Abstract

In the objective reality emerging in recent decades systemic transformation of a financial nature are manifested at the mega and macro level in the form of the phenomenon of "Finance for Finance", and also at the level of economic entities - in the form of a paradigm shift in corporate courses (moving from accounting model to financial model of measurement and management). These transformations are accompanied by radical changes in the financial behavior and thinking of economic agents, which are changing from the model of "economic man" to behavioral finance and modify the system of financial measurements - from the accounting tradition of analysis based on financial statements to the "war of metrics" ("Metric wars"). In this study, the author considers the problem of financial transformations in the economic systems of the industry level - by the example of the financial market. The driver of these transformations is FinTech (financial technology). Trends that have developed in this segment of the economy after the global crisis of 2007-2009, evidence the emergence of a new system quality in business models, not only inside the financial market, but also beyond it. This new systemic quality is a consequence of two objective megatrends: the financization of the economy, on the one hand, and its digitalization, on the other hand. Emergence of the new quality in the economic systems of the industry level makes it necessary to generalize the empirical experience and to interpret it from the point of view of fundamental theory.

Keywords: System transformationsfundamental theoryfinancial technologies (FinTech)global trendsRussian features

Introduction

Financial transformations, as everyone understood as a profound change in the quality of economic systems at different levels, are an objective phenomenon of recent decades. In the author's opinion, financial transformations of the industry level are almost not studied today. Their bright illustration is the profound changes in the quality of the financial market, the driver of which is FinTech. The trends caused FinTech have intensified after the global crisis of 2007-2009. Less than 10 years not provide us with enough empirical experience to draw conclusions, but it is ENOUGH to generalize, systematize and interpret the existing trends at present.

Problem Statement

FinTech as a result of the financization of the economy, on the one hand, and its digitalization, on the other hand, explane becoming of a new systemic quality in the financial market. The task of science is the generalization and systematization of this empirical experience and its interpretation from the point of view of fundamental economic theory.

Research Questions

To solve the problem, it is necessary to study the following questions:

to define FinTech, fundamentals and boundaries of this segment of the financial market;

to set forth the new system quality, which emerges at financial market owing to FinTech;

to reveal empirical common trends in FinTech development both in the world and its features in Russia;

to generalize the views of experts on the future development of FinTech in Russia.

Purpose of the Study

The purpose of this study is to interpret FinTech in the context of systemic financial transformations. Such can be irreversible economic phenomenon. In the case of FinTech, they are due to the financization and digitization of the economy.

Research Methods

The main methods used in this study - analysis and synthesis (including content-analysis of articles and analytical reports, event-analysis), systematization and classification, comparison, expert assessment (including the author’s assessment), information visualization and a lot others.

Findings

FinTech: fundamental theory

It is commonly known that the fundamental theory treats bank and related non-bank services as financial intermediation. The main function of organizations, which provide these services, is to accumulate temporarily free money from some market participants and to deliver it to the other participants, who need it, to use on a return, time limited and paid basis. Financial market institutes performing this function and activating payment system have been considered quite conservative for a long time, as far as business processes, tools and provided services have not been changed for decades and centuries. Activity of financial market institutes is strictly controlled. So that to avoid business competition, they constantly lobby additional restrictions. Due to these restrictions new services and facilities are declared to be financial (non-bank) and are prohibited to be rendered without license.

Meanwhile, at the fundamental level the main products of financial market, such as information and money, are easily digitalized. This implies that financial market can not keep out of the digital revolution. Technologies developed during the last decades thanks to the digital revolution modify financial market and financial services radically and thoroughly. Not merely economic but also political and legal basis is changed, which define financial market. Drivers of these changes (besides the digital revolution) are financial globalization, growth of business competition, deregulation of financial markets (as regards cancellation of international Bretton Woods system of monetary management for commercial and financial relations and transfer to Jamaica Monetary System), financial innovations. The scope of quality and quantity changes at financial market is increased owing to “blockchain” technology and crypto currency, which is beyond the government control3 and which undermine central banks’ monopoly of money flow control. In this context Swiss business magazine “Bilanz” forecasts a revolution in the financial world and the economy in general.

Modern technologies bring into life new business models, such as FinTech companies at financial market (fintech start-ups, fintech centres, fintech hubs, fintech clusters, financial ecosystems). In fact, most of these definitions are synonyms, but all together they build up fintech industry, which affects traditional financial institutes. In business community some experts forecast disappearance of these institutes in the near future, others predict inevitable mutual interference of traditional and new financial business models.

FinTech and its interpretation

The term FinTech appeared in early 90s. Professor Patrick Schueffel mentions that in that period bankers proposed projects on optimization of the process of bank services rendering by use of technology means. Such projects were called “FinTech” ones and were considered innovation and contributing to higher efficiency of financial service. Originally, definition FinTech was used when speaking about the technology of operation of financial institutes. Afterwards it was interpreted more generally, including projects on upgrading of financial competence and crypto currency, on the one hand, and was used beyond the English language becoming the world slogan, on the other hand. In practice, FinTech can turn into a bubble owing to some segments (for instance, crypto currency). If this bubble burst, the technology will remain and will be accepted as a business-standard of financial industry (Schueffel, 2017).

According to the opinion of many members of business community, FinTech is a financial industry with innovations. PwC interprets FinTech as a dynamically developing segment at the intersection of sectors of financial services and technologies, where technological start-ups and new market entrants apply innovation approaches to products and services, which at present are provided by the traditional sector of financial services (Global FinTech Report, 2017).

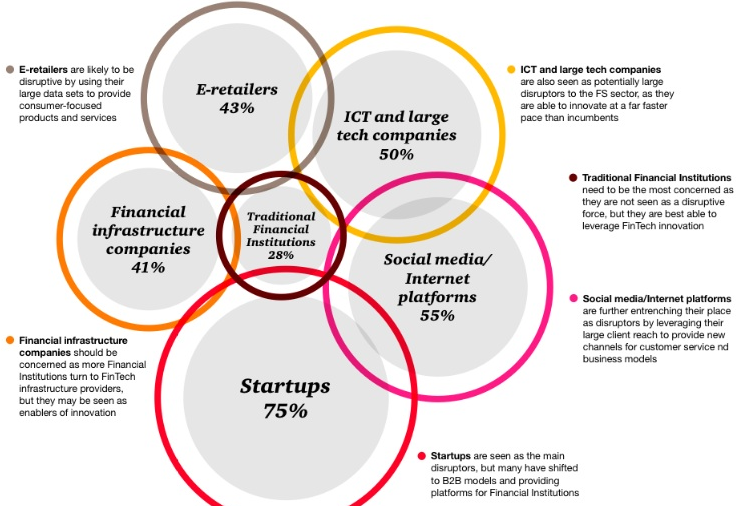

It should be noted that FinTech is adopted not only at financial market, but also beyond it: from IT-companies to retail and social media (Fig. 01). This demonstrates the convergence of the financial world (Global FinTech Report, 2017), which also shows its expansion and existence of the new system quality in this market segment.

FinTech as a new system quality

As is known, profound changes of system quality, which result into appearance of a new system, are called transformation (Khotinskaya & Chernikova, 2013, 2018). FinTech is a new phenomenon at financial market, which spreads outside its bounds. Its system characteristics are the following:

breakthrough financial technologies in the field of payments, money lending, investment, crypto currency, etc, which are rapidly implemented at various markets of products and services (financial market, trade, IT, social media, etc.);

reinterpretation of model of financial market and its interaction with product markets up to establishment of financial ecosystems;

change of format of interaction between people and institutes with money pursuant to the principle “manage myself” or to the principle of disintermediation (refusal from intermediators);

transparent and low-cost technological services, which enable new behavioural scenarios with the use of available mobile applications and new financial mentality of economic agents.

New system quality FinTech is based on the set of modern technologies, such as:

distributed databases Blockchain – chains of information units arranged according to certain rules;

concept of computer network of physical items (Internet of Things, IoT), equipped with built-in devices to communicate with each other or with the environment reducing human exertions;

big data, smart data;

cloud technologies, which ensure secure data storage and remote work with it, and mobile applications;

artificial Intelligence, AI, which in the recent years evolved from describing function to analytical, predictive and prescribing one. At present it is a set of related technologies aimed at understanding human intelligence with the use of computers, including voice recognition, machine learning, expert systems (digital assistants and bots inclusive), automated dialogue systems or virtual agents (chat-bots);

biometry for the purpose of unique person identification to ensure secure access to information and material objects.

The above mentioned technologies are not merely financial. They are the result of digitalization of economy. Nevertheless, participants of financial market intensively apply them for the transfer to new services and business-formats.

Online-services, by which clients are communicated with, are the specific feature of FinTech. This communication can be various depending on the involved parties. B2B stands for business-to-business; B2P - business-to-person; P2B – person-to-business; P2P – person-to-person or peer-to-peer. The essential feature of FinTech is the work with persons in formats B2P, P2B and chiefly P2P. For P2P format comfortable P2P-services are developed. In the centre of such business model is a retail consumer, who accomplish his aims using platform – solutions proposed by a FinTech-company. The most popular services, business relationship options are currently being formed: B2G (between business and government), B2E (between business and employees).

The traditional areas of financial services, where FinTech is rapidly developed, are as follows:

money transfer and payments: identity verification and generation of login accounts to keep money (for instance, bank accounts), devices for money depositing and withdrawal (for instance, cheques and debit cards), systems for secure money exchange between different countries (for instance, ACH);

borrowing and lending: consumer institutes, which aggregate money from depositors, and then lend it to borrowers (for instance, credit cards, mortgage or auto lending);

wealth management: advisors, which consult brokers and investment managers on the subject of financial investments (for instance, investments in the stock market), as well as pension planning (for instance, pension and aid) and real estate;

insurance: life insurance, property insurance (for instance, car or home insurance), accident insurance or health insurance;

currency.

Global trends in FinTech development and Russian features

Most of experts agree that the burst of FinTech started after the global financial crisis under the conditions of mistrust of banks and difficulties with taking out loans (Chishti & Barberis, 2016; He et al., 2017; Kleiner, 2002; Kornai, 1998; Myers, 1996; Philippon, 2017). The period after 2008 is the "golden age" of FinTech. This means that FinTech’s age is nearly 10 years. This is very little by historical standards. Meantime, this financial practice gives the empirical material which allows specifying the global trends and national (here is Russian) peculiar features:

the scope of global investments in FinTech has increased by 3 and more times: from $9 billion in 2010 to $31 billion in 2017 [KPMG – The Pulse of FinTech, 2017, 2018] – such impressive dynamics shows high potential of FinTech growth and almost unlimited opportunities for breakthrough innovations;

the shift of financial centres from developed economies to developing markets. Top-5 ranking of countries with the highest adoption of FinTech key segments (Tab.

01 ) demonstrates that China is the leader in money transfer and payments, in financial consulting (planning), in investments and lending (the largest market of P2P-lending - more than $150 billion);in FinTech global industry Russia is far behind the leaders – less than 0,1% of world investments. As regards the scope and the structure of FinTech, as well as institutional and regulatory environment this Russian economy segment is at its early stage of development;

however, as regards FinTech Adoption Index Russia took the 3rd place (43%) among the 20 largest world markets in 2017 compared to the average index of 33% (China – 69%, India – 52%) (Financial system change. Transforming capitalism to make it fit for a sustainable future. – EY, 2017). In our opinion, these estimates are overly optimistic, since Russia is represented mainly by Moscow and St. Petersburg, the most advanced regions in terms of FinTech. The country markets in this study are compared with the two megacities of Russia, which is not entirely correct from a methodical point of view.

the “digital gap” is a serious problem that impedes FinTech development in Russia: small and medium credit institutions fall far behind the largest banks and FinTech-companies in development of digital competence. Those, who won’t be able to reduce the “digital gap”, are very likely to be consolidated or gone away from the market (Digital-Russia-report, 2017).

Development prospects of Russian FinTech-industry

According to the experts’ opinion, the main trends in development of FinTech-industry in Russia in the near future will be as follows (Main directions of development of financial technologies for the period 2018-2020-CBR, 2018; Digital-Russia-report, 2017):

transformation of traditional banks (mostly, large ones) into entirely digital banks;

large banks will move out of the bounds of traditional banking business. Classic banks will be transformed towards financial ecosystem;

dynamic interaction of banks with high-technology companies within the framework of joint elaboration and implementation of innovation solutions, innovation outsourcing or other ways of cooperation (for example, small financial companies, which can not afford updating of their IT-system, can involve companies, which provide technological solutions in the format of outsourcing – from cloud services of data storage and processing to application of advanced analytical methods for big data analysis);

strategic partnership of banks with aggregators of user information (for example, social networks and communication operators), which give access to external data on clients in order to make credit scoring, cross-selling, etc. more accurate;

rearrangement of financial market in favour of new entrants;

focus of small and medium banks on basic services (work with balance sheet and transactions), including under White label, which will allow to compete at the market at the expense of cost reducing.

Conclusion

Which of these trends will prevail at the Russian market much depends on legislative regulation of FinTech-industry and efficiency of decisions taken.

References

- Chishti, S., & Barberis, J. (2016). The FINTECH book: The financial technology handbook for investors, entrepreneurs and visionaries. Moscow: Alpina Publisher.

- Digital-Russia-report. (2017). McKinsey & Company. URL: http://www.mckinsey.com. Accessed: 3/08/2018.

- Financial Stability Implications from FinTech. Supervisory and Regulatory Issues that Merit Authorities’ Attention. Financial Stability Board. (2017). Retrieved from: http://www.fsb.org/wp-content/uploads/R270617.pdf. Accessed: 3/08/2018.

- Financial system change. Transforming capitalism to make it fit for a sustainable future. – EY. (2015). URL: https://www.ey.com/Publication/vwLUAssets/EY-Financial-system-change/%24File/EY-Financial-system-change.pdf. Accessed: 3/08/2018.

- FinTech Adoption Index. (2017). URL: http://www.ey.com/gl/en/industries/financial-services/ey-fintech-adoption-index. Accessed: 3/08/2018.

- Global FinTech Report. (2017). PwC. URL: https://www.pwc.com/jg/en/publications/pwc-global-fintech-report-2017.pdf. Accessed: 3/08/2018.

- He, D., Leckow, R., Haksar, V., Mancini-Griffoli, T., Jenkinson, N., Kashima, M., Khiaonarong, T., Rochon, C., & Tourpe H. (2017). Fintech and financial services: Initial considerations. IMF Staff Discussion Note. Retrieved from: https://www.imf.org/en/Publications/Staff-Discussion-Notes/Issues/2017/06/16/Fintech-and-Financial-Services-Initial-Considerations-44985. Accessed: 3/08/2018.

- Khotinskaya, G.I., & Chernikova, L.I. (2013). Systemic transformation in the economy and Finance: theory, empirical regularities, adaptive tools. Finance and Credit, 4(532), 16-23.

- Khotinskaya, G.I., & Chernikova, L.I. (2018). Transformations in Economic Systems: The view of a financier. Moscow: KNORUS.

- Kleiner, G.B. (2002). System paradigm and the theory of the enterprise. Questions of Economy, 10, 47-69.

- Kornai, J. (1998). The system paradigm. William Davidson Institute Working Papers Series 278, William Davidson Institute at the University of Michigan. URL: https://ideas.repec.org/p/wdi/papers/1998-278.html. Accessed: 3/08/2018.

- Main directions of development of financial technologies for the period 2018-2020-CBR. (2018). URL: http://www.cbr.ru. Accessed: 3/08/2018.

- Myers, R. (1996). Metric wars. CFO Magazine, 12(10), 41-47.

- Philippon, T. (2017). The FinTech opportunity. BIS Papers, 655, 1-33. URL: https://www.bis.org/publ/work655.pdf. Accessed: 3/08/2018.

- Schueffel, P. (2017). Taming the beast: A scientific definition of Fintech. Journal of Innovation Management, 4(4), 35-54.

- The Pulse of Fintech 2017. (2018). Global analysis of investment in fintech, KPMG. URL: https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2018/07/h1-2018-pulse-of-fintech.pdf. Accessed: 3/08/2018.

- World FinTech Report. (2018). Capgemini, LinkedIn in collaboration with Efma. URL: https://www.capgemini.com/news/capgeminis-world-fintech-report-2018-highlights-symbiotic-collaboration-as-key-to-future-financial-services-success/. Accessed: 3/08/2018.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Khotinskay, G. (2019). Fin Tech: Fundamental Theory And Empirical Features. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 222-229). Future Academy. https://doi.org/10.15405/epsbs.2019.03.23