Abstract

Currently, a uniform methodology of the complex approach to the issues of compliance-control in economic subjects is not established. The problem of arrangement of internal control becomes especially relevant in connection with changes in the legislative framework, a difficult economic situation in the country and, as a result, strict requirements of owners of business related to risk reduction of economic activity. The main goal of compliance-control is to reveal weak points and wrong decisions, to correct them in due time and to prevent their recurrence. An opportunity for decrease in risk formation of financial security and a trend risk indicator on application of the compliance-control mechanisms by the economic subject is evaluated in the article. A probability for emergence of threats to financial security depending on availability of the compliance-control mechanism in the economic subject was estimated by using the described methodology on the basis of observation over 7 manufacturing enterprises throughout 2015-2017. Methods of observation and comparison, classical and statistical methods for probabilities of occurrence of an event were used when evaluating the possibility of emergence of threats. The presented tools of internal control represent actions, aimed at minimization of risks influencing on achievement of goals of the economic subject.

Keywords: Compliance-controlfinancial securityfinancial threatsmonitoring the financial threatseconomic subject

Introduction

A number of factors appear and promote their influence in conditions of the risk-oriented activity of economic subjects, evolved over the last decades. The tendencies of transition to international financial reporting standards, the risk nature of business dealing, implicating enhanced standards of profitability, volatility of financial instruments, high degree of uncertainty in the geopolitical sphere, commitment to values of transparency can be distinguished as generated by globalization. There is also financial instability and even insolvency of certain branches, states, political and economic blocks, caused by the processes of regionalization.

The above- mentioned factors lead to the fact that it becomes impossible to use conservative approaches to provision of financial security of the economic subject; otherwise there will be several negative financial consequences up to termination of the economic activity in view of unprofitability of functioning. One of new approaches to provision of financial security of the economic subject is introduction of the compliance-control mechanism, which allows minimizing certain financial risks.

Conception of compliance-control

Proceeding from the meaning of the verb "to comply" indicating obedience, fulfillment of something or commission of actions in accordance with requirements and instructions, it is necessary to note that interpretation of the term "compliance-control" is ambiguous in different sources. For example, Bondarenko suggests interpreting this concept as an integral part of corporate culture of the company, where performance of duties, including decision-making at all levels, by each employee should correspond to the standards of legality and conscientiousness established by the company for conducting its activity (Bondarenko, 2008). According to the definition of the international compliance association, the term means "Ensuring compliance of activity with the established requirements and standards". Kopytin (2010) initiated a proposal concerning differentiation of compliance-control into legal (compliance of activity with regulatory legal acts) and ethical (compliance with industrial standards, embodied in acts of self-regulatory organizations, and with internal norms of the company).

Under this article, the term refers to the policy of an economic subject aimed at voluntary compliance with the international legal acts, regulatory legal acts, regulatory contracts and business customs, which is carried out for provision of financial security. Financial security in its turn will be understood as ability and capability of an economic subject to exert impact on financial threats for their minimization and ensuring compliance of current indicators of activity with strategic ones, and provision of the adequate level of financial control.

Aspects of implementation of compliance-control in the Russian Federation

In the modern Russian practice regulatory legal acts do not provide clear interpretation of "compliance-control" and its actions. However, this notion is closely connected with the Federal Law № 115-FZ "On counteraction to legalization (laundering) of proceeds of crime and terrorist financing" dated 7 August, 2001, where one of the prime measures for providing this legal source is formulated:

Arrangement and implementation of internal control.

Except this legal source, similar relations are governed in particular by the Federal Law "On protection of competition" № 135-FZ dated 26 July 2006 and by the Federal Law "On anti-corruption enforcement" № 273-FZ dated 25 December, 2008.

Therefore, quality improvement of assets management and achievement of economic growth target as well as auditing, external and internal actions for ensuring financial control can be referred to actions, supporting the level of financial security. It is also necessary to include here tax inspections, cross checks of credit organizations etc. It means that internal and external financial control is a necessary condition for creation of the system of ensuring financial security of the economic subject. Introduction of the compliance-control instruments in daily activity of economic subjects, i.e. voluntary compliance with requirements of the monetary authorities, with the legislative system, with industry agreements, with the requirement of contractors for ensuring financial security of an organization i.e. provision of compliance of current indicators of activity to the strategic ones, seems rational in conditions of the Russian business, the low transparency level of financial transactions, the high share of shadow income and corruption.

Problem Statement

Proceeding from the definition of compliance-control, it should be noted that it is used by economic subjects in order to provide financial security, and, therefore, minimization of probability of emergence of financial threats. The hypothesis of the research is decrease in risk of emergence of threats to financial security and a trend risk indicator while application of the compliance-control mechanisms by the economic subject.

Analyzing the literature (Kirichenkо & Kim, 2014; Baryshnikova, 2004; Vagina, 2016) it is possible to emphasize certain essential features of the notion of financial security:

A part of the economic policy of the economic subject;

A set of the complex of measures for increase in business value;

A set of instruments of protection against external and internal financial threats;

Sustainable development of the economic subject;

Financial state, which is characterized by the system of specific indicators.

From the above-mentioned interpretations of the initial notion, it is possible to draw a conclusion that, firstly, compliance of the financial development strategy, implemented within the general corporate strategy, will be a resulting attribute of the organization’s activity with the high level of financial security. Secondly, the stable financial position allows the organization to minimize financial threats, originating from internal and external environment. It is necessary to note that it is possible to strengthen the financial security system of the economic subject in the long term by introduction of the compliance-control mechanisms to the organization’s activity.

If we speak about evaluation of the financial security system of the economic subject, then it is worth designating several indicators ranging the risk of emergence of this or that threat to financial security from high to low. Some of the approaches to interpretation of financial risks contain assumptions about the fact that the high-risk level of financial threats generates financial instability (Naumova, 2016; Papekhin, 2007). The direct dependence between the high-risk level and a possibility of improvement of the financial position is emphasized in other works (Brigham & Ehrhardt, 2013; Hlaing & Kakinaka, 2018). In some works, risk is defined as a probability for emergence of negative consequences or simultaneous chance of increase in profits of the organization due to high uncertainty of the business environment and achievement of financial and insolvent position (Steinbar et al., 2018; D’Amico et al., 2018).

Therefore, it is necessary to carry out the analysis of balance and conjugation of notions of financial security and compliance-control in organizations.

Research Questions

The following research questions were emphasized within this study:

What is the conceptual basis for compliance-control in the modern conditions of the Russian Federation?

How is it possible to describe the influence of the compliance-control mechanism on provision of the financial security system of the economic subject?

What is the current practice of implementation of the compliance-control instruments by the economic subjects?

Purpose of the Study

The following goals were set within the conducted research:

To study the conceptual basis for compliance-control in the modern conditions of the Russian Federation;

To explore the prospects of introduction of the compliance-control, its influence on the level of the financial security system of the economic subject;

To analyse the current practice of implementation of compliance-control instruments by the economic subjects.

Research Methods

It is necessary to distinguish the following threats to financial security, which are closely connected with the compliance function:

The previously allocated threats to financial security are negative consequences of both financial and reputation type, which can emerge at a certain financial position of the organization and at the certain level of interaction with contractors.

Following on from the monitoring technique of opportunities for emergence of financial threats with account of probability of their appearance (Naumova & Tyugin, 2018), it is worth mentioning the existence of trend dynamics of changes in the risk level of emergence of threats to financial security. Therefore, management of financial threats should take place on the basis of probability for their emergence. This is how the risk - oriented approach is shown. At the same time the probability for appearance depends on a quantitative interval of the indicator or point assessment of the qualitative characteristics, which are determined by expertise.

The main indicators of threats recommended for use in the course of assessment of financial security of the economic subject are found in the above-mentioned author’s methodology. They can be given quantitative and qualitative estimates based on indicators characterizing these or those economic processes. They allow the economic subject to position their activity in reference to threshold and critical values in the medium-term and long-term periods. It is offered to carry out monitoring the threats to financial security according to the existing economic subjects by applying the weighting coefficient determined by the share of proceeds of the economic subject in the total value of sales of the analysed organizations.

By ranging of the indicators in relation to the given values, it is necessary to determine the probability for emergence of threats to financial security, which can be identified with the notion of "Risk level". The expanded classification of probability for appearance of threats by the level will be high risk, increased risk, average risk, decreased risk and low risk. What is more, with increase in the risk level from low to high, the probability for emergence of the corresponding threats of financial security will also grow.

Findings

The probability for emergence of the threats to financial security depending on existence of the compliance-control mechanism in the economic subject was estimated through the use of the described methodology on the basis of observations over the activity of 7 manufacturing enterprises of the Samara region during 2015-2017. Among the analyzed organizations were:

PJSC «Kuznetsov»,

JSC «ROSSKAT»,

CJSC GK «Electroshield»-TM Samara,

PJSC «Kuibyshevazot»,

PJSC «Togliattiazot»,

JSC «Zhigulevskoe Pivo»

LLC «Yarholod»

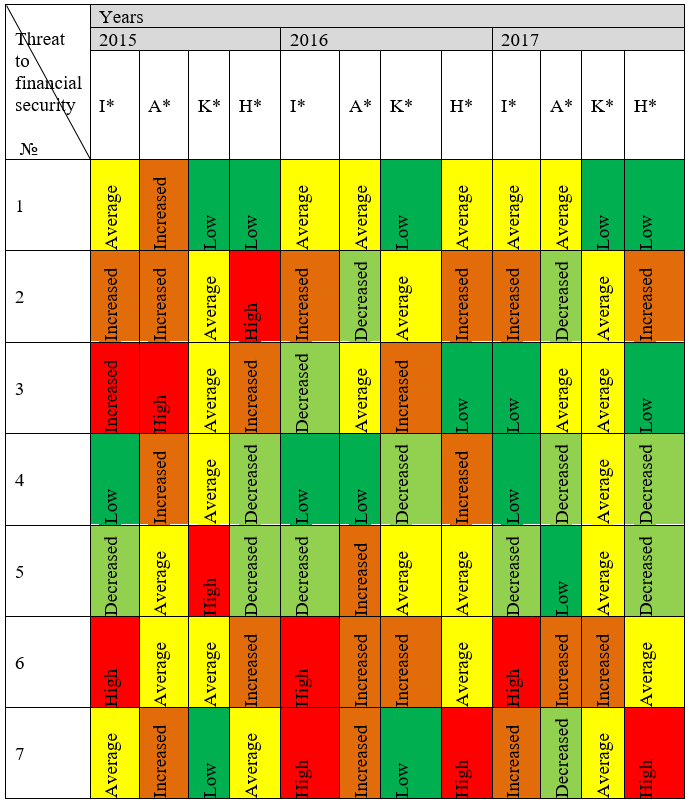

The results of the risk level of emergence of threats are presented in table

*Note: the characteristics of threats is given in table

Source:Authors.

On the basis of the data obtained at the enterprises, it is known that the compliance-control system was implemented in companies 1,4,5 over the whole analyzed period. In the organization 2 there is a separate legal division, which controls drawing up contracts and due diligence of contractors. The compliance-control mechanism has been implemented into the company 3 since 2016. As the analysis was carried out according to accounting reports on 31.12.2016, then there is reason to believe that this fact has already influenced on the research results.

In companies 6 and 7 compliance-control and its elements are absent.

According to the research results, presented in table

The revealed dependence between provision of the financial security system of the economic subject and implementation of the compliance-control mechanisms, allows defining the direction of the further analysis implying determination of economic efficiency of introduction of certain compliance-control mechanisms. Sometimes there can occur a situation, in which the marginal utility of one instrument, assuming risk decrease in emergence of threats to financial security, can be lower than the level of costs for implementation of this measure. It leads to growth of non-productive expenditures and, as a result, to emergence of threats to financial security. In its general view the compliance-control mechanism of the economic subject implies the following instruments:

The mentioned instruments of internal control represent the actions aimed at minimization of risks influencing on achievement of goals of the economic subject.

Complication of economic life requires development of due levels of local acts, which would ensure effective work of the internal control system on prevention of different risks, which are connected both with requirements of legal acts (for their non-compliance the organization can lose the reputation and get a fine) and with expectations of potential clients / investors.

In our opinion, the need for effectively working system of internal control of the economic entity will only increase in the future.

Conclusion

In the modern economy great attention is paid not only to the processes of production and distribution of cash flows, but also to the processes of arrangement and management. In this connection the greater attention is paid to the role of financial security in the control system of the economic subject. One of the methods of increase in the level of financial security is implementation of the compliance-control system.

Within this research it is defined that compliance-control is the policy of an economic subject aimed at voluntary compliance with the international legal acts, regulatory legal acts, regulatory contracts and business customs, which is carried out for provision of financial security. Financial security in its turn will be understood as ability and capability of an economic subject to exert impact on financial threats for their minimization and ensuring compliance of current indicators of activity with strategic ones, and also provision of the adequate level of financial control.

Considering the future vector set by the state, the professional community develops the typical approaches allowing minimizing the arising risks; standard control schemes, model forms of documents, etc.

The dependence between ensuring the financial security system of the economic subject and implementation of the compliance-control mechanisms, which allows defining the direction of the further analysis, implying determination of economic efficiency of introduction of certain compliance-control mechanisms is revealed in the research. The main instruments, which are available for implementation at enterprises, are presented.

Using this groundwork, the organizations will be able to apply them in their future activity. At the same time, they will be having justification, including the economic one, why application of compliance-control has positive impact on the level of financial security of the economic subject.

References

- Baryshnikova, D. (2004). Instruments of counteraction to financial risks. Ekonomicheskii Vestnik UFO: Research and Development Institute of Economics of the Southern Federal District, 5, 46-54.

- Bondarenko, Y. (2008). Effective management of compliance-risks: system approach and critical analysis. Korporativnyj yurist. 6, 15-20.

- Brigham, E., & Ehrhardt, M. (2013). European convention on certain international aspects of bankruptcy. Financial Management: Theory & Practice, 14, 302.

- D’Amico, G., Scocchera, S., & Storchi, L. (2018). Financial risk distribution in European Union. Statistical Mechanics and its Applications, 505, 252-267.

- Federal Law № 115-FZ (2001). On counteraction to legalization (laundering) of proceeds of crime and terrorist financing. Collected legislation of the Russian Federation, 33, 2363-2880.

- Federal Law № 135-FZ (2006). On Protection of Competition. Collected legislation of the Russian Federation. 31. 1005-1017.

- Federal Law № 273-FZ (2009). On anti-corruption enforcement. Collected legislation of the Russian Federation. 29. 2131-2148.

- Harris, C., & Roark, S. (2018). Cash flow risk and capital structure decisions. Retrieved from journal Finance Research Letters, 2, 106-120.

- Hlaing, S., & Kakinaka, M. (2018). Financial crisis and financial policy reform: Crisis origins and policy dimensions. European Journal of Political Economy, 55, 224-243.

- Kirichenkо, О., & Кim, Y. (2014). Influence of inflationary processes on financial security of the enterprise. Еkоnоmіkа ta derzhava, 1, 238.

- Kopytin, D. (2010). What is compliance, or play by the rules. Kadrovik, 2, 25-28.

- Naumova, О. (2016). Financial security of the enterprise. Development problems of enterprises: theory and practice. Samara: Samara state economics university.

- Naumova, О., & Tyugin, М. (2018). Monitoring methodology of financial security of the economic subject on the basis of risk assessment of emergence of financial threats. Vektor nauki TGU: Ekonomika i upravlenie, 2(33), 34-41.

- O'Connor, M., & Yaghoubi, M. (2016). The influence of cash flow volatility on capital structure and the use of debt of different maturities. Journal of Corporate Finance, 38, 18-36. https://dx.doi.org/10.1016/j.jcorpfin.2016.03.001

- Papekhin, R. (2007). External and internal threats to financial security of the enterprise. Finansy i kredit. 13. 8-16

- Steinbar, P., Raschke, R., Gal, G., & Dilla, W. (2018). The influence of a good relationship between the internal audit and information security functions on information security outcomes. Accounting, Organizations and Society, 71, 15-29.

- Vagina, N. (2016). Financial security of the enterprise: practical aspects. Ekonomika i Socium, 12, 1-19.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Aksinina, O., Naumova, O., & Tyugin, M. (2019). Impact Of The Compliance-Control System On Provision Of Financial Security. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 1032-1041). Future Academy. https://doi.org/10.15405/epsbs.2019.03.103