Abstract

This paper examines the share of foreign capital in the banking sector of Russia, analyzes its structure; considers the problems of the influence of foreign capital on the development of the domestic banking sector; identifies the factors contributing to the withdrawal of foreign capital from the domestic banking sector; proposes measures aimed at protecting national interests in the banking sector and maintaining the stability of the financial system as a whole. The positive and negative aspects of the expansion of foreign credit institutions in the national banking sector of the Russian Federation are considered. The assessment of competitive advantages of the foreign banks operating in the territory of the country in comparison with domestic commercial banks is given. The article reveals both positive and negative impact of foreign capital on the development of the banking sector. The features of the activity of banks with foreign capital, which were adopted as the main anti-crisis measures by the Central Bank of the Russian Federation, and the policy of foreign countries to place and attract investment in the banking system of foreign States. The directions for the growth of foreign investments in the Russian economy, especially in its banking sector, and increased confidence in foreign partners are identified.

Keywords: Foreign investmentsbanking sectorbanks with foreign capitalfinancial system

Introduction

A Bank with foreign capital, according to domestic legislation, is a Bank in which the share of capital owned by at least one foreign investor is not less than 10% (Gnidchenko, Mogilat, Mikheeva, & Salnikov, 2016).

Along with the concept of "Bank with foreign capital" there is a concept of "foreign Bank", the main features of which is the location of the center for strategic decision-making abroad and control of foreign owners.

The main reason for the attractiveness of the domestic banking market for foreign investors is the prospect of obtaining super profits due to high interest rates on loans (Drugov, Rysin, & Senishch, 2016).

Banks with foreign capital may focus more on speculative operations without providing a full range of quality banking services; these banking institutions may be less prone to credit activities, especially in the area of retail domestic business lending. Experience of many States with "transition economies", where emphasis was placed on external investment has shown that the banking systems of these countries are almost entirely composed of large international banks (Song, 2014).

Under these conditions, banks with foreign capital are beginning to exercise a decisive influence on the nature and priorities of economic development in these countries, to control the most effective areas of activity there. At the same time, these banks have specific, often inconsistent with national interests, strategic priorities (Graham, Harvey, & Puri, 2015).

Moreover, the decision on the terms of granting loans may be taken with regard to international customers or shareholders of the parent Bank, in most cases, may mean the refusal to Finance competitive production. Such a scheme of development of the banking system will lead to a violation of the integrity of the economic interests of the state, significantly impeding the development of national production, especially small and medium-sized businesses.

The result is an increase in unemployment and other social problems faced by the countries of Eastern Europe, in particular Poland, in recent years. The experience of banks in Poland, where in 2006. 70% of banking assets and 80% of the liabilities were concentrated by foreign banks shows that foreign banks in the beginning were created for the purpose of providing services to residents, and then begin to lobby for national interests and support the foreign companies dictate their interests to the banking system.

The negative consequences of the presence of branches of foreign banks also increase the sensitivity of the banking system to the world financial crisis, complicated banking supervision of operations of branches of foreign banks. Therefore, Russia should take into account not only the positive aspects that foreign capital brings to the development of the economy, but also take into account the shortcomings (Zaitova & Volik, 2017).

In addition, the tendency to curtail the activities of banks, in particular with foreign capital in the domestic banking sector continues under the influence of the cumulative effect of a number of subjective and objective factors: the absence in the near future of significant prerequisites for improving the business climate in Russia (negative trends in economic growth, expectations of further devaluation of the national currency); changes at the legislative level in terms of the prohibition of lending to the population in the currency; low-quality loan portfolio of banks.; the non-transparent judicial system and the absence of an institution for the protection of creditors ' rights; the complex post-crisis situation in the European Union; the introduction of increased capital adequacy requirements for European banking groups within the framework of Basel III; the gradual transformation of the business models of European banks in the context of optimization (reduction) of geographical presence in certain regions of Eastern, Central and South-Eastern Europe and a more balanced investment policy in selected reference markets (Ivanov, Kuzyk, & Simachev, 2012).

In our opinion, these factors should be added: political and currency instability in Russia; reduction of aggregate demand and the flow of savings from banking to non-banking sector; comprehensive reform of not only the banking but also the entire financial system, which causes concern among investors; high level of uncertainty regarding further economic development; reduction of economic activity of business entities and the like.

Problem Statement

There are the following research tasks:

presence of foreign banks and their influence on the development of the Russian banking sector to ensure stable development;

high dependence of the domestic financial system on the global banking sector of the country, particularly sensitive to exchange rate fluctuations;

additional risks in case of rapid outflow of foreign capital (Gavrilishin, 2014).

To date, it is impossible to give a clear assessment of the impact of foreign capital on the development of the domestic banking sector, as the activities of banks with foreign capital has a positive impact on the expansion of the resource potential of banks and the development of a competitive environment, and a negative impact on the stability of the financial system.

Research Questions

Based on the above, the following research question was identified in this study.

What is the role of the devaluation of the national currency to reduce the capitalization standards, the growth of the share of problem loans in the loan portfolio, the reduction of the share of foreign capital in the authorized capital of banks, as well as to reduce the number of banks with a banking license, including foreign capital?

Purpose of the Study

The aim of the work is to study the presence of foreign capital in the banking sector of Russia in the context of determining its impact on the stability of the financial system of the state in the long term.

Research Methods

Political and economic instability in the country, the pressure of external debts, the reduction of gold and foreign exchange reserves by 2.7 times during 2017 led to the largest in recent years, the devaluation of the national currency by 97% against the us dollar by 74.18% against the Euro, and for the first 2 months of 2018 - by 70.32% and 57%, respectively (Kurbatov & Bezborodova, 2016).

The study of the impact of the devaluation of the national currency makes it possible to identify the main and the main tool – the analysis and evaluation of the performance of banks.

Net outflow of foreign currency in favour of non-residents at the end of 2017 amounted to about 126 million dollars. US $ (equivalent), which was the first time since 2009. (In 2013. the volume of net foreign exchange earnings amounted to nearly 9 400 000 000$. USA) (Mau, 2010).

Net purchase of non-cash currency in the interbank currency market of Russia amounted to almost $ 10 billion last year. USA (equivalent), while in 2016 observed in its net sales (us $ 1600000000. USA.) In the cash segment of the foreign exchange market, the population's net purchase of foreign cash was $ 2,400,000,000. US $ (equivalent), slightly decreased compared to 2015 (2900000000 dollars. USA) (Birkinshaw & Hood, 1998).

As of 01.01.2018, 163 banks were operating in Russia, including 51 banks with foreign capital, including 19 banks with 100% foreign capital.

If as of 01.01.2017, 25 banks were in liquidation, then a year later, as of 01.01.2018, due to the deterioration of solvency, 26 banks decided to liquidate, introduced a temporary administration in 13 banks. Despite the liquidation of troubled banks, the share of foreign capital in the authorized capital of banks decreased to 32.6% as of 01.01.2018, returning to the level of 2007.

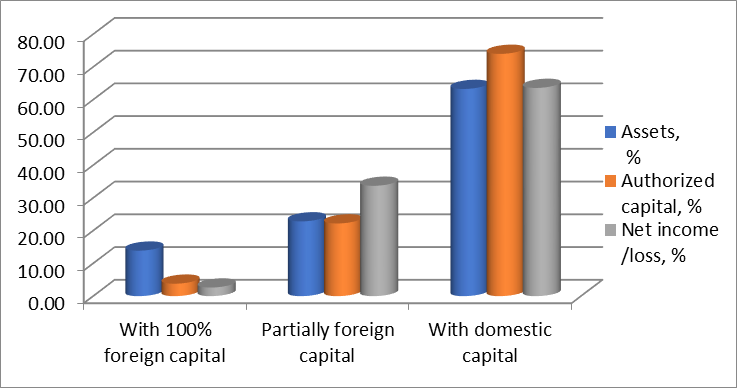

Along with the quantitative reduction of banks with foreign capital, their impact on the development of the domestic banking sector is very significant, since these banks concentrate 32.60% of the authorized capital, more than 36% of assets and net profit (Fig. 1) (Kostyuk, 2014).

It should be noted that banks with foreign capital form their liabilities mainly due to: term deposits (deposits) of other banks and loans received from other banks (mainly parent). The dominant direction of active activity is lending to business entities and individuals, term deposits in other banks (Gurkov, Morgunov, Saidov, & Arshavsky, 2018).

As of 01.01.2018, there were 19 banks in the Russian banking sector with 100% foreign capital, which concentrated 3.8% of the authorized capital, 13.89% of assets and 2.63% of net profit. Foreign capital of these banks is represented by 10 countries, among which the largest share is occupied by Russia, Cyprus, Hungary, Germany, Turkey (table.

As of 01.01.2017, 32 banks with partially foreign capital operated in the banking sector of Russia, and in 18 of them, the share of shares owned by non-residents amounted to more than 95%.

Findings

Based on the study of economic literature, the following conclusions can be proposed: to prohibit the opening of Bank branches from offshore zones and to grant permission to operate only to banks with high reliability rating; fulfilment by branches of all economic standards established by the Central Bank; annual audit; legislative regulation of the use of income by branches of foreign banks and the process of their liquidation (Abramova et al., 2013).

Conclusion

Thus, the impact of foreign capital on the development of the banking sector can be both positive and negative. The positive impacts include: the maintenance of balance of payments and inflow of foreign currency into the country; accelerating the introduction of modern banking technologies; growth in employment; the expansion of Bank credit; the growth in tax revenues in the budget; strengthening effective competition in the market of banking services and expanding the range of banking products; dissemination of international experience of banking business; improving the quality and range of services; improving customer service; improving the transformational function of the banking system in the process of distribution of credit and financial resources. In turn, the negative consequences of the impact include: complications of banking supervision; increased risk of capital outflow from domestic banks to foreign countries; increased dependence of the economy on the efficiency of foreign investors; increased vulnerability of the banking sector to fluctuations in financial markets; increased competition in the banking sector and the like. The outflow of foreign capital during 2014 should be considered as a negative phenomenon, as a result of which access to cheap credit resources is limited, the implementation of European standards and transparency of banking business is hampered (Dzyublev & Vladimir, 2015). To maintain the stability of the financial system, a system should be introduced state regulation of the share of foreign capital in the authorized capital of the domestic banking sector.

In the post-crisis period, the features of banks with foreign capital were adopted, as the main anti-crisis measures by the Central Bank of the Russian Federation, and the policy of foreign countries to place and attract investment in the banking system of foreign States (Kozyrev, 2011).

Today they say that the role of foreign investors in the growth of capitalization of the Russian banking sector is becoming more noticeable (Schönbohm & Zahn, 2016). At the same time, for the growth of foreign investments in the Russian economy, especially in its banking sector, and to increase confidence in foreign partners, it is necessary to improve the legislative support of investors ' rights, to raise the quality of corporate governance in organizations and enterprises of all sectors of the economy, to reduce non-commercial investment risks, to accelerate the transition of organizations and enterprises to the world standards of accounting and financial reporting.

References

- Abramova, E., Apokin, A., Belousov, D., Mikhailenko, K., Penukhina, E., & Frolov, A. (2013). Budushchee Rossii: makroekonomicheskie stsenarii v global'nom kontekste. Future of Russia: Macroeconomic Scenarios in the Global Context, 2, 6-25

- Birkinshaw, J., & Hood, N. (1998). Multinational subsidiary evolution: Capability and charter change in foreign-owned subsidiary companies. Academy of Management Review, 4, 773–795.

- Drugov, A., Rysin, V., & Senishch, I. (2016). Evolution and prospects for the development of banking systems in Poland and Russia. Bulletin of the National Bank of the Russian Federation, 5, 8-11.

- Dzyublev, A., & Vladimir, A. (2015). Foreign capital in the banking system of the Russian Federation: influence on the development of the foreign exchange market and the activities of banks. Bulletin of the National Bank of the Russian Federation, 5, 26-33.

- Gavrilishin, N. (2014). Problems and Prospects for the Development of the Banking Sector of Russia. The date of appeal: 20.04.2018 http://www.rusnauka.com/ 21_ NNP_2014 / Economics / 70564.doc.htm

- Gnidchenko, А., Mogilat, А., Mikheeva, О., & Salnikov, V. (2016). Foreign Technology Transfer: An Assessment of Russia’s Economic Dependence on HighTech Imports. Foresight and STI Governance, 1, 53–67.

- Graham, J.R., Harvey, C.R., & Puri, M. (2015). Capital allocation and delegation of decision-making authority within firms. Journal of Financial Economics, 3, 449–470.

- Gurkov, I., Morgunov, E., Saidov, Z., & Arshavsky, A. (2018). Perspectives of Manufacturing Subsidiaries of Foreign Companies in Russia: Frontier, Faubourg or Sticks? Foresight and STI Governance, 2, 24–35.

- Ivanov, D., Kuzyk, M., & Simachev, Y. (2012). Stimulirovanie innovatsionnoy deyatel'nosti rossiyskikh proizvodstvennykh kompaniy: novye vozmozhnosti i ogranicheniya. Fostering Innovation Performance of Russian Manufacturing Enterprises: New Opportunities and Limitations, 2, 18-41.

- Kostyuk, A. (2014). Foreign capital in the banking sector in the context of the transformation of the business model of European banks. Bulletin of the National Bank of the Russian Federation, 6, 28-35.

- Kozyrev, A. (2011). The role of banks with foreign capital in the banking system of the Russian Federation. Young Scholar, 4, 156-158. The date of appeal: 20.04.2018. https://moluch.ru/archive/27/2962.

- Kurbatov, E., & Bezborodova, T. (2016). Analysis of factors influencing foreign capital on the banking sector of the Russian Federation. International scientific review, 8, 94-96.

- Mau, V. (2010). Economic Policy in 2009: Between Crisis and Modernization. Voprosy Ekonomiki, 2, 4–25.

- Schönbohm, A., & Zahn, A. (2016). Reflective and cognitive perspectives on international capital budgeting. Critical Perspectives on International Business, 2, 167–188.

- Song, S. (2014) Unfavorable Market Conditions, Institutional and Financial Development, and Exits of Foreign Subsidiaries. Journal of International Management, 2, 279–289.

- Zaitova, E.Z., & Volik, M.V. (2017). Modern information technologies in the banking sector. Youth and Science: Actual Problems of the Socio-Economic Development of Russian Regions, 5, 94-100.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Mardeyan, N., Isakova, J., Gurieva, L., & Pozmogov, A. (2019). The Impact Of Foreign Capital On The Russian Banking Sector. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 1090-1096). Future Academy. https://doi.org/10.15405/epsbs.2019.03.109