Abstract

The paper deals with the problem of reflexive control based on non-equilibrium interpretation of the economy and focuses on traditional representation of the trajectory of the economic system development; characteristics of non-equilibrium as a general property of the economy; reflection displays in non-equilibrium control conditions; description of the economic evolution in non-equilibrium. The purpose is to reveal the problem of reflexive economic management. The methodology is theoretical analysis of the economy using principles of evolutionism and non-equilibrium approach. It is proved that any economic system acquires a non-equilibrium state, which is the engine of its effective evolutionary development; the evolutionary essence of the economy is incompatible with an equilibrium state and stability; in economics, a more perfect description is the state of equilibrium-non-equilibrium in the form of parameters that reflect equality-inequality, and equivalence-non-equivalence of the elements and parts of economic systems. Innovations are continuously introduced in the economy. Inaccurate interpretation of economic development is the result of an imperfect toolkit used to represent the economy. The system of decision-making with feedback by the mismatch between required and true structures of the economy is proved. Structural transformation of the economy can be carried out in the form of phase transitions within the economic cycle, cyclic transitions themselves. In the modern system of accounting and statistics, transitions are considered only at discrete time intervals at the end of the current month, quarter, year, etc. The non-equilibrium state of the economy makes economic evolution irreversible and ensures its unlimited progress.

Keywords: Market equilibriumeconomic modelcycleregulation

Introduction

Evolutionary economic theory has not been the mainstream in the economy over the past hundred years. However, since modern neoclassics are unable to explain modern economic processes, therefore decisions and theories of the representatives of evolutionary economic theory are supported by scientists- economists. The examples of such solutions are as follows:

1. Inability to explain technological and innovation processes in the economy within the framework of the neoclassical theory. However, critical works by Nelson and Winter (1974), and Verspagen 2004) resolved these problems.

2. Simplification of the economy in the framework of the neoclassical theory and formulation of simple decisions in economic management, which often do not work. The examples of Asian Tigers in the second half of the twentieth century that did not follow traditional economic growth trend (Lawson, 2006; Colander, Holt & Jr Rosser 2004) led to revision of the concepts of traditional economic theory (Arrow, 1962; Fullbrook, 2003; Romer, 1994).

3. The complexity and diversity of economies, the lack of common recipes to ensure the economic growth of different countries led to convergence of 2 schools: neoclassicists and evolutionists. A number of policy provisions in science, technology and innovation were developed (Laranja, Uyarra, & Flanagan, 2008); hybrid models were proposed (Dodgson, 2011); similarities and differences between the two approaches were explained (Eparvier, 2005; Silva & Teixeira, 2009); the failures of the market and economic systems were explained (Gustafsson & Autio, 2011) and elements of neoclassical and evolutionary economies were combined in formulation of economic policies (Dosi, Fagiolo, & Roventini, 2010; Dosi, Fagiolo, Napoletano, & Roventini 2013; Fagiolo & Roventini, 2012).

Today, the number of fundamental differences between traditional and evolutionary approaches to studying economics decreases (Martina, 2012). Criticism combined with the success of the industrial policies in some developing countries, in particular the countries of South-East Asia and Latin America, were important factors in changing the approaches of the traditional economy. The maturity of the evolutionary economy and the change in the traditional economy make it possible to develop policy recommendations based on two approaches.

However, despite the obvious success of evolutionary economic theory, neoclassical theory still dominates in some of the areas. One of these areas is insurance of the economic equilibrium as the main postulate in economic management.

The idea that dominates in modern economic theory is economic development in the form of an equilibrium system with constant development parameters, which, in our opinion, is far from reality, since in fact, the economy is a non-equilibrium system with its characteristic economic growth trajectory. The development situation, is typically understood as the movement of the economy under the impact of various factors from one equilibrium point to another one. Thus, it is emphasized that equilibrium is the initial and natural economic state. In our opinion, this interpretation of the essence of economic development is incorrect and formulation of the task of formal reflection of economic development is false.

Traditional presentation of the economic development trajectory

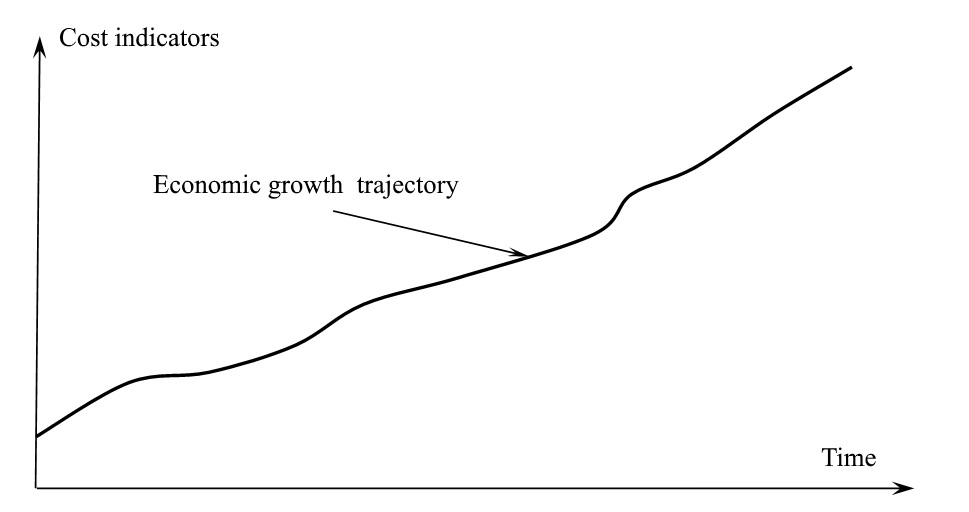

This understanding of the economy is most often represented as a trajectory of economic development along the ascending line of economic growth towards increased volume of the national product (Fig. 1).

The development situation is typically understood as the movement of the economy under the impact of various economic and social factors from one equilibrium point to another one. Thus, it is emphasized that the initial and natural state of the economy is equilibrium. For example, Italian professor J. Dozy in this regard notes, “According to Schumpeter, an entrepreneur introduces innovations, and this brings him a non-equilibrium income, which causes change in relative prices, “creative destruction”, etc. Thus, the economic system is modified and adapted to new conditions through technological imitation and innovation spread. This transition state is maintained until the system comes to a new (equilibrium) cycle with a new set of fundamental economic parameters” (Dosi, 2012).

Meanwhile, innovations are being continuously introduced in the economy without any obvious intervals and no respite to restore the equilibrium and stability within it. Innovative economic development does not provide intervals. This state is a natural way of its existence.

In our opinion, incorrect interpretation of the essence of economic development, as a movement from one equilibrium state to another, is caused by an imperfect tool used to represent the dynamics of the economic system. The equilibrium economic situation is traditionally interpreted as the intersection point of the hypothetical demand and supply curves in two-dimensional space with the set parameters of the equilibrium output and equilibrium price of the goods. The use of this tool does not answer a naturally arising question: what is the state of economic non-equilibrium? In any shift in demand or supply curves, they generally always intersect with each other, ultimately demonstrating only “wandering” of the equilibrium point in the economic space without any specific developmental logic. It is difficult to see any development trajectory in this movement. Most likely, it is a “Brownian movement” that cannot be strictly systematized.

Therefore, when the non-equilibrium process is described, for example, in the following way: “Entrepreneurs planning their business for the future in conditions of uncertainty of future current prices are oriented precisely to the excess of real demand over real supply, that is, to occurrence of a non-equilibrium process” (Zoidov, 2009), it is not absolutely clear why a shifted equilibrium point along the curve, for example, supply, suggests a non-equilibrium process?

Maevsky (1997) sheds some light on the issue, “The theory of general equilibrium considers non-equilibrium states only. These are a kind of initial conditions, states at the first moment of a period, which means that at some initial prices the demand for products or production factors are greater (less) than the supply. Then, when prices, incomes and interest rates change and due to budgetary restrictions, utility functions, technological conditions of production, etc. non-equilibrium states are transformed into equilibrium states. Non-equilibrium states disappear”.

Understanding of the non-equilibrium situation appeared to be a purely conditional hypothetical judgment of the economic system state within assessment by some expert. He identifies signs of non-equilibrium and recommends to change them in order to obtain an equilibrium state. In fact, all these judgments – assessment of the equilibrium-non-equilibrium of the economy – are subjective and lack objective grounds and formal logic of evaluating events that could accurately determine the system non-equilibrium conditions, in other words, its inconsistence with the state of the stationary trajectory. Such shaky subjective arguments are used to elaborate recommendations for developing control actions, which, like any subjectivism, cannot wear stable long-term properties without solid objective grounds, as demonstrated by modern macroeconomics, which, in essence, is a set of diverse recommendations within various schools and areas.

Thus, hypothetical nature of the tools used to assess the state of the economy in modern economic theory inevitably leads to subjectivity in judgments, discrepancies in assessments and impossibility of making an objective decision that could have significant signs of reliability and impartiality, and formal signs of causality independent of subjective judgments and the outcome of events. Therefore, a changed subject of the economic system management appears to have quite radical consequences in the nature of its functioning. In short, economic theory does not yet have a sufficiently sophisticated tool for analysis, forecasting, and development of control decisions to ensure automatic or almost automatic movement along the optimal trajectory.

Non-equilibrium as a property inherent in the economic system

The description of equilibrium by means of supply and demand curves cannot provide a complete picture of the economic system state, equilibrium or non-equilibrium one. A more perfect description of equilibrium-non-equilibrium in the form of parameters, which one way or another can reflect equality or inequality, equivalence or non-equivalence of individual elements and parts of economic systems. This type of description of the economy, which is a very complex system, shows that it cannot be found in an equilibrium state in any brief moment. In fact, any economic system is always in non-equilibrium, which is its characteristics and never disappears and never turns in even instantaneous equilibrium. A non-equilibrium state in the economy rules supreme, rarely acquiring its opposite – equilibrium. In the economic space there is no place for equilibrium. The dynamic evolutionary essence of the economy is incompatible with the state of quiescence and stability. The representation of economic systems as equilibrium is in complete contradiction with reality.

Gusarov (1995) writes about this, “The analysis of an equilibrium economic system is its imprint with the constant needs of business entities, with given resources, technologies and staff intelligence, and a pecific set of forms and methods of labor processes. At the same time, the quantity and quality of all economic resources, well-known technology for turning them into finished products are implied, the “pyramid” of needs for this generation of people is fixed ... In reality, the internal and external links of economic systems are constantly changing, the conditions for functioning of traditional forms and structures change, the components themselves and their subordination change and sometimes these are avalanche-like changes. In addition, in equilibrium systems, predictive research is impossible, there is no place for genetic points (nuclei) of future industries or technological structures, there are no wave and cyclical processes, no dynamics of economic contradictions, and scientific and technical progress is considered only in statics. There is no place for special points of non-equilibrium – points of bifurcation. Finally, the equilibrium condition causes the entropic nature of economic phenomena, which is inconsistent with the data of modern economic and social theories”.

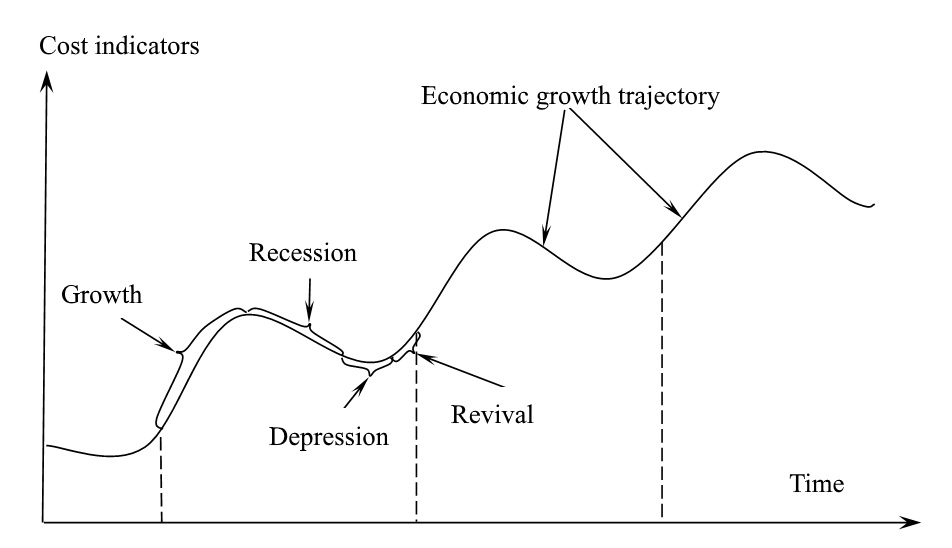

The postulate of a general state of economic non-equilibrium is also confirmed by economic theory itself in some theoretical interpretations of reality. Thus, the interpretation of the economic growth trajectory is often shown not just as a smooth ascending curve, but as a curve more complex in shape like the one shown in Fig.

In the curve, the economic evolution is an ascending sinusoid divided by cyclical periods of traditionally understood economic development with alternating phases of growth, recession, depression and revival. Obviously, the economy in these phases is characterized by variable structure, different growth and increment rates, and different values of other macroeconomic indicators (inflation rates, exchange rates, unemployment, etc.). A diverse and more complex understanding of the economic state, which does not coincide with its equilibrium representation, is increasingly becoming the subject of expert judgment. Thus, J. Dozy, an Italian economist, writes, “The empirical evidence of the heterogeneity of companies is in good agreement with the evolutionary view of idiosyncratic learning, innovation (or lack thereof) and adaptation. Heterogeneous companies compete with each other and at certain prices (possibly different for different companies and regions) receive different profits or, in other words, different quasi rent/loss, which are higher or lower than the profit margins under perfect competition” (Dosi, 2012).

Problem Statement

Research Questions

1. What is the natural way of the economy existence?

2. What is the correct interpretation of the essence of economic development?

3. How to describe the process of a non-equilibrium situation in economy?

Purpose of the Study

The problem of reflexive control of economic systems based on non-equilibrium interpretation of the economy is that virtually any economic system is always in non-equilibrium, which is its characteristic and never disappears, and it is never replaced by even instantaneous equilibrium. Therefore, it is necessary to prove a more effective method for control and regulation of this non-equilibrium economic system based on

Research Methods

The non-equilibrium approach in the theoretical analysis of economics means that we, unlike other authors, consider the imbalance in the economy as the difference in the state of our characteristic parameters of economic agents (commodity producers or commodity consumers) in accordance with their position in the ranked series in descending order of values as the main characterizing indicator – the unit cost of production. For example, if we are talking about any prices for a unit of goods, its cost, or other cost indicators, it means (unless nothing else is specifically stipulated) that the value indicators of the same type for different producers are at one and the same moment of time differs from each other in its absolute and relative values. That is, the values of this cost indicator for individual economic agents do not typically coincide in their value. This is the main meaning of non-equilibrium we assume in our theory.

Findings

Development of the economy is represented using a non-equilibrium model. The expansion of theoretical ideas about the state of the economy, an increased dominance of views considering the economy as a non-equilibrium system, the transition from a planar, two-dimensional representation of the economy to a spatial, three-dimensional one – enrich the theory with new findings. In particular, the dynamics of a three-dimensional economic system not only in terms of the volume of manufactured goods, that is along the ordinate axis of the three-dimensional economic space and in the direction of its movement, or rather gradual transition in the direction of the axis of abscissas, that is towards the most efficient part of the economy, is of interest within the framework of the evolutionary approach. Thus, the ideas of the dynamics of the economic system in the form of economic growth should be supplemented with ideas in the form of economic development, as a characteristic of constant economic restructuring.

Moreover, the structural transformation of the economy can be carried out in the form of: 1) phase transitions within the economic cycle; 2) cyclic transitions. In both cases, within the modern accounting and statistics system, this movement can be taken into account only at discrete time intervals, depending on the recorded results of economic functioning at the end of the current month, quarter, year, etc.

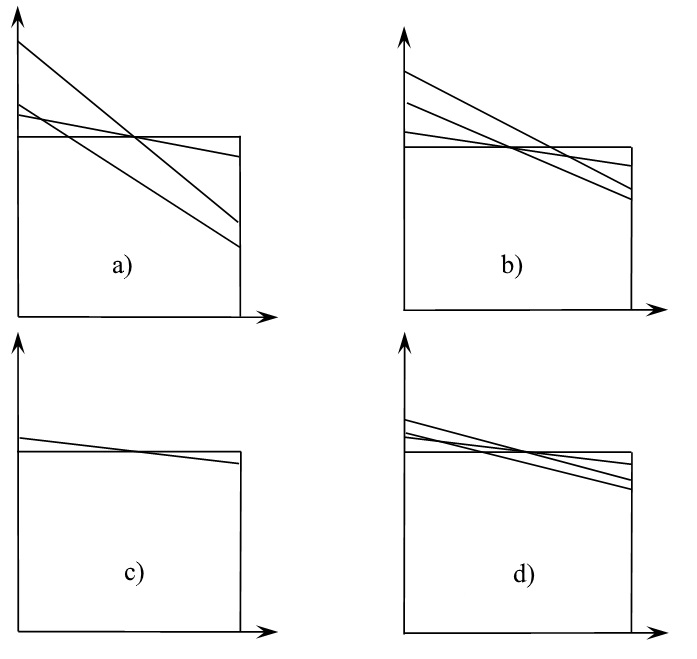

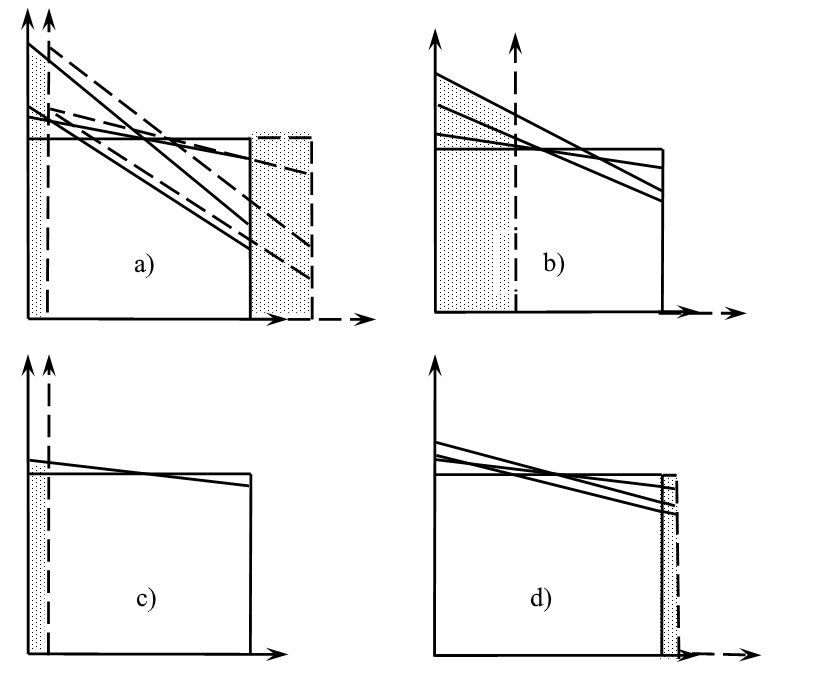

If you try to plot the first case of economic development on the front of a non-equilibrium model, which is perpendicular to the plane of a traditional description of the economic growth trajectory, the structural proportions of the model will change. At the same time, the anatomy of the economy in different phases of the economic cycle remains typical, but its structure can vary significantly (Fig. 3)

Thus, in the growth phase (a), the economy is characterized by a high rate of economic growth and a high current rate of profit (profitability). In the phase of recession (b), it is characterized by economic decline (negative economic growth) and unprofitability. In the phase of depression (c), the economy reaches its final point of decline and exhibits zero economic growth and zero profitability. In the recovery phase (d), the economy begins to intensify and shows slow economic growth and insignificant profitability.

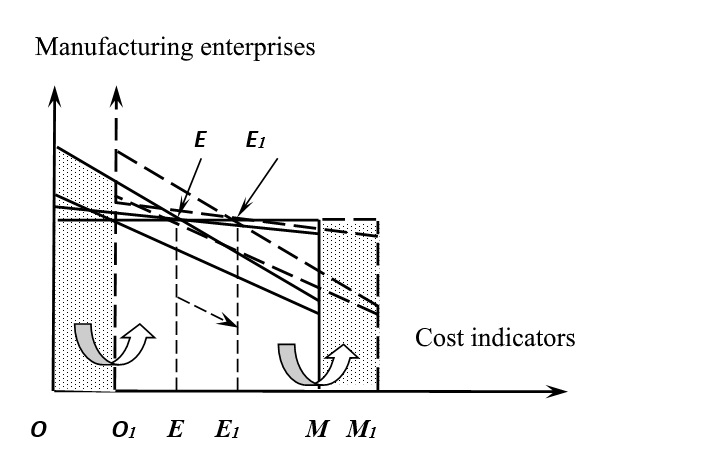

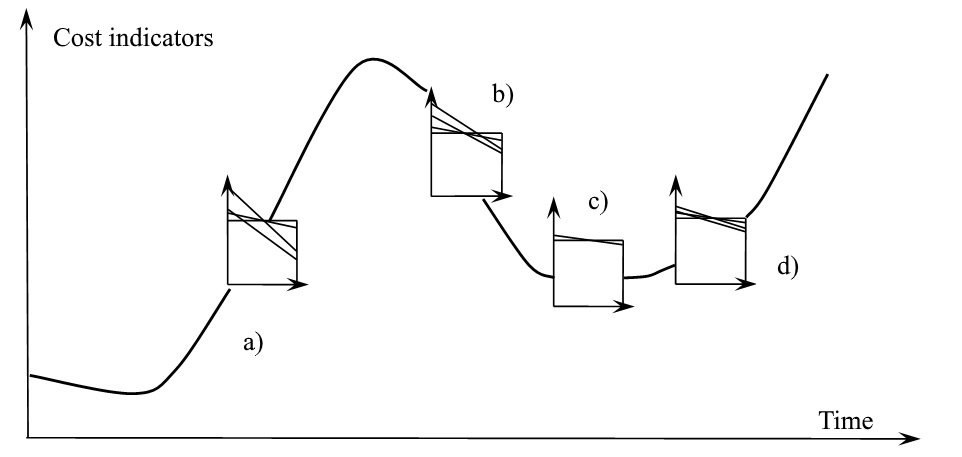

The second case of the development dynamics will be a step-by-step movement of the economy in three-dimensional space to the right after passing each subsequent economic cycle (Fig. 4).

As can be seen, Fig. 4 differs, for example, from Fig.

Таким образом, и в данном случае «самоорганизация выступает как источник эволюции систем, так как она служит началом процесса возникновения качественно новых более сложных структур в развитии системы» (Ruzavin, 1999).

In this case, "self-organization serves as a source of system evolution, since it implies qualitatively new, more complex structures in the system" (Ruzavin, 1999).

This transformation of the elements of the economy causes its transformation and simultaneous shift to the right in the phase economic space, which is shown in the figure by transition from position of the vertical line of conditional equilibrium of the economy

It is the non-equilibrium of the economy that underlies the laws of orientation and irreversibility of the evolution of the economy and its unlimited progress, since manufacturing enterprises employing advanced technologies and industrial management cannot go back to outdated technologies. Even in cases of severe economic crises, the problems are solved through the innovative development and the introduction of advanced technologies, which is characterized by further development from simple to complex due to eternal, continuous and absolutely necessary strive of society for relative independence from environmental conditions and for the greatest adaptability to this environment.

As a matter of fact, this refers to implementation of the principle of natural selection in the economy, as Mayevsky (1999) notes, “... Modern economists put forward the concept of economic "natural selection" as one of the basic ideas of evolutionary economics, when new economic entities (or institutions) develop due to exclusion of other economic entities (or institutions) from the economic space".

Taking into account the transformation of inefficient enterprises into effective ones, representation of the economy in the phases of the economic cycle, in comparison with the image in Fig.

The tools of evolutionary economics are currently underdeveloped. This can be evidenced by the following opinions. The representative of natural science – physics – Chernavsky (2005) writes, “Evolutionary economics has no particular tools, and this is not a disadvantage, but rather an advantage, since it allows evolutionary economics to be part of natural sciences and not to stand apart from them”. Russian scientist-economist Maevsky (1999) expresses the same opinion, but he explains the need for the development of these tools, “... Evolutionary economics should acquire, including by means of synthesis, its own method adequate to the economy and the corresponding conceptual apparatus”.

The above remarks regarding the improvement of the tools of evolutionary economics cannot be underestimated. However, a number of mathematical methods can be used to display evolutionary processes in economics, in particular, linear-dynamic models for displaying reproduction processes. They are distinguished by adequate reproduction of the evolutionary processes occurring both in living nature and in artificial systems created by man. In addition to linear-dynamic models, non-equilibrium models can be used to describe evolutionary processes, as was shown above. They can be calculated at regular intervals in accordance with, for example, typical states of the economy in different phases of economic cycles. If we compile a list of the model states of the economy in dynamics, it will be the prototype of a documentary film about economic development, when each frame records the movement of the economy, like any other characters in the film. At the same time, the economy will have its own personalized image in the form of a non-equilibrium model of one form of the economy or another, depending on its state in the corresponding phase of the economic cycle. Economy represented using a non-equilibrium model will embody all its characteristic features and demonstrate its particular features and differences depending on the evolutionary state in one or another model image.

In a number of non-equilibrium models characteristic of individual phases of the economic cycle, the economy will be a reflection of evolutionary process provided that a sufficient number of "frames" is calculated to simulate the evolution process. This is not a difficult task due to advanced information technologies.

Thus, the tools of non-equilibrium analysis can help conduct a series of computational experiments with a graphic image of the economy in different phases of the economic cycle over the required period of time in the context of various segments of the economy (industries, regions, etc.). As a result, a visual dynamics of the development of the economic system can be represented in the form of evolutionary process. A more reliable forecast of the future development of the economy and society can be made based on this dynamics. The forecast of economic development involves the development of measures to regulate economic and social processes.

Among the economic-mathematical model tools, non-equilibrium modeling is the most valuable one in terms of informativeness and visualization of the evolutionary process in the development of the economy (and society) (Bakhtizin, 2009; Govorushko & Kronikovsky, 2014), as can be seen in the simplest form in Fig.

To sum up, we note that improvement of the model tools of evolutionary analysis regarding non-equilibrium modeling enables representation of the current state of the economy as a non-equilibrium model at any point along the trajectory of its evolutionary development.

This representation of evolutionary development of the economy will significantly enrich and simplify the procedure for its managing and regulating.

Conclusion

Thus, we have proved that any economic system exhibits non-equilibrium state, which is the engine of its effective evolutionary development.

Evolutionary essence of the economy is incompatible with the state of equilibrium and stability; description of the state of equilibrium-non-equilibrium presented in the form of parameters that show equality-inequality and equivalence- non-equivalence of elements and parts of economic systems is the most appropriate in economic systems.

Improvement of the model tools of evolutionary analysis regarding non-equilibrium modeling enables representation of the current state of the economy as a non-equilibrium model at any point along the trajectory of its evolutionary development.

This representation of evolutionary development of the economy will significantly enrich and simplify the procedure for its managing and regulating.

References

- Arrow, K. (1962). The economic implications of learning by doing. Rev Econ Stud, 29, (3), 155–173.

- Bakhtizin, A. (2009). The future of social sciences is an agent-based model. Retrieved from http://www.youngscience.ru/includes/periodics/interview/2009/0506/13584218 / detail.shtml

- Chernavsky, D.S. (2005). Comparison of mathematical foundations of the classic and evolutionary economy International Symposium Evolutionary Theory, Innovation and Economic Change (pp 103). Moscow, UNITY.

- Colander, D., Holt, R.P., Jr Rosser, J.B. (2004). The changing face of mainstream economics. Rev Polit Econ, 16(4), 485–500.

- Dodgson, M. (2011). Systems thinking, market failure, and the development of innovation policy: the case of Australia. Research Policy.

- Dosi, G. (2012). Economic Coordination and Dynamics: Some Elements of an Alternative "Evolutionary" Paradigm. Retrieved from: http://www.lem.sssup.it/WPLem/files/2012-08.pdf

- Dosi, G., Fagiolo, G., Napoletano M., Roventini, A. (2013). Income distribution, credit and fiscal policies in an agent-based Keynesian model. l. J Econ Dyn Control, 37(8), 1598–1625.

- Dosi, G., Fagiolo, G., Roventini, A. (2010). Schumpeter meeting Keynes: a policy-friendly model of endogenous growth and business cycles. J Econ Dyn Control, 34(9), 1748–1767.

- Eparvier, P. (2005). Some comments on the methodological principles of nelson and Winter’s evolutionary theory. Evol Inst Econ Rev, 1(2), 221–234.

- Fagiolo, G., Roventini, A. (2012). On the scientific status of economic policy: a tale of alternative paradigms. Knowl Eng Rev, 27(2), 163–185.

- Fullbrook, E. (2003). The crisis in economics: teaching, practice and ethics. Routledge, London.

- Govorushko, T.A., Kronikovsky, D.O. (2014). Neural network modeling of socio-economic objects. Modern Science - Moderni Veda, 1, 49–56.

- Gusarov, Yu.V. (1995). Adaptation of the economic system to cyclical changes. Saratov, Saratov University Publishing House.

- Gustafsson, R., Autio, E. (2011). A failure trichotomy in knowledge exploration and exploitation. Res Policy, 40(6), 819–831.

- Laranja, M., Uyarra, E., Flanagan, K. (2008). Policies for science, technology and innovation: translating rationales into regional policies in a multi-level setting. Res Policy, 37(5), 823–835.

- Lawson, T. (2006). The nature of heterodox economics. Camb J Econ, 30(4), 483–505.

- Martina, B.R. (2012). The evolution of science policy and innovation studies. Res Policy, 41(7), 1219–1239.

- Mayevsky, V. (1997). Introduction to evolutionary macroeconomics. Moscow, Japan Today Publishing House.

- Mayevsky, V.I. (1999). Evolutionary theory and non-equilibrium processes (for the USA). Economic Science of Modern Russia, 4, 45–62.

- Nelson, R., Winter, S. (1974). Neoclassical vs evolutionary theories of economic growth. Econ J, 84, 886–905.

- Romer, P. (1994). The origins of endogenous growth. J Econ Perspect, 8, 3–22.

- Ruzavin, G.I. (1999). Concept of Modern Natural Science: Culture and Sport. Moscow, UNITI.

- Silva, S.T., Teixeira, A.C. (2009). On the divergence of evolutionary research paths in the past 50 years: a comprehensive bibliometric account. J Evol Econ, 19(5), 605–642.

- Verspagen, B. (2004). Innovation and Economic Growth. Fagerberg. The Oxford Handbook of Innovation, pp. 487–513.

- Zoidov, K.Kh. (2009). Evolutionary approach and its importance for development of economic science in post-Soviet countries. Economics and Mathematical Methods, 45 (2), 96–112.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

29 March 2019

Article Doi

eBook ISBN

978-1-80296-057-0

Publisher

Future Academy

Volume

58

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-2787

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Nusratullyn, I. V., Nusratullyn, V. K., Gaysina, A. V., & Habibullin, R. G. (2019). Reflexive Management Based On Non-Equilibrium Interpretation Of Economic System Evolution. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism, vol 58. European Proceedings of Social and Behavioural Sciences (pp. 1422-1434). Future Academy. https://doi.org/10.15405/epsbs.2019.03.02.165