Abstract

This work presents the study of the budget self-sufficiency and balanced-state of the Russian local budgets. Current development of the Russian Federation in social, economic and fiscal respect is followed by maladjustments and spatial inequality of the sub-federal level. This phenomenon depends on a great number of external and internal factors manifested in various aspects. The issue of achieving high degree of stability of local budgets is quite topical in conditions of complicated economic conjuncture. The difficulties, associated with generation of revenue at various levels of the budget system, require a more effective use and efficient allocation of the budget. Account must be taken of the needs of the lower budgets whose extent of the expenditures does not always, quite frequently in most cases, correspond to revenue sources. Thus, evaluation of budget balance processes and securing of budget autonomy of local units is the top target. This article examines the budget federalism mechanism developed when Russian economy switched to the market management system. The work provides clarification of the adjustment mechanism for inter-budgetary relations. It contains trend data characterizing the structure of the local budgets’ revenue sources. Extent and structure of unrequited budgetary aid to regions were assessed in dynamics of the last three years. The study shows peculiarities characterizing growth of financial dependence of local budgets on the federal center. Guidelines for reconstruction and decentralization of powers have been suggested to generate expenditure commitments of local units depending on available revenue sources.

Keywords: Budgetary federalismgrantssubventionssubsidiesrevenue

Introduction

Local budgets with low financial capacity receive financial aid from other budgets of the system, which predetermines their dependence. At the same time, efficiency of this help and its well-balanced distribution among all the budgets depend on the quality of inter-budgetary relations which is defined by budgetary federalism (Tavbulatova, Abayev, & Kulakova, 2018). Definition and concept of “budgetary federalism” came from the study of the American scientists who characterized this phenomenon as the ability of budgets of different levels of the budget system to exist independently (Shash, Borodin, & Tatuyev, 2014).

Russian fiscal legislation misses the definition of the budgetary federalism, however in study materials and academic literature it is defined as the system of fiscal relations between the government agencies of different levels at all the stages of the budget process. Another definition of this term is the following: it is the budgetary relations strategy that, in case of each budget being autonomous, allows combining interests of the Federation with interests of its constituent entities and municipal authorities (Zhidkova, 2014).

There are three principles underpinning budgetary federalism, the essence of which is the following: ensuring the unity and balanced state of all the levels of the state budgetary system as well as attainment of autonomy of the local budgets (regional and municipal). It is important to stress that one of the crucial principals is a real budget autonomy of the territorial entities which requires them to achieve self-sufficiency. On the other hand, accomplishment of this principle involves judgmental estimate of the available economic capacity and it effective use for filling the revenue sources and securing expenditure commitments current.

Problem Statement

The main challenge of ensuring effective performance of the budgetary federalism for the Russian public finances system is to achieve the highest possible fiscal capacity. If the levels of the budgetary system don’t fulfil the self-sufficiency principle, then there is a risk of the system becoming unbalanced which will result in the need of financial budgetary aid in order to balance out the budgets of the territorial entities. Then the inter-budgetary control shall be applied and it is designed to even out the gap between general volume of the revenue sources and expenditure commitments. Getting back to the causes of these negative events, it should be pointed out that the gaps within the national economy occur due to the high irregularity in social and economic development of the regions and their significant polarization. Taxable regional capacities are quite different which predetermines disproportions in the budgets’ income generation. Levelling of these disproportions requires budgetary control that evens out economic security of the different levels of the budgetary system re-allocating revenues and expenditure commitments among them.

Peculiarities of inter-budgetary relations and means of budgetary control were studied by various foreign academic economists: Z. Asatrian, T. Baskaran, H. Blochlinger, B. Gase, L. Gobillon, I. Joemard, J. Duranton, D. King, P.M. Konsgrud, V. Oats, J. Overman, S. Rosefild, M. de Silva, J. Stiglitz, J. Wallis, L.P. Feld, K. Charbit and others.

When analyzing the results of the conducted studies of budgetary control and used approaches, it is necessary to define them as a set of tools, methods, approaches, mechanisms and ways of inter-budgetary relations carried out to achieve required budget balance at all the levels of the budget system.

Current model of the Russian budget system is often criticized because the fiscal sharing practice doesn’t correspond to the budgetary federalism principles (due to a large reallocation of resources, local authorities act only as power performers). Another group of academics focuses on insufficient powers of the budgets in fulfillment of the expenditure commitments.

Research Questions

Achievement of the fiscal capacity of the territorial units require qualitative research of relations and processes developing within the framework of inter-budgetary equalization. Hence, the researchers are to evaluate and analyze the key factors detrimental for the autonomy of the local budgets and degree of their dependence on the grants. Pursuance of the research requires addressing the following tasks:

1. To analyze the state and structure of the revenue sources of the territorial units over time;

2. To identify peculiarities of the federal budgets’ revenue generation;

3. To identify the challenges of inter-budgetary relations within the framework of the Russian fiscal mechanism;

4. To suggest possible ways to reform budget federalism to increase self-sufficiency of the local budgets.

Purpose of the Study

The purpose of the study is to assess the current state and challenges of inter-budgetary relations during equalization of the fiscal capacity.

Research Methods

Power and authority issues are closely related to the policy of inter-budgetary transfer disbursement. It is maintained that the budget system is too centralized due to political centralization, and political motivation ousts the federalism principles when developing relations with the regions and municipal power. This translates into useless and costly red tape for the lower level, suppresses proactivity and prevents development of the local government (Mau & Kuzminova, 2013). Recently, the constituent entities of the RF faced the challenge of unfunded mandates and the system of inter-budgetary transfers becomes more complicated and intricate (Akindinova, Kuzminov, & Yasin, 2014).

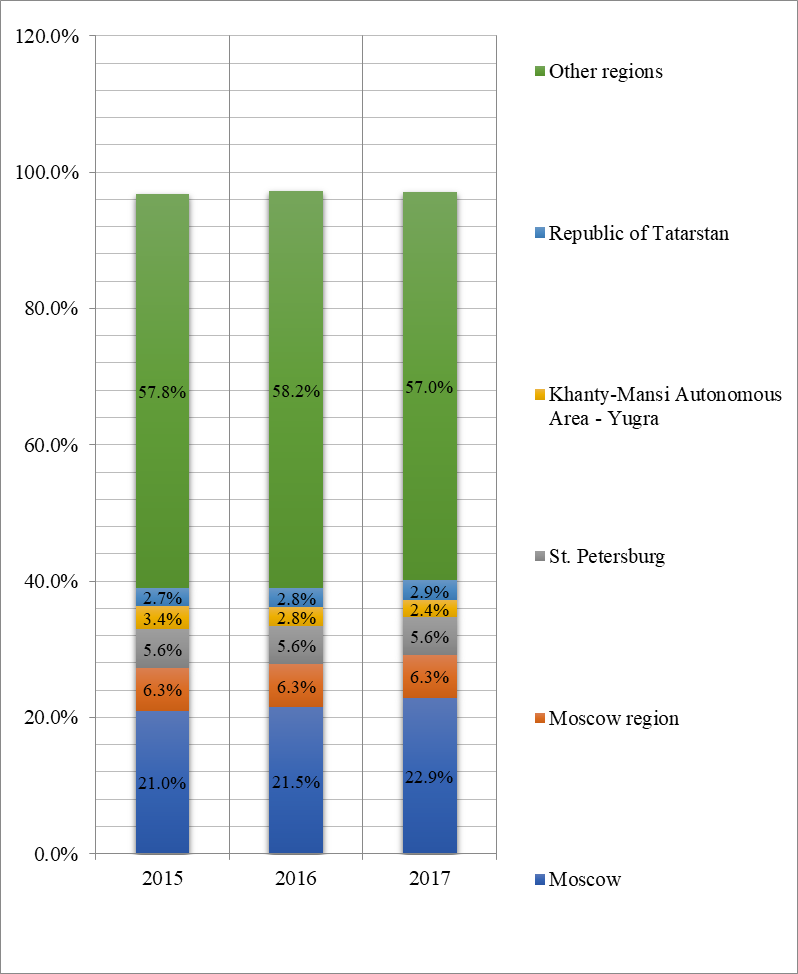

The reason provided by the supporters of the current fiscal sharing model is the utmost inequality in the conditions of the social and economic development of the RF regions (and as a result more than 40% of the tax receipts of the budget system are generated by the five entities) (Fig. 1), they also reason that the current model corresponds to the principles of the budgetary federalism demanding, particularly, to leave at the local level only the taxes with immobile conjuncture base independent from the cycle to the fullest extent (Siluanov, 2012).

The issue of developing a budget system, eligible to the established principles of the budgetary federalism and ensuring balance at each level of the system, becomes more complicated due to the generally acknowledged dependence of the Russian economy on the external pricing environment of the energy market and contradictory appraisal of its impact on the economic development (“resource curse”) (Polterovich, Popov, & Tonne, 2007). Thus, the requirement to redistribute large amounts of tax and customs revenues, with concentration of the international business taxes and unevenly-based taxes at the federal level, expands the role of the federal budget and increases significance of the inter-budget relations.

Apparently, macroeconomic volatility inherent in the economies with overexposure to homogenous export (Guriyev, Plekhanov, & Sonin, 2010) falls over to the budgetary relations because the significant role of redistribution increases the risk of the receiving budget’s income generation (often greater than or equal to the risk of tax shortfalls in diversified economy). Besides, this economy involves increased role of the state economic policy – to make adjustments to market failures that also affect the structure of the tax receipts.

Given the situation, increased centralization of the budgetary funds is justified which, however, imposes on the federal budget (and maybe on the budget of a constituent entity of the RF, too) the duty to redistribute the resources as per the chosen policy of inter-budgetary relations. But a large share of redistribution includes a lot of risks, in particular, the issue of the soft budgetary constraints the bottom line of which is that provision of transfers under certain conditions leads to inefficient budget expenses. For instance, transfer of sums, that weren’t planned in advance in an official document or generated without any clear and open allocation rule, encourages the receiving budget to pursue the policy (in such areas as provision of public goods, imposition of taxes and borrowings) based on the expectation of an additional financial aid (Kadochnikov, 2006). Receiving budget can make decision associated with high risks of financial insolvency expecting that in a critical situation it will receive financial aid (Vigneau, 2006).

Generally, in the situation of the forced vertical unbalance with the objective need in redistribution of the resources, the donating budget will inevitably happen to oppose its reasons regarding budgetary limitations and the need to make efforts and mobilize own revenues to the receiving budget’s reasons regarding the need in transfer increase due to insufficiency of revenues for execution of the expenditure powers. Thus, the issue of development of the effective system of inter-budgetary relations becomes pressing (Zavyalov, 2012).

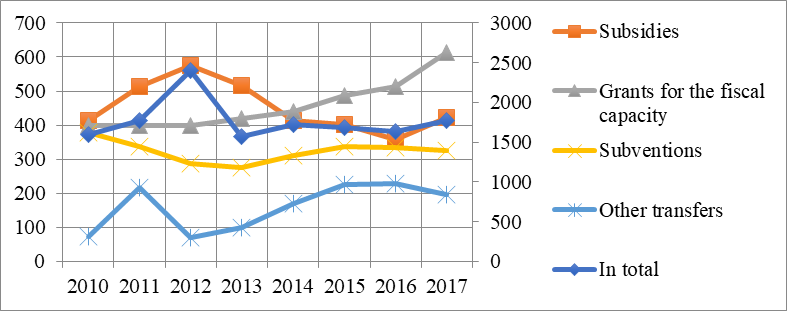

Starting from 2012 the trend is the reduction of the absolute amounts of transfers provided by the budgets of the constituent entities of the RF (Fig. 2).

When considering dynamics of the indicators shown in the Figure

The crucial components of an effective fiscal policy of the budgetary federalism are balance between revenue sources and expense obligations (no unfunded mandates), strict budget constraints, united area controlled by the federal legislation which at the end will result in autonomy and accountability of the budgets. In such a system, an essential role belongs to inter-budgetary transfers; direct expenses of the federal budget at the region’s territory (for instance, under the federal dedicated program), that sometimes deemed to be a replacement for inter-budgetary transfers (Kadochnikov, 2003), can even be harmful if they undermine the private sector of the regional and local economy (for example, by creating unfair competition to the private sector).

A potentially more effective way of direct investment of the budgetary funds is the arrangements of conditions favorable for private investment yield increase through productive expenditures (into infrastructure and education) (Idrisov & Sinelnikov-Murylev, 2013). But, anyway, large projects require well-developed public administration institutes.

Direct federal expenses are not only potentially dangerous for private incentives, their peculiarity is that they are to be performed within the framework of the expenditure powers assigned to the federal level, i.e. they should meet the requirements of the scale economy and generate large external economies, as well as to only slightly consider local specifics of a territory (otherwise, there are no grounds to use them instead of the inter-budgetary transfers). So, the budgetary federalism theory developed quite a simple rule to define the level at which public goods are financed in a multi-level budget system (Oates, 1968) considering three goals of the government control formulated by R. Musgrave: given various interests of taxpayers and financial autonomy of the budgets, decision making and provision of public goods shall be performed at the minimum level of government control (in order to achieve economic efficiency) considering the limitations of the scale economy effects and external economies (including measures for social equity, macroeconomic stabilization in the sense of full employment together with an acceptable price level) (Blaug, 2008).

When financial resources are insufficient, inter-budgetary transfers are used at one of the levels of the budget system. These transfers are to address the following tasks in the field of reallocation of the budgetary means: fiscal capacity equalization, internalization of the neighborhood effects (or externalities) and adjustment of the tax system (Slavgorodskaya, Letunova, & Khrustalyov, 2008).

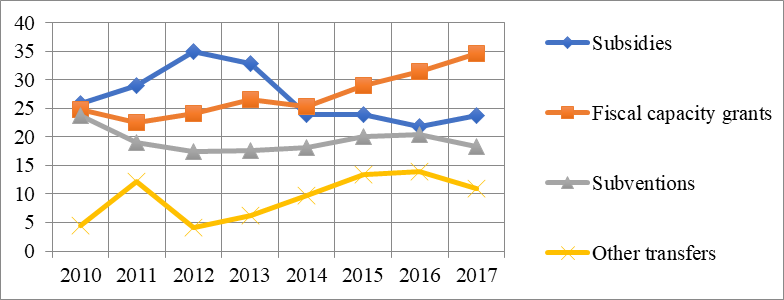

Dedicated transfers prevail in the structure at the federal level given gradual reduction of the total value of the transfers allotted by the budgets of the constituent entities of the RF (Fig. 3); in case of objective difference of the economic development level of the constituent entities of the RF, the share of equalization grants, ensuring provision of the same amount of public goods and relevant opportunities to generate tax receipt, has an apparent downtrend that shall be viewed negatively (Tashtamirov & Kulakova, 2018).

Findings

Optimization of distribution of the dedicated transfers (subsidies and subventions) is the subject of wide speculation in the literature. It is suggested to reduce the role of subventions in the inter-budgetary relations of the federal budget and the budget of a constituent entity of the RF because funding of the delegated powers usually cannot ensure full cover of expenses upon their performance. A small part of the currently deputed powers is to be left for the Federation, withdrawing from delegation, a bigger part is to be given to a region as its own expenditure commitments with corresponding revenue powers.

To increase autonomy of the budget systems of the constituent entities of the RF, it is suggested applying the practice of provision of widely dedicated subsidies in order to eliminate adverse impact of the federal initiatives in the field of powers of the Russian constituent entities when the federal budget actually defines regional policy of expenses. The concept of widely dedicated (block) transfers is extremely popular in the literature (Starodubovskaya, 2011).

Reformation of no-purpose transfers is driven by the resolution of the problems associated with the soft budget constraints. It is suggested leaving out any grants that do not perform equalization of the fiscal capacity and urgent crisis response measures while increasing the share of the former in the general structure of transfers (which will be supported by the recommended reduction of the subventions).

Under the current practice, receiving budget can hardly forecast the revenues from non-repayable receipts and strict adherence to the declared rules and conditions of the budgetary means allocation can solve this issue. If practical adherence to this rule involves big expenses (planning expenses, or its performance will be associated with negative consequences), it makes sense to pass a list of exceptions from this rule.

Conclusion

When developing inter-budgetary relations within the Russian budget system, it is recommended to reduce the number of transfers by terminating use of balance grants and proceeding with widely dedicated block subsidies, reducing the number of subventions as much as possible. All transfers shall be distributed as per an open and clear formula, subsidies – considering calculations of the fiscal capacity. Sums and assignments of the transfers, their periods of enrolment to the account of the receiving budget shall be defined at the beginning of a budget year and shall not be re-considered in the course of budget execution during the current budget year. The structure of transfers is to move from the dedicated to no-purpose, grants for equalization should be distributed more progressively and not carry out no other parallel functions but equalization and the receiving budget should get more powers to choose the ways and dates of application of the received subsidies and subventions.

Recommended decentralization of decisions on application of own revenues, improvement of the policy of inter-budgetary transfers will eliminate the risk of increase of unfinanced mandates, ensure the balance of revenue sources and expenditure commitments, implementation of the autonomous budget principle.

References

- Akindinova, N.V., Kuzminov, Ya.I., Yasin, Ye.G. (2014). Russian Economy at the Turn: Presentation for the KXV International Scientific Conference for the Economy and Society Development Issues (April 1-4 2014, Moscow). – M: Publishing House of the HSE.

- Blaug, M. (2008). One Hundred Great Economists after Keynes. StP: Economic School.

- Guriyev, S., Plekhanov, A., Sonin, K. (2010). Economical Mechanism of the Commodity Development Model. Economic Matters, 3, 4 – 23

- Idrisov, G., Sinelnikov-Murylev, S. (2013). Budget Policy and Economic Growth. Economic Matters, 8, 35 - 59.

- Kadochnikov, P. (2003). Redistribution of the Regional Revenues Within the Inter-Budgetary System of Russia. Economic Matters, 3, 77 - 93.

- Kadochnikov, P. (2006). Reform of the Fiscal Federalism in Russia: The Issue of Soft Budgetary Constraints. Economic Policy, 3, 148 - 181.

- Mau, V.A., Kuzminova Ya.I. (2013). Strategy-2020: New Growth Model – New Social Policy. Final Report on the Results of the Expert Work on the Topical Issues of Russian Social and Economic Strategy for the Period through to 2020. M.: Publishing House “Delo” of the RANEPA.

- Oates W.E. (1968) The Theory of Public Finance in a Federal System. The Canadian Journal of Economics. Vol. 1. N 1. P. 37 – 54

- Polterovich, V., Popov, V., Tonne, A. (2007). Mechanisms of the Resource Curse and Economic Policy. Economic Matters, 6, 4 - 27.

- Shash, N.N., Borodin, A.I., Tatuyev, A.A. (2014). Courses of the Budget Decentralization and Efficiency of Inter-Budgetary Control. Finances and Credits, 335 (611), 2-11

- Siluanov, A.G. (2012). Ways to Improve Inter-Budgetary Relations in the Russian Federation. Russian Entrepreneurship, 2, 43-50.

- Slavgorodskaya, M., Letunova, T., Khrustalyov, A. (2008). Analysis of the Financial Aspects of Implementing Local Government Reform. Scientific Papers. No. 120Р. M.: Publishing House of IET.

- Starodubovskaya, I. (2011). Social Overheads Within in the Context of Spatial Policy. Economy Policy, 3, 25 – 29

- Tavbulatova, Z.K., Abayev, R.M., Kulakova, N.V. (2018). Development of the Revenue Base of Local Budgets: Problems and Solution Paths (based on the information on the Chechen Republic municipal entities). Financial Economics, 4, 243-250

- Tashtamirov, M.R., Kulakova, N.V. (2018). Topical Issues of the Local Budget Generation and Their Solution Paths (based on the information on the budget of Grozny). Chechen State University Reporter. No. 1. P. 62-28.

- Vigneau, M. (2006). Soft Budgetary Constraints of Subnational Governments: Theory, Practice and Conclusions for Russia. Economic policy, 2, 180 - 208.

- Zhidkova, Ye.Yu. (2014). Budget System of the Russian Federation: Study Guide. Stavropol: North-Caucasus Federal University.

- Zavyalov, D.Yu. (2012). Improvement of Financial Support Fund Generation: Alternate Solution. Finances, 6, 14 - 18.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 March 2019

Article Doi

eBook ISBN

978-1-80296-057-0

Publisher

Future Academy

Volume

58

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2787

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Tavbulatova, Z., Tashtamirov, M., Kulakova, N., & Nazayeva, M. (2019). Peculiarities Of Inter-Budgetary Equalization In Russia. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism, vol 58. European Proceedings of Social and Behavioural Sciences (pp. 1655-1662). Future Academy. https://doi.org/10.15405/epsbs.2019.03.02.192