Abstract

The national automotive manufacturers play an essential role in the Russian economy. Despite the active influence of imports phase-out, a lot of car manufacturers depend on foreign suppliers. It is they who more or less take part in forming the added value. Automobile industry is the vivid example of the industry characterized by the high percent of foreign participants in the production chain. At present trend data of production output and product distribution of these manufacturers remains quite unstable. The article deals with the analysis the application of imported car components in the Russian automotive industry. The main types of imported car components in the Russian automotive industry are listed. The paper gives analysis of the trend data of imported car components application in one of the Russian car manufacturers. The main risks of the Russian automotive industry are presented. Automotive market is highly competitive and high-technological. Stable development in such conditions depends on effective competitive advantages, such as the availability and geographic distribution of business processes based upon the relative competitive advantages of certain countries. Based on the research findings we have come up to the following conclusions: at present the foreign suppliers play a leading role for the Russian automotive industry, providing more than 1/5 of the total number of car components for the national car market.

Keywords: Value chain creationautomotive industrycar componentstrend dataimported car componentsforeign supplier

Introduction

The modern market is exposed to changes in its own peculiar way, contributing to difficult economic situation. Foreign researchers highlight the fact that international enterprises are getting more and more involved in the activity of national car companies (Maloni, Carter, & Kaufmann, 2012). It is they who more or less influence the creation of value chains providing the Russian manufacturers with machine-tools and car components.

Problem Statement

The problem has been investigated by the Russian as well as the foreign researchers (Saleheen et al., 2014; Thomas, 2013; Liu & Zhang, 2014; Sun, Zhou, Lin, & Wei, 2013; Pusavec & Kenda, 2014). So Volgina (2017) defines separate features of value chains creation in automotive industry. Pisareva (2018) gives a detailed comparison of global value chains in automotive industry in the countries of Central and Eastern Europe. Gereffi and Sturgeon (2013) pay special attention to the stages of global value chains.

At the same time there is a lack of research connected with the consequences of the increasing ratio of imported car components in the automotive industry, specifically in Russia.

Research Questions

It is supposed that the involvement of foreign companies in value chains creations in automotive industry produces much impact on the manufacturing activities of car companies and directly influences their financial output. The capital outflow also presents a problem. At the same time, this involvement is not suggested to be the one of such kind (Azevedo et al., 2012). So, it is required to carry out an investigation of the consequences of such correlation.

Purpose of the Study

The main purpose of the research is to reveal main consequences of involvement of international suppliers into the creation of value chains in the automotive industry in Russia.

Research Methods

The research is based on the statistical data on the problems of the Russian automotive industry. The research methods are empirical approach and statistical analysis, deductive reasoning, graphical representation of statistical data.

The analysis of internal and internal risk factors in the Russian automotive industry has also been made. The results have allowed to estimate the degree of uncertainty of the economy sector.

Findings

Concerning the application of imported car components, special attention is given to the Russian automotive industry. The automotive industry has been considered to be in the downfall lately, and it has a negative impact on some regions as well as the country’s economic indicators in general.

The attempts to «revive» and recapitalize certain car companies have led to the greater involvement of international companies into manufacturing processes. By influencing only certain stages of the production process such cooperation does not always allow to achieve definite results.

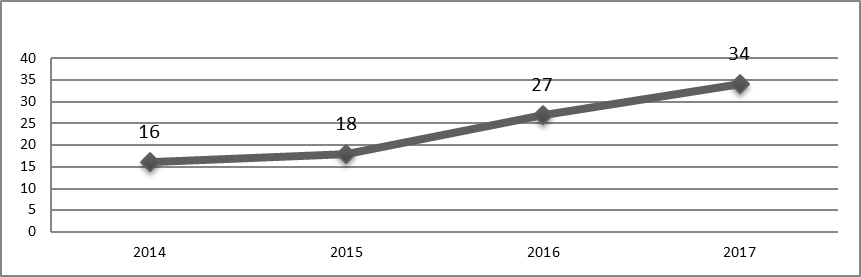

Thus, considering the analysis of imported car components application in the Russian car manufacturing plants it is clear that the numbers are increasing every year. The statistics are shown on Figure

Source: compiled by the author (Analytical statement, 2017).

The graph shows not only the rise of application of the imported car components but also growth rate. Taking into account prolongation of the formerly imposed sanctions and the policy of active imports phase-out development, such economic trends present a special phenomenon and also hamper the development of the Russian automotive industry (Ashmarina & Kandrashina, 2016).

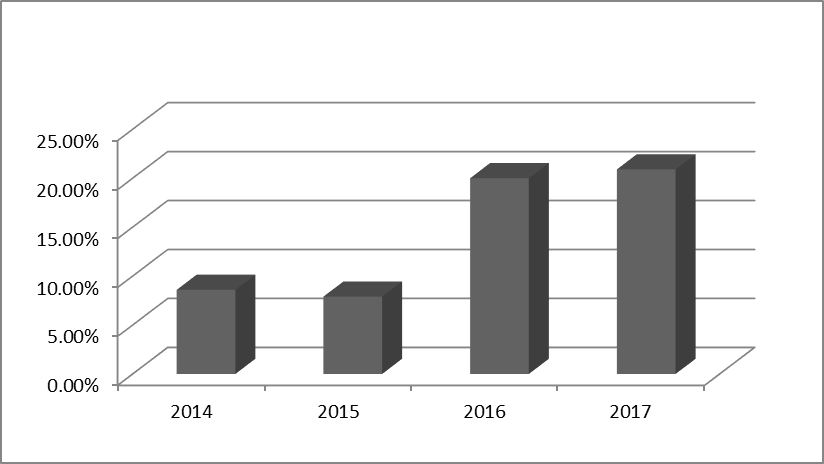

Speaking about annual expenses on purchasing the imported car components, it should be mentioned that they are quite high in the overall cost structure of the Russian car manufacturers. Having studied one of the largest car manufacturers in Russia – PAO AvtoVAZ, despite its unstable financial situation, - it should be noted, that the presented cost behavior analysis looks quite disappointing (Figure

Source: compiled by the author based on the annual financial statements of PAO AvtoVAZ

The sharp increase in 2016 was caused by the fact that in 2016 Nicolas Maure became the CEO of PAO AvtoVAZ. He concentrated the policy upon the quality improvement of products by many ways including the increasing numbers of imported car components. Among these car components are brakes, carburetors, injectors, shock absorbers, ball bearings and electronic units. Despite the fact that domestic car components are used in more quantities for production, the ratio of imported car components are getting higher and higher. In the end of 2017 PAO AvtoVAZ made an official statement, that they were not planning to reject imported car components, but they might suggest reducing their number in production process. So, in the nearest future its price policy is expected to change because of main suppliers’ replacement.

Due to the fact, that consumers cannot always understand price formation, what kinds of car components are used in production, when target price is actually defined, there occurs a misunderstanding of attitudes towards the price between consumers and the producers observing all the production processes and stages by themselves. (Krzywdzinski, 2017; Carter & Easton, 2011)

Thereby, it is important to study risk factors which result from these phenomena as well as the consequences that these factors can lead to. Concerning the Russian automotive industry, the external and internal risk factors are the following (Table

According to the external and internal risks analysis one can state that the core of the most problems lies in the product quality. This leads to low competitiveness of the company in the international market and low product appeal for the prospective customers.

Furthermore, the existence reliance and dependence on the foreign suppliers and the customer’s lack of understanding about the creation of added value chain are posing actual risks for the car companies. It can cause a change in governmental attitude to the car makers and, consequently, lead to the absence of governmental and state financial support.

Obtained results can be applied for the degree of uncertainty analysis of the organization environment based on Duncan’s matrix. As it has been said before, there are lots of environmental factors that affect the business activity of a company. These factors may be implicit, that is leading to the uncertainty of situation in the company.

In case with the Russian automotive industry, the company can be characterized to be in “difficult-stable” environment.

Such choice of “difficult environment” condition may be proved by the fact, that the external factors having an impact on the analyzed company are quite different. So, economic crisis, foreign competitors and drop in the value of national currency – economic factors, legislative amendments and government refusal to support companies – political factors, erosion of purchasing power – social factors.

“The stable environment” can be determined by the fact that the above-mentioned factors have influenced the company activity for a long time and their number has not changed much. The influence of these factors took hold of the company from the beginning of 2008 crisis and has not changed since then. At present some changes connected with the changes in company activities may be predicted and evaluated to some extent. However, they will be predictable, thus corresponding with the stable environment.

Many of the above-listed factors are interrelated with each other, and if one of them is influenced upon, the others are also likely to be affected, adjusted or repealed. For example, if the dependence on foreign suppliers is reduced it is expected to have a higher impact on the prime cost and product quality, and as a consequence on the demand (Ashmarina, Kandrashina, Streltsov, & Yakhneeva, 2017).

Earlier there has existed the opportunity to decrease the number of the imported car components in the automotive industry. At the beginning of 2015 the negotiations with the senior managers of JSC United Automobile Technologies were held about an agreement and to get them involved into supplying car components which were previously imported from other countries. The negotiations were stopped, because the sides could not come to an agreement. Despite it, the similar attempts seem to be quite successful in terms of imports phase-out policy.

The probable consequences of increasing involvement of the foreign companies in the creation of value chains in the Russian automotive industry appear to be the following:

capital outflow: there is a strong tendency that the capital does not transfer from the one branch of industry to another within the country, but there is a complete capital flight out of the country – to the foreign manufacturers;

the exclusion of the national manufacturers: the foreign companies take greater share of the market not allowing the national companies to compete and fill a specific market niche. All these things restrict opportunities for the development of the national companies and reduce their competitiveness, therefore influencing country’s economic figures in general (including GDP);

it is suggested that imported car components appear to be of higher quality in comparison with the local ones. So, there is a risk of intentional price reduction of car components by the foreign contractors for the sake of quality. Therefore, there will be further decrease in demand and the violation of company financial stability;

there can be risks that foreign suppliers will overprice the car components causing cost price of products. In this case the company either faces the fall in the profits or has to increase the price which therefore can lead to decrease in demand.

Conclusion

Based on the research findings we have come up to the following conclusions: at present the foreign suppliers play a leading role for the Russian automotive industry, providing more than 1/5 of the total number of car components for the national car market. There is a steady tendency of increasing the ratio of the imported car components applied by the national car makers; however, it is possible to replace the imported car components by the car components produced by national manufacturers. For example, there is an opportunity to use ball bearings made by national companies, which are located all over the country. The further development of the tendency in the same way can lead to negative consequences not only for the automotive industry but for the economy of Russia.

References

- Analytical statement. (2017). Statisticheskiy obzor rynka legkovyh avtomobilei (OAO “ASM-holding”). Retrieved from URL: http://www.asm-holding.ru/profile/edition/sdippmcif/ [in Rus.].

- Ashmarina S.I., Kandrashina E.A., Streltsov A.V., & Yakhneeva I.V. (2017). Osobennosti upravleniya organizatsionnimy izmeneniyamy predprinimatelskyh struktur, Economika I predprinimatelstvo, T 7(84),1085-1089 [in Rus.]

- Ashmarina, S.I., & Kandrashina, E.A. (2016). Problemy razvitiya predpiyatiy mashinostroeniya v usloviyah izmeneniya structury rynkov, Nauka XXI veka: aktualnye napravleniya razitiya, T 1, 27-30 [in Rus.].

- Azevedo, S., Carvalho, H., Duarte, S., & Cruz-Machado, V. (2012). Influence of green and lean upstream supply value chain practices on business sustainability, IEEE Transactions on Engineering Management, 59 (4), 753-765

- Carter, C.R.P., & Easton, L. (2011). Sustainable supply chain management: evolution and future directions, International Journal of Physical Distribution and Logistics Manaement, T 41 (1), 46-62.

- Gereffi G., & Sturgeon T. (2013). Global value chain-oriented industrial policy: the role of emerging economies. In Deborah K Elms and Patrick Low (Ed.), Global value chains in a changing world, Geneva: World Trade Organization.

- Krzywdzinski, M. (2017). Automation, skill requirements and labour-use strategies: high-wage and low-wage approaches to high-tech manufacturing in the automotive industry, New Technology, Work and Employment,T 32 (3), 247-267.

- Liu, C.L., & Zhang, Y. (2014). Learning process and capability formation in cross-border buyersupplier relationships: A qualitative case study of Taiwanese technological firms, International Business Review,T 23(4), 718-730

- Maloni, M., Carter, C.R., & Kaufmann, L. (2012). Affiliation in supply value chain, International Journal of Physical Distribution and Logistics Management, T 42 (1), 83-101.

- Pisareva S.S. (2018). Tsepochki stoimosti v avtomobilestroenii stran Tsentralnoy I Vostochnoy Evropy. Opyt dlya Rossii. Moskow: KnoRus [in Rus.]

- Pusavec, F., & Kenda, J. (2014). Innovative upgrade in the tooling industry. J. Clean. Prod., T 76, 180–189

- Saleheen, F., Miraz, M.H., Habib, Dr. Md. Mamun., Hanafi & Dr. Zurina. (2014). Challenge of warehouse operations: a case study in retail supermarket. International Journal of Supply Chain Management, 3(4), 63-67

- Sun, Y., Zhou, Y., Lin, G.C.S., & Wei, Y.H.D. (2013). Subcontracting and supplier innovativeness in a developing economy: evidence from China's information and communication technology industry. Regional Studies,V 47(10), 1766-1784

- Thomas, K., (2013). The automotive supply chain in the new normal: analysis of the industry opportunities. SCMA, V 7, Retrieved from URL: www.scmresources.ca/documents/.

- Volgina, N.A. (2017). Globalnye tsepochki stoimosty, industrializatsiya I promyshlennaya politika, ETAP: economicheskaya teoriya, analis, practika, 2, 23-34. [in Rus.]

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Aleshkova, D., Smolina, E., Shepelev, A., Kandrashkina, O., & Zharinova, I. (2019). Foreign Manufacturers In The Value Chains Creation Of The Russian Automotive Industry. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 1108-1114). Future Academy. https://doi.org/10.15405/epsbs.2019.03.111