Abstract

The Russian stock market has been formed rather recently. Despite this fact, this market has already been affected by the dependence of the financial system on the world environment changes. This overexposure was considerably severe in 2014-2015 due to the weakening of the rouble against major world currencies caused by the plunge in oil prices which export the state budget revenues depends on. Another factor which affects the Russian stock market was restrictions to the free access to the world financial market imposed due to the events in Ukrain. These external shocks led to a currency crisis which was a result of double external shock (falls of oil quotations and financial sanctions). Thus the Moscow Stoc exchange indexes declined and the investment environment became rather unfavorable. Hence, one of the most important issues of the Bank of Russia and other government institutions is to search how to reduce the financial and stock market sensitiveness to the external shocks. The set of external shocks was aggravated significantly by conditions of investment into the Russian stock market. Falling of oil quotations affected the state budget, and the multiplicative effect began to exert harmful impact on economic activity in the sectors adjacent with power, and in a consequence on economic growth. In the conditions of sanctions pressure, foreign markets became actually closed for the Russian borrowers.

Keywords: Stock marketdevelopmentshocksexternal shocks

Introduction

The stock markets play a fundamental role in economic development of the countries as they provide cash flow from one holder to others, and their dynamics is a peculiar indicator of economic health. Most of investors believe that the share price essentially depends on fundamental macroeconomic factors, such as an interest rate, an exchange rate and a rate of inflation (Gan, Lee, Yong, & Zhang, 2006). Nowadays there are a lot of scientific papers devoted to revealing the financial factors which influence the stock markets of both developed and developing countries. Speaking about influence of an interest rate on the stock market, the article by Ferrando, Ferrer and Jareño (2017) is to be mentioned, this article is devoted to an interest rate extent of influence on the stock market of Spain in 1993-2012 by means of quantile regression. Empirical results of this research show that the Spanish stock market has considerable degree of sensitivity to interest rates though a degree of this sensitivity differs depending on an industry and the researched interval of time. Besides, the authors pay attention to the fact that influence of an interest rate realignments on share yield is more expressed during economic crises, than in the period of relative stability. They explain it with panic of investors in the period of economic shocks when their actions only exacerbate the situation in the stock market.

The work by Kontonikas, MacDonald, and Saggu (2013) studies the influence of a rate of U.S. Fed on profitability of the American shares in the period 1989-2009. The authors of this article concluded that the rate of the American shares showed growth when the management of FRS unexpectedly made the decision on decrease in a rate on federal funds. At the same time, it is noted that the American shares dismantled the largest growth while the interest rate realignment matched the periods of recessions, bearish trends and tightening of credit market conditions. However, the authors pay attention to that fact that this regularity was distinctly traced only till September 2007 when the financial crisis took place and it enforced important structural changes. In particular, during the financial crisis investors ceased to react positively to decrease in a FRS rate. Thus, it is possible to draw a conclusion that the American stock market became less sensitive to interest rate realignments. The article by Jareño, Ferrer and Miroslavova (2016) highlights the sensitivity of the USA stock market to nominal and real interest rates and inflation in 2003-2013. By means of quantile regression (quantile regression), the authors come to the conclusion that the stock market is considerably sensitive to interest rate realignments and the rate of inflation. At the same time, it is noted that the stock market is more sensitive to these changes during economic downturns. The influence of inflation on share yield was also studied in the article by Sanvicente, Adrangi and Chatrath (2018) in which the inverse relation between these indicators was revealed. It is also worth noting the article by Engle and Rangel (2008) which studies the dependence between volatility of the stock indexes of 48 developed and developing countries (including Russia) and volatility of the key macroeconomic indicators by means of Spline-GARCH model. The authors come to the conclusion that stock markets volatility depends on volatility of the following macroeconomic variables: inflations, an interest rate and a real GDP. There are also researches confuting the assumption that inflation influences a stock market dynamic. For example, the article by Floros (2014) the interrelation between the index of shares of Stock exchange of Athens and the rate of inflation as which the Greek consumer price index is used comes to light by means of various econometric methods. The author of this work drew a conclusion that the rate of inflation doesn't correlate with share yield in Greece. The same conclusions are made in the article by Azar (2014) which studies the influence of inflation and rate fluctuations of the US dollar on share yield, and the author concluded that inflation doesn't exert significant impact on the American shares profitability included in the S&P 500 index. Speaking about influence of exchange rates on stock market dynamics, we should note the work by Caporale, Hunter, & Ali (2014) in which the interrelation between share yields and the exchange rates in the USA, Great Britain, Canada, Japan, the Eurozone and Switzerland was statistically confirmed. Using the GARCH-BEKK model, the authors of this research considered how bank crisis of 2007-2010 affected the interrelation of two variables, and they concluded that the correlation between share yields and the exchange rates amplified during the crisis period. Also, the article by Fowowe (2015) is of particular interest. This work highlights the interrelation between stock prices and the exchange rates of two largest countries of the African continent - South Africa and Nigeria. The author of this work revealed the correlation between the exchange rate and the share price in Nigeria, however the correlation in South Africa wasn't revealed. Besides, it was revealed that there is a cause and effect relationship between the share’s dynamic of the London Stock Exchange and the shares dynamic of the exchanges of the researched countries. Thereby, the author proved that the international stock markets have a certain impact on dynamics of the stock markets in Nigeria and South Africa. In the article by Akdogu and Birkan (2016) the interrelation between indexes of shares and the exchange rates of 21 developing countries in 200-3-2013 is determined. Th results showed statistically significant cause and effect dependence between the researched variables in 13 countries out of 21. It is supposed that in emerging economies there is no universal nature of interrelation between a share price performance and dynamics of the exchange rate. In general, there is a set of works in which influence of set of macroeconomic indicators on dynamics of the stock market is studied. For example, Pramod and Puja (2012) researched the interrelation between the index of shares of the BSE Sensex and five macroeconomic indicators: the index of industrial production, a wholesale price index, a money supply, a rate according to treasurer bills of exchange and the exchange rate. The authors established that the index is only influenced by some of the considered macroeconomic variables, namely, the index of industrial production, a wholesale price index, a money supply. At the same time, it was revealed that the cash offer influences the Indian stock index only in the longer term. This is because a change of money supply is reflected in real production volume only indirectly while a change of real GDP directly determines dynamics of share yield is explained. The article by Gan, Lee, Yong, & Zhang (2006) researches the interrelation between the index of shares of the New Zealand Stock Exchange and such macroeconomic indicators as a rate of inflation, an exchange rate, long-term and short-term interest rates, real GDP, cash offer, and oil prices. A high degree correlation was established between the index of shares of the New Zealand Stock Exchange and an interest rate, the cash offer and real GDP. The authors also paid attention to the fact that since the stock market of New Zealand is considerably small in comparison with the stock markets of developed countries, the New Zealand stock market can be very sensitive to global macroeconomic factors or macroeconomic factors of its main trading partners. In the research of Yartey (2008) institutional and macroeconomic determinants of market development of shares with use of panel these 42 emerging economies are considered. As an indicator which determines the level of development of the stock market, the percentage ratio of an equity market capitalization, undergone listing, to GDP was chosen. The work concludes that macroeconomic factors, such as income level, gross internal investments, the level of development of the banking sector, flows of a private equity and liquidity of the stock market are important determinants of market shares development in the study countries. Speaking about influence of the world stock indexes on dynamics of the stock markets, we should note the article by Thuan and Yuan (2011) which is devoted to the analysis of interrelation between stock markets of the USA and Vietnam. By means of GARCH-ARMA and EGARCH-ARMA models the authors showed the high level of influence of the American index of the shares S&P 500 on the Vietnamese VN index. An identical conclusion was received also concerning the Dow Jones index that emphasizes once again that the Vietnamese investors should consider the dynamics of the USA stock market to make investment decisions. As for the issue on influence of macroeconomic factors on dynamics of the Russian stock market, the research by Oikonomikou (2018) is of particular interest where the author determined the influence of the following variables on the index of shares of MICEX: GDP, a US dollar exchange rate, euro/dollar rates, a balance of capital movement, Brent brand world oil price by means of EGARCH model. The authors came to conclusion that the greatest extent of influence on the index of MICEX is rendered by an oil price and a US dollar exchange rate. At the same time, it is noted that "for the Russian Federation the increase in world oil prices makes some salutary effect on the stock market growth and respectively on the national economy growth: an essential growth of the stock indexes and GDP is being observed, gold and foreign exchange reserves are replenished, the budget of the country becomes surplus. However, the increasing revenue stream from oil export is capable to lead to strengthening of a negative impact of the global financial crisis when uncontrollable flows of "hot money" from the countries of OPEC destabilize the world foreign exchange market and turn on the mechanism of untwisting of inflation in many of the industrial countries". Based on the analysis of the literature devoted to determination of the macroeconomic factors influencing the stock market dynamics it is possible to draw a conclusion that there is no unambiguous point of view about what macroeconomic factors exert indisputable impact on the stock market. Moreover, although in some researches the interrelation between certain macroeconomic factors and share yield is traced, in other works this communication is statistically not significant or it is absent at all.

This difference in results and conclusions consists in use by the authors of various methodologies, variables and the periods of a research. Nevertheless, the majority of researches nevertheless confirm availability of interrelation between the stock market dynamics and the following macroeconomic variables: an interest rate, an exchange rate, an inflation rate, cash offer, gross domestic product, oil prices.

Problem Statement

External shocks are the shocks which influence a system from the outside, from the environment. In macroeconometrics to research external shocks it is accepted to characterize them as an unpredictable exogenous change of a variable in a model. It should be noted that a shock and an external shock are two different shocks. The first one is internal and relates to "not ideality" of economy, the second one stalls on economy from the outside world. Within this research of the concept "external shock" and "exogenous shock" are used as identical that corresponds to scientific, business and language practice. It is possible to allocate a set of various external shocks which make exerting impact on dynamics of the stock market. The analysis of the literature allowed to draw a conclusion that the bulk of scientific works is devoted to a research of influence of oil shocks and political shocks on the stock market dynamics. Therefore, the main research objective is studying influence of external shocks on market development of shares in the current conditions.

Research Questions

The main research questions are the following: - study of methodological and theoretical background to the research of the stock market dynamics ; identification of the key external shocks influencing the economy of Russia, and their influence on the Russian stock market dynamics ; evaluation of the efficiency of the Bank of Russia actions for leveling the external shocks; development proposal to decrease sensitivity degree of the Russian stock market to changes of the world environment.

Purpose of the Study

The purpose of the study is to research the mechanism of external shocks impact on the Russian stock market and develop mechanisms to level this impact.

Research Methods

In the course of the study, the following methods were used: dialectical approach based on general scientific methods (abstract and logical, structural, comparative and institutional approaches). The theoretical base of the study is consisted of the classical and modern fundamental works of the Russian and foreign scientists in the field of the stock market dynamics and influence of macroeconomic factors on it and the results of the researches devoted to the analysis of external shocks impact on the stock markets dynamics. The Informational background of the study includes day data on dynamics of the main Russian indexes of shares, a cost dynamics of the future for Brent crude oil, dynamics of a key interest rate of the Bank of Russia for the period 2009-2018, monthly data on interventions of the Bank of Russia in the domestic foreign exchange market and annual inflation figures of Russia for the period 2010-2017 and also data on the number of clients in the system of the biddings of the Moscow Exchange in March, 2018. As data sources the websites of the Bank of Russia and Moscow Exchange and also the information terminal of Bloomberg was used.

Findings

External market and political shocks have become one of key problems of the Russian economy over the last years. In 2014 impact of two external shocks began directly: steep drop in oil prices which caused reducing receipt of a currency earnings to the country; the imposition of sanctions against Russia. We start analyzing the influence of oil prices shock on the Russian stock market.

As it is known about 70% of the Russian export are energy carriers and primary goods of the fuel and energy block, at the same time almost all of them, directly or indirectly, are dependent on world oil prices.

The prices of Brent crude oil (the European oil) and WTI (the American oil) traded on platforms of the Intercontinental Exchange network are the conventional world reference points for the oil industry. At the same time the cost of about 70% of grades of oil, delivered from the different countries, is determined on the basis of the quotations of Brent. The Russian grade of Urals oil differs in a little lower quality owing to what it is traded a little cheaper than the European benchmark crude (Chatzis, Siakoulis, V., Petropoulos, 2018). Therefore, in view of discount of the Russian grades of oil and exemplarity of the Brent brand, as a price reference point it is accepted to use the cost of the future for Brent crude oil.

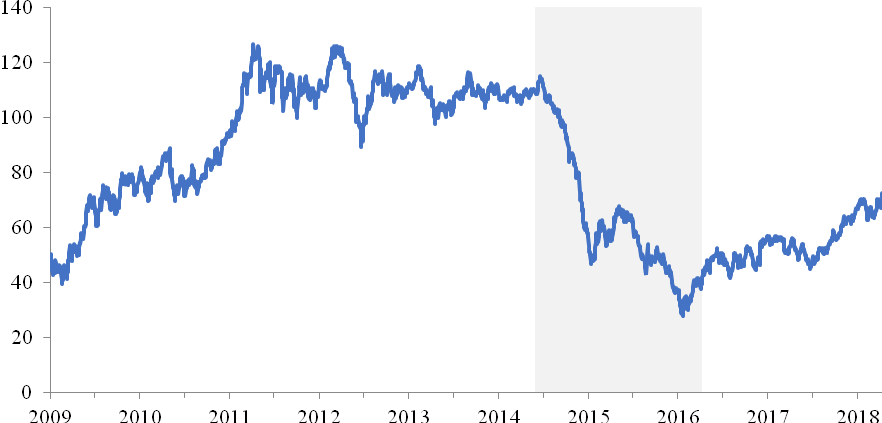

The peak of oil quotations was fixed in the summer of 2014 when the cost of the future for Brent crude oil reached a point in 115,19 US dollars per barrel. In the autumn of 2014 there was a reduction of price of oil connected with oil demand contraction in the main consuming countries, the USA and China. At the same time there was an excess supply because of high levels of production of oil in the USA (first - slate) and preservation of high export volumes from Saudi Arabia. It should be noted that, according to many experts, oil prices didn't reflect a real ratio of the demand and supply and were rather caused by financial speculations which outweighed the real factors of the demand and supply (Xu, Wang, & Zhu, 2018). The CEO and Chairman of the board of the Rosneft company Igor Sechin in Financial Times interview, for example, said about it.

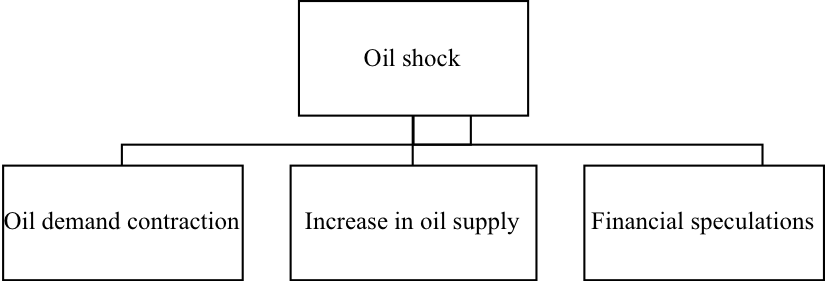

Thus, steep drop in oil prices was caused by a set of factors, which are the following: oil demand contraction, increase in oil supply, financial speculations (Figure

By December 31, 2014 oil quotations decreased to 55,27 US dollars, and the intermediate minimum was reached in the beginning of January, 2015 when the price of Brent fell up to 45,13 US dollars per barrel. That is, the oil price fell by 60%.

By the middle of summer 2015 the oil price grew up to 65 US dollars per barrel. Nevertheless, the end of 2015 was saddened by rapid fall of oil quotations when the price of Brent fell up to 36,8 US dollars. On January 21, 2016 the oil price fell to a recorded mark since the beginning of the 2000th, to 27,5 US dollars (Ahmad & Sharma, 2018). Thus, from the middle of the summer 2014 oil quotations dropped by 75%. The situation was normalized in the spring of 2016 when oil overcame a mark of 40 US dollars per barrel and continued to increase (Balcilar, Gupta, & Sousa, 2018).

Brent crude oil futures dynamics for the period under review is provided in the Figure

Such a steep drop in oil prices caused a considerable loss to economy of Russia. According to Minakir (2016), academician of Russian Academy of Sciences, the result couldn't but become sad as nearly 70% of export, 40% of federal revenues and consequently also the most part of a total revenues of economic agents, are connected with oil (production, export, conversion). Fall in prices led to "domino effect" - reduction in currency income, rise in price of money, disinvestment, drop in internal revenue, decline in aggregate demand, fall in growth rates, etc. The compensators failed to appear, in "corpulent years" a core of economic policy was not economy restructuring and formation of these most structural compensators but increasing the state and personal consumption. The situation with personal consumption is more or less clear, it was necessary to offset the awful losses of the 1990th in this field, then the situation with state consumption is much less clear (Alam, Pu, & Hettler, 2018). Instead of generating of domestic demand growth due to development of business and new structural sectors of economy, "exhibition economy" was being constructed, pure state consumption prospered instead of investment of export income".

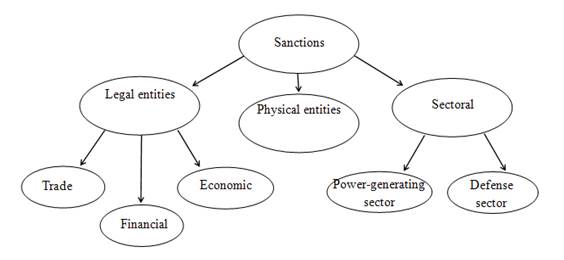

Another considerable external shock which caused an essential loss to economy of Russia were the anti-Russian sanctions (Zhao, Wang, & Wang, 2018). The sanctions began to be imposed by the USA in March, 2014 in connection with heightening of geopolitical tensions. Hereafter the European countries and other countries solidary with a position of the USA and the European Union joined the sanctions. Due to the foreign policy of Russia, new sanctions measures continue to be taken even in 2018. They are aimed at isolation of Russia from the benefits of the western civilization in the form of finance, investments and technologies (Contreras, Ignacio Hidalgo, & Nunez, 2018). As the Russian scientist Guriev (2015) claims, isolation, most likely, will remain in the short term and will continue to limit Russia from opportunities of international trade and investments.

Both physical, and legal entities, including officials, military and businessmen, bank and investment companies, the high-tech and defensive enterprises, the organizations of the oil and gas industry and power, transport companies, and even the wine-making enterprises of the Crimea were slapped with the sanctions. The main anti-Russian sanctions classification is presented by criterion of subjects to imposing in Figure

According to Minakir (2016), this shock caused fall in investment demand, capital flight and one more upsurge of decrease in consumer demand through depreciation of ruble, inflation growth in consumer market (Liu & Zhang, 2018), reduction of technological capabilities. The most obvious consequences of financial shock were depreciation of ruble and capital outflow from Russia.

According to Sholomitskaya (2017, p.95), "deterioration in terms of trade and imposition of sanctions, thus, aggravated already collected problems, i.e. simultaneous influence of several serious factors which promoted recession of investment demand took at once place".

In our opinion, the greatest loss to economy of Russia was brought by blocking of assets, the ban of financial transactions and the ban on attraction of financing of certain physical and legal entities and also restriction of deliveries of military products and oil and gas production products.

Thus, the Russian economy faced a set of the external shocks which significantly aggravated conditions of investment into the Russian stock market. Falling of oil quotations affected the state budget, and the multiplicative effect began to exert harmful impact on economic activity in the sectors adjacent with power, and in a consequence on economic growth. In the conditions of sanctions pressure, foreign markets became closed for the Russian borrowers. The foreign trade communications with some developed countries of the world (Chen, Huang, & Zheng, 2018) often crucial for several investment projects, and, eventually, and the whole branches, were frozen. All these factors caused a powerful loss not only to the stock market, but also all economic system of the country in general.

Conclusion

The stock markets play a fundamental role in economic development of the countries as they provide cash flow from one owner to others, and their dynamics is a peculiar indicator of economy health. Most of investors believe that dynamics of the stock markets can depend on various macroeconomic factors, such as, for example, interest rate, exchange rate, rate of inflation, monetary offer, gross internal product, price of oil. Besides, dynamics of the stock markets can depend on various external shocks. Nevertheless, cause and effect effects between macroeconomic indicators and external shocks and dynamics of the stock markets substantially depend on what country and what time span are studied.

External market and political shocks became one of the key problems of the Russian economy during last years. In 2014 the influence of two external shocks began at once: steep drop in oil prices which caused reduction in currency revenue of the country; imposition of sanctions against Russia.

The set of external shocks was aggravated significantly by conditions of investment into the Russian stock market. Falling of oil quotations affected the state budget, and the multiplicative effect began to exert harmful impact on economic activity in the sectors adjacent with power, and in a consequence on economic growth. In the conditions of sanctions pressure, foreign markets became actually closed for the Russian borrowers. The foreign trade communications with some developed countries of the world, often crucial for a number of investment projects, and, eventually, and the whole branches, were frozen. All these factors rendered a powerful loss not only to the stock market, but also all economic system of the country in general.

Impact of external shocks on the Russian stock market began in March 2014 when the anti-Russian sanctions were imposed due to heightening of geopolitical tensions. The index of volatility of the Russian market grew by 93% in a month. The index of the Moscow Exchange decreased by 16,8%, the dollar RTS Index decreased by 19,3%. It was one of the largest collapses for all history of the Russian stock market.

The following stage of influence of external shocks began in the middle of the summer 2014 when the largest Russian companies which shares are placed on the Moscow Exchange were placed on the sanction lists. Capitalization only of these companies made 27,5% of the general capitalization of shares of the companies placed on the Moscow Exchange. During the same period unceasing falling of oil quotations began. By the end of 2014 price of oil dropped by 48%. The index of volatility of the Russian market during this time grew by 256%. At the same time the index of the Moscow Exchange showed volatility, abnormal for the Russian stock market, and the dollar RTS Index dropped by 49% in last 4 months 2014.

The following external shock occurred on April 6, 2018 when the sanctions against 26 Russian large businessmen and the high-ranking officials were imposed - and 15 related companies, having cut off them from the American financial system and having forbidden contractor business relations under the threat to fall under secondary sanctions for this cooperation. This news literally excited the Russian stock market, the index of volatility of the Russian market the next trading day after the announcement of sanctions grew by 109%. By the middle of April, the index of the Moscow Exchange fell by 6,64%, RTS – by 13,4%. Also, capitalization of the Russian stock market failed. The next trading day after the announcement of sanctions capitalization decreased by 3,220 trillion rubles, or by 8%. It was the largest stock market collapse since 2014.

The key role in leveling of external shocks was played by the Bank of Russia which is a mega-regulator of the financial market. For this purpose, the Bank of Russia used various instruments of monetary policy, such as interest rate, transition to the mode of a floating exchange rate, introduction of new types of operations with foreign currency were key, namely: transactions "a currency swap" selling US dollars for rubles and the repo auctions in foreign currency. Actions of the Bank of Russia allowed to overcome a sharp phase of crisis, to prevent threat for financial stability and to create conditions for earlier than was predicted, renewal of economic growth and decrease of the inflation rate to target levels. Besides, the actions of the Bank of Russia allowed to lower degree of sensitivity of the Russian economy to external shocks.

Its diversification can be one of methods to decrease the degree of sensitivity of the Russian stock market to changes of the world environment. Diversification is possible by means of involvement of the companies of small and average capitalization into the Russian stock market. For their stimulation it is possible to apply tax benefits to the companies of small and average capitalization coming for the IPO. Besides, for expansion of depth of the market it is necessary to speed up work within EURASEC on attraction on the Russian market of issuers from the countries of the former CIS. At diversification of the Russian stock market it is possible only if IPO companies of small and average capitalization are successful. It has to be promoted by reform of corporate management (including in the state companies) and creation of the mechanism of assessment of efficiency of activity of the manager depending on growth of capitalization of the company.

The successful IPO will attract new investors to the Russian stock market and will lower degree of its dependence on foreign institutional investors. For more active development of investment from private investors it is necessary to create the mechanism of insurance of private investors upon fraud (indemnification funds) and also to increase the sum of means on the individual investment account to the sum comparable to an insurance on deposits of banks.

References

- Ahmad, W., & Sharma, S.K. (2018). Testing output gap and economic uncertainty as an explicator of stock market returns. Research in international business and finance, 45, 293-306.

- Akdogu, S. K., & Birkan, A. O. (2016). Interaction between stock prices and exchange rate in emerging market economies. Research in World Economy, 7(1), 80-94.

- Alam, P., Pu, X., & Hettler, B. (2018). The sensitivity of the credit default swap market to financial analysts' forecast revisions. Accounting and finance, 58(3), 697-725.

- Azar, S. A. (2014). The determinants of US stock market returns. Open Economics and Management Journal. 1(1), 1-13.

- Balcilar, M., Gupta, R., & Sousa, R. M. (2018). Wealth-to-Income Ratio and Stock Market Movements: Evidence from a Nonparametric Causality Test. International review of finance, 18(3), 495-506.

- Caporale, G. M., Hunter, J., & Ali, F. M. (2014). On the linkages between stock prices and exchange rates: Evidence from the banking crisis of 2007–2010. International Review of Financial Analysis, 33, 87-103.

- Chatzis, S.P., Siakoulis, V., & Petropoulos, A. (2018). Forecasting stock market crisis events using deep and statistical machine learning techniques. Expert systems with applications, 112, 353-371.

- Chen, Z., Huang, W., & Zheng, H. (2018). Estimating heterogeneous agents behavior in a two-market financial system. Journal of economic interaction and coordination, 13(3), 491-510.

- Contreras, I., Ignacio Hidalgo, J., & Nunez, L. (2018). Exploring the influence of industries and randomness in stock prices. Empirical economics, 55(2), 713-729.

- Engle, R. F., & Rangel, J. G. (2008). The spline-GARCH model for low-frequency volatility and its global macroeconomic causes. The Review of Financial Studies, 21(3), 1187-1222.

- Ferrando, L., Ferrer, R., & Jareño, F. (2017). Interest rate sensitivity of Spanish Industries: a quantile regression approach. The Manchester School, 85(2), 212-242.

- Floros, C. (2014). Stock returns and inflation in Greece. Applied Econometrics and international Development, 4(2), 55-68.

- Fowowe, B. (2015). The relationship between stock prices and exchange rates in South Africa and Nigeria: structural breaks analysis. International review of applied economics, 29(1), 1-14.

- Gan, C., Lee, M., Yong, H. H. A., & Zhang, J. (2006). Macroeconomic variables and stock market interactions: New Zealand evidence. Investment Management and Financial Innovations, 3(4), 89-101.

- Guriev, S. (2015). Deglobalizing Russia. Carnegie Moscow Center, 16, 6 [in Rus.].

- Jareño, F., Ferrer, R., & Miroslavova, S. (2016). US stock market sensitivity to interest and inflation rates: a quantile regression approach. Applied Economics, 48(26), 2469-2481

- Kontonikas, A., MacDonald, R., & Saggu A. (2013). Stock market reaction to fed funds rate surprises: State dependence and the financial crisis. Journal of Banking & Finance, 37(11), 4025-4037.

- Liu, W., & Zhang, J. (2018). BM (book-to-market ratio) factor: medium-term momentum and long-term reversal. Financial innovation, 4(1), 112-124.

- Minakir, P.A. (2016). Shocks and Institutes: Paradoxes of the RF crisis//Spatial Economics. №. 1, pp.7-12.

- Oikonomikou, L.E. (2018). Modeling financial market volatility in transition markets: a multivariate case. Research in international business and finance, 45, 307-322.

- Pramod, K. N., & Puja, P. (2012). The Impact of Macroeconomic Fundamentals on Stock Prices Revisited: Evidence from Indian Data. Eurasian Journal of Business and Economics, 10(5), 25-44.

- Sanvicente, A. Z., Adrangi, B., & Chatrath, A. (2018). Inflation, output and stock prices: evidence from Brazil. The Journal of Applied Business Research, 18(1), 2-10.

- Sholomitskaya, E.V. (2017). The influence of the key macroeconomic shocks on the investments in Russia. Economic Journal of Higher School of Economics. 21(1), 89-113.

- Thuan, L.T., & Yuan, C. (2011). The relationship between the United States and Vietnam stock markets. International Journal of Business, 5(1), 77-89.

- Xu, X.-J., Wang, K., & Zhu, L. (2018). Efficient construction of threshold networks of stock markets. Physics A-statistical mechanics and its applications, 509, 1080-1086.

- Yartey, C. A. (2008). The determinants of stock market development in emerging economies: Is South Africa different? International Monetary Fund, 8, 3-30.

- Zhao, L., Wang, G.-J., & Wang, M. (2018) Stock market as temporal network. Physics A-statistical mechanics and its applications, 506, 1104-1112. https://dx.doi.org/10.1016/j.physa.2018.05.039

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Konovalova, M., Kuzmina, O., & Semochkina, Y. (2019). Development Of The Russian Stock Market Under External Shocks. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 1446-1456). Future Academy. https://doi.org/10.15405/epsbs.2019.03.147