Abstract

In modern conditions, development of the intellectual capital market is the most important direction of economic policy in developed and developing countries which have intellectual resources. Adaptation to the new conditions of reproduction concludes in the form of economic processes transformation, which key factor is the reorientation towards usage intensification of economic development new pushing factors. It creates a global informational space where knowledge is generated and has a significant impact on the development of a new type of economy — innovation-based one, where the knowledge sector has a crucial role, and the production of knowledge is a source of economic growth. The study analyzed theoretical aspects of formation and structural composition of intellectual capital at the micro and macro levels. Taking into account the results of analysis of existing approaches used for assessing market efficiency, the authors developed a method for evaluating intellectual capital market efficiency in terms of innovative development based on the length of a vector in three dimensions which is characterized by comprehensive decomposition of its structural elements and takes into account the innovative nature of social and economic development of various countries. The method for assessing the intellectual capital market efficiency at the macro level involves a system of indicators reflecting its features, and allows leveling out the deviations when using intellectual capital and intellectual products in the context of innovative development. The method was tested on data from twenty-five countries which were clustered by the criterion scale determined development of effective innovative management decisions.

Keywords: Innovative developmentintellectual capitalintellectual capital market

Introduction

In modern economic conditions, innovative development serves as a platform for implementing competitive advantages of the economy and ensures sustainable economic growth, improves the quality and living standards of the population through active involvement of intellectual capital and harmonization of the interests of participants of the information space. One of the reasons for increased attention to intellectual capital formation at different management levels is the lack of restrictions on its use. Existing theoretical and methodological materials taking into account peculiarities of a socio-economic system can be used.

T. Stewart (Stewart, 2007), E. Brooking (Brooking, 2011), J. Ruus (Ruus, Pike, & Fernstrom, 2010), L. Edvinsson (Edvinsson, 2014), K. Sveiby (Sveiby, 2011), V. Mavridis (Mavridis, 2014), A. Pulic (Pulic, 2000) contributed to research on the intellectual capital. Due to the fact that the concept “intellectual capital market” has been recently developed in economics, a limited number of works deal with development of the intellectual capital market. Having analyzed these researches, we can conclude that the issue of evaluation of the intellectual capital market efficiency is understudied and controversial

Problem Statement

The lack of a universal definition of the term “intellectual capital” and its structure indicates the need for deeper studies on this aspect. Most researches deal with development of the intellectual capital at the micro level which requires studies on the macro level of the intellectual capital market. In order to diagnose the current state of the intellectual capital market, determine development trends and directions, make management decisions, it is necessary to determine market efficiency. The problem is the lack of a unified approach to intellectual capital market efficiency at the macro level. In practice, the problem involves justification of the use of development tools for revealing characteristics of material, technical, financial, organizational, methodological, informational and other measures ensuring the continuity of transformation of the intellectual capital into intellectual resources. All these arguments demonstrate the need for comprehensive studies on assessment of intellectual capital market efficiency in the conditions of innovative development

Research Questions

Having considered various interpretations of “intellectual capital” (Stuart, 2007; Brookings, 2011; Ruus, Pike, & Fernstrom, 2010; Mavridis, 2014; Zeghal, & Maaloul, 2010), one can conclude that most scientists interpret it as a set of knowledge, skills, intangible assets creating value added and increasing wealth of stakeholders.

Currently, the most popular version of the intellectual capital structure is a triune system which includes human, structural and relational types of capital. Human capital is a combination of knowledge, skills, competencies of employees; structural capital is an intangible infrastructure of the company strengthening and codifying the knowledge and quality of employees; relational capital is a resource for building mutually beneficial relations with the external and internal environments.

Analyzing the views of various authors (Corpakis, 2011; North, Kares, 2011; Pasher, & Shachar, 2005; Bontis, 2004; Smedlund, & Pöyhönen, 2011; Rembe, 1999; Lin, Edvinsson, 2008) on intellectual capital, one can conclude studies on intellectual capital of the company are practical-theoretical, i.e., the theory is formed on the basis of practical observations, experiments and initiatives implemented at the national and regional levels. It should be noted that the interest of scientists in the intellectual capital of the region and the country is directed at the study of managerial, organizational aspects, consideration of intellectual capital in the system of factors of regional competitiveness, while studies on intellectual capital of an organization are reduced to identification of the structure of intellectual capital and its assessment (Roze, 2017).

In the process of intellectual capital transformation from knowledge into a ready-made commercialized innovative product, the intellectual capital market is formed. It can be defined as a set of economic relations arising from the purchase or sale of intellectual products, and consisting of intellectual capital producers - innovators or owners of intellectual resources forming the supply, and consumers of intellectual capital - the state, households, various organizations forming the demand for intellectual resources.

The intellectual capital market consists of the knowledge market, the intellectual property market, and the innovation market. The process of transformation of intellectual capital begins with the knowledge market whose incoming flows are information, human resources, etc., and new knowledge generated by the market and highly qualified employees who create intellectual property objects. As a result, the intellectual property market is formed. Further, during the materialization and commercialization of intellectual property, an innovation market develops. Its outgoing flows are innovative products, technologies, etc. (Mashkina, 2017).

Purpose of the Study

The modern economy and its development are directly related to the efficiency of the intellectual capital market, since intellectual capital today is one of the main factors determining the competitiveness of the economy and welfare of the population. Thus, the purpose of the study is to assess intellectual capital market efficiency in terms of innovative development. The following tasks were set: to study theoretical foundations of intellectual capital and the intellectual capital market; to analyze existing approaches to market efficiency assessment; to develop an approach to intellectual capital market efficiency assessment based on existing approaches; to assess intellectual capital market efficiency assessment based on methods developed abroad; to build a map of intellectual capital market efficiency and make recommendations for further development of the market

Research Methods

The following methods were used: abstraction which specifies the most significant motives for the behavior of participants in the intellectual capital market; structural-logical analysis and synthesis which form a holistic picture of the intellectual capital market; the evolutionary historical approach identifying causal relationships and key patterns of intellectual capital market transformation under various external and internal events; economic and statistical analysis identifying structural proportions, intellectual capital market development dynamics and trends; the structural-functional approach, sociological survey identifying problems of intellectual capital market development and main prerequisites for its efficiency.

To assess intellectual capital market efficiency, a complex approach based on the analysis of existing approaches (functional, econometric, criteria-based, incremental, complex) consisting of functional and criteria-based approaches was suggested. The approach involves assessment of the efficiency of each structural element of the intellectual capital market, namely, the knowledge market, the intellectual property market and the innovation market.

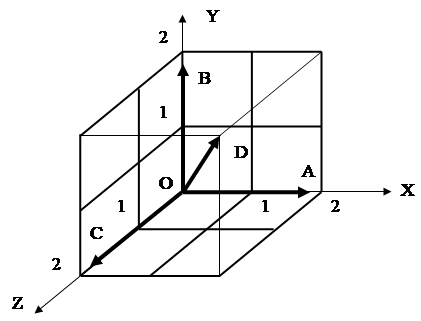

To calculate the integral index, we used the method for determining the length of a vector in three-dimensional space based on the interrelation function of three variables (Figure

OA is the knowledge market efficiency, OB is the intellectual property market efficiency, OC is the innovation market efficiency, OD is the intellectual capital market efficiency calculated by formula

(1)

Evaluation of the efficiency of structural components of the intellectual capital market is calculated using the quotient of division of the effect of the i-th market on investment for developing the i-th market

Findings

The developed method for assessing intellectual capital market efficiency taking into account available statistical data has been tested in a number of countries. MS Excel software package was used calculation. Statistical reports of the Higher School of Economics "Science Indicators: 2017" (Voinilov, Gorodnikova, & Hochberg, 2017). "Indicators of Innovation Activity: 2017

A criterion scale reflecting peculiarities of intellectual capital market development was suggested (Table

The lower and upper borders of the criteria are justified by the fact that the intellectual capital market is specific, since its main object is intellectual labor. Complex identification, delineation and assessment determine its high cost. Consequently, the market whose main object is an intellectual product can be considered effective only if investment is cost-effective (Mashkina, 2017).

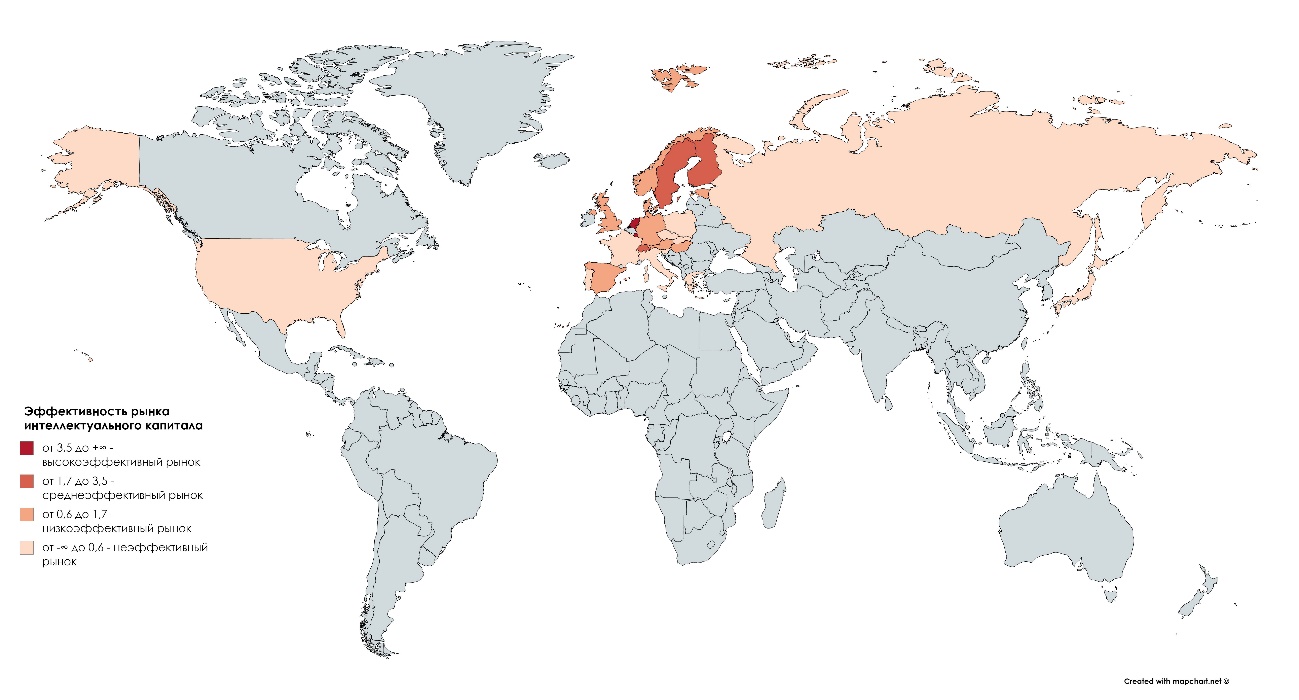

Thus, according to the intellectual capital market efficiency scale, the intellectual capital market of Luxembourg and the Netherlands are high-efficient, the intellectual capital market of Switzerland, Sweden and Finland are medium-efficient, and the intellectual capital market of Germany, Norway, Estonia , Spain, Austria, Great Britain, Denmark, Hungary, Belgium are low-efficient. Other 11 countries have inefficient intellectual capital markets. To visualize the grouping of countries by the level of intellectual capital market efficiency, the results of calculations are presented as a heat map (Figure

Depending on the calculated efficiency indicators of market elements, recommendations were developed to improve the efficiency of the intellectual capital market.

When assessing the knowledge and intellectual property markets as inefficient or low-efficient, it is advisable to implement the following measures to improve the efficiency of the intellectual capital market: developing the infrastructure of knowledge and intellectual property markets, increasing investment in science, research and development; creating favorable conditions for intensification of scientific and innovation activities; strengthening the legal framework regulating the knowledge and intellectual property markets.

With an average level of efficiency of the knowledge and intellectual property markets, the following support measures were recommended: improvement of the efficiency level; modernization of the existing infrastructure of the knowledge and intellectual property markets; investment control.

If the knowledge and intellectual property markets are effective, measures to strengthen the level of efficiency, modernize the existing infrastructure, and improve the legal framework regulating this area have to be taken.

To improve the efficiency of the entire intellectual capital market, it is necessary to pay attention to critical points, namely the efficiency of its structural elements, and to carry out measures which are necessary for market development. It is also necessary to pay attention to growth points to strengthen the markets. It is necessary to establish and maintain direct and inverse relationships between structural elements to obtain a synergistic effect from interaction of structural components and to strengthen the legislative base.

Conclusion

The tasks of intellectual capital market efficiency assessment were solved.

The study of theoretical foundations of intellectual capital and the intellectual capital market made it possible to develop a method and determine the subject area of the study. The analysis of strengths and weaknesses of existing approaches used for assessing market efficiency showed that there is no universal method for assessing intellectual capital market efficiency. However, the results formed the basis for developing a method for assessing intellectual capital market efficiency based on an integrated approach, consisting of functional and criterion approaches, involving individual assessment of the efficiency of each structural element of the intellectual capital market.

Using the developed method and criterion scale, the intellectual capital market efficiency in 25 countries was assessed. The results showed that highly efficient intellectual capital markets are in countries with developed legislation regulating intellectual property and a high level of exported innovative goods, works and services.

Recommendations aimed at improving the efficiency of the intellectual capital market focusing on development of the market infrastructure, investment management and legislative base were suggested. ]

References

- Bontis, N. (2004). National intellectual capital index: a United Nations initiative for the Arab region», Journal of Intellectual Capital, 5(1), 13-39.

- Brookings, E. (2011). Intellectual capital: the key to success in the new millennium. Petersburg, Mysl.

- Corpakis, D. (2011). European regional path to the knowledge economy: challenges and opportunities. Intellectual Capital for Communities. Nations, regions and cities, 5, 213-226.

- Edvinson, L. (2014). Corporate longitude. Knowledge-based navigation in the economy. Moscow: INFRA-M.

- Eurostat, (2015). Database. Labor market. Retrieved from: https://ec.europa.eu/eurostat/web/labour-market/earnings/database

- Gorodnikova, N.V., Gokhberg, L.M., Ditkovsky, K.A. (2017). Indicators of innovation activity: 2017: statistical compilation. Higher School of Economics, Moscow: HSE.

- Lin, C.Y.Y. and Edvinsson, L. (2008). National intellectual capital: comparison of the Nordic countries. Journal of Intellectual Capital, 9, 4, 525-545.

- Mashkina, D.I. (2017). Approach to assessing the effectiveness of the regional intellectual capital market. Economics and Management: Problems, Solutions, 12, 201–206.

- Mavridis, D. (2014). The intellectual capital performance of the Japanese banking sector. Journal of Intellectual Capital, 5, 1, 92115.

- North, K., Kares, S. (2011). Ragusa or how to measure ignorance: the ignorance meter. Intellectual Capital for Communities. Nations, regions and cities, USA, HGR-Publ.

- Pasher, E. and Shachar, S. (2005). The intellectual capital of state of Israel, in Bounfour, A. and Edvinsson, L. (Eds) Intellectual Capital for Communities. Nations, Regions and Cities. Elsevier Butterworth-Heinemann, Burlington, MA.

- Pulic, A. (2000). VAIC™ - an accounting tool for IC management. International Journal of Technology Management, 20, 5/6/7/8, 702-714.

- Rembe, A. (1999). Invest in Sweden: Report 1999, Halls Offset AB, Stockholm.

- Roze, N.Sh. (2017). Structural and functional model of intellectual capital at the micro, meso and macro levels. Russian regions in the focus of change: a collection of reports of the XII International Conference. November 16-18, (pp. 31-46), Ural Federal University named after the first President of Russia B.N. Yeltsin - Ekaterinburg: UTI Training Center.

- Ruus, J., Pike, S., Fernstrom, L. (2010). Intellectual Capital. Management practice. Moscow: Higher School of Management.

- Stuart, T.A. (2007). Intellectual capital. New source of company wealth. Moscow: Generation.

- Smedlund, A., Pöyhönen, A. (2011). Intellectual capital creation in regions: a knowledge system approach. Intellectual Capital for Communities. Nations, regions and cities. USA: HST Publ..

- Sveiby, K.E. (2011). A knowledge-based theory of the firm to guide in strategy formulation. Journal of Intellectual Capital, 2, 4, 344-358.

- Voinilov, Yu.L., Gorodnikova, N.V., Hochberg, L.M. (2017). Science indicators: 2017: statistical compilation. Moscow: Higher School of Economics.

- Zeghal, D., Maaloul, A. (2010). Analyzing value added as an indicator of intellectual capital and its consequences on company performance. Journal of Intellectual Capital, 11, 1, 39-60.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 March 2019

Article Doi

eBook ISBN

978-1-80296-057-0

Publisher

Future Academy

Volume

58

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2787

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Kuzminykh, N. A., Mashkina, D. I., & Roze, N. S. (2019). Assessment Of The Intellectual Capital Market Efficiency. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism, vol 58. European Proceedings of Social and Behavioural Sciences (pp. 751-757). Future Academy. https://doi.org/10.15405/epsbs.2019.03.02.85