Abstract

The main goal of the research is to assess the potential of using an innovative blockchain technology in the oil and gas industry in Russia, to increase the competitiveness of Russian companies in the international arena, and to contribute to development of a successful partnership between the state and business. In the age of research and development, technologies evolve to such an extent that new ideas, as soon as they emerge, instantly become obsolete and evaporate in a flash. What are the most advanced of the latest technologies, which the whole world is watching for today. The application of innovative technologies is the main benefit of any industry that is open for their use. Industrial complexes in the field of oil and gas extraction monitor closely the situation of developing new technologies. However, the fact that the oil and gas industries are of global importance, these industries are old-fashioned activities that do not hurry to apply new technologies. Considering the number of daily processes occurring in the natural resources sector, we need to move beyond the usual manner of doing business. Oil and gas companies should introduce a simplified form of document management by using safe technologies. Millions of new technologies can positively or negatively influence the development of the fuel and energy complex. Therefore, the most important thing is to evaluate technologies, analyze their suitability for the industry and determine priorities for further opportunities.

Keywords: Blockchainnew technologiesoil sectorbusiness

Introduction

Blockchain is a standard chain of blocks, i.e. the information technology performing operations between equal participants of a single network without intermediaries, such as data transmission, money transfer, signing contracts, etc. (Blockchain, 2017; Drecher, 2017). The uniqueness of this technology is a transparency and openness of information, data identification, and the main thing is a protection from information aberration or its destruction. The international oil and gas companies gradually start their explorations with the introduction of blockchain technology, without regard to its inexperience, the lack of stereotypes and absence of specifities. Such oil-extracting companies as BP, Shell, Statoil and raw traders as Gunvor, Mercuria, Koch Supply & Trading, using the blockchain, have developed trading platform to implement oil transactions on the spot market (S7 Siberia, 2016).

The distinctive feature of oil companies is the stock of impressive quantity of material objects, growing in price, great expense for solving investment problems, special opportunities of operational solution confirmations, considerable volume of investment projects and urgent necessity to manage a supply chain (Azieva, 2017). The usual result of declining external and intra-branch competitive environment is the need to economize investment and the operating efficiency increase. Data of studying PWC testified that, the oil and gas industry is annually responsible for $700 billion capital investments generally in the world, and the question of cost savings for stabilization of a competitive ability can be minimum $140 billion a year. (If we estimate operational costs of the world oil and gas industry at $1 trillion, then achievable savings from business processes digitizing are estimated at the level of $30-50 billion in extraction and $15-20 billion in downstream. According to the research of the Oil&Gas Monitor oil and gas companies in the world spend more than $50 billion for information technologies, expecting that profitability from investments will make no less than 40%, and in comparison with such expenses the costs for introducing blockchain are insignificant, and the expected ROI is much higher.

Problem Statement

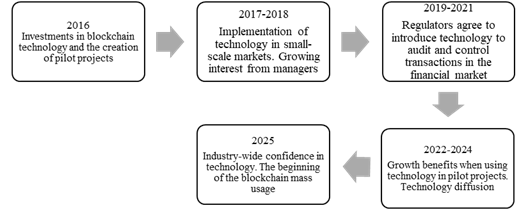

Today most investors give preference to blockchain technology. The first investments into the companies, recommending the solution of many problems based on this technology, were offered in 2012, and their sum reached $2.13 mln. In 2016 the volume of investments into blockchain was $587 mln. that exceeds the level of the previous year of $103 mln. or 21.3%, and in 2017 it was $2.4 bln , this is 340% higher than in 2016. J. P. Morgan’s analysts consider that mass use of blockchain technology is possible only in several years, as it is presented in Figure

Research Questions

Indeed, blockchain technology has not used widely yet, however, the considerable number of companies, accepts the advantages and estimates superiority of using this technology in business processes (Table

By the forecasts of Marketsand Markets analysts the blockchain market will grow up from $210.2 mln. in 2016 to $2312.5 mln. by 2021 with compound annual growth rate (CAGR) of 61.5%.

Earlier the oil and gas industry cautiously considered the application of blockchain technology, but now the large companies actively look for ways of implementing this technology at their enterprises. For example, the large international oil traders Trafigura and Mercuria introduced blockchain projects to increase the effect of oil deals, accelerating trade finance processes.

In general the oil industry, where VIOC (Vertically Integrated Oil Companies) more prevail owing to the complicated structure and a bigger share of "paper" and "manual" processes, gives almost limitless opportunities to business for improving and radical rethinking the processes and creating new business models based on the blockchain technology. Today we see a considerable amount of scenarios of the maximum use of blockchain technology in Russian oil companies. More than 175 thousand oil wells function in Russia, and about 150 thousand of them are extracting. Less than 3% of them are connected to information networks. Consequently, 20-30 wells are monitored by at least one operator, who walks round the wells, takes down parameters of their work, detect defects and manually fill in the data from the magazine into the computer. To enhance the quality and operational efficiency of decision making it is necessary to minimize the role of a human, that is, to rely on telemetry and digital technologies of decision making more widely. According to some estimates, the transition to modern information systems can increase oil recovery in scales of Russia by 5-10%. And having delegated doing creative tasks to computer systems, preparing effective engineering solutions, it is possible to achieve even more impressive results. It is obvious that the upstream sector is objectively interested in the digital technologies, known as “Industrial Internet of Things, IIoT”. In fact, it is the single network of physical objects capable to measure its own or external parameters, to collect information and to transfer it to other devices. Everything that is connected with gas stations and also with industrial control system at oil refineries needs downstream in IIoT. No less important subject, both at oil refinery, and at any other plant, is production discipline. It defines the quality and timeliness of achieving all process parameters and project design.

Purpose of the Study

The research goals and problems consist in implementation of experimental launching the use of blockchain technology. The smart contract is the tool for recording received information. It is the program which is launched remotely in the blockchain network by performing the set conditions. The result of launch is confirmed by all participants of network. All that is necessary for delivery control information gets to unified space:

parameters of delivery components;

information about the producer;

certificates and inspection control reports;

parameters of a complete product;

planned and actual parameters of delivery of material resources;

accompanying and transport documents.

Owing to blockchain technology the data of the company is stored safely. This technology allows to computerize such processes as: trade payables; monitor the quality; objects permission.

At the beginning of 2018 the companies: PJSC “Gazpromneft” and LLC “Gazproneft-Supply” started using blockchain technology as an experiment. Its use allowed to connect freights to an information field by means of GPS sensors and RFID radio-frequency tags. Tags are read out in all warehouses throughout the journey of freights, employees download the supporting documentation using special interface. Thus, the history of all logistic operations is gathered in global space, and the blockchain technology allows to provide its authenticity and safety as it replaces information storage in the centralized server. Each user networked to stores the duplicated records and confirms addition of new ones. It allows to provide reliability of data at all stages of the movement of a material resource.

Research Methods

Nowadays the PJSC “Gazpromneft” introduces the platform a blockchain which will allow to rank suppliers of the oil and gas industry, consequently, purchasing processes become simpler and its efficiency increases. (Idigova, Hadzhiyeva, & Dudaev, 2017),i.e. Gazpromneft and Mail.Ru Group are engaged in creating a universal business control system which will operate unified production online, implement and deliver products from production assets of the company anywhere in the world. Moreover, the mechanisms of fast mutual payments at petol stations based on blockchain are formed. A result of the joint activity can become the prototypes of essentially new marketing processes which in real time can feel deviations of a market situation. Consequently, costs will decrease and risks at conducting payment transactions become neutrals (Idigova, Hadzhiyeva, Chazhayev, & Dudaev, 2018; Strategy, 2013). Furthermore, the Lukoil company is actively involved in the process of digitalization, and has come a long way on the development and application of information technologies. Today the key business processes of group are automated, and through the program of digital transformation the company develops opportunities of obtaining additional effects.

In each segment of business a number of initiatives has already been implemented, offers on use of digital technologies have been formed. By 2018 18 digital projects are implemented and operated in Lukoil. (11 projects are at the circulation stage, 12 are pilot projects, the concepts of three projects are worked out). 36 new initiatives are prepared for consideration. What is the strategy of Lukoil on digitalization of the company activity?

It is important to realize that in the near future in the industry there will be serious changes connected with IT development: digital twins, robotics, artificial intelligence. The leaders of the industry are those companies which are capable to quickly implement new technology solutions. Sustainable development of the oil and gas companies during the era of the fourth industrial revolution is based on the continuous introduction of innovations. The main objective of digitalization for Lukoil is to improve the efficiency of investments at increase in technological complexity of oil business. In this regard branch initiatives of the largest oil companies, involving the experts having practical experience of digitalization project implementation as well as developers of IT solutions are analyzed. One of the key Lukoil partners in digital transformation is the SAP Company. Based on the blockchain technology, the company can count on the possibility of introducing the logistic platform assuming the creation of distributive infrastructure for all participants of a supply chain, tracking freights on-line and automation of monitoring of transport conditions. In general, we can say that blockchain technology could replace traditional clearing and calculating processes. Owing to its use the level of information security increases and duplication of information input is reduced. The largest companies, including Lukoil, participate in such events as the International oil and gas summit of SAP. What are such platforms valuable for? Lukoil is a participant practically of all key actions of the oil and gas industry and IT. Such actions are necessary for the company for a variety of reasons. First of all, this platform is for experience exchange, current issues discussion, acquaintance with achievements and implementing innovative solutions in the field of information technologies. The core business of the company is investigation, production, processing and sales of oil products. The business model of the Company is based on the principle of effective vertical integration for ensuring its sustainable development by diversification of risks. The development strategy of the Company is based on business diversification that promotes strengthening competitive advantages of the Company in the international market. We will consider the Company market capitalization as an integrated sustainability index. For this purpose we need to define the list of factors (indicators) defining it.

The size of capitalization is influenced by the following financial and economic coefficients (indicators): the current liquidity is calculated as the ratio of current assets to current liabilities, demonstrates the ability of the company to repay the current (short-term) liabilities at the expense of only current assets, i.e. characterizes its paying capacity; equity ratio is calculated as the ratio of owned capital to the value of all assets, it demonstrates how the company is independent of creditors; the maneuverability coefficient demonstrates the ability of the Company to level own current assets by means of own capital; the asset turnover ratio allows to estimate the efficiency of using all assets of the company and is calculated as the ratio of earnings to the average annual asset cost; return on assets coefficient – it characterizes the return from all assets and is calculated as the ratio of net profit to the value of all assets; dividend yield – is calculated as the ratio of the dividend per share (per a year) to share price, estimates investment attractiveness of the company; the coefficient of the validity of non-current assets – is calculated as the ratio of depleted cost of WA to their overall initial cost.

To calculate the above-mentioned coefficients the consolidated financial statements of the Company during 2008-2017 are used as initial base.

The reported coefficient values were used for calculating coefficients. According to the calculations, the average coefficient of the current liquidity for the considered period equals 1.73 at optimum value of 1.5-2.5. It means that the company is solvent and can easily discharges its the short-term liabilities at the expense of own working capital.

The average coefficient of autonomy equals 0.7, it means that the core part of company assets is formed from own funds (70%), and the rest (30%) is covered from borrowed funds. Thus, the dependence of the company on creditors is small that increases its investment attractiveness. The average coefficient of the validity of WC equals 0.93 that demonstrates good technical condition of fixed assets, therefore, the companies are not required serious costs for their repairing and updating. (Swon, 2017)

The average coefficient of flexibility equals 0.34, at optimum value 0.2-0.5. It means that the company can support the adequate level of current capital from own funds. The average coefficient of turnaround was 1.33 for the studied period, it means that for every 1.33 rubles of used assets there is 1,33 rubles of revenue. The average coefficient of profitability of assets equals 0.12, i.e. for each 100 rubles, enclosed in assets of the company, there are 12 rubles of clear gain

Findings

Thus, the level of capitalization is influenced by a set of factors – both the internal and external environment. It causes carrying out the analysis directed to identification of force of influence of these or those factors on productive sign, i.e. to market capitalization

The large oil and gas companies rank among top-10 the largest customers of the IT companies. In 2017, according to TAdviser, the Russian hi-tech companies received 25% of proceeds from the oil and gas industry.

Digital technologies in the oil and gas industry are used in all segments: exploration and production, processing, supply management, logistics (storage and transportation) as well as in process forecast and planning. They are staked on, trying to obtain increase in equipment working efficiency, decrease in operating and capital expenditure. Such companies as the Norwegian “Equinor” (the previous “Statoil”), the Anglo-Dutch concern “Royal Dutch Shell”, the American “Chevron” actively make experiments on implementing smart technologies to optimize expenses, protection of dividends and infrastructure preservation.

Conclusion

Recently much attention has been paid to the development of digital technologies in Russia, both at various management levels, and at the enterprises of fuel and energy complex. The oil and gas sector is on the threshold of the new technological era connected with revolutionary transformations of operational model of business and large-scale use of digital technologies. For Russia technological revolution is not only the creation of new sectors, but deep technological and organizational innovations in traditional industries.

But modern scientists still did not come to a consensus about whether the blockchain is a new technology of management or a base of information storage. At the moment it is possible to tell that the blockchain is in the condition of transition from the usual database to new administrative technology which allows to reduce expenses, to optimize various business - processes, to reduce time for doing certain operations that finally increases competitiveness of the enterprise.

The blockchain technology quite corresponds today to the general trend: the world becomes more and more digital. Hence, it just one more current which will promote global digital-evolution.

References

- Azieva, R.H. (2017). Investment attractiveness of the oil industry to foreign and domestic investors// Components scientific and technological progress, 2 (17), 36-40.

- Drescher, D. (2017) Blockchain Bascis: A Non-Technical Introduction in 25 Steps. Frankfurt am Main: Apress.

- Idigova, L. M., Hadzhiyeva, M. M., Dudaev, R. R. (2017) Successful development of the industry of the Chechen Republic is possible only by improvement of investment climate. Problems of economy and management of oil and gas complex, 3, 13-20

- Idigova, L. M., Hadzhiyeva, M. M., Chazhayev, M. I., Dudaev, R. R. (2018) Results of development of industrial development of the region. Problems of economy and management of oil and gas complex, 3, 15-19

- S7 Siberia (2016). Alfa-Bank and S7 Airlines carried out the transaction letter of credit using blockchain for the first time in Russia Retrieved from: https://www.s7.ru/home/about/news/s7-airlines-i-alfa-bank-vpervye-v-rossii-proveli-sdelku-akkreditiv-s-ispolzovaniem-blokcheyn

- Strategy of development of the industry of the Chechen Republic until 2020, is approved by the order of the Ministry of Industry and Energy of the Chechen Republic No. 125-p (2013). Retrieved from: http://minpromchr.ru/images/stories/programm/development-strategy.pdf

- Swon, M. (2017), Blockchain. Scheme of new economy. Olympe-business Publishing house.

- TADviser (2017). Blockchain Retrieved from: http://www.tadviser.ru/index.php/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 March 2019

Article Doi

eBook ISBN

978-1-80296-057-0

Publisher

Future Academy

Volume

58

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2787

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Husainovna, A. R. H., Ibragimovic, C. M. I., Gilaniyevich, C. H., Usmanovna, G. S., & Hasanovich, M. K. (2019). Innovative Breakthrough Of Blockchain Technology In Oil And Gas Industry. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism, vol 58. European Proceedings of Social and Behavioural Sciences (pp. 142-149). Future Academy. https://doi.org/10.15405/epsbs.2019.03.02.17