Determining Turkish Major Ports’ Potential In Logistics Clusters Perspective: A Quantitative Approach

Abstract

The presence of logistics clusters makes an important contribution to the effectiviness of the logistics operations, so the development of national economies as well. However, establishing a cluster is a very costly and time consuming process, and the selection of the regions where the cluster is planned to be established is required a detailed planning and many factors should be taken into consideration. Otherwise, there is a risk that the return of these serious investments may not be at the desired level. Certain conditions must be met in order for establishing logistics clusters that will be effectively operated; the presence of a strong hinterland, availability of robust transportation infrastructure for all modes and the hosting of the organized industrial zones. In addition to these, and more important than all, it is the ports that allow access to international markets. Establishing clusters in areas that do not have international sea gateways will not be a very strategic move, as most of global trade is carried out by sea transportation. Considering these factors, potential of Mersin, Samsun and İzmir cities being host for logistics clusters was discussed by literature review and judicial conclusions and suggestions on9the matter were made. In addition, studies on MCDM methods for logistics cluster selection and strengths and weaknesses of these three cities have also been listed in order to strengthen the claim of this study.

Keywords: Leadership styleslearning orientationfirm performancehigh performing organizations

Introduction

Businesses or business functions are clustered and concentrated in a specific region in order to benefit from many advantages of geographical proximity. Today, among the most popular are Silicon Valley (California, USA) in the field of technology, Hollywood (California, USA) in the film industry and many more to list. Besides, as for Turkey in particular, Teknopark/İstanbul and Teknokent/Ankara are in the field of technology. Clustering is defined in the dictionary as "a group of similar things or people positioned or occurring closely together" (Oxford Dictionaries, 2018). Cluster concept also includes density, closeness, similarity notions (Peneder, 1999). According to Rosenfeld (1997), Cluster is due to its geographical proximity and interdependence, and is defined as concentrations where enterprises produce synergies. In addition, Rosenfeld (1997) notes that in today's industry structure, the relationship between businesses must take a significant place in the policies of enterprises and that this is highly relevant to economic development. From Roelandt and den Hertog’s (1999) perspective, Clusters are defined as a group of companies that are highly interdependent and that form a value creating chain of firms. Clustering is a geographical concentration of interrelated entities or institutional structures. Clusters highlight other issues that are important for competition by creating a series of industries with each other (Porter, 1998). Swan and Prevezer (1996) also see clusters as a community of businesses in the same geographical region, indicating that it is not relevant to any sub-discipline and may cover all sectors. Cluster does not necessarily mean network. There might be some misunderstanding about definitions, also a substitution of the two words and there can be a confusing perception between Clusters and Networks definitions. To put these differences in the most basic sense; Networks have restricted membership, while Clusters are open, Networks depend on contracts, while Clusters make advances in an environment of trust, Networks create cooperation, while Clusters create both cooperation and competition (Rosenfeld, 1997). Cooperation and competition are also stressed by Porter (1998) as a promoter of clusters.

The desire to use and develop many of the advantages that come from proximity to each other shows that the concept of the Cluster has a rather lucrative proposition. When examined from this point of view, the researchers' intense interest in this issue is seen especially in the twentieth century (Kuah, 2002). As stated by Alfred Marshall (1920) in his “Principles of Economics” book, the development of industrial complexes are driven by positive externalities stemming from close geographical distance from one's business. Marshall segregates these externalities by: (1) sharing and spillover knowledge among companies with geographical proximity; (2) developing a specialized and efficient supplier; and (3) developing specialized labor power in the field. The above-mentioned externalities are also mentioned in Michael Porter's work (Porter, 1998). In other words, Porter states that Cluster includes the specialization of the supplier network to which a certain product or service is provided or includes the pool of workers with specialized and experienced employees and knowledge sharing. Clustering is a geographical concentration of interrelated entities or institutional structures. Clusters highlight the other issues that are important for competition by creating a series of industries with each other. Another point that can be counted as benefiting from the positive externalities of the clusters is; cooperation with each other or with research centers, universities and other related institutions are among the cornerstones of the innovation process (Roelandt & den Hertog, 1999).

Numerous advantages of clusters are in present from many perspectives. When the literature is examined, cluster benefits are shaped in knowledge sharing, efficient supplier, expert and experienced employee. Co-location of firms behaves as a solver of problems occurred during daily activities and in the meantime, it creates flexibilities, efficiency and effectiveness. Because the firms in the cluster are more trust-oriented and closer to each other than formal relationships which pose formal linkages and inflexibilities (Porter, 1998). Besides, regional clusters improve the global, national and regional economies (Enright, 2003). Benefits of Cluster Formations can be compiled from the literature as:

Increased productivity (Porter, 1998; Boari, 2001)

Creates an innovative environment (Porter, 1998; Romanelli & Khessina, 2005)

Development of Economy (Porter, 1998; Rosenfeld, 1997; Roelandt & den Hertog, 1999; Romanelli & Khessina, 2005; Enright, 2003).

Creates an environment for start-ups (Porter, 1998)

Spill over effect of knowledge, technology, etc. (Marshall, 1920; Peneder, 1999).

Industrial clusters are big organizations. For this reason, governments are the stakeholders of the clusters. There is no doubt that governments are making great contributions to the formation and / or development of an industrial cluster. It is about the strategies that governments will put together with industry representatives, to what extent they will be included in the clusters. In this context, strategies identified for the development of clusters are reviewed under five categories in terms of government intervention according to Enright (2003):

Non-Existent where no intervention is in presence by government,

Catalytic, where government solely plays an indirect role with a limited support,

Supportive, where government plays a direct role by supporting in terms of infrastructure, education, training, etc.

Directive, where government intervenes with directive programs upon cluster formation,

Interventionist, where government plays an important role on making strategic decisions rather than private sector and provides incentives and passes effective regulations in favor of cluster development.

According to the knowledge-based background, three types of cluster definitions are expanded: (1) Techno Clusters where high technology research and development activities are carried out, (2) industry clusters, where traditional activities based on know-how are performed, (3) Factor Endowment Clusters, where activities are based on geographical advantages such as logistics and transportation. Subsequently, the logistics cluster will be explored in the narrow framework of this study. However, the literature has a fairly rich content on the agglomeration of many industrial branches, but work in the field of logistics clustering is very limited (Prause, 2014). Logistics is a distinguished industry and its clustering has recently been started to be explored. Although logistics is both an industry in its own and a strategic supporter of other industries, there is few studies on this special topic. Therefore, the ultimate aim of this study is to enlighten the logistics clustering concept and examine some of the Turkish cities in terms of logistics clustering potentials by using judicial decision making techniques.

Methodology

This study is based on critical review of related literature and firstly the concept of logistics clustering is mentioned. Subsequently, the selection of the logistics centers including the cities of İzmir, Mersin and Samsun were researched. In the literature, which Multi-Criteria Decision Making (MCDM) and classical methods are used for logistics center selection are listed. Result of the decision-making processes, the findings and ranks of which provinces are suitable for the establishment of the international logistics centers are listed together with the methods used in aforementioned studies and a separate list is intended to reveal the strengths and weaknesses of these cities regarding their logistics potential. Consequently, the purpose of monitoring this methods and the main contribution of this study is to determine whether the cities of İzmir, Mersin and Samsun are suitable for the establishment of international logistics clusters. The authors aim to explain the points they want to emphasize in this study by means of judicial decision making techniques using qualitative research methods.

Literature Review

Logistics Clusters

According to Rodrigue (2012) most of the logistics investments were made by the private sector and were usually focused on warehouse and distribution centers, and regions where commercial activity was intense were preferred. The contribution of the state was only about the provision of transportation infrastructure. In today's developing and growing trade activities, it is necessary to take tangible and consistent steps in terms of logistics. Even if this step requires firms to use each other's (competitor’s) transportation means to reduce costs and consolidate logistics activities (Sheffi, 2010; Rivera, Sheffi, & Knoppen, 2016).

Logistics intensive clusters bring together three firm types. These are: (1) Firms providing logistics services, (2) Firms mainly providing vehicle maintenance, information system, legal and financial services to logistics companies, (3) Firms requiring logistics services (manufacturers, distributors, etc.) (Sheffi, 2010). Logistics clusters are usually formed around an important port or airport, in order to increase and support the contribution of service firms such as forwarders and custom brokers to international trade (Sheffi, 2010).

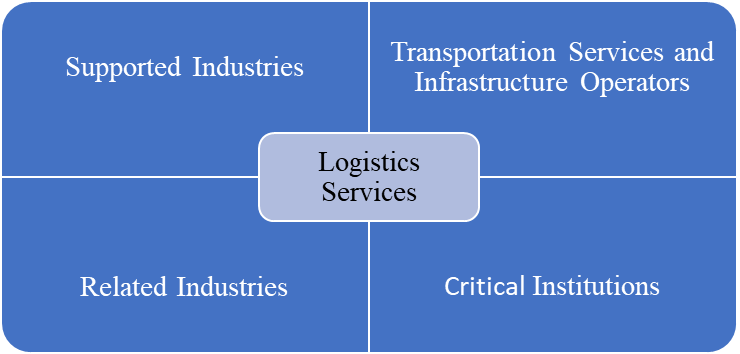

Through improvement of three pillars of logistics clusters, namely Infrastructure, Operations, Human Resources, it results in improved supply chain integration, transport assets utilization and employment opportunities, and lower costs (Lambourdiere, Corbin, & Savage, 2012). Similarly, Munoz and Rivera (2010) refers to the four main components that make up the structure of logistics clusters as shown in Figure

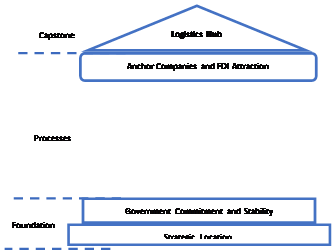

Another comprehensive structure for logistics clusters formation is also given by Munoz and Rivera (2010). This clustering formation consists of three main structure and seven factors as shown in Figure

The closer they are to each other geographically or organizationally, the greater the synergy between them (van den Heuvela, et al., 2014). For this reason, logistics activity provides great benefits to enterprises operating in the clusters. These benefits include (Rivera, Sheffi, & Knoppen, 2016; van den Heuvela, et al., 2014; Rodrigue, 2012; Elbert & Schönberger, 2009);

Reduced transportation costs,

Improvement of customer service,

Sharing resources to create surplus value,

Increasing employment,

Easy access to the maintenance facilities

Easy access to the labor,

Frequency of sending or receiving cargo from other logistics firms,

Multimodal transportation,

Ease of expansion,

Creation of time advantages to the firms served.

Review of Logistics Cluster Research in the Context of Turkey

Bayraktutan and Özbilgin (2014), in their study of fuzzy logic, found that cities have logistics cluster investment priority level 1 (cities eligible for international logistics cluster investment, level 2 (cities eligible for regional logistics cluster investment) and level 3 (local logistics cluster investment the cities that are suitable for the three groups). After the analysis, the cities of İstanbul, Kocaeli, İzmir, Adana and Mersin were found to be in first category.

Hamzaçebi, İmamoğlu, and Alçı (2016) found that Samsun should primarily be established as a logistics center among the 18 Black Sea region cities. In the study conducted with MOORA-Reference and MOORA-Ratio methods, criteria were selected as population export and import values, airline transport in tonnes, industry and electricity power (MWh), railway, material handling, vehicle-km, tons-km and total distance.

Önder and Yıldırım (2014), in their study with AHP and VIKOR methods, prioritized the 11 candidate provinces for the selection of the most suitable logistics village location. Mersin has the advantage of being close to the highway system and the "initial size of the land", while Samsun has the advantage of being close to the port and airport. The priority ranking of 11 candidate regions is as follows, Samsun (Gelemen), Eskişehir (Hasanbey), İzmit (Köseköy), İstanbul (Halkalı), Mersin (Yenice), Denizli (Kaklık), Uşak (OSB), Erzurum (Palandöken), Kayseri (Boğazköprü), Konya (Kayacık) ve Balıkesir (Gökköy).

Demiroğlu and Eleren (2014) examined the logistics village concept through sea ports with rail and sea connections. In the study in which the AHP and PROMETHEE methods were used, priority order was found as Mersin, İzmir, Haydarpaşa, Bandırma, İzmit, İskenderun and Samsun.

Es, Hamzacebi, Umit and Firat (2018) evaluated cities in Turkey under five different categories depending on the intensity of logistics activities. The most striking aspect of the study with the K-means clustering algorithm is that despite the city of Mersin has a railway network, a sea port, strong hinterland, geographical advantage and social and cultural capacity, it has been categorized as "less strong" with the other 17 cities. The result is that the logistics potential of the city of Mersin can not be used efficiently. It is located in the same category with Samsun which is another port city and has an airport.

What is important in the planning of logistics centers is not how many are there in the country but how functional these centers will be. For this reason, it is necessary to consider the legislation, site selection and equipment issues in detail within the scope of functionality factor (Elgün & Elitaş, 2011). In their study with Delphi method, Elgün and Elitaş (2011) found that Mersin was the strongest candidate for the "international logistics center" category in the selection of the ideal logistics center location. While Mersin has a fair road connection and it has well established connections to Europe, Middle East and North African countries with maritime routes, it was observed less strong in terms of local efficiency and land suitability criteria.

The following Table

Conclusion and Discussions

Considering that more than 70 percent of the volume of the commodities subject to global trade has been transported by sea (UNCTAD, 2017), the establishment of logistics clusters in regions with advanced transport infrastructure and national and international transport corridors is obvious. Accordingly, considering the major seaport logistics cluster model, Mersin, Samsun and İzmir cities have high potential to host logistics clusters due to their connectivity to foreign markets through their ports; Samsun has connection to East and West Black Sea countries, Mersin has connection to North Africa and East Mediterranean countries and İzmir has connection to Mediterranean / South European countries, which confirms the compatibility of these cities with the major seaport type logistics cluster model. Another factor that has the potential to establish logistics clusters in these cities is that they have multiple modes of transport besides being port cities (Acar & Alemdar, 2017).

Mersin, Samsun and Izmir have enough foreign trade potential and all transportation modes that provide advantages for establishing international logistics clusters. The establishment of an international logistics cluster in İzmir province and the agglomeration of logistics activities that spread throughout the province are very important for bringing the benefits of the clustering. When the literature is examined, it is seen that the logistics potential of Izmir is not used effectively. Since the foreign trade and air, sea, road and rail transportation volumes of the Izmir put the city in top five among all cities across Turkey, it is clearly seen the necessity of building an international logistics cluster here. Izmir, which is a multifunctional city with the features of industry, transportation, port, military and university (Çevik & Kaya, 2010) was selected by China as one of the 70 most convenient cities to invest in the World (İzmir Chamber of Commerce, 2008). Izmir Alsancak port as having a capacity of over 12 million tons, one of Turkey's most important export port (İzmir Chamber of Commerce, 2008) and 91% of the city's exports are made by sea transportation (Çevik & Kaya, 2010). The Alsancak port is as important for the entire Aegean region as it is for İzmir since it is 25 minutes to Adnan Menderes Airport, 20 minutes to Aegean Free Zone, 35 minutes to Çiğli Atatürk Industrial Zone and 50 minutes to Aliağa Industrial Zone (Çevik & Kaya, 2010).

Bayraktutan and Özbilgin (2014) stated that the most important factors in choosing the location of the logistics center are the existing trade volume and marine transportation infrastructure in the region. Samsun is not a big industrial city but it has a strong hinterland which is one of the important terms to have a international logistics center (Bayraktutan & Özbilgin, 2014). In the Black Sea region, only the cities of Amasya, Karabük, Samsun, Tokat and Zonguldak have access for railway network. For this reason, it can be said that the Black Sea region does not have a sufficient rail network in general (Hamzaçebi, İmamoğlu, & Alçı, 2016). However, the inner parts of the black sea are connected to each other by only two railway lines, one of which ends up in Samsun (Terzi & Bolukbas, 2016). The existence of organized industrial zones (OIZ) in Samsun provides an advantage for the city, at the same time inadequate land and lack of specialization in main industries are also seen (Middle Black Sea Development Agency, 2018). Despite this, the existence of all modes of transport and the hosting of five organized industrial zones, provides a great potential for accessing to the 400 million population of the Middle East, Central Asian and Caucasus regions (Delegation of the European Union to Turkey, n.d.). Samsun Logistics Center Project which is being conducted by Turkey-EU supported Central Black Sea Development Agency is an important step for the city to use its potential on logistics (SLC, n.d.). In addition to this investment, the ship acceptance and container handling and stocking capacity of the Samsun port is also required to be increased so that the logistics potential can be fully utilized.

Mersin is a southern city with sea, railway and highway connections and a high logistics potential. Mersin International Port (MIP) took a place in the “One Hundred Container Ports 2016” rankings of Lloyd’s List due to its container handling volume (Lloyd's List). MIP is directly connected (railway and highway connections) to industrially developed cities such as Ankara, Kayseri, Kahramanmaraş and Konya (The World's Port of Call, 2014). The port is considered as an important transit hub for the Middle East region and it is has a great importance for the export / import operations of Central Anatolia, East-Southeast Anatolia and Mediterranean regions. The Terminal has a total quay length of 3370 m. and vessels up to 400 m. can berthed and operated. The annual container handling capacity is 2,600,000 TEU, and at the same time the general cargo, dry bulk cargo, liquid bulk cargo and Ro-Ro operations are carried out (Mersin International Port, n.d.). Besides the capacity of the container port that Mersin has, it can be said that its strong hinterland is quite sufficient for installation of logistics cluster (Terzi & Bolukbas, 2016; Es, Hamzacebi, Umit, & Firat, 2018). However, when looking at the literature, it can be seen that the advantages of the city's real logistics potential has never been used effectively. But it is certain that with the new international logistics center which is under construction and the International Çukurova airport which is planned to be functional by the end of 2018, has the vital importance for improving logistics performance of the city.

Future Study

When the literature is examined in detail, it is seen that the concept of cluster has been intensively researched in the manufacturing industry, high technology development ecosystem and similar fields. When assessed on the basis of the logistics sector, studies in the case of Turkey seem to have been examined in a narrower frame, mostly by keeping the concept of logistics center in front of the concept of clustering. It is evaluated by the authors that, in the following studies, it is necessary to elucidate this concept confusion and to determine the sub-factors that define the concept of logistics clustering. Following the definition of the clustering concept under a concrete framework, it is highly recommended that the weighting and ordering of the cities in terms of logistics cluster candidate cities using multi-criteria decision making techniques will contribute to the literature.

References

- Acar, A. Z., & Alemdar, A. (2017). Propose of a port based hierarchical logistics clustering model for logistics center in Turkey. 1-15.

- Bayraktutan, Y., & Özbilgin, M. (2014). The determination of logistic center investment levels of the cities in Turkey by using fuzzy logic. Journal of Erciyes University Faculty of Economics and Administrative, 43, 1-36. https://dx.doi.org/ 10.18070/euiibfd.67041

- Boari, C. (2001). Industrial clusters, focal firms and economic dynamism: A perspective from italy. Washington, D.C.: World Bank Institute. Retrieved from https://www.researchgate.net/publication/239793063_Industrial_Clusters_Focal_Firms_and_Economic_Dynamism_A_Perspective_from_Italy_The_World_Bank_Institute

- Çevik, S., & Kaya, S. (2010, November). Türkiye'nin lojistk potansiyeli ve İzmir'in lojistik faaliyetleri açısından durum (SWOT) analizi. AR&GE Bülten. İzmir Ticaret Odası. Retrieved from http://www.izto.org.tr/portals/0/iztogenel/dokumanlar/turkiyenin_lojistik_potansiyeli_s_kaya_25.04.2012%2010-51-19.pdf

- Delegation of the European Union to Turkey. (n.d.). Samsun Logistics Centre Project. (European Union) Retrieved from https://www.avrupa.info.tr/en/samsun-logistics-centre-project-6863

- Demiroğlu, Ş., & Eleren, A. (2014). Global freight village and in this context a regional study on freight villages in Turkey. Dumlupınar University Journal of Social Sciences(42), 189-202. Retrieved from http://dergipark.gov.tr/dpusbe/issue/4784/65993

- Elbert, R., & Schönberger, R. (2009). Logistics clusters-How regional value chains speed up global supply chains. In G. Reiner, Rapid modelling for increasing competitiveness (pp. 233-245). London: Springer.

- Elgün, M. N., & Aşıkoğlu, N. O. (2016). The location selection of freight villages with TOPSIS multi criteria decision making method. Journal of Economics and Administrative Sciences, 23(1), 161-170. https://dx.doi.org/ 10.5578/jeas.27638

- Elgün, M. N., & Elitaş, C. (2011). Modal proposal for choosing of logistics village centers regarding regional, national and international transportation and trade. Celal Bayar University The Journal of Social Sciences, 9(2), 630-645. Retrieved from https://arastirmax.com/en/system/files/dergiler/123831/makaleler/9/2/arastirmax-yerel-ulusal-uluslararasi-tasima-ticaret-acisindan-lojistik-koy-merkezlerinin-seciminde-bir-model-onerisi.pdf

- Enright, M. J. (2003). Regional clusters: What we know and what we should know. In J. Bröcker, D. Dohse, & R. Soltwedel, Innovation clusters and interregional competition (pp. 99-129). Berlin: Springer-Verlag.

- Es, H. A., Hamzacebi, C., Umit, S., & Firat, O. (2018). Assessing the logistics activities aspect of economic and social development. Int. J. Logistics Systems and Management, 29(1), 1-16. https://dx.doi.org/ 10.1504/IJLSM.2018.088577

- Hamzaçebi, C., İmamoğlu, G., & Alçı, A. (2016, April). Selection of Logistics Center Location with MOORA Method for Black Sea Region of Turkey. Journal of Economics Bibliography, 3(15), 74-82. Retrieved from http://www.kspjournals.org/index.php/JEB/article/view/785/985

- İzmir Chamber of Commerce. (2008, June). Project of the İzmir Logistcs Center. Retrieved from http://izto.org.tr/demo_betanix/uploads/cms/yonetim.ieu.edu.tr/6183_1447838544.pdf

- Kuah, A. T. (2002). Cluster theory and practice: Advantages for the small business locating in a vibrant cluster. Journal of Research in Marketing and Entrepreneurship, 4(3), 206-228. https://dx.doi.org/ 10.1108/14715200280001472

- Lambourdiere, E., Corbin, E., & Savage, C. J. (2012). Global supply chains, logistics clusters and economic growth: What could it mean to Caribbean territories? Conference on the Economy. Port of Spain -Trinidad and Tobago. Retrieved from https://sta.uwi.edu/conferences/12/cote/documents/GlobalSupplychainslogisticsclustersandeconomicsgrowthwhatcoulditmeantocaribbeanterritoriesDr.pdf

- Lloyd's List. (n.d.). One hundred container ports 2016. Retrieved from https://lloydslist.maritimeintelligence.informa.com/one-hundred-container-ports-2016#row

- Marshall, A. (1920). Principles of economics. London: Macmillan.

- Mersin International Port. (n.d.). Mersin International Port Web Page. Retrieved from https://en.mersinport.com.tr

- Middle Black Sea Development Agency. (2018). Samsun Yatırım Destek ve Tanıtım Stratejisi 2017-2020. Retrieved from http://www.oka.org.tr/Documents/SAMSUN%20YATIRIM%20STRATEJ%C4%B0S%C4%B0_2018.pdf

- Munoz, D., & Rivera, M. L. (2010). Development of Panama as a logistics hub and the impact on Latin America. Massachusetts Institute of technology. Retrieved from http://hdl.handle.net/1721.1/61183

- Önder, E., & Yıldırım, B. F. (2014). Vikor method for ranking logistics villages in Turkey. Journal of Management and Economics Research, 12(23), 293-314. Retrieved from http://dergipark.gov.tr/yead/issue/21808/234426

- Oxford Dictionaries. (2018). Retrieved April 14, 2018, from English Oxford Living Dictionaries: https://en.oxforddictionaries.com/definition/cluster

- Peneder, M. (1999). Creating a coherent design for cluster analysis and related policies: The Austrian "TIP" experience. In Boosting innovation: The cluster approach (pp. 339-359). Paris, France: OECD Publications Service.

- Porter, M. E. (1998). Clusters and the new economics of competition (Vol. 76). Boston: Harvard Business Review.

- Prause, G. (2014). Sustainable development of logistics clusters in green transport corridors. Journal of Security and Sustainability Issues, 4(1), 59–68. https://dx.doi.org/ 10.9770/jssi.2014.4.1(5)

- Rivera, L., Sheffi, Y., & Knoppen, D. (2016). Logistics clusters: The impact of further agglomeration, training and firm size on collaboration and value added services. International Journal of Production Economics, 179, 285-294. https://dx.doi.org/ 10.1016/j.ijpe.2016.05.018

- Rodrigue, J. P. (2012). The benefits of logistics investments: Opportunities for Latin America and the Caribbean. Washington DC: Inter-American Development Bank.

- Roelandt, T., & den Hertog, P. (1999). Cluster analysis and cluster-based policy making in OECD countries: An introduction to the theme. In OECD Boosting Innovation: The Cluster Approach (pp. 9-23). Paris, France: OECD Publications Service.

- Romanelli, E., & Khessina, O. M. (2005). Regional industrial identity: Cluster configurations and economic development. Organization Science, 16(4), 344-358. https://dx.doi.org/ 10.1287/orsc.1050.0131

- Rosenfeld, S. A. (1997). Bringing business clusters into the mainstream of economic development. European Planning Studies, 5(1), 3-23. https://dx.doi.org/ 10.1080/09654319708720381

- Şehircilik, Planlama ve İnşaat Müdürlüğü. (2008, June). İzmir lojistik merkezi projesi. Retrieved from http://izto.org.tr/demo_betanix/uploads/cms/yonetim.ieu.edu.tr/6183_1447838544.pdf

- Sheffi, Y. (2010). Logistics intensive clusters. Época/Epoch, 20(1-2), 11-17. Retrieved from http://web.mit.edu/sheffi/www/documents/Spanishpaper-LogisticsIntensiveClusters.pdf

- SLC. (n.d.). Samsun Logistics Centre. (Samsun National and International Logistics Center Operation Corporation Joint Stock Company) Retrieved from http://en.samsunlogisticscentre.com/

- Swann, P., & Prevezer, M. (1996). A comparison of the dynamics of industrial clustering in computing and biotechnology. Research Policy, 25(7), 1139-1175. https://dx.doi.org/ 10.1016/S0048-7333(96)00897-9

- Terzi, N., & Bolukbas, O. (2016). An analysis of logistics villages in Turkey: Halkalı and Yenice. Journal of Management, Marketing and Logistics, 3(3), 190-204. https://dx.doi.org/ 10.17261/Pressacademia.2016321977

- The World's Port of Call. (2014, March 18). Groundbreaking of Mersin Port expansion project. Retrieved from https://www.globalpsa.com/assets/uploads/nr140318.pdf

- UNCTAD. (2017). Review of maritime transport. Newyork and Geneva: United Nations. Retrieved from http://unctad.org/en/PublicationsLibrary/rmt2017_en.pdf

- van den Heuvela, F. P., de Langena, P. W., van Donselaar, K. H., & Fransoo, J. C. (2014). Proximity matters: Synergies through co-location of logistics establishments. International Journal of Logistics Research and Applications: A Leading Journal of Supply Chain, 17(5), 377-395. https://dx.doi.org/ 10.1080/13675567.2013.870141

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 January 2019

Article Doi

eBook ISBN

978-1-80296-053-2

Publisher

Future Academy

Volume

54

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-884

Subjects

Business, Innovation, Strategic management, Leadership, Technology, Sustainability

Cite this article as:

Acar, A. Z., Kırmızı, M., & Karakaş, S. (2019). Determining Turkish Major Ports’ Potential In Logistics Clusters Perspective: A Quantitative Approach. In M. Özşahin, & T. Hıdırlar (Eds.), New Challenges in Leadership and Technology Management, vol 54. European Proceedings of Social and Behavioural Sciences (pp. 312-323). Future Academy. https://doi.org/10.15405/epsbs.2019.01.02.28