Abstract

In modern theory and practice of banking there are various approaches to assessing credit rating, depending on the category of clients. Taking into account the lack of unity of methodology, credit institutions are developing their own methods for assessing credit rating, taking into account the recommendations of the Central Bank and the Basel Committee. Most of the methods are based on a system of indicators that assesses the liquidity, turnover, profitability and financial stability of the borrower. Analysis of statistical data allows concluding about the growth of overdue debts of the population and enterprises to commercial banks, which is evidence of the imperfection of methods used by credit institutions to assess credit rating. Based on a study of the positive and negative sides of various methods and rating of expert opinions, the study develops recommendations for improving credit rating methods used in AB Devon-Credit in modern economic conditions. The study is based on positive and negative aspects of various methods and expert assessment. The authors develop recommendation how to improve the methodology for credit rating used by AB Devon-Credit in the modern economy. A review of the problems that credit experts face in credit rating suggests that current methodologies do not allow assessing the potential of potential clients. Credit experts face many problems that are associated with the imperfection of the methodology for credit rating, the lack of adequate financial and statistical information, the lack of long-term development plans for most borrowers, and other problems.

Keywords: Borrowercredit ratingmethodology for credit ratingcommercial banksbanking risks

Introduction

Taking into account the unstable economic situation in the country, the negative impact of sanctions, reduction in the cost of hydrocarbons in the world market, reduction in the cost of the ruble, inflation, lack of funds from enterprises and the population, the problem of credit rating is one of the most urgent issues for commercial banks (Endovitsky, 2017). These negative phenomena lead to an increase in banking risks in the lending market, because for a number of reasons, borrowers, who are individuals and legal entities, cannot fulfil their obligations, which leads to financial losses for banks, which have a negative impact on the financial condition of banking structures.

Currently, there is no uniform methodology for credit rating, which could give full confidence that the lent money will be returned on time and in full. Each bank, taking into account the recommendations of the Central Bank and the Basel Committee, develop their own methodology for credit rating, often similar to each other (Zhang & Tadikamalla, 2016).

The main part of the methodology for credit rating, which is used in lending by Russian banks, has been developed abroad, so it does not take into account the specifics of the Russian market, the particularities of development of industries, regions and the standard of living of the population. In this regard, the methodology used often fails, because it does not allow foreseeing the risks of loan defaults, as evidenced by the significant overdue debt of the population and enterprises to commercial banks.

Problem Statement

The main issue is to study the positive and negative aspects, as well as the main problems of the methodology for credit rating used by AB Devon-Credit.

Research Questions

In the course of the study, the following research questions are considered:

1) Review of foreign and domestic methodology for credit rating;

2) Analysis of credit experts’ opinion of AB Devon-Credit on the main problems of credit rating;

3) Analysis of the strengths and weaknesses of the methodology for credit rating used by AB Devon-Credit;

4) Directions for improving the methodology for credit rating used by AB Devon-Credit, taking into account foreign experience and features of the domestic economic development in modern conditions.

Purpose of the Study

The main purpose of the study is to develop proposals for improving the methodology for credit rating used by Devon-Credit Joint-Stock Bank (hereinafter, AB Devon-Credit), taking into account foreign and all-Russian trends.

Research Methods

The study represents general scientific and specific research methods such as: analysis and synthesis, scientific abstraction, induction and deduction, nomination and testing of hypotheses, comparison and generalization (Da Fonseca, J., & Gottschalk, K., 2014) .

In the domestic and foreign practice, different systems of indicators are used, reflecting credit rating. Most systems include an assessment of liquidity, turnover, profitability, and financial sustainability. Thus, the American scientist E. Reed proposed a system for credit rating according to the following four groups of criteria: liquidity, turnover, fundraising ratio, profitability ratio (Reed, Cotter, & Gill, 1991). A group of American scientists led by Shim (1996) suggested the following criteria for credit rating: long-term solvency ratios, profitability, liquidity, coefficients based on market criteria: market capitalization, earnings per share, market risk, share of profit retention, and others. Other best-known in world methodology for credit rating includes such systems as PARSER, CAMPARI, Rule C.

The methodology for credit rating in Russian banking practice contains a certain system of ratios: absolute liquidity ratio, intermediate coverage ratio, total coverage ratio, independence ratio. In most banks, the values of liquidity ratios and the independence of the borrower are divided into three classes of creditworthiness. Currently, a new methodology for credit rating is based on analysis of cash flows and business risk. When making credit rating of individuals, two approaches are mainly used: assessment analysis and empirical analysis, that is, credit scoring.

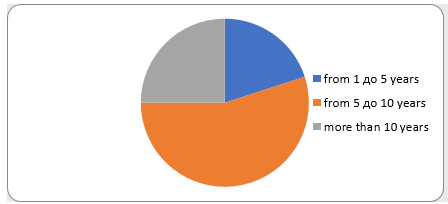

The problems of credit rating in the current economic conditions were identified by interviewing 20 credit experts with AB Devon-Credit. The structure of credit experts taking into account their work experience is clearly presented in Figure

Most of the loan officers work in the bank in this position from 5 to 10 years, therefore, has a fairly extensive experience and can provide reliable information about the problems associated with credit rating.

Note that the methodology for credit rating used by AB Devon-Credit includes a quantitative and qualitative analysis of the borrower’s activity indicators. A quantitative analysis of credit rating used by AB Devon-Credit includes an assessment of four groups of financial indicators (profitability, turnover, liquidity and financial stability), as well as an assessment of the sufficiency of the borrower’s turnover. A qualitative analysis of credit rating used by AB Devon-Credit includes an expert assessment of business risk indicators and the borrower’s credit history. The overall rating of the borrower consists of the estimates obtained as a result of coefficient analysis, sufficiency of turnover, business risk assessment and credit history assessment. It uses a simple summation of all points.

According to credit experts of AB Devon-Credit, when making credit rating, they face the following problems:

The main problem is related to the fact that in our country it is still difficult to obtain meaningful financial and other information about the borrower, since the available financial and statistical reports, according to credit experts, do not always allow for a detailed and in-depth analysis of the financial situation of the borrower (Nikiforova, 2016; Sarker, & Nahar, 2017).

Most of the existing methodologies for credit rating, including the methodology used by AB Devon-Credit, only occasionally allow assessing all factors affecting credit rating. Difficulties in assessing credit rating arise because of the existence of such factors as reputation, credit history, which can be assessed and quantified only conditionally (Bychuk, & Haughey,2014).

Credibility depends on many factors, which in itself means difficulties, since each of them must be assessed and calculated, because it is a risk factor for the bank. It is extremely difficult, according to credit experts, to determine the relative weight of each individual factor among other indicators of credit rating. The current methodology for credit rating used by AB Devon-Credit has determined the relative weights of each factor based on an analysis of their impact on credit rating, which facilitates the work of credit experts in determining the influence of each factor on credit rating.

According to experts, it is not always possible to assess the future credit rating, since the assessment process uses information only for past periods due to the lack of development plans of the majority of borrowers, which make it possible to predict future turnovers of the enterprise.

Great difficulties in credit rating take place when assessing the prospects for changing the factors determining credit rating, since it is impossible to foresee all the causes and circumstances that may arise from the borrower during the term of the loan agreement. At the same time, the future ability of the borrower to meet his obligations is of real importance for the bank (Dietsch, & Petey, 2015). Despite the fact that for the bank the predictable indicators of credit rating are important, most of the existing methodologies, including the one used by AB Devon-Credit, are a thing of the past because the indicators are calculated on the basis of past reporting data, and the data on balances not turnovers are studied. According to experts, the current methodology for credit rating does not allow assessing the future turnover of the borrower, since there is no information about the concluded contracts. All this suggests that the existing indicators of credit rating are of limited value.

Significant difficulties are generated by the unequal dynamics of the volume of turnover of borrowers’ funds, which is associated with the outpacing price increases for the products sold; inflation, which distorts the indicators characterizing the ability of the borrower to repay the loan debt. The methodology for credit rating used by AB Devon-Credit also takes insufficient account of inflation and other negative environmental factors affecting credit rating (Pozdeeva, 2017). Consequently, long-term credit rating is rather difficult to assess, since the financial condition of the borrower may deteriorate for various reasons.

The methodology for credit rating, used by AB Devon-Credit, only partially takes into account the industry characteristics of borrowers, as it highlights certain criteria for assessing manufacturing and trading enterprises, while the production sphere is not taken into account. After all, some indicators are optimal for machine building, others are for construction, and others are for food and processing industries, and so on. Consequently, a unified methodology for credit rating, used by AB Devon-Credit, does not allow for an adequate assessment of borrowers working in different industries. In addition, the current methodology does not imply a comparative analysis of the dynamics of indicators of financial stability, liquidity, profitability and business activity for enterprises operating in conditions comparable to the borrower (the same activity profile, the same dimensions).

One of the problems faced by bank specialists in lending to borrowers is force majeure related to the personality of the manager. For example, disputes between heirs after the death of a manager lead to the freezing of accounts, which as a result leads to the fact that the bank cannot timely return its money and interest on it.

Findings

A review of the problems that credit experts face in credit rating suggests that current methodologies do not allow assessing the potential of potential clients. Credit experts face many problems that are associated with the imperfection of the methodology for credit rating, the lack of adequate financial and statistical information, the lack of long-term development plans for most borrowers, and other problems.

A comparative analysis of the methodologies for credit rating of most banks showed that all banks carried out coefficient analysis of the financial condition of the borrower, studied the credit history and assessed the business risk; in coefficient analysis, the same indicators are used predominantly. At the same time, the number of estimated indicators varies from bank to bank.

The advantages of AB Devon-Credit include the calculation of a wide range of mandatory ratios; formalization and specification of each indicator; use of scoring, both for the coefficient and quality assessment of indicators; simplicity of calculations and interpretation of results; sufficiency of turnover.

The disadvantages of the methodology include the weakness of business risk indicators; lack of criteria for assessing equity risks; poor use of bank credit histories; insufficient automation of calculations; insufficient attention to the dynamics of the financial condition of the borrower, lack of clear boundaries of the rating; lack of indicators to calculate long-term credit rating.

Conclusion

In order to improve the methodology for credit rating used by AB Devon-Credit AB, it is recommended:

The proposed methodologies will significantly improve the quality of credit rating, which in turn will help reduce the level of overdue debt of businesses and individuals.

References

- Bychuk, O., & Haughey, B. (2014). Hedging Market Exposures: Identifying and Managing Market Risks, United States:Korner

- Da Fonseca, J., & Gottschalk, K. (2014). Cross-hedging strategies between CDS spreads and option volatility during crises. Journal of International Money and Finance, 49, 386-400.

- Dietsch, M., & Petey, J. (2015). The credit-risk implications of home ownership promotion: the effects of public subsidies and adjustable-rate loans. Journal of Housing Economics, 21, 103-120.

- Endovitsky, D.A. (2017). Comparative analysis of approaches to quantitative assessment of credit rating. Accounting and Finance Problems, 2 (25), 3-14.

- Nikiforova, N.A. (2016). Methods and indicators for analyzing credit risk in a bank. Financial Management, 6, 91-102.

- Pozdeeva, V.A. (2017). Credit rating of individuals on the basis of modern banking technologies. Investment and Innovation Management, 3, 85-89.

- Reed, E., Cotter, R., & Gill, E. (1991). Commercial banks. SPb.: Cosmopolis.

- Sarker, N., & Nahar, Sh. (2017). The impact of ownership structure on bank credit risk: evidence from Bangladesh. Eurasian Journal of Business and Economics, 10 (19), 19-36.

- Shim, J. (1996). Financial Management. Moscow: Filin.

- Zhang, F., & Tadikamalla P.R. (2016). Corporate credit-risk evaluation system: integrating explicit and implicit financial performances. Shang J.-International Journal of Production Economics, 177, 77-100.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Gusarova, L., Mirgaleeva, I., & Magdeeva, M. (2019). Problems Of Credit Rating In Modern Economic Conditions. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 1069-1074). Future Academy. https://doi.org/10.15405/epsbs.2019.03.106