Abstract

The study considers organizational structures that ensure the effective management of production systems in oil and gas companies. The structure of the business model has been formed and it represented by three main components: organizational, functional and informational. This combination determines the management efficiency of production systems, ensuring the development of oil and gas companies. The analysis of existing business processes revealed “bottlenecks” and contributed to the development of recommendations for their optimization. The authors analyze the interaction of business processes, their performers and key performance indicators. To solve the problems aimed at the development of oil and gas companies, the principles of personal responsibility of participants of investment projects are presented. Stages with key decision points for simple, most complex and capital-intensive projects are recommended. Thresholds of performance serve as a cut-off factor in the process of initiating and approving projects. The life cycle of investment realization is presented as an activity of business processes ensuring the development of the company. It includes stages that differ in the composition of work performed and are necessary for decision-making of production departments engaged in operational activities. Depending on the size and complexity of projects, the number of stages required for their implementation may vary. The decision on investing applicability is made by the head of the structural unit (department) and is directed to conduct a technical, technological and economic appraisal of the business opportunity.

Keywords: Business processorganizational modelfunctional modelinformation modelintegrationinvestment project

Introduction

As a result of the restructuring of Russian oil and gas companies in the beginning of the 21st century, the production assets of these companies switched to a process approach in management. This transition led to a decrease in management costs, an increase in the company’s competitive advantage, etc. However, as companies operate, a number of weaknesses in the introduced management system became apparent: inconsistency in actions between services, various key indicators on business processes, clashing of engineering decisions made at different levels of business processes, reduction in overall performance of the company. The identified weaknesses determine the need to improve the management system and impose increased requirements on the performance management of business processes of refineries. The competitive advantage of companies largely depends on the right choice of the business management strategy.

The management efficiency of production systems in refineries contributes to the development of their competitive advantage in the industry. The evolutionary development of the management of organizations has determined the most effective tool for creating an optimal organizational management system. Business processes are a tool for organizations to achieve their goals. Business processes are a set of rules that an organization applies to take action (Nelson & Zima, 1982).

Business process management includes methods and tools to support the design, management and analysis of operational business processes (Ivanov & Blinkov, 2010). Process management involves special process-oriented technologies and tools. Process-oriented management is the fundamental basis of modern management, offering a methodology for determining a set of processes performed in organizations and further work on their improvement.

The business model is used as a toolkit, i.e. the concept of the company, aimed at obtaining a higher financial result. The business model of refineries is the generation of income through the involvement of production departments in the decision-making process in the field of investment management. The creation and implementation of business models are based on process and system approaches.

The structure of the business model can be represented in the form of three main components (Chaplygina & Meleshko, 2016):

Organizational model - the organizational structure of the company and the roles of employees in the management system of the company;

Functional model - business processes and events that initiate these business processes, output results;

Information model - a scheme of information flows in the management, built on the basis of the functional model.

Functional model. The development of a business model is aimed at building a functional business model. It is necessary to represent the management of the company in the form of business processes (workflows) that transform input data into output data that are consumed by other processes or external consumers. The task of this stage is to transform management into a process environment and, without going into details of specific operations, identify macro processes, outline the boundaries of macro processes, determine inputs and outputs, and establish existing relationships between them at the event level.

Organizational model. It involves the creation of an organizational model based on the structure of the company. It should be noted that the organizational model should not be viewed as a graphical reflection of the staffing table, but as a system of elements united by relations and management functions (Sumbal, Tsui, Cheong, & See-to, 2018). In the organizational model, both formally existing structural units and associations of structural units on a target basis (standing commissions, project groups, councils, committees, etc.) should be presented.

Information model. An object model presented in the form of information describing the parameters and variables of the object that are essential for this consideration, relationships between them, inputs and outputs of the object, allowing stimulating possible sates by submitting information on changes in input values.

The business model presented in this study contains graphic and text descriptions that allow understanding and simulating the investment management process in the company. The content of a particular business process is determined by its functions based on the types of activities (Stapran, 2018).

The content of business process management within the company is determined by a system of management decisions aimed at creating information, financial and material flows that drive the resources of the company for the efficient production of products, works, services and their systematic profitable implementation.

The developed structure of the business model seems to be the most successful, since its simplicity takes into account the integration of all elements.

Problem Statement

The problem statement determined the need for a scientific solution of the following interrelated tasks:

Select and justify the structural elements of a business model of refineries that provide business process management of investment activities;

Develop the life cycle through investment business activities;

Identify participants and key indicators of the life cycle of investment.

Research Questions

To solve the set tasks, it is necessary to carry out an analysis of business processes, which allows revealing “bottlenecks” and making recommendations for optimization; to carry out the decision-making process on the investment attractiveness of the offer; and to develop the life cycle of investment in refineries.

This study focuses only on the oil sector in the oil industry, which limits the generalizability of results for other companies.

Purpose of the Study

As a result of the activity analysis of refineries, the purpose of the study was formulated, which is to scientifically substantiate the development and application of a business model that ensures greater efficiency in making management decisions, and to form participants and key indicators of the life cycle of investment.

Research Methods

The study used the methods of system research, comparative analysis, expert assessments, etc. The study also reflected the results of specific economic research of the authors on the problems of effective management of production processes in the changing internal environment of the refinery.

Currently, in most Russian refineries, development business processes are responsible for the company’s investment activities, aimed at extracting profits in the future and requiring substantiation of economic and strategic expediency.

The beginning the investment development project has the following stages: initiation, appraisal and execution, review and approval.

The initiators of the business opportunity can be any employees of the company. The decision on the feasibility of assessing business opportunities is made by the head of the business unit. This is followed by a technical-technological and economic appraisal of business opportunities. After economic appraisement of the business opportunity and calculating the KPI, the business opportunity becomes a project (Li, Ren, Zou, Bao, & Luo, 2018).

Economic appraisal is carried out on the basis of macroeconomic prerequisites for project appraisal. These prerequisites for project appraisal are based on the scenario macroeconomic conditions formed at the beginning of the business planning cycle and can be expanded and refined due to the longer horizon of project planning (Rachman & Ratnayake, 2018).

As a rule, companies have developed recommendations on threshold performance indicators for investment development projects by type of activity. Efficiency thresholds serve as a cut-off factor in the process of initiating and approving projects: projects that do not meet efficiency thresholds are considered to be inappropriate to the goals of the company.

In the case of a positive investment decision on the project, the decision is communicated to the participants of investment activities. The project is transferred to the implementation with financial obligations (for example, entering into contracts, payments to third parties, etc.) and approved funding for the project or the phase of the project is allocated, subject to availability of appropriate funds in the approved or revised business plan (Kompanejtseva, 2016).

In the framework of investment activity, the company has the following goals:

Ensure sustainable business growth by attracting investment in efficient and competitive projects, increasing investment income, systematically optimizing the project portfolio and minimizing investment risks (Khamidullin, 2018);

Ensure compliance with the principles of high social responsibility in the field of environmental and industrial safety, ensure safe working conditions, protect health, improve the quality of life of workers and their families, support education, and contribute to the socio-economic development of regions.

Achieving the goals of investment activity is carried out by solving the following tasks:

Develop and optimize the investment portfolio in order to improve economic efficiency and ensure long-term growth, including the acquisition of new high-performance assets and low-performing asset disposition;

Ensure the continued availability of business opportunities, the required amount of financing which exceeds the available amount of investment;

Ensure the ongoing process of reviewing projects and making investment decisions;

High-quality project preparation;

Ensure the effective investment decision-making process for the project: the timeliness, soundness and speed of decision-making to maximize the identified value of the project;

Conduct regular monitoring throughout the project life cycle;

Identify and develop measures to reduce the risk of projects before and during their implementation;

Hearing of projects is aimed at inclusive investment decision-making. At the same time, the principle of personalization of responsibility for achieving the goals and results of projects is observed.

The approach to solve the problems of investment activity is based on the following basic principles that are mandatory for business processes related to investment activity:

The existence of an investment decision for each project: each project must go through a full review procedure (initiation, economic appraisal, review);

Each project exceeds its threshold performance indicators: when making investment decisions, it is necessary to ensure that the project’s performance exceeds the threshold performance indicators;

The authority and responsibilities of project decision makers must correspond to their importance: the investment decision-making system provides for a hierarchy of bodies authorized to make decisions on projects depending on their capital intensity and strategic importance;

Personalization of responsibility throughout the project life cycle;

Monitoring the implementation of the project at all stages of its life cycle;

Phasing of project implementation: in order to improve the quality of project management, they may include the stages of development and implementation;

Interconnectedness with related processes.

After the preparation of the investment project, it is submitted for consideration by the investment committee, in case of a positive decision about the beginning of the project, the investment is included in the Business Plan of the extractive company (Semerkova & Ostrouhova, 2017).

Equipment is being purchased in accordance with the approved Business Plan, preparation of design and technological documentation for the development of the field and design and estimate documentation for the construction of capital facilities is being carried out.

As a rule, the Long-term Planning Department is responsible for the preparation of a business plan. And the Materials Management Department is responsible for the implementation of project documentation for the construction of facilities. Equipment procurement is controlled by the Logistics Department.

Based on the completed project, construction and installation works of infrastructure facilities are performed, after which the facilities are commissioned, the field is put into development, thereby the result of the investment project is transferred to operational activities (Nimmagadda, Reiners, & Wood, 2018).

The construction and installation works are provided by the Facilities Construction Department, and the commissioning of the facilities is supervised by the Chief Engineer Department. Thus, the development activities of business - processes of the extractive society can be represented as the life cycle of investment (Chaplygina & Meleshko, 2016).

Findings

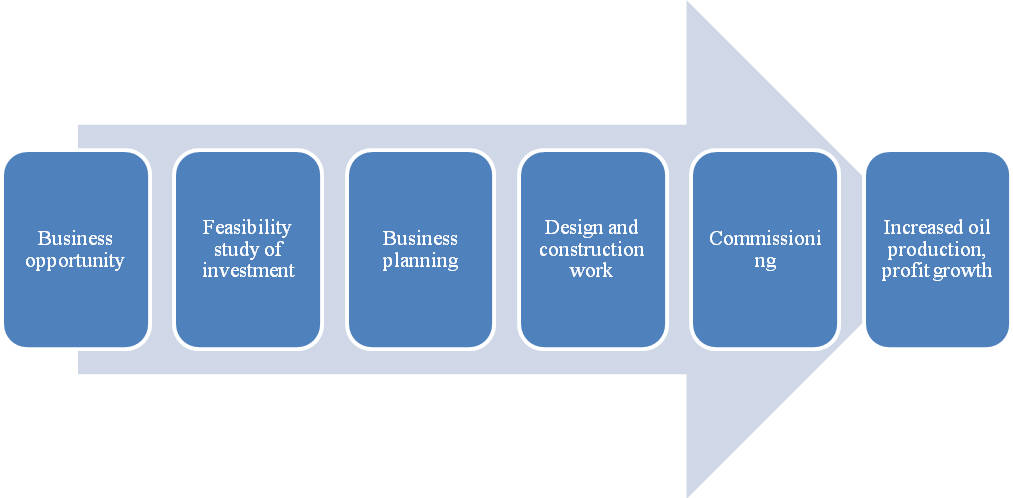

The life cycle of investment in the extractive company includes several stages that differ in the composition of the work performed and the available information for decision-making (Figure

In most projects, at the time of their initiation, there is a high level of uncertainties and risks due to the lack of information about the project and the incomplete study of the project implementation plan, which does not allow making decisions immediately on authorizing investment for the entire project (Saraeian, Shirazi, & Motameni, 2018).

In this regard, investment decisions on most projects should be made in stages, with the exception of projects that are not complex and not long-lasting.

The purpose of each stage is to collect and analyze information for the transition to the next stage at the decision point (Cherepovitsyn & Kraslavski, 2016).

Depending on the size and complexity of projects, the number of stages and decision points required for the implementation of projects may vary. For the most complex and capital-intensive projects, it is recommended to use a system with six key decision points, and for simple projects it is possible to have only two key decision points (initiation and completion):

1. Identification of business opportunities;

2. Justification of investment, making decisions on the implementation of business opportunities;

3. Planning of capital investment in the short-term production program - business planning;

4. Provision of project documentation, as the site of mineral resources, and directly capital construction objects;

5. Construction and installation works;

6. Transfer of objects into operation.

Regardless of the number of stages when executing projects, the following tasks should be solved:

1. Evaluation of investment opportunities;

2. Analysis and selection of the most alternative and effective option;

3. Conduct an economic appraisal;

4. Detailed design;

5. Develop and implement a procurement strategy and plan;

6. Direct implementation of the project, including, for example, the creation of fixed assets and their commissioning.

At each stage of execution, an economic appraisal of the project is required based on updated information about it, including an appraisal of the impact of risks on the project.

Updating the approved project’s indicators should take into account the actual work performed (volumes and costs) and the results obtained, as well as the forecast for subsequent periods, taking into account the results of the fact, approved changes, removing uncertainties, current resource limitations / opportunities, including financial, scenario macroeconomic conditions and so on (Babordina et al., 2017).

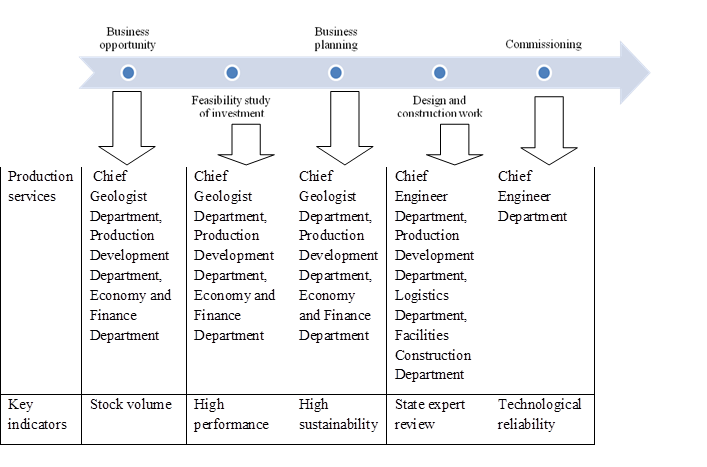

If you look at activities of the oil and gas company in the context of business processes, then the main processes are activities of the Chief Geologist and Chief Engineer, indirect processes are activities of the Facilities Construction Department, Material Support Department, Economy and Finance Department, etc.

In general, the process of implementing investment in oil and gas companies includes a large number of production departments, which in turn are also engaged in operating activities. The team of authors proposed a model for managing investment companies, taking into account the life cycle of their implementation, the organizational structure of management and key indicators formed at each stage of the business process (Figure

Conclusion

Thus, in accordance with the purpose, the study has developed a business model of refineries that provides revenue through the involvement of production departments in the decision-making process in the field of investment management.

The relationship of the organizational structure of business process management, their executives and key indicators ensures cost optimization and efficiency of management decision-making. The presented life cycle of investment determines the activity of business processes and the structure of the business model of refineries that provides additional profit.

References

- Babordina, O.A., Garanina, M.P., & Chaplygina, T.P. (2017). Effektivnost upravleniya proizvodstvennymi protsessami v usloviyakh izmenyayushcheysya vnutrenney sredy neftedobyvayushchego predpriyatiya. Evraziyskiy Yuridicheskiy Zhurnal, 1(104), 353-356.

- Chaplygina, T.P., & Meleshko, M.S. (2016). Upravleniye effektivnostyu razrabotki mestorozhdeniya na vsekh stadiyakh zhiznennogo tsikla. Proizvodstvenno-Tekhnicheskiy Neftegazovyy Zhurnal «Inzhenernaya Praktika», 12, 84-87.

- Cherepovitsyn, A.E., & Kraslavski, A (2016). Issledovanie innovatsionnogo potentsiala neftegazovoj kompanii na raznyh stadijah `ekspluatatsii mestorozhdenij. Zapiski Gornogo Instituta, 222, 892-902.

- Ivanov, P.V., & Blinkov, O.G. (2010). Sovepshenstvovanie biznes-modele jkompanijnefte gazovogo kompleksa. Problemy Ekonomiki i Upravlenija Neftegazovym Kompleksom, 8, 41-45.

- Khamidullin, R.I. (2018). Milestones of mathematical model for business process management related to cost estimate documentation in petroleum industry. Journal of Physics: Conference Series, 1015, 32-53.

- Kompanejtseva, G.A. (2016). Proektnyjpodhod: ponjatie, printsipy, faktory `effektivnosti. Nauchno-Metodicheskij Elektronnyj Zhurnal «Kontsept», 17, 363-368. URL: https://e-koncept.ru/2016/46249.htm 2016/46249.htm.

- Li, Z., Ren, L., Zou, X., Bao, S., & Luo, T. (2018). Innovation of strategic cost management of natural gas in China's petroleum enterprises. Natural Gas Industry, 38(5), 140-147.

- Nelson, R.R., & Winter, S.G. (1982). An evolutionary theory of economic change. Cambridge, MA: Harvard University Press.

- Nimmagadda, S.L., Reiners, T., & Wood, L.C. (2018). On big data-guided upstream business research and its knowledge management. Journal of Business Research, 89(С), 143-158. DOI:

- Rachman, A., & Ratnayake, R.M.C. (2018). Adoption and implementation potential of the lean concept in the petroleum industry: state-of-the-art. International Journal of Lean Six Sigma. DOI:

- Sapiuly, K.M. (2017). Proektnoe upravlenie kak instrument realizatsii strategii, realii i perspektiv yprimenenija v neftegazodobyvajuschih predprijatijah Respubliki Kazahstan. Vestnik Voronezhskogo Gosudarstvennogo Universiteta Inzhenernyh Tehnologij, 69(1), 332-337.

- Saraeian, S., Shirazi, B., & Motameni, H. (2018). Towards an extended BPMS prototype: open challenges of BPM to flexible and robust orchestrate of uncertain processes. Computer Standards and Interfaces, 57, 1-19.

- Semerkova, L.N., & Ostrouhova, N.G. (2017). Issledovanie biznes-modelej predprijatij toplivno-`energeticheskogo kompleksa Rossii. Izvestija Vysshih Uchebnyh Zavedenij. Povolzhskij Region. Obschestvennye Nauki, 2(42), 184-198. DOI:

- Stapran, D. (2018). Outsourcing vs vertical integration in oil & gas industry in Russia: a case of virtual organization? International Journal of Mechanical Engineering and Technology, 9(5), 993-1002.

- Sumbal, M.S., Tsui, E., Cheong, R., & See-to, E.W.K. (2018). Critical areas of knowledge loss when employees leave in the oil and gas industry. Journal of Knowledge Management, 22(7), 2-18.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Babordina, O., Garanina, M., Ilyina, L., & Garanin, P. (2019). Formation Of The Business Model Of Oil Producing Enterprises. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 230-238). Future Academy. https://doi.org/10.15405/epsbs.2019.03.24