Abstract

To solve the problems of the Russian macroeconomy, the Russian authorities are currently apt to implement recommendations of international organizations. It was revealed that one of the reasons for that is an almost unanimous support of these methods by foreign scholars. However, the results of the Russian researchers are traditionally ignored by the authorities. The results of the author’s independent estimation (both expert and econometric) confirm the positions of the Russian scholars. Thus, under the situation when monopoly or oligopoly predominates in almost all Russian markets, the attempts of the Russian government to rely on the “invisible hand” of the market and to cease its regulation are equivalent to transferring power to the largest corporations (including foreign ones). The traditional ignoring of the failure to target inflation for reducing it middle-term and long-term leads to the situation when the money are attracted to the economy from other sources and on worse conditions. Thus, regression modeling confirms the close connection between the values of external debt and foreign reserves; this indicates the erroneousness of withdrawal money from the Russian economy and investing it to foreign reserves, as the demand for money will persist and it will be reimbursed by external borrowings. All this allows recommending our government to reject the Western recipes and transfer to new managerial decisions for the development of the Russian macroeconomy.

Keywords: Macroeonomic management“invisible hand” of the marketinflation targetingexternal debtforeign reservescorporate external debt

Introduction

For a long time, the Russian government and the Russian Central Bank fail to solve the key problems facing the Russian economy. At that, they often fail to reach the set goals of solving the minor problems in our macroeconomy. This situation has been repeatedly discussed by both competent scholars as Delyagin (2008), Dmitrieva (2013), Glazyev (2014), Rogozin (2015), and deputies of the State Duma (as a rule, within the annual reports of the Russian government in the State Duma). In this connection, it is important to determine the economic reasons of this situation and to propose measures for their elimination.

Problem Statement

As is commonly known, the opinion dominating among the top Russian officials is that macroeconomy functioning is based on simple classical hypotheses and regularities from the course in Economic Theory. However, these simplifications often distort the sense of the original hypotheses. For example, the limitations under which the “invisible hand” of the market can independently regulate the economy are not taken into account; inflation in Russia is claimed to be of monetary character and to be influenced by the amount of monetary funds in the economy only. This is indicated by both the statements of those officials and the actions of the Russian Central Bank (transfer to the ruble free float in 2014; almost complete rejection of the financial market regulation; increasing the key rate during apparent crises in 2008 and 2014) and the Russian Ministry of Finance (the main anti-crisis measures were considered to be reduction of state expenditures; address state support for the largest organization and more active withdrawal of money from the economy by increasing taxes (for example, VAT). We believe that such an opinion was formed under the influence of IMF recommendations, works by foreign scholars and the Russian institutional environment, in which priority is given to simple decisions, having some positive short-term effect but creating serious problems middle- and long-term.

Research Questions

Upon studying these problems, the following questions arise: do some foreign scholars actually propagate erroneous ideas? Are these ideas really erroneous? What has to be done if these ideas prove to be erroneous?

Purpose of the Study

In this connection, we plan, first, to study the position of the foreign and Russian scholars in the said sphere. Second, to carry out an independent estimation of the revealed ideas from the viewpoint of their adaptability to the Russian conditions. Third, to identify the ways of solving the revealed problems.

Research Methods

To achieve the set goals, we used abstract-logical, economic-statistical and economic-mathematical methods. Econometric package QSR Eviews was applied for modeling.

Findings

Literature review

The check the proposed hypotheses, we reviewed the Russian and foreign research. Thus, Hill (1990) asserts that the transaction costs and opportunisms risks are reduced not by state regulation but by the “invisible hand” of the market. Cassell and Nelson (2013) note that the following statement is typical for the adherents of neo-liberalism: “the “invisible hand” of the market is the most effective and fair mechanism of structuring economy and society”. Turner, O'Donnell and Kwon (2017) write that the position of neoclassical economics that governments should defunct and rely on the “invisible hand” of the market was very hard and slowly promoted in Asia and was adopted in the Asian countries only after pressure from international financial institutions. Kesztenbaum (2018) informs that the usual practice is the producers and profiteers trying everyone to believe that the market functions autonomously (the “invisible hand” of the market).

Newlove-Eriksson, Giacomello and Eriksson (2018) emphasize that the “invisible hand” of the market regulates macroeconomy only if there are many independent participants in the market, having similar influence on this market. However, when monopolizing or oligopolizing trends prevail in the market, the profitability is, as a rule, strangled and the positive effects of the markets and competition are lost. The above position can be agreed with, except the thesis on reducing profitability. On the contrary, when the market is seized by monopolists, they may dictate any prices and significantly increase their profitability.

Uryadnikova (2017) rightfully marks that the “invisible hand” of the market laws is no longer aimed at society development, as to be successful a producer must sell expensive and low-quality goods. This position is quite logical, as a producer of quality goods will not be able to sell the same items every few years instead of the broken or malfunctioning ones. Supplementing her opinion, it can be noted that cheap and low-quality goods (for example, food with GMO or oversaturated with chemicals) also prevail in the market. The breakthrough inventions, capable of shattering the power of the existing monopolists, are not introduced into industry.

Gungor and Berk (2006) wrote that, in case of stable interaction between money supply and inflation, the former may be considered a future indicator of inflation. Nevertheless, Roger (2010) proved that inflation targeting leads to stable inflation indicators in all cases. Al Husseini, Taleb, & Saadoun (2018), Walid and Bashichi (2017) point out that only inflation targeting can serve the basis for monetary-credit policy management, while all other measures are ineffective. At that, Walid and Bashichi (2017) assert that fact despite the unsuccessful application of inflation targeting in Algeria and further rejection of this measure by the Algerian Central Bank. Dumrul and Dumrul (2015), after studying inflation targeting in Turkey and Brazil, assert that it can be applied in any developing country as a strategy of monetary-credit policy for reducing inflation.

Woodford (2014), after disastrous actions of the Russian Central Bank during the apparent crisis, insists that inflation targeting should be continued with a more precise adjustment to current conditions.

At the same time, Andryushin (2014), Glazyev (2015a) and Manevich (2016) convincingly demonstrated that in our country inflation targeting had led to inflation growth and to decreasing the business and investment activity. At that, the use of a single financial market management tool (key rate) by the Russian Central Bank had led to this market seizure by foreign profiteers. Andryushin (2014) absolutely correctly recommends using a wide range of direct and indirect tools, proposed by him, to control the flows of public and private capital. Manevich (2016), echoing the opinion by Baranov and Somova (2015) that inflation is of non-monetary character, rightfully proposes to activate the emission possibilities of the Russian Central Bank. Kartaev, Filippov, & Khazanov (2016), based on econometric modeling of panel data on 141 countries, proved that in the developed countries the transfer to generally did not negatively influence on GDP dynamics, but there is evidence of its negative influence on GDP in developing countries.

As a result of estimating these positions, one may conclude that most foreign authors is apt to recommend, without any proofs or based on just a few evidences, to rely on the “invisible hand” of the market and implement inflation targeting in all developing countries. At the same time, the Russian scholars, relying on a strong evidentiary basis, argue against introducing the Western recipes of solving economic problems in Russia.

Received results

The independent estimation of the revealed problems allowed making several conclusions.

In cases of monopoly or oligopoly, economic regulation is carried out by large corporations. Today, almost all highly profitable and strategic markets of any state are monopolies or oligopolies. Under these conditions, calls to transit to self-regulation of economy in a country actually mean that the government should transfer the power in the economic markets into the hands of the largest corporations.

At the same time, the hypothesis that there is perfect competition in the financial market is true only if the largest participants do not enter the “game” in the financial market, they are being able to correct or ultimately change the situation therein. This well-known fact is also largely ignored as hardly probable. Whereas today the USA regularly interfere with the financial market functioning, changing the situation therein to their advantage.

Against that background, it is apparent that the state’s waiver of the currency rate regulation will lead to the forthcoming of profiteers who will first destabilize this market and then finally collapse it and bring the country to default. This very situation took place in Russia in 2014, after the Russian Central Bank transferred to the ruble free float; this vividly shows the excessive simplicity of the contemporary conceptions related to the classical rules of a country macroeconomy functioning.

At the same time, in July 2014 IMF approved the increase of directive interest rates and urged to increase them again in 2015 to reduce inflation and decrease the capital outflow from our country. If one sticks to monetary conception of inflation occurrence, this measure seems logical. Thus, if as much money as possible is withdrawn from the country’s economy, inflation will not occur. However, such “exsanguination” of the economy, repeatedly carried out in Russia under B.N. Yeltsin, led only to deficit and barter, but not to eliminating inflation. Today, this scheme is implemented in our country again, though in somewhat masked forms. The examples are reduced state expenditures; additional money extraction by increasing taxes; unavailability of credits for organizations due to the increased key rate; address support for the largest organization (banks first) which spend the majority of the obtained funds abroad or invest in foreign currency or securities, etc. As Glazyev rightfully noted, it is extremely indicative that IMF gives the opposite recommendations to the USA: “the early increase of rates may cause hardened financial conditions or loosening financial stability, which will impede economic growth” (Glazyev, 2015b, p. 18). All this indicates that inflation in our country is of non-monetary character, that is, it cannot be improved by withdrawing money. Moreover, the attempts to “bar” the economy from the “excess” money result in its return to our country in other forms and on other conditions.

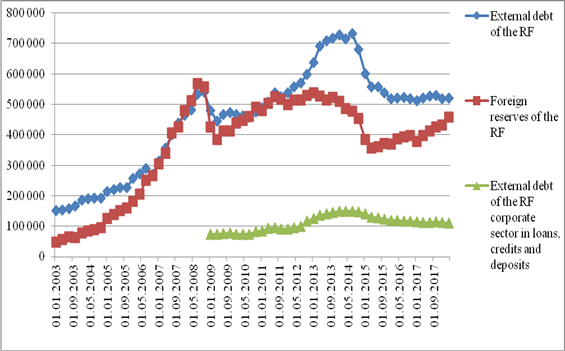

For example, accumulation of the Russian money in various reserve funds, which are mainly invested into foreign assets, has just led to increasing the external debt of both the RF and the Russian corporations (see Figure

Figure

To estimate the closeness between indicators in Fig.

The first regression model is based on quarterly absolute values of the RF external debt and foreign reserves in USD mln from 1 January 2003 till 1 April 2018 (the total of 62 observations), using the data from the Russian Central Bank website. The explained variable is the value of the RF external debt (further – ED RF) and the explanatory variable is the value of the RF foreign reserves (further – FR RF):

FR RF = -15239.7 + 0.845* ED RF + е (1)

(-0.6) (16)

In brackets below the formula in this and further models, the values of t-statistics are given. This model shows a very good connection between the studied indicators. For them, R2 is 0.81; t-statistics is 16; F-value is 0.0000, F-statistics is 256. The positive sign in the model indicates the presence of direct connection between these indicators. Thus, the model shows that the RF external debt grows with the growth the RF foreign reserves.

The second regression model is based on quarterly absolute values of the RF external debt and the RF corporate external debts in USD mln from 1 January 2009 till 1 April 2018 (the total of 38 observations), using the data from the Russian Central Bank website. The explained variable is the value of the RF corporate external debts (further – CED RF) and the explanatory variable is ED RF:

CED RF = 233590.8 + 2.933* ED RF + е (2)

(7.33) (10.37)

Regression model (3) is based on the same data as the model (2), but its explained variable is ED RF and the explanatory variable is CED RF:

ED RF = -32103.8 + 0.255* CED RF + е (3)

(-2.32) (10.37)

In models (2) and (3), the connection between the studied indicators is very good. In them, R2 is 0.74; t-statistics is 10.37; F-value is 0.0000, F-statistics is 107. The positive sign in the models indicates the presence of direct connection between these indicators. Thus, the models show that the RF external debt grows with the growth the RF corporate external debt, and vice versa, the RF corporate external debt grows with the growth the RF external debt. This confirms that the demand for money in Russia is determined by the external conditions, i.e., worsening of the economy functioning influences similarly on the state authorities and the corporate sector, making them increase the volumes of external credits and loans.

Thus, regression models confirm the close connection between the values of external debt and foreign reserves; this indicates the erroneousness of withdrawal money from the Russian economy to foreign reserves, as the demand for money will persist and it will be reimbursed by external borrowings. At that, the situations which make the state increase its external debt also influence the domestic organizations, making them increase their debts too.

Conclusion

The carried-out research confirms the necessity to reject the excessive simplicity of the classical economic theory conceptions, propagated in our country due to IMF recommendations and works by Western scholars, “creatively” reviewing the classical rules and regularities of macroeconomy functioning. The reason is that the Russian economy usually functions within the frameworks of exceptions and limitations related to the classical ideas of economic theory. This demands rejecting the Western recipes and transfer to new managerial decisions for the development of the Russian macroeconomy.

References

- Al Husseini, A.K., Taleb, A.H., & Saadoun, A. (2018). Assess the experience of targeting inflation in Iraq (a standard study for the period 2000-2015). Journal of the Faculty of Management and Economics for Economic Studies, 681 (27), 181-212.

- Andryushin, S.A. (2014). Prospects of inflation targeting regime in Russia. Issues of Economics, 11, 107-121.

- Baranov, A.O., & Somova, I.A. (2015). Analysis the key factors of inflation dynamics in Russia in the post-Soviet period. Issues of Forecasting, 2, 16 - 32.

- Cassell, J. A., & Nelson, T. (2013). Exposing the effects of the “invisible hand” of the neoliberal agenda on institutionalized education and the process of sociocultural reproduction. Interchange, 43 (3), 245-264.

- Delyagin, M.G. (2008). State between the people and business. Polis. Political studies, 3, 134-147.

- Dmitrieva, O.G. (2013). Economic circulations and financial “vacuum cleaners”. Issues of Economics, 7, 49-62.

- Dumrul, C., & Dumrul, Y. (2015). Price-Money Relationship after Inflation Targeting: Cointegration Test with Structural Breaks for Turkey and Brazil. International Journal of Economics and Financial Issues, 5 (3), 701-708.

- Glazyev, S.Yu. (2014). The USA sanctions and policy of the Bank of Russia: double blow on the national economy. Issues of Economics, 9, 13-29.

- Glazyev, S.Yu. (2015a). On inflation targeting. Issues of Economics, 9, 124-135.

- Glazyev, S.Yu. (2015b). On urgent measures for strengthening the economic safety of Russia and leading the Russian economy to the trajectory of priority development. Russian Economic Journal,5, 3-62.

- Gungor, C., & Berk, A. (2006). Money supply and inflation relationship in the Turkish economy. Journal of Applied Science, 6(9), 2083-287.

- Hill, C. W. L. (1990). Cooperation, opportunism, and the invisible hand: Implications for transaction cost theory. Academy of Management Review, 15 (3), 500-513.

- Kartaev, F.S., Filippov, A.P., & Khazanov, A.A. (2016). Econometric estimation of the influence of inflation targeting on GDP dynamics. Journal of New Economic Association, 1, 107-128.

- Kesztenbaum, L. (2018). Selling Paris. Property and Commercial Culture the Fin-de-siècle Capital.. The Journal of Economic History, 78 (1), 313-314.

- Manevich, V.E. (2016). Functioning of the monetary-financial system and depression of the Russian economy. Issues of Economics, 2, 34-55.

- Newlove-Eriksson, L., Giacomello, G., & Eriksson, J. (2018). The Invisible Hand? Critical Information Infrastructures, Commercialisation and National Security. The International Spectator, 53 (2), 124-140.

- Roger, M.S. (2010). Inflation targeting at 20: achievements and challenges. In D. Cobham, Ø. Eitrheim, S. Gerlach & J. F. Qvistad (Eds.), Twenty Years of Inflation Targeting: Lessons Learned and Future Prospects (pp. 25-56). Cambridge: Cambridge University Press.

- Rogozin, D.M. (2015). Cognitive analysis of economic crisis perception. Monitoring of public opinion: economic and social changes, 2, 3-22.

- Turner, M., O'Donnell, M., & Kwon, S. H. (2017). The politics of state-owned enterprise reform in South Korea, Laos, and Vietnam. Asian Perspective. 41 (2), 181-184.

- Uryadnikova, M.V. (2017). “Invisible” but very tough “hand” of the contemporary market. Scientific review, 18, 108-110.

- Walid, & Bashichi. (2017). Requirements for implementing the inflation targeting strategy as a modern framework for managing monetary policy in Algeria. Journal of Al-Quds Open University for Research & Studies, 41 (2). 103-116.

- Woodford, M. (2014). Inflation targeting: fix it, don’t scrap it. Issues of Economics, 10, 44-55.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Manushin, D. (2019). Does The Russian Economy Need Western Recipes Or New Managerial Decisions?. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 1513-1519). Future Academy. https://doi.org/10.15405/epsbs.2019.03.154