Abstract

New industrial revolution and related issues of structural transformations have been the focus of considerable attention in recent years. Developing economies experience dynamic change as the pace of technological innovation is accelerating. There are signs that countries are revaluating their approach toward industrial policies and face a challenge to find the right balance between the responsibilities of government, public entities and business for innovation-driven development. This study aims a) to identify business group’s characteristics that make it an institute capable of coordinating innovation-driven development during the shift to a new technological paradigm, b) to analyse innovation-driven development within business groups in situation of instability caused by the structural transformations. The study uses business group-level reports and strategies to explore the role of administrative power, planning and structural factors in determining innovation outcomes of business groups in terms of technological and economic changes. We exploit a two-sector model imply that there is sector with surplus resources (basic sector financing innovation) and sector with scarce resources (pioneer sector providing innovation) in business group. While modelling the processes of innovation-driven development in the situation of economic instability, we reached the conclusion that institutions determine the direction and the level of business groups’ impact on innovations growth in a time of structural transformations.

Keywords: Business groupsinstitutionsstructural transformationsinnovation

Introduction

The world is undergoing another industrial revolution as economic growth continues at a staggering pace in some developing countries. At the same time, these growing economies are dealing with new challenges related to the need of structural transformation of the economy to conform to the new technological order. In particular, there are challenges related to innovation-driven growth coordination and financing.

Governments should be the main coordinator in this case, but, nevertheless, the private and public sectors share responsibilities during the process of structural transformation (Golichenko, 2017). The question is which private economic entities can perform this role in developing countries.

For developed countries this question is resolved in favour of corporations as they can effectively manage internal and external environments through the system of long-term contracts. The system allows planning of business development when there is a substantial time gap between initial investment and releasing innovative product to the market (Galbraith, 1973).

In developing countries, the system of contracts is not as effective as in developed countries, due to the high possibility of the contract not being fulfilled by one of the parties and low level of contract security. In this case, contracts are replaced with companies integrating to form business groups (Manikandan & Ramachandran, 2015; Gordeeva & Antipina, 2013; Khanna & Yafen, 2015).

Developing countries face another problem: investing in innovation. The process of structural transformation makes this issue even more complicated as there is a need to synchronize innovation-driven development of related industries. Financial markets cannot solve this problem, which pushes business groups to fill the gap in financial market capabilities.

Problem Statement

Questions associated with business groups’ development and management have been the focus of considerable attention of academic research (Khanna & Yafen, 2015; Zhang, Sjogren, & Kishida, 2016). The problems of industrial organization and monopoly power of groups (Singh, Pattnaik, Gaur, & Ketencioglu, 2018), groups’ involvement in the financial sector (Buchuk, Larrain, Muñoz, & Urzúa, 2014; Chittoor, Kale, & Puranam, 2015), the relations between business groups and governments (Dieleman & Boddewyn, 2012) are widely discussed by different economists.

There are papers focused on such research problems as business group opportunities in innovation development (Culpan, 2014; Lee, Lee, & Gaur, 2017; Gubbi, Aulakh, & Ray, 2015), modernization management (Bessonova & Gonchar, 2017; Chepurenko, 2017), and business groups’ role in catching up economic development (Morck & Nakamura, 2018; Nakamura, 2015).

There is no proper research done on the question of including business groups in a mechanism of innovation-driven development at the state level. Therefore, there is a need to explore questions of business group role as an economic entity participating in the process of structural transformation to a new technological paradigm.

Organizational structure and economic specifics of business groups make it so that they can perform institutional functions toward the innovation sector, especially taking into account governmental regulations being in place. First of all, groups have a centralized hierarchical structure which allows synchronization with affiliated companies (Yang, Schwarz, & Multilevel, 2016). Secondly, business groups are highly diversified but at the same time interested in synergy effect from affiliated industry growth (Purkayastha, Kumar, & Lu, 2017; Lee, Lee, & Gaur, 2017; Oh, Chang, Lee, & Seo, 2018). Last, business groups have resource availability and/or have mechanisms to find resources. Despite these prerequisites, the results of business groups’ support for the innovation sector differ. In Japan, South Korea, and India, groups contribute to innovation, and at the same time this trend is not as noticeable in other countries (Joint Research Centre, 2018). Therefore, the question about specific business group management and factors influencing innovation-driven growth of business groups is very important to explore.

Research Questions

Considering the need to fill in this research gap, here are questions explored in the current study:

Purpose of the Study

The objectives of the study are:

Research Methods

Hypothesis Development

Coordinating innovation-driven development based on business groups

Business groups have a special way of coordinating economic interests for stakeholders. Khanna & Yafen (2015), Yakovlev, Simachev, & Danilov (2010) emphasize that connections within business groups resemble internal company transactions rather than being a form of external corporate control, bearing administrative character.

H1: Business groups are managed not only by using administrative power. Economic interests structured as a plan play the role of the initial element, while administrative power is a way to implement the plan.

The management system of business groups’ based on administrative power and planning allows delegating them coordination of innovation-driven development while shifting to a new technological paradigm.

Innovation-driven development within business groups in situation of instability caused by the structural transformation

Tarasevich & Miropolsky (2014) developed a two-sector economy model, characterized by sharing between a sector with surplus resources and a sector with scarce resources. Innovations are primarily driven by a sector with scarce resources and financed by a sector with surplus resources. Structure of the business group contains both a sector with scarce and a sector with surplus resources. Generally, business group innovations’ development is affected by the proportion between sectors with scarce and surplus resources (Gordeeva, 2016).

H2: Structural transformation is usually associated with economic disruption, which can lead to a temporary decrease in the share of a sector with scarce resources and a slowdown in the pace of innovation-driven development.

Population and Sample

The sample contains business groups of several developing countries: Korea, India, Turkey, Russia, China, Brazil, Mexico, and Argentina. Data from about 68 business groups was analysed.

Data collection procedures

During conducting this research, the following data sources were used:

The graphic model

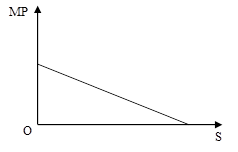

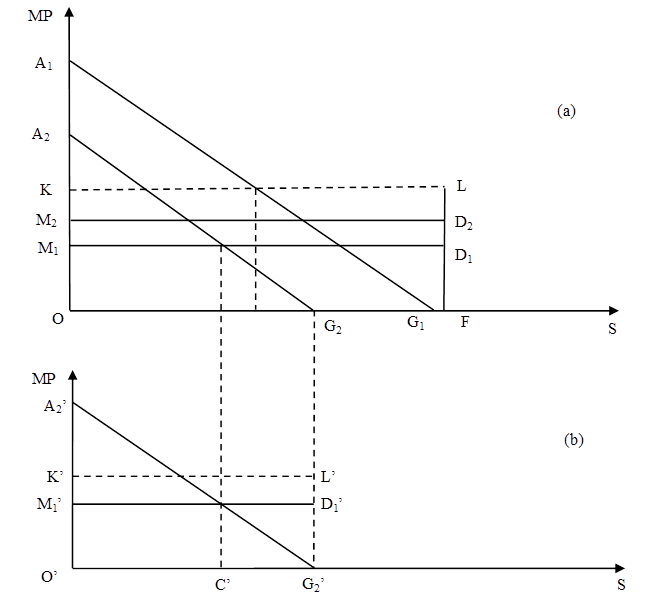

The process of innovation development in business groups is described with the two-sector model (Gordeeva, 2016). The model considers business group as a process of production and consumption of a product. In figure

At figure

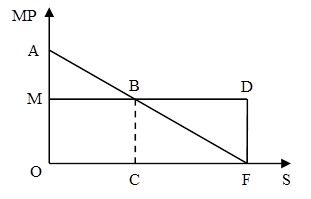

Because business group in a two-sector model is the result of production and consumption, we can combine figure

In figure

The first sector (OABC) has a surplus of resources and it is the basis of a business group. Here the value of produced goods (OABC) is higher than the value of consumed goods (OMBC.) As a result, there is a surplus of resources equal to MAB. High productivity creates an effective correlation between results and expenses while producing a basis product.

The second sector (CBDF) has scarce resources. In this sector, expenses are higher (CBDF) than the value of the produced goods (CBF) on BDF. The main product here is a pioneer, which has a more complicated definition that innovation. Besides innovative products, pioneer products include goods that are already being launched by other companies, but not by the business group that starts producing it. A pioneer product is not a necessity product, and in the production process it uses more resources than the resulted value of the product. As a result, the pioneer sector can only exist in terms of the basis product redistribution between sectors of one business group.

The proportion between basic and pioneer sectors can be identified based on the consolidated financial report. Basic activities would include operational activity of the business group, excluding pioneer product output. It would be part of the pioneer sector, together with uncompleted construction, social responsibility of the company, investment, research, and development.

Different financial mechanisms, transfer prices, and other instruments allow redistribution of part of the basic product to the pioneer sector. Transfer prices are usually set lower than the value of the product. Meanwhile at the external market, the situation can be the opposite. Pioneer product prices are set higher than its value.

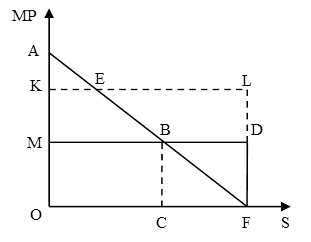

Figure

Findings

Coordinating innovation-driven development based on business groups

The analysis of strategies and annual financial reports from business groups in Korea, India, Turkey, Russia, China, Brazil, and Mexico showed planning being basis of their operations and innovation development.

The financial core of a business group is a key to this system. Meanwhile, basic and pioneer production is supported by a multi-level planning process. Planning is usually performed by a bank as part of a business group or another financial affiliate. In order to plan, the financial core would calculate the relation between metrics of the investment efficiency (ROE, ROI, ROCE), average market value of capital and weighted average capital cost (WACC), efficiency spread (ES), and other metrics. Based on this analysis, a financial plan is developed. Consolidated capitalization is typically planned, which provides capital growth metrics. For affiliated companies, individual capitalization is planned, which helps to reach a goal for the business group overall. The main principle of planning is to have higher growth rate of market capitalization in comparison with growth rate of revenue.

The increase in a market capitalization of the business group can be reached by two main ways. First is the use of financial mechanisms like a pool of treasury stocks, mergers and acquisitions with security of the acquired companies, stock price manipulations, and so on.

Second is investment in undervalued assets. Capital is invested in affiliated companies showing high growth rates of revenue and stable dividends. Instruments of the corporate control are also used, but the investment objects should match the criteria of high competitiveness. The main criterion is market position. Business groups usually invest in a company-market leader or the company that has potential to become one in the near future. All investment projects are evaluated based on the market value of the capital and expected investment rate of return. At the same time, affiliates are responsible for their liabilities. It is common to take on an investment that can be returned in 3 to 5 years.

Operational planning is the next level of planning after financials. In this case, in addition to revenue, strategic development is planned. For each business area, specific criteria are set up to allow competitive advantages at the market, to increase management effectiveness, and to stimulate information systems. The benchmark of competitive advantages growth is an increase in market share and volume. These parameters are usually stated in the operational plan.

The planning and administrative power of headquarters creates structural competition between different branches of the business group for recourses and competencies, which impacts the proportions between basis and pioneer sectors. Competition between different branches of the business group may complicate innovation development in the process of shifting to a new technological paradigm. Hierarchical structure and centralized planning in a business group creates both the possibility to redistribute recourses and economic benefits for the pioneer sector, and also limits development opportunities and product variation through investment effectiveness criteria.

Additional difficulties are associated with distribution of resources between areas of business during the secondary phase of planning in accordance with a financial plan. In this case, the necessity to increase business group capitalization plays against increasing innovation.

Therefore, risk and initiative needed for innovation sector growth are only possible within the levels affordable from the position of economic efficiency. Business groups are more likely to redistribute resources to innovation activities that can provide predictable economic results reachable in a period of 3 to 5 years.

The factors listed above prove that planned-administrative type of management allows a business group to perform some functions of coordinating innovation-driven development moving towards a new technological paradigm. Effective planning, though, is only possible in relation to incremental innovations. Radical innovation development requires a high level of interest from beneficiaries from the headquarters of the business group.

Innovation-driven development within business groups in situation of instability caused by the structural transformation

It is also worth exploring what opportunities and limitations a business group may have in the time of structural economic transformation. The nature of the new technological paradigm together with the monetary policies implemented by developed countries allows identification of several factors of economic instability in developing countries:

The graph in figure

The shift from КLD1М1 to КLD2М2 shows that the basis sector revenue does not cover expenses that the business group needs to take on to support the pioneer sector and innovation. It causes a surplus of the pioneer product.

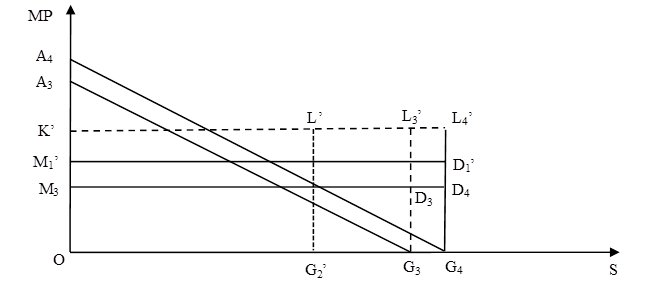

A negative environment and unpredictable demand on produced goods lead to a decrease in production and investment. As a result, the production in pioneer and basis sectors declines to О'А2'G2' (please see figure

It is possible to overcome this issue if government creates demand on investment to innovation product development (see figure

The group costs decrease from M1’D1’ to М3D3 which rises the profit of affiliates to КLD3М3. The profit increase stimulates investment to a business group and allows to expand a production in basis and pioneer sectors, including production of the innovative product (see the shift of the marginal product of production to А4G4 at figure

Conclusion

In developing countries business groups should have an array of functions and responsibilities in the process of structural transformation of the economy to support innovation due to management system based on administrative power and planning as well as a high asset concentration under the governance. Special characteristics of business groups have guaranteed the market for innovative products, control over costs, investment, resources, technologies, and personnel. In addition, internal investment between a business groups’ affiliates and the targeted investment based on the multi-level planning create prerequisites for the affiliated industries synchronized development needed during a shift to a new technological paradigm.

The two-sector model described in 5.4 above confirms that proportion between the basis and pioneer sectors do not create any limitations on innovation development within the business group. While modelling the processes of innovation development in the situation of economic instability, we reached the conclusion that external shocks and structural shifts in the economy, incorrect risk evaluation, and governmental regulations can change the trajectory of pioneer sector development. However, world leading innovative corporations show that the short-run decline of the pioneer sector can go together with an expansion of its innovation component, as evidenced by capital expenditures reduction of €77bn compared with the R&D increase of €64bn in 2017 (Joint Research Centre, 2018). All the listed factors confirm that institutions determine innovation-driven development direction and the level of the business groups’ impact on innovations support in a time of instability.

Structural transformation of the developing economies outlines general directions for further research in view of business groups’ institutional environment. This includes paying attention to evaluation metrics and methods of increasing the institutions’ efficiency as well as to new institutional instruments of business group management that would allow a shift to a new technological paradigm.

References

- Bessonova E., & Gonchar K. (2017). Incentives to innovate in response to competition: the role of agency costs. Economic Systems, 41 (1), 26-40. DOI:

- Buchuk, D., Larrain, B., Muñoz, F., & Urzúa, F.I. (2014). The internal capital markets of business groups: Evidence from intra-group loans. Journal of Financial Economics, 112, 190-212. DOI:

- Chepurenko, A. (2017). Innovation entrepreneurship in transition economies: problems and outlook. Foresight and STI Governance, 11(3), 6-9. DOI:

- Chittoor, R., Kale, P., & Puranam, P. (2015). Business groups in developing capital markets: Towards a complementarity perspective. Strategic Management Journal, 36, 1277–1296. DOI:

- Culpan, R. (2014). Open Innovation through Strategic Alliances. Palgrave MacMillan. DOI:

- Dieleman, M., & Boddewyn, J.J. (2012). Using organization structure to buffer political ties in emerging markets: a case study. Organization Studies , 33, 71- 95. DOI:

- Galbraith, J. (1973). Economic and the public purpose. Boston: Houghton Mifflin Harcourt

- Golichenko, O. (2017). Public policy and national innovation system failures. Voprosy Ekonomiki, 2, 97-108.

- Gordeeva, E. (2016). Economic mechanism of financial-industrial groups: to the question about the possibilities of the development of innovative sector. Journal of Economy and entrepreneurship, 77 (12-4), 154-161.

- Gordeeva, E., & Antipina, Z. (2013). Financial industrial groups in an era of globalization. St. Petersburg: Prima.

- Gubbi, S.R., Aulakh, P.S., & Ray, S. (2015). International search behavior of business group affiliated firms: Scope of institutional changes and intragroup heterogeneity. Organization Science, 26, 1485–1501. DOI:

- Joint Research Centre (2018). The 2017 EU industrial R&D investment scoreboard Luxembourg: Publications Office of the European Union. Luxemburg: Publications Office of the European Union. DOI:

- Khanna, T., & Yafen, Y. (2015). Business groups in emerging markets: paragons or parasites? Review of Economics and Institutions, 6 (1), 2(1-60). DOI:

- Lee, CY., Lee, JH., & Gaur, A.S. (2017). Are large business groups conducive to industry innovation? The moderating role of technological appropriability. Asia Pacific Journal of Management, 34, 313-337. DOI:

- Manikandan, K.S., & Ramachandran, J. (2015). Beyond institutional voids: Business groups, incomplete markets, and organizational form. Strategic Management Journal, 36, 598–617, DOI:

- Morck, R., & Nakamura, M. (2018). Japan's ultimately unaccursed natural resources-financed industrialization. Journal of The Japanese and International Economies, 47, 32-54. DOI:

- Nakamura, M. (2015). Economic development and business groups in Asia: Japan’s experience and implications. International Advances in Economic Research, 21, 81-103. DOI:

- Oh, WY., Chang, Y.K., Lee, G., & Seo, J. (2018). Intragroup transactions, corporate governance, and corporate philanthropy in Korean business groups. Journal of Business Ethics, 153(4), 1031-1049. DOI:

- Purkayastha, S., Kumar, V., & Lu, J.W. (2017). Business group heterogeneity and the internationalization-performance relationship: Evidence from Indian business groups. Asia Pacific Journal of Management, 34, 247-279. DOI:

- Singh, D., Pattnaik, C., Gaur, A.S., & Ketencioglu, E. (2018). Corporate expansion during pro-market reforms in emerging markets: The contingent value of group affiliation and diversification. Journal of Business Research, 82, 220-229. DOI:

- Tarasevich L., & Miropolsky D. (2014). Structure and institutions: regional cooperation in the economic system. Economy of Region, 3, 36-48. DOI: 10.17059/2014-3-3

- United Nations (2018). World investment report. Investment and new industrial policies. Geneva: United Nations

- Yakovlev, A., Simachev, Y., & Danilov, Y. (2010). Corporate governance in Russian companies: before and after the crisis. Moscow: HSE Publishing House

- Yang, K., Schwarz, G.M., & Multilevel, A. (2016). A multilevel analysis of the performance implications of excess control in business groups. Organization Science, 27, 1219-1236. DOI:

- Zhang, L., Sjogren, H., & Kishida, M. (2016). The emergence and organizational persistence of business groups in China, Japan, and Sweden. Industrial and Corporate Change, 25, 885–902. DOI: 10.1093/icc/dtw006.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Antipina, Z. P., & Gordeeva, E. S. (2019). Business Groups, Innovation And Srtructural Transformations In Developing Economies. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 102-112). Future Academy. https://doi.org/10.15405/epsbs.2019.03.11