Abstract

Dividend policy is an integral part of the modern company’s activities with share capital. The right dividend policy allows the company to maintain stable growth and development, as well as attract new shareholders. Shareholders are interested in a stable profit in the future. They are interested not only in the growth of the value of the company they own shares, but also regular in receiving the dividend payments. Russian companies use the experience of foreign companies in developing their own dividend policy. At the same time Russian and foreign companies differ in their dividend policy. A comparative analysis of the Russian and foreign experience of dividend policy suggests a more complex correlation between foreign companies and their shareholders. Dividend policy of Russian companies is much easier. It can be explained by a different degree of development of market relations in the country. The economic culture of investment in securities in Russia is less developed than in USA and Europe. This is due to the period of interruption of market relations in Russia. The dividend policy differences can be explained by country's legislative framework and the return on equity. Loan capital is cheaper for foreign companies than for Russian companies. As a result, foreign companies use the policy of buying back shares very often. Russian companies usually use a policy of dividend payment in the form of cash.

Keywords: Dividend policyequitysharesreturn on equity

Introduction

Most companies face the problem of dividend payments. It happens because the owners of the company’s shares are ready to invest their funds only in case of receiving additional profit in the future. This issue is urgent for Russian joint-stock companies, since the number of non-state companies that place their shares on world exchanges is constantly growing.

Problem Statement

Today there is a growing tendency of implementation of a dividend policy based on the buyback of shares. For example, in the USA, the country with the highest market capitalization, there is no positive correlation between the price of a share in the market and the dividend paid per share (Brealey, 2008). Besides, there is a trend of decrease in the profit share that companies send to pay dividends in cash in comparison with the profit share that is sent to buy back shares.

One of the factors that has influence on the growth of share buyback is a high level of return on equity. Loan capital is cheaper for US companies, so they pursue a policy of buying back shares, rather than paying dividends in the form of cash.

Research Questions

The authors have the following research questions:

features of dividend policy of the largest American companies and the Russian company Yandex;

analysis of the influence of the key figures of companies on the buying back shares;

features of market capitalization of companies by country.

Purpose of the Study

As the purpose of the study, the authors stress the development of recommendations for improving the dividend policy of a modern companies based on foreign and Russian experience.

Research Methods

The main methods were generalization, analysis and synthesis and methods of comparative analysis.

Analysis of the impact on the performance of Microsoft buying back shares shows that the share of equity in the company's financial structure decreases with the repurchase of shares. If the management of the company understands that its own capital is more expensive for their purposes, then it is worth buying out its shares. Moreover, the number of traded shares on the market is decreasing, which leads to an increase in demand and, as a result, higher prices (Abdrakhmanova, 2015). The Microsoft's EPS figure is increasing. It means that next year the company would have more earnings per share than if there were no repurchase of shares. In addition, if the company buys back its shares above market value, the company's managers are confident in further growth of the company. All this contributes to the value of the company's shares.

Microsoft began the policy of buy-back of shares in 5-7 years after the IPO. The company began to pay dividends in the form of cash 28 years after the IPO under the pressure of public opinion and because of the tax reform in the USA. Today, there is a similar company - Google - whose accounts have accumulated $ 86 billion. Google has a positive cash flow, and only in 2015 (9 years after the IPO) began a policy of buying back shares. This suggests that such companies should not introduce a dividend policy until they no longer need additional financing and are going to have the positive cash flow for 5-6 years.

The dividend policy of the company may be influenced by the tax legislation of the state in which the company is registered. In 2003, the United States adopted the Law “On Alignment of Tax Payments”.

According to the adopted law:

firstly, the maximum tax rate on individuals' personal income received in the form of dividends decreased from 38.6% to 35%;

secondly, dividends and capital gains began to be taxed equally (Fedorova, 2016).

As a result, investors at Microsoft began to expect that the company would begin to pay dividends along with the policy of buyback share, since for them the difference between the two types of payments has disappeared.

Another reason that Microsoft decided to pay dividends in the form of cash funds is that a large amount of money was accumulated in the company's accounts - $ 56 billion. Microsoft took the first place in the world in terms of the amount of money on the company's accounts, and investors exerted pressure to do something with cash. Given the circumstances, the company made the largest dividend payments in its history in 2003 (Liljeblom, 2016).

The share of dividend payments in the form of cash in the free cash flow of the company has increased from 17% to 49% from 2003 to 2018. The share of funds allocated for the repurchase of shares varies on average between 25% and 60%, depending on the company's profit in a particular year (Kozlova, 2016).

Microsoft financial reports show that dividend payments in the form of cash funds are constantly growing regardless of the financial performance of the company or the market situation in the country.

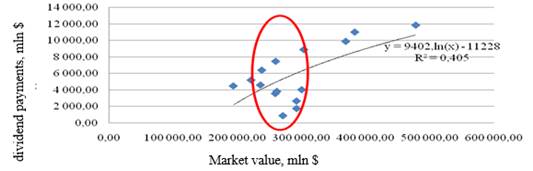

Figure

Source: compiled from Microsoft's annual reports

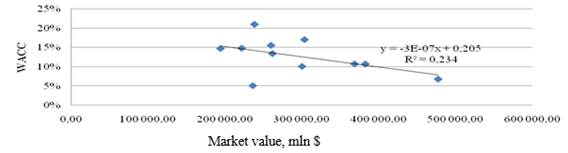

Figure

Source: compiled from Microsoft's annual reports

Since WACC depends on the company's capital structure, it can be stressed that the structure of the company slightly affected the market value of the company for the period from 2007 to 2017. Thus, dividends, as a constituent part in calculating the cost of equity, also did not have a significant impact on the company's market value.

Dividend policy had a big impact on the cost of equity. If the cost of equity becomes more expensive than borrowed capital, the company begins to increase the share of borrowed capital in the structure of the company.

The largest number of shares was bought by Microsoft in 2007 with the lowest price level for shares of this company in the last decade. In 2008, when the value of the shares increased by 20%, the company drastically reduced the repurchase of shares from $ 27 billion to $ 5-12 billion in subsequent years.

The flexibility is main advantage of the buyback policy. The company announces its plans to buy back its shares for the following years. However, each analytical report states that the announcement of the redemption of shares is not a mandatory and guaranteed action of the company in the future (Revenko, 2017). In case of changes in the world economy, the appearance of a new project, etc., the company has the right to refuse without prior notice the previously announced share redemption plan. At the same time, it cannot be done when the company provides information on cash dividend payments for the coming year.

Another company in the sphere of high-tech economy is Google. This company draws attention to the fact that it, unlike Microsoft, is at the stage of growth. Google is a transnational public corporation investing in search engines, cloud computing, advertising technologies and other projects. It was founded in 1996, and in 8 years in 2004 the company began selling its shares on the NASDAQ stock exchange. Since then, the company's share price has increased from $ 54.15 per share to $ 1,036 per share (as of December 4, 2017). Apart this company, only Apple can show such growth rates (Sharif, 2015). The balance of cash on the company's accounts and cash equivalents increased annually and in 2016 amounted to $ 86 billion.

The company has three types of shares: Class A - has 1 vote, Class B - has 10 votes, Class C - does not have a vote. The directors of the company (three people) own 92.4% of Class B shares (Strelkova, 2018).

The company has never paid dividends, does not pay them and, as reported in the last annual report, does not intend to pay, preferring to reinvest profits in the development of new projects (Simonov, 2017; Pucheta-Martinez, 2017).

However, the company has a policy of redemption of shares. In 2015-2016 years, the company's board of directors authorized the purchase of shares for a total of $ 12,118 million without specifying dates.

In spite of the fact that the company is not obliged to repurchase its shares, in 2016, Class C shares were bought out in the amount of USD 5,473 million (less than 1% of the market capitalization). As a result, as shown in Table

Today, Google is the only company that, with the largest amount of cash, does not pay dividends. This new dividend policy positively affects the market value of the company.

The Russian company Yandex, with its high liquidity and the availability of a large amount of cash, has practically the same the market value of shares since the date of their initial placement in 2011. The company can create demand for shares on the MOEX exchange, so that exchange differences do not affect the size of future dividend payments in cash and in the form of repurchase of its own shares on the Russian market. It is also important to calculate the profitability of all the company's projects, since if the company continues to invest in projects, the net profit of the company will be reduced, and the cost of shares will be reduced (Bolshakov, 2015; Belousova, 2016).

The company Yandex is able to increase the annual free cash flow and introduce a policy of buying back its own shares on the US exchange in the amount of no more than 10-15% of the free cash flow. The objective is to signal to investors about the sustainability of its development and increase the market value of shares.

In 2007, Yandex was restructured and the Dutch company Yandex N.V. become the parent company. Yandex N.V. is the final recipient of all funds received from the Russian office. Yandex pays the income of the Dutch parent company in the form of dividends, which are taxed at a rate of 5% under the agreement concluded between the Netherlands and Russia (Lee, 2017).

In May 2011, the company Yandex N.V. held an initial public offering on a high-tech NASDAQ exchange. During the initial public offering, the company raised $ 1.3 billion, which was the second most-watched result at that time, after Google with $ 1.67 billion of raised equity.

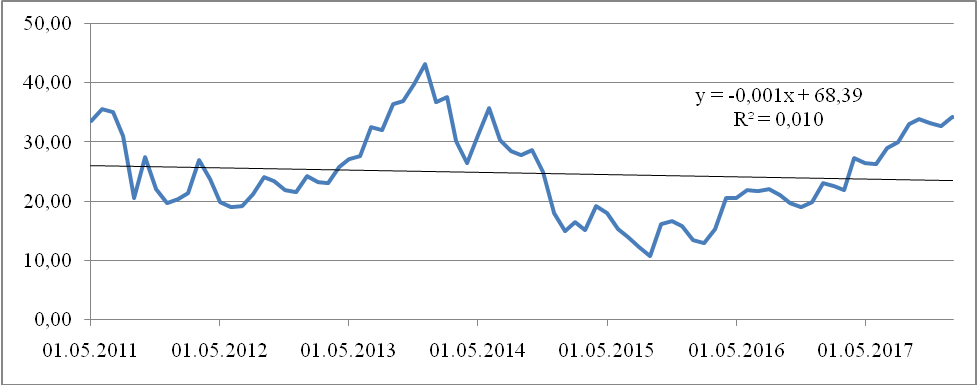

Source: compiled by the authors based on the performance of the company

As shown in the Fig.

In 2014, the company had the IPO on the Russian market as a foreign issuer. The value of the company's shares from June 2014 to January 2018 increased by 60% from 1163 rubles per share up to 1942 rubles per share. At first sight, the value of the company's shares has a constant tendency to increase. The growth of shares on the Russian market may be due to the fact that the company's shares in dollar terms in 2015 became undervalued, and their value began to move to around $ 32 per share (at 1 ruble = 60 US dollars), as they stand on the American stock exchange. Thus, the value of the company's shares on the Russian market duplicates the value of shares on the US stock exchange in dollar terms. Therefore, when analyzing the dividend policy, it is more appropriate to consider its possible impact on the NASDAQ index (Tran, 2017).

Based on the data obtained, we can conclude that the company develops actively, but its performance is not stable. This is due to the fact that the company is young. However, even if this factor is taken into account, the growth rate of the Yandex company lags far behind the pace of American companies like Google.

Findings

In general terms, the authors can resume the following:

1) The level of return on equity is an essential factor that has great influence on the repurchase of company’s shares. If the return on equity is high, then companies resort to a policy of buy back shares. The borrowed capital of the foreign companies is cheaper, so they pursue a policy of buyback of shares, rather than paying dividends in the form of cash.

2) Yandex is a young company, and its growth rates lag far behind the growth rates of US companies, such as Google. The annual financial statements for the past few years indicate that the company did not announce dividend payments or has no intention of paying dividends in the near future. This reflects the essence of the company's dividend policy strategy.

3) The company's dividend policy is affected by the tax legislation of the countries (or states) in which the company is registered. The law "On equalization of tax payments" in the USA had a positive impact on the dividend policy of Apple, Google, Microsoft for shareholders, because Microsoft decided to pay dividends in cash along with the policy of share buyback.

4) The share of market capitalization of Russian companies remains low. According to the World Bank, Russia ranks 29th overall in the state in terms of GDP. One of the obvious reasons is the imperfection of Russian legislation, which regulates the work of joint-stock companies and affects their dividend policy. In particular, it should be revised such legislative clauses as: taxation of income from the companies with the policy of repurchase of shares and its reflection in the accounting.

Conclusion

There is a growing trend in the world to introduce a dividend policy based on the buyback of shares. In the United States, as in the country with the highest market capitalization, there is no positive correlation between the price of a share in the market and the dividend paid per share. There is also a trend towards a decrease in the share of profits that companies send to pay dividends in cash in comparison with shares of profit, which is sent to buy back shares. An important advantage of the policy of buy-back of shares is its flexibility. The Russian company Yandex is one of the most successful companies in the country. Given the company's high liquidity and the availability of a large amount of cash, the market value of the company's shares has practically not changed since the company's IPO in 2011. This is partly due to the problems that the company faces in dividend policy.

References

- Abdrakhmanova, G. (2015). Information society: the demand for information and communication technologies by the population of Russia. Moscow: NIU VSHE.

- Belousova, A. (2016). Dividend payments and cross-country differences in the choice of dividend. International Journal of Economics and Financial Issues, 1, 46-51.

- Bolshakov, S. (2015). Financial decisions and standards for their adoption at the state and corporate levels. Journal of Contemporary Science: Actual Problems of Theory and Practice, 6, 5-6.

- Brealey, R. (2008). Principles of Corporate Finance, 9-th edition, Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate.

- Fedorova, E. (2016). The influence of external factors on the dividend policy of Russian companies. Finance and credit, 38, 27-36.

- Kozlova, A. (2016). Directions for perfection of dividend policy of Russian companies. Economics and entrepreneurship, 2, 134-139.

- Lee, K. (2017). Evaluation: analysis and prediction using IFRS. Moscow: Al’pina Pablisher

- Liljeblom, E. (2016). Shareholder protection, ownership, and dividends: Russian evidence. Finance & Trade, 10, 2414-2433.

- Pucheta-Martínez, M. (2017). How foreign and institutional directorship affects corporate dividend policy. Investment Analysts Journal, 1, 44-60.

- Revenko, N. (2017). Digital Economy in the Era of Information Globalization: Current Trends. USA & Canada: Economics, Politics, Culture, 8 (572), 81- 84.

- Simonov, N. (2017). Every fourth company has failed in digital transformation. Chief information Officer, 9, 6-12.

- Sharif, S. (2015). The effects of corporate disclosure practices on firm performance, risk and dividend policy. International Journal of Disclosure and Governance, 4, 311-326.

- Strelkova, I. (2018). Digital Economy: New Opportunities and Threats for the Development of the World Economy. International Scientifiс and Practical Journal, 2, 23-24.

- Shchurina, S. (2018). The Dividend Policy of High-Tech Companies in the Digital Economy. Еkonomika. Nalogi. Pravo., 2, 90-102.

- Tran, Q. (2017). Dividend policy: shareholder rights and creditor rights under the impact of the global financial crisis. Economic Modelling, 64, 502-512.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 March 2019

Article Doi

eBook ISBN

978-1-80296-056-3

Publisher

Future Academy

Volume

57

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1887

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Shchurina, S., Malofeev, S., & Prunenko, M. (2019). Dividend Policy Of Russian And Foreign Companies: Comparative Analysis. In V. Mantulenko (Ed.), Global Challenges and Prospects of the Modern Economic Development, vol 57. European Proceedings of Social and Behavioural Sciences (pp. 1001-1008). Future Academy. https://doi.org/10.15405/epsbs.2019.03.100