CreateSpace

- Solovev, S.A. (2016). Music production in the digital age (Unpublished master’s thesis). Moscow: Moscow Art Theatre School.

- World Bank (2016). World Development Report 2016: Digital Dividends. Washington, DC: World Bank. DOI:

- World Economic Forum. (2016). Alternative Investments 2020: The Future of Capital for Entrepreneurs and SMEs. Retrieved from URL: http://www3.weforum.org/docs/WEF_AI_FUTURE.pdf Accessed:12/09/2018.

- World Intellectual Property Organization. (2016). Global market for digital content. Retrieved from URL: https://www.wipo.int/edocs/mdocs/mdocs/en/wipo_gdcm_ge_16/wipo_gdcm_ge_16_inf_2.pdf Accessed:12/09/2018.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Solovev, S., & Solovev, A. (2019). Financial Aspects Of The Music Industry In The Digital Age. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 472-486). Future Academy. https://doi.org/10.15405/epsbs.2019.03.47