Abstract

The paper reflects the results of systematization of the authors’ approach to assessing the innovative activity of various economic systems, the distinguishing features of which are expressed in a limited set of calculated (analytical) indicators, including indicators of financing innovation in industrial (sectoral) complexes. This means that the applied methodologies for assessing the results of innovation activity cannot be adequate and represent the results of a comprehensive assessment of the factor influences on the change in the level of innovation activity of the industrial (sectoral) complex. Basing on the authors’ approach to the grouping of sources of financing innovations, their comparative characteristics, advantages and disadvantages in order to determine the completeness of information support for assessing the innovative activity of the industrial complex on the use of financial potential, published data on the sources of financing technological innovations are analyzed. The possibilities and limitations in the information support for assessing the effectiveness of market instruments for financing technological innovations are revealed. It has been established that this assessment is limited due to the lack of detailed indicators reflecting the volumes and structure of credit and venture investments in the context of the scale of industrial companies, industries and their integrated structures.

Keywords: Methodologyinformation supportexternal financingtechnological innovationsassessment

Introduction

The scientific and technological development necessary to respond to the great challenges facing Russia and related to achieving the competitiveness of the country in the global digital market is based on fundamental principles of public policy, out of which the concentration of all resources, including the financial ones on the development of competitive products and services is important.

Problem Statement

The transition to modern models of analysis and evaluation of the economic efficiency of innovation, new industries and markets, on the basis of which an effective management system in the field of technology and innovation should be established requires scientific understanding of ways to improve the methodological support of these analytical procedures, ensuring the identification of innovative development factors of industrial complexes (enterprises, industries), the activation of which should contribute to the improvement of conditions for the creation and implementation of breakthrough technologies, achieving country’s competitive advantage in the global digital market.

Research Questions

Classification of authors’ approaches to assessing the innovative activity of the economic systems of various levels shows that most researchers turned to studying the methodological tools for evaluating the innovative (innovative and technological) potential of a region or sub-federal region (Sergeev, 2008; Akberdina, 2009; Danilova, 2007; Kiselev, 2009; Zadumkin, 2010; Shtertser, 2005). The methodologies of these authors are distinguished by the opportunity based on expert assessments, complicated calculations and factorial analysis of regional rankings by the level of innovation potential, determination of trends in the rating of competitiveness of a region, etc. At the same time, the multilevel structure of the innovative potential of a region is taken into account.

As for the approaches to assessing the innovation potential of an industrial enterprise or industry (Sukhorukova, &Kuzbozhev, 2006; Pochukayeva, 2008 Anisimov, Peshkova, & Solntseva 2006; Zaikin, 2010; Maksimov, 2006), the groups of industries or industrial enterprises can be distributed by the effectiveness of innovation on their basis. They are characterized by the use of published statistics, and, therefore, by the limited composition of calculated (analytical) indicators, the lack of consideration of differences between the indicators of the innovation potential and the results of its use.

The consideration of the authors’ approaches to assessing the impact of external financing mechanisms for innovation in the industrial complex, in particular, the cost of technological innovation, on its level of development, also leads to the conclusion that there are no uniform approaches to the use of methodological tools and grouping the forms and methods of financing innovation. This means that factors of financing innovation in the industrial complex remain undetected, on the basis of which optimal combinations are established in the use of various financial resources, the priority strategies are identified for the formation of monetary funds to finance technological innovations through the financial market.

Purpose of the Study

Based on the established relationships between the use of the financial potential of the industrial complex and the level of its innovative activity (Demilkhanova, 2013a), and taking into account that “the result of functioning of the industrial complex embedded in the innovation mechanism, namely its competitive position strengthening, is determined not only by the level of development processes of formation and use of the innovation potential of enterprises, industry complexes, but also processes associated with joint participation of each element of industrial complex in its development” (Demilkhanova, 2013b), it seems necessary to identify opportunities and limitations in the information support for assessing the effectiveness of market tools for financing technological innovations in terms of the stages of development of innovative processes and the size of enterprises included in the industrial complex, as well as their associations.

Research Methods

Comprehensive assessment of the effectiveness of external (market) tools aimed at financing technological innovations in the context of their need for digital transformation of hotel companies, as well as integrated structures that are part of the industrial complex of the territory, which set the main technological trends in the field of digital transformation of the real economy, is of particular importance.

Based on the results of the identified advantages and disadvantages of external (market) tools for financing technological innovations the following can be noted:

lending by Russian banks is based on high lending rates, therefore, under the conditions of low capitalization of industrial enterprises (including small innovative companies) and the lack of guarantees of fund repayment it is difficult to implement, which in practice determines the distance of banks from the innovation activities of economic entities;

syndicated lending, which has been regulated from 1 February 2018 by the Federal Law "On the Syndicated Credit (Loan) and Amendments to Certain Legislative Acts of the Russian Federation" (Federal Law, 2017), where the share of Russian transactions in the global volume is 0.2% (4) can be used in accordance with its conditions and requirements (Table

1 ), the largest and big Russian companies with a stable financial position, ensuring their creditworthiness, as well as large collateral;project financing is also characterized by excessive requirements to the borrower, aimed at investing in projects that are the stage of implementation, where the production of competitive products, providing a certain level of profitability and solvency of the borrower is carried out;

venture capital funding, basing on its requirements and terms of provision (Table

A necessary condition for carrying out a comprehensive assessment of the effectiveness of market-based tools for financing technological innovations is the availability of detailed and aggregated (cross-cutting) indicators, on the basis of which various analytical (calculated) indicators can be determined on the dynamics and structure of financing, categories of industrial enterprises, and their integrated structures (IP), among which are the following:

financial and industrial groups, holdings, self-developing structures that have a technological chain at the base of their activities, and unite the research and development, as well as engineering units of industrial enterprises, scientific research institutes, financial structures (banks, microfinance organizations, foundations, etc.) into a single balanced research and production system;

associations and consortia created for the purpose of conducting strategically significant R&D, implementing large-scale scientific and technical programs;

joint research centers of the academic and industrial sectors created for the implementation of research programs and projects.

Findings

The analysis of the content of various open sources of information on the participation of Russian banks, including the investment ones, and venture funds in financing innovations in the industrial complexes (Table

Result 1

There are data on loans granted to legal entities and small and medium-sized businesses in the whole country and regions, as well as on loans provided by 30 large banks to legal entities and individual entrepreneurs in the industry as a whole. However, there are no aggregated (consolidated) data on loans from Russian banks provided for R&D and implementation of technological innovations not only by industry and complex, but also by integrated structures that are part of the industrial complex of the territory

Result 2

There are general data on the volume of syndication by borrower and creditor companies, as well as by sectors in which borrowers operate (oil and gas industry, mining, etc.). These data do not allow to determine the degree of involvement of large banks in the implementation of technological innovations in the industrial complexes, since they do not reflect data on the innovative enterprises

Result 3

There are no data on project financing of investment projects in general, and, in particular, innovative ones, which also do not allow revealing the degree of investment banks’ involvement in the innovation processes occurring in the industrial complexes, capital-intensive and knowledge-intensive industries.

Result 4

More complete data is found on venture financing

first, there are aggregated data on venture funds aimed at financing technological innovations by industry (sector) and federal districts;

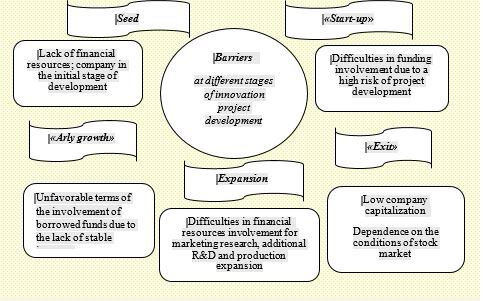

second, the volumes of venture capital investments by stages of development of innovative companies are reflected, which makes it possible to identify the role of venture funds in overcoming the lack of financial resources at different stages of development of these companies.

Conclusion

Thus, the establishment of the best possible combinations in the use of various financial resources, as well as the construction of suitable models for financing the industrial complex in terms of the stages and scales of development of the innovation processes taking place in it, can be achieved on the basis of a complete statistical base containing commensurate data on financing innovation in industry. To carry out a more detailed assessment of factor relationships between the effectiveness of the considered sources of financing technological innovation and increasing (changing) the innovation activity of the industrial complex, the transparent and specific data are needed, reflecting the volume of credit and venture investments distributed not only by the stages of the innovation processes, but also by the size of industrial enterprises included in the industrial complex, as well as integrated structures.

The assessment of factor relationships should help identify the following:

the efficiency of market tools for financing technological innovations and its impact on the change in the level of innovation of industrial complexes (enterprises, industries and their integrated structures);

primary strategies for the development of financial resources for innovative development that underlie suitable models for financing technological innovations.

The analytical indicators obtained on the basis of modernized statistical observation data, as well as the results of their use for evaluating innovative processes occurring in the industrial complexes, should become a reliable basis for monitoring the implementation of goals and objectives of strategic planning in Russia.

References

- Akberdina V. V. (2009). Evaluation of the innovation and technological potential of the region. Regional economy: theory and practice, 23,42-50.

- Anisimov Yu. P., Peshkova I. V., Solntseva E. V. (2006). Methodology for evaluating the innovation activity of an enterprise. Innovations,.11, 88-91.

- Danilova T. N. (2007). Approaches to assessing the innovative potential of the region. Regional economy: theory and practice, 5 (44),43-49.

- Demilkhanova B. A. (2013a). Financial potential for the development of industrial complex: assessment of factor relationships. Financial research, 2 (39), 46-59.

- Demilkhanova B. A. (2013b). Methods for assessing the innovative activity of the industrial complex. Economic analysis: theory and practice, 9 (322), 17-26.

- Federal Law “On the Syndicated Credit (Loan) and Amendments to Certain Legislative Acts of the Russian Federation” dated 31 December 2017 No.486-FZ.

- Kiselev V. N. (2009). On the evaluation of innovative activity of the Russian Federation. Innovation, 10, 77-81.

- Maksimov Yu. (2006). Innovative development of the economic system: assessment of innovative potential. Innovation, 6, 53-56.

- Parasotskaya, N.N. (2015). Comparative Characteristics of Venture Capital Funding and Project Lending. Economy. Taxes. Law, 5, 123-129.

- Sergeev V. A., Skobeeva V. V., Bashirov K. E. (2008). Assessment and analysis of innovative potential. Innovation, 1, 93-99.

- Shtertser T. A. (2005). Empirical analysis of innovation activity factors in the regions of the Russian Federation. Bulletin of the NSU. Ser.: Social and Economic Sciences, 5, 69-75.

- Sukhorukova O. A., Kuzbozhev E. N. (2006). Innovative potential of the industry: definition, analysis and measurement. News of Kursk State Polytechnic University, 2, 173 - 179.

- Zadumkin K. A. (2010). Methods of comparative assessment of the scientific and technical potential of the region. Economic and social changes: facts, trends, forecast, 4, 86-100.

- Zaikin N. A. (2010). Method for evaluating the effectiveness of innovation activities of industrial enterprise units. Economics, 6, 63-67.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 March 2019

Article Doi

eBook ISBN

978-1-80296-057-0

Publisher

Future Academy

Volume

58

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2787

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Demilkhanova, B. (2019). Evaluation Of Funding Sources Of Technological Innovation: Information Support. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism, vol 58. European Proceedings of Social and Behavioural Sciences (pp. 376-382). Future Academy. https://doi.org/10.15405/epsbs.2019.03.02.43