Abstract

Nowadays lease seem to find a wide use in all global markets. Leases of fixed assets, is a central component in the financing strategy for many companies. Leasing can be used to minimize risk, increase cash flow, reduce costs or improve the financial reports. Any agreement requires compliance with the interests of the parties involved. In modern conditions, the company's success increasingly depends on taking into account interest of stakeholders. Searching a balance of interest has been a problem since ancient times. During process of searching a balance of interests, a large number of theories which is devoted this issue are emerged. The study examined the theory of stakeholders, the Balanced Scorecard, the Ethical Decision Model and the Game Theory. In this article, we consider the issues of finding a balance of interests in the discussion of the main parameters of a leasing deal. It presented parameters analysis and points that is needed to count in the process of searching the balance of interests. During process of searching a balance of interests, a large number of theories which is devoted this issue are emerged. Consider some of the theories on the basic criteria: the nature of the theory, the emergence of the theory, its features, advantages and disadvantages.

Keywords: Leasingleasing transactionsthe balance of intereststhe search of balance

Introduction

In modern conditions, the company's success increasingly depends on taking into account interest of stakeholders. Searching a balance of interest is not the new problem, since ancient times, parties of the conflict have tried to solve the problem of "fighting for" and move to work over the "agreement about." By themselves, the words "interest" and "balance" are widely used in our speech. The concept of "balance of interests" is used in areas such as economics, politics, history, law.

History gives us many examples in different areas how was achieved a balance of interests. For example, in the XIX century, Napoleon, who was preparing the invasion to Russia, has pushed Turkey to war, to separate the Russian army. Russia was in need a peace, but the Turkish sultan would not hear about peace. However, the commander in chief Kutuzov succeeded in making peace, despite the dissatisfaction of the Emperor Alexander I, who would like to complete surrender of the Turkish troops and as result the commander in chief was, send to resignation. However, it is indisputable that Kutuzov realized balance between the interests of Russia and Turkey better then Alexander I, and this allowed reaching an agreement, which influenced the course of history: saving the uniform Russian army. This small historical example, allows us to understand the importance consideration of the balance of interests.

Word interest (lat. Interest - Important thing, having a value) represents the desire for cognition of an object or phenomenon, to mastering this or other kind of activity.

The category of interest is studied in economic sociology and the theory of economic interest. Ivanova A.N. is considering interest as the dominant motive of intentions of the subject to economic action which has at its core the freedom to choose options of investments available in his hands of resources into the economic system and identified with this investment (Ivanova, 2001).

The word "balance" is translated from the Latin language has two meanings: "the scales" and "equilibrium". Literally: bis - twice, lanz - scales (Abushenkova, 2013).

By itself, the balance of interests is a middle ground, which is achieved during the negotiations of its participants.

Problem Statement

Any process of finding a balance of interests begins with the confrontation of the parties and the strict upholding of pre-planned positions. This behavior leads to an escalation of the conflict, and gradual approximation to the peak of the negotiations, where the participants have the question reaching agreement or a break in relations. An agreement in this situation is achieved through compromise on each item of the conflict.

Rent, as a contemporary of emerging industries is becoming a very important form of investment and financing in financial sector, as in developed markets, and in developing markets (Bashi & Molla, 2013).

A lease is a form of debt financing, usually, the main purpose of organizing a leasing deal for a lessee is obtaining tax benefits (Marcus, 1978). Leases of fixed assets is a central component in the financing strategy for many companies. Leasing can be used to minimize risk, increase cash flow, reduce costs or improve the financial reports (Berk & DeMarzo, 2010).

Leasing is a vital issue for a wide range of companies, and the drastically different accounting and tax consequences of buying or leasing an asset strongly influence the business’s decision as to the method by which an asset is acquired. The appropriate accounting policies and disclosure to apply in relation to leases depend on the classification of leases. A lease is classified as a finance lease if it transfers substantially all the risks and rewards incidental to ownership; otherwise, a lease is classified as an operating lease (Ho, Kan, & Wong, 2010).

The leasing deal will be concluded only when the participants of the leasing process are interested in it. The interest will be determined by the financial results that can be achieved with a balance of expectations of all participants. Thus, our task is to understand how a balance of interests is achieved when discussing a leasing transaction.

Research Questions

By analyzing the essence of a balance of financial interests between the participants of the leasing deal, it is clear that each of its members strives to achieve its own interests in the maximum extent. As part of the leasing transaction, the lessor acquires the leased property at the supplier contractually purchase and sale agreement, while the lessee acquires the right to use of the property by the way of the lease agreement conclusion, for a fee in the form of an agreed size of the lease payments. Lessor accumulates in the interest of the lessee the funds needed to pay for the leased property, and then owns the object of the lease for term of the contract. Increasing competition among leasing companies leads to a change in the order of work on the leasing contracts, i.e., their individualization. This allows taking into account in negotiating the contract on the one hand the special requirements of the lessee and the other party to influence the formation of the cost of the leased asset.

Purpose of the Study

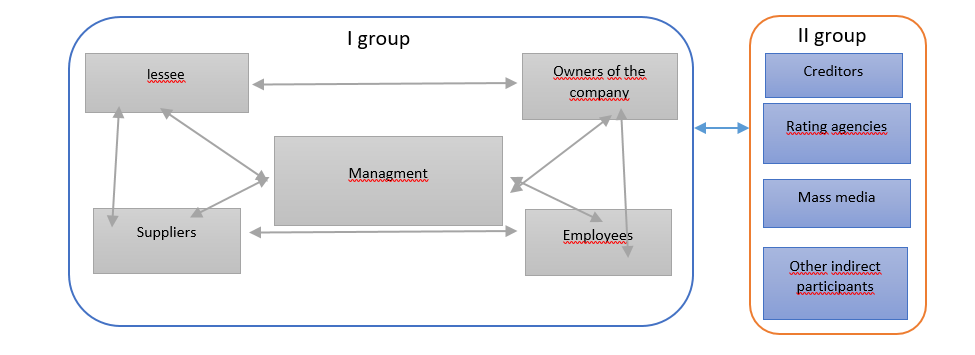

Regarding leasing, the conflict of interests between participants in a transaction can be presented in the form of a scheme depicted in the figure

The figure

I.A group of stakeholders directly involved in the leasing process.

II.A group of stakeholders able to influence the participants in the leasing process.

The first group includes a lessor, a lessee and a supplier. The contractual agreement represents the lease between the two Parties, the lessee and the lessor, and gives the contract to the lessee the right to use certain assets for a specific time period owned by the lessor in return for periodic payments paid by the tenant for the owner.

The second group has an indirect effect. For example, the rating agency influences the desire of suppliers and lessees to work with this company. Employees can choose an employer with a higher rating. Therefore, the actions leading to the review and downgrade of the company's rating are undesirable for it. The government also affects the participants in the transaction. While making the decision about signing a leasing agreement, an entity needs to take into account the current legislation in force. It is the regulations that will have an impact on the rights and obligations of the parties to the agreement, their tax charges and the requirements to be met by them (Wysłocka & Szczepaniak, 2012).

Thus, this study is devoted to the first group of stakeholders. The purpose of this study is to understand how the balance of interests for each parameter is sought in the individualization of a leasing transaction.

Research Methods

During process of searching a balance of interests, a large number of theories which is devoted this issue are emerged. Consider some of the theories on the basic criteria: the nature of the theory, the emergence of the theory, its features, advantages and disadvantages.

The Theory of Stakeholders

The first theory: The theory of stakeholders (Ivanova, 2001). The nature of the theory: stakeholder theory claims that managers in decision-making must take into account the interests of all participants in the business. These include individuals or groups that may significantly affect, or which may be affected, in order to increase the company's profitability – such persons are not only creditors, but also employees, customers and clients, the government, etc. (Jensen, 2002).

The emergence of the theory: The main provisions of this theory have been formed in the period from 1984 to 1992, spontaneously under the influence of a variety of different works and studies. However, in the last decade, this theory continues to evolve, and produces many derivatives.

Features: Spontaneous formation of stakeholder theory has led to the presence in it of different, sometimes controversial provisions of the various authors and the lack of a clear and coherent methodology and conceptual-categorical apparatus (Ivanova, 2001).

Advantages: Stakeholder theory teaches managers to think more creatively and on a large scale as to take into account in the policy of management of the company relationships with all-important counterparts and analyze the consequences of the decisions.

Disadvantages: Stakeholder theory is not without drawbacks, since it does not give an exact answer, what decision criteria should be used and how to take into account the interests of all stakeholders both internal and external, but still has a certain popularity. One explanation for the popularity of this theory is that the lack of clear criteria for decision-making, this allows people who responsible for decision-making, take into account first of all their personal interests and only then the interests of the company, which in turn leads to an increase in agency costs. Stakeholder theory does not provide a clear understanding of exactly whose interests must be balanced. If included in the balance of all those who can exert any influence on the company, the number of parties that must be taken into account in the calculations can be infinite. The theory does not give us an answer how divide the participants of business processes on specific groups.

The Balanced Scorecard

The second theory: Balanced Scorecard. The nature of the theory: The balanced scorecard - this is a management concept that aimed at the implementation of the strategy, being developed and implemented by enterprises around the world, regardless of size and industry (Klochkov, 2010).

The emergence of the theory: At the end of the 80s. Professor Robert Kaplan and David Norton conducted a study of 12 companies on the basis of this study formulated balanced scorecard. It consists in the fact that the financial measures are not sufficient to lead to effective management decisions (Kaplan, 1992).

Features: The study showed that the company uses only the usual financial performance over time lose their market advantages. This is because in the modern world, the company's success is increasingly dependent on customer loyalty, brand positioning, innovation activity, etc.

For the effective implementation of a balanced scorecard, Robert Kaplan identifies four stages:

1. The conversion of the company's strategy into a set of goals.

2. Formation of causality (alignment indicators and integrating them at all levels).

3. Scheduling order to achieve established targets.

4. Step feedback and learning (Kaplan, 2014). Balanced Scorecard by Robert Kaplan has four components – financial, customer, internal business processes and staff training and development (Stepanova, 2006).

Advantages: Reflecting the company's strategy in specific tactical actions, which is reflected in the establishment and monitoring of indicators. Creating a link between the four components of the balanced scorecard allows creating a clear understanding of existing business processes. Into account not only financial performance, but also non-financial.

Disadvantages: Lack of a clear development strategy in most companies. Strategy is the link of all four components of the system. Without solving the issue with the formation of strategy of development is not possible to proceed to the formulation of the problems of lower level, as it leads to the rupture of the integrity of the system. Another drawback is the excessive confidence in the new system and the lack of the market of large number of qualified staff able to develop and implement an effective system. During the development of the project should involve all levels of management of the company, as middle managers do not always have a complete view of the situation in the company.

The Ethical Decision Model

The third theory: «Ethical Decision Model» (Stermberg, 2000). The nature of the theory: This theory says that it is necessary to take into account an ethical point of view in process of taking business decision, as well as take into account role of contractors and business features. It offers a specific criterion: the ethical attitude to business that satisfies the individual freedom of each party and the interests of business owners (Sternberg, 1999).

The emergence of the theory: This theory originated in the late XX century.

Features: E. Stermberg in her work «The Stakeholder Concept: A Mistaken Doctrine» notes that the business is ethical when it maximizes long-term value of the company for its owners, subject to equitable distribution and ordinary decency. Ethical decision model determines what information influences the decision making of the ethical decisions based on ethical principles and defines the way to manage and find solutions of ethical problems in business. E. Stermberg in her work describes five basic steps of the model: 1. clarifying the issue. 2. Determining the appropriateness of the issue in relation to the activities of the company. 3. The definition of indirect restrictions. 4. Evaluation of options available. 5. Choosing the right course (Sternberg, 1999).

Advantage of this theory is an attempt to include in the decision taken by the company is not only target of increasing the profit, but also "human" criteria.

Disadvantages: When used in making decisions ethical norms, any person primarily based on their own experience. On the ethics used in decision-making affects, the person received the information from different sources. Consciously considering it human forms its own code of ethics and can be biased in making decisions.

The Game Theory

The fourth theory: Game Theory. The nature of the theory: Under the game in game theory is the process wherein the number of sides of two or more. Each side is fighting for the realization of their interests. Game theory helps to choose the best strategy taking into account the representations of the other participants, their resources and their possible actions.

The emergence of the theory: John von Neumann and Oskar Morgenstern set out the first foundations of the theory in 1944 in "Theory of Games and Economic Behavior" (Neumann & Morgenstern, 1944). In 1949 John Nash continued research in his dissertation on the theory of games, after 45 years, he received the Nobel Prize in economics (Nash, 1950b).

Features: In 1950, John Nash introduced the concept of an equilibrium situation, later named his name, as a method of solving non-cooperative games (i.e. games that do not allow for the possibility of building coalitions) (Nash, 1950a). The situation is formed as a result selecting by all players some of its strategies called equilibrium if none of the players disadvantageous to change their strategy if other players adhere equilibrium strategies. 1) Game theory in economic research is analyzing the situation in which the behavior of individuals interdependent: a solution of each of them have an impact on the results of interaction and solutions of other individuals. 2) In game theory does not require the full rationality of individuals, it uses a number of models of individuals from the individual as a perfect calculator to individual robot. 3) Game theory does not presuppose the existence uniqueness and Pareto optimality of equilibrium in the interaction.

Advantages: The main advantage of game theory - is the possibility to analyze situations, depending on the actions of individuals, problems of coordination and coherence actions.

Disadvantages: In reality, players can join the coalition, and therefore work together with each other, as opposed to the actions of third parties.

Following consideration of the existing theories to find a balance of interests, the following conclusions:

It is reasonable to assume that the number of parties that should be taken into account in the calculations should be limited.

We agree with the theory of interest groups that under the balance of interests should be understood definite nature of the interaction between the participants of the business process in which the investments in this process is justified by the achievement of the desired, a mutually satisfactory outcome for each of the participants in the process.

According to the authors, the balanced scorecard is one of the best attempts to organize the process of achieving a balance of interests for all the time of development of the issue and use of this system in conjunction with the theory of interest groups is a promising direction of economic thought.

There are two main limitations of applicability of the theory of ethical decision models: subjectivity and the different level of moral qualities in different people.

Thus, achieving a balance of interests is not achieved by the way of bilateral concordance but multilateral concordance of deal’s conditions. This can be explained from the position that in order to make a concession to a certain set of parameters leasing company must reach agreements with other stakeholders on other parameters. For example, receive a discount from provider, cancel the indexing of employee salaries or reduce dividend payments to owners.

Findings

Consider the basic parameters of the leasing transaction, in terms of the balance of interests of the leasing agreement.

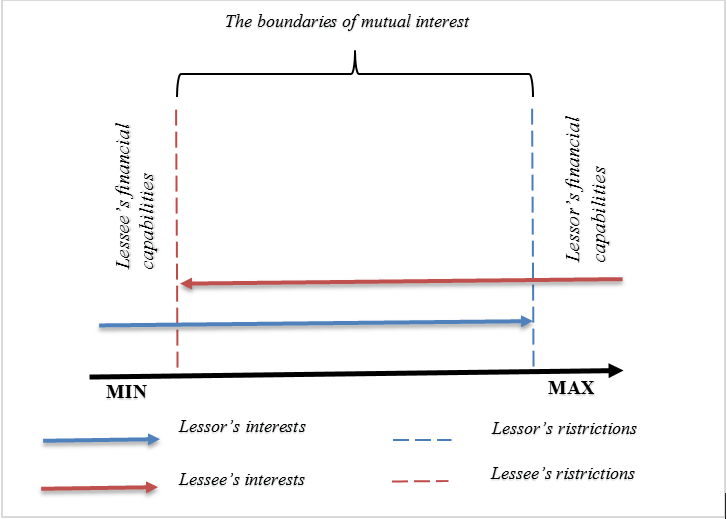

Lease payments (size, number)

The ability to determine the costs of the lessee for the entire period of the contract, are one of the important advantages of leasing. Interest’s lessor bases on a desire to maximize the amount of the lease payments in order to compensate for all costs incurred and to be rewarded in the form of commissions and margin. The main task of the lessee under the coordination of the leasing agreement is the minimization of lease payments. This is especially important for small companies with a high level of uncertainty of future profits.

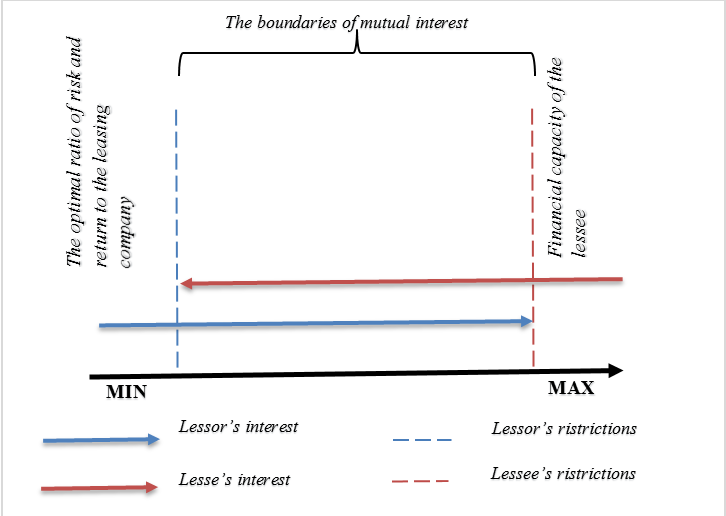

The balance of interests in this parameter is possible to find through negotiations and the implementation of various schemes of leasing payments: on the terms and frequency of payments. Dialogue between lessor and the lessee at the formation of the lease payments is shown in figure

However, in determining the amount and number of payments, the lessor determines its optimal balance between risk and return. The smaller the size of the lease payments, particularly in the initial periods of the when the amount of debt of lessee is high, the higher the profitability of the transaction, but at the same time and the higher the risk.

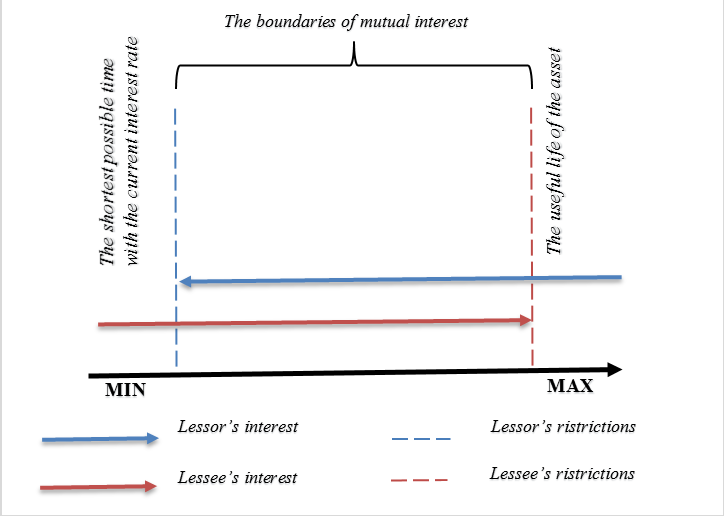

The term of the leasing contract and the interest rate

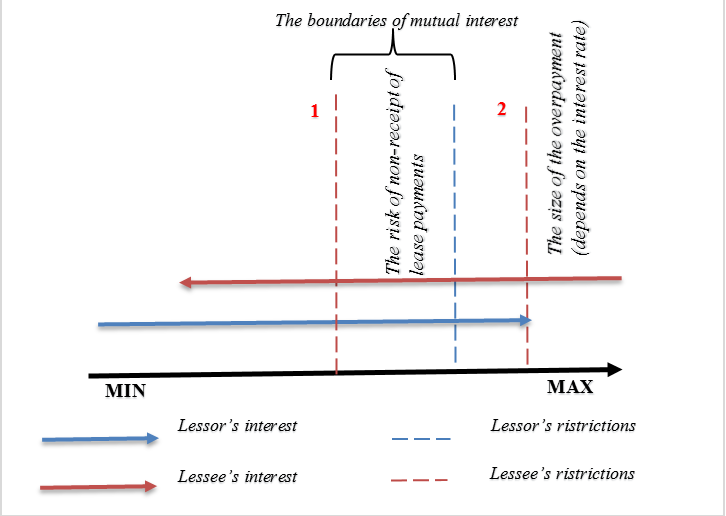

The total cost of leasing agreement depends on its duration. The longer the contract, the better it is for the lessee, and vice versa. The opposite effect show the effect of interest rate. For the leasing company is the most profitable option of leasing is a high interest rate for a shorter period. Not least on this preference is affected by the level of risk acceptable to the lessor. Graphically, the interests of parties to the transaction in the parameter "Lease term" shown in figure

The optimum ratio of the parameters "term of the lease" and "Interest Rate" will determine the attainability of the balance of interests of participants of the transaction, at the same time when the allowable combinations of risk and return of the leasing company are achieved. The balance of the interests of participants in the deal will be made at achieving a balance between the term of the leasing contract and the interest rate, which satisfies the interests of both sides and at the same time when the allowable ratio of return and risk of the transaction for the lessor are achieved.

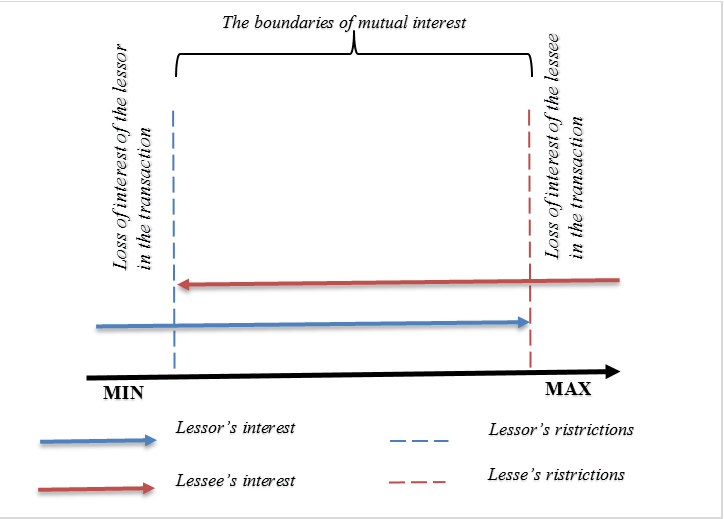

Downpayment amount

The maximum size of the downpayment is determined by the financial possibilities of the lessee. The lower limit of the parameter is determined by the lessor under the influence of indicators of risk and return on the deal. This is because the larger the down payment, the lower the yield of the lessee, however, and lower risk. Graphically, this description is shown in figure

Deferring of payment

The leasing company provides deferred payment to help the lessee to earn additional income for the subsequent lease payments at the same time the lessee can start using the equipment immediately. Provision postponing is beneficial for leasing company, as it allows obtaining a greater amount of interest income; this is because during the period of postponement, repayment of principal is not going. In addition, postponement always imposes additional risk associated with lease payments shortfall. If necessary, provide a postponement a balance of interests is situated at the point of intersection of the acceptable level of risk and the greatest possible grace period. Graphically, this ratio is represented in figure

Currency

When buying imported equipment leasing company enters into a contract of sale in foreign currency, but the currency of the leasing agreement may be different. In this situation, the leasing company may experience additional costs associated with currency fluctuations. In order to avoid such a situation, the lessor is to strive for the conclusion of contracts of sale and lease in the same currency. However, it does not always agree lessee whose income, for example, in rubles and in the absence of proceeds in foreign currency, he does not want to bear the risk of additional costs related to exchange rate fluctuations. Graphically, this is shown in figure

Conclusion

Thus, the formally the interest of each participant is expressed by a function of the leasing transaction, depending on the parameters and presented in the form of a formula 1.

I=f(x,y,z…n) , (1)

I – interest by party transaction

x, y, z ….n – options transactions that are critical to decision-making

Therefore, the interests of the leasing company will be expressed: I_(s=) f(x_s,y_s,z_s…n_s ), а the interests of the lessee: I_(c=) f(x_c,y_c,z_c…n_c ), the intersection of these functions show the intersection of interests of participants of the leasing deal. Changing a parameter will affect the function and as a result in the interest of either party in the transaction.

References

- Abushenkova, М. (2013). About balance in the balance sheet. And about the authorized capital. Glavbukh, 6. URL: http://e.glavbukh.ru/articleprint.aspx?aid=307972. [in Rus.].

- Bashi, E., & Molla, F. (2013). The future of leasing accounting. Journal of Applied Economics and Business, 1(3), 65-78.

- Berk, J., & DeMarzo, P. (2010). Corporate Finance. New York, NY: Pearson.

- Coskin, Y. (2013). Financial engineering and engineering of financial regulation: guidance for compliance and risk management. Journal of Securities Operations & Custody, 6(1), 81-94.

- Ho, D., Kan, S., & Wong, B. (2010). International lease accounting and tax consequences: the Hong Kong perspective. International Journal of Economics and Finance. 2(4), 233-243.

- Ivanova, А.N. (2001). The balance of interests in the management of the organization (the theoretical and methodological aspect). Moscow: State University of Management. [in Rus.].

- Jensen, M.C. (2002). Value maximization, stakeholder theory, and the corporate objective function. Business Ethics Quarterly, 12(2), 235-256.

- Kaplan, R.S. (1992). The balanced scorecard: translating strategy into action. Harvard Business Review, 71-79.

- Kaplan, R.S. (2014). Strategy maps. Transformation of intangible assets into tangible results. Moscow: Olimp-Business. [in Rus.].

- Klochkov, A.K. (2010). KPI and motivation. The complete collection of practical tools. Moscow: Eksmo.

- Kotlyrov, E.D. (2011). Innovative models of financial business: analysis and prospects of development. Money and Credit, 5, 52-57.

- Marcus, R.P. (1978). The cost of leasing: inflation and residual value. Financial Analysts Journal, 34(2), 58-60.

- Marwan, M.A.O. (2014). The impact of leasing decisions on the financial performance of industrial companies. Global Journal of Management and Business Research, 14(2-C), 24-44.

- Nash, J. F. (1950a). Equilibrium points in n-person games, Proceedings of the National Academy of Sciences, 36, 48–49.

- Nash, J. F. (1950b). Non-cooperative games (Doctoral dissertation). Princeton, USA: Princeton University

- Neumann, J. & Morgenstern, O. (1944) Theory of Games and Economic Behavior. Princeton, USA: Princeton University Press

- Stepanova, G.N. (2006). Balanced scorecard as a tool for management of competitiveness of the modern enterprise. Modern Management, 10(94), 20-25. [in Rus.].

- Stermberg, E. (2000). Just business: business ethics in action. Oxford: Oxford University Press.

- Sternberg, E. (1999). The stakeholder concept: a mistaken doctrine. UK: Centre for Business and Professional Ethics University of Leeds and Analytical Solutions.

- Tapiero, C. S (2013). The future of financial engineering. New York: NYU-POLY.

- Wysłocka, E., & Szczepaniak, W. (2012). The effectiveness of leasing as a method of financing the development of a company. Polish Journal of Management Studies, 6, 129-142.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Kornilova, E. (2019). Leasing: The Balance Of The Financial Interests Between Participants. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 299-311). Future Academy. https://doi.org/10.15405/epsbs.2019.03.31