Abstract

The fight against cartels is one of the most priority and at the same time difficult to implement areas of state anti-monopoly regulation. In Russia, an important activity of the Federal Antimonopoly Service is the suppression of anticompetitive agreements, as well as the identification of cartels in commodity markets. At the same time, the fight against cartels is carried out through criminal and administrative punishment of participants in cartel agreements, that is, only when such an agreement has already been concluded and has begun to be implemented. The methods used in the practice of the FAS for analyzing the state of competition in the commodity market do not allow identifying a market predisposition for cartelization. Due to the fact that the circumstantial evidence is increasingly important in anti-cartel investigations, it is necessary to focus on those markets where the existence of cartels is most likely. The purpose of the study is to develop a methodological tool for identifying markets that are problematic in terms of concluding and maintaining cartel agreements. The authors have formed a matrix model that combines market characteristic in a single information field, reflecting the existence of conditions for cartels in the commodity market and ensuring their sustainability. The choice of criteria is due to their presence in the standard information array, which is formed when analyzing the state of competition in commodity markets by the FAS of Russia.

Keywords: Cartel agreementsthe Federal Antimonopoly Service of Russiaanalysis of the state of competitionconditions for cartelsstability of cartels

Introduction

The support and development of competition is widely viewed as a priority task of state economic policy. One of the key problems impeding the development of Russian economy, is an insufficient level of competition, largely due to cartelisation of the economy.

Cartelization occurs through the illegal collusion of companies to maximize profits by restricting competition. Modern cartels are increasingly focusing on such topical issues as effective access to new markets, coordinating development strategies of the participants of this association, developing and implementing a unified marketing policy.

It should be noted that, in the conditions of a worsening economic background, cartelisation of markets is sharply increasing. Cartel agreements are used as protective mechanisms that provide, firstly, clear rules of the game on the market within the cartel, secondly, the ability to plan their activities without regard to competition and, thirdly, to accumulate resources that are diminishing in the conditions of economic crisis.

Activities to identify and prevent cartels in commodity markets of the Russian Federation are carried out by a special body, the Federal Antimonopoly Service of Russia. If the result of such activities is assessed in other areas controlled by antimonopoly authorities (good behavior of dominant companies or control of concentration in mergers and acquisitions), since negative consequences for the market may not occur, then cartels are prohibited without exception, regardless of the effect created, economic benefits of the cartel and the extent of the damage.

The relevance of the study is that the fight against cartels is one of the most priority and at the same time difficult areas to implement the antitrust regulation (Bos & Harrington, 2010). The damage caused by the collusion of companies in commodity markets is very high. In addition to overpriced and underproduced volumes, cartels also lead to a non-optimal allocation of resources, slower rates of innovation and unproductive costs.

The annual volume of purchases in the Russian Federation for state needs and needs of state companies amounts to more than 30 trillion rubles. Despite the fact that the secrecy of cartels is extremely high, the cumulative damage from the activities of cartels can reach up to 1.5-2% of GDP (Federal Antimonopoly Service of Russia, 2018). Cartels have a very negative impact not only on the public procurement sector, but also on commodity markets across individual constituent entities of the Russian Federation and the country as a whole. However, as shown by a number of studies (Davies, Mariuzzo, & Ormosi, 2018; Bos & Harrington, 2015), an effective anti-cartel policy can significantly reduce this negative impact.

The FAS of Russia on its own, without conducting operational search activities, annually reveals several hundred cartels and other anti-competitive agreements. Antimonopoly authorities bring to administrative responsibility annually up to one and a half thousand economic entities of the country for participation in such agreements. In this regard, the issue of improving the methodology, which would allow effectively assessing conditions conducive to the creation and maintenance of cartels in a particular commodity market, becomes extremely relevant.

Problem Statement

At present, the main focus of the FAS of Russia is to suppress anti-competitive agreements, as well as to identify cartels in commodity markets. On the territory of the Russian Federation, issues related to the protection of competition, including the prevention and suppression of monopolistic activity, are regulated by Federal Law No. 135-FZ of July 26, 2006 “On Protection of Competition”. The rules for determining the commodity market and, accordingly, competitors are regulated by the Procedure for analyzing the state of competition in the commodity market, approved by order No. 220 of the FAS of Russia of April 28, 2010. In accordance with this methodology for the qualification of the cartel, it is necessary:

1. To determine the geographical and grocery boundaries of the commodity market in order to prove that the parties of the agreement sell goods on the same commodity market;

2. To prove that producers or sellers of goods are in a competitive relationship;

3. To prove the existence of an agreement leading to the establishment or maintenance of prices; the division of the commodity market on any basis; reduction or termination of goods; refusal to enter into contracts with certain sellers or buyers (customers).

In cartel cases, two categories of evidence are used: direct and indirect. The first is documents (contracts, agreements, protocols, statements, letters, etc.) and testimony that directly indicate the facts of violation. The main way to get direct evidence is an unnounced inspection. During such inspections, inspectors often came across documents containing clearly anti-competitive agreements and signatures of their participants.

In recent years, antitrust authorities are less likely to find documents that openly testify to the formation of cartels. In this regard, circumstantial evidence which points to incidental facts that are in causal or other connection with the facts of violation is of increasing importance in anti-cartel investigations. To get them, it is necessary to carry out an analysis of business entities, a market analysis, a mathematical examination, the results of which, in fact, are indirect evidence.

In the world practice there are four stages of evidence:

1. To identify inconsistent, illogical behavior of an economic entity in the market;

2. To identify a “breakdown” in the behavior of the entity;

3. To identify differences in the behavior of entities suspected of the cartel from the behavior of competitors;

4. To prove the probable existence of the cartel.

Applied at the first three stages, economic models, as a rule, are not fixed in documents, but accumulate over time: every year new models appear and old ones are refuted. The description of economic models usually begins with the conditions under which they can be applied. The antimonopoly authority must compare them with actual circumstances and select the model that most closely matches them.

Following the results of the first three stages, both the antimonopoly authorities and the parties of a possible cartel accumulate a huge amount of data from consumers, statistical services and other sources. Using them in the fourth stage, the antimonopoly authority must decide whether a cartel exists or there is no cartel. An antitrust authority usually selects one mathematical model and proves why it applies it. And those accused of creating a cartel prove that the model used by the anti-monopoly authority is not applicable in this situation.

The practice of applying the existing methodology for analyzing commodity markets shows that it provides information on the state of markets, which is overview and does not allow identifying possible cases of cartel agreements.

In the conditions of the volatile economic environment and the influence of the global economic crisis, more and more companies are trying to control over sectors of individual markets, and sometimes establish control over the comodity market as a whole. The level of cartelization of the economy, taking into account a high latency of cartels, remains a highly debatable issue. This fact is pointed out by Harrington and Chang (Harrington & Chang, 2009), who developed a model of cartels formation in order to improve competition policy.

Considering the importance of timely detection of cartels in the conditions of their secrecy and the need to collect and process extensive evidence, it is necessary to focus on those commodity markets where the conditions for concluding and maintaining cartel agreements are as favorable as possible.

Research Questions

In order to improve the analytical work on the identification of cartels in commodity markets, the study raises the following research questions:

How to determine whether a particular commodity market is favorable for the creation and continued existence of cartels;

How can information arrays, formed in the framework of the FAS of Russia on analyzing competition in commodity markets, be used to predict the existence of cartels?

Purpose of the Study

Based on the research questions, the purpose of the study is to develop a methodological tool for identifying markets that are problematic in terms of concluding and maintaining cartel agreements.

Research Methods

A cartel is a horizontal agreement that is reached between economic entities which operate in the same market and they are competitors. Moreover, horizontal agreements are subject to prohibition regardless of the market share of the parties of agreements (Kinev, 2013).

An important direction for the development of the methodology analyzing the commodity market takes into account signs indicating the market predisposition to effective cartelization, as well as the potential life cycle of the cartel.

The analysis of the literature allows identifying the main factors contributing to collusion.

1. Collusion is more likely in highly concentrated markets - this is because it is easier to conclude an agreement in markets where there are few competing firms. In addition, collusion with few competitors is easier to maintain (Cabral Luis, 2017).

2. The economic incentive for collusion of competitors is about the same conditions of demand and costs for each of them. The coincidence of competitors’ interests encourages them to establish interaction in order to implement market policies in the general interest, since this can maximize profits without changing the size of costs by implementing agreed pricing policies or by dividing the market according to different criteria (Stigler, 1964).

3. Another factor of collusion is the establishment of a trusting relationship between competitors. It is also a feature of oligopolistic markets, in which competitors are forced to “respectfully” treat the competitor’s market policies (Vouros & Rozanova, 2002).

The issue of sustainability of cartels is the subject of a number of empirical studies (Harrington & Chang, 2009; Diamantoudi, 2005; Levenstein & Suslow, 2006; Weikard, 2009). The reasons for the collapse of cartels can be the deception or the lack of mechanisms to monitor the behavior of cartel members, but the biggest problems faced by cartels are adjustments to agreements on collusion in response to changing economic conditions.

Thus, from an economic point of view, collusion should be considered as a special type of market concentration based not on the market share of each individual entity (as in the case of a monopoly or a dominant position), not on the special corporate connection of economic entities and their founders (as in the case of a group monopoly) and not on the features of the market and goods substitution (as in the case of a natural monopoly), but on the behavior of competing entities that, using a collective single-market strategy, can achieve the effect of market power that is comparable in its economic consequences to the activity of a monopolist in the realization of the dominant market position. The prerequisites for collusion are not only such market factors as market characteristic, but also the behavior of its participants.

Findings

The economic analysis, unreasonably ignored, opens up a wide range of methods for predicting, proving and preventing cartel collusion to law enforcers.

The use of multi-factor matrix models makes it possible to compare factors of different nature and mechanisms of influence in a single information field.

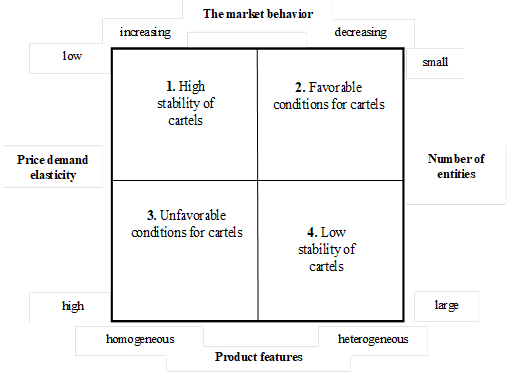

To build an analytical matrix, four factors were chosen that characterize the market.

1. The number of business entities operating in the commodity market. As shown above, in highly concentrated markets, a cartel agreement is easier to conclude and easier to maintain.

2. An indicator of price demand elasticity. Low price demand elasticity stimulates price increases and stimulates the maintenance of collusion, including tacit collusion between market participants (Yusupova & Kiseleva, 2015).

3. Characteristics of products - as far as products sold in this market are homogeneous / heterogeneous. The homogeneity of products in economic theory is defined as the infinite elasticity of their interchangeability. Product homogeneity is an important factor contributing to a cartel agreement, which is confirmed by the analysis of collusion in the procurement of petroleum products (Eremina & Zoroastrova, 2012).

4. The market behavior - the analyzed market is characterized by growth rates or reduction rates. The higher the growth rate of demand, the greater collusion is and the easier it is to support it, since players expect to increase their winnings in the future due to the impact of two factors: an increase in demand and a price increase (Avdasheva & Shastitko, 2007).

The use of these criteria is due to the fact that such data are presented in a standard information array of the analysis of competition in the commodity market by the FAS of Russia.

The cross-imposition of these indicators on the matrix will allow determining whether a particular commodity market is favorable for the creation and continued existence of cartels (Fig. 01). That is, the market will be assessed in terms of the availability of favorable conditions for the emergence and maintenance of sustainable cartels.

Thus, based on the above model, it can be argued that markets, after analyzing the state of the competitive environment will fall into the zone of square 1, a pool of the most stable cartels will be formed, in the zone of square 2 there will be markets with the most favorable conditions for cartels, in the zone of square 3 the conditions for cartels are the most unfavorable and, finally, the formation of unstable cartels is possible in the zone of square 4.

The use of the presented model will contribute to a more qualitative and meaningful analysis of the competitive environment in the commodity market. The results of the study, supplemented by such tools, will be not only informational, as it was before, but they will also bring experts and specialists to nodal points, which are individual commodity markets that are most susceptible to cartelization. This model should be introduced into the existing methodology for analyzing the competitive environment in commodity markets, by introducing an additional item that requires disclosure and description of the above model. Thus, work will be carried out to merge an array of disparate information into a single whole, with subsequent conclusions about the presence and sustainability of cartels in commodity markets.

Consider the application of the generated matrix in the analysis of commodity markets.

Figure

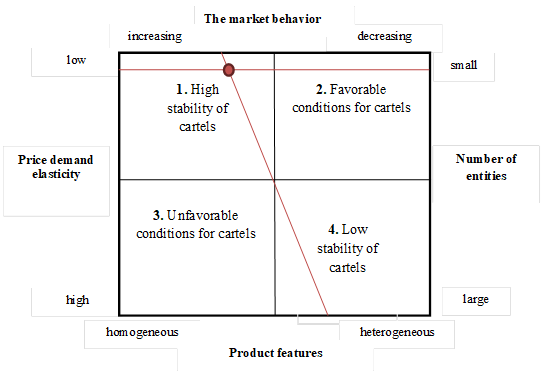

The analysis of this commodity market, conducted according to the methodology established by the FAS, shows that growth rates are higher in this market than the average for the economy in the period 2015-2016. A small number of business entities are operating in this market, while a market concentration ratio CR3 is 94.24% in 2016. Price demand elasticity was low, and products are differentiated, their production requires complex engineering solutions. Thus, the investigated market falls into the zone of square 1, that is, the conditions of this market contribute to the formation of sustainable cartels. This conclusion is confirmed by the observed simultaneous increase in the profits of several large “players” in the market.

Figure

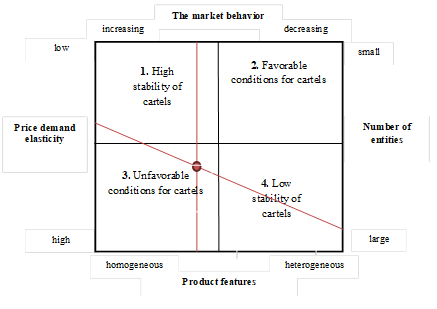

From the analysis of the competitive environment in the retail market of motor gasoline in the Samara region in 2016, it follows that a large number of business entities operate in this market. After some reduction in the crisis period, the market shows a slight increase. The products represented on this market, automobile gasoline, can be considered homogeneous, while price demand elasticity is low. Figure

Figure

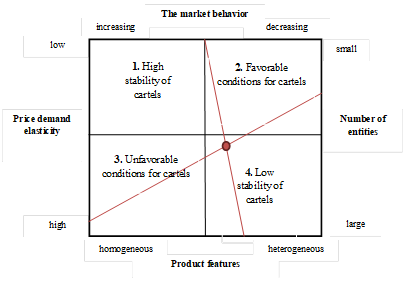

The market for waste management is legally regulated, its volumes are stable. This market is characterized by a very limited number of participants, while in the past few years there has been a tendency to reduce them. The services provided are very heterogeneous, price demand elasticity is high. Based on the foregoing, it can be argued that the creation of cartels in this market, although possible, but at the same time they will have low stability.

Thus, based on data from research on the state of competition in commodity markets conducted in accordance with a regulatory procedure, it is possible to assess the possibility of cartels and their potential sustainability using the new model. This model will improve the work on identifying signs of cartels agreements.

Conclusion

Modern Russian anti-monopoly legislation seeks to solve the problem of post-factum cartelization - by criminal and administrative punishment of participants in cartel agreements, that is, only when such an agreement has already been concluded and started to be implemented. This is explained by the fact that the antimonopoly authority learns about it only when it already influences the market for some time, that is, when it is already possible to diagnose and establish an increase in the share of certain companies in the market, unreasonable and synchronous reduction / increase in prices, reduction in production / supply.

However, these facts can already be called “symptoms of the advanced stage of the disease”, when only radical methods of “treatment” are needed (sanctions, etc.). As for the “prevention of the disease”, we have to admit that today in our country there is almost no system of measures aimed at preventing market cartelization, that are not related to government coercion. Also, when controlling over cartelization processes, the analytical activity is completely ignored, and it is possible to identify the market predisposition to cartelization in the early stages.

The study allowed developing a tool for a more targeted analysis of the competitive environment in commodity markets. The developed model allows increasing the concentration of analytical work on the nodes that are most susceptible to cartelization. It should be noted that the factors contributing to or impeding the formation of cartels and the maintenance of their stability are not limited to those included in the model. The model can and should be expanded, including new factors, taking into account the further practice of using the competition analysis methodology.

In general, the conducted study allowed systematizing the data obtained as a result of analysis carried out according to the standard method, which will ensure an increase in the efficiency of generated data sets. Thus, this model will increase the effectiveness of the antitrust regulation.

References

- Avdasheva, S.B., & Shastitko, A.E. (2007). Economic foundations of antitrust policy: Russian practice in the context of international experience. Economic Journal of the Higher School of Economics, 11 (2), 234–270.

- Bos, I., & Harrington, J. E. (2010). Endogenous cartel formation with heterogeneous firms. RAND Journal of Economics, 41(1), 92-117. DOI: 10.1111 / j.1756-2171.2009.00091.x

- Bos, I., & Harrington, J. E. (2015). Competition policy and cartel size. International Economic Review, 56 (1), 133-153. DOI: 10.1111 / iere.12097

- Cabral Luis, M.B. (2017). Introduction to industrial organization. Cambridge, Massachusetts: MIT Press.

- Davies, S., Mariuzzo, F., & Ormosi, P. L. (2018). Quantifying the deterrent effect of anti-cartel enforcement. Economic Inquiry, 56(4), 1933-1949. DOI: 10.1111 / ecin.12574

- Diamantoudi, E. (2005). Stable cartels revisited. Economic Theory, 26(4), 907-921. DOI: 10.1007 / s00199-004-0550-0

- Eremina, A.V., & Zoroastrova, I.V. (2012). Identifying factors contributing to collusion in government procurement of petroleum products for municipal needs in the constituent entities of the Russian Federation. Economics and Management, 12 (86), 37-42.

- Federal Antimonopoly Service of Russia (2018). Access mode: http: //www.fas gov.ru

- Harrington, J. E., & Chang, M. (2009). Modeling and evaluation policy. Journal of the European Economic Association, 7 (6), 1400-1435. DOI: 10.1162 / JEEA.2009.7.6.6.1400

- Kinev, A.Yu. (2013) Sincere recognition of cartels. EJ-Lawyer, 49.

- Levenstein, M.C., & Suslow, V.Y. (2006). What determines cartel success? Journal of Economic Literature, 44 (1), 43-95. DOI: 10.1257 / 002205106776162681

- Stigler, G.J. (1964). A Theory of Oligopoly. Journal of Political Economy, 72 (1), 44-61. DOI: 10.1086 / 258853.

- Vouros, A., & Rozanova, N. (2002). Economics of industrial markets. Moscow: TEIS.

- Weikard, H. (2009). Cartel stability under an optimal sharing rule. Manchester School, 77 (5), 575-593. d DOI: 10.1111 / j.1467-9957.2009.02111.x.

- Yusupova, G., & Kiseleva, O. (2015). Was there a silent agreement? Once again about the monopolistically high prices of Russian oil companies. Economic policy, 10 (4), 178-195. DOI: 10.18288 / 1994-5124-2015-4-08.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Kandrashina, E., Ashmarina, S., & Vukolov, D. (2019). How To Identify Predisposition Of Markets To Cartelization?. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 1827-1836). Future Academy. https://doi.org/10.15405/epsbs.2019.03.186