Abstract

This article provides the analysis of two models of housing market financing: share participation and project financing of developers. Currently share participation that involves financial borrowing from individuals and legal entities for housing development sector is well developed in Russia. Both proprietary investments and loan funds can be borrowed. At the same time this model has some problems and risks. The study analyses some statistics showing that share participation as it works today is not able to provide the population with housing. And it is mostly for risks but not for the cost value that makes the procedure troublesome. One of the possible risks is the risk of incompleted construction through the increase in the cost of construction materials and operations. There is a risk of the lack of financing as a result of the falling incomes of the population that leads to the decrease in demand in the housing market. Finally, there can be fraud on the part of the developer. Project financing is currently developed in foreign countries, but in Russia it has been recently launched. In Russia the implementation of this model has encountered a number of problems. Beyond that, the model does not function to the full extent in comparison to foreign countries. However, measures expected in the near future could allow providing the population with housing without customers' taking the risk, and, on the other hand, raising funds for developers throughout the process of constructing buildings up to the transfer of the ownership.

Keywords: Investmentsprojectfinancingshareparticipationaccount

Introduction

For the implementation of any construction project considerable financial investments are required. Internationally investing in the construction sector is as follows: 2/3 of the investments are through the bank project financing, and 1/3 is the company's own funds. In our country today the situation is somewhat different. Today, about 80% of the housing constructed in Russia is financed by the participants of shared construction. Across the country there were registered (01.07.2018) around 1.1 million contracts in force for shared participation. According to the Bank of Russia, the debt of citizens on the mortgage borrowed against contracts in force for shared participation is about 1.2 trillion roubles.

The remaining 20% are accounted for by the sale of apartments in constructed buildings through presale contracts and real estate certificates or through a cooperative housing society model that is still valid in the market.

At the same time, in the next three years, according to the approved "roadmap", it is expected to gradually move on to the financing of housing construction through the project financing mechanism. Project financing for our country is a relatively new but long-range phenomenon. Such a model would solve a number of social problems. In particular, it would protect spending groups' interests in the housing market. On the other hand, it would provide the construction sector with resources.

Problem Statement

Propriety investing in shared-equity construction is a good opportunity to get housing at a reasonable price. In the meanwhile, it must be said that participation in shared-equity construction can have its risks as well as any investments. The risks include the failure to deliver the house, increased costs, fraud, bankruptcy of the market participants and other contingency costs and possible losses.

The number of hoodwinked investors is more than 38 000 people in 72 sub-federal units where there are 830 troublesome construction sites and their number continues increasing. The problem of providing the population with housing and protecting them from unscrupulous developers pushes to find new ways to solve it.

Research Questions

Project financing is the financing of investment projects where flows of money services the certificate of indebtedness debenture. Project financing is a way to attract long-term financing for large projects that is based on a cash flow loan within the project. It is a complex financial and organizational measure to control the execution and financing. Project financing is a relatively new phenomenon that has recently become more widespread in various countries of the world. Lately, project financing has been actively used in Russia (Petrikova & Petrikova, 2015).

The project financing method is based on the following criteria:

1.Usage of project financing by means of a legal entity for a juristically and economically specific project;

2.Application of project financing for a new targeted project exactly but not for the business set up before;

3.The source of payback is the profit from the implementation of the investment project. In this conditions the share of the borrowed money supply is up to 80%;

4.Insurance arrangements and security are not provided by investors since they do not cover financial risks;

5.The influx of money supply is dependent on future profits from the project. (Petrikova, 2015)

There are following types of project financing:

1.With full regressive claim to the borrower. It is usually used in the financing of marginal projects. In such a project, the borrower bears all possible risks.

2.Without regressive claims to the borrower. In this type of financing the lender is responsible for all possible risks. Such projects are more appealing for investing, and, therefore, they are more profitable. As a result, the project provides competitive products.

3.With limited regressive claims to the borrower. It is the most common type of financing. Project risks are shared by the participants, so that all the parties are interested in a positive result of the project at any stage of implementation (Smirnov, 2012a).

Project financing is characterized by the following types of risks: economic risk; political risk; legal risk; delay in object commissioning; increase in the cost of the necessary raw materials; excess of construction estimates (Smirnov, 2012b).

Project financing involves such participants as an engineering company, investors and lenders.

The project financing mechanism is operated as follows: after accreditation of the project by the Bank and the start of lending, the developer-investor is engaged in raising funds from private investors, and the creditor Bank is responsible for controlling the distribution of financial flows and the construction itself. The main advantages of project financing for the developer is primarily guaranteed financing, and furthermore, additional external risk control and "image-building" profit. Among the drawbacks there are high commission rates, strict requirements for documentation that is time-consuming, and project control by the Bank.

The demand for project financing in the construction sector is generated at high level. This is largely determined by the specifics of the industry since the average economic cycle is usually of three years at least. But the market situation is quite volatile and highly dependent on the overall macroeconomic situation. All the factors require long-term loans with flexible service conditions. However, project funding has not yet become widely available.

The main reason is the relative complexity of such mechanisms as they require significant competence from the credit institution (assessment, preparation, audit). Moreover, there are risks that are difficult to anticipate. The reasons do not provide sufficient conditions for development in the context of the relatively low competition in the financial sector. The application of this mechanism is not yet widespread. As a rule, we see that in recent years project financing has been implemented in the largest and most long-term infrastructure projects featuring the state or quasi-state companies. It should be expected that mass distribution of such mechanisms will take place when there is enough competition in both the banking sphere and in the construction industry.

The trend of recent years is an increase of the number of projects with the involvement of project financing. However, to ensure that the scheme remains attractive to developers, it is necessary for the procedure of getting the project financing to be simplified so that to reduce the time for the approval of the loan as well as to reduce the debt burden for the developer (Smirnov, 2012b).

The advantage of project financing is the possibility to get up to 70-80% of the project budget from the Bank over an extended time frame. Disadvantages of the scheme are as follows: construction is dependent on fluctuations in the financial market; a lot of hard going terms (including high rates) lead to a significant increase in the debt burden for the developer; the final cost per square meter is also increasing.

Project financing allows to reduce risks in housing projects as the construction cycle is less dependent on current sales. Accordingly, the open credit line allows minimizing possible risks for equity construction investor.

Developers are traditionally considered to be an attractive category of clients for banks, and the sphere of housing construction is also a priority for them. However, one of the trends in the market is a more critical attitude to developers-borrowers and a more thorough assessment of the financial condition of both the company and parent company as a whole. On the one hand, this makes it more difficult for developers to work, but on the other hand, this approach has a positive impact on the quality of the construction industry (Fedotova, & Nikonova, 2012).

Purpose of the Study

The purpose of the research is to compare the project financing of the housing market and the equity mechanism financing. In this article we will highlight the advantages of project financing and the importance for the market to use it.

Research Methods

This research uses the method of analysing housing market conditions and the risks related to financing. Both statistical data coming from official sources and expert opinion on the housing market conditions are analysed.

Findings

As for Russia, today the financing of the housing market through the mechanism of share participation is highly developed. It is regulated by the Federal Law No. 214-FL from 30.12.2004 "on shared participation in the housing construction and other real estate objects, and on amendments to some legislative acts of the Russian Federation". This model assumes the financing of housing construction in the erection phase. And the financing can be implemented both through propriety investments and loan funds by means of mortgage credit lending.

The main advantage of this model is, in our opinion, the possibility of purchasing housing in the erection phase at a much lower price than when the building is already put into operation. Today, when household income is falling, this model is a solution to the problem of providing with housing.

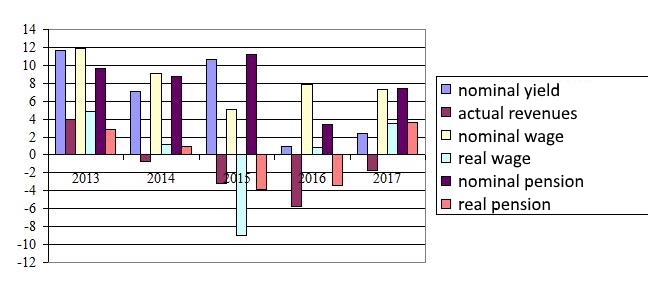

According to Federal Service of State Statistics in 2017 the decline in real income of Russians continued, but its pace slowed to 1.7% from 5.8% in 2016, 3.2% in 2015 and 0.7% in 2014 (see figure

According to the annual report of the Ministry of Construction of Russia at the end of 2017 26 million families need housing in Russia.

According to the estimates of the Ministry of Construction Industry of the Russian Federation 70% of the budget for housing construction was actually based on propriety investments. In the difficult conditions for the Russian economy when there is a lack of external credits ("cheap and long" money of international credit institutions), and there is reduction of domestic sources of investment, many construction companies are on the brink of collapse. The level of capacity utilization of developers is 60%.

As there is a risk for developers to be financed by housing equity holders suffering the continuing decline in incomes, on the one hand, and due to the growth of defrauded investors on the other hand, the solution may be found in the transition to project financing of developers carried out by commercial banks.

Project financing is a way to attract long-term financing for large projects that is based on a cash flow loan organised within the project. It is a complex financial and organizational measure to control the execution and financing. Attracting investments within the framework of project financing is implemented at the stage of the existing project, when the potential borrower has already created the project at his own expense and, thus, left all pre-project risks behind (Nikonova, 2012; Nikonova & Smirnov, 2016).

At the stage of project financing the developer has a permit for construction and installation works and necessary agreements including engineering networks, the file of development documents and a thorough business plan as well as a well-structured financial model of the project payback.

It is this stage when the Bank enters the project and accommodates loan facilities for the implementation of the project. While implementing the project, the borrower services the debt and pays interest on the loan. And at the end of construction, the Bank receives borrowed funds back from the profit when implementing the functions of the constructed object.

Project financing is a relatively new phenomenon that has recently become more widespread in various countries of the world.

Nowadays project financing is one of the most common forms in industrialized and new industrial as well as developing countries for attracting and organizing investments in the real sector of the economy since this form provides an opportunity for active interaction between the real sector of the economy and the financial and banking sector (Nikonova, 2012).

Internationally, project financing is characterized by parallel and consistent funding. Parallel financing is often referred to as "co-financing". It is when several credit institutions provide loans for facilitating the project. On the one hand, it allows banks to retain the maximum permitted amounts of loans. On the other hand, it contributes to reducing credit risks.

Often in such a banking group there is an initiator, a reliable commercial Bank or international financial institution. They provide an additional guarantee for the timely repayment of obligations by the debtor. This is facilitated by adding "cross-default" conditions in the terms of the loan agreement. They give the creditor the right to early loan repayment (and sometimes there are other sanctions there) if the debtor fails to meet the payment obligations for all other debtees involved in co-financing (Smirnov, 2012a).

The main task that the state solves in industrialized countries is to create a stable environment for projects and investments, macroeconomic, legislative and fiscal stability. This allows creating a long-term resource base of banks, investment companies and funds to develop tools for the currency issue and distribution of "long" money.

Project financing (despite the organizational and economic mechanism) is a more reliable way of financing large investment projects:

* the probability of default is less for the project than for corporate lending;

* the probability of financial losses due to default is lower than in corporate lending transactions;

* failures to meet a deadline for payments are rare; in case of late payment, there is a high probability that the payment schedule will be restructured;

* the number of successfully restructured projects that avoided bankruptcy is significantly higher than in corporate lending transactions;

* the capacity of the contract structure allows reducing the negative impact of deficiencies in the legal framework and institutional environment.

The prevailing trend in the development of project financing in industrialized countries is the use of a full range of sources and tools for financing investment projects: own funds of industrial enterprises (depreciation and accumulated profit earned surplus), shares, bank loans, corporate loans, financial leasing, issue of shares, funds raised from direct and strategic investors and their mobilization in the stock market, etc. In some cases, public funds may also be used (in the form of guarantees and tax benefits, sometimes in the form of government loans and grants).

An important part of the international experience of project analysis and project financing is investment consulting. In many cases the bank advises and participates in the financing of the project confirming the objectivity of its assessment and the seriousness of its recommendations (Potapova, & Fominykh, 2016; Laenko & Uskova, 2016).

An important participant in project financing transactions abroad is the state which uses a wide range of state support instruments.

Within the contractual framework of project financing there is a common feature: the system of bilateral agreements which unites pairs of parties in a large number of participants of project financing. The more developed the institutional environment in the country is, the more effective such an approach is. Violation of contractual obligations of one of the participants can lead to a "domino effect" and significant disbenefits for the rest of the project participants and, ultimately, to the impossibility of effective implementation of the entire project. Therefore, the main condition for the successful implementation of the project and the applicability of project financing (in other words, the condition of the "collateral" project) is the country having an effective system of conventional laws, developed institutions of civil relations that effectively protect the interests of all the parties of the convention while implementing project financing.

To ensure coordination of all the project participants and increase the efficiency of the "project team", consortia are often created that make temporary agreements on production, commercial and financial cooperation. Sometimes the project sponsors or the project company become a part of the consortium and sometimes they take an outside-the-consortium position playing the role of its client. The consortium has a manager who receives special compensation for operations management services. General (strategic) management is carried out by management committees and administrative boards. Coordination committees will be established at the level of participants to address organizational and technical issues (Petrikova & Petrikova, 2015).

In the next three years in Russia, according to the provisions of the "roadmap" adopted at the end of 2017, it is expected to carry out a gradual transition from the system of shared participation construction with the use of citizens ' funds to project financing where developers will be provided by commercial banks. This means that in the future developers will not be able to raise funds from housing equity holders to finance constructing. This practice is explored in many foreign countries and involves the financing of construction through bank lending. The implementation of this program involves the use of an escrow account.

In the developed real estate markets under this scheme the Bank invests in the implementation of residential construction projects, which act as collateral for debt obligations. The payback to the credit institution involves cash flows generated by the new project without using the developer's assets. In other words, the construction of the house is carried out with the money of the bank. Thus, the rates for project financing can be much lower than for current loans for developers.

This scheme would eliminate the risk for citizens to lose their investments in housing under construction and lose the accommodation unit as a result. For developers, the mechanism of raising funds for construction sector is simplified (instead of numerous individuals, it will be one or two banks). In addition, the risks of non-compliance of the volume of attracted financing with the stages of construction will be removed. Financing will be carried out within the approved volume on an as-needed basis (Yakhontov, 2017).

During the transition to project financing, a number of experts assume a possible increase in housing prices. Indeed, this financing is not complimentary. And investors will be confident about the positive result of investments by this model of financing. On the other hand, it can be assumed that interest rates are likely to vary depending on the force of attraction of the project and the level of risk.

In the meanwhile, today the financial and economic sphere, both in Russia and in the world is very unstable. The fact affects the construction industry negatively. And even having liabilities or resources for more than three years, banks try not to invest them in construction projects for such a long period. In our country the range of companies that have the opportunity to raise targeted funding for the project is very limited: medium and small businesses do not have a chance to use it due to the lack of their own funds. The assets of such construction companies do not meet the requirements, and it turns out to be impossible to implement the project.

Internationally, the project financing scheme assumes that the initiator of the project should invest at least 30% of its own funds, while the bank invests the rest money as a loan or credit line. In Russian reality, most often banks tighten these conditions, offering to share the risks in an amount equal to 50% by 50%, even if the borrower has a good credit record.

The main difficulties that prevent developers from using project financing are the lack of necessary security and non-compliance with strict requirements of banks at the stage of signing the contract. Project financing as a tool for raising funds is available mainly to large companies that have long been in partnership with banks. It requires a high degree of involvement of the bank throughout the project implementation process and implies high requirements for the developer. Moreover, it involves increased cost on both sides as well as strict control of the construction process by the lender. For this reason, only a few construction companies explore this scheme. In a difficult economic situation, it is important to take the correct decision. Cash flows and interest payments to the bank should be calculated thoroughly. Furthermore, a wrong positioning of the object may lead to adverse demand.

Currently, one of the main problems hindering the development of project financing in the Russian Federation is the lack of appropriate regulations and legal framework. In such circumstances, banks cannot provide large-scale and long-term financing. It is necessary to legislate all forms and types of guarantees and obligations, all the features of sharing profits and risks and introduce updated models for project evaluation that will take into account the specific character of doing business in the country. Project financing in Russia is able to develop at a very high rate if there is an appropriate legislative consolidation (Yakhontov, 2017).

The social significance of the investment market for housing construction determines the need to form a system of legal support for the mechanism and infrastructure of project financing.

Moreover, a significant obstacle for success is that domestic sources of debt financing are underdeveloped. Domestic credit markets do not have sufficient liquid assets or financial resources to finance high-value projects. There happen situations for lenders who are eager to participate in the project but cannot do it, because the maximum amount of risk per group of borrowers or one borrower exceeds the permissible regulatory values.

The availability of qualified personnel is also an important factor for the successful development of project financing. Currently, there are few highly qualified staff in the sphere. In addition, the problem is that there are no well-designed and high-quality projects in project financing. Often, project initiators do not have detailed proposals, even when applying to the bank with a loan application. Banks reject loan applications because the projects are not viable or the team is non-professional and due to other similar factors. Numerous complex control and supervisory procedures as well as excessive regulatory activity do not contribute to the implementation of significant projects.

One of the most important conditions for the development of project financing to implement promising projects and improve the investment system in the country is to explore the international financial reporting standards in Russia as a tool for the exchange of financial information at the international level (Yakhontov, 2017).

However, our country has sufficient potential for investing in housing construction sector through project financing. It will allow us to systematically develop and improve economic indicators and the overall quality of life.

Conclusion

Share participation involves the financing of housing construction in the erection phase, while financing can be carried out both through propriety investments and through borrowed funds under mortgage lending programs.

The main advantage of this model is the possibility to purchase housing in the erection phase at a much lower price than when the building is already put into operation. Today, when household income is falling, this model is a solution to the problem and can help provide people with housing.

In the difficult conditions for the Russian economy when there is a lack of external credits ("cheap and long" money of international credit institutions), and there is reduction of domestic sources of investment, many construction companies are on the brink of collapse. As there is a risk for developers to be financed by housing equity holders suffering the continuing decline in incomes on the one hand, and due to the growth of defrauded investors on the other hand, the solution may be found in the transition to project financing of developers carried out by commercial banks.

Project financing of developers abroad is widely used, but for Russia it is a relatively new phenomenon and, as a result, development of this model encounters a number of problems. Not all banks are ready to invest in long-term financing that does not actually involve any collateral. However, this model allows protecting individuals from unscrupulous developers. Indeed, the application of this model may lead to some increase in the cost of housing, but will protect buyers from the risks they would face when buying housing accommodations during the construction phase. On the other hand, in the conditions of declining incomes and sanctions imposed on Russia developers suffer from a scarcity of funding. The project financing model implemented in Russia will provide developers with the necessary resources.

References

- Fedotova, M., Nikonova, I. (2012). Prospects of development of project financing in Russia Finance and credit, No. 28 (508), 24-29.

- Laenko, O. A., Uskova, A. A. (2016). Project financing: the analysis of trends and development prospects Strategic and project management: collection of scientific articles: Vol. VIII. (pp. 158-160) Perm State Research Univ. – Perm.

- Nikonova, I. A. (2012). Responsible project financing National interests priorities and safety, 35 (176), 11-16.

- Nikonova, I. A., Smirnov, A. L. (2016). Project financing in Russia. Problems and directions of development. Moscow Publishing House Konsaltbankir.

- Petrikova, E. M., Petrikova, S. M. (2015). Project financing: theory and practice Finance and investment, 6, 85-94.

- Potapova, E. V., Fominykh, V. D. (2016). Problems of project financing in the construction industry Strategic and project management: collection of scientific articles: Vol. VIII. (pp. 218-224) Perm State Research Univ. – Perm.

- Smirnov, A. L. (2012a). Investment business banking market. Management in a credit institution,. 4, 8-19.

- Smirnov, A.L. (2012b). Project loan documentation: international practice Banking No. 10 (226), 34-38.

- Yakhontov, V. (2017). Project financing: the collapse of the Russian market and international experience. Retrieved from: https://realty.rbc.ru/news/5a1d12489a794726e33e4c8c

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 March 2019

Article Doi

eBook ISBN

978-1-80296-057-0

Publisher

Future Academy

Volume

58

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2787

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Ildusovna, S. A. (2019). Role Of Transition To Project Financing Of Real Estate Market In Russia. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism, vol 58. European Proceedings of Social and Behavioural Sciences (pp. 1519-1528). Future Academy. https://doi.org/10.15405/epsbs.2019.03.02.176