Abstract

The article considers the concept of sustainable development and systematization of its indicators of integrated reporting of enterprises. Integrated reporting is the element of corporate reporting that reflects the development of integrated thinking that is aimed on the effective allocation of capital, financial stability and sustainable development. Actuality of the research is the subject to the necessity of the development of the new approach to information representation in the annual report of the largest companies that could satisfy growing demands of stakeholders and provide compatibility of the data, that is used by the world capital markets. The aim of the article is to develop the structure and the content of integrated reporting. In writing the article used the following methods of scientific knowledge: system analysis and synthesis, comparison, comparison, monographic. The structure and indicators of the integrated reporting of the enterprises are offered. The approaches to data formation in the integrated reporting are developed, taking into account the special character of their activity on the financial markets and convergence with international tendencies in corporate reporting submission, particularly, in accordance with international standard for integrated reporting. This article represents the contribution to the development of theory and methodology of integrated reporting and indicators of sustainable development. It could be used by different organizations while preparing annual reports, as well as during the study process in Higher education institutions of the Russian Federation.

Keywords: Sustainable developmentmanagement and integrated reportingintegrated reporting standard

Introduction

The principles and structure of integrated reporting have been developed by IIRC (International Council for Integrated Reporting). It is an element of corporate reporting, reflects the development of integrated thinking aimed at the efficient allocation of capital, financial stability and sustainable development. Sustainable development is the organizing principle for meeting human development goals while at the same time sustaining the ability of natural systems to provide the natural resources and ecosystem services upon which the economy and society depend.

The development of economic relations is associated with a change in the subject composition of economic relations, the objects that have been the subject of such relations, the nature and content of the relationship. Accounting as a science that reflects these processes, at a minimum, includes the study of the economic content of the processes in which there is an organization, the definition of methods for the most objective reflection of such processes, and the development of ways to present the information received. Consequently, the development of accounting may be associated with both the technical aspect (accounting methods and methods of reporting) and the essential (content and economic meaning of the generated and presented information). In addition, it is advisable to highlight the regulatory aspect – the development of the order of legal regulation of accounting and reporting, which, in turn, is associated not only with the development of society and economic relations, but also with the development of theory and practice of the state and law.

Currently, neither in practice nor in theory there is a clear definition of the structure of the accounting system and its components. IFRS increase the importance of professional judgment of the accountant and assume convergence of accounting and analytical activity and financial function with the questions traditionally solved in system of financial management. Reporting should most objectively reflect reality, the choice of methodological and methodical methods of accounting of various objects should be justified, because all these factors affect management decisions.

Problem Statement

The new forms of financial reporting recommended by the Ministry of Finance have become more aggregated. Their analysis, from the point of view of the value of the results obtained, becomes difficult or useless without appropriate transcripts, explanations, characteristics of the results and description of the organizational structure of the enterprise or organizations belonging to the group of companies in all their diversity of relationships and tax systems.

The attitude of owners to reporting is changing, there is a need to increase its "transparency". On the one hand, financial statements reflect the current state of Affairs in the company, in this sense, is considered as a result of management, and on the other hand, is a prerequisite for the further development of the company, as determines the decisions made by internal and external users. Thus, the reporting allows to calculate various indicators – the rate of revenue growth, increase or decrease in turnover, profitability, etc., on the basis of which the creditworthiness of the borrower is estimated and the possibility of obtaining external financing is considered.

So, for external users providing the integrated report in which not only financial and economic activity of the organization is fully reflected can become relevant, but also information in the field of sustainable development, achievement of the enterprises of goals is in a complex opened, the vector of innovative development of the company is presented. Reporting of this sort is designed to become the information platform for conducting dialogue by all interested subjects of the market. The integrated reporting (IR) brings together financial and non-financial information and reflects ability of the organization to create and support the cost in short, average and long-term the period.

Integrated reporting has occurred as the result to solve the problem of lack of information about enterprise functioning from the part of stakeholders. Financial reporting couldn’t fully show how successfully the enterprise is developing. There has been occurred the necessity to develop the report, that could include not only quantitative, but also qualitative indicators, information about risks and perspectives of development, and therefore could help managers, owners and suppliers of capital to take more weighted decisions taking into account sustainable development of the enterprise and socially responsible allocation of the resources.

Research Questions

Among the latest works we could mention Dilling & Harris (2018), Montecalvo, Farneti, & de Villiers (2018), Adams (2018), Gibassier, Rodrigue, & Arjaliès (2018), Rinaldi, Unerman, & de Villiers (2018), Lai, Melloni, & Stacchezzini (2018), Raut, Naoufel, & Kharat (2017), Yip & Bocken (2018), Gibson (2011) and Ramin & Reiman (2013). Overview of the ideas of these authors is represented in the table below.

In our country we have the Concept of Transition of the Russian Federation to sustainable development since 1996. It results is in need of drawing up the integrated reporting.

In Russia since 2010 the discussion about the content and structure of integrated reporting has been supported by auditors and scientists – theorists. We can mention among them Akhmetshin & Osadchy (2015), Vahrushina & Tolcheeva (2017), Get’man (2014), Kamordzhanova (Safonova, 2015), Kogdenko & Mel’nik (2014), Sheremet (2017), Sheshukova & Kolesen’ (2011), Horuzhij & Tryascina (2017).

In the late decade in Russian Federation there are irreversible changes in preparation and submission of corporate data for different users of information, that are related with the changes of approaches in accounting and reporting regulation, extension of stakeholders and increasing of the value of data represented in reporting. Distinctive contribution to the development of integrated reporting theory belongs to Malinovskaya (2016). Main concepts of Russian scientists are represented in the table below.

The common result for all these studies is the following three aspects:

The wide range of legal entities and individuals who will be able to estimate probability of risks and prospects of an investment of own means is interested in the reporting of the large companies. Thus, selection, justification and development (if necessary) of the indicators meeting information requirements of all interested parties becomes one of the major tasks.

The following information can be provided in the integrated report:

As a result users of the integrated reporting will be able to receive not only assessment to a financial condition and financial results of activity of the participant of the market, but also will see effective use material and a manpower, will be able to estimate the level of social responsibility of owners and heads of the organizations.

Focusing on resources which the company consumes and creates: financial, production, human, intellectual, natural, etc. is one of characteristic features of the integrated reporting. Therefore an important stage on the way of introduction of the integrated reporting is reasonable selection of a financial and natural indicators.

In the Standard on the integrated reporting, published in December, 2013, are opened elements of the integrated report contents:

Industry features, business model of the organization, reflecting the specifics of business and financial management, determine the practice of accounting and reporting information to external users.

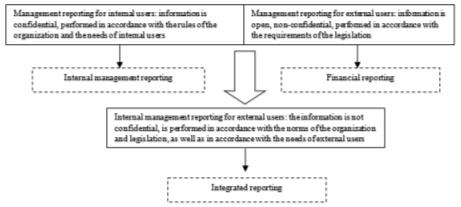

We agree with the opinion of Efimova (2014) that today, when developing the company's reporting, we should focus not only on the needs of internal users, but also take into account the needs of external users. In her articles Efimova (2014) examines the relationship of reporting with the sustainable development of the company. Sustainable development is a long-term strategy based on the analysis and integrated management of the most important financial and non-financial factors of the company's value creation, which are the result of its interaction with stakeholders (stakeholders). Efimova (2017) notes that the problem of sustainable development can not be solved without appropriate information and analytical support, which allows, on the one hand, the company itself to assess the degree of achievement of financial and non-financial goals of long – term development, and on the other-allowing all interested users to assess the intentions and success of the company's efforts to ensure its long-term sustainability.

There are two main tasks of preparation of information reports of the enterprise :

1) for internal users – is the construction of a system of value drivers (financial and non-financial), which contributes to the constant coordination and coordination of actions both within the company and in ensuring interaction with the environment (investors, creditors, competitors, government agencies, the public);

2) for external users – is the implementation of effective information dialogue with key stakeholders about the strategy in the field of sustainable development, the results of the actions taken, comparing the results with the results of other companies.

Figure

To ensure that internal reporting meets the needs of managers, it is necessary to strive to eliminate the following shortcomings:

The content of integrated report’s elements are disclosed below (table

The main methodological problem is the lack of indicators of sustainable development and a format of their representation.

The System of Ekological and Economic Account has been offered by Statistical department of the Secretariat of the UN in 1993. The purpose of System of Ekological and Economic Account is accounting of an ecological factor in national statisticians.

The System of Ekological and Economic Account raises the questions of inclusion in a national wealth along with the capital made by human work, the natural capital and also gives the chance to estimate ecological expenses (exhaustion and impact on quality of natural resources). The natural capital includes renewable resources (for example, the woods), and not renewable (the soil and subsoil assets) and also ecological services. Expansion of ecologically corrected macroeconomic units happens due to consideration of natural assets: adjustment not only GDP, but also the net value added and a national wealth is possible.

And let’s see if the largest companies are publish such reporting? In our investigation we have seen integrated reporting of Gazprom, Sberbank, Norilsk Nickel, T Plus group, General Motors, TOYOTA, Procter & Gamble.

The implemented comparison of corporate reporting indicators allows us to make the following conclusions.

Purpose of the Study

In general, integrated reporting improves the quality of information for the suppliers of financial capital and facilitates the objectivity augmentation of their estimation. In reports there is a sufficiently full disclosure of position of bank in sector, priority directions of development and information about risk-management.

Nevertheless, there is lack of attention to the description and interconnection of different kinds of capital. Also, there is important to mention several aspects:

Problems of software adaptation and implementation of technological platform corresponding to necessary requirements are not exposed.

Research Methods

While preparation of this article the authors have been trying to apply creative, logical and complex thinking that could contribute to comprehensive information assessment. To reach the aim of the research, the directions of changes in preparation and reflection of information in reporting have been observed, preconditions for integrated reporting appearance have been identified. The principles and structure of integrated reporting developed by IIRC (International Council for Integrated Reporting) have been learnt. The analysis of annual reports of the largest companies was held from the position of compliance of disclosing information to the international requirements.

Findings

As the requirements to disclosure are of recommendatory nature, organizations, including banks do not publish information about “unpopular” measures that are accepted and realized to achieve the maximum financial effectiveness. These measures can be related with, for example, staff reduction, financing of ecologically unsafe projects and disclosure of the other “weaknesses” (technological gap, lack of effective system of internal control, decrease of liquidity). In integrated reporting companies are represented from the best side.

We have mentioned this fact earlier (tables

All the considered reports contain only a description without a clear structure and a constant set of indicators. therefore, it is almost impossible to make any comparison or analysis.

In our study, we suggest using the indicators shown in table

The above indicators are not without criticism, but this list can become the basis for further research, search for new forms of data presentation on sustainable development in accordance with the content of this process.

Conclusion

Perhaps, in the future the problem of a format will be resolved by use of the XBRL format, what in their work wrote Ramin & Reiman (2013). However it confirms need of development of the system of indicators even more. The proposed indicators can be supplemented with ideas from the works of Barbier (2014) and Scerri & James (2010). The report could include indicators, calculated in the system of BSC – Balanced Scorecard.

The offered format of integrated reporting provides complex vision and comprehensive estimation of business activity, it includes financial and non-financial information, reflects the actual situation and the perspectives of development, takes into account international approaches and requirements of Russian regulatory acts. This structure allows to understand, how the management plans to develop business will influence the level of profit and dividends in medium-term period and to estimate more objectively considerable part of shareholder value, so in total, to form more objective vision of organization.

Thereby, integrated reporting is the new format of report, that facilitate the expansion of investment activity of enterprises and search of new sources of capital. It is aimed to reduce the gap between the real content of corporate reporting and the expectations of investors. Stakeholders need more transparent information about the strategy, business-models, risks and development perspectives. Existing prescriptions are not enough for objective estimation of business. Organizations disclosure just that part of their activity, that describes them from the best side, disregarding the significant information to be taken into account by stakeholders. So the generally accepted principles of reporting formation, and integrated reporting, particularly, are disrupted.

The solving of these problems will contribute to the prosperity of integrated reporting formation culture and to implementation of integrated thinking, directed on effective and productive allocation of capital, encouraging financial stability and sustainable development of economy as the basis of business practices.

Acknowledgments

The author expresses gratitude and deep appreciation to Prof., Doc. of Economics, scientific supervisor accounting, audit and economic analysis department Perm State University Tatiana G. Shesukova for advice and valuable comments during the research.

References

- Adams, C.A. (2018). Debate: integrated reporting and accounting for sustainable development across generations by universities. Public Money & Management, 38(5), 332-334. DOI:

- Akhmetshin, E.M., & Osadchy, E.A. (2015). New requirements to the control of the maintenance of accounting records of the company in the conditions of the economic insecurity. International Business Management, 9(5), 895-902. DOI:

- Barbier, E.B. (2014). Natural resources and economic development. New York, NY: Cambridge University Press.

- Beattie, V., & Smith, S.J. (2013). Value creation and business models: refocusing the intellectual capital debate. British Accounting Review, 45(4), 243-254.

- Dilling, P.F.A., & Harris, P. (2018). Reporting on long-term value creation by Canadian companies: a longitudinal assessment. Journal of Cleaner Production, 191, 350-360. DOI:

- Efimova, O.V. (2014). Sustainable development report as a new form of corporate reporting. Audit Statements, 8, 36-47. [in Rus.].

- Efimova, O.V. (2017). Matrix approach to the formation and disclosure of information about resources in the integrated reporting of the organization. Audit Statements, 3, 23-34. [in Rus.].

- Get'man, V.G. (2014). About the conceptual framework and the structure of the international standard for integrated reporting. Accounting. Analysis. Audit, 1, 74-85. [in Rus.].

- Gibassier, D., Rodrigue, M., & Arjaliès, D.-L. (2018). Integrated reporting is like God: no one has met Him, but everybody talks about Him: the power of myths in the adoption of management innovations. Accounting, Auditing & Accountability Journal, 31(5), 1349-1380. DOI:

- Gibson, C.H. (2011). Financial reporting & analysis: using financial accounting information. Mason, South-Western: Cengage Learning.

- Horuzhij, L.I., & Tryascina, N.YU. (2017). The formation of the sustainable development information in the integrated reporting of agricultural enterprises. Accounting in Agriculture, 4, 58-69. [in Rus.].

- Kogdenko, V.G., & Mel'nik, M.V. (2014). Integrated reporting: the issues of formation and analysis. International Accounting, 10, 2-15. [in Rus.].

- Lai, A., Gaia, M., & Stacchezzini, R. (2018). Integrated reporting and narrative accountability: the role of preparers. Accounting, Auditing & Accountability Journal, 31(5), 1381-1405. DOI:

- Lowe, A., Locke, J., & Lymer, A. (2012). The SEC’s retail investor 2.0: interactive data and the rise of calculative accountability. Critical Perspectives on Accounting, 23(3), 183-200.

- Malinovskaya, N.V. (2016). Methods of integrated reporting. Accounting in Construction Organizations, 4, 58-68. [in Rus.].

- McKernan, J.F., & McPhail, K. (2012). Editorial – accountability and accounterability. Critical Perspectives on Accounting, 23(3), 177-182.

- Montecalvo, M., Farneti, F., & de Villiers, Ch. (2018). The potential of integrated reporting to enhance sustainability reporting in the public sector. Public Money & Management, 38(5), 365-374. DOI:

- Plotnikov, V.S., & Plotnikova, O.V. (2018). Qualitative characteristics of integrated reporting information. Accounting. Analysis. Audit, 1, 6-17. [in Rus.].

- Ramin, K.P., & Reiman, C.A. (2013). IFRS and XBRL: how to improve business reporting through technology and object tracking. Chichester, UK: Wiley.

- Raut, R., Naoufel, Ch. & Kharat, M. (2017). Sustainability in the banking industry: a strategic multi-criterion analysis. Business Strategy and the Environment, 24(7), 550-568. DOI:

- Rinaldi, L., Unerman, J., & de Villiers, Ch. (2018). Evaluating the integrated reporting journey: insights, gaps and agendas for future research. Accounting, Auditing & Accountability Journal, 31(5), 1294-1318. DOI:

- Safanova, F. (2015). Methodology of integrated reporting. In N.А. Kamordzhanova (Ed.), Development of an integrated system of accounting: methodology and practice (pp. 153-163). Moscow, Russia: Prospect. [in Rus.].

- Scerri, A., & James, P. (2010). Accounting for sustainability: combining qualitative and quantitative research in developing 'indicators' of sustainability. International Journal of Social Research Methodology, 13(1), 41-53. DOI:

- Sheremet, A.D. (2017). Analysis and audit of indicators of sustainable development of the enterprise. Audit and Financial Analysis, 1, 154-161. [in Rus.].

- Sheshukova, T.G., & Kolesen', E.V. (2011). Economic potential of the enterprise: essence, components, structure. Vestnik of Perm University. Series: Economy, 4(11), 118-127. [in Rus.].

- Vahrushina, M.A., & Tolcheeva, A.A. (2017). Corporate reporting as a result of the evolution of accounting information of a company. Vestnik of Perm University. Series: Economy, 2, 297-310. [in Rus.].

- Yip, A.W.H., & Bocken, N.M.P. (2018). Sustainable business model archetypes for the banking industry. Journal of Cleaner Production, 174, 150-169. DOI: 10.1016/j.jclepro.2017.10.190.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Kotova, X., & Pashchenko, T. (2019). Integrated Reporting Indicators: Unification As The Basis For Sustainability Assessment. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 312-325). Future Academy. https://doi.org/10.15405/epsbs.2019.03.32