Abstract

The article proves the necessity of using modern financial technologies in corporate finance so as to solve specific issues and improve the efficiency of financial management. Based on the analysis of various information sources, the article reveals that there is no systematic approach to the study of the impact of financial technologies on the corporations’ market value. The purpose of the study is to determine the impact of financial technologies on the financial activities of corporations on the basis of a cognitive approach, while forecasting profit under different scenarios of activity. The focus is placed on assessing the rationality of using financial technologies in the organization's adopted financial policies. As for the methods of conducted research, a cognitive approach was used in which, based on the SWOT-analysis of the assessment of financial technologies in the organization, a cognitive framework was constructed to establish cause-effect relationships in assessing the results of applying financial technologies in corporate finance. A binary logistic regression model is proposed. The created model of logistic regression allows to predict the dynamics of getting the profit of the corporation while using modern financial technologies. The authors note that financial technologies within the framework of the corporation's main operations in the financial market are one of the most important directions for ensuring the growth of the company market value.

Keywords: Financial technologiescorporate financecognitive managementvaluationcost factorslogistic regression

Introduction

For the efficient functioning of corporations at the present stage, it is necessary to use forward-looking financial technologies that allow to increase the effectiveness of financial management and ensure balanced functioning. New financial technologies are actively used in conducting operations on lending, insurance, asset management, settlement operations. The introduction of new financial technologies is conditioned by the influence of a number of factors: the need for innovations that transform the demands of customers, and increasing pressure from the regulatory authorities. In business environment, organizations interact with customers, as well as with each other. Digital technologies in processes allow to optimize costs, make transactions transparent and improve the quality of interaction with customers. FinTech at the present stage is developing in different directions, offers products not only for financial institutions, but also for business in other areas based on global digital transformation. Block chain technologies, scoring models with the use of big data, technology for remote identification of customers are spreading. The main priority is to provide users with suitable and profitable services. Information technologies, based on the digitization of most relationships, in which industrial production is one of the platforms included in industrial development serve as integrator of new technologies. At the same time, it should be noted that the corporate sector has a great potential in comparison with the consumer services sector.

Problem Statement

At the present stage, the key problem is the choice of financial technologies, which are aimed at solving specific issues which will improve the efficiency of financial management.

For the implementation of financial technologies, the following scheme is conditionally used:

identification of financial problems that must be prevented;

an estimation of rationality of possible decisions use in the accepted financial policy;

choice of the solution by "cost/effectiveness" criterion.

Constant innovations in financial management are especially necessary in situations of dynamic transformations in the external environment, increasing of the scope of available financial technologies, which is confirmed by the analysis of various studies. The study by Wang (2018) found that information and communication technologies led to a constant adjustment of financial policies and advanced innovations in China's financial economy. The study by Gabor & Brooks (2017) draws an important conclusion about the digital revolution. Digitalization adds new layers to the material cultures of financial technologies, offering to the State new ways to expand the inclusion of new forms of "profiling" poor households in generators of financial assets. An attempt to create a framework for managing operations in financial services was undertaken in the study of Pinedo & Xu (2017). The article of Paiva, Thome, Silva, & Alves (2014) used a cognitive approach to the study of capital problems of companies. Cognitive design can be seen as a way to reduce the complexity and unpredictability of this environment, as notes the article of Bertolotti & Magnani (2016). The study by Hendershott, Zhang, Zhao, & Zheng (2017) outlines that the abbreviation "Financial Technologies" refers to the inflow of technological tools, platforms and ecosystems that make financial services or products more accessible and effective. The article by Albekov and Lakhno (2018) describes the mechanism of development of cooperation of the BRICS countries in the field of financial technologies. The authors Grinin, Grinin, & Korotayev (2017) classify modern technological revolutions as the sixth wave of Kondratiev / the fourth industrial revolution, that is, in the field of additive, nano-, bio-, robo-, info- and cogno-technologies.

The generalization of the practice of the activities of corporations makes it possible to determine negative positions in financial processes:

deficiencies in the movement of flows of various types of information;

storage and accumulation of information as a database is not formed;

lack of motivation for managers to maintain and track financial documents;

the deadlines for document circulation between departments are violated;

coincidence of functions of different departments;

financial function is often performed by non-financial departments;

instruments of financial analysis and generalization of conclusions based on analysis results are not clearly used.

Research Questions

Recently, many sources have noted the pace of financial technologies spread in many areas. However, there is no systematic approach to the study of the use of financial technologies in corporate finance. The following main issues of financial technologies can be highlighted:

1. Definition of needs in the application of financial technologies;

3. Identification of factors that contribute to and impede the use of financial technologies;

4. Assessment of the effectiveness of the use of financial technologies.

To assess the effectiveness of financial management, it is important to choose goals. To do this, it is necessary to identify the strengths and weaknesses of the organization, opportunities and negative impacts on the organization. In determining the goal, the possibility of measurement, concreteness, attainability is taken into account. The use of modern information technologies in the financial management system is aimed at creating an adequate tool for cognitive management of the organization. Cognitive management makes it possible to identify problems, interrelations and offers solutions in conditions of uncertainty and risk. Technologies of cognitive management take into account the impact of the internal and external environment, the use of objective trends. The mechanism of cognitive management can be used for strategic and current planning in virtually all structures.

Based on the analysis of problems in the activities of organizations, such needs for the following groups of financial technologies can be identified:

problems associated with the sale of goods - pricing policy, management of receivables;

problems of financial resources lack - ways to attract financial resources, management of accounts payable;

problems in efficient allocation of financial resources - distribution of net profit for investment purposes, project financing;

Financial technologies are realized through conducting various types of transactions and operations performed by the corporation in the financial market.

Purpose of the Study

The research is to determine the impact of financial technologies on the financial activities of corporations on the basis of a cognitive approach, while forecasting profit under different scenarios of activity.

The objectives of the research are the following: the identification of factors that affect the effective functioning, the definition of cause-effect relationships, the construction of a cognitive map, the definition of a set of control factors.

Currently, the development of small, medium-sized and large organizations is possible only when taking into account modern directions of effective financial technologies. Financial technologies provide reasonable access of organizations to financial resources, form the principles of the activities of credit, insurance and guarantee companies. Adequate choice of specific financial technologies is the main task of the organization's operational tactics. Modern financial technologies change traditional campaigns to the system of interaction of the human factor and information systems in solving managerial tasks, and the effectiveness of decision-making on the basis of cognitive methods is increased. There is a possibility of effective management using new forms of conducting digital business. Programs of digitalization of management processes are the developing segment of FinTech. FinTech products include accounting and management accounting, financial analysis and planning, personnel turnover accounting (Morozko, Morozko & Didenko, 2018a). The Uptake project, as a business management system, tops the list of the most promising start-ups, which confirms the materiality and significant level of the spread of the possibilities of financial technologies.

Research Methods

The growth of the level of financial management causes the increase of demand for modern financial technologies for efficient use of resources. Corporate finance is affected by many factors, both positive and negative. The selection of the main factors is based on the SWOT analysis (Table

Based on the analysis of various possible combinations of strengths and weaknesses with threats and opportunities (SWOT analysis), the problematic field of the corporations under investigation is formed: shortening the terms of payments and transfers; decrease in the cost of goods, works and services produced; significant costs for the purchase of software; risks of cyber-attacks during operations. In a large corporate segment, the issues of information security and elimination of operational risks are usually a constraining factor.

The strategy for solving development problems consists of strategic steps that determine the sequence of changes in the state of the system:

Where: - is the initial state,

Sc — is the target state,

Si → Si +1 - a strategic step, which identifies the problem and the analysis of factors, the change of which leads to the desired change in the target values.

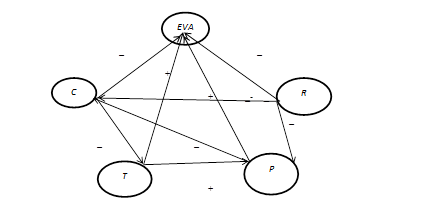

Notes:

EVA - economic added value shows the excess of net operating profit after tax and the cost of using the capital

T - Reduction in terms of payments and transfers

P - decrease in the cost of goods, works and services produced

C - significant costs for the purchase of software, Cybersecurity costs

R - risks of cyber-attacks during operations.

The EVA variable reflects susceptibility to a set of argument factors, the function acts as the probability of a particular outcome, considering the given set of factors, is determined based on the calculation of the logistic regression equation.

The binary logistic regression model is expressed by the equation:

where: pi - i is the probability of the event being studied;

zi - is a linear combination of independent factors;

e - is the base of the natural logarithm

where it acts as a "point of intersection",

- Regression coefficients for independent variables

The intersection point is the background value of the dependent variable, i.e. reflects the value of Z, with the values of the argument-factors equal to zero. The regression coefficients reflect the level of influence of the corresponding argument-factor. A positive sign before the regression coefficient indicates that this independent variable increases the probability of the analysed event. A negative value of the coefficient means that this factor reduces the probability of the analysed event. A large value of the regression coefficient means that this factor has a significant effect on the probability, an almost zero regression coefficient means that this factor has little effect on the dependent variable (Morozko, Morozko & Didenko, 2018b).

The limiting effect of the Z value on the probability is the derivative of the probability function:

Z is a function of the variable that determines the required probability, and f (z) is the density function of the distribution.

The values of the logistic function can range from minus infinity to plus infinity, the function F (z) can vary from 0 to 1. The variable Z reflects the susceptibility to some set of argument factors, the function F (z) stands as the probability of a particular outcome, given the set factors.

For the set of corporate business organizations

F (z) -dependent variable: 1- in case of a positive economic added value, 0 - in case of a negative economic added value

One can calculate the logistic regression model in almost all programs for professional statistical data analysis such as SPSS, SAS, R, Statistica and others.

In the logit-model, the coefficients have a multiplicative effect on the dependent variable, in contrast to the linear regression model. In this model, the parameters reflect the change in the probability of the value of the function, due to a change in the argument by one unit, with the remaining parameters being taken as constants. The vector of the dependence is determined based on the sign of the coefficient.

The model of logistic regression thus formed allows to predict the dynamics of receiving a profit by a corporation when using modern financial technologies.

Findings

In corporate business, the major part of solutions is the tailor-made constructor. Financial technologies will be in higher demand in corporate risk management. Almost all new technologies in the sphere of finance are aimed at successful integration into the new reality conditions related to the changes in the B2B and B2C payments spheres, levelling the barriers in the process of the industry transition to digital technologies, creating new electronic payment standards, optimizing the business, reducing costs through automation, a reduction in the burden on workers, the use of electronic assistants, the personification of goods and work. For successful business in modern conditions, it is important not to use unsystematically individual tools, but a valid strategy of digital transformation.

Financial technologies allow to reduce the time for reporting within the corporation and in the provision of financial statements, and the control over money management is strengthened. Processes should contain the basic standards of successful business conduct, should be efficient and economical, which leads to an increase in profits and, accordingly, to the growth of economic added value.

Conclusion

The use of modern financial technologies can cut the costs of corporations, it is justified to determine the directions of strategic behaviour in the market, adequately organize financial functions in management. This will increase the market value of the corporation, which positively affects the strategic development of the corporation.

Financial technologies within the framework of the corporation's main operations in the financial market show that they constitute one of the essential directions for ensuring the growth of the company's market value. Therefore, the introduction of financial technologies into practice is one of the main strategic goals aimed at improving the financial management system of the corporation.

References

- Albekov, A., & Lakhno Y. (2018). Building of Multilateral Cooperation of BRICS Countries in the Field of Financial Technologies. Network AML/CFT Institute International Scientific and Research "FinTech and RegTech" KnE Social Sciences, 8, 68-76

- Bertolotti, T., & Magnani, L., (2016). Contemporary Finance as a Critical Cognitive Niche: An Epistemological Outlook on the Uncertain Effects of Contrasting Uncertainty. Methods and Finance: SAPERE, 34, 129-150

- Gabor, D., & Brooks, S. (2017). The digital revolution in financial inclusion: International development in the fintech era. New Political Economy, 22 (4), pp. 423-436.

- Grinin, L., Grinin, A., & Korotayev, A. (2017). The MANBRIC-Technologies in the Forthcoming Technological Revolution. Industry 4.0. Entrepreneurship and Structural Change in the New Digital Landscape, 4, 243-261

- Hendershott, T., Zhang, M. X. J., Zhao L., & Zheng, E., (2017). Call for Papers—Special Issue of Information Systems Research Fintech – Innovating the Financial Industry Through Emerging Information Technologies. Home Information, 28 (4), 681-886

- Morozko, N., Morozko, N., & Didenko, V. (2018a). Determinants of the savings market in Russia. Banks and Bank Systems, 13 (1), 196-208

- Morozko, N., Morozko, N., & Didenko, V. (2018b). Rationale for the development strategy of small business organizations using the real options method. Academy of Strategic Management Journal, 17(2), 1-11.

- Paiva, F.D., Thome, K.M., Silva, M., & Alves, T.S., (2014). The Financial Strategy Process under the Influence of Cognitive Biases. International Journal of Advances in Management and Economics,1, 1-13

- Pinedo, M., & Xu, Y. (2017), Operations in Financial Services: Processes, Technologies, and Risks, Foundations and Trends® in Technology, Information and Operations Management, 1, 223-342.

- Wang, J. (2018). From aperture satellite to "Internet finance": Institutionalization of ICTs in China's financial sector since 1991. Telecommunications Policy, 42(7). 566-574.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Morozko, N., Morozko, N., & Didenko, V. Y. (2019). Cognitive Approach In The Analysis Of Using Financial Technologies In Corporate Finance. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 1075-1081). Future Academy. https://doi.org/10.15405/epsbs.2019.03.107